Major Accounting Issues for Clubs JOHN D. DAUM, CPA, PARTNER JAMES W.

49 Slides853.30 KB

Major Accounting Issues for Clubs JOHN D. DAUM, CPA, PARTNER JAMES W. GILSON, CPA, PARTNER CONDON O’MEARA MCGINTY & DONNELLY LLP

Introduction Condon O’Meara McGinty & Donnelly LLP Providing audit, tax and other consulting services to private clubs for approximately 28 years Currently providing services to approximately 350 private clubs in 20 states Information We Will Cover Current Issues Affecting Clubs Accounting Standards Update (ASU) 2016-14 – Not-for-Profit Financial Statements Accounting Standards Codification (ASC) 606 – Revenue Recognition ASC 842 – Accounting for Leases ASC 715 – Compensation – Retirement Benefits: Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost On the Horizon

Current Issues Affecting Clubs Real Estate Taxes – A “Growing” Concern IRS Audits – Yes Please! Sales Tax Audits – Oh No! Service Charges – Are You at Risk? Cyber Attack – Are You Vulnerable?

Fun Facts and Other Nonsensical Stuff Florida is the southernmost U.S State. True or False

Fun Facts and Other Nonsensical Stuff False Which State is?

ASU 2016-14 – Not-for-Profit Entities (Topic 958) Presentation of Financial Statements of Not-for-Profit Entities Effective For Years Beginning After December 15, 2017 (December 31, 2018) Implementation Liquidity Disclosures Functional Net Expense Assets Terminology Without With Donor Restrictions Donor Restrictions

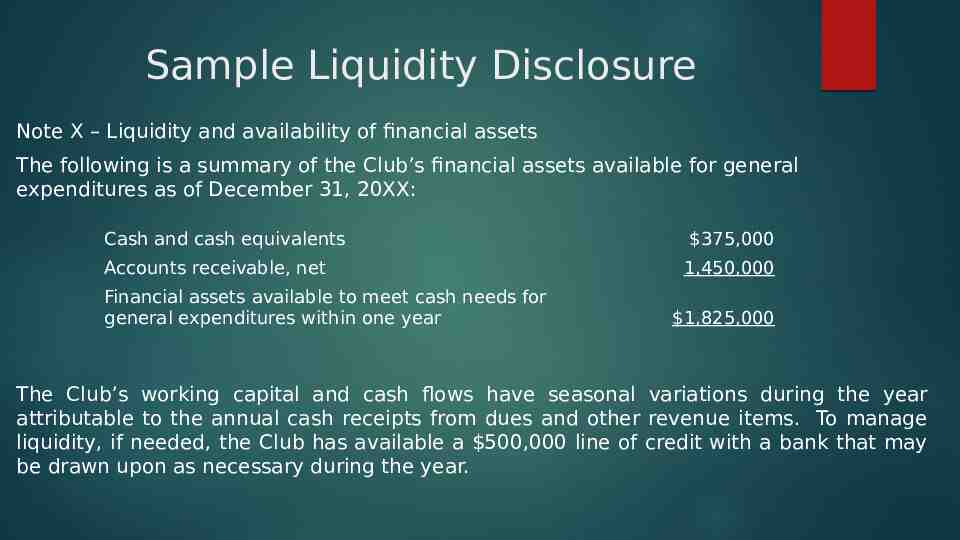

Liquidity Disclosure ASU 2016-14 Requires that an organization Provide Qualitative Information that communicates how an organization manages its liquid resources available to meet cash needs for general expenditures within one year of the balance sheet date; and Quantitative information that communicates the availability of an organization’s financial assets at the balance sheet date to meet cash needs for general expenditures within one year of the balance sheet date. Financial Assets consist of cash, investments, current receivables

Sample Liquidity Disclosure Note X – Liquidity and availability of financial assets The following is a summary of the Club’s financial assets available for general expenditures as of December 31, 20XX: Cash and cash equivalents Accounts receivable, net Financial assets available to meet cash needs for general expenditures within one year 375,000 1,450,000 1,825,000 The Club’s working capital and cash flows have seasonal variations during the year attributable to the annual cash receipts from dues and other revenue items. To manage liquidity, if needed, the Club has available a 500,000 line of credit with a bank that may be drawn upon as necessary during the year.

