實驗經濟學一:行為賽局論 Experimental Economics I: Behavioral Game

58 Slides1.40 MB

實驗經濟學一:行為賽局論 Experimental Economics I: Behavioral Game Theory 第十一講:認證標籤賽局 Lecture 11:Signaling 授課教師:國立臺灣大學 經濟學系 王道一教授( Joseph Tao-yi Wang ) 本課程指定教材 : Colin E. Camerer, Behavioral Game Theory: Experiments in Strategic Interaction. New York: Russell Sage Foundation; New Jersey: Princeton UP, 2003. 【 本 著 作 除 另 有 註 明 外 , 採 取 創用 CC 「姓名標示-非商業性-相同方式分享」臺灣3.0版 授權釋出】 Author Nam 1

The Big Picture What have we learned up to now? – Camerer (BGT 2003) report Game Theory Experiments (test theory & inspire new theory) 1. Mixed-strategy Nash Equilibrium (MSE) 2. Subgame Perfect Equilibrium (SPE) 3. Bayesian Nash Equilibrium (BNE): auction 4. Sequential Equilibrium (SE) [today] Why theory works well in some situations? Author Nam 2

The Big Picture Why theory works well in simple situations? 1. Learning to play Nash? 2. Limited strategic reasoning – Backward Induction fails! 3. Initial response (level-k reasoning) 4. Cannot detect deviations 5. Coordination & pre-game Communication Author Nam 3

The Big Picture Camerer (BGT 2003) purposely reported different classes of game theory experiments 1. MSE (Ch. 3) 2. SPE and dominant solvable games (Ch. 5) 3. Learning (Ch. 6) 4. Coordination (Ch. 7) 5. SE and Signaling and Reputation (Ch. 8) 6. Games of Social Preferences (Ch. 2) Author Nam 4

The Big Picture We also saw Risk and Time Preferences What about Market Behavior? Applications? 1. Auction (auction chapter in EL) 2. Cheap Talk Games (and Lying) 3. Voting Games (special case of MSE!) 4. Bargaining Market Design 5. Field Experiments 6. Prediction Markets and Bubbles Author Nam 5

What Makes a Signal Work? A Signal must be affordable by certain types of people – Cost Benefit (if receivers decodes it) A signal must be too expensive for players of the wrong type to afford – Cost Benefit (even if receivers decodes it) Separating Equilibrium: Those who buy and those who don't are of different types Author Nam 6

What Makes a Signal Work? Separating Equilibrium consists of a circular argument: – Signal senders buy the signal anticipating receivers decode it – Receivers get assurance about sender types from the signal and act different with/without it – This is a self-fulfilling prophecy Spence (Dissertation 1974) Author Nam 7

Screening Experiment 1. CHT Telecom has 2 cell phone plans: – Plan A: NT 1 per minute – Plan B: NT 168 for 300 minutes, NT 1.5 beyond 2. Your monthly usage (based on card received): – Spades: 0-100 minutes – Hearts: 200-300 minutes – Diamonds: 400-500 minutes – Clubs: 600-700 minutes 3. Which plan would you choose? Why? Author Nam 8

Signaling Experiment 1. Suppose you are in – National Daiwan University: Graduates earn 35k – Private So-What University: Graduates earn 22k 2. In your senior year, you can choose to: – Take master entrance exam for National Daiwan University: Graduates earn 40k, but need to repay tuition/cram school loans 5k monthly 3. Would you choose apply for a master? Why or why not? Author Nam 9

Applying for Economics Graduate School An Example of Signaling Author Nam10

Questions What should I apply? MBA or Econ PhD? What's the most important factor if I apply? Are foreigners/females discriminated against? Is mathematics needed in graduate school? Is MA (at NTU) required before PhD? How should I prepare myself now? Author Nam11

What Program Should I Apply? MBA or Econ PhD? This depends on Your Career Interest However, MBA is not for newly graduates – MBA is designed for people who have worked for years and are heading for top management Teach undergraduate level Economics, but 1. Tie it with actual working experience 2. Socializing with other CEO-to-be's is a bonus Author Nam12

