Executive’s Guide to IRS Travel and Business Expense Rules August 2012

12 Slides93.62 KB

Executive’s Guide to IRS Travel and Business Expense Rules August 2012

Overview 2 Audit findings and risks IRS “Accountable Plan” rules Risk of an IRS Audit Executive Card Use Travel Expense Rules Taxable Payments Business Expense Rules Club Membership Rules Summary

Internal Audit & Tax Office Findings Internal Audits has reviewed Executive Card and travel expenses - findings included: Tax Office has reviewed the Travel Policies and Procedures – findings included: 3 Documentation of expenses was sometimes inadequate Reimbursements were not appropriately authorized Expense reporting methods were not consistent Clarification needed for the IRS Accountable Plan Rules IRS exception needs to be identified for foreign travel Explanation needed for Executive Card paid

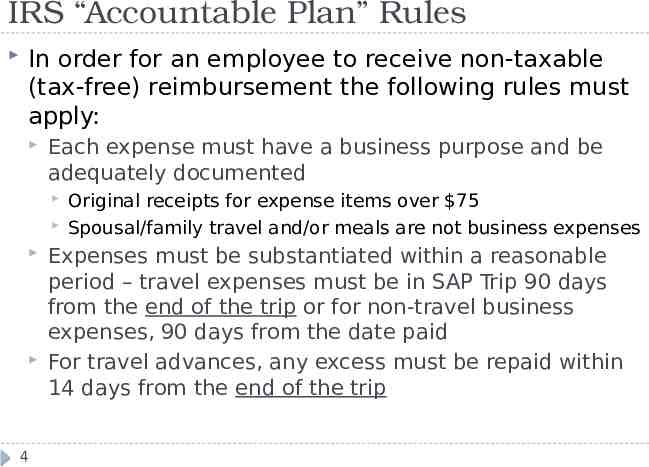

IRS “Accountable Plan” Rules In order for an employee to receive non-taxable (tax-free) reimbursement the following rules must apply: Each expense must have a business purpose and be adequately documented 4 Original receipts for expense items over 75 Spousal/family travel and/or meals are not business expenses Expenses must be substantiated within a reasonable period – travel expenses must be in SAP Trip 90 days from the end of the trip or for non-travel business expenses, 90 days from the date paid For travel advances, any excess must be repaid within 14 days from the end of the trip

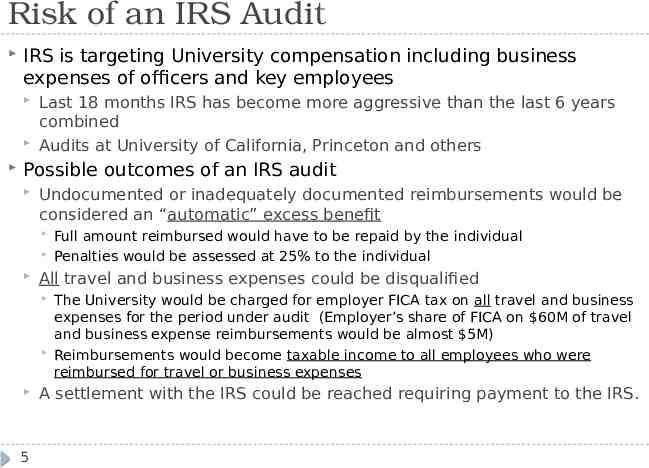

Risk of an IRS Audit IRS is targeting University compensation including business expenses of officers and key employees Last 18 months IRS has become more aggressive than the last 6 years combined Audits at University of California, Princeton and others Possible outcomes of an IRS audit Undocumented or inadequately documented reimbursements would be considered an “automatic” excess benefit All travel and business expenses could be disqualified 5 Full amount reimbursed would have to be repaid by the individual Penalties would be assessed at 25% to the individual The University would be charged for employer FICA tax on all travel and business expenses for the period under audit (Employer’s share of FICA on 60M of travel and business expense reimbursements would be almost 5M) Reimbursements would become taxable income to all employees who were reimbursed for travel or business expenses A settlement with the IRS could be reached requiring payment to the IRS.

