INVESTOR PRESENTATION 30 JULY 2008 Koos Vorster WORLD

22 Slides1.94 MB

INVESTOR PRESENTATION 30 JULY 2008 Koos Vorster WORLD CLASS MANUFACTURER OF COPPER AND OPTICAL FIBRE COMMUNICATION CABLES AND CABLE ACCESSORIES

AGENDA STRUCTURE AND SHAREHOLDING FACILITIES PRODUCT OVERVIEW MARKET GROWTH PROSPECTS QUESTIONS

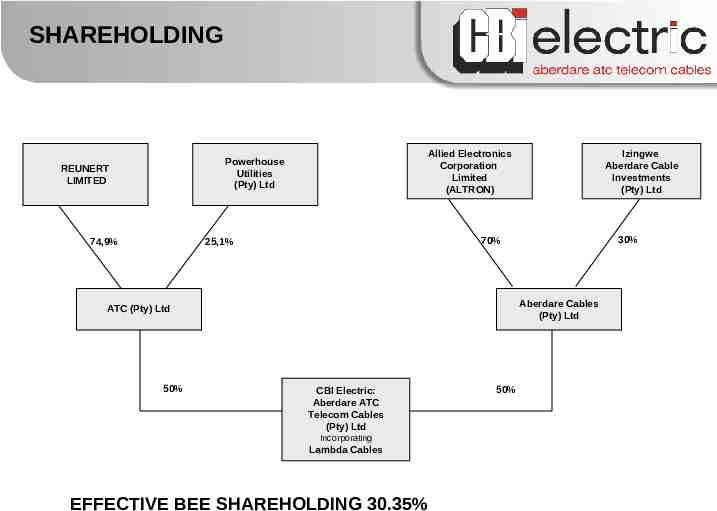

SHAREHOLDING Allied Electronics Corporation Limited (ALTRON) Powerhouse Utilities (Pty) Ltd REUNERT LIMITED 74,9% 30% 70% 25,1% Aberdare Cables (Pty) Ltd ATC (Pty) Ltd 50% Izingwe Aberdare Cable Investments (Pty) Ltd CBI Electric: Aberdare ATC Telecom Cables (Pty) Ltd Incorporating Lambda Cables EFFECTIVE BEE SHAREHOLDING 30.35% 50%

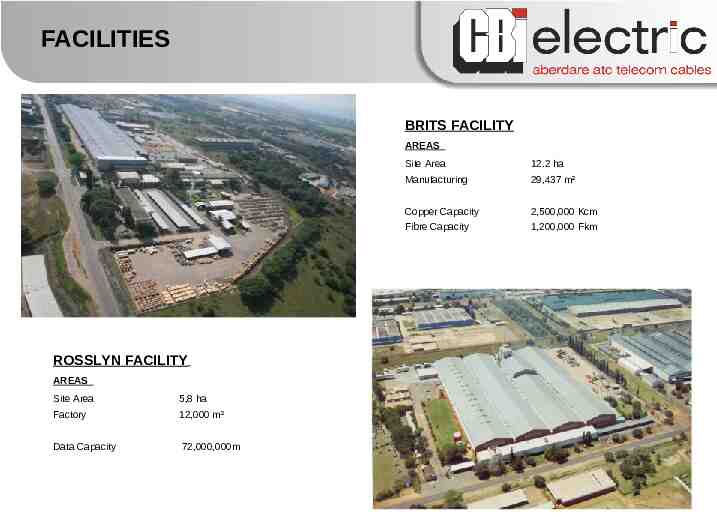

FACILITIES BRITS FACILITY AREAS ROSSLYN FACILITY AREAS Site Area 5,8 ha Factory 12,000 m² Data Capacity 72,000,000m Site Area 12.2 ha Manufacturing 29,437 m² Copper Capacity 2,500,000 Kcm Fibre Capacity 1,200,000 Fkm

