Investor Panel 2020 Matt Dundon; Principal, DUNDON ADVISERS

5 Slides176.00 KB

Investor Panel 2020 Matt Dundon; Principal, DUNDON ADVISERS LLC Richard Fels; Managing Director, Odeon Capital Gary Hindes; Managing Director, THE DELAWARE BAY CO Dave Miller; Equity Partner, Sr. Portfolio Manager, Elliott Management Steve Gidumal, Moderator; Managing Partner, Virtus Capital Distressed Investing 2020 Conf. December 2, 2020

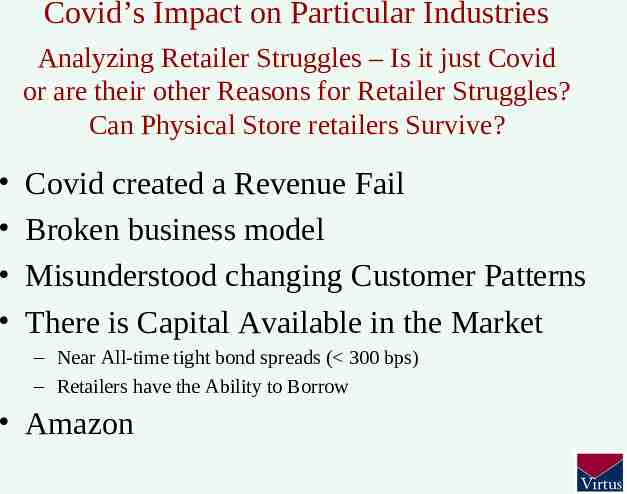

Covid’s Impact on Particular Industries . Analyzing Retailer Struggles – Is it just Covid or are their other Reasons for Retailer Struggles? Can Physical Store retailers Survive? Covid created a Revenue Fail Broken business model Misunderstood changing Customer Patterns There is Capital Available in the Market – Near All-time tight bond spreads ( 300 bps) – Retailers have the Ability to Borrow Amazon

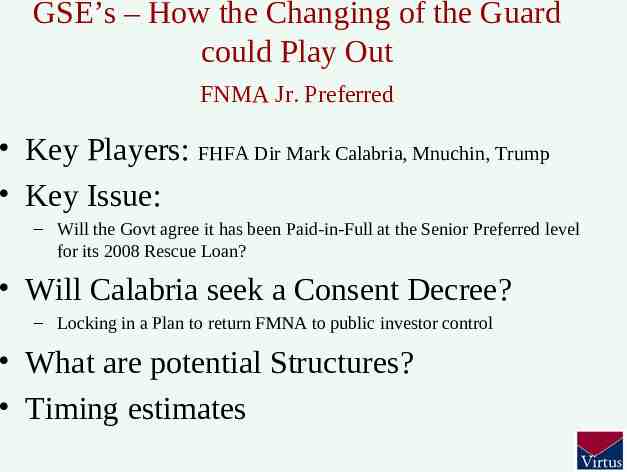

GSE’s – How the Changing of the Guard could Play Out . FNMA Jr. Preferred Key Players: FHFA Dir Mark Calabria, Mnuchin, Trump Key Issue: – Will the Govt agree it has been Paid-in-Full at the Senior Preferred level for its 2008 Rescue Loan? Will Calabria seek a Consent Decree? – Locking in a Plan to return FMNA to public investor control What are potential Structures? Timing estimates

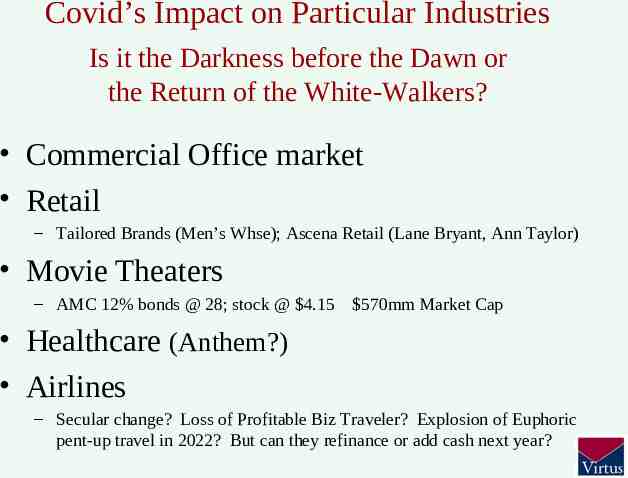

Covid’s Impact on Particular Industries . Is it the Darkness before the Dawn or the Return of the White-Walkers? Commercial Office market Retail – Tailored Brands (Men’s Whse); Ascena Retail (Lane Bryant, Ann Taylor) Movie Theaters – AMC 12% bonds @ 28; stock @ 4.15 570mm Market Cap Healthcare (Anthem?) Airlines – Secular change? Loss of Profitable Biz Traveler? Explosion of Euphoric pent-up travel in 2022? But can they refinance or add cash next year?

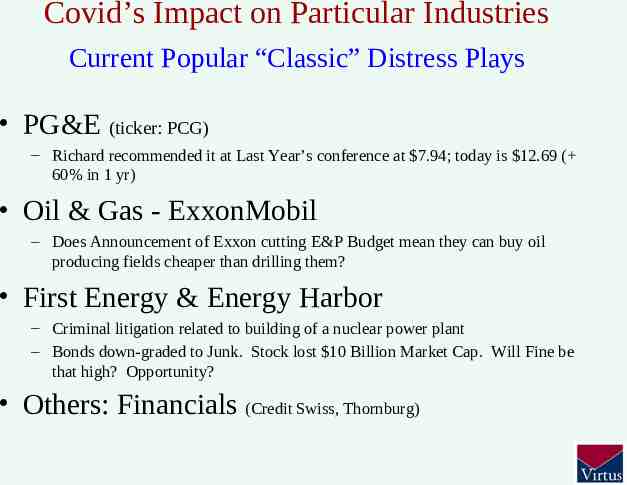

Covid’s Impact on Particular Industries . Current Popular “Classic” Distress Plays PG&E (ticker: PCG) – Richard recommended it at Last Year’s conference at 7.94; today is 12.69 ( 60% in 1 yr) Oil & Gas - ExxonMobil – Does Announcement of Exxon cutting E&P Budget mean they can buy oil producing fields cheaper than drilling them? First Energy & Energy Harbor – Criminal litigation related to building of a nuclear power plant – Bonds down-graded to Junk. Stock lost 10 Billion Market Cap. Will Fine be that high? Opportunity? Others: Financials (Credit Swiss, Thornburg)