HOW TO PROCESS AN EXPENSE REPORT What Can You Learn? Step-by-step

74 Slides4.71 MB

HOW TO PROCESS AN EXPENSE REPORT What Can You Learn? Step-by-step instructions on how to submit an expense report Travel policies and procedures Tips and tricks Prepared by: Jennifer Marleau Updated: January 2022

WHAT IS AN EXPENSE REPORT? An expense report is submitted for expenses that you have incurred and/or reconcile a travel advance. For example: An expense report can be prepared for all the costs related to attending a conference/meeting/seminar/workshop (i.e. conference registration fees, airfare, accommodations, meals, etc.)

WHAT IS AN EXPENSE REPORT? Each trip requires a single and complete expense report with all expenses included and all travel advances reconciled. An expense report is prepared AFTER the trip takes place and all receipts/documents have been prepared and collected. An expense report must be submitted within 30 days following the return date of the trip. Any expense reports that are submitted after 90 days following the oldest receipt date will not be reimbursed.

REQUST FOR DOMESTIC & INTERNATIONAL TRAVEL As of April 2021 Student Scenario Student to submit their request to their supervisor Supervisor will submit request to departmental Chair Departmental Chair will submit request to John Stix John Stix and Faculty of Science Dean will discuss and provide decision via email Professor Scenario Professor will submit their request to departmental Chair Departmental Chair will submit request to John Stix John Stix and Faculty of Science Dean will discuss and provide decision via email

THINGS TO KNOW All advances and expense reimbursements to Employees and Students will be made through direct deposit in Canadian dollars. Ensure your banking information in Minerva is up to date. Claimants are notified of the direct deposit, by email, on the day the Central Travel Desk processes the advance or expense report request. Direct deposits appear in bank accounts within 2 business days of the processing date.

THINGS TO KNOW Keep all ORIGINAL receipts with proof of payment. Credit card sales slips, credit card statements, canceled cheques, airline itinerary confirmations or fare quotes are NOT acceptable receipts for travel-related expenses.

THINGS TO KNOW For conferences/workshops: attach the conference program/prospectus to your expense report. For a meeting: attach the meeting agenda or email communication as supporting documentation. For If a talk: attach your poster. you are a presenter: it’s preferable attach the page with your name and title of your presentation along with the conference program/prospectus.

THINGS TO KNOW – Travel Award If you received a Travel Award, a copy of your award letter must be submitted with your expense report and the amount will need to be deducted from your expenses. Example: GREAT Award, GEF Award, Graduate Mobility Award, Zamboni Award, CSC 2001 Award If you are eligible for the 850 Travel Award, please use fund 172658 when processing your expense report.

THINGS TO KNOW All original receipts need to indicate “paid” or have a “zero” balance. If indicated and paid by debit/credit card, include your debit/credit card statement as proof of payment (black out all personal information and the primary account number (PAN) except for the last 4 digits). Exchange rates for USD, GBP and Euro are automatically populated – you may override it. If the expense was paid by credit/debit card, enter the exchange rate as indicated on your statement. To search for an exchange rate, click on the hyperlink

THINGS TO KNOW Any receipts in a foreign language must be accompanied by an explanation of the item, in English or French, on the claim or receipt. If an acronym is used, elaborate. i.e. CSC (Canadian Society for Chemistry) i.e. ACS (American Chemical Society) i.e. GRC (Gordon Research Conference) i.e. QOMSBOC (Quebec-Ontario Mini-Symposium on Bioorganic and Organic Chemistry) i.e. CBGRC (Chemistry and Biochemistry Graduate Research

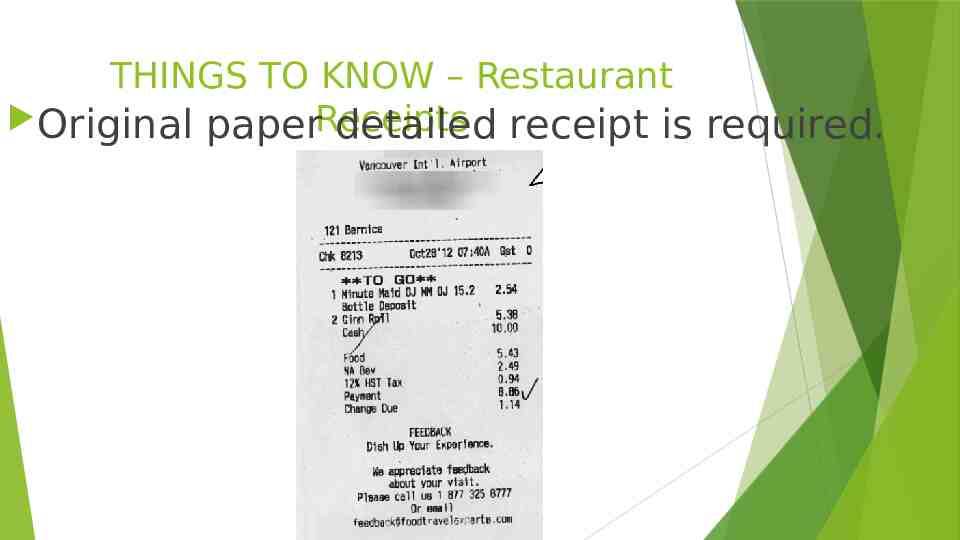

THINGS TO KNOW – Restaurant Original paperReceipts detailed receipt is required.

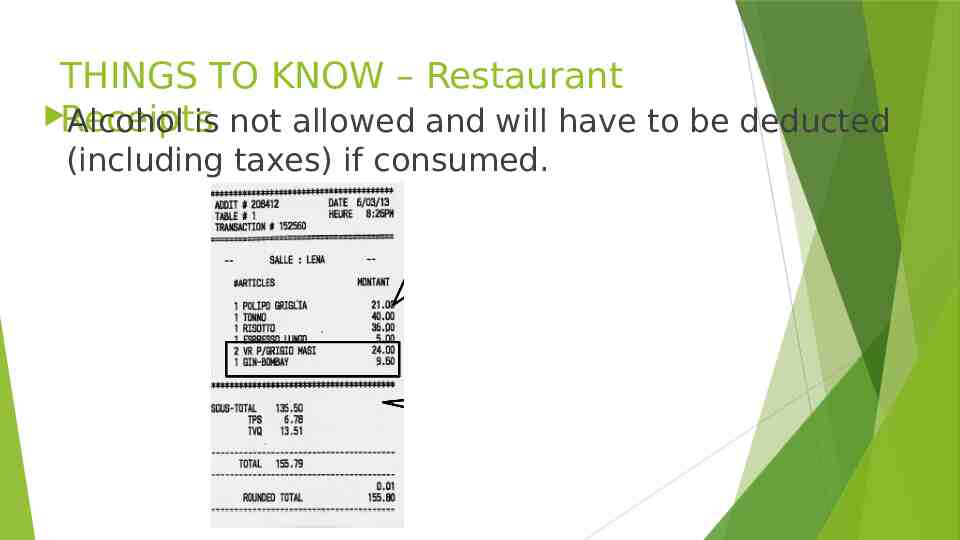

THINGS TO KNOW – Restaurant Receipts Alcohol is not allowed and will have to be deducted (including taxes) if consumed.

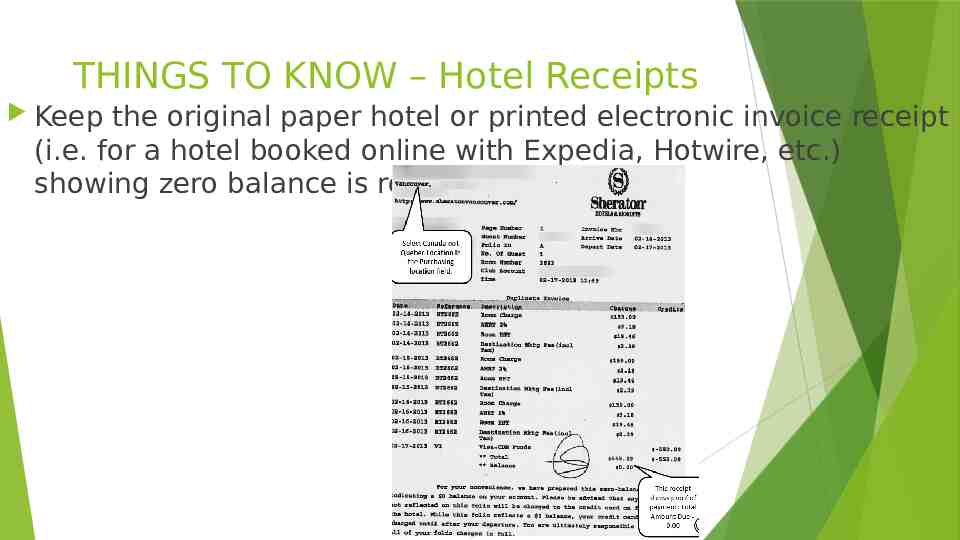

THINGS TO KNOW – Hotel Receipts Keep the original paper hotel or printed electronic invoice receipt (i.e. for a hotel booked online with Expedia, Hotwire, etc.) showing zero balance is required.

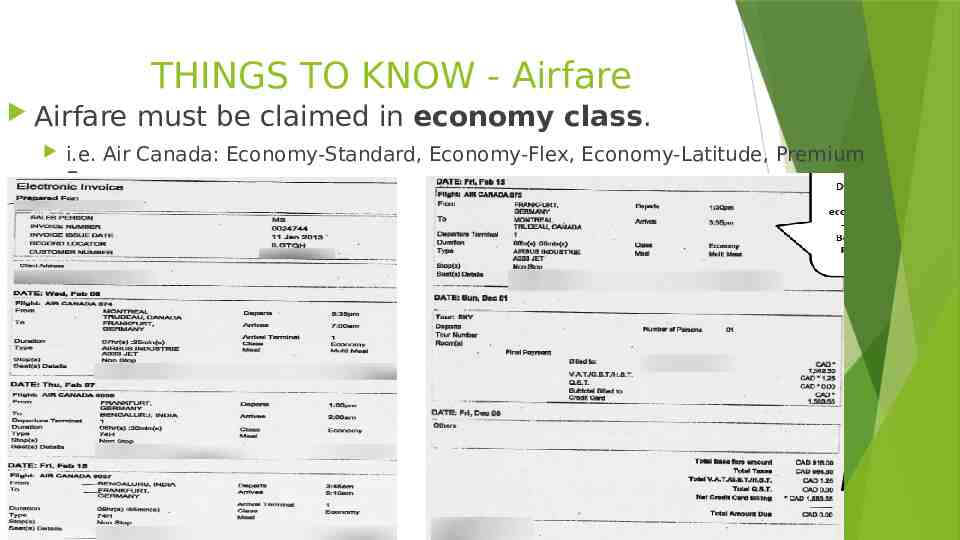

THINGS TO KNOW - Airfare Airfare must be claimed in economy class. i.e. Air Canada: Economy-Standard, Economy-Flex, Economy-Latitude, Premium Economy

PERSONAL EXTENSIONS Should you decide to extend your trip for personal reasons, you cannot claim expenses (such as lodging, meals and transportation) during that portion of the trip. You will need to indicate the dates of your personal time in the description of your expense report. For airfare, you will need to obtain a quote before your departure with the dates had you not extended your trip. The quote needs to be included with your expense report. Example: If you are attending a conference held from July 10-15, you would obtain a quote for July 9-16. If the quote is lower than the airfare you paid, you are only eligible to claim the amount of the quote. If the quote is higher than the airfare you paid, you can claim the amount you paid.