What Program Should I Apply? Econ PhD provides you the rigorous training to modern economic analysis techniques This is used by – Academics (Economics, Public Policy, Law,.) – Economics Consulting Firms – Public Policy Evaluation – Financial Companies (like Investment Banking) – International Organizations (APEC, IMF, etc.) Author Nam13

Most Important Factor What is the Most Important Factor when I Apply for Graduate School? Petersons Guide surveyed both students & admission committee members (faculty) They find that both agree No.1 factor is: – Letter from someone the committee knows Why is this No.1? Credible Signaling! Author Nam14

Most Important Factor No.1: – Letter from someone the committee knows Who are the people committees know? What if I cannot find someone to write? Find Other Credible Signals! – GPA? – GRE or TOEFL? – Other Distinct Features such as AWA 5.0 or higher? Author Nam15

Discrimination and Gender Are Foreigners or Females Discriminated Against? Foreigners: – Different Programs have different policy – UCLA (8/35) vs. MIT (25/30) Women: Only 16% of Faculty are Female – Does the market favor women? Maybe – Comparison: 33% Math Professors are Female Author Nam16

Is Mathematics Needed? Advice for Econ PhD Applicants: – Take a heavy dose of mathematics during undergraduate. - Peterson's Guide So, the answer is generally yes. – There is a gap between undergrad & graduate But, the ability to find economic intuition behind the math is even more essential – My first year micro comp. experience They need Bilingual People! Author Nam17

Is Mathematics Needed? What Kind of Math is Needed? Introduction to Real Analysis (aka Advanced Calculus) – Score A or A – The thinking process required for you to score A/A is what's important Linear Algebra – Basic Tool for Econometrics Advance Statistical Inference – .Econometrics The more the better, but mastering these three is better than being a jack of all traits. Author Nam18

Is MA required before I enter PhD? No. Most Top-10 have only PhD programs – Chicago: Give you a master if you cannot finish But you may not be able to survive studying both math & economics in English. Hence, a MA might help since – MA classes are similar to PhD classes – You may not be sure if you want to go for PhD Condition on passing 1st year comp's, MA is unnecessary, but you may want to hedge. Author Nam19

How Should I Prepare Myself Now? Create Credible Signals! Such As: GPA 4.0, ranked 1/160 Good References A Published Research Paper Take a Heavy Dose of Mathematics Take Graduate Level Courses in Economics Take Economics Courses Taught in English Author Nam20

What Makes a Signal Work? Exercise: Show which types of people can afford the following signals: – GPA 4.0, ranked 1/160 – Good References – A Published Research Paper – Take a Heavy Dose of Mathematics – Take Graduate Level Courses in Economics – Take Economics Courses Taught in English – AWA 5.0 Author Nam21

Theory of Signaling Harsanyi (MS 1967-68) – Types: Privately observe a move of Nature Bayesian-Nash Equilibrium (simultaneous) or PerfectBayesian Equilibrium (sequential) – Separating Equilibrium – Pooling Equilibrium – Semi-pooling Equilibrium Refinements: Sequential, Intuitive, Divine, Universal Divine, Never-Weak-BR, Stable Author Nam22

