DRAFT NYSE American: INDO indo-energy January 2021 1

17 Slides3.87 MB

DRAFT NYSE American: INDO indo-energy.com January 2021 1

DRAFT DISCLAIMERS AND CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS Readers are cautioned that the securities of Indonesia Energy Corporation Limited (“IEC”) are highly speculative. No representation or warranty, expressed or implied, is or will be made and, save in the case of intention or fraud, no responsibility or liability is or will be accepted by IEC or by any of its directors, employees, agents or affiliates as to or in relation to the presentation or the information contained therein or forming the basis of this presentation or for any reliance placed on the presentation by any person whatsoever. Save in the case of intention or fraud, no representation or warranty is given and neither IEC nor any of its directors, employees, agents or affiliates assume any liability as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in the presentation. This presentation contains or may contain forward-looking statements about IEC’s plans and future outcomes, including, without limitation, statements containing the words “anticipates”, “projected”, “potential” “believes”, “expects”, “plans”, ”estimates” and similar expressions. Such forward-looking statements involve significant known and unknown risks, uncertainties and other factors which might cause IEC’s actual results, financial condition, performance or achievements (including without limitation, the results of IEC’s oil exploration and commercialization efforts as described herein), or the market for energy in Indonesia, to be materially different from any actual future results, financial conditions, performance or achievements expressed or implied by such forward-looking statements. Given these uncertainties, you advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as at the date of this presentation. IEC expressly disclaims any obligation to update any such forward-looking statements in this presentation to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based, unless required by law or regulation. 2

DRAFT INDONESIA ENERGY The Right Place at the Right Time Exchange/Symbol: NYSE American: INDO Completed IPO in December 2019 Low Cost - High Value Production & Development Assets Kruh Block: Goal to Increase Production and cash flow by 400% over next 12 months and Drive Down Production Costs to below 20/barrel. Plan to drill 18 wells over next 3 years: 5 wells in 2021; 6 wells in 2022 and 7 wells in 2023 Commence Appraisal & Development Activities in 2021 on the 1Million Acre De-Risked Citarum Block Citarum Block has a 30-year term; where Natural Gas prices are 300% higher than in USA and Block is only 16 miles form Jakarta 3

DRAFT Indonesia Energy Assets IEC Currently Owns a Producing Asset and a De-risked Development & Exploration Property KRUH BLOCK (PRODUCTION) Stable cash flow generating asset owned controlled until 2030 275 BOPD average productivity in 2019 Currently producing from 1 out of 7 structures Average production costs in 2018 was 21.34 per barrel of oil CITARUM BLOCK (APPRAISAL & DEVELOPMENT) 1 million acre appraisal & development block controlled until 2048 16 miles from Jakarta significant pipeline infrastructure in place Adjacent fields producing 45,000 BOPD and 450 MMSCFD “Derisked” asset with proven presence of hydrocarbons 40M invested by prior owner, Pan Orient Energy, drilled 4 discovery wells Downstream integration opportunities KRUH CITARUM 4

DRAFT Indonesia’s Growth Opportunities Largest economy in S.E. Asia, fourth most populous nation ( 262MM), 16th largest global economy and a member of the G-20 Annual GDP Growth: Indonesia vs. World Area 735,358 sq.miles Capital Jakarta "Designed by Freepik" Source: data.worldbank.org/indicator World's largest island country Over 17,000 islands Coastline of 50,331 miles 7th largest in combined sea & land area 14th largest by land area Population Over 262MM (2018) World ranking: 4th Work force over 50% of population, major concentration on Java island Languages Official: Bahasa Indonesia English is widely used, the standard for O&G industry Agriculture Produces rice, palm oil, tea, coffee, cacao, medicinal plants, spices and rubber GDP 2018 1 trillion (16th largest economy) 3,846 per capita Rich in natural resources Oil, natural gas, tin, copper and gold A leading global thermal coal exporter 2nd largest tin producer Currency Indonesia Rupiah Rp14,246 per US Legal Framework Civil Law Mature legal framework for O&G (2018 average) 5 Sources: www.worldbank.org/en/country/indonesia/overview, Marine And Fisheries Ministry Republic Of Indonesia The World Fact Book-www.cia.gov, The World Bank-www.data.worldbank.org, Bank of Indonesia, The World Justice Report 2017-2018