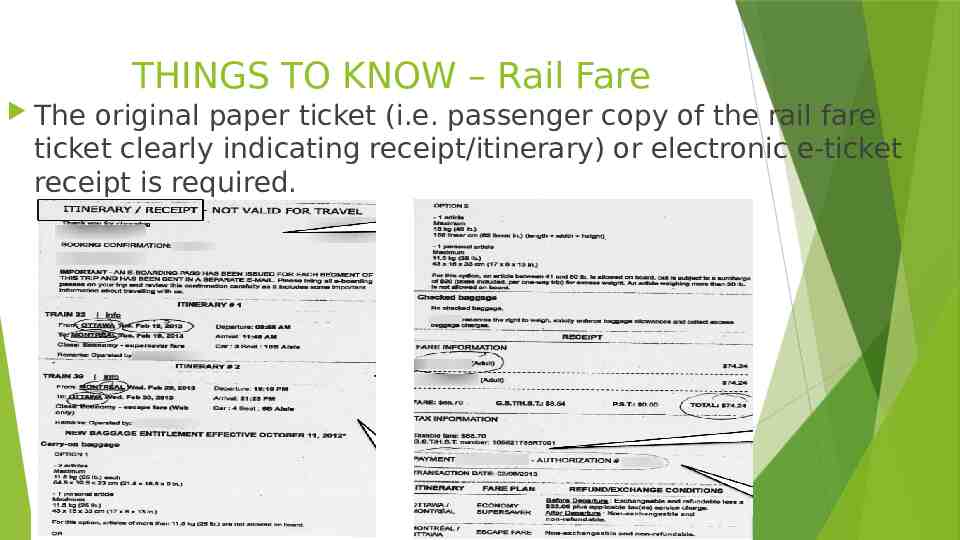

THINGS TO KNOW – Rail Fare The original paper ticket (i.e. passenger copy of the rail fare ticket clearly indicating receipt/itinerary) or electronic e-ticket receipt is required.

THINGS TO KNOW – Car Rental The original paper or electronic receipt is required. Gas receipts are also allowed to be claimed.

THINGS TO KNOW – Personal Kilometer allowance or the actual cost of gas may be claimed. Automobile You cannot claim both mileage and gas.

THINGS TO KNOW – Taxi Original UBER. paper receipt is required or electronic receipt if you used

THINGS TO KNOW – Conference & Seminar Registration Fees Original paper conference receipt or electronic invoice receipt is required. The full name of the conference must be indicated in the Trip Purpose field of the expense report.

THINGS TO KNOW – Conference & Seminar Membership Fees Membership fees are not allowed on FRQ funds unless the membership is required in order to be able to attend the conference.

THINGS TO KNOW Avoid paying on behalf of other fellow students; every student should be paying for their own expenses and should be submitting their own expense report. Example: If one person is paying for a group meal, settle payments among the group and then each person should only claim their own share. Exception: If sharing an Airbnb and only one person pays for the full amount, make sure to indicate the student’s name, ID number and expense report number on your expense report. If each party is claiming their own portion of the Airbnb, you will need to reference each others name, ID number and expense report number along with proof that you paid your part.

TRAVEL ADVANCES Travel advances are requested to attend conferences or meetings. In cases where more than one payment is required in advance of a trip, multiple advance requests (and types) may be requested at different intervals prior to the trip. STUDENTS - You can see Chelsea Briand-Pitts in the Chemistry main office and she will process your travel advance.

TRAVEL ADVANCES – For Academics Travel advances are requested to attend conferences or meetings. In cases where more than one payment is required in advance of a trip, multiple advance requests (and types) may be requested at different intervals prior to the trip. There are 3 types of Travel Advances: Third Party Prepayments These are payments made directly to third party suppliers in advance of the trip. Examples include payments to conference registration or to a travel agency.

TRAVEL ADVANCES – For Academics Out-of-Pocket in Advance of Trip The claimant is out-of-pocket for expenses they personally paid for in advance of the trip. Examples include conference registration or airline ticket paid by the traveler. This type of advance maybe requested at any time (and in multiple instances as the claimant prepays), with receipt and proof of payment. Cash Advances This payment to the claimant is to cover cash needs for anticipated expenses to be incurred during the trip. Cash advances should be limited to field studies, extended trips, and when trips occur in countries where cash is the only mode of payment. Cash advances will only be issued 30 days prior to the start of the trip. A breakdown of the estimated costs should be included in the description.

RECONCILING TRAVEL ADVANCES All advances must be cleared by submitting an expense report 30 days following the return date of the trip. Advances not reconciled 30 days following the return date of the trip are considered overdue. Once an advance is considered overdue, no additional advances may be requested, nor will any expense report be reimbursed to the Claimant until the overdue advance is cleared.

RECONCILING A TRAVEL ADVANCE If you requested a Travel Advance prior to your trip, you will have to enter the receipts corresponding to that advance as an item in your expense report. Examples of Travel Advances: Conference registration fees, airfare, accommodations. You will have to reconcile the Travel Advance at the end of your expense report. (This will be explained later in the presentation).

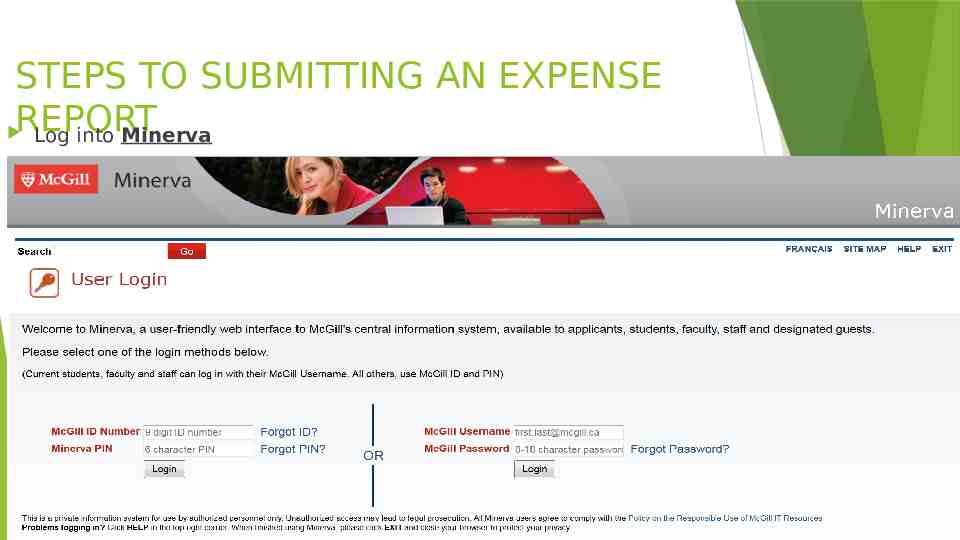

STEPS TO SUBMITTING AN EXPENSE REPORT Log into Minerva

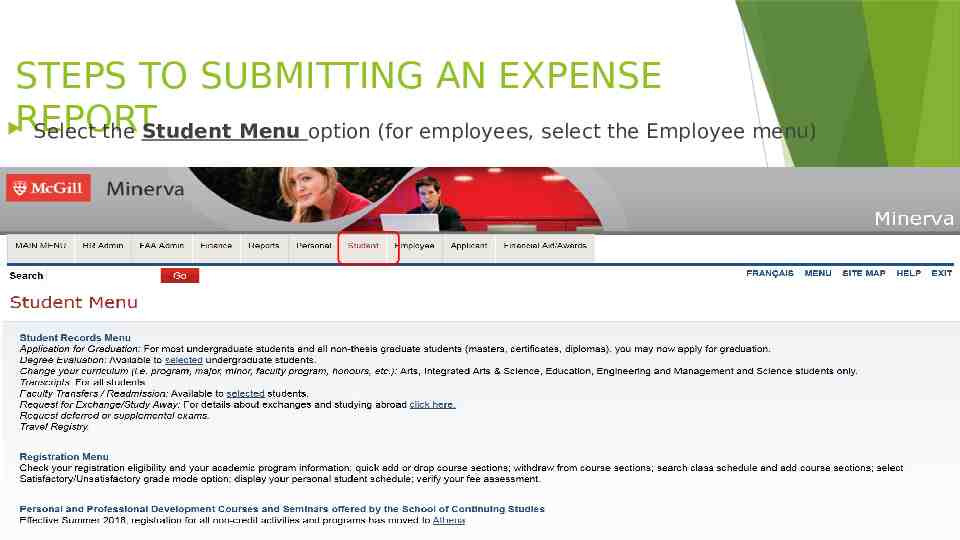

STEPS TO SUBMITTING AN EXPENSE REPORT Select the Student Menu option (for employees, select the Employee menu)

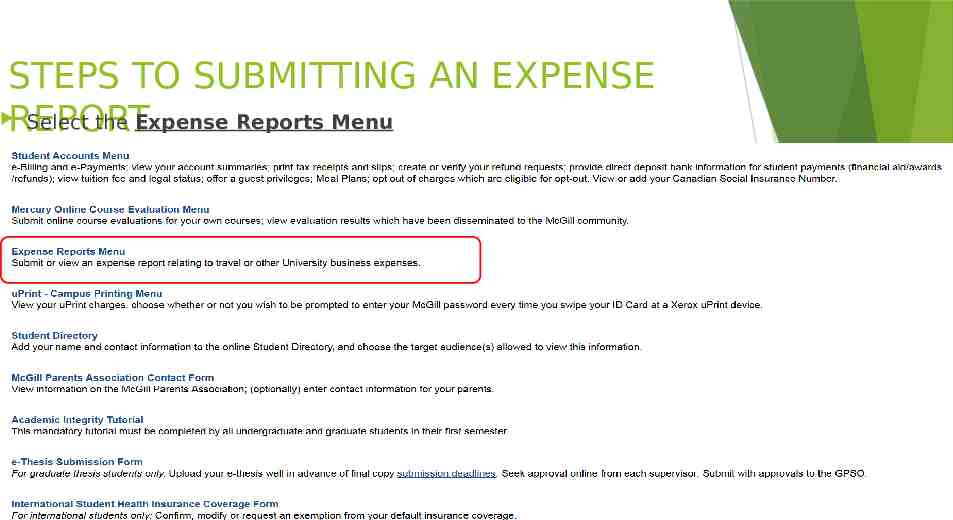

STEPS TO SUBMITTING AN EXPENSE REPORT Select the Expense Reports Menu

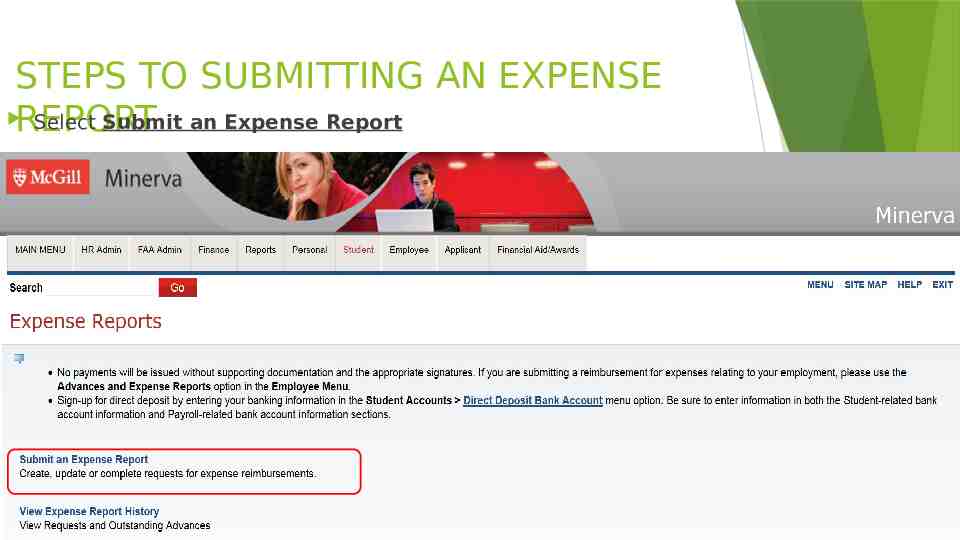

STEPS TO SUBMITTING AN EXPENSE REPORT Select Submit an Expense Report

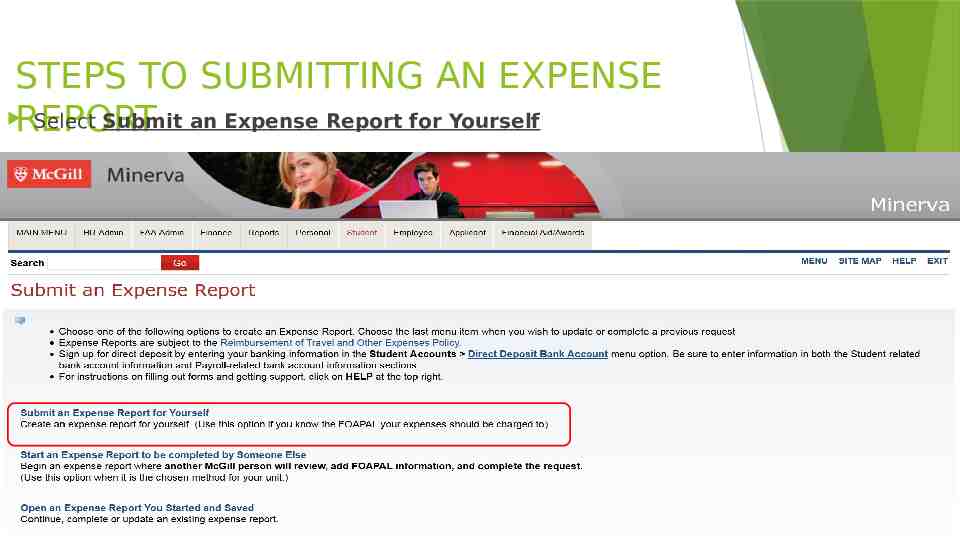

STEPS TO SUBMITTING AN EXPENSE REPORT Select Submit an Expense Report for Yourself