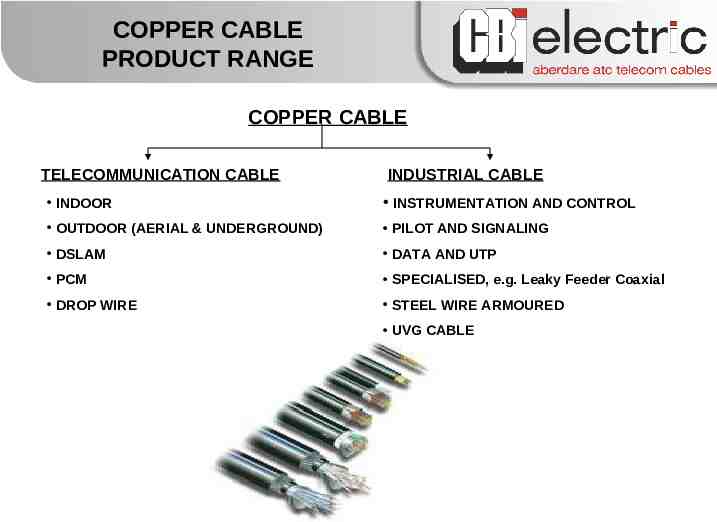

COPPER CABLE PRODUCT RANGE COPPER CABLE TELECOMMUNICATION CABLE INDUSTRIAL CABLE INDOOR INSTRUMENTATION AND CONTROL OUTDOOR (AERIAL & UNDERGROUND) PILOT AND SIGNALING DSLAM DATA AND UTP PCM SPECIALISED, e.g. Leaky Feeder Coaxial DROP WIRE STEEL WIRE ARMOURED UVG CABLE

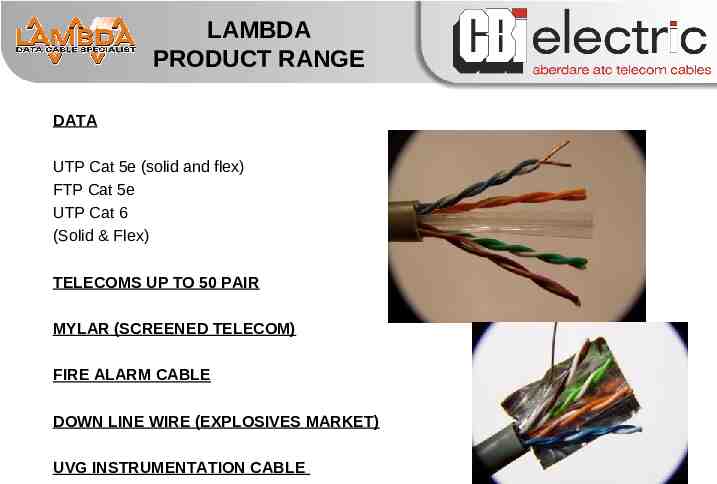

LAMBDA PRODUCT RANGE DATA UTP Cat 5e (solid and flex) FTP Cat 5e UTP Cat 6 (Solid & Flex) TELECOMS UP TO 50 PAIR MYLAR (SCREENED TELECOM) FIRE ALARM CABLE DOWN LINE WIRE (EXPLOSIVES MARKET) UVG INSTRUMENTATION CABLE

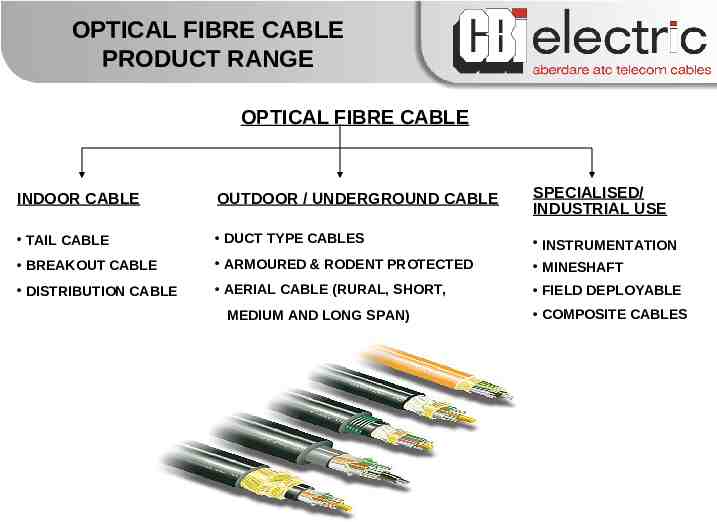

OPTICAL FIBRE CABLE PRODUCT RANGE OPTICAL FIBRE CABLE INDOOR CABLE OUTDOOR / UNDERGROUND CABLE SPECIALISED/ INDUSTRIAL USE TAIL CABLE DUCT TYPE CABLES INSTRUMENTATION BREAKOUT CABLE ARMOURED & RODENT PROTECTED MINESHAFT DISTRIBUTION CABLE AERIAL CABLE (RURAL, SHORT, FIELD DEPLOYABLE MEDIUM AND LONG SPAN) COMPOSITE CABLES