DRAFT Indonesia’s Growing Demand for Energy Demand for energy is only expected to grow in the years to come, especially in the region where IEC’s gas asset is located (West Java) Years 2016 to 2050 Electricity Demand Increase by 2050 Natural Gas Demand Growth Total Energy Demand Growth Industrial Sector Energy Demand Growth Natural Gas Demand for Electricity Growth Transportation Sector Energy Demand Growth 740% 6.3% / Year 5.3% / Year 6.1% / Year 4.9% / Year 4.6% / Year Gas Market Potential in West Java Country/Regional Outlook Indonesia's gas market is expected to expand to support the growing economy West Java expects gas demand to increase from 2,521 MMSCFD in 2020 to 3,032 MMSCFD in 2035 Annual growth of gas transmission and distribution pipeline was 4.7% in 2017 Indonesia’s Government Interest Initiated incentive plans to attract investors for development of new O&G blocks Introducing a new Production Sharing Contract (“PSC”) plan based on the sharing of a “Gross Production Split” PSC provides O&G companies flexibility in operational activities to promote cost efficiency and reducing delays Estimated Gas Shortage in 2028 Ongoing government involvement in approving key regulations of upstream business developments (i.e. from the PSC award up to production) 1,836 MMSCFD Source: Indonesian Agency for the Assessment and Application of Technology (BPPT) - Indonesia Energy Outlook 2018; PWC - Oil and Gas in Indonesia: Investment and Taxation Guide May 2018, 9th Edition; Petromindo – 2018 Indonesian Oil and Gas Book 6

DRAFT Oil Majors Continue to Invest Billions in Indonesia Indonesia Fact: Exploration Drilling Success Ratio 2012 - 2018 Year 2012 2013 2014 2015 2016 2017 2018 Exploration Wells 96 75 64 33 33 15 22 Discovery Wells 65 53 47 27 23 10 13 68% 71% 73% 82% 70% 67% 59% Success Ratio Source: SKK Migas, 2017&2018 Annual Report Average drilling success ratio from 2012 to 2018 7 70%