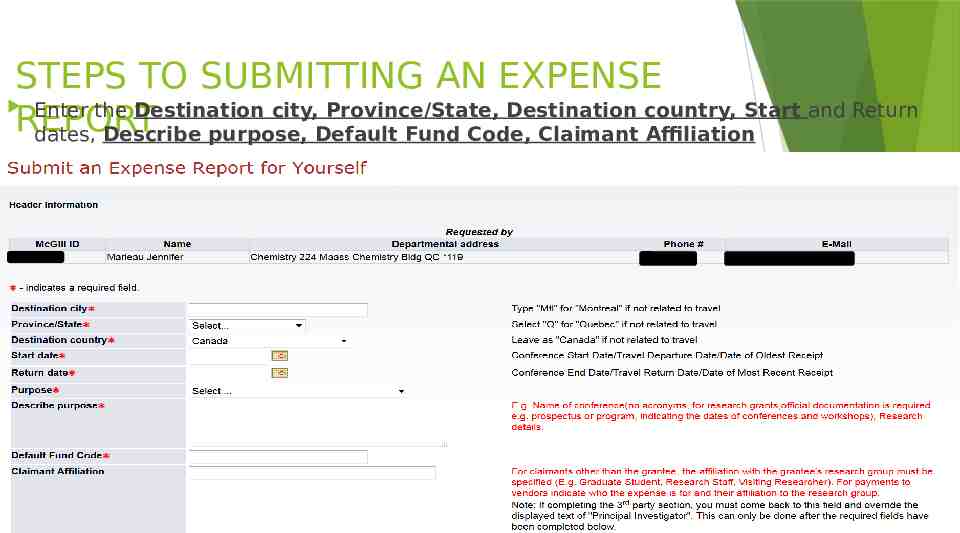

STEPS TO SUBMITTING AN EXPENSE Enter the Destination city, Province/State, Destination country, Start and Return REPORT dates, Describe purpose, Default Fund Code, Claimant Affiliation

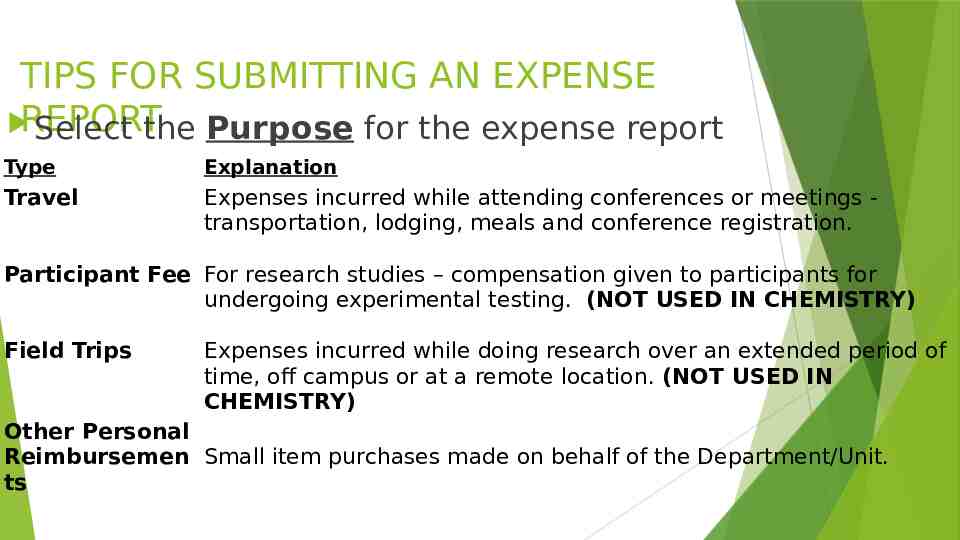

TIPS FOR SUBMITTING AN EXPENSE REPORT Select the Purpose for the expense report Type Explanation Travel Expenses incurred while attending conferences or meetings transportation, lodging, meals and conference registration. Participant Fee For research studies – compensation given to participants for undergoing experimental testing. (NOT USED IN CHEMISTRY) Field Trips Expenses incurred while doing research over an extended period of time, off campus or at a remote location. (NOT USED IN CHEMISTRY) Other Personal Reimbursemen Small item purchases made on behalf of the Department/Unit. ts

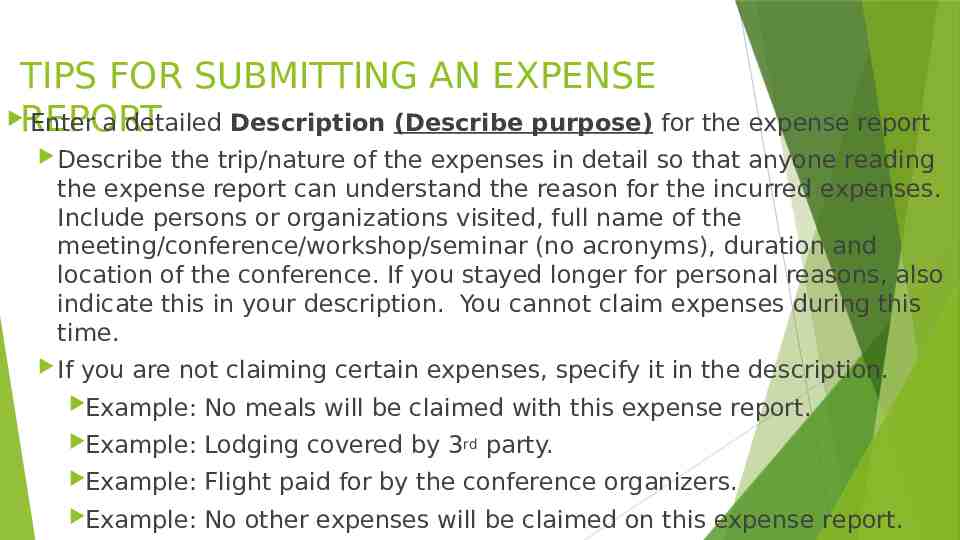

TIPS FOR SUBMITTING AN EXPENSE REPORT Enter a detailed Description (Describe purpose) for the expense report Describe the trip/nature of the expenses in detail so that anyone reading the expense report can understand the reason for the incurred expenses. Include persons or organizations visited, full name of the meeting/conference/workshop/seminar (no acronyms), duration and location of the conference. If you stayed longer for personal reasons, also indicate this in your description. You cannot claim expenses during this time. If you are not claiming certain expenses, specify it in the description. Example: No meals will be claimed with this expense report. Example: Lodging covered by 3rd party. Example: Flight paid for by the conference organizers. Example: No other expenses will be claimed on this expense report.

TIPS FOR SUBMITTING AN EXPENSE REPORT STUDENTS Ask your supervisor which fund they want you to use and enter it under the Default Fund Code You will be able to split FOAPALs and to override this fund code when entering in individual expense items on the next screen.

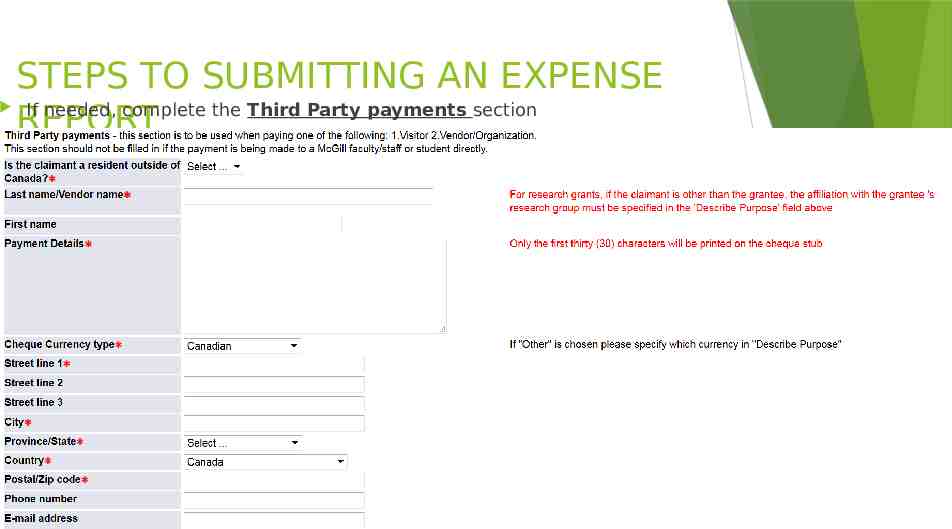

STEPS TO SUBMITTING AN EXPENSE If needed, complete the Third Party payments section REPORT

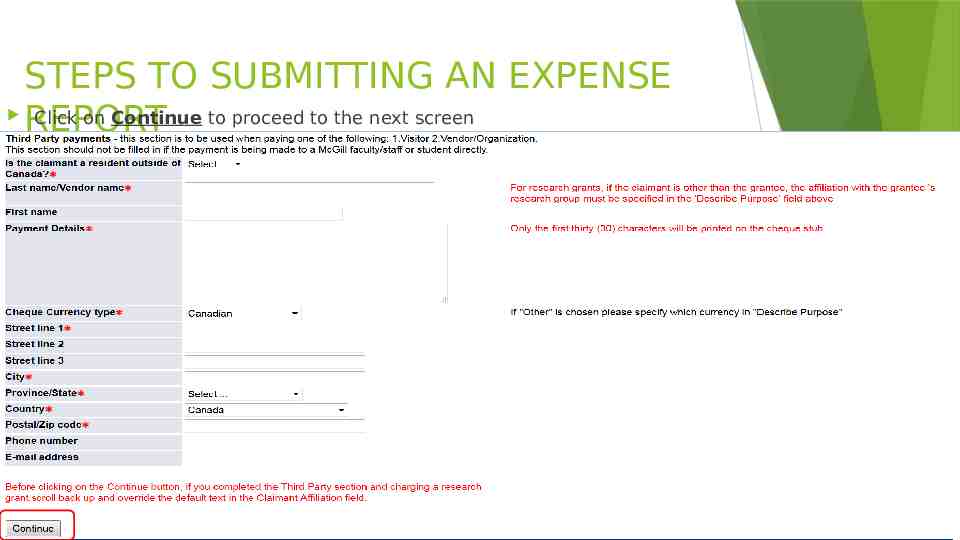

STEPS TO SUBMITTING AN EXPENSE Click on Continue to proceed to the next screen REPORT