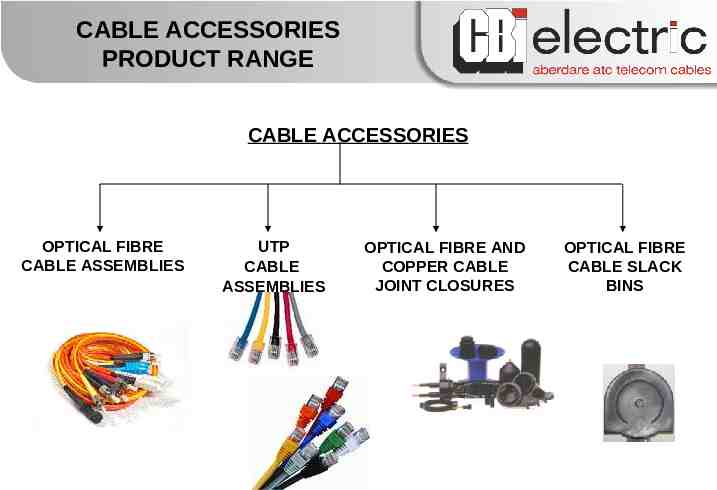

CABLE ACCESSORIES PRODUCT RANGE CABLE ACCESSORIES OPTICAL FIBRE CABLE ASSEMBLIES UTP CABLE ASSEMBLIES OPTICAL FIBRE AND COPPER CABLE JOINT CLOSURES OPTICAL FIBRE CABLE SLACK BINS

CUSTOMER BASE TELECOM NETWORKS FIXED LINE OPERATORS TELKOM /NEOTEL MOBILE OPERATORS MTN/VODACOM OTHER - INFRACO EXPORTS CITY COUNCILS/METROS POWER UTILITIES AND TRANSPORT ESKOM SPOORNET TRANSNET SARCC/METRO RAIL MINES PROCESS MARKET GOLD PLATINUM DIAMOND COAL PETROCHEMICAL PAPER AND PULP LARGE AND DIVERSE MARKET BOTH LOCALLY AND ABROAD DATA MARKET OEM’S MIDDLE EAST PETROLEUM DEVELOPMENT OMAN SAUDI ARAMCO

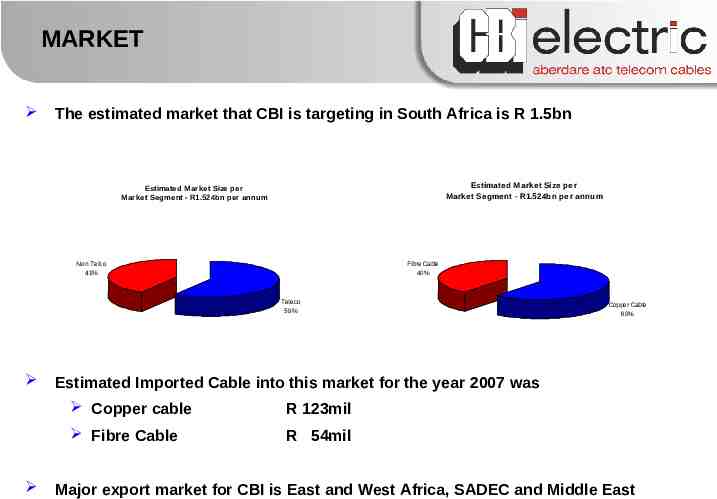

MARKET The estimated market that CBI is targeting in South Africa is R 1.5bn Estimated Market Size per Market Segment - R1.524bn per annum Estimated Market Size per Market Segment - R1.524bn per annum Fibre Cable 40% Non Telco 41% Teleco 59% Copper Cable 60% Estimated Imported Cable into this market for the year 2007 was Copper cable R 123mil Fibre Cable R 54mil Major export market for CBI is East and West Africa, SADEC and Middle East

