GRADE 12 ACCOUNTIN G

14 Slides331.66 KB

GRADE 12 ACCOUNTIN G

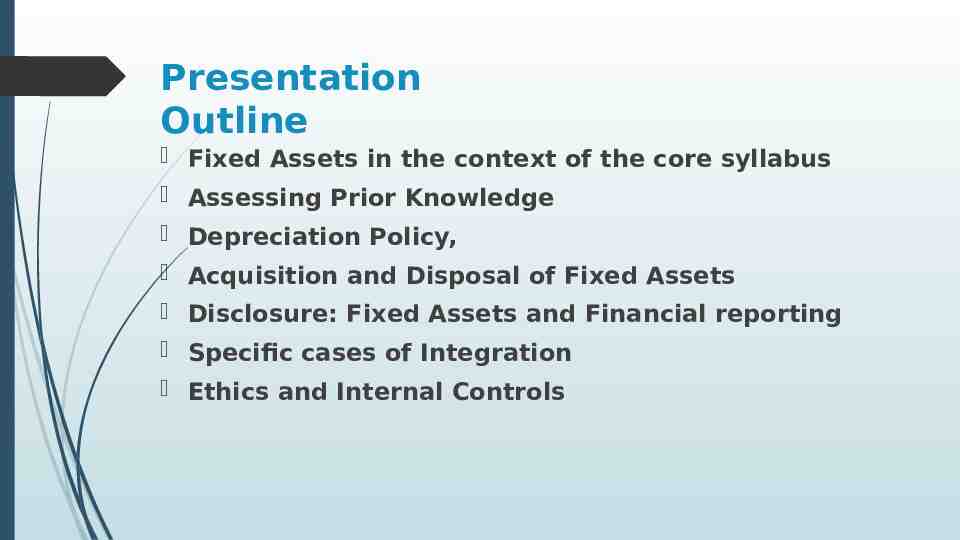

Presentation Outline Fixed Assets in the context of the core syllabus Assessing Prior Knowledge Depreciation Policy, Acquisition and Disposal of Fixed Assets Disclosure: Fixed Assets and Financial reporting Specific cases of Integration Ethics and Internal Controls

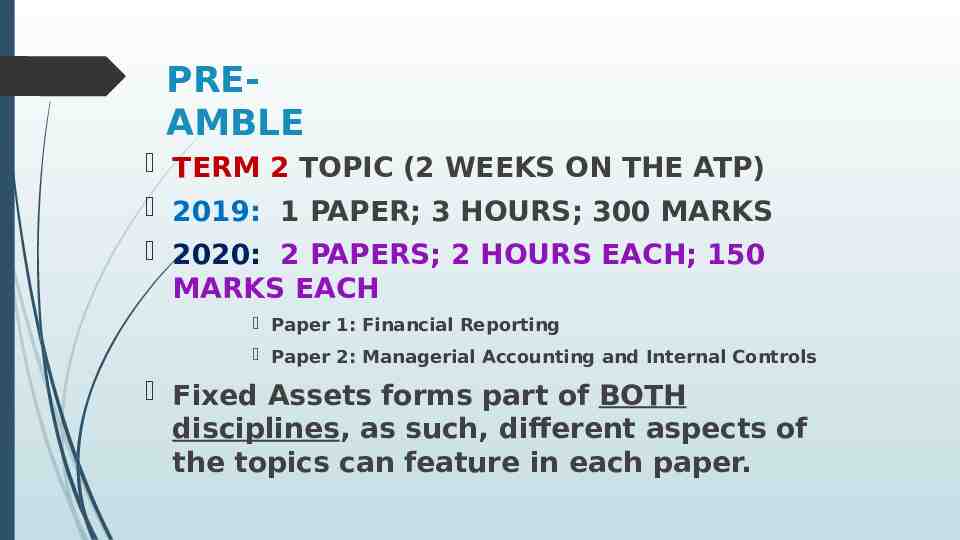

PREAMBLE TERM 2 TOPIC (2 WEEKS ON THE ATP) 2019: 1 PAPER; 3 HOURS; 300 MARKS 2020: 2 PAPERS; 2 HOURS EACH; 150 MARKS EACH Paper 1: Financial Reporting Paper 2: Managerial Accounting and Internal Controls Fixed Assets forms part of BOTH disciplines, as such, different aspects of the topics can feature in each paper.

Introducti on What are fixed assets? Why do we buy them? What are the different categories / types? How and where do we record them?