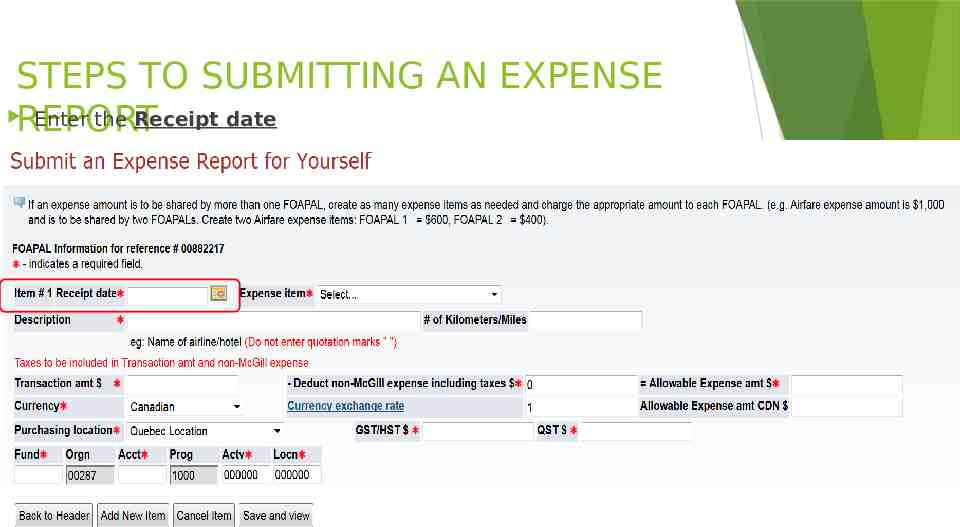

STEPS TO SUBMITTING AN EXPENSE Enter the Receipt date REPORT

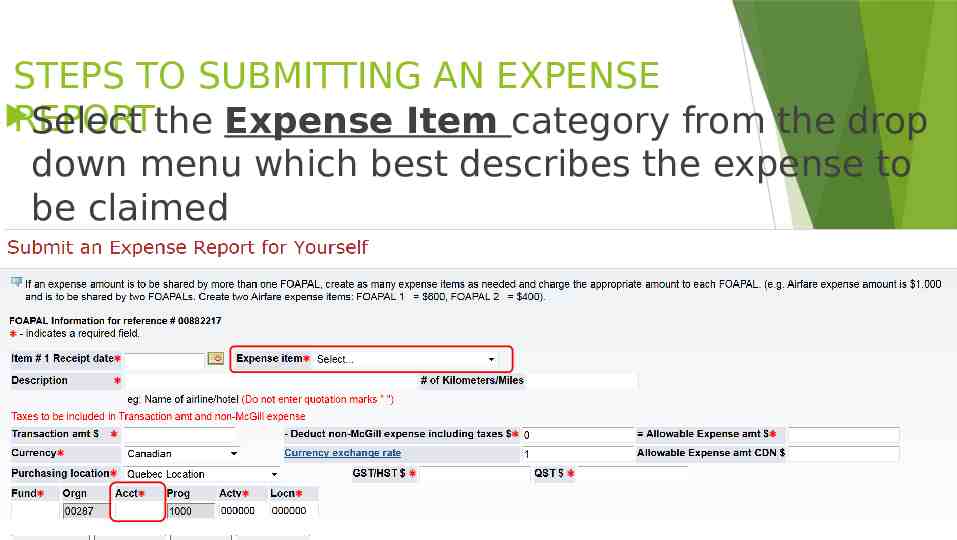

STEPS TO SUBMITTING AN EXPENSE REPORT Select the Expense Item category from the drop down menu which best describes the expense to be claimed

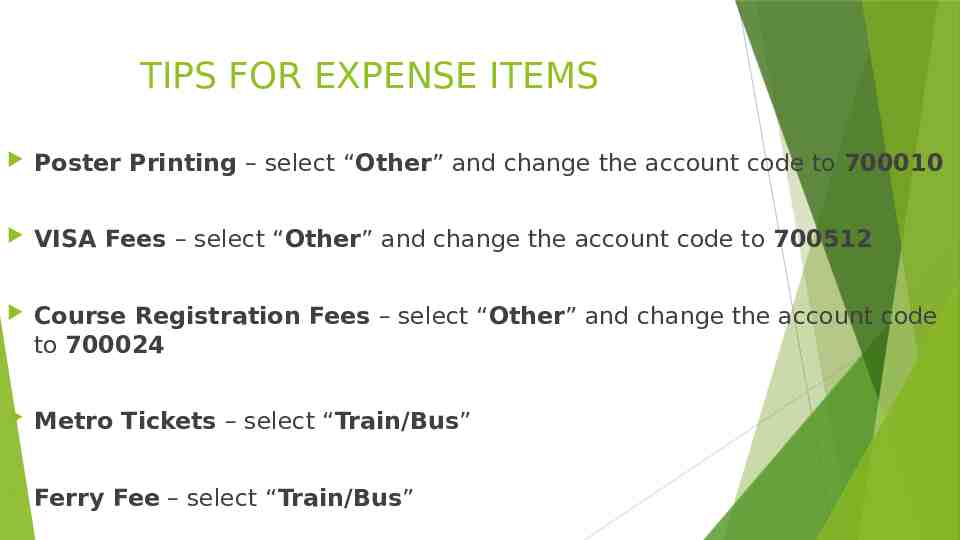

TIPS FOR EXPENSE ITEMS Poster Printing – select “Other” and change the account code to 700010 VISA Fees – select “Other” and change the account code to 700512 Course Registration Fees – select “Other” and change the account code to 700024 Metro Tickets – select “Train/Bus” Ferry Fee – select “Train/Bus”

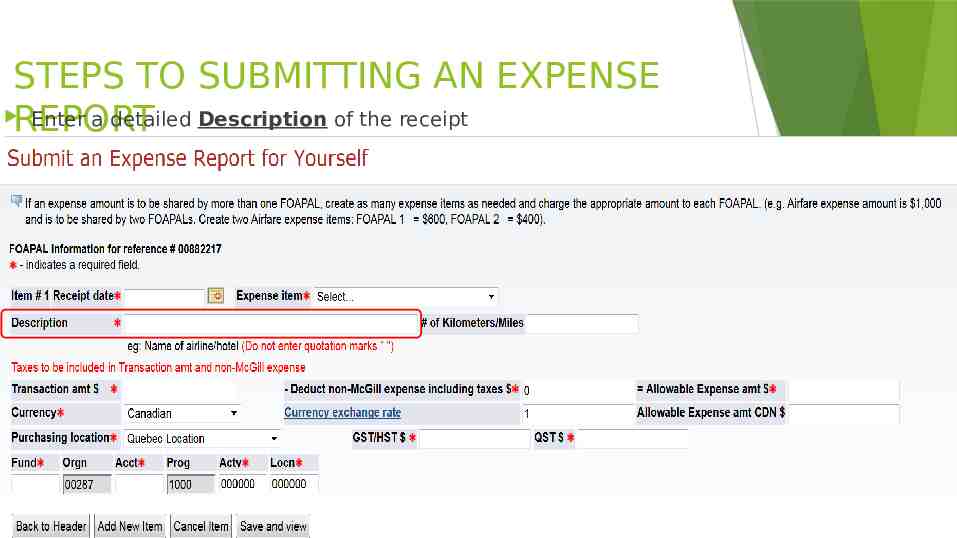

STEPS TO SUBMITTING AN EXPENSE Enter a detailed Description of the receipt REPORT

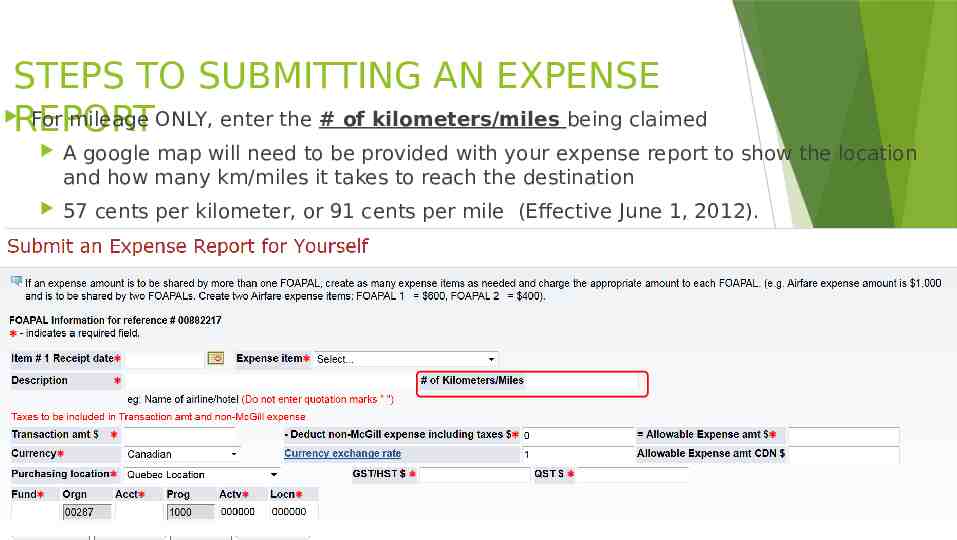

STEPS TO SUBMITTING AN EXPENSE For mileage ONLY, enter the # of kilometers/miles being claimed REPORT A google map will need to be provided with your expense report to show the location and how many km/miles it takes to reach the destination 57 cents per kilometer, or 91 cents per mile (Effective June 1, 2012).

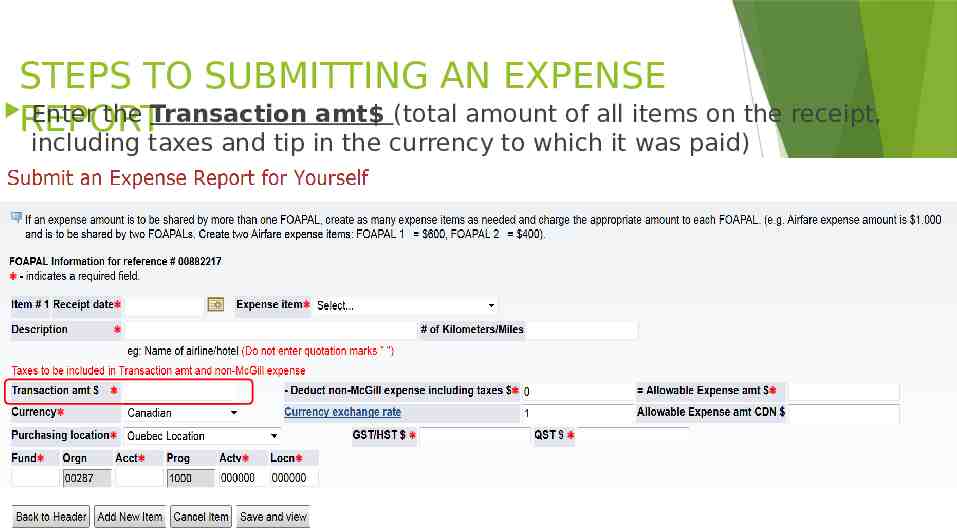

STEPS TO SUBMITTING AN EXPENSE Enter the Transaction amt (total amount of all items on the receipt, REPORT including taxes and tip in the currency to which it was paid)

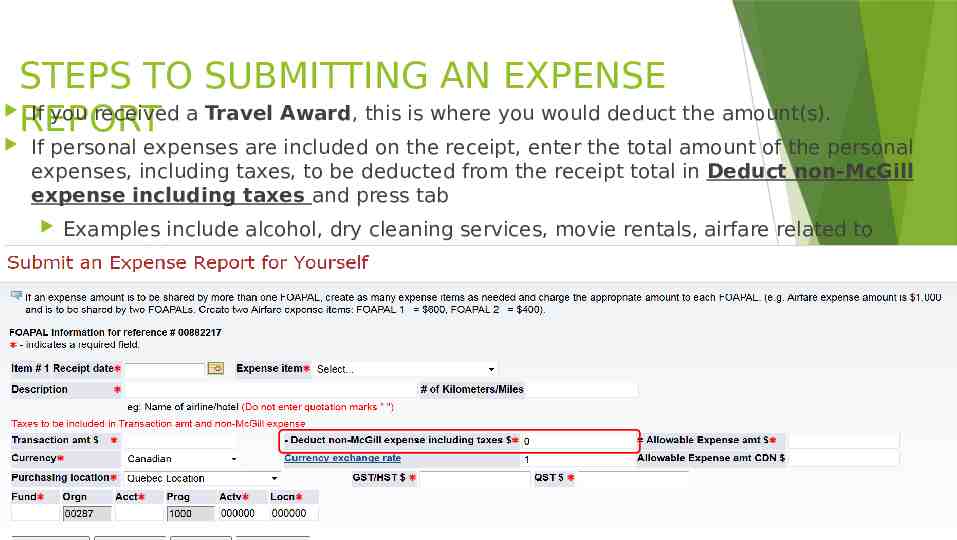

STEPS TO SUBMITTING AN EXPENSE If you received a Travel Award, this is where you would deduct the amount(s). REPORT If personal expenses are included on the receipt, enter the total amount of the personal expenses, including taxes, to be deducted from the receipt total in Deduct non-McGill expense including taxes and press tab Examples include alcohol, dry cleaning services, movie rentals, airfare related to personal time