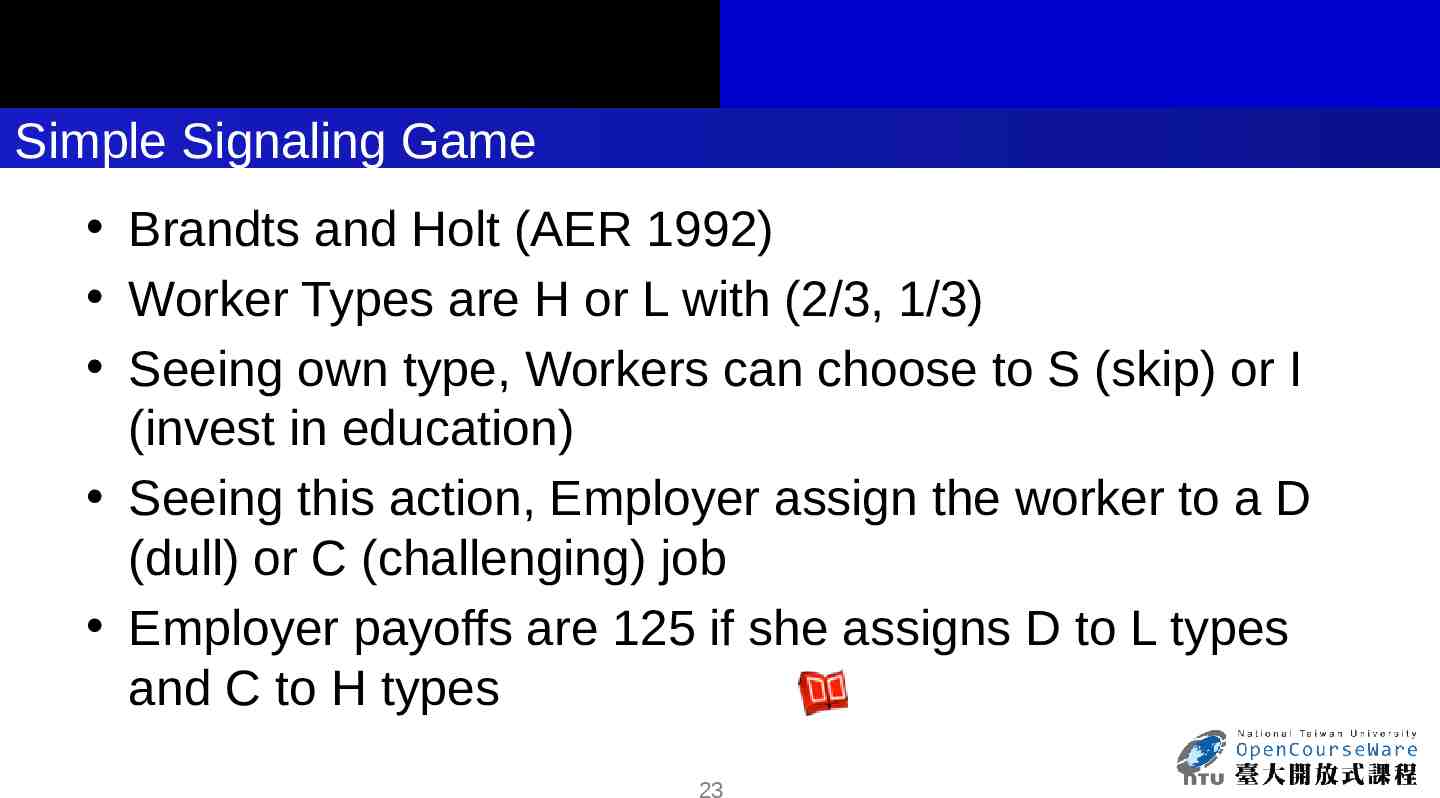

Simple Signaling Game Brandts and Holt (AER 1992) Worker Types are H or L with (2/3, 1/3) Seeing own type, Workers can choose to S (skip) or I (invest in education) Seeing this action, Employer assign the worker to a D (dull) or C (challenging) job Employer payoffs are 125 if she assigns D to L types and C to H types Author Nam23

Simple Signaling Game Workers get 100 doing C and 20 doing D L types get additional 40 for taking action S H types get 40 if take action I, 20 if take S Action seeing S Action seeing I CS DS CI DI Type L 140, 75 60, 125 100, 75 20, 125 Type H 120, 125 2040, 75 140, 125 60,75 Author Nam24

Simple Signaling Game Two Pooling Equilibria: Sequential Equilibrium – Both Types choose S, Employers assign C – Out-of-equilibrium Belief: choosing I means L – Hence, Employers assign D if they see I Intuitive Equilibrium – Both Types choose I, Employers assign C – Out-of-equilibrium Belief: choosing S means L – Hence, Employers assign D if they see S Author Nam25

Simple Signaling Game: Extensive Form Sequential Equilibrium: Beliefs: C 2 Invest 1 Skip 2 C (140,125) D (60,75) H D N C L C (100,75) 2 Invest 1 Skip 2 D (20,125) D Author Nam26 (120,125) (20,75) (140,75) (60,125)

Simple Signaling Game: Extensive Form Intuitive Equilibrium: Beliefs: C 2 Invest 1 Skip 2 C (140,125) D (60,75) H D N C L C (100,75) 2 Invest 1 Skip 2 D (20,125) D Author Nam27 (120,125) (20,75) (140,75) (60,125)