Functional Expense Reporting ASU 2016-14 Requires that an organization Provide Reporting of amounts of expenses by both their natural classification and their functional classification. Presentation Required to be On face of statement of activities; or Separate statement of functional expenses; or Footnote

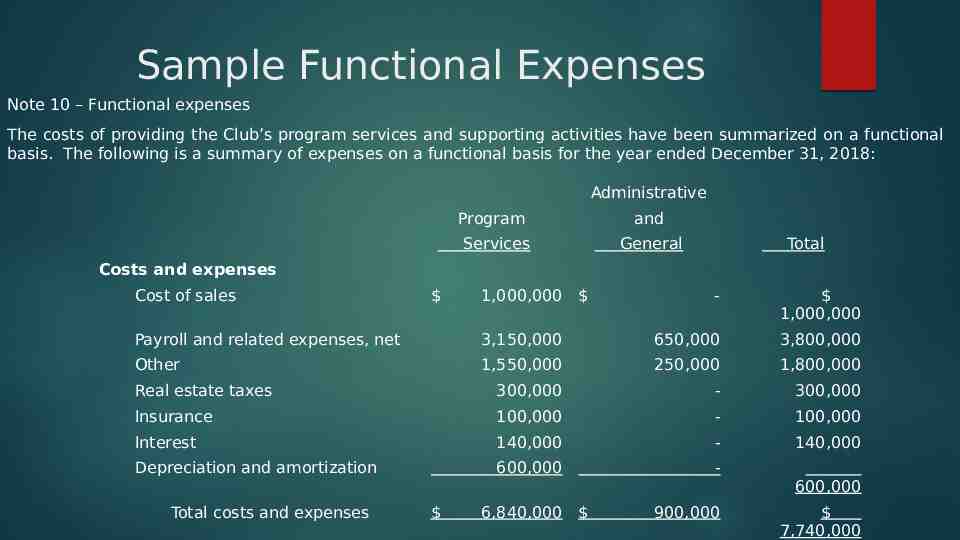

Sample Functional Expenses Note 10 – Functional expenses The costs of providing the Club’s program services and supporting activities have been summarized on a functional basis. The following is a summary of expenses on a functional basis for the year ended December 31, 2018: Administrative Program and Services General Total Costs and expenses Cost of sales 1,000,000 - 1,000,000 Payroll and related expenses, net 3,150,000 650,000 3,800,000 Other 1,550,000 250,000 1,800,000 Real estate taxes 300,000 - 300,000 Insurance 100,000 - 100,000 Interest 140,000 - 140,000 Depreciation and amortization 600,000 - Total costs and expenses 6,840,000 900,000 600,000 7,740,000

Fun Facts and Other Nonsensical Stuff Who named Florida? A) Christopher B) Flo Columbus Rida C) Ponce de Leon D) Lewis & Clark

Fun Facts and Other Nonsensical Stuff C) Ponce de Leon Named in 1513 and the word Florida means “flower”

ASC 606 – Revenue from Contracts with Customers FASB Definition of Revenue: Inflows or other enhancements of assets of an entity or settlements of its liabilities (or a combination of both) from delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major or central operations. FASB Definition of Customer: A party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration

ASC 606 – Revenue from Contracts with Customers Five Step Revenue Recognition Model Step 1 – Identify the Contract with a Customer Step 2 – Identify the Performance Obligations in the Contract Step 3 – Determine the Transaction Price Step 4 – Allocate the Transaction Price to the Performance Obligations Step 5 – Recognize Revenue When (or As) the Entity Satisfies a Performance Obligation

ASC 606 – Revenue from Contracts with Customers Step 1 – Identify the Contract with a Customer Contract – An agreement between two or more parties that creates enforceable rights and obligations The requirements of ASC 606 shall be applied to each contract that meets the following criteria: Approval and commitment of the parties Identification of the rights of the parties Identification of the payment terms The It contract has commercial substance is probable that the entity will collect the consideration to which it will be entitled in exchange for the goods or services that will be transferred to the customer

ASC 606 – Revenue from Contracts with Customers Step 2 – Identify the Performance Obligations in the Contract A Performance Obligation is a promise in a contract with a customer to transfer a good or service to the customer If more than one good or service is promised in the contract each promise should be accounted for as a performance obligation only if It is distinct A series of distinct goods or services that are substantially the same and have the same pattern of transfer A good or services is distinct if both of the following criteria are met: Capable Distinct of being distinct within the context of the contract

ASC 606 – Revenue from Contracts with Customers Step 3 – Determine the Transaction Price The transaction price is the amount of consideration (for example, payment) to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer.