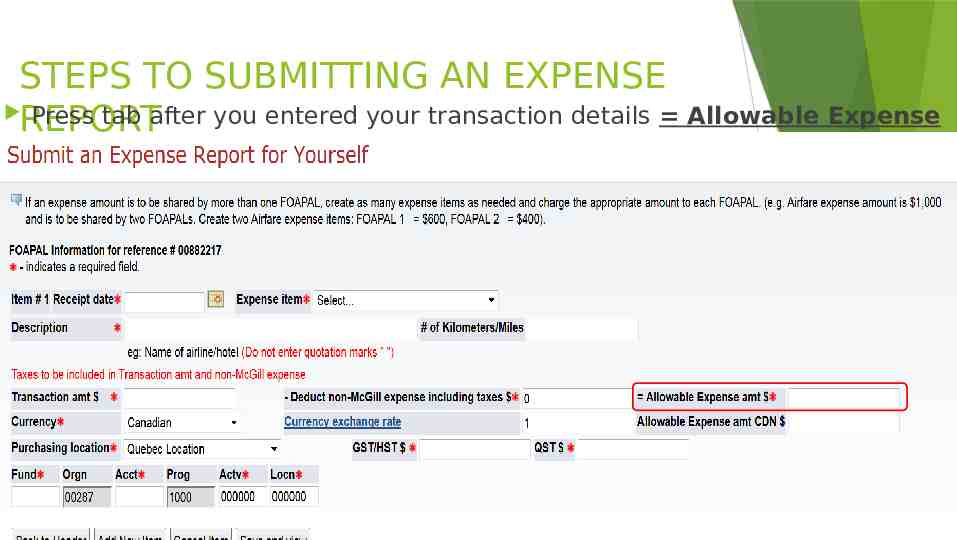

STEPS TO SUBMITTING AN EXPENSE Press tab after you entered your transaction details Allowable Expense REPORT amt

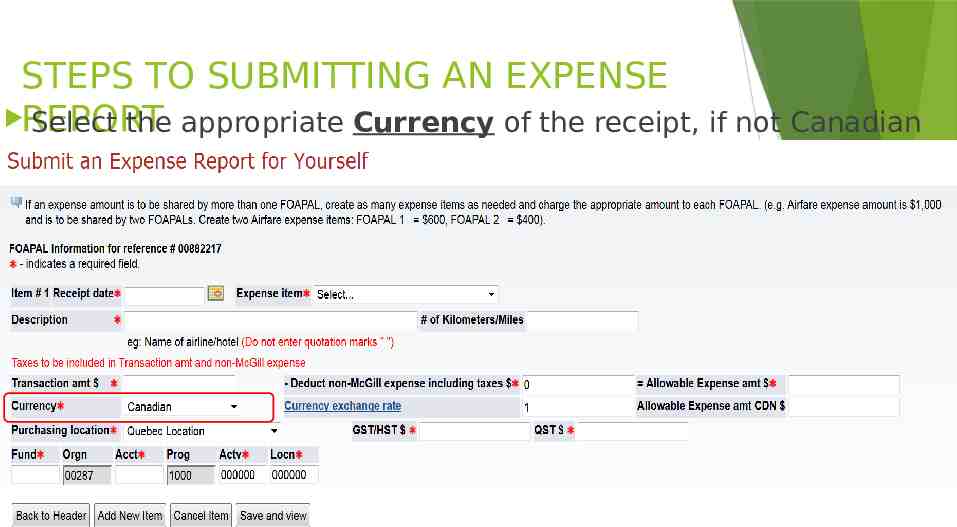

STEPS TO SUBMITTING AN EXPENSE REPORT Select the appropriate Currency of the receipt, if not Canadian

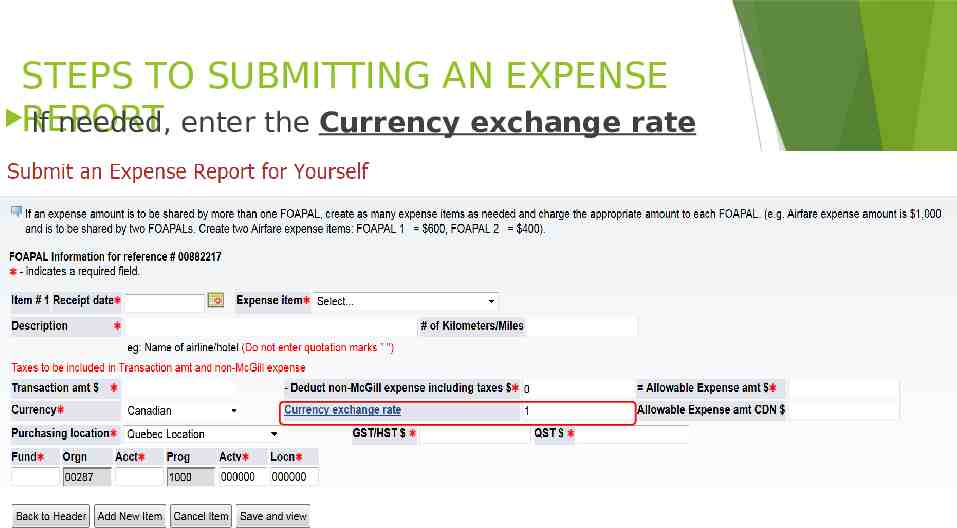

STEPS TO SUBMITTING AN EXPENSE REPORT If needed, enter the Currency exchange rate

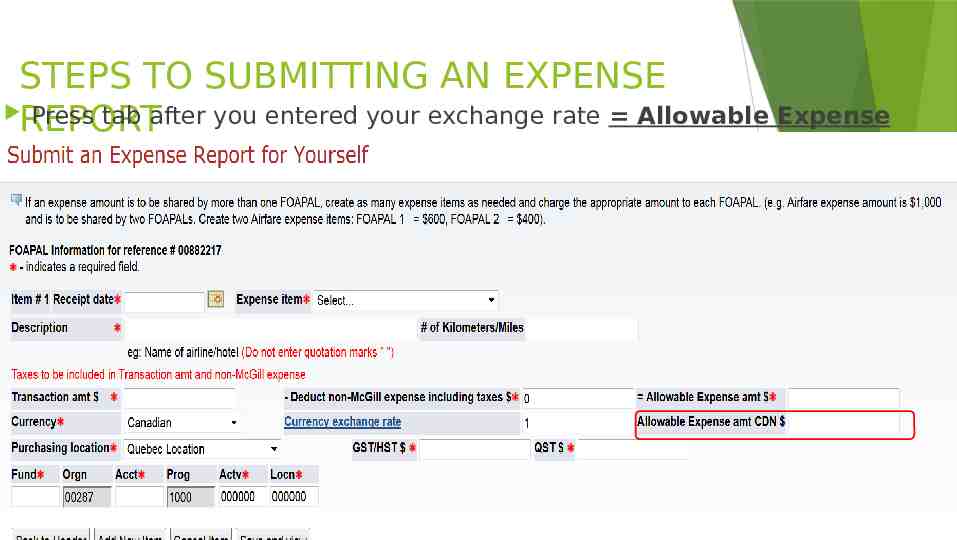

STEPS TO SUBMITTING AN EXPENSE Press tab after you entered your exchange rate Allowable Expense REPORT amt CDN

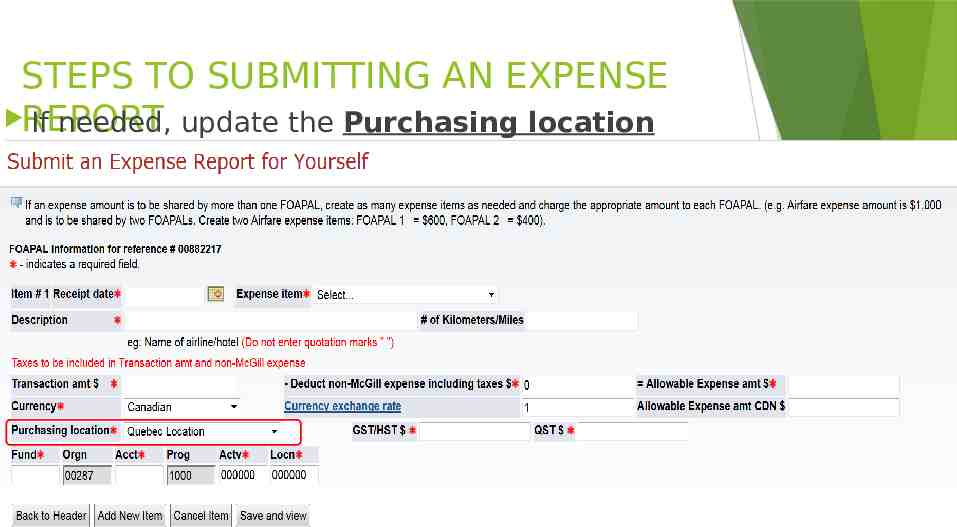

STEPS TO SUBMITTING AN EXPENSE REPORT If needed, update the Purchasing location

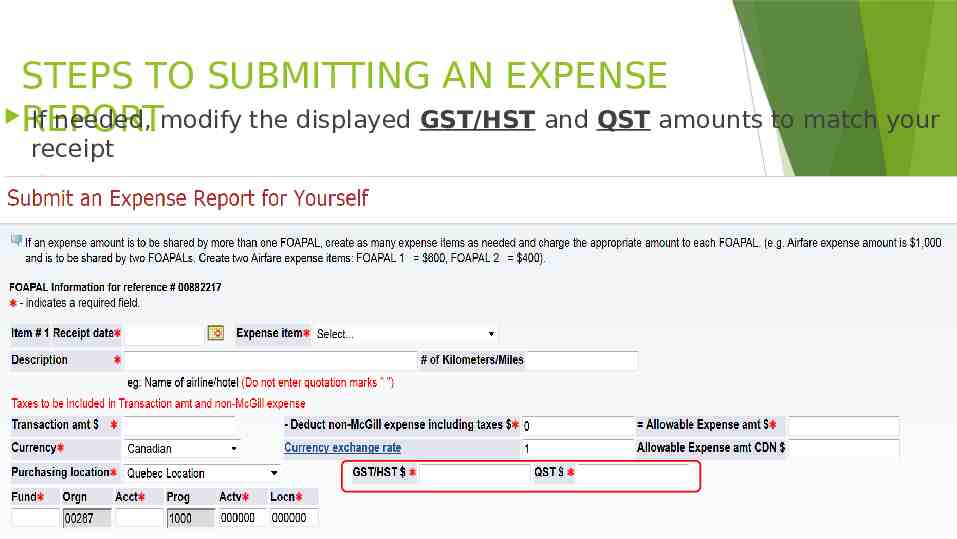

STEPS TO SUBMITTING AN EXPENSE REPORT If needed, modify the displayed GST/HST and QST amounts to match your receipt When calculating airfare, taxes are not automatically calculated, enter 0.00