Simple Signaling Game Message Type I H I L 1-4 100 25 5-8 100 58 9-12 100 75 Suggest Actions: C S, D I 1-4 50 13 5-8 75 33 Periods Action Type C I 100 100 98 D S 74 100 60 60 33 46 67 Author Nam28 Equilibrium Predictions Intuit. Seq. 100 0 100 0 100 0 100 100 0 0

Follow-up Studies Banks, Camerer and Porter (GEB 1994) Design 7 games, separating: – Nash vs. non-Nash – Sequential vs. Nash – Intuitive vs. Sequential – Divine vs. Intuitive – Universal Divine vs. Divine – NWBR vs. Universal Divine – Stable vs. NWBR Author Nam29

Table X, Banks, Camerer & Porter, GEB94' Author Nam30

Follow-up Studies Results show that subjects do converge to the more refined equilibrium up to intuitive After that, subjects conform to neither – Except for possibly Stable vs. NWBR Is this a test of refinements, or a test of equilibrium selection? Exercise: Show how equilibria in Table 8.3 (BCP94') satisfy corresponding refinements Author Nam31

Follow-up Studies In game 2-6, different types send different messages – No simple decision rule explains this – But weak dominance and 1 round IEDS hold Are people just level-1? Also, how does the convergence work? Author Nam32

Follow-up Studies More studies on learning: Brands and Holt (IJGT 1993) – Subjects lead to play less refined equilibrium – Why? Initial random play produces history that supports the non-intuitive equilibrium Anderson and Camerer (ET 2000) – EWA yields δ 0.54 (0.05); – Does better than choice reinforcement (δ 0) and weighted fictitious play (δ 1) Author Nam33

Specialized Signaling Games Potters and van Winden (IJGT 1996) – Lobbying Cadsby, Frank & Maksimovic (RFS 1990) – Corporate Finance Cooper, Kagel, Lo and Gu (AER 1999) – Ratchet Effect Cooper, Garvin and Kagel (Rand/EJ 1997) – Belief Learning in Limit Pricing Signaling Games Author Nam34

Lobbying: Potters & van Winden (IJGT96) Lobby group is type t1 or t2 with (1-p, p) Lobby group can send a signal (cost c) Politician chooses action x1 or x2 (match type) Type No signal Costly Signal x1 x2 t1 (1-p) 0, b1 a1, 0 –c, b1 a1–c, 0 t2 (p) 0, 0 a2, b2 –c, 0 a2–c, b2 Author Nam35 x1 x2

Lobbying For ; there are 2 equilibrium: Pooling: Lobby groups both don't send signal Politician ignores signal and chooses x1 – Intuitive, divine, but not universally divine Semi-pooling: type t2 always send signal Politicians mix x1, x2 w/ (1-c/a1, c/a1) if signal type t1 mixes by sending signal with prob. β – Universally divine Author Nam36

Lobbying: Pooling Equilibrium Equilibrium: Beliefs: ( 0, b1) (a1, 0 ) ( 0, 0 ) (a2, b2) x1 R x2 x1 R x2 t1 R x1 x2 t2 x1 S Not Send N Not S Author Nam37 Send R x 2 (-c, b1) (a1 -c, 0) (-c, 0 ) (a2 -c, b2)

Lobbying: Semi-Pooling Equilibrium Beliefs: ( 0, b1) (a1, 0 ) ( 0, 0 ) (a2, b2) x1 R x2 ( -c, b1) (a1 -c, 0) t2 x1 (-c, 0 ) (a2 -c, b2) S Send N x1 R x2 t1 R x1 x2 Not Not S Author Nam38 Send R x 2

Lobbying Treatme nt 1 2(2c) 2a(6c) 3 4 Aver. Signal Freq. (t1, t2 ) x2 Freq. (no sig., sig) β Actual Pred. c/a1 Actual Pred. 0.25 0.75 0.75 0.25 0.75 0.25 0.75 38, 76 46,100 83, 93 16, 85 22, 83 27, 81 50, 92 25,100 75,100 75,100 25,100 75,100 25,100 75,100 0.25 0.25 0.25 0.75 0.75 0.25 0.75 2, 5 3, 79 11, 54 0, 53 5, 80 5, 46 2, 66 0,25 0,25 0,25 0,75 0,75 0,25 0,75 Author Nam39