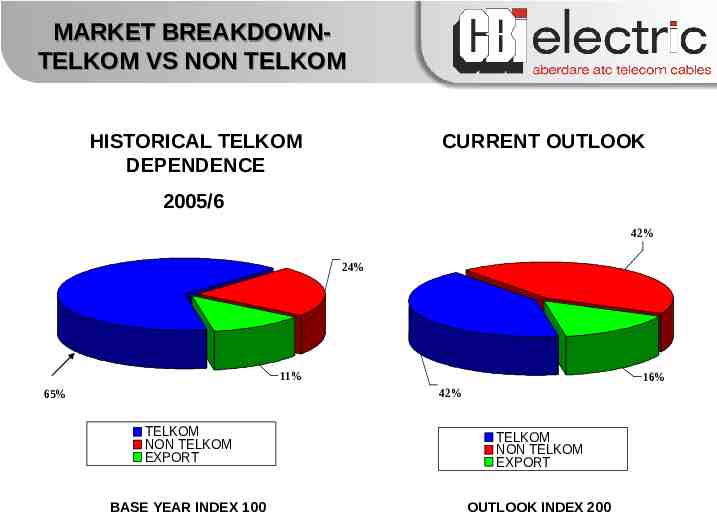

MARKET BREAKDOWNTELKOM VS NON TELKOM HISTORICAL TELKOM DEPENDENCE CURRENT OUTLOOK 2005/6 42% 24% 11% 16% 42% 65% TELKOM NON TELKOM EXPORT TELKOM NON TELKOM EXPORT BASE YEAR INDEX 100 OUTLOOK INDEX 200

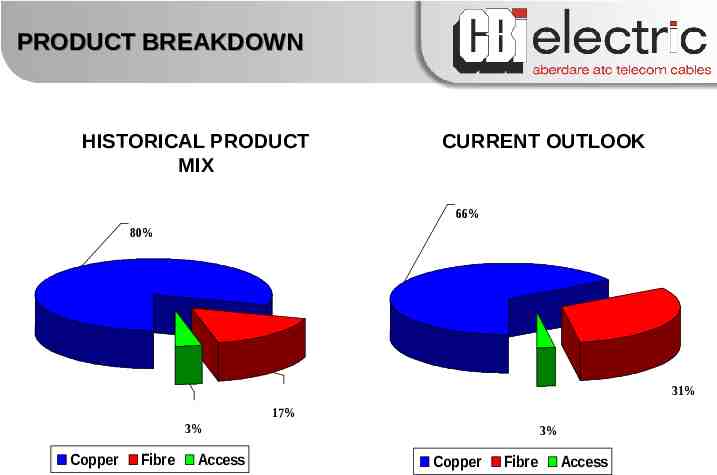

PRODUCT BREAKDOWN HISTORICAL PRODUCT MIX CURRENT OUTLOOK 66% 80% 31% 17% 3% Copper Fibre Access 3% Copper Fibre Access

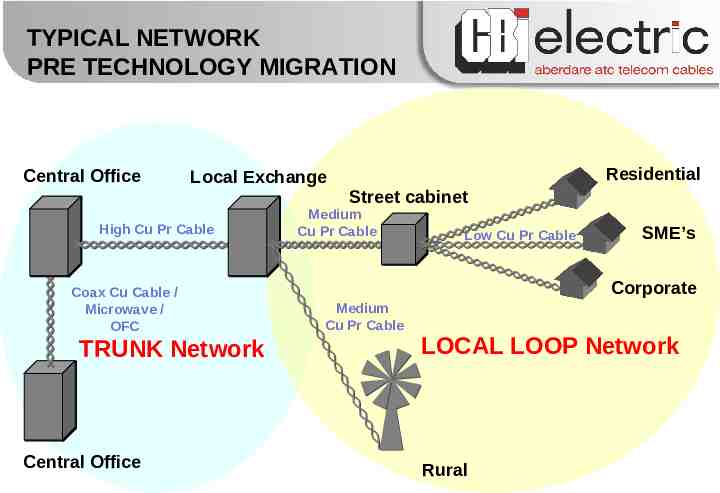

TYPICAL NETWORK PRE TECHNOLOGY MIGRATION Central Office Local Exchange High Cu Pr Cable Coax Cu Cable / Microwave / OFC TRUNK Network Central Office Residential Street cabinet Medium Cu Pr Cable Low Cu Pr Cable SME’s Corporate Medium Cu Pr Cable LOCAL LOOP Network Rural

