Economic Development Course December 4, 2018 Financing

26 Slides4.63 MB

Economic Development Course December 4, 2018 Financing Economic Development Federal Program

Gary W. Smith President and CEO Chester County Economic Development Council

IDA Tax Exempt Program Private Activity Bonds Industrial Revenue Bonds

Eligible Applicants Manufacturing Enterprises Defined as companies where “tangible” products are made as well as intangible property New Farmers (Next Generation Farmer Loan Program) Defined as farmers who do not own more than 30% median size farm in county Non-Profit 501(c)(3) Does not require volume cap Exempt facilities (sewer, water)

Eligible Uses Fixed Asset Expansion Acquisition of Land and Buildings Acquisition of New Equipment Leasehold Improvements

Additional Requirements Project must create or retain jobs in Pennsylvania Job Creation of 1 New Job for Every 50,000 Borrowed Not applicable for New Farmer Loans 501(c)(3) projects (no job requirements) Exempt facilities (no job requirements)

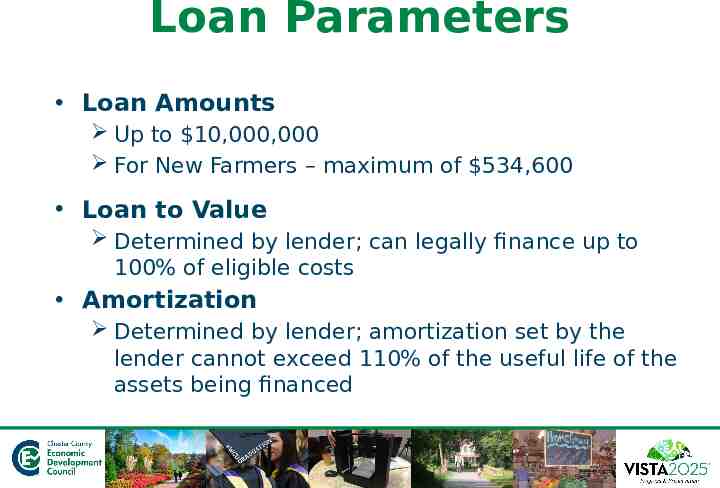

Loan Parameters Loan Amounts Up to 10,000,000 For New Farmers – maximum of 534,600 Loan to Value Determined by lender; can legally finance up to 100% of eligible costs Amortization Determined by lender; amortization set by the lender cannot exceed 110% of the useful life of the assets being financed

Loan Parameters Rate and Term Negotiated between borrower and lender Usually 75 - 80% of Prime Often variable rate Fixed rates with balloons are the norm with banks and purchase money mortgages Proceeds must be spent over three years

Bank Structure Borrower Identifies financing needs Provides information to other parties for structuring Issuer (Local Industrial Development Authority) Provides access to tax-exempt markets Helps to identify the financing team Advises borrowers on structure, timing and marketing Lender Performs due diligence and negotiates the financing structure, security and financial covenants with the company Issues letter of credit which provides security for bondholders Issues commitment to finance

Example of Manufacturer Using Tax Exempt Financing Acquisition of new equipment Construction of new addition and/or renovations Portion of costs of issuance of Authority Note Project Cost - 4,500,000 Amount of Tax Exempt Financing - 4,500,000

Example of 501(c)(3) Tax Exempt Financing Examples Fraternal Organizations, Charter Schools and YMCA’s Case Study: Private School building a new Fine Arts Center with renovations to Health/Gym Project Cost - 10,000,000 Amount of Tax Exempt Financing - 7,500,000

Next Generation Farmer Loans Son to build duck house on family farm in Berks County to raise Pekin Ducks for Berks County poultry farmer 156 acre family crop farm in Chester County 995,000 total project 485,000 bank loan 250,000 Next Generation loan 200,000 PIDA loan Borrower benefits from low interest rate

SBA Loan Program Basics For-profit businesses Personal guaranty Owner-occupied properties Purchase, construct, renovation or improve Existing structure - 51% or greater of under-roof usable square footage; 60 to 80% required for new construction Machinery and Equipment – Useful life 10 years Other eligible uses of SBA financing include working capital, inventory, refinance, change of ownership

SBA 504 Highlights Up to 90% Financing of Fixed Asset Purchases 50%Bank 40% SBA 10% equity Up to 12.5 million total project – Up to 5 million 504 portion Real Estate purchase 20 year fixed rate Machinery an equipment 10 year fixed rate 50% 1st Lien Bank 10% Borro wer Equit y 40% 2nd Lien SBA/ CDC

Storage/Shelving/Stair and Mezzanine Manufacturer Property Acquisition – 104 Jobs Retained

PIDA/SBA 504 Success Story Manufacturing facility 2.7 MM building expansion 50/40/10 Financing Structure 1.350MM PIDA 1.092MM SBA 270M equity Benefits to borrower: Long term low interest rates Low equity contribution 32 Jobs Created

Ice Rink Refinance and Expansion Project

SBA 7a Loan Specifics Loan Specifics Deficiency guaranty program (75 to 85%) Collateral requirements (business/personal) Project Maximum loan size of 5 million Up to 90% financing Longer term financing o 7-10 years: working capital o 10-15 years (useful life): machinery & equipment o 20-25 years: real estate Bank Requirements Lend in accordance with conventional/ small business policies Interest in projects varies bank by bank

SBA 7a Use of Proceeds Purchase, construct, renovate or improve owner-occupied building(s) Leasehold improvements Machinery and equipment Business acquisition or expansion, including franchises Working capital Inventory and supplies Energy conservation loans Debt refinance/restructure

SBA 7a Project Examples Challenging industry request (restaurant) Leasehold improvements (rental) with working capital Change of ownership – buying assets and customer list Business expansion (projection based) Refinance/restructure with longer repayment terms

SBA 7a Success Story Veterinary Radiation Treatment Center, start-up location, but existing multiple locations 1.5 million request to fund leasehold improvements, equipment and working capital – 80% financing – 20% borrower equity

PSBCI Program Highlights Federally sourced mezzanine loan program Managed by independent Pennsylvania area loan organizations through PAEDC Can be used for any eligible business expense except passive real estate investment Requires matching private funds Rate and term set by lender and Seedcopa Risk-based pricing

SBA 504/PSBCI Success Story Manufacturing facility located in Coatesville 1.6MM building purchase using the SBA 504 50/40/10 financing structure Complimentary financing of 600,000 in Improvements and Machinery & Equipment 300,000 direct bank loan 300,000 subordinate PSBCI loan

USDA Business and Industry Loan (USDA B&I) Deficiency guaranty program similar to the SBA 7a Must be located in a designated rural development area Balance Sheet tangible equity position – 10% or 20% Purchase property, M&E, supplies, inventory, leaseholds; conversion/modernization; business acquisition (economic benefit) Up to 30 years on commercial RE Can finance non-owner occupied property, however the project is reviewed competitively with other projects and must display significant economic benefit

Questions?

Thank you for your time and attention! Gary W. Smith President and CEO Chester County Economic Development Council 737 Constitution Drive Exton, PA 19341 610-321-8218 www.ccedcpa.com