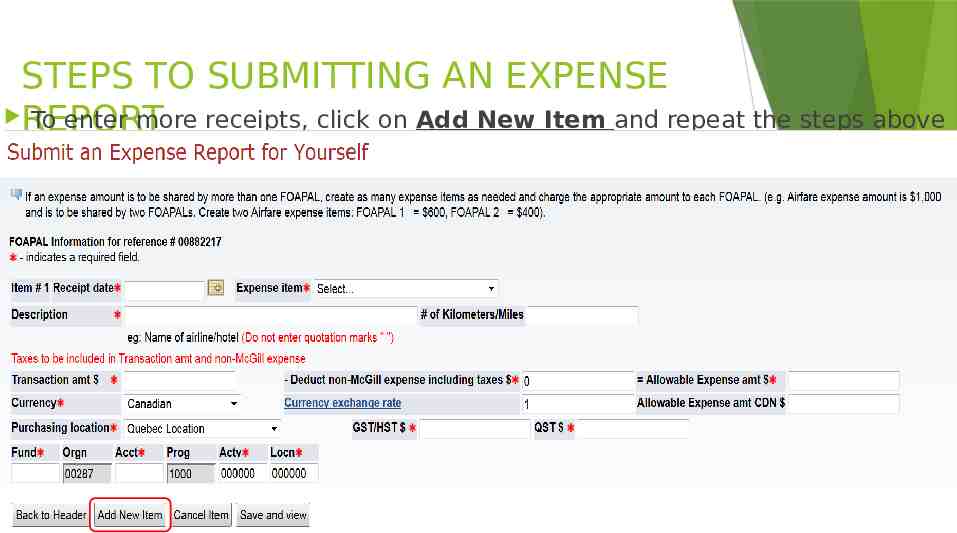

STEPS TO SUBMITTING AN EXPENSE REPORT To enter more receipts, click on Add New Item and repeat the steps above

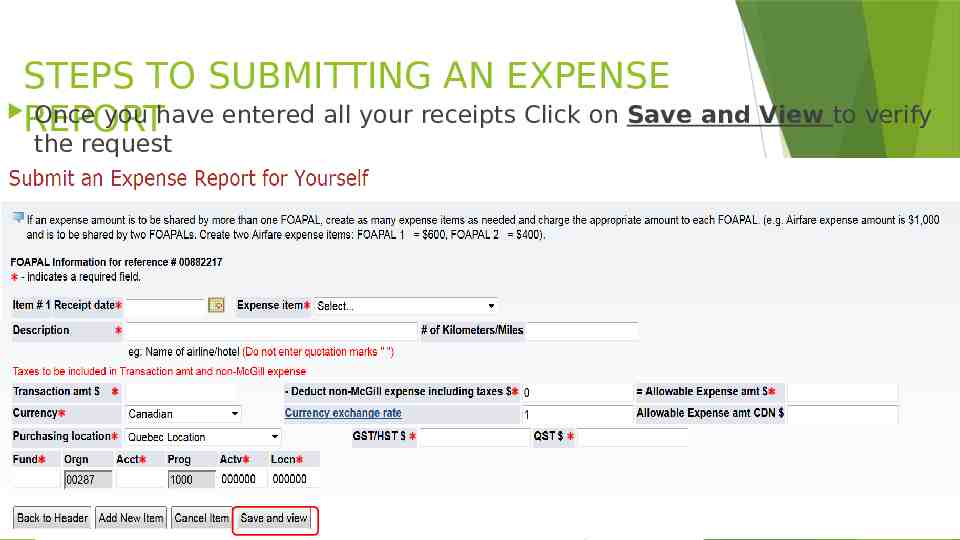

STEPS TO SUBMITTING AN EXPENSE Once you have entered all your receipts Click on Save and View to verify REPORT the request

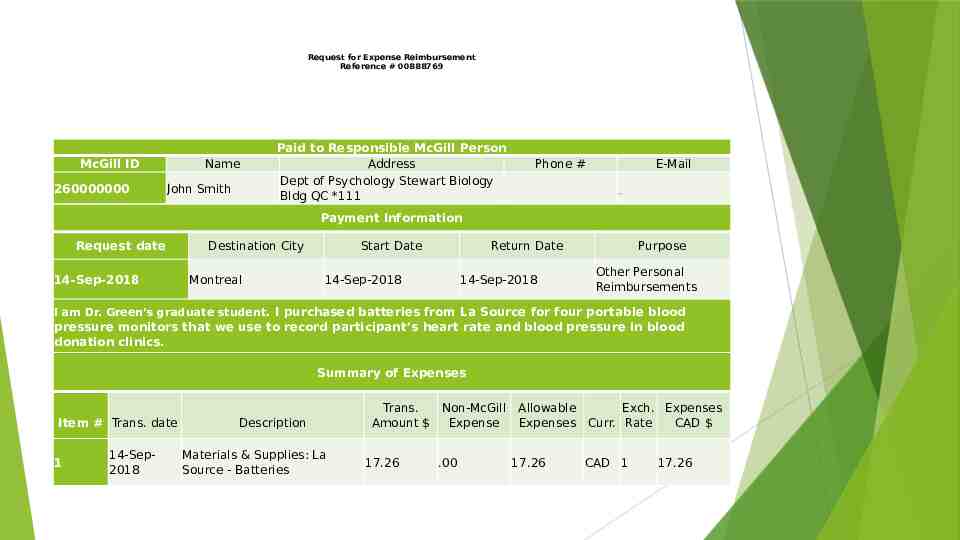

Request for Expense Reimbursement Reference # 00888769 McGill ID 260000000 Name John Smith Paid to Responsible McGill Person Address Dept of Psychology Stewart Biology Bldg QC *111 Phone # E-Mail Payment Information Request date 14-Sep-2018 Destination City Montreal Start Date Return Date 14-Sep-2018 14-Sep-2018 Purpose Other Personal Reimbursements I am Dr. Green’s graduate student. I purchased batteries from La Source for four portable blood pressure monitors that we use to record participant’s heart rate and blood pressure in blood donation clinics. Summary of Expenses Item # Trans. date 1 14-Sep2018 Description Materials & Supplies: La Source - Batteries Trans. Non-McGill Amount Expense 17.26 .00 Allowable Expenses 17.26 Exch. Expenses Curr. Rate CAD CAD 1 17.26

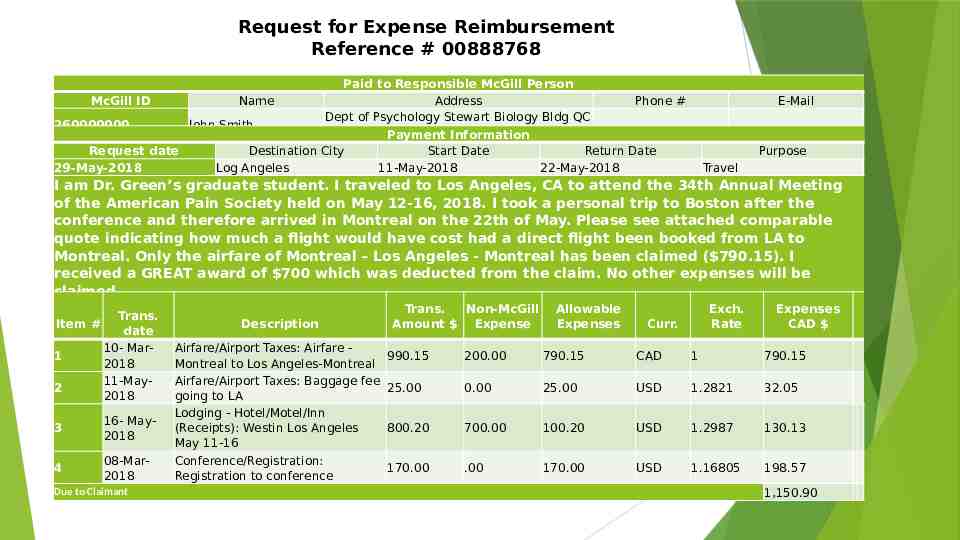

Request for Expense Reimbursement Reference # 00888768 Paid to Responsible McGill Person McGill ID Name Address Phone # Dept of Psychology Stewart Biology Bldg QC 260000000 John Smith *111 Payment Information Request date Destination City Start Date Return Date 29-May-2018 Log Angeles 11-May-2018 22-May-2018 E-Mail Purpose Travel I am Dr. Green’s graduate student. I traveled to Los Angeles, CA to attend the 34th Annual Meeting of the American Pain Society held on May 12-16, 2018. I took a personal trip to Boston after the conference and therefore arrived in Montreal on the 22th of May. Please see attached comparable quote indicating how much a flight would have cost had a direct flight been booked from LA to Montreal. Only the airfare of Montreal – Los Angeles - Montreal has been claimed ( 790.15). I received a GREAT award of 700 which was deducted from the claim. No other expenses will be claimed. Item # 1 2 Trans. date 10- Mar2018 11-May2018 3 16- May2018 4 08-Mar2018 Due to Claimant Description Airfare/Airport Taxes: Airfare Montreal to Los Angeles-Montreal Airfare/Airport Taxes: Baggage fee going to LA Lodging - Hotel/Motel/Inn (Receipts): Westin Los Angeles May 11-16 Conference/Registration: Registration to conference Trans. Non-McGill Amount Expense Allowable Expenses Exch. Rate Curr. Expenses CAD 990.15 200.00 790.15 CAD 1 790.15 25.00 0.00 25.00 USD 1.2821 32.05 800.20 700.00 100.20 USD 1.2987 130.13 170.00 .00 170.00 USD 1.16805 198.57 1,150.90

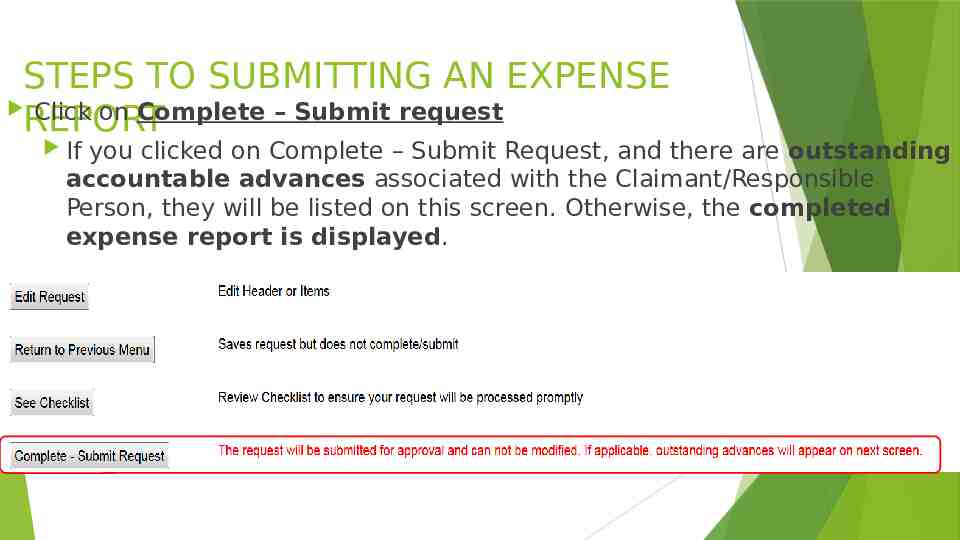

STEPS TO SUBMITTING AN EXPENSE Click on Complete – Submit request REPORT If you clicked on Complete – Submit Request, and there are outstanding accountable advances associated with the Claimant/Responsible Person, they will be listed on this screen. Otherwise, the completed expense report is displayed.

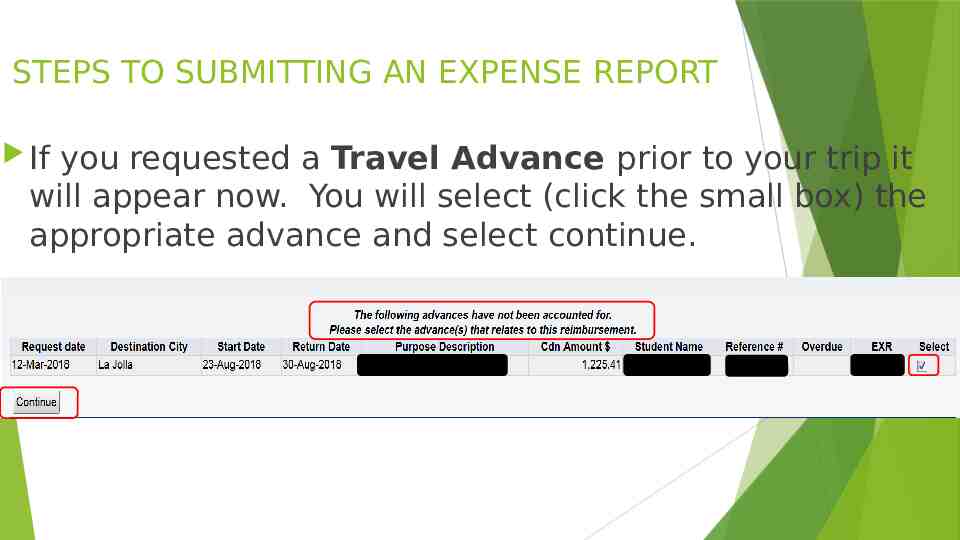

STEPS TO SUBMITTING AN EXPENSE REPORT If you requested a Travel Advance prior to your trip it will appear now. You will select (click the small box) the appropriate advance and select continue.