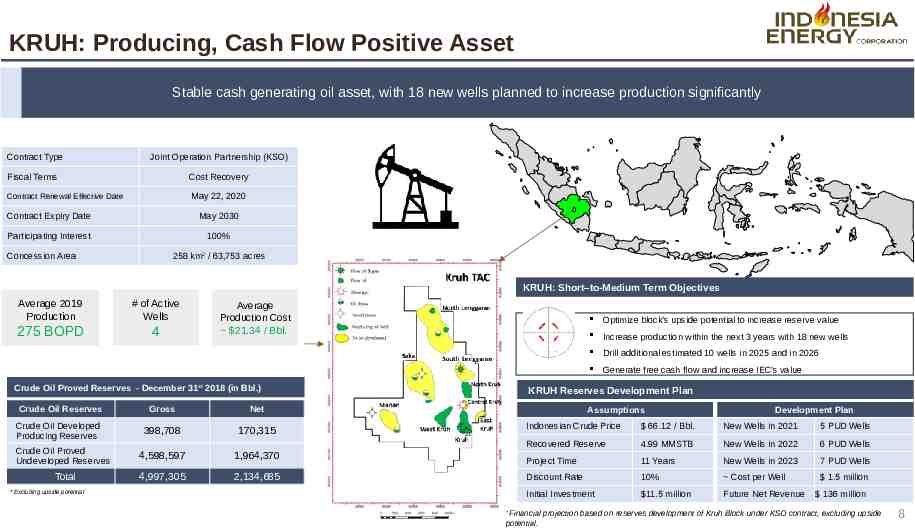

DRAFT KRUH: Producing, Cash Flow Positive Asset Stable cash generating oil asset, with 18 new wells planned to increase production significantly Contract Type Joint Operation Partnership (KSO) Fiscal Terms Cost Recovery Contract Renewal Effective Date May 22, 2020 Contract Expiry Date May 2030 Participating Interest 100% Concession Area 258 km2 / 63,753 acres KRUH: Short–to-Medium Term Objectives Average 2019 Production # of Active Wells 275 BOPD 4 Average Production Cost 21.34 / Bbl. Optimize block’s upside potential to increase reserve value Increase production within the next 3 years with 18 new wells Drill additional estimated 10 wells in 2025 and in 2026 Generate free cash flow and increase IEC’s value Crude Oil Proved Reserves - December 31st 2018 (in Bbl.) Crude Oil Reserves Crude Oil Developed Producing Reserves Gross Net 398,708 170,315 KRUH Reserves Development Plan Assumptions Development Plan Indonesian Crude Price 66.12 / Bbl. New Wells in 2021 5 PUD Wells Recovered Reserve 4.99 MMSTB New Wells in 2022 6 PUD Wells Crude Oil Proved Undeveloped Reserves 4,598,597 1,964,370 Project Time 11 Years New Wells in 2023 7 PUD Wells Total 4,997,305 2,134,685 Discount Rate 10% Cost per Well 1.5 million Initial Investment 11.5 million Future Net Revenue * Excluding upside potential 136 million Financial projection based on reserves development of Kruh Block under KSO contract, excluding upside potential. * 8

DRAFT KRUH: SINGLE WELL ECONOMICS HISTORICAL WELL DATA OPERATING INDICATORS & ASSUMPTIONS Location Kruh Block, South Sumatra Well Depth – TVD Average 3,300 feet Number of wells drilled 29 wells 0% Average 1st Year Daily Production 173 BOPD Oil Realization Discount Production Operation Cost per Bbl (2019) Average 1st Year Gross Production 63,112 Bbl Well Drilling and Completion Cost 1,500,000 Production Type 100% Crude Oil Decline Rate 21% Well Type Infill Vertical Well Lifting Method Artificial Lift AVERAGE HISTORICAL WELL PRODUCTION PROFILE Monthly Production Kruh Block, South Sumatra Initial Production 191 BOPD 200 39/Bbl 49/Bbl 1st Year Net Revenue 2.1 million 2.6 million First 6-months Net Revenue 1.1 million 1.4 million 1st Year Net Cash Flow 0.8 million 1.3 million BOPD 180 200,000 Daily Rate Cumulative 180,000 160 160,000 140 140,000 120 120,000 100 100,000 80 80,000 60 60,000 40 40,000 20 20,000 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 0 PRODUCTION MONTH 9 BBLS AVERAGE KRUH WELLS ECONOMIC INDICATOR Oil Price (US /Bbl) 20.77 / Bbl

DRAFT INDONESIA INDUSTRY CITARUM: “Derisked” 1 Million Acre Property Proven hydrocarbon presence located 16 miles from Jakarta, a metropolitan area with large & growing gas demand and established gas pipeline infrastructure network Producing O&G Fields in Northwest Java Basin Block Contract Type CITARUM Production Sharing Contract Fiscal Terms Gross Split Contract Expiration Date July 5, 2048 Acreage 3,925 km2 / 969,807 acres Opportunity Citarum block shares its border with producing gas fields of Subang, Pasiriadi, Jatirarangon and Jatinegara Existing pipeline network allows the gas produced from Citarum to be directly distributed into the market Combined Oil Production in Northwest Java Basin Combined Gas Production in Northwest Java Basin 45,000 BOPD 450 MMSCFD For past two years, success ratio of Indonesian exploration drilling was above 55% Citarum’s economic model assumes a conservative 28% exploration success rate, producing in 8 out of 28 prospects in the block 10