ASC 606 – Revenue from Contracts with Customers Step 4 – Allocate the Transaction Price to the Performance Obligations in the Contract For contracts with multiple performance obligations, an entity should allocate the transaction price to each performance obligation in an amount that depicts the amount of consideration to which the entity expects to be entitled in exchange for satisfying each performance obligation To allocate an appropriate amount of consideration to each performance obligation Determine Allocate the standalone selling price of the distinct goods or services the transaction price on a relative standalone selling price basis

ASC 606 – Revenue from Contracts with Customers Step 5 – Recognize Revenue When (or As) the Entity Satisfies a Performance Obligation Revenue is recognized when (or as) Performance Obligation(s) are satisfied by transferring goods or services to a customer Transfer occurs when (or as) a customer obtains control of that good or service Entity should determine if performance obligations are satisfied over time by transferring control of a good or service over time. If an entity does not satisfy a performance obligation over time, the performance obligation is satisfied at a point in time. Criteria for satisfying performance obligation(s) and recognizing revenue over time: Customer simultaneously receives and consumes the benefits provided as the entity performs them Entity’s performance creates or enhances an asset that the customer controls as the asset is created or enhanced Entity’s performance does not create an asset with an alternative use to the entity and the entity has an enforceable right to payment for performed completed to date

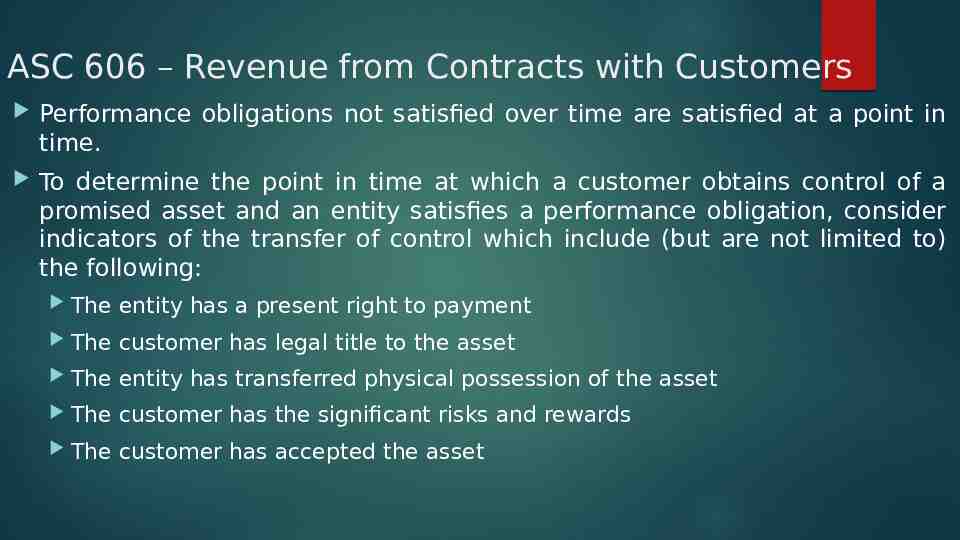

ASC 606 – Revenue from Contracts with Customers Performance obligations not satisfied over time are satisfied at a point in time. To determine the point in time at which a customer obtains control of a promised asset and an entity satisfies a performance obligation, consider indicators of the transfer of control which include (but are not limited to) the following: The entity has a present right to payment The customer has legal title to the asset The entity has transferred physical possession of the asset The customer has the significant risks and rewards The customer has accepted the asset

