Callable bonds Bonds that may be repurchased by the issuer at

26 Slides188.50 KB

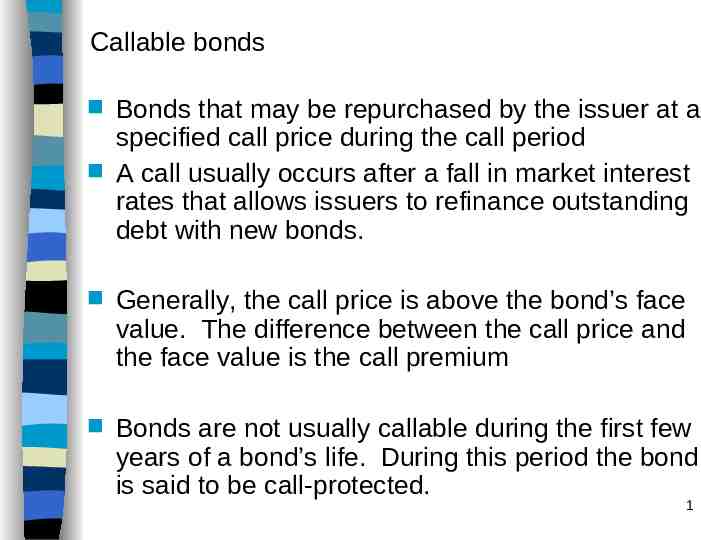

Callable bonds Bonds that may be repurchased by the issuer at a specified call price during the call period A call usually occurs after a fall in market interest rates that allows issuers to refinance outstanding debt with new bonds. Generally, the call price is above the bond’s face value. The difference between the call price and the face value is the call premium Bonds are not usually callable during the first few years of a bond’s life. During this period the bond is said to be call-protected. 1

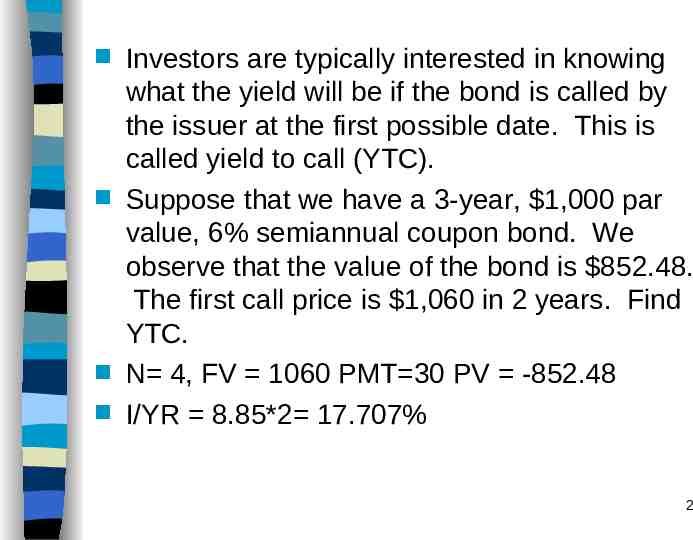

Investors are typically interested in knowing what the yield will be if the bond is called by the issuer at the first possible date. This is called yield to call (YTC). Suppose that we have a 3-year, 1,000 par value, 6% semiannual coupon bond. We observe that the value of the bond is 852.48. The first call price is 1,060 in 2 years. Find YTC. N 4, FV 1060 PMT 30 PV -852.48 I/YR 8.85*2 17.707% 2

