Maximum Loan Amount

19 Slides635.50 KB

Maximum Loan Amount

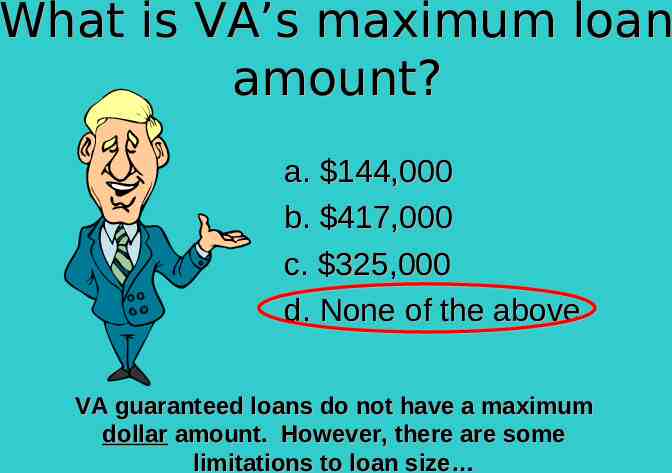

What is VA’s maximum loan amount? a. 144,000 b. 417,000 c. 325,000 d. None of the above VA guaranteed loans do not have a maximum dollar amount. However, there are some limitations to loan size

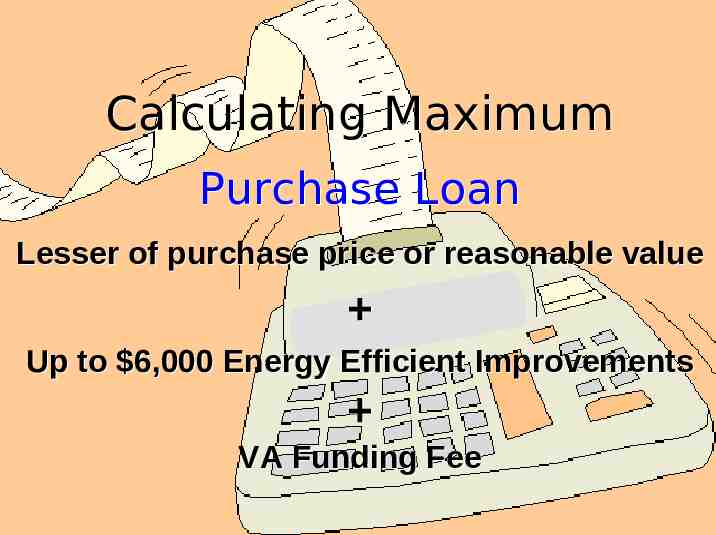

Calculating Maximum Purchase Loan Lesser of purchase price or reasonable value Up to 6,000 Energy Efficient Improvements VA Funding Fee

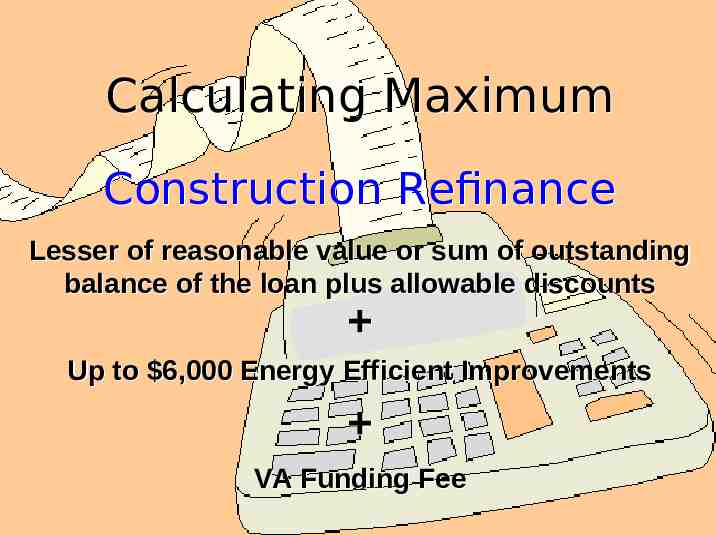

Calculating Maximum Construction Refinance Lesser of reasonable value or sum of outstanding balance of the loan plus allowable discounts Up to 6,000 Energy Efficient Improvements VA Funding Fee

Calculating Maximum Installment Land Sales Contract Lesser of reasonable value or sum of outstanding balance of the loan plus allowable discounts Up to 6,000 Energy Efficient Improvements VA Funding Fee

Calculating Maximum Loan assumed by veteran at an interest rate higher than the proposed refinance Lesser of reasonable value or sum of outstanding balance of the loan plus allowable discounts Up to 6,000 Energy Efficient Improvements VA Funding Fee

Calculating Maximum Interest Rate Reduction Refinance Loan (IRRRL) Existing VA loan balance Up to 6,000 Energy Efficient Improvements Allowable closing costs and up to 2% discount VA Funding Fee

Calculating Maximum Cash-Out Refinance Loan Up to 90% of the reasonable value Up to 6,000 Energy Efficient Improvements VA Funding Fee

REMINDER! VA does not have a maximum dollar amount for the VA-guaranteed loan. – However, the lender generally needs a 25% guaranty from VA in order to sell the loan on the secondary market. – If you are unsure if you have a marketable loan, speak to your company’s post closing department or the investor.

Maximum Guaranty

Maximum Guaranty Effective December 10, 2004, VA’s maximum guaranty for certain loans in excess of 144,000 is 25% of the Freddie Mac conforming loan limit.