Lobbying Supporting universally divine equilibrium Fictitious Play Learning: – Past frequency of x2 after signal is r(m)t-1 Should signal if r(m)t-1 a1 - c 0 – Subjects signal 46% if 0, 28% if 0 – Politicians choose x2 77% if 0, 37% if 0 Potters and van Winden (JEBO 2000) – Similar results; little difference between students and professionals Author Nam40

Corporate Finance Cadsby, Frank & Maksimovic (RFS 1990) Firms are either H or L with (50%, 50%) – Worth BH, BL if carry project – Worth AH, AL if pass Need capital I to finance the project Investors can put up I and get S shares Exercise: When will there be pooling, separating, and semi-separating equilibria? Author Nam41

Corporate Finance Example: L types worth 375/50 with/without project H types worth 625/200 with/without project Capital I 300 Separating equilibrium: S 0.80 Pooling equilibrium: S 0.60 Semi-pooling equilibrium: S 0.68 Exercise: Show that these are equilibria! Author Nam42

Corporate Finance Cadsby et al. ran 10 sessions (Table 8.11) Results support equil. (pooling if multi.) – When unique pooling: all firms offer shares – When unique separating: Initially, both offer (pool), but H types learn not to offer (separate) – When multiple: Converge to pooling equilibrium Cadsby, Frank and Maksimovic (RFS 1998) – Add costly signals (see Table 8.12 for results) Author Nam43

Ratchet Effect Cooper, Kagel, Lo and Gu (AER 1999) Firms are either H or L with (50%, 50%) Choose output level 1-7 Planner choose easy or tough target – Set easy if Pr( L output ) 0.325 Pooling Eq: L chooses 1 or 2; H pools with L Myopic K firms: Naively pick 5 (& get tough) – Exercise: Prove these with payoffs in Table 8.13. Author Nam44

Ratchet Effect 70-90% L firms choose 2 Most H firms choose 2 or 5 Period 1-12: 54-76% myopic 80% tough Period 13-36: Convergence to pooling Big context effect only for Chinese manager – Provides language to folster learning from exp. Cooper, Garvin and Kagel (Rand/EJ 1997) – Belief Learning in Limit Pricing Signaling Games Author Nam45

Reputation Formation Camerer and Weigelt (Econometrica 1988) 8 period trust game Borrower: normal (X) or nice (Y) (New) Lender each period: Lend or Don't Borrower chooses to Default or Repay – Normal types default; nice types repay Author Nam46

Reputation Formation Author Nam47

Reputation Formation What does the equilibrium look like? Last Period: Lend if P8(nice) τ 0.79 – Normal borrowers default; nice ones repay Period 7: – Normal borrowers weigh between default now (and reveal) and default later Author Nam48

Conditional Frequency of Lending Round 3-5 6-8 9-10 Predict 1 2 3 4 5 6 7 8 100 100 100 100 64 64 64 64 100 100 100 64 64 64 64 64 100 100 100 64 64 64 64 64 Actual Predict Actual Predict Actual Author Nam49

Conditional Frequency of Lending Round 3-5 6-8 9-10 1 2 3 4 5 6 7 8 Predict 100 100 100 100 64 64 64 64 Actual 94 96 96 91 72 59 38* 67 Predict 100 100 100 64 64 64 64 64 Actual 96 99 100 95* 85* 72 58 47 Predict 100 100 100 64 64 64 64 64 Actual 93 92 83 70 63 72 77 33 Author Nam50

Conditional Frequency of Repay (by X) Round 3-5 6-8 9-10 Predict 1 2 3 4 5 6 7 8 100 100 100 81 65 59 44 0 100 100 73 68 58 53 40 0 100 100 73 67 63 56 42 0 Actual Predict Actual Predict Actual Author Nam51

Conditional Conditional Frequency Frequency of of Repay Repay (by (by X) X) Round 3-5 6-8 9-10 1 2 3 4 5 6 7 8 Predict 100 100 100 81 65 59 44 0 Actual 95 97 98 95* 86* 72 47 14 Predict 100 100 73 68 58 53 40 0 Actual 97 95 97* 92* 85* 70* 48 0 Predict 100 100 73 67 63 56 42 0 Actual 91 89 80 77 84* 79* 48 29 Author Nam52