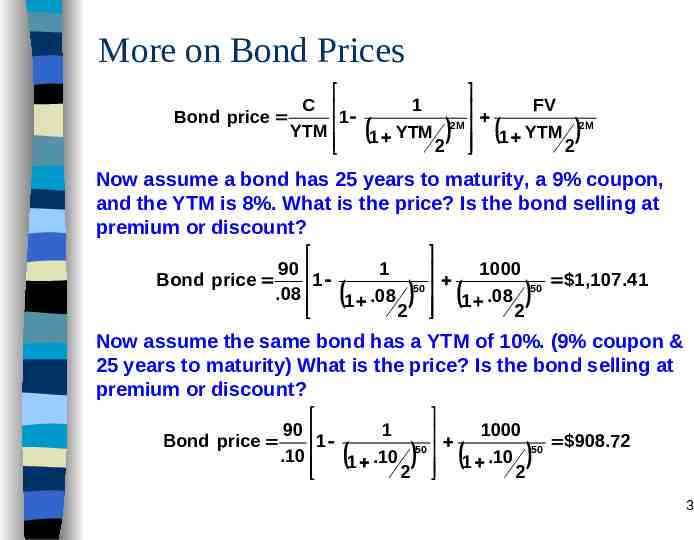

More on Bond Prices C 1 FV Bond price 1 2M 2M YTM YTM YTM 1 1 2 2 Now assume a bond has 25 years to maturity, a 9% coupon, and the YTM is 8%. What is the price? Is the bond selling at premium or discount? 90 1 1000 Bond price 1 1,107.41 50 50 .08 1 .08 1 .08 2 2 Now assume the same bond has a YTM of 10%. (9% coupon & 25 years to maturity) What is the price? Is the bond selling at premium or discount? 90 1 1000 Bond price 1 908.72 50 50 .10 1 .10 1 .10 2 2 3

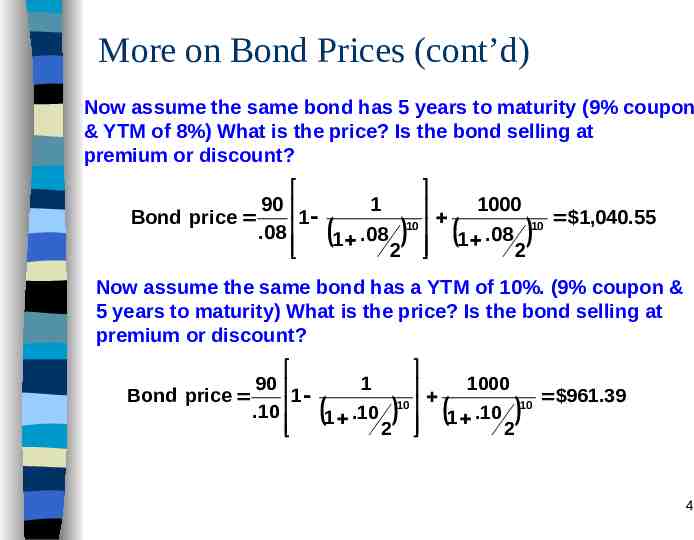

More on Bond Prices (cont’d) Now assume the same bond has 5 years to maturity (9% coupon & YTM of 8%) What is the price? Is the bond selling at premium or discount? 90 1 1000 Bond price 1 1,040.55 10 10 .08 1 .08 1 .08 2 2 Now assume the same bond has a YTM of 10%. (9% coupon & 5 years to maturity) What is the price? Is the bond selling at premium or discount? 90 1 1000 Bond price 1 961.39 10 10 .10 1 .10 1 .10 2 2 4

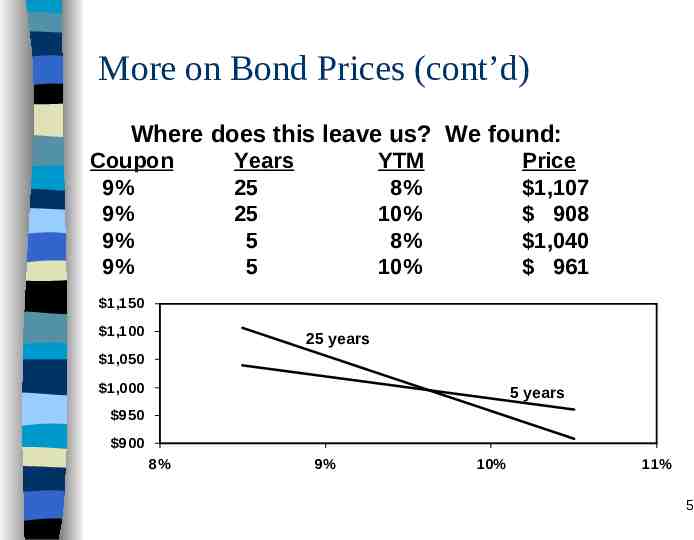

More on Bond Prices (cont’d) Where does this leave us? We found: Coupon 9% 9% 9% 9% Years 25 25 5 5 YTM 8% 10% 8% 10% Price 1,107 908 1,040 961 1,150 1,100 25 years 1,050 1,000 5 years 950 900 8% 9% 10% 11% 5