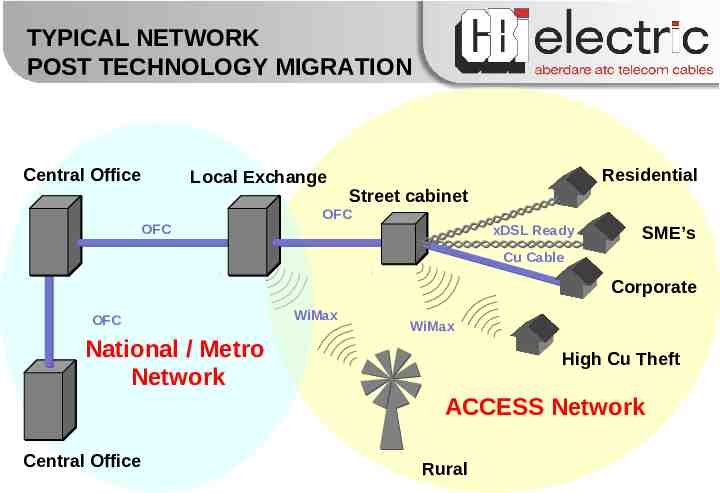

TYPICAL NETWORK POST TECHNOLOGY MIGRATION Central Office Local Exchange OFC Residential Street cabinet OFC xDSL Ready SME’s Cu Cable Corporate OFC WiMax WiMax National / Metro Network High Cu Theft ACCESS Network Central Office Rural

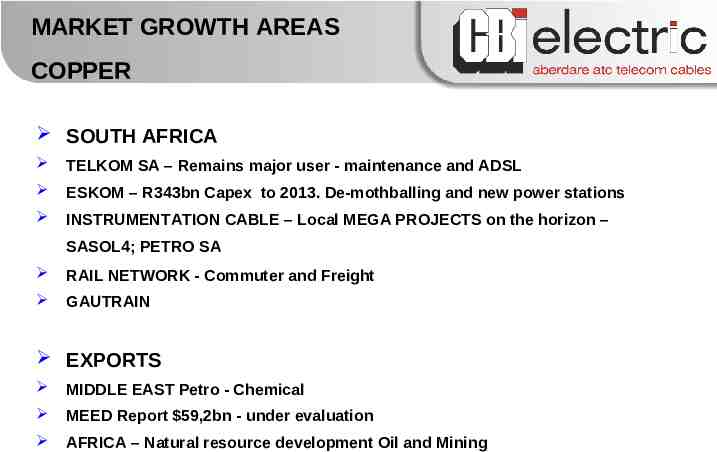

MARKET GROWTH AREAS COPPER SOUTH AFRICA TELKOM SA – Remains major user - maintenance and ADSL ESKOM – R343bn Capex to 2013. De-mothballing and new power stations INSTRUMENTATION CABLE – Local MEGA PROJECTS on the horizon – SASOL4; PETRO SA RAIL NETWORK - Commuter and Freight GAUTRAIN EXPORTS MIDDLE EAST Petro - Chemical MEED Report 59,2bn - under evaluation AFRICA – Natural resource development Oil and Mining