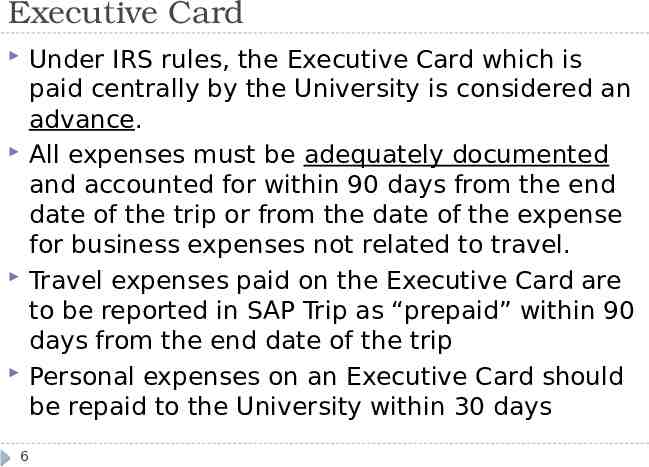

Executive Card Under IRS rules, the Executive Card which is paid centrally by the University is considered an advance. All expenses must be adequately documented and accounted for within 90 days from the end date of the trip or from the date of the expense for business expenses not related to travel. Travel expenses paid on the Executive Card are to be reported in SAP Trip as “prepaid” within 90 days from the end date of the trip Personal expenses on an Executive Card should be repaid to the University within 30 days 6

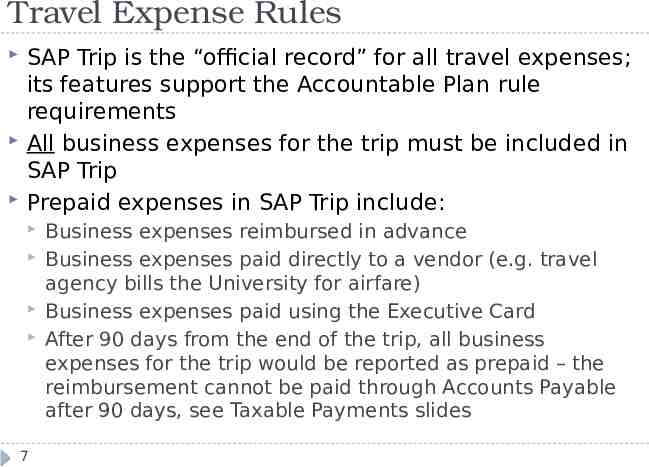

Travel Expense Rules SAP Trip is the “official record” for all travel expenses; its features support the Accountable Plan rule requirements All business expenses for the trip must be included in SAP Trip Prepaid expenses in SAP Trip include: 7 Business expenses reimbursed in advance Business expenses paid directly to a vendor (e.g. travel agency bills the University for airfare) Business expenses paid using the Executive Card After 90 days from the end of the trip, all business expenses for the trip would be reported as prepaid – the reimbursement cannot be paid through Accounts Payable after 90 days, see Taxable Payments slides

Domestic versus International Travel Domestic All business expenses can be reimbursed tax-free with proper documentation if substantiated within 90 days from the end of the trip International – special rule All business expenses can be reimbursed tax-free with proper documentation as long as this IRS exception applies 8 Vacation was not a major consideration for the trip If this exception does not apply contact the University Tax Office

Taxable Payments Defined These expenses are taxable if paid to (or on behalf of) the employee: 9 Expense reimbursements 90 days after the end of the trip or 90 days from the date paid for nontravel business expenses Spousal/family travel expenses and/or meals Non-business expense paid on an Executive Card that has not been reimbursed within 30 days from the date of the purchase

Business Expense Rules Types of business expenses other than travel Documentation of each business expense must include: Business Meals (not related to business travel) Entertainment with a business purpose Club memberships (requires documentation of all use) Date and amount Location of the activity Business purpose Names of those who attended, and Business relationship of each person named Overnight travel should be submitted separately from local travel, fully costed with all expenses for the trip Local travel, such as mileage and parking, should be submitted monthly 10

Club Memberships Rules Annual fee for clubs IRS Rule: Must be allocated between business and personal based on actual usage Annual membership fees paid by JHU will be treated as taxable income (with a gross up for taxes if approved) Use of club for meals and/or entertainment for business purposes – follow the documentation rules for each activity 11 Non-business portion is taxable income if paid by JHU Date and amount Location of the activity Business purpose Names of those who attended, and Business relationship of each person named

Summary of Key Points One-up approval with expenses summary template Timely substantiation of the business purpose with adequate documentation of expenses Full reporting of all travel expenses in SAP Trip including all “prepaid” expenses Check box required for foreign travel to identify the IRS exception that applies to the trip Proper handling of personal expenses as taxable income if paid by the University Annual membership fees paid by JHU will be 12 treated as taxable income