Export Competitively and Boost Sales Using Accounts Receivable

20 Slides3.26 MB

Export Competitively and Boost Sales Using Accounts Receivable Insurance ACE Exports Webinar January 11, 2018 Main Title of Presentation Stephen Maroon, Director of Marketing Communications Sub-heading Elizabeth Thomas, Director of Sales and Marketing Name of Presenter Title of Presenter Date

OBJECTIVES TODAY Understand EXIM Bank Learn how its products can increase the sales of U.S.based companies Q&A

WHO IS EXIM BANK? EXIM is an official independent agency of the U.S. Government Mission: Maintain and create U.S. jobs by supporting the growth of U.S. exports Established in 1934 with HQ in Washington, DC Self-sustaining Supports all U.S.-based companies

WE ARE SMALL BUSINESS FOCUSED About 90% of EXIM Bank transactions supported small business exports. No company or transaction is too small. EXIM has supported sales of just a few thousand dollars.

FOUR PRIMARY PRODUCTS Export Credit Insurance Working Capital Guarantees Loan Guarantees Direct Loans (few and rare) 5

Elizabeth Thomas, EXIM Director of Sales and Marketing Joined EXIM in 2016 Experienced international business executive working in the U.S., Europe and Asia Sales, marketing and health-policy leadership with Hewlett-Packard, InTouch Health and other high-tech firms MBA, Emory University Goizueta Business School 6

GROWING INTERNATIONAL SALES WITH LESS WORRY Should I enter that new market? When will I get paid? How can I match my foreign competitors who are offering credit terms? Where will I get funds to fulfill the sales order? 7

SMALL BUSINESSES EXPORT WITH CONFIDENCE Export Credit Insurance Reduce your risk of nonpayment by foreign buyers Offer competitive “open account” credit terms to your foreign buyers Working Capital Loan Guarantee Obtain working capital loan funds to finance U.S.-made goods and services for export 8

MADE IN THE USA! High quality, durable, and safe Flexible and prepared to modify products and services Reputation for excellent after-sales service and warranty coverage Honest end-to-end solutions that create long-term value 9

What if my buyer doesn’t pay? Export Credit Insurance Protects against nonpayment Extends terms Monetizes receivables Accelerate cash flow

EXIM SOLUTION: EXPORT CREDIT INSURANCE Risk Protection Protects against nonpayment by foreign buyers due to commercial and political risks 11 Sales Tool Offers competitive terms to foreign buyers (generally up to 180 days, some products may qualify for 360 day terms) Financing Aid Enables additional financing to fulfill sales orders. Insured foreign receivables may be added to your borrowing base

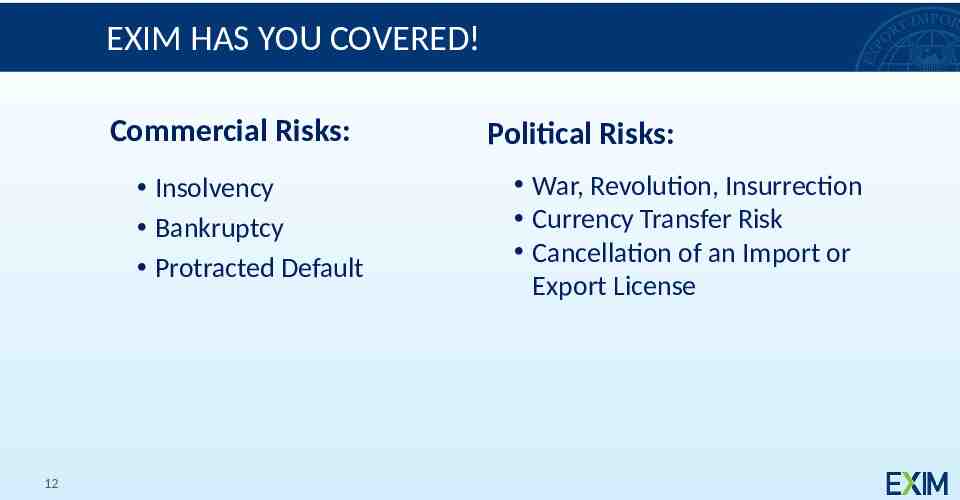

EXIM HAS YOU COVERED! Commercial Risks: Insolvency Bankruptcy Protracted Default 12 Political Risks: War, Revolution, Insurrection Currency Transfer Risk Cancellation of an Import or Export License

EXTEND “OPEN ACCOUNT” COMPETITIVE CREDIT TERMS Up to 180 days for consumable products, as well as sales to distributors Up to 360 days for some bulk agricultural products and sales to end-users of capital equipment Note: EXIM also has medium-term buyer finance insurance 13