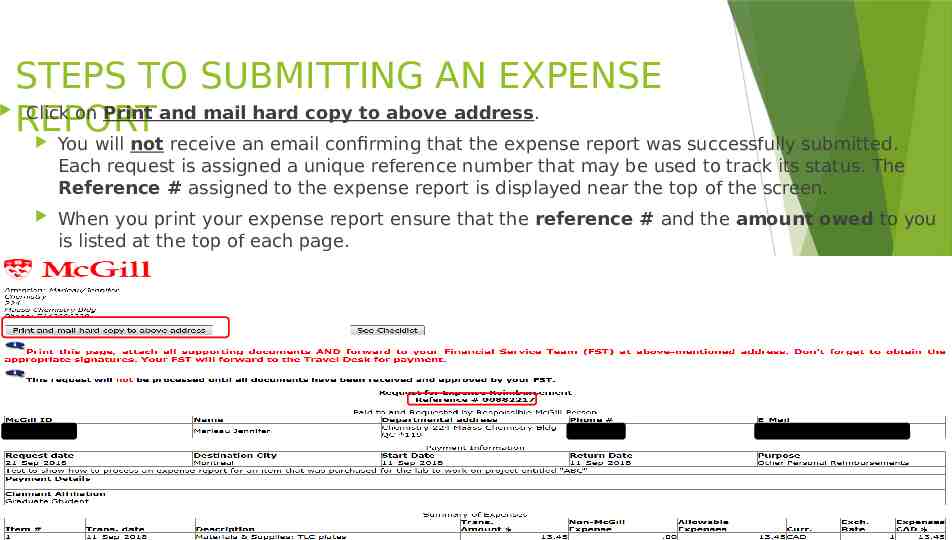

STEPS TO SUBMITTING AN EXPENSE Click on Print and mail hard copy to above address. REPORT You will not receive an email confirming that the expense report was successfully submitted. Each request is assigned a unique reference number that may be used to track its status. The Reference # assigned to the expense report is displayed near the top of the screen. When you print your expense report ensure that the reference # and the amount owed to you is listed at the top of each page.

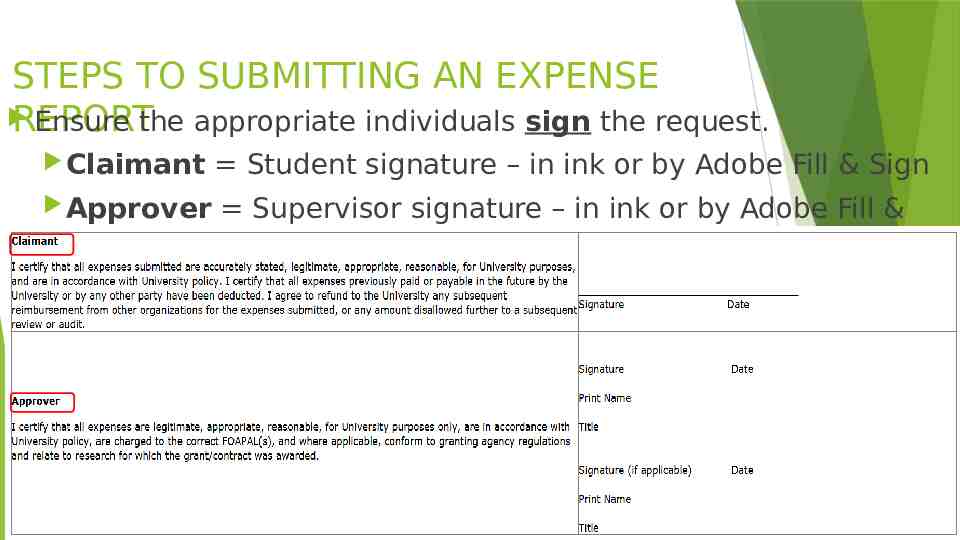

STEPS TO SUBMITTING AN EXPENSE REPORT Ensure the appropriate individuals sign the request. Claimant Student signature – in ink or by Adobe Fill & Sign Approver Supervisor signature – in ink or by Adobe Fill & Sign

TIPS FOR SUBMITTING AN EXPENSE REPORT Scan and Email the completed expense report and all original receipts to [email protected] Ensure that you keep the original expense report and receipts for your records in the event of an audit. Note that any claim under 2.00 will not be reimbursed. If you have a balance owing, you can issue an Interac e-Transfer from your banking institution. New contact: [email protected] Message: include your full name, ID#, and the Expense Report Reference Number (#01XXXXXX). Note: If you are a customer of Desjardins, you will not be able to send an Interac e-Transfer and you will need to refund McGill via a cheque.

TIPS FOR SUBMITTING AN EXPENSE REPORT Individual Receipts Expenses must be claimed: In the correct currency Receipts must be entered in the same currency and amount to which it was paid.

TIPS FOR SUBMITTING AN EXPENSE REPORT Taxi Receipts Select “Taxi – Travel” if your claim is for travel outside of Montreal. Select “Taxi – Local” when claiming taxi receipts in Montreal for a trip that did not involve an overnight stay. Lodging A Allowance 20.00/night lodging allowance is given if someone is away and stays with friends or family instead of a hotel/motel.

TIPS FOR SUBMITTING AN EXPENSE REPORT Meals Each receipt needs to be entered separately. The original receipt needs to show all the items that were consumed (itemized receipt) and proof of payment. Alcohol is not allowed and will have to be deducted (including taxes) if consumed. Meals cannot be claimed when the meal is included in the conference, lodging or airfare. Meal receipts or per diem cannot be claimed for conferences held in Montreal. If you are entertaining, include the name of the attendees if 10 people or less. If more than 10 people, indicate the description and number of people that attended. If you do not have detailed receipts, the per diem amount will be applied.

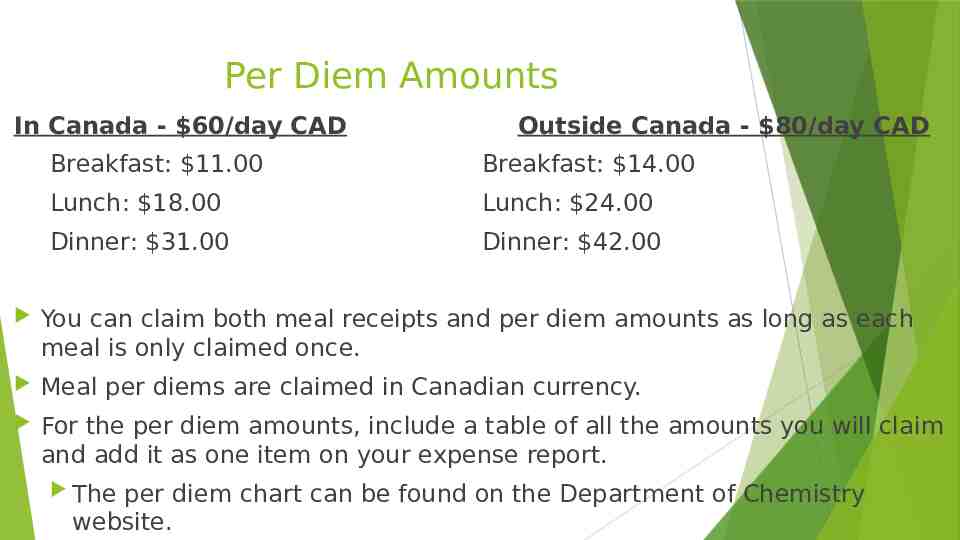

Per Diem Amounts In Canada - 60/day CAD Outside Canada - 80/day CAD Breakfast: 11.00 Breakfast: 14.00 Lunch: 18.00 Lunch: 24.00 Dinner: 31.00 Dinner: 42.00 You can claim both meal receipts and per diem amounts as long as each meal is only claimed once. Meal per diems are claimed in Canadian currency. For the per diem amounts, include a table of all the amounts you will claim and add it as one item on your expense report. The per diem chart can be found on the Department of Chemistry website.

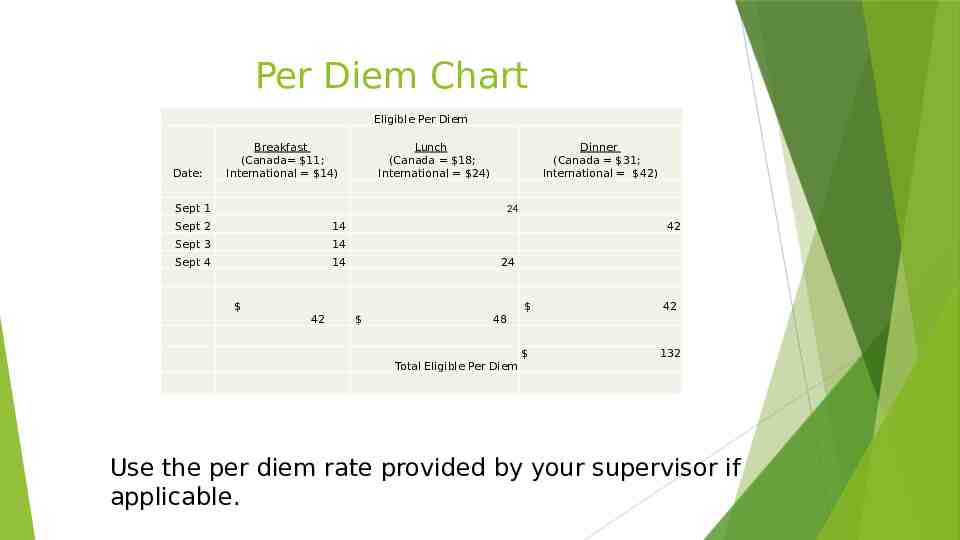

Per Diem Chart Eligible Per Diem Date: Breakfast (Canada 11; International 14) Lunch (Canada 18; International 24) Sept 1 Dinner (Canada 31; International 42) 24 Sept 2 14 Sept 3 14 Sept 4 14 42 24 42 42 48 Total Eligible Per Diem 132 Use the per diem rate provided by your supervisor if applicable.

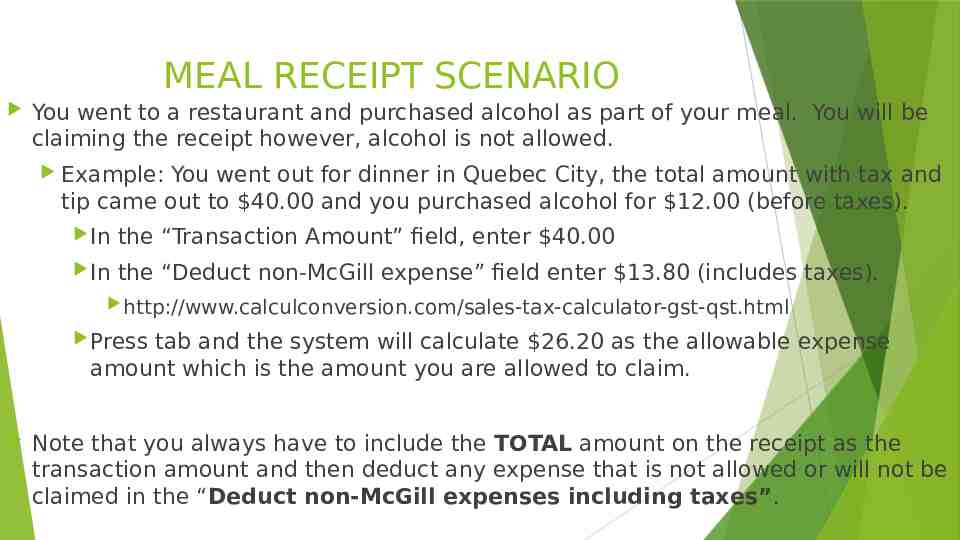

MEAL RECEIPT SCENARIO You went to a restaurant and purchased alcohol as part of your meal. You will be claiming the receipt however, alcohol is not allowed. Example: You went out for dinner in Quebec City, the total amount with tax and tip came out to 40.00 and you purchased alcohol for 12.00 (before taxes). In the “Transaction Amount” field, enter 40.00 In the “Deduct non-McGill expense” field enter 13.80 (includes taxes). http://www.calculconversion.com/sales-tax-calculator-gst-qst.html Press tab and the system will calculate 26.20 as the allowable expense amount which is the amount you are allowed to claim. Note that you always have to include the TOTAL amount on the receipt as the transaction amount and then deduct any expense that is not allowed or will not be claimed in the “Deduct non-McGill expenses including taxes”.

