DORCHESTER CAPITAL ADVISORS, LLC Presentation to NCPERS 2009

24 Slides398.00 KB

DORCHESTER CAPITAL ADVISORS, LLC Presentation to NCPERS 2009 Public Safety Employees Pension & Benefits Conference

Table of Contents The Hedge Fund Industry 3 Fund Of Hedge Funds 15 New Hedge Fund Era 20 Dorchester Capital Advisors, LLC CONFIDENTIAL 2

The Hedge Fund Industry

History of Hedge Funds Contrary to popular belief, hedge fund investing has been around for decades Alfred Winslow has been credited by many with starting the first hedge fund in 1949, introducing the concepts of shorting, leverage, performance fees, and investing firm capital alongside partners Other than a few small peaks and valleys, the industry inched along in relative obscurity until the 1990’s, when the popular press picked up on the uncorrelated returns achieved by hedge fund managers that had become household names Between increased media awareness of the hedge fund industry and the explosion of derivative instruments previously unavailable, the hedge fund industry grew rapidly with hedge funds numbering in the thousands managing hundreds of billions of dollars Contrary to media reports in Q4 2008, the hedge fund industry is still vibrant with an estimated 1.4 trillion in assets under management Dorchester Capital Advisors, LLC CONFIDENTIAL 4

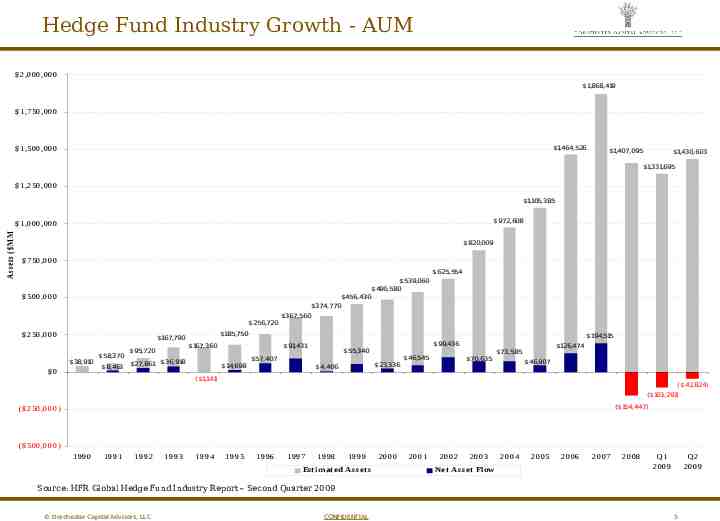

Hedge Fund Industry Growth - AUM 2,000,000 1,868,419 1,750,000 1,464,526 1,500,000 1,407,095 1,430,603 1,331,695 1,250,000 1,105,385 972,608 A ssets ( M M ) 1,000,000 820,009 750,000 625,554 539,060 490,580 456,430 500,000 374,770 367,560 256,720 250,000 185,750 167,790 38,910 0 58,370 8,463 194,515 167,360 95,720 27,861 36,918 99,436 91,431 14,698 55,340 57,407 23,336 4,406 126,474 73,585 46,545 70,635 46,907 ( 1,141) ( 42,824) ( 103,291) ( 154,447) ( 250,000) ( 500,000) 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 Esti mate d Asse ts 2000 2001 2002 2003 Ne t Asse t Flow 2004 2005 2006 2007 2008 Q1 2009 Q2 2009 Source: HFR Global Hedge Fund Industry Report – Second Quarter 2009 Dorchester Capital Advisors, LLC CONFIDENTIAL 5