Decreasing yields cause bond prices to rise, but long-term bonds increase more than short-term. Similarly, increasing yields cause long-term bonds to decrease in price more than short-term bonds. 6

Malkiel’s Theorems Summarizes the relationship between bond prices, yields, coupons, and maturity: all theorems are ceteris paribus: 1) Bond prices move inversely with interest rates. 2) The longer the maturity of a bond, the more sensitive is it’s price to a change in interest rates. 7

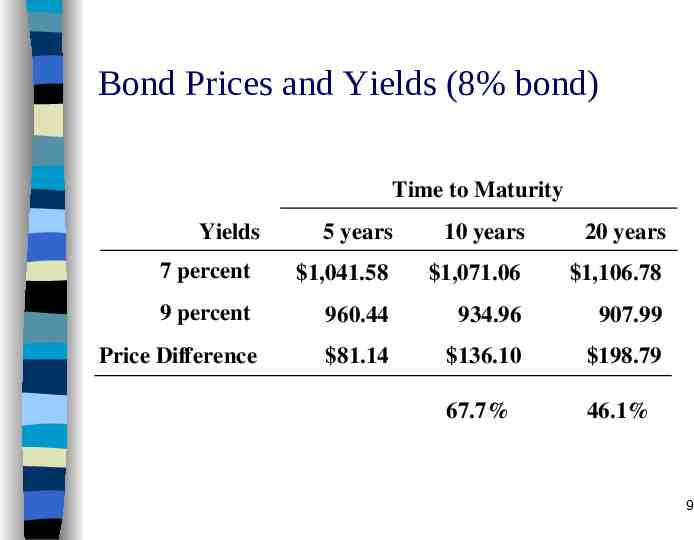

3) The price sensitivity of any bond increases with it’s maturity, but the increase occurs at a decreasing rate. A 10-year bond is much more sensitive to changes in yield than a 1-year bond. However, a 30-year bond is only slightly more sensitive than a 20-year bond . 8

Bond Prices and Yields (8% bond) Time to Maturity Yields 5 years 10 years 20 years 7 percent 1,041.58 1,071.06 1,106.78 9 percent 960.44 934.96 907.99 Price Difference 81.14 136.10 198.79 67.7% 46.1% 9

4) The lower the coupon rate on a bond, the more sensitive is it’s price to a change in interest rates. If two bonds with different coupon rates have the same maturity, then the value of the one with the lower coupon is proportionately more dependent on the face amount to be received at maturity. As a result, all other things being equal, the value of lower coupon bonds will fluctuate more as interest rates change. Put another way, the bond with the higher coupon has a larger cash flow early in its life, so its value is less sensitive to changes in the discount rate 10