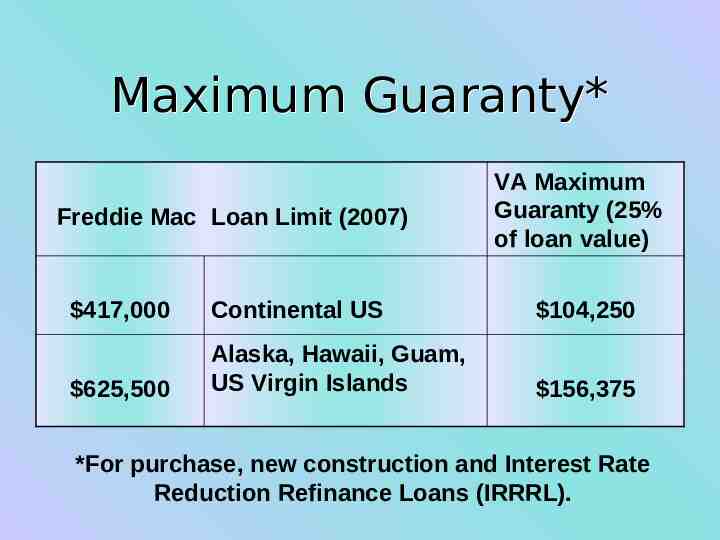

Maximum Guaranty* Freddie Mac Loan Limit (2007) VA Maximum Guaranty (25% of loan value) 417,000 Continental US 104,250 625,500 Alaska, Hawaii, Guam, US Virgin Islands 156,375 *For purchase, new construction and Interest Rate Reduction Refinance Loans (IRRRL).

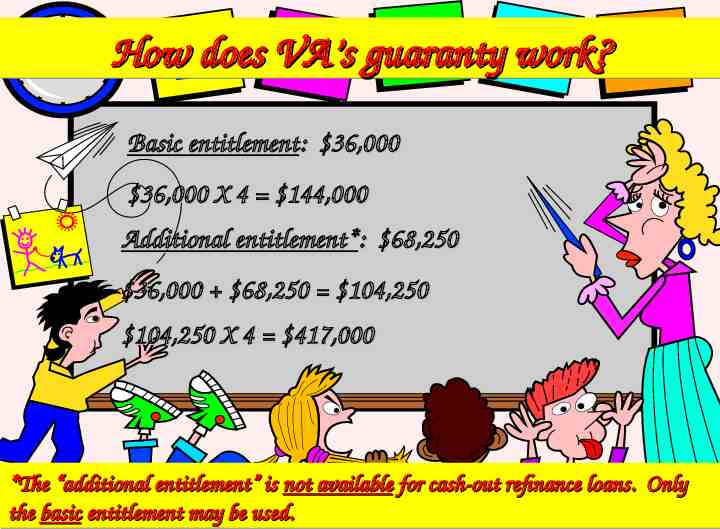

How does VA’s guaranty work? Basic entitlement: 36,000 36,000 X 4 144,000 Additional entitlement*: 68,250 36,000 68,250 104,250 104,250 X 4 417,000 *The “additional entitlement” is not available for cash-out refinance loans. Only the basic entitlement may be used.

Notes: The maximum guaranty table is located in Chapter 3, section 4a of the VA Lenders Handbook The percentage amount of guaranty is based on the loan amount including the funding fee.* *If included in loan amount.

“Remaining Entitlement” *The lender is responsible for ensuring they have a marketable loan.

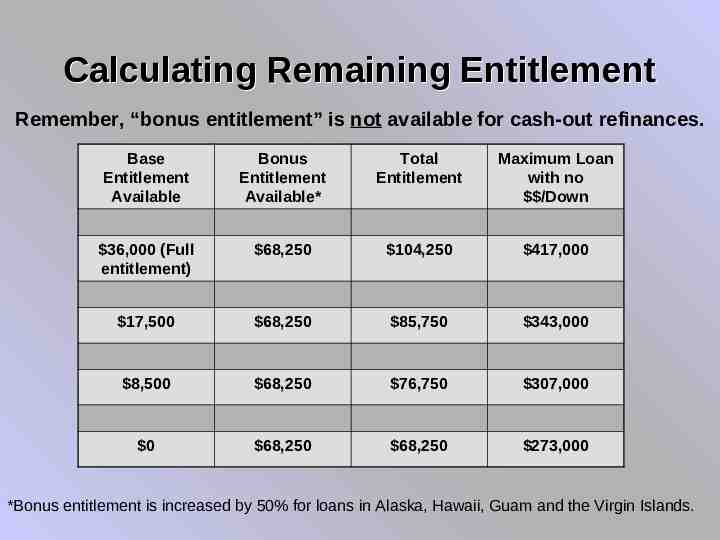

Calculating Remaining Entitlement Remember, “bonus entitlement” is not available for cash-out refinances. Base Entitlement Available Bonus Entitlement Available* Total Entitlement Maximum Loan with no /Down 36,000 (Full entitlement) 68,250 104,250 417,000 17,500 68,250 85,750 343,000 8,500 68,250 76,750 307,000 0 68,250 68,250 273,000 *Bonus entitlement is increased by 50% for loans in Alaska, Hawaii, Guam and the Virgin Islands.

Questions? Contact your nearest VA Regional Loan Center telephone or e-mail. via

Reference: VA Lenders Handbook Chapter 3 Sections 3 and 4

Thank you for your interest in the VA Home Loan Program! We appreciate your support!