Follow-up Studies Neral and Ochs (Econometrica 1992) – Similar repeated trust games Jung, Kagel and Levin (Rand 1994) – Entry deterrence in chain-store paradox Camerer, Ho and Chong (JET 2002) – Sophisticated EWA (strategic teaching!) Author Nam53

Conclusion Cooper, Garvin and Kagel (EJ 1997) – "We do not suggest that game theory be abandoned, but rather as a descriptive model that it needs to incorporate more fully how people actually behave." Possible improvements: QRE, level-k or Cognitive Hierarchy Learning (EWA or belief learning) Author Nam54

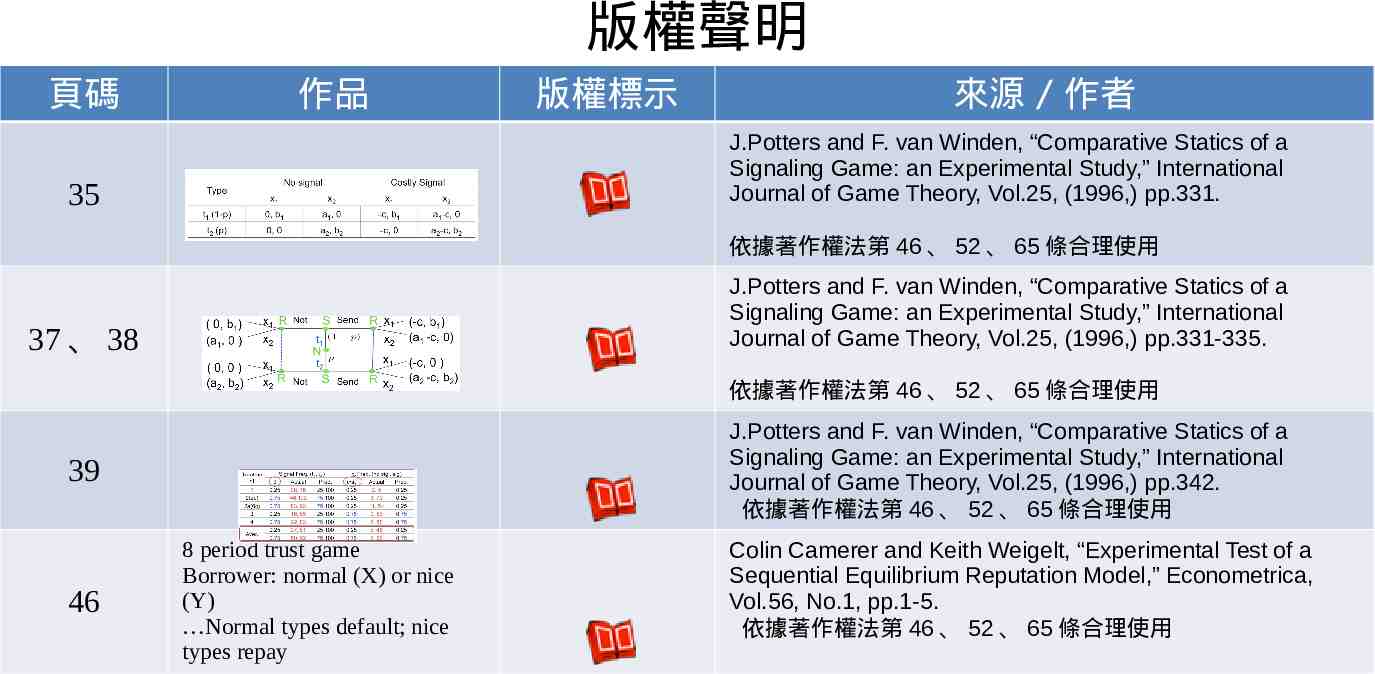

版權聲明版權聲明 頁碼 作品 24 26 、 27 來源 / 作者 國立臺灣大學 經濟學系 王道一 教授 1-54 23 版權標示 Worker Types are H or L with (2/3, 1/3) Employer payoffs are 125 if she assigns D to L types and C to H types J.Brandts and C.A. Holt, “An Experimental Tests of Equilibrium Dominance in Signaling Games,” American Economic Journal, Vol.82, No.5, (1992), pp.1350-1365. 依據著作權法第 46 、 52 、 65 條合理使用 J.Brandts and C.A. Holt, “An Experimental Tests of Equilibrium Dominance in Signaling Games,” American Economic Journal, Vol.82, No.5, (1992), pp.1353. 依據著作權法第 46 、 52 、 65 條合理使用 J.Brandts and C.A. Holt, “An Experimental Tests of Equilibrium Dominance in Signaling Games,” American Economic Journal, Vol.82, No.5, (1992), pp.1353. 依據著作權法第 46 、 52 、 65 條合理使用

版權聲明版權聲明 頁碼 作品 J.Banks, C.Camerer, and D. Porter, “An Experimental Analysis of Nash Refinements in Signaling Games,” Games and Economic Behavior, vol.6, pp.15. 依據著作權法第 46 、 52 、 65 條合理使用 30 33 來源 / 作者 Colin E. Camerer, Behavioral Game Theory: Experiments in Strategic Interaction. New York: Russell Sage Foundation; New Jersey: Princeton UP, 2003. pp.414. 依據著作權法第 46 、 52 、 65 條合理使用 28 33 版權標示 Subjects lead to play less refined equilibrium Initial random play produces history that supports the nonintuitive equilibrium J.Brandts and C.A. Holt, “Adjustment Patterns and Equilibrium Selection in Experimental Signaling Games,” International Journal of Game Theory, Vol.22, (1993), 279302. 依據著作權法第 46 、 52 、 65 條合理使用 EWA yields δ 0.54 (0.05); Does better than choice reinforcement (δ 0) and weighted fictitious play (δ 1) C.M.Anderson and C. Camerer, “Experience-Weighted Attraction Learning in Sender-Receiver Games,” Economic Theory, Vol.16, (2000),pp.689-718. 依據著作權法第 46 、 52 、 65 條合理使用