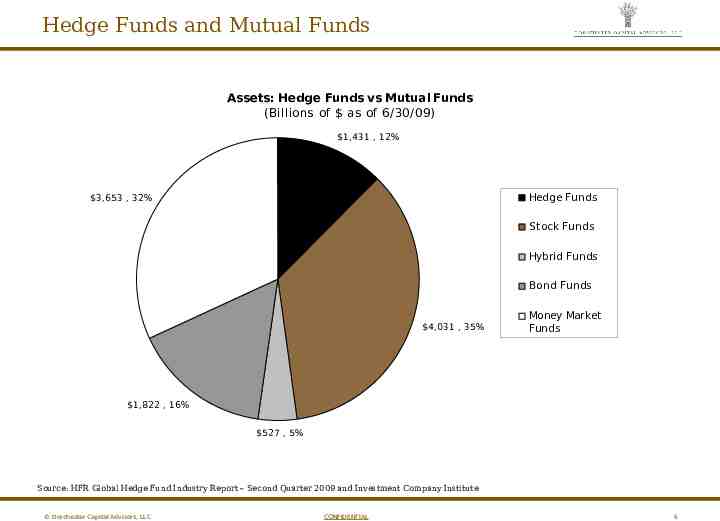

Hedge Funds and Mutual Funds Assets: Hedge Funds vs Mutual Funds (Billions of as of 6/30/ 09) 1,431 , 12% Hedge Funds 3,653 , 32% Stock Funds Hybrid Funds Bond Funds 4,031 , 35% Money Market Funds 1,822 , 16% 527 , 5% Source: HFR Global Hedge Fund Industry Report – Second Quarter 2009 and Investment Company Institute Dorchester Capital Advisors, LLC CONFIDENTIAL 6

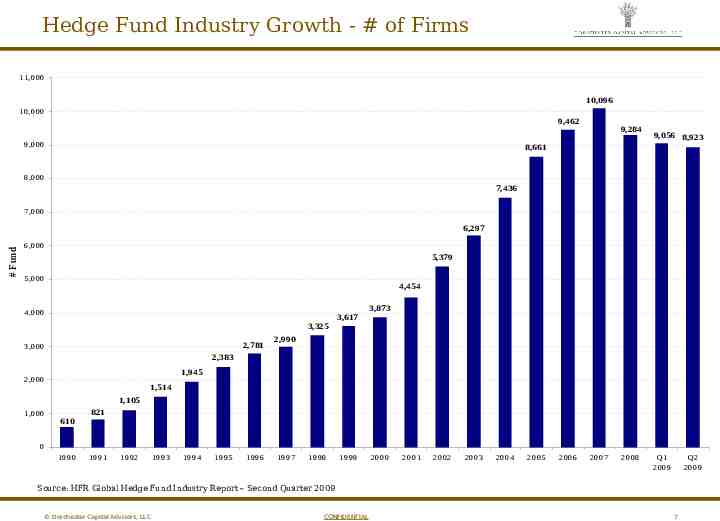

Hedge Fund Industry Growth - # of Firms 11,000 10,096 10,000 9,462 9,000 9,284 9,056 8,923 8,661 8,000 7,436 7,000 # Funds 6,297 6,000 5,379 5,000 4,454 4,000 3,617 3,873 3,325 2,781 3,000 2,990 2,383 1,945 2,000 1,514 1,105 1,000 610 821 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Q1 2009 Q2 2009 Source: HFR Global Hedge Fund Industry Report – Second Quarter 2009 Dorchester Capital Advisors, LLC CONFIDENTIAL 7