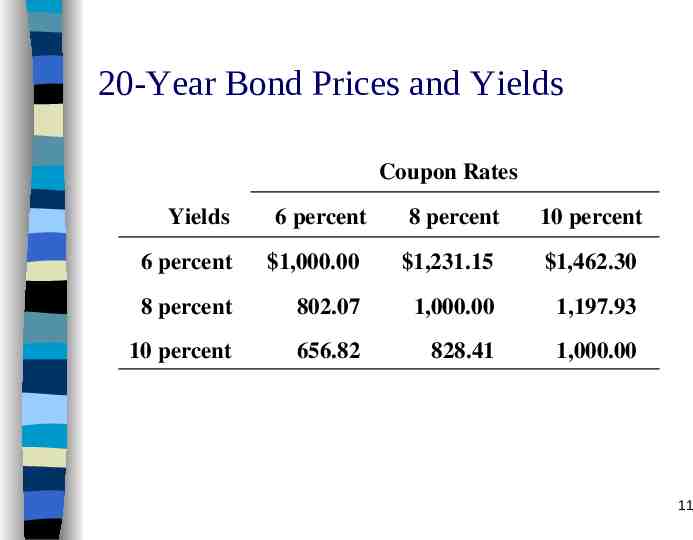

20-Year Bond Prices and Yields Coupon Rates Yields 6 percent 8 percent 10 percent 6 percent 1,000.00 1,231.15 1,462.30 8 percent 802.07 1,000.00 1,197.93 10 percent 656.82 828.41 1,000.00 11

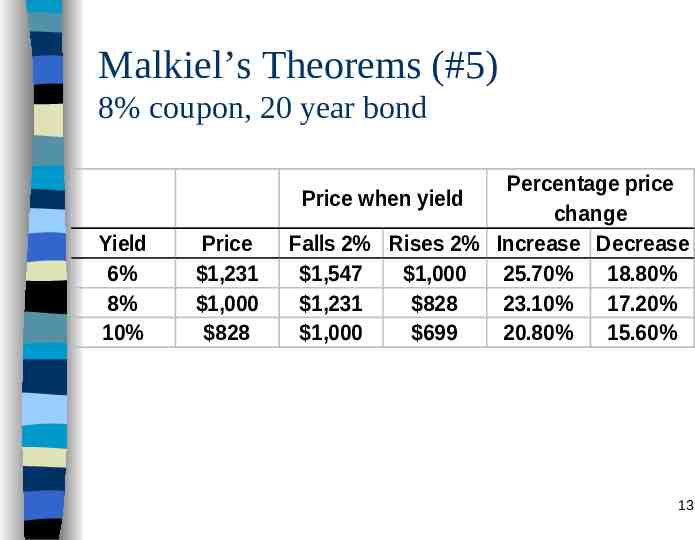

5) For a given absolute change in a bond’s yield to maturity, the magnitude of the price increase caused by a decrease in yield is greater than the price decrease caused by an increase in yield 12

Malkiel’s Theorems (#5) 8% coupon, 20 year bond Yield 6% 8% 10% Price 1,231 1,000 828 Percentage price Price when yield change Falls 2% Rises 2% Increase Decrease 1,547 1,000 25.70% 18.80% 1,231 828 23.10% 17.20% 1,000 699 20.80% 15.60% 13

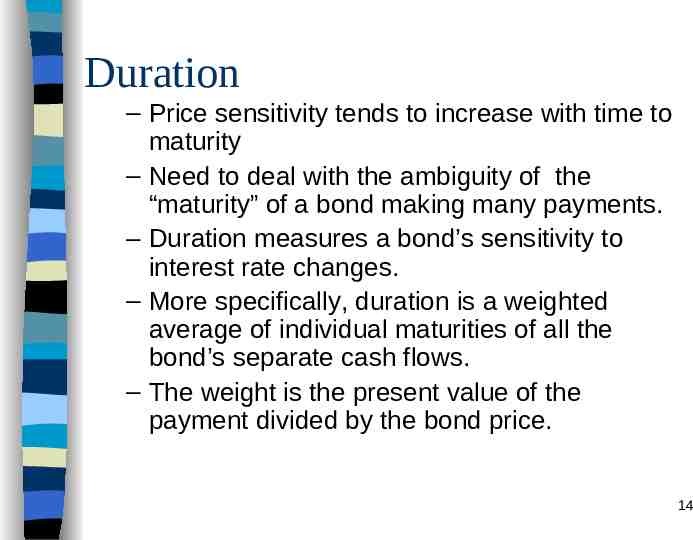

Duration – Price sensitivity tends to increase with time to maturity – Need to deal with the ambiguity of the “maturity” of a bond making many payments. – Duration measures a bond’s sensitivity to interest rate changes. – More specifically, duration is a weighted average of individual maturities of all the bond’s separate cash flows. – The weight is the present value of the payment divided by the bond price. 14