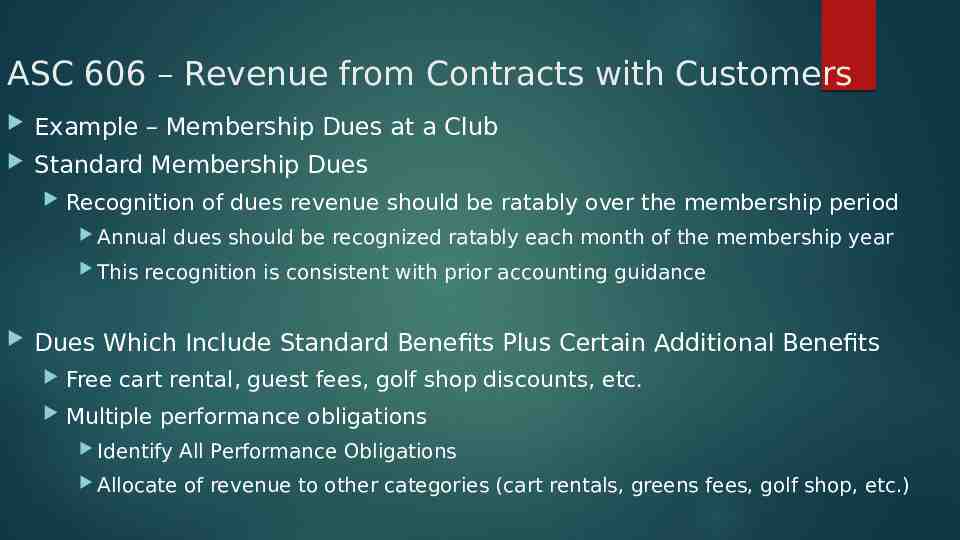

ASC 606 – Revenue from Contracts with Customers Example – Membership Dues at a Club Standard Membership Dues Recognition of dues revenue should be ratably over the membership period Annual This dues should be recognized ratably each month of the membership year recognition is consistent with prior accounting guidance Dues Which Include Standard Benefits Plus Certain Additional Benefits Free cart rental, guest fees, golf shop discounts, etc. Multiple performance obligations Identify Allocate All Performance Obligations of revenue to other categories (cart rentals, greens fees, golf shop, etc.)

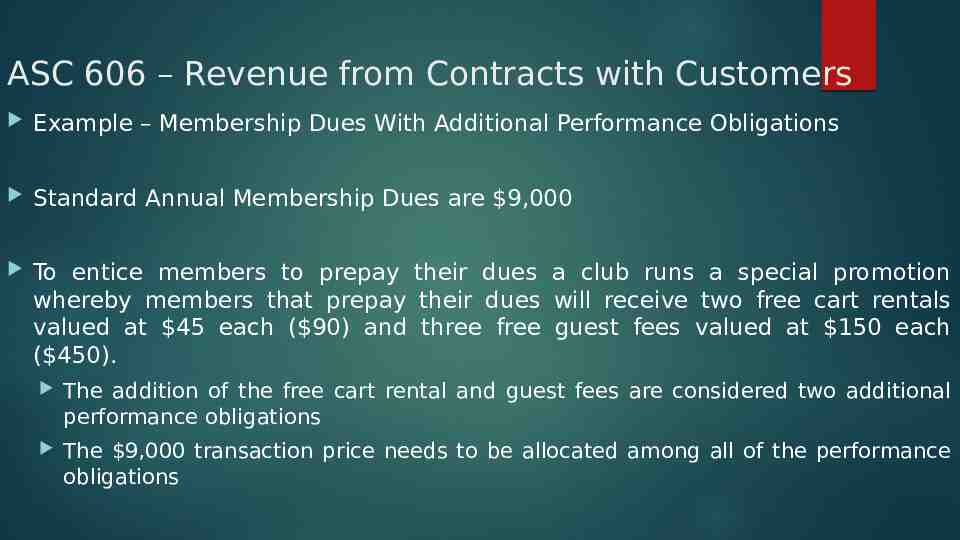

ASC 606 – Revenue from Contracts with Customers Example – Membership Dues With Additional Performance Obligations Standard Annual Membership Dues are 9,000 To entice members to prepay their dues a club runs a special promotion whereby members that prepay their dues will receive two free cart rentals valued at 45 each ( 90) and three free guest fees valued at 150 each ( 450). The addition of the free cart rental and guest fees are considered two additional performance obligations The 9,000 transaction price needs to be allocated among all of the performance obligations