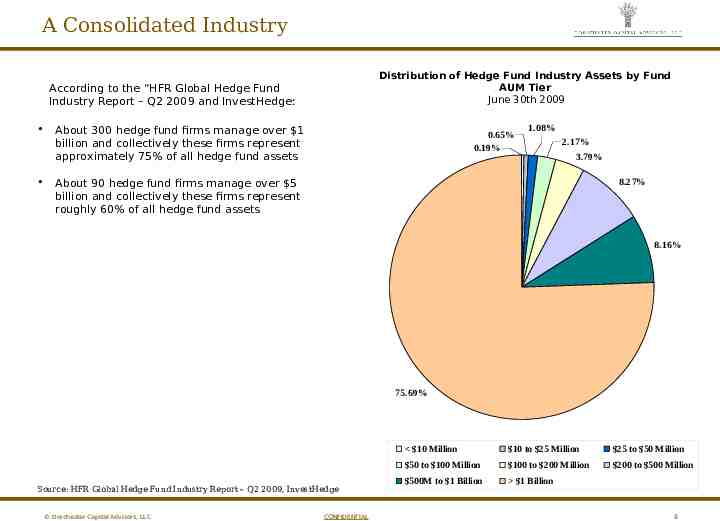

A Consolidated Industry Distribution of Hedge Fund Industry Assets by Fund AUM Tier June 30th 2009 According to the “HFR Global Hedge Fund Industry Report – Q2 2009 and InvestHedge: About 300 hedge fund firms manage over 1 billion and collectively these firms represent approximately 75% of all hedge fund assets 0.65% 0.19% 1.08% 2.17% 3.79% 8.27% About 90 hedge fund firms manage over 5 billion and collectively these firms represent roughly 60% of all hedge fund assets 8.16% 75.69% Source: HFR Global Hedge Fund Industry Report – Q2 2009, InvestHedge Dorchester Capital Advisors, LLC CONFIDENTIAL 10 Million 10 to 25 Million 25 to 50 Million 50 to 100 Million 100 to 200 Million 200 to 500 Million 500M to 1 Billion 1 Billion 8

Characteristics Of Hedge Funds Benefits Flexible Mandate: less constrained regarding benchmarks, use of short selling, leverage, and permitted securities; therefore, can focus on absolute returns Incentive Structure: fee structure attracts highly talented money managers who personally invest in their funds; therefore, interests are aligned with investors Diversification: hedge funds are typically uncorrelated with traditional asset classes Dorchester Capital Advisors, LLC CONFIDENTIAL 9

Characteristics Of Hedge Funds Drawbacks Transparency: hedge funds can seem opaque to new or nervous investors because disclosure standards are not universal across strategies or managers Manager Risk: so much of a fund’s performance may be the result of a few key people Liquidity: hedge fund investing involves lock ups Dorchester Capital Advisors, LLC CONFIDENTIAL 10

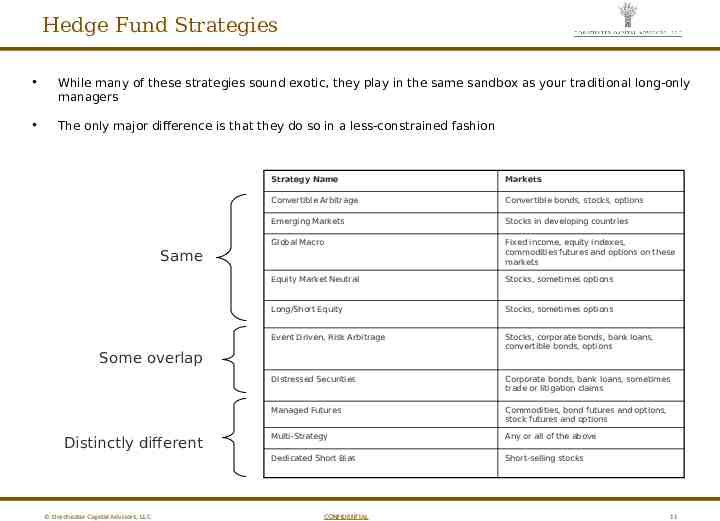

Hedge Fund Strategies While many of these strategies sound exotic, they play in the same sandbox as your traditional long-only managers The only major difference is that they do so in a less-constrained fashion Same Strategy Name Markets Convertible Arbitrage Convertible bonds, stocks, options Emerging Markets Stocks in developing countries Global Macro Fixed income, equity indexes, commodities futures and options on these markets Equity Market Neutral Stocks, sometimes options Long/Short Equity Stocks, sometimes options Event Driven, Risk Arbitrage Stocks, corporate bonds, bank loans, convertible bonds, options Distressed Securities Corporate bonds, bank loans, sometimes trade or litigation claims Managed Futures Commodities, bond futures and options, stock futures and options Multi-Strategy Any or all of the above Dedicated Short Bias Short-selling stocks Some overlap Distinctly different Dorchester Capital Advisors, LLC CONFIDENTIAL 11