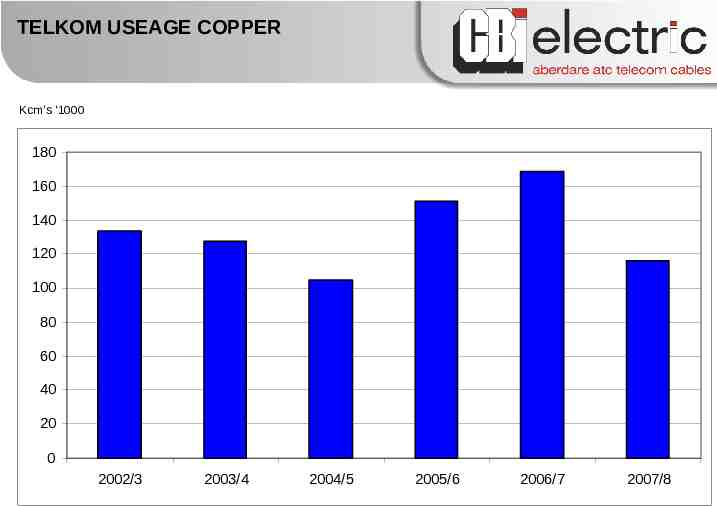

TELKOM USEAGE COPPER Kcm’s ‘1000 180 160 140 120 100 80 60 40 20 0 2002/3 2003/4 2004/5 2005/6 2006/7 2007/8

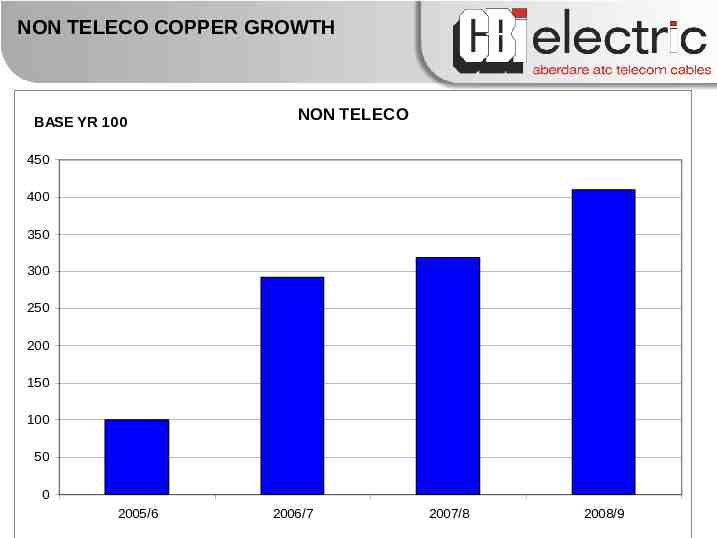

NON TELECO COPPER GROWTH BASE YR 100 NON TELECO 450 400 350 300 250 200 150 100 50 0 2005/6 2006/7 2007/8 2008/9

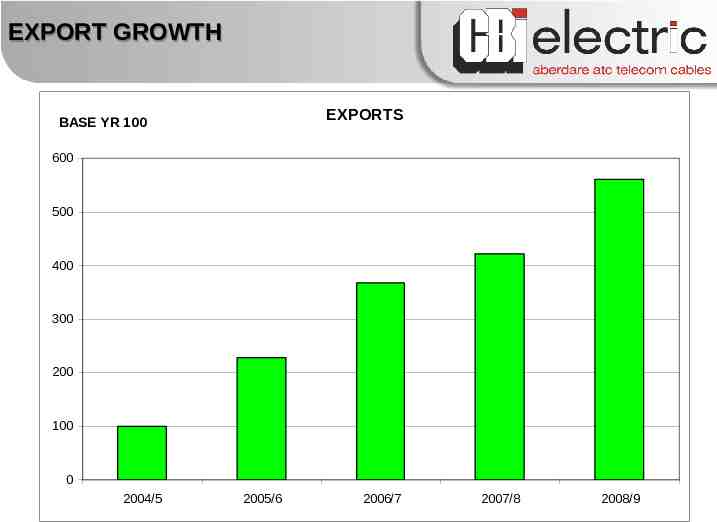

EXPORT GROWTH EXPORTS BASE YR 100 600 500 400 300 200 100 0 2004/5 2005/6 2006/7 2007/8 2008/9

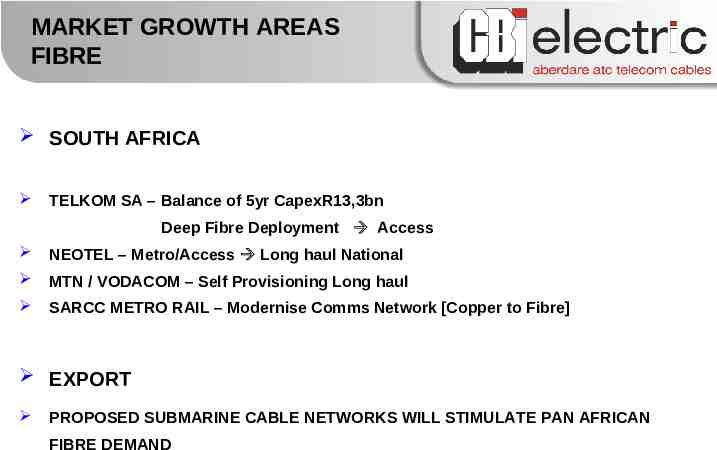

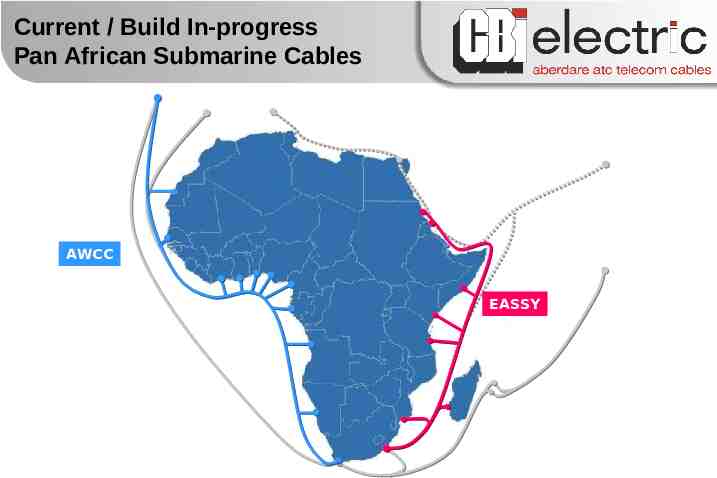

MARKET GROWTH AREAS FIBRE SOUTH AFRICA TELKOM SA – Balance of 5yr CapexR13,3bn Deep Fibre Deployment Access NEOTEL – Metro/Access Long haul National MTN / VODACOM – Self Provisioning Long haul