版權聲明版權聲明 頁碼 作品 版權標示 來源 / 作者 J.Potters and F. van Winden, “Comparative Statics of a Signaling Game: an Experimental Study,” International Journal of Game Theory, Vol.25, (1996,) pp.331. 35 依據著作權法第 46 、 52 、 65 條合理使用 J.Potters and F. van Winden, “Comparative Statics of a Signaling Game: an Experimental Study,” International Journal of Game Theory, Vol.25, (1996,) pp.331-335. 37 、 38 依據著作權法第 46 、 52 、 65 條合理使用 J.Potters and F. van Winden, “Comparative Statics of a Signaling Game: an Experimental Study,” International Journal of Game Theory, Vol.25, (1996,) pp.342. 依據著作權法第 46 、 52 、 65 條合理使用 39 46 8 period trust game Borrower: normal (X) or nice (Y) Normal types default; nice types repay Colin Camerer and Keith Weigelt, “Experimental Test of a Sequential Equilibrium Reputation Model,” Econometrica, Vol.56, No.1, pp.1-5. 依據著作權法第 46 、 52 、 65 條合理使用

版權聲明版權聲明 頁碼 作品 版權標示 來源 / 作者 Colin Camerer and Keith Weigelt, “Experimental Test of a Sequential Equilibrium Reputation Model,” Econometrica, Vol. 56, No.1, pp.4. 依據著作權法第 46 、 52 、 65 條合理使用 47 49 、 50 Colin Camerer and Keith Weigelt, “Experimental Test of a Sequential Equilibrium Reputation Model,” Econometrica, Vol. 56, No.1, pp.16. 依據著作權法第 46 、 52 、 65 條合理使用 51 、 52 Colin Camerer and Keith Weigelt, “Experimental Test of a Sequential Equilibrium Reputation Model,” Econometrica, Vol. 56, No.1, pp.14 依據著作權法第 46 、 52 、 65 條合理使用 54 We do not suggest that game theory be abandoned, but rather as a descriptive model that it needs to incorporate more fully how people actually behave David J. Cooper, Susan Garvin andJohn H. Kagel,” Adaptive learning vs. equilibrium refinements in an entry limit pricing game,” Economic Journal, Vol.107, Issue.442,(1997) pp.555. 依據著作權法第 46 、 52 、 65 條合理使用