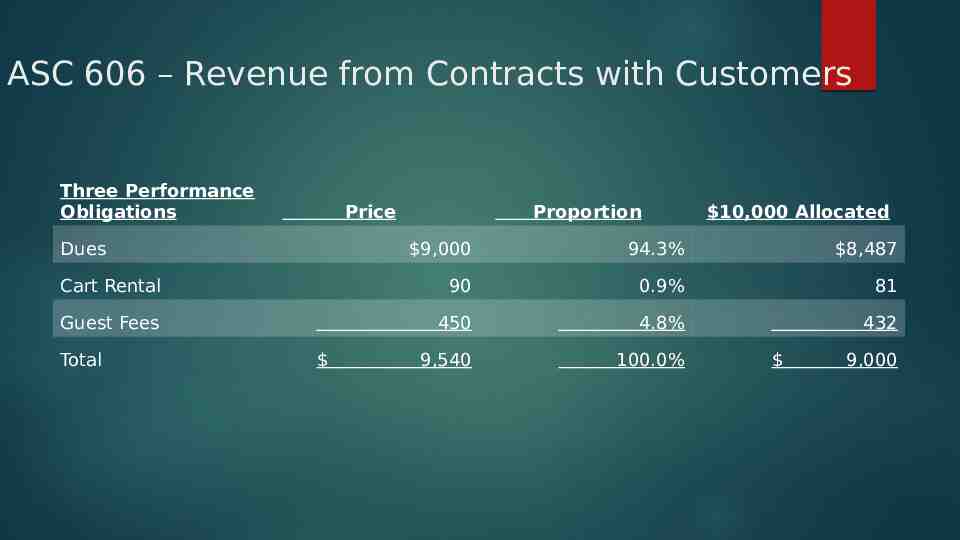

ASC 606 – Revenue from Contracts with Customers Three Performance Obligations Price Dues Proportion 10,000 Allocated 9,000 94.3% 8,487 Cart Rental 90 0.9% 81 Guest Fees 450 4.8% 432 9,540 100.0% Total 9,000

ASC 606 – Revenue from Contracts with Customers Accounting for The Three Performance Obligations Dues would be recorded as contract liability for dues for 8,487 when billed and then recognized into revenue ratably over the 12-month membership period at 707.25 per month. The Cart Rental and Guest Fees would be recorded as contract liabilities for these items when the dues are billed and recognized into revenue when the member utilizes these services.

ASC 606 – Revenue from Contracts with Customers Initiation Fees Under prior accounting standards initiation fees were typically recognized as revenue when billed Under ASC 606 the revenue recognition for such fees will depend on the individual club’s interpretation of the Standard Are members customers? If no (equity members), ASC 606 does not apply. If, under the definition contained in the standard, it is determined that a member is a customer the club must determine whether the initiation fee relates to future goods and services If initiation fees are deemed to related to future goods and services such fees should be amortized into revenue based on satisfaction of the relative performance obligations (i.e. time, usage, etc.) If the initiation fees are deemed to not be related to future goods or services, such fees should be recognized when billed (same as prior standards)

ASC 606 – Revenue from Contracts with Customers ASC Topic 606 is effective as follows: Public organizations – annual beginning after December 15, 2017 reporting periods Nonpublic companies – annual reporting periods beginning after December 15, 2018 (2019 Calendar Year & Fiscal Years ending in 2020)

Fun Facts and Other Nonsensical Stuff How many total professional sports teams, in the four major sports, does Florida have? A) 8 B) 9 C) 10 D) 11

Fun Facts and Other Nonsensical Stuff B) 9 Can you name them?

ASC – 842 – Accounting for Leases FASB definition of a lease – A contract, or part of a contract, that conveys the right to control the use of identified property, plant, or equipment (an identified asset) for a period of time in exchange for consideration. Control over use of the asset means the customer has: The right to obtain substantially all of the economic benefits from the use of the asset and The right to direct the use of the asset

ASC – 842 – Accounting for Leases ASU 2016-02 (ASC Topic 842) Leases – revised the accounting standards for leases FASB decided that lessees should be required to recognize the assets and liabilities arising from leases on the balance sheet (statement of financial position). Under previous GAAP only capital leases were reflected on the balance sheet.