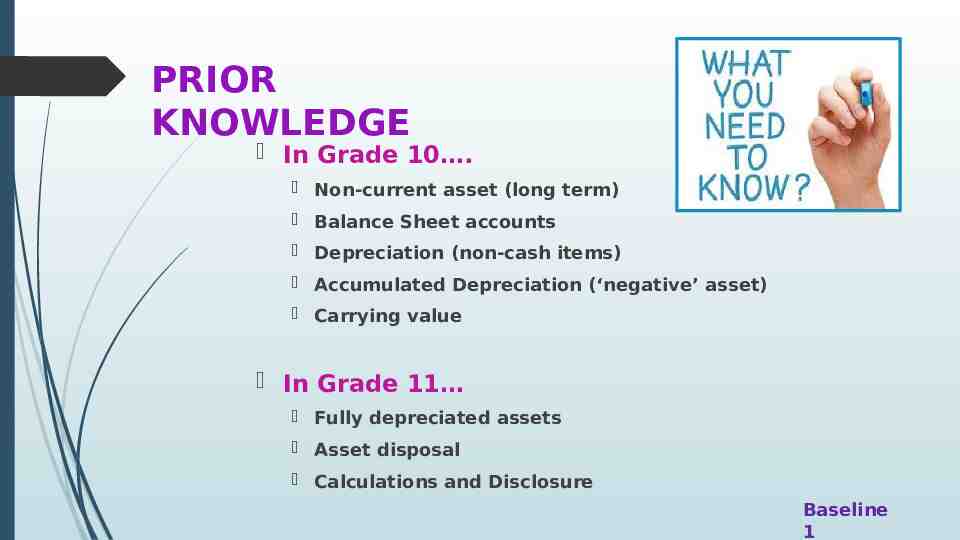

PRIOR KNOWLEDGE In Grade 10 . Non-current asset (long term) Balance Sheet accounts Depreciation (non-cash items) Accumulated Depreciation (‘negative’ asset) Carrying value In Grade 11 Fully depreciated assets Asset disposal Calculations and Disclosure Baseline 1

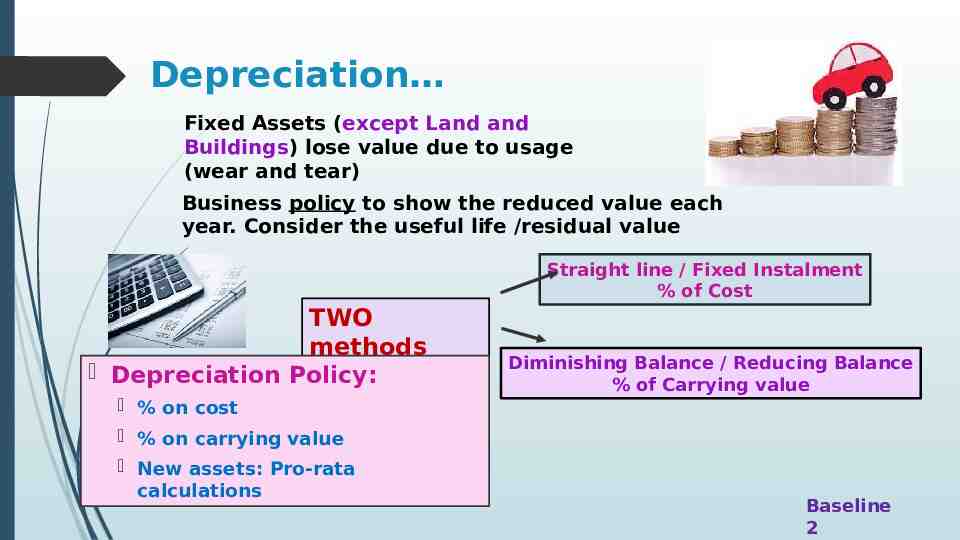

Depreciation Fixed Assets (except Land and Buildings) lose value due to usage (wear and tear) Business policy to show the reduced value each year. Consider the useful life /residual value Straight line / Fixed Instalment % of Cost TWO methods Depreciation Policy: % on cost % on carrying value New assets: Pro-rata calculations Diminishing Balance / Reducing Balance % of Carrying value Baseline 2