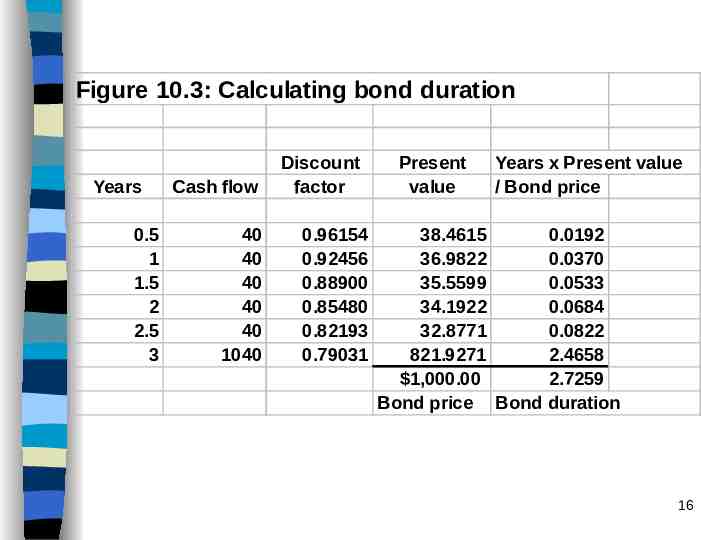

Calculate a duration for a bond with three years until maturity. 8% of Coupon rate and yield. 15

Figure 10.3: Calculating bond duration Years 0.5 1 1.5 2 2.5 3 Cash flow 40 40 40 40 40 1040 Discount factor 0.96154 0.92456 0.88900 0.85480 0.82193 0.79031 Present value Years x Present value / Bond price 38.4615 0.0192 36.9822 0.0370 35.5599 0.0533 34.1922 0.0684 32.8771 0.0822 821.9271 2.4658 1,000.00 2.7259 Bond price Bond duration 16

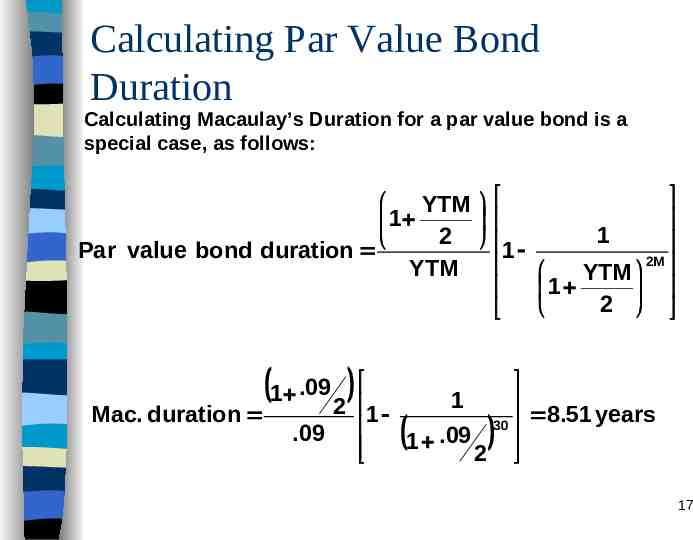

Calculating Par Value Bond Duration Calculating Macaulay’s Duration for a par value bond is a special case, as follows: YTM 1 2 Par value bond duration YTM 1 .09 2 1 Mac. duration .09 1 1 2M YTM 1 2 1 8.51 years 30 .09 1 2 17