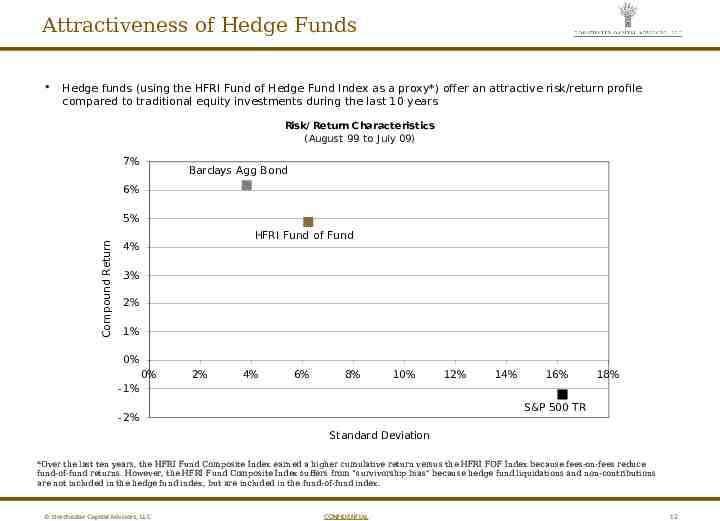

Attractiveness of Hedge Funds Hedge funds (using the HFRI Fund of Hedge Fund Index as a proxy*) offer an attractive risk/return profile compared to traditional equity investments during the last 10 years Risk/ Return Characteristics (August 99 to J uly 09) 7% Barclays Agg Bond 6% Compound Return 5% HFRI Fund of Fund 4% 3% 2% 1% 0% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% - 1% S&P 500 TR - 2% Standard Deviation *Over the last ten years, the HFRI Fund Composite Index earned a higher cumulative return versus the HFRI FOF Index because fees-on-fees reduce fund-of-fund returns. However, the HFRI Fund Composite Index suffers from “survivorship bias” because hedge fund liquidations and non-contributions are not included in the hedge fund index, but are included in the fund-of-fund index. Dorchester Capital Advisors, LLC CONFIDENTIAL 12

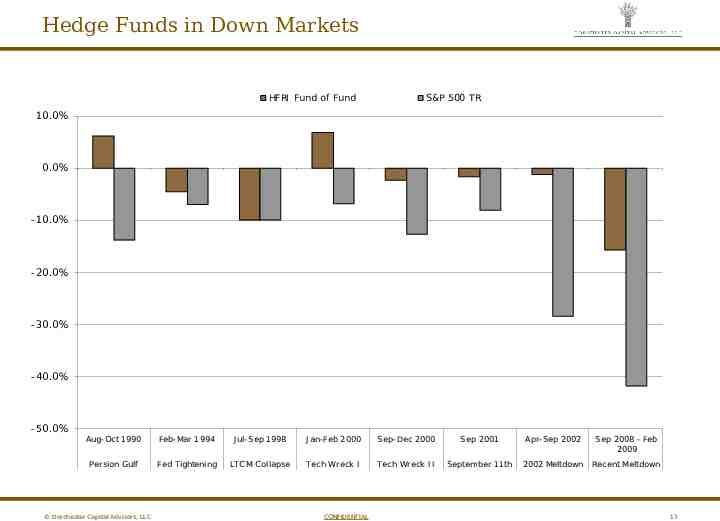

Hedge Funds in Down Markets HFRI Fund of Fund S&P 500 TR 10.0% 0.0% - 10.0% - 20.0% - 30.0% - 40.0% - 50.0% Aug-Oct 1990 Feb-Mar 1994 J ul-Sep 1998 J an-Feb 2000 Sep-Dec 2000 Sep 2001 Apr-Sep 2002 Sep 2008 - Feb 2009 Persion Gulf Fed Tightening LTC M C ollapse Tech Wreck I Tech Wreck I I September 11th 2002 Meltdown Recent Meltdown Dorchester Capital Advisors, LLC CONFIDENTIAL 13