ASC – 842 – Accounting for Leases FASB maintained two classes of leases Operating Finance leases (operating leases) leases (capital leases) The classification criteria for distinguishing between operating and finance leases is substantially similar to the classification criteria for distinguishing between operating leases and capital leases in previous GAAP The effect of leases on the statement of comprehensive income (statement of activities) and the statement of cash flows is largely unchanged from previous GAAP

ASC – 842 – Accounting for Leases The core principle of ASC 842 is that a lessee should recognize the assets and liabilities that arise from leases. Under prior GAAP assets and liabilities were only recognized for capital leases, therefore the assets and liabilities created by most leases were not reflected on the statement of financial position Recognize a liability to make lease payments (lease liability) Recognize a right-of-use asset Short-term leases – leases of less than one year, the customer can elect short-term lease recognition and measurement exemption

ASC – 842 – Accounting for Leases ASC 842 Requires the lessee to separate lease components from non-lease components in a contract Non-lease components can include maintenance services and are not included within the scope of ASC 842 Practical Expedient for Lessees: Lessees may make an accounting policy election by class of underlying asset not to separate lease components from non-lease components

ASC – 842 – Accounting for Leases Finance Leases For a finance lease, a lessee is required to do the following: Recognize a right-of-use asset and a lease liability, initially measured at the present value of the lease payments, in the statement of financial position Recognize interest on the lease liability separately from amortization of the right-of-use asset in the statement of comprehensive income (statement of activities) Classify repayments of the principal portion of the lease liability within financing activities and payments of interest on the lease liability and variable lease payments within operating activities in the statement of cash flows

ASC – 842 – Accounting for Leases Finance Leases A lease shall be classified as a finance lease when the lease meets any of the following criteria at lease commencement: Transfer of ownership of underlying asset to lessee by end of term Lease contains an option to purchase the underlying asset that the lessee is reasonably certain to exercise Lease term is for the major part of the remaining economic life of the underlying asset (i.e. 75% or more) Present value of the sum of the lease payments and any residual value guaranteed by the lessee that is not reflected in the lease payments equals or exceeds substantially all of the fair value of the underlying asset (i.e. 90% or more) The underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term

ASC – 842 – Accounting for Leases Operating Leases When none of the finance lease criteria are met a lessee shall classify the lease as an operating lease For operating leases, a lessee is required to do the following: Recognize a right-of-use asset and a lease liability, initially measured at the present value of the lease payments, in the statement of financial position Recognize a single lease cost, calculated so that the cost of the lease is allocated over the lease term on a generally straight-line basis Classify all cash payments within operating activities in the statement of cash flows

ASC – 842 – Accounting for Leases Other Items to Note Initial direct costs incurred by lessee are incremental costs of a lease that would not have been incurred if the lease had not been obtained, such as commissions Initial direct costs shall be capitalized in the initial measurement of the right-of-use asset and are amortized ratably over the lease term as part of the total lease cost. Discount For Rate a lessee, the discount rate for the lease is the rate implicit in the lease unless that rate cannot be readily determined. In that case, the lessee is required to use its incremental borrowing rate.

ASC – 842 – Accounting for Leases Common Disclosure Requirements for Clubs A lessee shall disclose the following: A general description of its leases Basis and terms and conditions of options to extend or terminate the lease Existence and terms and conditions of residual value guarantees Restrictions or covenants imposed by the leases A lessee shall disclose the following amounts for each period presented: Finance lease cost – segregated between amortization of the right-ofuse asset and interest expense Operating lease cost Short-term lease cost

ASC – 842 – Accounting for Leases Common Disclosure Requirements for Clubs A lessee shall disclose the following amounts for each period presented: Amounts segregated between those for finance and operating leases for the following items: Cash paid for amounts included in the measurement of lease liabilities, segregated between operating and financing cash flows Supplemental non-cash information on lease liabilities arising from obtaining right-of-use assets Weighted-average Weighted remaining lease term average discount rate

ASC – 842 – Accounting for Leases Lease Example – Purchase Option Reasonably Certain to be Exercised Lease details: Five-year Annual End lease payments total 59,000 ( 295,000 total) of lease option to purchase equipment for 5,000 Expected Fair residual value of the equipment at lease end is 75,000 value of the equipment at lease commencement is 250,000 Economic No lease for equipment life of the equipment is 7 years initial direct costs or lease incentives required to be paid by lessee Discount rate for the lease is lessee’s incremental borrowing rate of 6.5% (Present Value of Lease Payments at Inception 248,834) What type of lease is this?