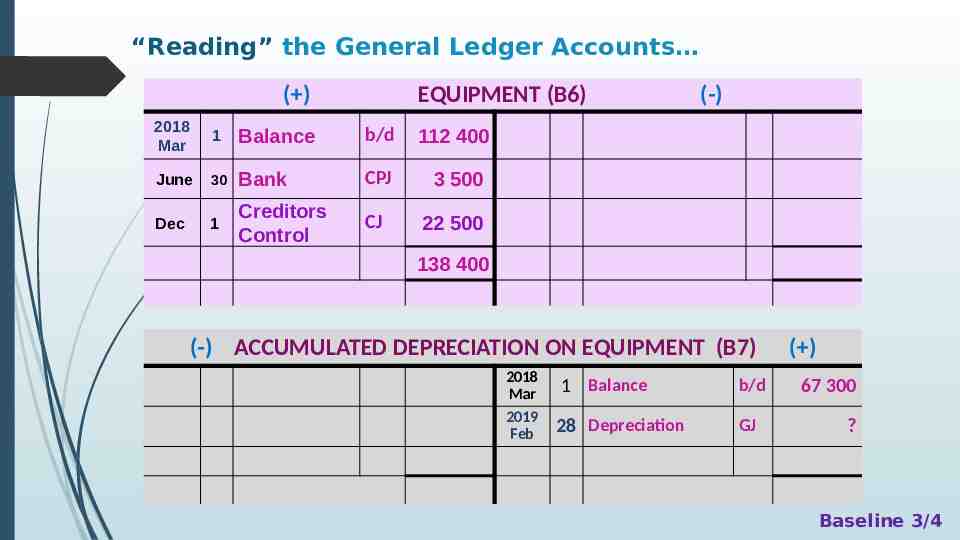

“Reading” the General Ledger Accounts ( ) EQUIPMENT (B6) 2018 Mar 1 Balance b/d 112 400 June 30 Bank CPJ 3 500 Dec 1 Creditors Control CJ 22 500 (-) 138 400 (-) ACCUMULATED DEPRECIATION ON EQUIPMENT (B7) 2018 Mar 2019 Feb 1 Balance b/d 28 Depreciation GJ ( ) 67 300 ? Baseline 3/4

Asset disposal (Sale of fixed assets) Reasons Accounting treatment (WHAT WE NEED TO KNOW) 1.Date of sale 2.Depreciation policy (rate and method) 3.Cost of the asset sold 4.Carrying value of asset sold (Accumulated Depreciation) 5.Amount received/receivable for the asset (Proceeds) 6.Profit/Loss on sale of asset

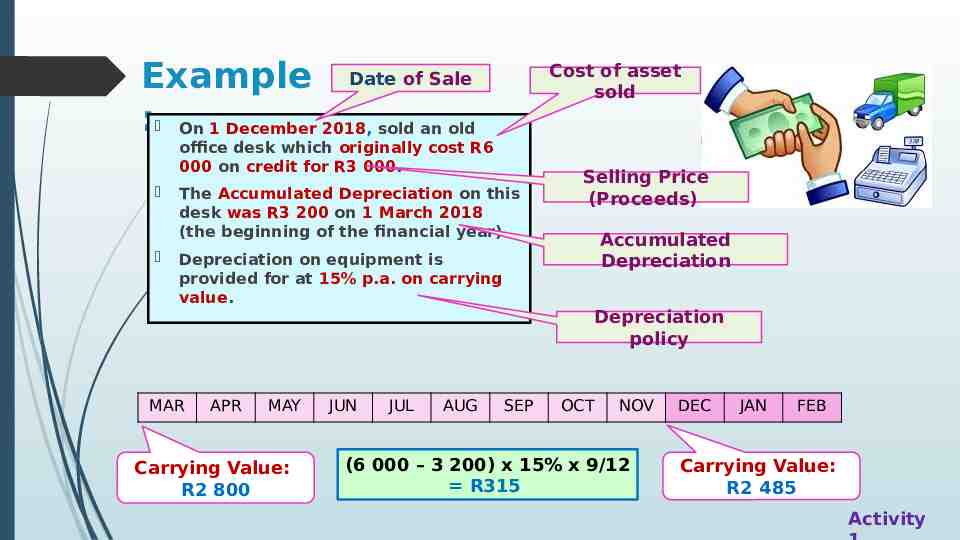

Example Date of Sale : On 1 December 2018, sold an old Cost of asset sold office desk which originally cost R6 000 on credit for R3 000. The Accumulated Depreciation on this desk was R3 200 on 1 March 2018 (the beginning of the financial year). Selling Price (Proceeds) Accumulated Depreciation Depreciation on equipment is provided for at 15% p.a. on carrying value. Depreciation policy MAR APR MAY Carrying Value: R2 800 JUN JUL AUG SEP OCT NOV (6 000 – 3 200) x 15% x 9/12 R315 DEC JAN FEB Carrying Value: R2 485 Activity