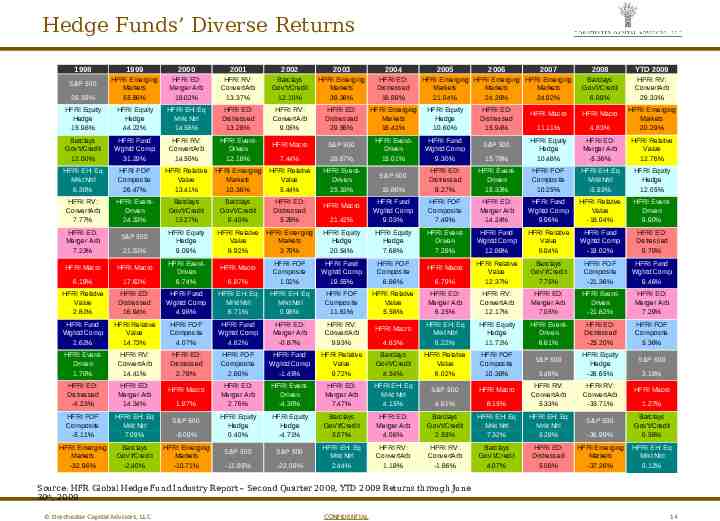

Hedge Funds’ Diverse Returns 1998 1999 2000 2001 2002 2003 2004 28.59% HFRI Emerging Markets 55.86% HFRI ED: Merger Arb 18.02% HFRI RV: ConvertArb 13.37% Barclays Gov't/Credit 12.10% HFRI Emerging Markets 39.36% HFRI ED: Distressed 18.89% HFRI Equity Hedge 15.98% HFRI Equity Hedge 44.22% HFRI EH: Eq Mrkt Ntrl 14.56% HFRI ED: Distressed 13.28% HFRI RV: ConvertArb 9.05% HFRI ED: Distressed 29.56% HFRI Emerging Markets 18.42% HFRI Equity Hedge 10.60% Barclays Gov't/Credit 12.00% HFRI Fund Wghtd Comp 31.29% HFRI RV: ConvertArb 14.50% HFRI EventDriven 12.18% 7.44% 28.67% HFRI EventDriven 15.01% HFRI Fund Wghtd Comp 9.30% HFRI EH: Eq Mrkt Ntrl 8.30% HFRI FOF Composite 26.47% HFRI Relative Value 13.41% HFRI Emerging Markets 10.36% HFRI Relative Value 5.44% HFRI EventDriven 25.33% HFRI RV: ConvertArb 7.77% HFRI EventDriven 24.33% Barclays Gov't/Credit 13.27% Barclays Gov't/Credit 9.40% HFRI ED: Distressed 5.28% HFRI Equity Hedge 9.09% HFRI Relative Value 8.92% HFRI Emerging Markets 3.70% S&P 500 HFRI ED: Merger Arb 7.23% S&P 500 21.03% HFRI Macro 2005 10.86% 21.42% HFRI Fund Wghtd Comp 9.03% HFRI FOF Composite 7.49% HFRI ED: Merger Arb 14.24% HFRI Fund Wghtd Comp 9.96% HFRI Relative Value -18.04% HFRI EventDriven 9.90% HFRI Equity Hedge 20.54% HFRI Equity Hedge 7.68% HFRI EventDriven 7.29% HFRI Fund Wghtd Comp 12.89% HFRI Relative Value 8.94% HFRI Fund Wghtd Comp -19.02% HFRI ED: Distressed 9.70% HFRI Fund Wghtd Comp 19.55% HFRI FOF Composite 6.86% 6.79% HFRI Relative Value 12.37% Barclays Gov't/Credit 7.75% HFRI FOF Composite -21.36% HFRI Fund Wghtd Comp 9.46% HFRI Relative Value 5.58% HFRI ED: Merger Arb 6.25% HFRI RV: ConvertArb 12.17% HFRI ED: Merger Arb 7.05% HFRI EventDriven -21.82% HFRI ED: Merger Arb 7.29% HFRI Equity Hedge 11.71% HFRI EventDriven 6.61% HFRI ED: Distressed -25.20% HFRI FOF Composite 5.36% HFRI FOF Composite 10.39% HFRI Macro 6.87% HFRI EH: Eq Mrkt Ntrl 6.71% HFRI EH: Eq Mrkt Ntrl 0.98% HFRI FOF Composite 11.61% HFRI Fund Wghtd Comp 2.62% HFRI Relative Value 14.73% HFRI FOF Composite 4.07% HFRI Fund Wghtd Comp 