ASC – 842 – Accounting for Leases A Finance Lease! Because the lease grants the lessee an option to purchase the underlying asset that it is reasonably certain to exercise, the lessee classifies this lease as a finance lease Lessee recognizes lease liability and right-of-use asset at present value of future lease payments plus the present value of the purchase option Lessee amortizes right-of-use asset over economic life of seven years (not the five-year lease term) Lessee recognizes expense for amortization of right-of-use asset and interest on the lease liability each year of the lease

ASC – 842 – Accounting for Leases ASC Topic 842 is effective as follows: Public organizations – annual reporting periods beginning after December 15, 2018 Nonpublic companies – currently effective annual reporting periods beginning after December 15, 2019 (2020 Calendar Year & Fiscal Years ending in 2021) On October 16, 2019, FASB decided to defer mandatory effective date for nonpublic entities by an additional year. Therefore, ASC 842 will be effective for nonpublic entities for years beginning after December 15, 2020 (2021 Calendar Year & Fiscal Years ending in 2022) – Final Accounting Standards Update to be voted upon by FASB

Fun Facts and Other Nonsensical Stuff

Fun Facts and Other Nonsensical Stuff The water tower on the previous slide has a name. What is it? A) Walt’s Water B) Earffel Tower C) Mickey’s Water Works D) It’s Friday afternoon, I need a drink and I could care less

Fun Facts and Other Nonsensical Stuff B) Earffel Tower Only a few more minutes people .be strong

ASC 715 – Compensation – Retirement Benefits ASC 715 was amended by ASU 2017-07 in March, 2017 This amendment was made to improve the presentation of net periodic benefit cost and net periodic post retirement benefit cost ASU 2017-07 requires that an employer report the service cost component in the same line item or items as other compensation costs arising from services rendered by the pertinent employees during the period. Other components of net benefit cost are required to be presented in the income statement separately from the service cost component and outside a subtotal of income from operations, if one is presented. ASU 2017-07 is effective for public business entities for annual periods beginning after December 15, 2017 and for non-public business entities for annual periods beginning after December 15, 2018 (2019 calendaryear and fiscal years ending in 2020).

References To Prepare this Program We Utilized the Following Sources: FASB https://fasb.org/home ASU 2016-14 https://www.fasb.org/jsp/FASB/Document C/DocumentPage?cid 1176168381847&acc eptedDisclaimer true ASC 606 (ASU 2016-08) https://www.fasb.org/jsp/FASB/Document C/DocumentPage?cid 1176167987739&acc eptedDisclaimer true ASC 842 (ASU 2016-02) https://asc.fasb.org/imageRoot/39/117422939.pdf ASC 715 (ASU 2017-07) https://fasb.org/jsp/FASB/Document C/DocumentPage?cid 1176168888120&accepte dDisclaimer true

On the Horizon Proposed Accounting Standards Update (Revised) Debt (Topic 470): Simplifying the Classification of Debt in a Classified Balance Sheet (Current versus Noncurrent) Original issuance January 10, 2017 Re-issuance September 12, 2019, comments due by October 28, 2019 Main Provisions: Introduce a principle for determining whether debt or other instruments within the scope of the proposed amendments would be classified as a noncurrent liability as of the balance sheet date. Would require short-term debt that is refinanced after the balance sheet date to be reported as a current liability (as a non-recognized subsequent event)

Thank You! Condon O’Meara McGinty & Donnelly LLP John D. Daum, CPA Partner Telephone: (212) 661-7777 Email: [email protected] James W. Gilson, CPA Partner Telephone: (212) 661-7777 Email: [email protected]