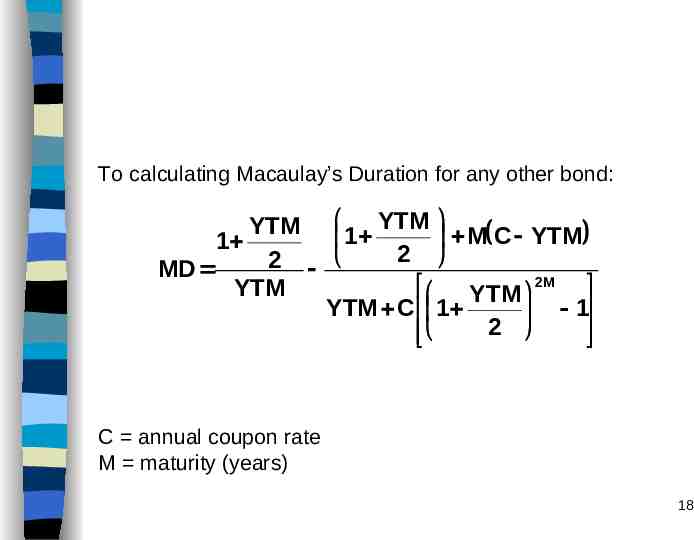

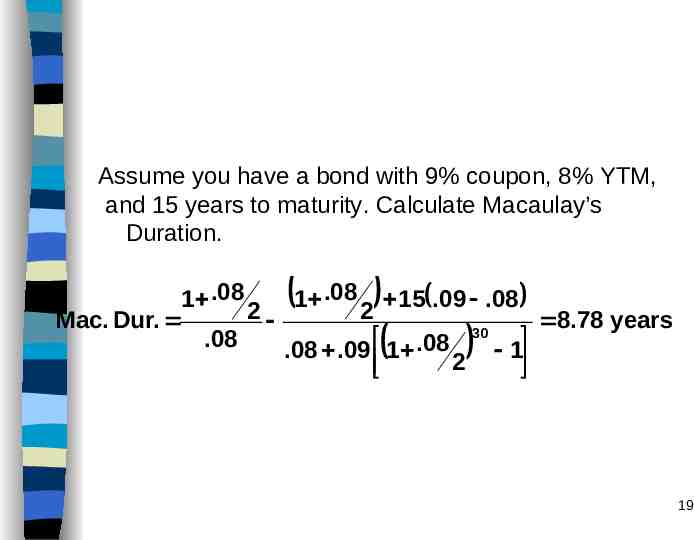

To calculating Macaulay’s Duration for any other bond: YTM 1 YTM M C YTM 1 2 2 MD 2M YTM YTM YTM C 1 1 2 C annual coupon rate M maturity (years) 18

Assume you have a bond with 9% coupon, 8% YTM, and 15 years to maturity. Calculate Macaulay’s Duration. 1 .08 1 .08 15 .09 .08 2 2 Mac. Dur. 8.78 years 30 .08 .08 .09 1 .08 1 2 19

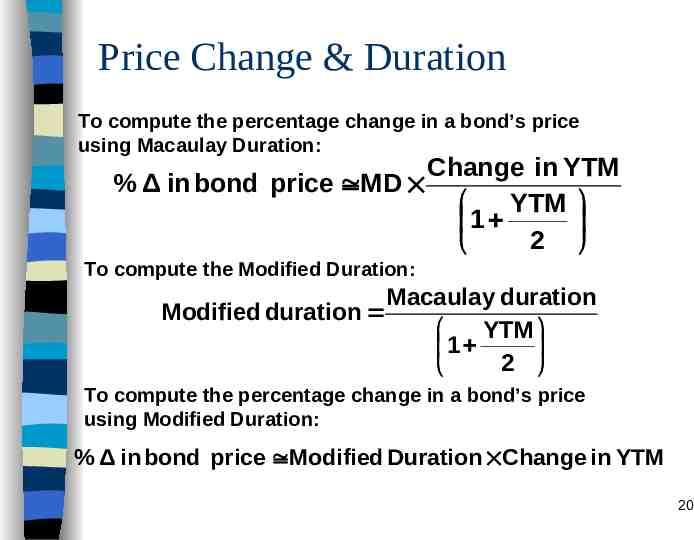

Price Change & Duration To compute the percentage change in a bond’s price using Macaulay Duration: Change in YTM % Δ in bond price MD YTM 1 2 To compute the Modified Duration: Macaulay duration Modified duration YTM 1 2 To compute the percentage change in a bond’s price using Modified Duration: % Δ in bond price Modified Duration Change in YTM 20