4.62% HFRI ED: Merger Arb -0.87% HFRI RV: ConvertArb 9.93% 4.63% HFRI EH: Eq Mrkt Ntrl 6.22% HFRI EventDriven 1.70% HFRI RV: ConvertArb 14.41% HFRI ED: Distressed 2.78% HFRI FOF Composite 2.80% HFRI Fund Wghtd Comp -1.45% HFRI Relative Value 9.72% Barclays Gov't/Credit 4.54% HFRI Relative Value 6.02% HFRI ED: Distressed -4.23% HFRI ED: Merger Arb 14.34% HFRI ED: Merger Arb 2.76% HFRI EventDriven -4.30% HFRI ED: Merger Arb 7.47% HFRI EH: Eq Mrkt Ntrl 4.15% HFRI FOF Composite -5.11% HFRI EH: Eq Mrkt Ntrl 7.09% HFRI Equity Hedge 0.40% HFRI Equity Hedge -4.71% Barclays Gov't/Credit 5.07% HFRI Emerging Markets -32.96% Barclays Gov't/Credit -2.40% HFRI EH: Eq Mrkt Ntrl 2.44% HFRI Emerging Markets -10.71% S&P 500 S&P 500 -11.85% -22.09% HFRI Relative Value 12.76% HFRI Equity Hedge 12.05% HFRI Fund Wghtd Comp 4.98% -9.09% 4.83% HFRI ED: Merger Arb -5.36% HFRI Macro HFRI EH: Eq Mrkt Ntrl -5.93% 17.62% S&P 500 11.11% HFRI Emerging Markets 20.29% HFRI Macro HFRI FOF Composite 10.25% S&P 500 HFRI ED: Distressed 16.94% 1.97% HFRI RV: ConvertArb 29.33% 15.78% 6.19% HFRI Macro YTD 2009 HFRI EventDriven 15.33% HFRI Relative Value 2.81% HFRI Macro HFRI ED: Distressed 15.94% 2008 Barclays Gov't/Credit 6.09% HFRI ED: Distressed 8.27% S&P 500 HFRI FOF Composite 1.02% HFRI Macro 2007 HFRI Equity Hedge 10.48% HFRI EventDriven 6.74% HFRI Macro 2006 HFRI Emerging HFRI Emerging HFRI Emerging Markets Markets Markets 21.04% 24.26% 24.92% HFRI Macro HFRI Macro S&P 500 5.49% HFRI Equity Hedge -26.65% HFRI RV: ConvertArb -33.71% S&P 500 S&P 500 HFRI Macro 4.91% 8.15% HFRI RV: ConvertArb 5.33% HFRI ED: Merger Arb 4.08% Barclays Gov't/Credit 2.55% HFRI EH: Eq Mrkt Ntrl 7.32% HFRI EH: Eq Mrkt Ntrl 5.29% HFRI RV: ConvertArb 1.18% HFRI RV: ConvertArb -1.86% Barclays Gov't/Credit 4.07% HFRI ED: Distressed 5.08% S&P 500 3.19% HFRI Macro 1.27% -36.99% Barclays Gov't/Credit 0.59% HFRI Emerging Markets -37.26% HFRI EH: Eq Mrkt Ntrl 0.12% S&P 500 Source: HFR Global Hedge Fund Industry Report – Second Quarter 2009, YTD 2009 Returns through June 30th, 2009 Dorchester Capital Advisors, LLC CONFIDENTIAL 14