DRAFT CITARUM: A Proven Hydrocarbon Opportunity From 2009-2016, over 40M was invested in Citarum by previous operator Pan Orient Energy Corp (TSXV:POE) POE drilled 4 wells and discovered natural gas and gas flow from each well Pasundan-1: Gas depth between 6,000-9,000ft. Cataka-1: Gas depth between 1,000-2,737ft. Jatayu-1: Gas depth between 5,800-6,700ft. Geulis-1: Gas depth between 1,000-4,300ft. With gas depths between 1,000 to 6,000ft., the potential for commercially developable gas discoveries is high Large capex program by previous operator that successfully discovered hydrocarbons derisked our unique development asset As an experienced operator, IEC has an opportunity to acquire significant market share via the Citarum appraisal and development program 11

DRAFT CITARUM: Appraisal & Development Program 3 Year Exploration & Appraisal Program Year 1 2 3 First Priority: Confirm the Value of the Block by Proving Reserves and Monetize the Asset through Production and Sale of Gas Citarum 3 areas division map: I. Jonggol; II. Purwakarta-subang; and iii. majalengka Geological and Geophysical Studies Drilling: First exploration well (Jonggol Area) Drilling: 2 delineation wells 2D Seismic (300 km2) 3D Seismic (100 km2)* Propose Plan of Development Phase 1 At least 7 proven sources rock, “kitchens”, are located north (and possibly more in the south) of the block. Activity 3D Seismic, drilling of delineation wells and first plan of development are subject to having discovery. * West Java Oil & Gas Transmission Network Map Economic model: assuming success on only 8 out of 28 prospects (or more) Development from West to East JONGGOL: 19 prospects PURWAKARTA: 9 prospects MAJALENGKA Under evaluation 12

DRAFT Potential Additional New Block – Rangkas Area An onshore area of 981,008 acres adjacent to Citarum block with a proven petroleum system Location Area Proved hydrocarbon generating province by the numerous oil/gas seeps within the Rangkas block Occurrence of Eocene-Oligocene-Miocene Source, Reservoir and Seal rocks similar to adjacent major producing hydrocarbon areas in West Java Multiple sub-basins from geophysical data showing potential for higher chances of multiple hydrocarbon accumulations Four pre-WWII wells and two 1991 wells have either flowed oil or indications of oil Data-driven approach to appraisal program expanding economic resource A dozen prospects with individual closure area up to 3,700 acres have been identified with typical stacked reservoirs between 300m and 2,000m depth IEC, through its subsidiary GWN, obtained approval to initiate Joint Study program in November 2018 If Joint Study produces satisfying results, a PSC contract for Rangkas Area could be available through direct tender process GWN will have right to match best offer following results of bidding process Timeline for tender contingent upon DGOG’s plans and schedule 13

DRAFT Executive Team IEC’s executive team is built to capture opportunities in Indonesia and execute projects with excellence Chairman & Chief Executive Officer Dr. Wirawan Jusuf Co-founder and founding Chairman of the board of directors Strong qualifications in business development, government relations and President Frank Ingriselli Seasoned leader and entrepreneur with over 40 years of wide-ranging oil strategic planning Master’s in Public Health at the Gajah Mada University-Jogjakarta in Central Java, Indonesia, and medical degree at the University of Tarumanegara in Jakarta, Indonesia Holds professional memberships with the Indonesian Petroleum Association (IPA) and Officer in Indonesian Doctors Association (IDI) Chief Operating Officer Dr. Chiahsin “Charlie” Wu Highly qualified and recognized oil and gas industry veteran with over 40 years of global energy experience Responsible for building and leading the upstream exploration and production teams for 3 independent O&G companies in Indonesia over the last 15 years Postgraduate Diploma in Business Administration at DeMontfort University, and Ph.D. in Geosciences at the University of Texas Chief Business Development Officer Mirza F. Said Experienced oil and gas veteran with expertise within the energy and infrastructure sector Master of Engineering Management, Curtin University of Technology in Perth, Australia, and Bachelor’s degree in Engineering at the Chemical Engineering Institute Technology of Indonesia Holds professional memberships with the Indonesian Petroleum Association (IPA) and Society of Indonesian Petroleum Engineers (IATMI) exploration and production experience in diverse geographies, business climates and political environments Former President of Texaco International’s operations, a capacity that directed Texaco’s global initiatives in E&P Previous founder and CEO of two public NYSE listed energy companies BSBA from Boston University, an MBA from New York University and a JD from Fordham School of Law Chief Financial Officer Gregory Overholtzer Experienced Chief Financial Officer for oil and gas public corporations Served as PEDEVCO’s (PED:NYSE) CFO prior to joining IEC in early 2019 Former CFO, Corporate Controller or Senior Director for seven different companies engaged in various industries: hi-tech, bio-tech and energy industries MBA and BA degree from the University of California, Berkeley Chief Investment Officer James J. Huang, CFA Co-founder of IEC with educational and career background in finance, law and business management Holds the Chartered Financial Analyst (CFA) designation Maintains an Attorney at Law professional license from the Brazilian Bar Association (OAB/SP) Bachelor’s degree in law at the São Paulo Law School of Fundação Getúlio Vargas and participant in the Double Degree Business Management Program at 14 the São Paulo Business School of Fundação Getúlio Vargas.