SARCC METRO RAIL – Modernise Comms Network [Copper to Fibre] EXPORT PROPOSED SUBMARINE CABLE NETWORKS WILL STIMULATE PAN AFRICAN FIBRE DEMAND

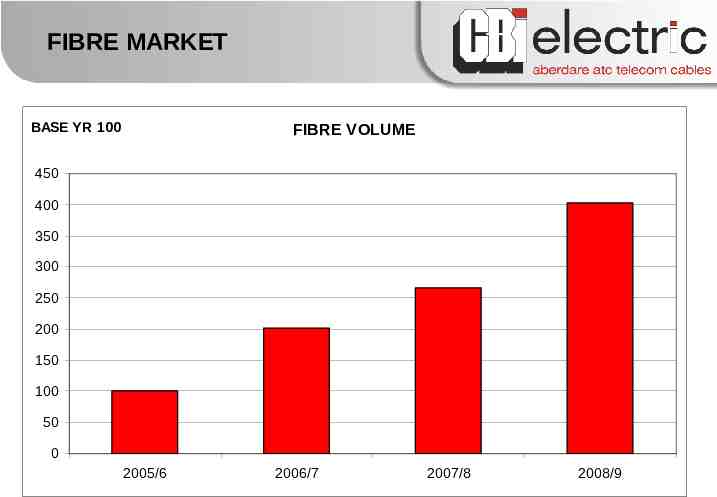

FIBRE MARKET BASE YR 100 FIBRE VOLUME 450 400 350 300 250 200 150 100 50 0 2005/6 2006/7 2007/8 2008/9

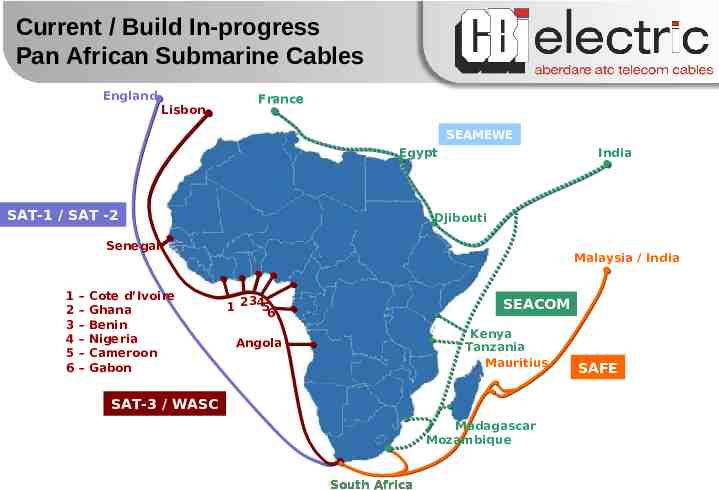

Current / Build In-progress Pan African Submarine Cables England Lisbon France SEAMEWE India Egypt SAT-1 / SAT -2 Djibouti Senegal 1 2 3 4 5 6 – – – – – – Cote d’Ivoire Ghana Benin Nigeria Cameroon Gabon Malaysia / India 3 1 2 45 6 SEACOM Kenya Tanzania Mauritius Angola SAT-3 / WASC Madagascar Mozambique South Africa SAFE

Current / Build In-progress Pan African Submarine Cables AWCC EASSY