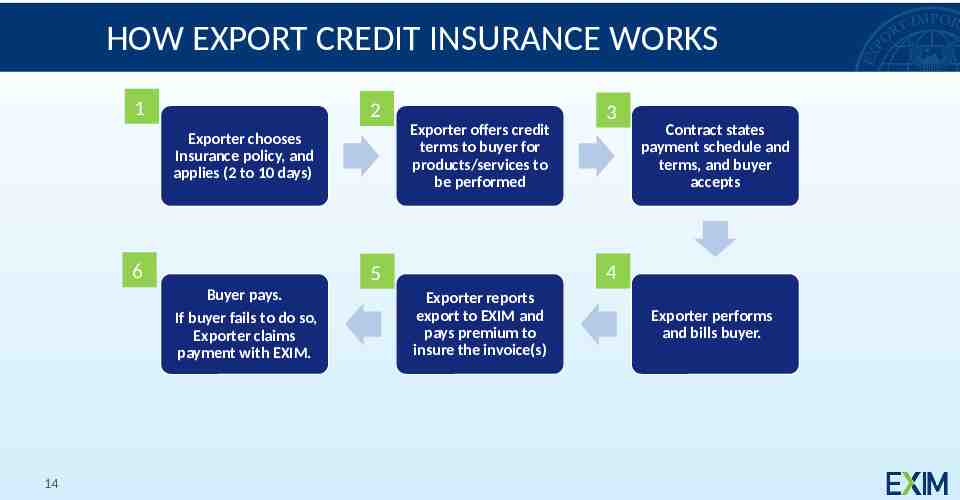

HOW EXPORT CREDIT INSURANCE WORKS 1 2 Exporter offers credit terms to buyer for products/services to be performed Exporter chooses Insurance policy, and applies (2 to 10 days) 6 14 Contract states payment schedule and terms, and buyer accepts 4 5 Buyer pays. If buyer fails to do so, Exporter claims payment with EXIM. 3 Exporter reports export to EXIM and pays premium to insure the invoice(s) Exporter performs and bills buyer.

EXAMPLE: EXPRESS INSURANCE RATES Sell to a foreign buyer on terms up to 60 days open account Premium cost is 0.65 per 100 of the gross invoice value Gross invoice is covered to 95% on a 30,000 sale, 28,500 is covered for a 195 premium No application fee, no deductible, pay-as-you-ship premium 15

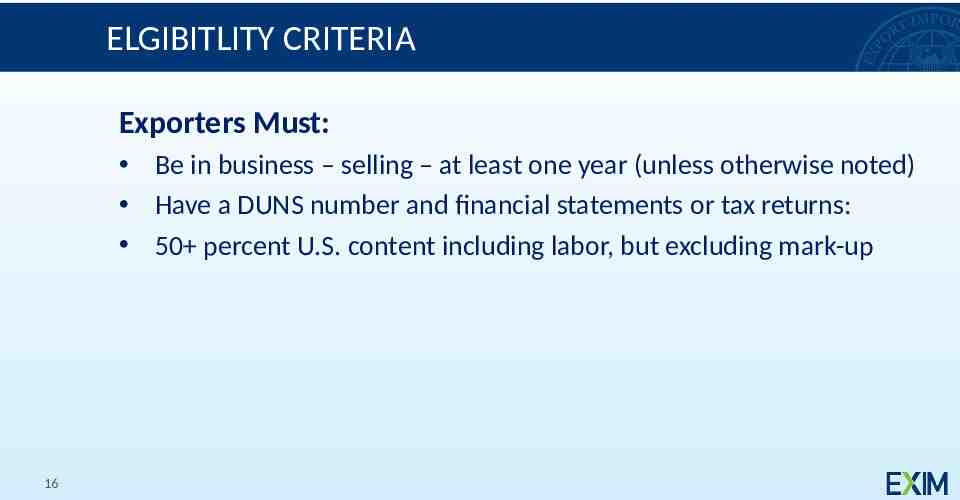

ELGIBITLITY CRITERIA Exporters Must: Be in business – selling – at least one year (unless otherwise noted) Have a DUNS number and financial statements or tax returns: 50 percent U.S. content including labor, but excluding mark-up 16

JUST A FEW RESTRICTIONS No military or defense-related products or obligors (exceptions apply) Restricted countries (Country Limitation Schedule) Shipping from U.S. port 17

RESOURCES Get a DUNS number to establish your credit file US Department of Commerce https://export.gov SBA Export Business Planner EXIM Country Limitation Schedule [email protected] 18

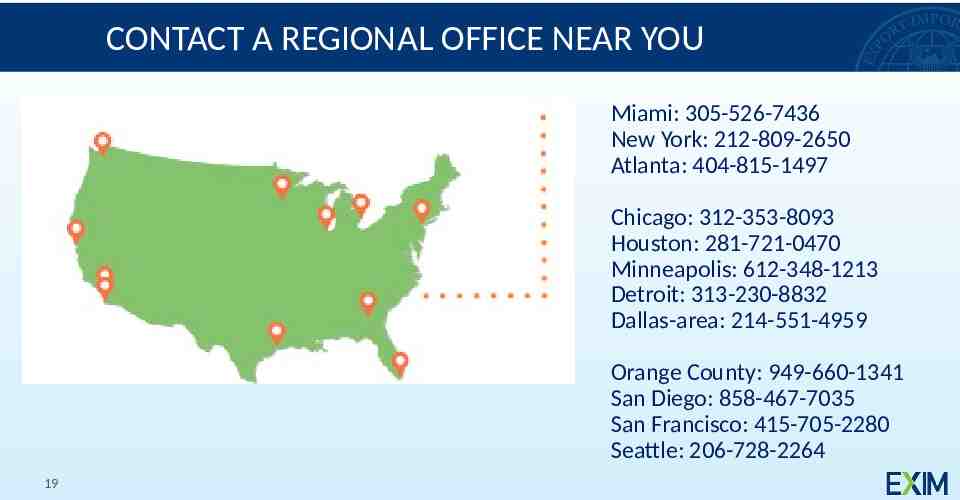

CONTACT A REGIONAL OFFICE NEAR YOU Miami: 305-526-7436 New York: 212-809-2650 Atlanta: 404-815-1497 Chicago: 312-353-8093 Houston: 281-721-0470 Minneapolis: 612-348-1213 Detroit: 313-230-8832 Dallas-area: 214-551-4959 Orange County: 949-660-1341 San Diego: 858-467-7035 San Francisco: 415-705-2280 Seattle: 206-728-2264 19

QUESTIONS? EXIM Contact: Elizabeth Thomas, Director of Sales and Marketing Phone: 202.565.3488 Email: [email protected] exim.gov 800.565.3946 (EXIM)