DRAFT Board of Directors IEC’s board of directors is built to capture opportunities in Indonesia and execute projects with excellence Director Mochtar Hussein Director Roderick de Greef Highly qualified and recognized veteran with over 30 years of experience in Rich experience in fields of investigative auditing, compliance and corporate the Medical Devices and Life Sciences industry governance Has been a member of the Board of Directors for four U.S. publicly listed Served as Inspector General of The Ministry of Energy and Mineral Resources companies, providing financial and corporate governance oversight and transactional guidance of the Republic of Indonesia in 2013-2018 Served as Commissioner of PT Timah (Persero) Tbk, an Indonesian state Experienced senior financial executive with demonstrated track record of owned enterprise engaged in tin mining and listed on Indonesia Stock Exchange from 2014 to 2018 building teams and managing financial operations in high growth environments, raising debt and equity capital, negotiating and structuring strategic merger and acquisition and commercial transactions, and implementing investor relations programs Holds a Forensic Auditor Certification Bachelor’s degree in Economics at the Brawijaya University, Malang in East Java MBA at University of Oregon and B.A. in Economics and International Relations at San Francisco State University Director Benny Dharmawan Served as Director of PT Panasia Indo Resources Tbk., a holding company that primarily engages in yarn manufacturing, synthetic fibres and mining Acted in several executive positions with the Macquarie Group from 2007 to 2015 Earned Graduate Certification in Applied Finance and Investments in Kaplan, Australia, and Bachelor’s degree in Commerce at the Macquarie University in Australia Director Tamba P.Hutapea Rich experience in fields of investment planning and policy, investment licensing, investment compliance and corporate governance Served in several Head and Directorial roles within Indonesia Investment Coordinating Board (or BKPM) since 2004 Master of City Planning at the University of Pennsylvania and Bachelor’s degree in Agronomy at the Bogor Agricultural University in Bogor, West Java Holds the Certified Anti Money Laundering Specialist (CAMS-ACAMS) credential Note: Executive Officers: Dr. Wirawan Jusuf, James J Huang and Mirza F Said also serve as Directors of Indonesia Energy Corp. 15

DRAFT A Commitment to Driving Results 2021 Operating Plans to Create Long-Term Shareholder Value Drill Approximately 5 producing Wells on Kruh Block over the next 12-months Initial Production from each Well Estimated at 190 BOPD Production in Kruh Block Expected to increase by 400% over next 12 months Conduct Appraisal & Development Activities on 1 Million Acre De-Risked Citarum Block to Unlock Resource Value Maintain Strong Balance Sheet to Offset Commodity Cyclicality Fund E&P Activities with Free Cash Flow, Moderate use of Debt and Equity Focus on Validating the Reserves of our Blocks to Provide Visible Growth Trajectory 16

DRAFT THANK YOU 17