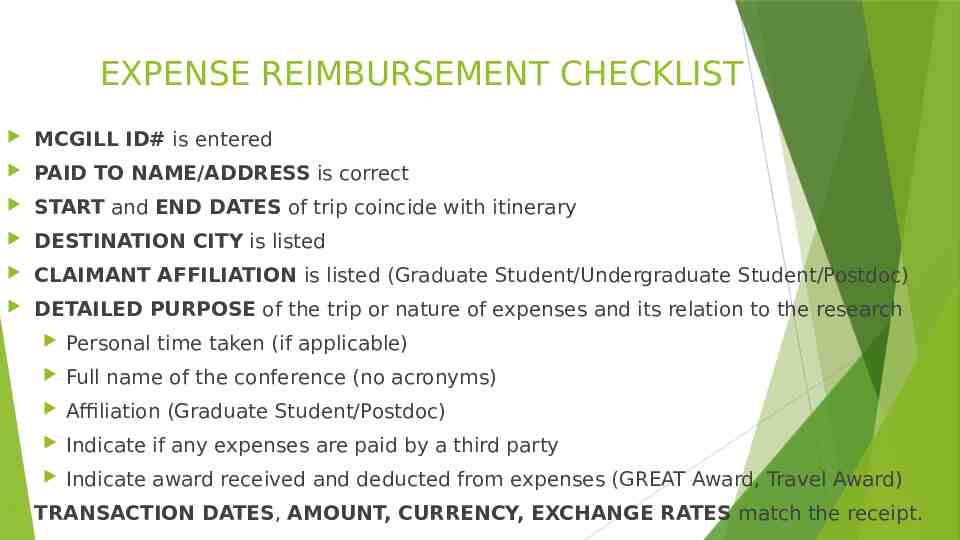

EXPENSE REIMBURSEMENT CHECKLIST MCGILL ID# is entered PAID TO NAME/ADDRESS is correct START and END DATES of trip coincide with itinerary DESTINATION CITY is listed CLAIMANT AFFILIATION is listed (Graduate Student/Undergraduate Student/Postdoc) DETAILED PURPOSE of the trip or nature of expenses and its relation to the research Personal time taken (if applicable) Full name of the conference (no acronyms) Affiliation (Graduate Student/Postdoc) Indicate if any expenses are paid by a third party Indicate award received and deducted from expenses (GREAT Award, Travel Award) TRANSACTION DATES, AMOUNT, CURRENCY, EXCHANGE RATES match the receipt.

EXPENSE REIMBURSEMENT CHECKLIST ALL EXPENSES PERTAINING TO A SINGLE TRIP PROVIDED Airfare ( comparison required if personal time is included) /Train/Mileage/Car Rental Baggage fee Lodging Meals - verify if any meals are provided by the conference/workshop Conference/workshop registration fee Taxis – indicate pick up and destination Poster/printing costs (use account code 700010) DOCUMENTATION PERTAINING TO TRIP Prospectus/Agenda E-mail confirmation

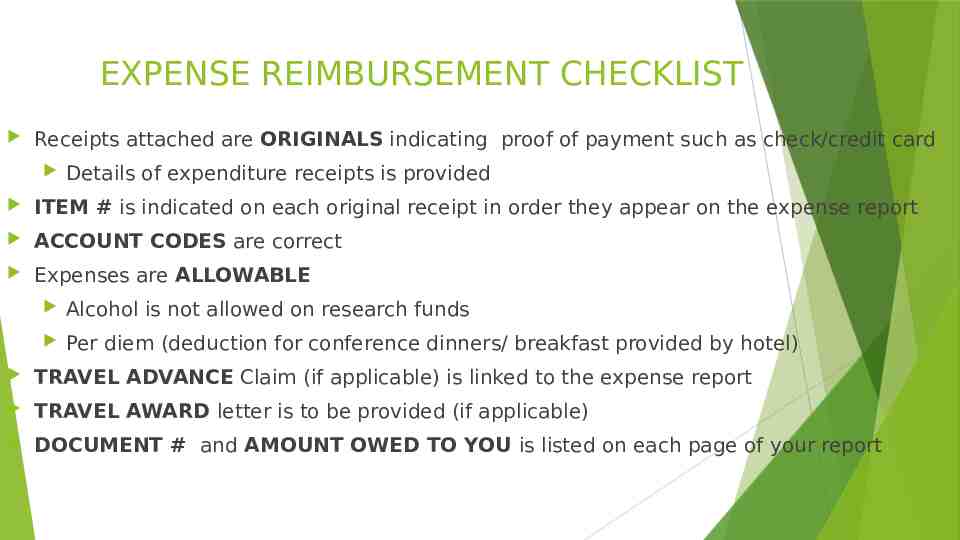

EXPENSE REIMBURSEMENT CHECKLIST Receipts attached are ORIGINALS indicating proof of payment such as check/credit card Details of expenditure receipts is provided ITEM # is indicated on each original receipt in order they appear on the expense report ACCOUNT CODES are correct Expenses are ALLOWABLE Alcohol is not allowed on research funds Per diem (deduction for conference dinners/ breakfast provided by hotel) TRAVEL ADVANCE Claim (if applicable) is linked to the expense report TRAVEL AWARD letter is to be provided (if applicable) DOCUMENT # and AMOUNT OWED TO YOU is listed on each page of your report

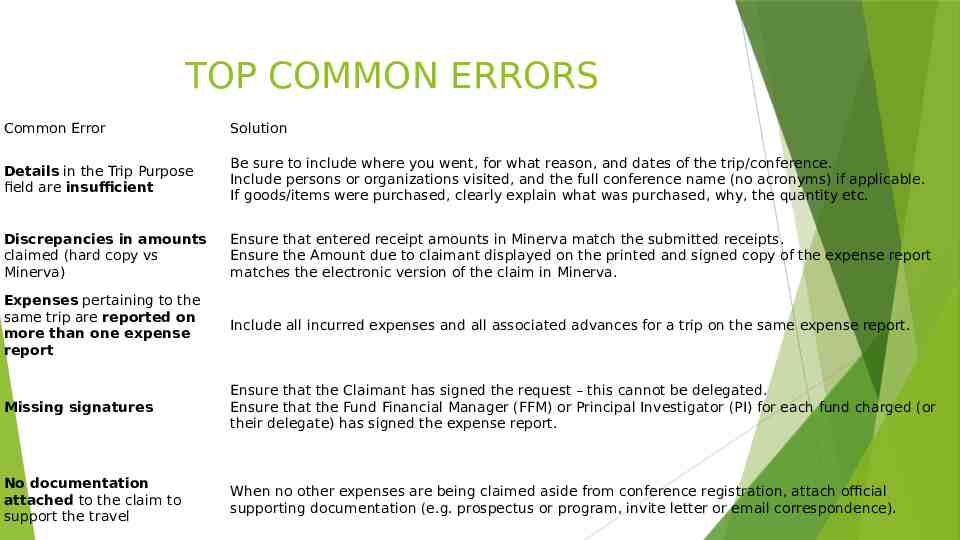

TOP COMMON ERRORS Common Error Solution Details in the Trip Purpose field are insufficient Be sure to include where you went, for what reason, and dates of the trip/conference. Include persons or organizations visited, and the full conference name (no acronyms) if applicable. If goods/items were purchased, clearly explain what was purchased, why, the quantity etc. Discrepancies in amounts claimed (hard copy vs Minerva) Ensure that entered receipt amounts in Minerva match the submitted receipts. Ensure the Amount due to claimant displayed on the printed and signed copy of the expense report matches the electronic version of the claim in Minerva. Expenses pertaining to the same trip are reported on more than one expense report Include all incurred expenses and all associated advances for a trip on the same expense report. Missing signatures Ensure that the Claimant has signed the request – this cannot be delegated. Ensure that the Fund Financial Manager (FFM) or Principal Investigator (PI) for each fund charged (or their delegate) has signed the expense report. No documentation attached to the claim to support the travel When no other expenses are being claimed aside from conference registration, attach official supporting documentation (e.g. prospectus or program, invite letter or email correspondence).

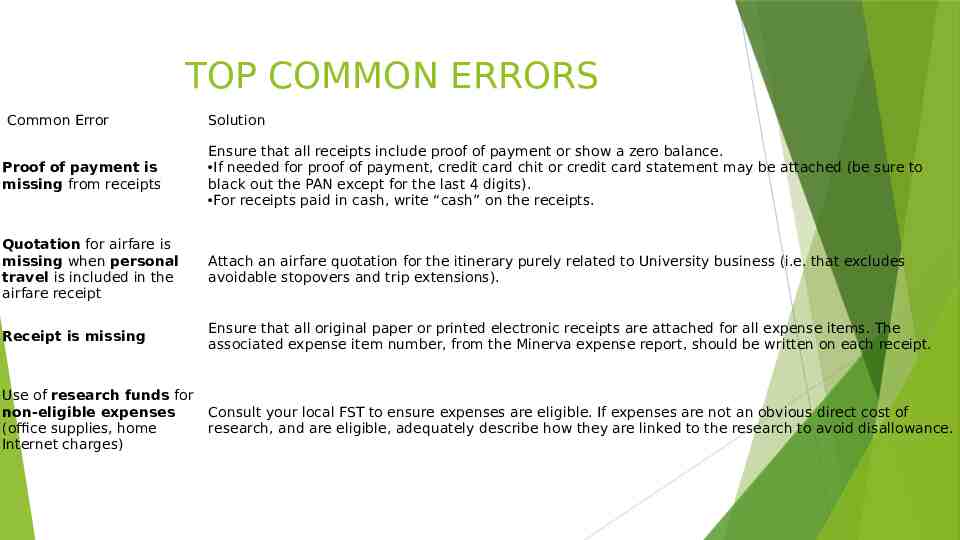

TOP COMMON ERRORS Common Error Solution Proof of payment is missing from receipts Ensure that all receipts include proof of payment or show a zero balance. If needed for proof of payment, credit card chit or credit card statement may be attached (be sure to black out the PAN except for the last 4 digits). For receipts paid in cash, write “cash” on the receipts. Quotation for airfare is missing when personal travel is included in the airfare receipt Attach an airfare quotation for the itinerary purely related to University business (i.e. that excludes avoidable stopovers and trip extensions). Receipt is missing Ensure that all original paper or printed electronic receipts are attached for all expense items. The associated expense item number, from the Minerva expense report, should be written on each receipt. Use of research funds for non-eligible expenses (office supplies, home Internet charges) Consult your local FST to ensure expenses are eligible. If expenses are not an obvious direct cost of research, and are eligible, adequately describe how they are linked to the research to avoid disallowance.

CONTACT DETAILS POD 3 Office: Otto Maass, Room 224 Edith Salifou– Accounts Administrator, Tel: 514-398-3275 Jennifer Marleau – Research Accounts Administrator, Tel: 514-398- 3769 Juan We Li – Research Accounts Administrator, Tel: 514-398-5288 can be reached via email at: [email protected]

REFERENCES AND USEFUL LINKS Student Checklist: https://www.mcgill.ca/chemistry/department/forms Per Diem Chart: https://www.mcgill.ca/chemistry/department/forms Procedures for Travel and Other Reimbursable Expenses: https://www.mcgill.ca/financialservices/travel How To’s for Minerva-Minerva Advances and Expense Reports Menu Options & Instructions (Finance, Employee and Student Menus): https://www.mcgill.ca/financialservices/travel/howto#EXR Step-by-step tutorial on how to submit an expense report: https://www.mcgill.ca/financialservices/files/financialservices/how to submit an exr for yourself tutorial.pdf Bank of Canada currency converter:

QUESTIONS