Fund of Hedge Funds

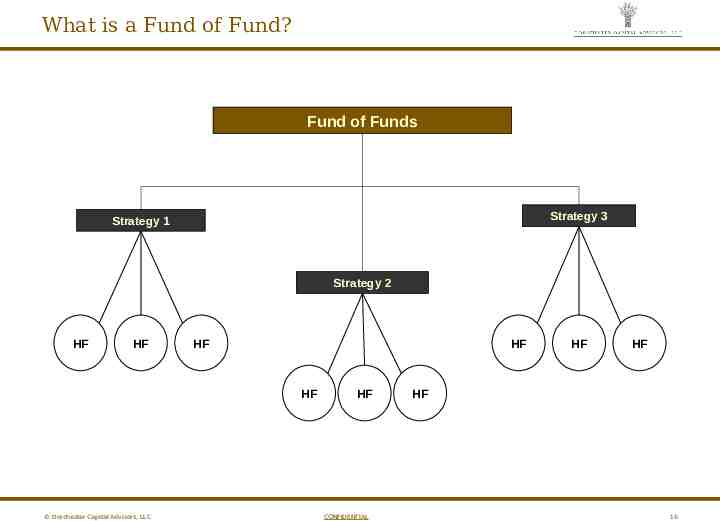

What is a Fund of Fund? Fund of Funds Strategy 3 Strategy 1 Strategy 2 HF HF HF HF HF Dorchester Capital Advisors, LLC HF CONFIDENTIAL HF HF HF 16

Benefits of Fund of Funds One-stop shop for hedge fund managers and strategy diversification Less expensive than building a direct and diversified portfolio in-house which requires dedication of time and staff Skilled and experienced staff dedicated to sourcing managers and performing comprehensive investment and operations due diligence, analysis and monitoring Risk management overlay to monitor portfolio exposures by asset classes, geography, market cap and leverage and to perform stress tests and scenario analysis “Liquidity pooling” allows for greater liquidity and flexibility for reallocation between strategies than direct investments “Termination risk” is absorbed at the fund-of-fund level adding liquidity while limiting the likelihood for exposure imbalances when unwinding direct investments with staggered liquidity Enhanced returns due to the inheritance of the high-water marks in their underlying managers in 2009 Dorchester Capital Advisors, LLC CONFIDENTIAL 17

What Other Say About Fund-of-Funds Barclays Capital Fund of Funds Overview, January 2009 For institutions investing less than 500M in hedge funds, Fund of Hedge Funds provide a valuable service that is not easily replicated without substantial investments in people, infrastructure, and processes. AIMA’s Roadmap to Hedge Funds, November 2008 Manager selection has become more difficult as well as labor-intensive over time, this despite the whole industry becoming more transparent and more information being available. A couple of years ago, a fund of funds would have argued that his value proposition was based on generating “alpha.” Today, the value-added of a fund of funds manager is probably better described as offering a laborious service at a lower cost than could otherwise be obtained by the investor directly. Dorchester Capital Advisors, LLC CONFIDENTIAL 18

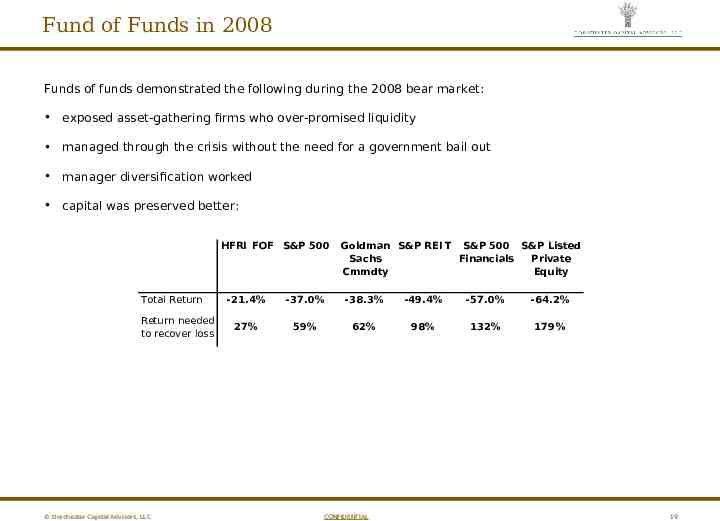

Fund of Funds in 2008 Funds of funds demonstrated the following during the 2008 bear market: exposed asset-gathering firms who over-promised liquidity managed through the crisis without the need for a government bail out manager diversification worked capital was preserved better: HFRI FOF S&P 500 Total Return Return needed to recover loss Dorchester Capital Advisors, LLC Goldman S&P REI T S&P 500 S&P Listed Sachs Financials Private Cmmdty Equity -21.4% -37.0% -38.3% -49.4% -57.0% -64.2% 27% 59% 62% 98% 132% 179% CONFIDENTIAL 19