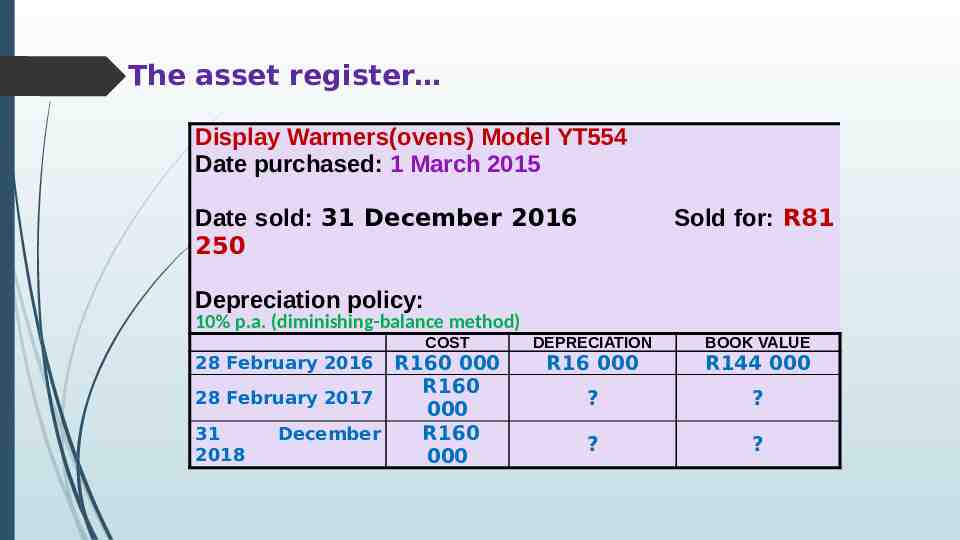

The asset register Display Warmers(ovens) Model YT554 Date purchased: 1 March 2015 Date sold: 31 December 2016 250 Sold for: R81 Depreciation policy: 10% p.a. (diminishing-balance method) COST R160 000 R160 28 February 2017 000 R160 31 December 2018 000 28 February 2016 DEPRECIATION BOOK VALUE R16 000 R144 000 ? ? ? ?

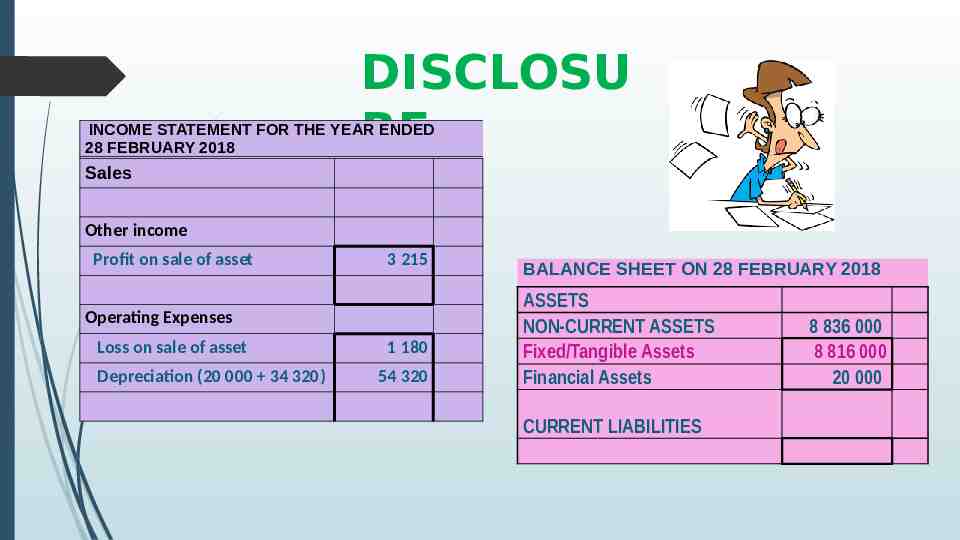

DISCLOSU RE INCOME STATEMENT FOR THE YEAR ENDED 28 FEBRUARY 2018 Sales Other income Profit on sale of asset 3 215 Operating Expenses Loss on sale of asset Depreciation (20 000 34 320) 1 180 54 320 BALANCE SHEET ON 28 FEBRUARY 2018 ASSETS NON-CURRENT ASSETS Fixed/Tangible Assets Financial Assets CURRENT LIABILITIES 8 836 000 8 816 000 20 000

FIXED ASSET NOTE LAND AND BUILDINGS EQUIPMENT TOTAL Carrying value on 1 March 2016 3 850 000 645 000 ? Cost 3 850 000 ? 4 970 000 0 ? ? 180 000 1 165 000 Accumulated depreciation Movements: Additions (at cost) ? ? 1 465 000 Disposals (at carrying value) 0 (67 000) (67 000) (233 000) (233 000) Depreciation (total) Carrying value on 28 February 2017 Cost ? 1 420 000 ? Accumulated depreciation 0 ? ? Baseline 5

EXTENSION ACTIVITIES . GROUP WORK EACH GROUP WILL REPORT ON A DIFFERENT ACTIVITY Activity 2 and 3 Examples 1 – 4

INTERNAL CONTROL PROCESSES and ETHICS Thank you