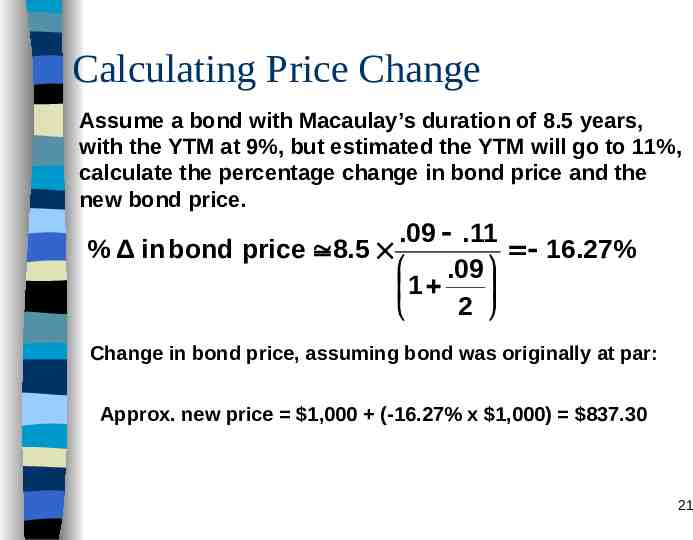

Calculating Price Change Assume a bond with Macaulay’s duration of 8.5 years, with the YTM at 9%, but estimated the YTM will go to 11%, calculate the percentage change in bond price and the new bond price. .09 .11 % Δ in bond price 8.5 16.27% .09 1 2 Change in bond price, assuming bond was originally at par: Approx. new price 1,000 (-16.27% x 1,000) 837.30 21

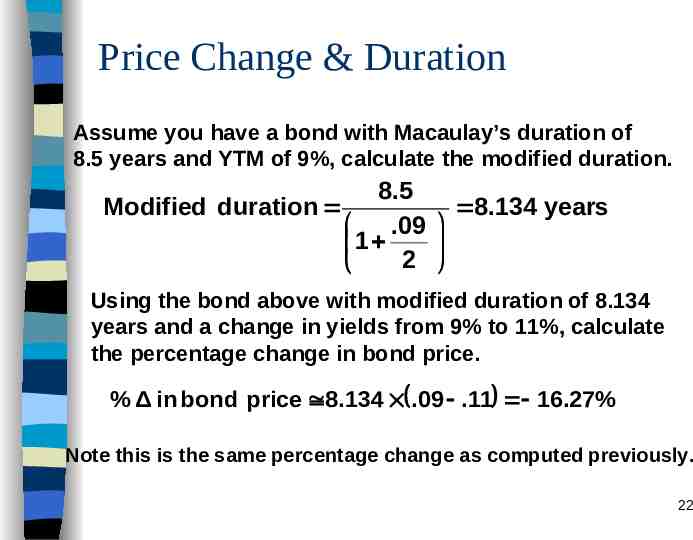

Price Change & Duration Assume you have a bond with Macaulay’s duration of 8.5 years and YTM of 9%, calculate the modified duration. 8.5 Modified duration 8.134 years .09 1 2 Using the bond above with modified duration of 8.134 years and a change in yields from 9% to 11%, calculate the percentage change in bond price. % Δ in bond price 8.134 .09 .11 16.27% Note this is the same percentage change as computed previously. 22

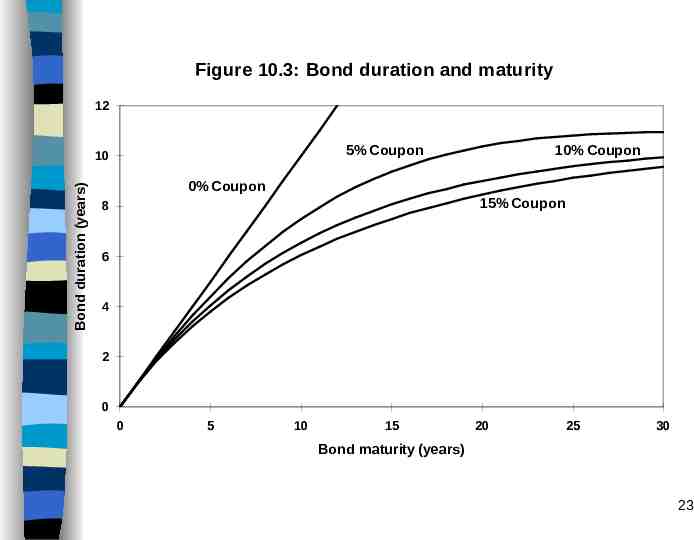

Figure 10.3: Bond duration and maturity 12 5% Coupon Bond duration (years) 10 10% Coupon 0% Coupon 15% Coupon 8 6 4 2 0 0 5 10 15 20 25 30 Bond maturity (years) 23

Zero coupon bond: duration maturity Duration Properties – Longer maturity, longer duration – Duration increases at a decreasing rate as maturity lengthens – Lower coupon, longer duration – Higher yield, shorter duration 24

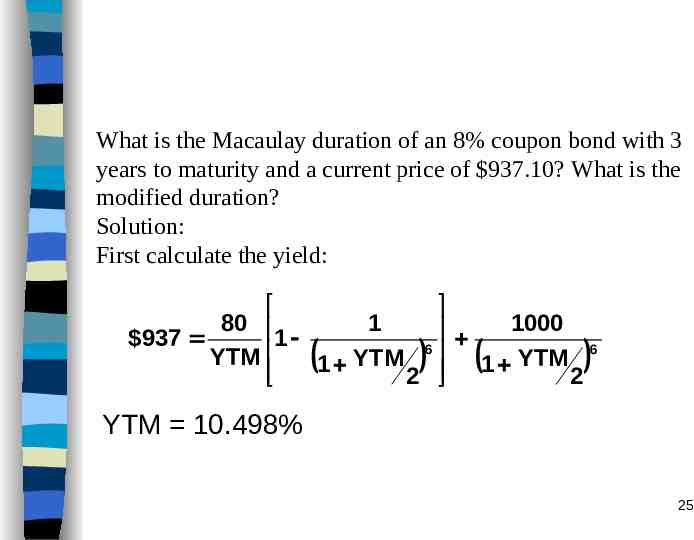

What is the Macaulay duration of an 8% coupon bond with 3 years to maturity and a current price of 937.10? What is the modified duration? Solution: First calculate the yield: 80 1 1000 937 1 6 6 YTM YTM YTM 1 1 2 2 YTM 10.498% 25

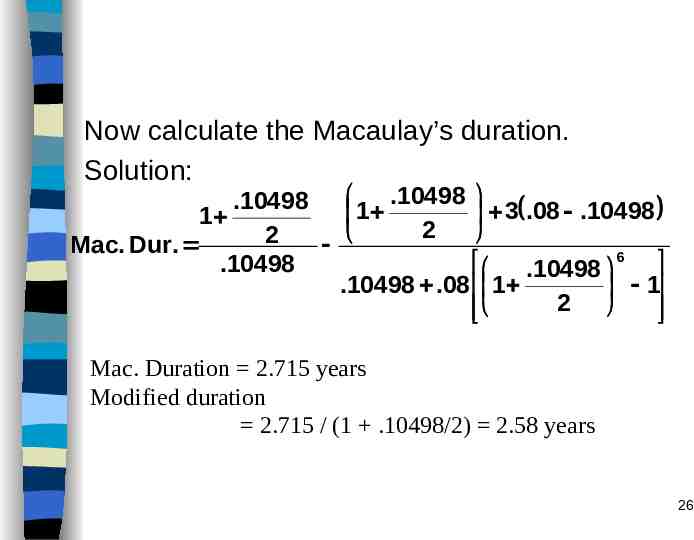

Now calculate the Macaulay’s duration. Solution: .10498 1 .10498 3 .08 .10498 1 2 2 Mac. Dur. .10498 .10498 6 .10498 .08 1 1 2 Mac. Duration 2.715 years Modified duration 2.715 / (1 .10498/2) 2.58 years 26