New Hedge Fund Era

State of the Markets The markets today: Market volatility spiked in the last half of 2008. Many hedge fund managers mismanaged (or failed to manage) this volatility Credit is no longer cheap. Hedge fund strategies that rely on leverage for returns stopped working for investors We anticipate the following changes will be prominent in the New Hedge Fund Era: Recognition that low volatility does not equate with alpha but, rather, entails liquidity and pricing risks Migration to lower leverage strategies where the ROA of investments is sufficient to achieve the ROE for investors Preference for managers that are large enough to survive as institutions, yet small enough to retain an entrepreneurial culture and commercial focus Greater attention to managers adding value from alpha through security selection versus through sector market timing or leverage Dorchester Capital Advisors, LLC CONFIDENTIAL 21

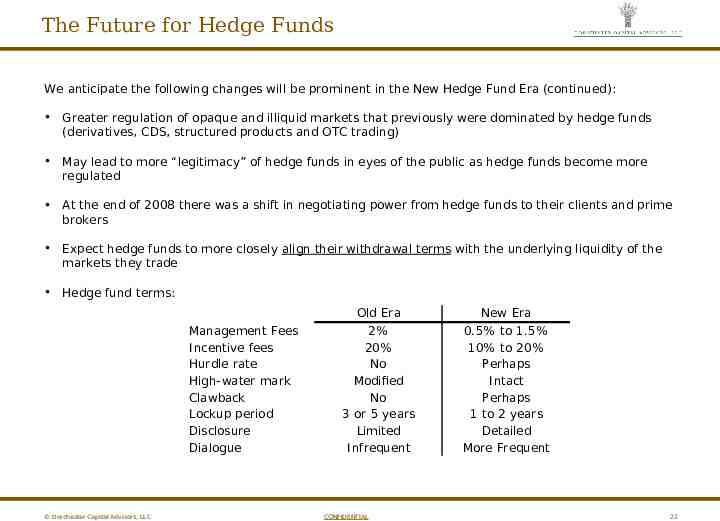

The Future for Hedge Funds We anticipate the following changes will be prominent in the New Hedge Fund Era (continued): Greater regulation of opaque and illiquid markets that previously were dominated by hedge funds (derivatives, CDS, structured products and OTC trading) May lead to more “legitimacy” of hedge funds in eyes of the public as hedge funds become more regulated At the end of 2008 there was a shift in negotiating power from hedge funds to their clients and prime brokers Expect hedge funds to more closely align their withdrawal terms with the underlying liquidity of the markets they trade Hedge fund terms: Management Fees I ncentive fees Hurdle rate High-water mark Clawback Lockup period Disclosure Dialogue Dorchester Capital Advisors, LLC Old Era 2% 20% No Modified No 3 or 5 years Limited I nfrequent CONFIDENTIAL New Era 0.5% to 1.5% 10% to 20% Perhaps I ntact Perhaps 1 to 2 years Detailed More Frequent 22

Disclosure / Disclaimer Dorchester Dorchester Capital Capital Advisors, Advisors, LLC LLC is is the the General General Partner Partner of of Dorchester Dorchester Capital Capital Partners, Partners, LP LP (“DCP”), (“DCP”), Dorchester Dorchester Capital Capital Partners Partners Select Select Opportunities, Opportunities, LP LP (“DCPSO”), (“DCPSO”), Dorchester Dorchester Capital Capital Partners Partners III, III, LP LP (“DCP (“DCP III”), III”), Dorchester Dorchester Capital Capital Partners Partners Global, Global, LP LP (“DCPG”), (“DCPG”), Dorchester Dorchester Capital Capital Partners Partners Low Low Volatility, Volatility, LP LP (“DCPLV”), (“DCPLV”), and and Dorchester Dorchester Capital Capital International International Retirement Retirement Plan, Plan, Ltd Ltd (“DCIRP”). (“DCIRP”). Dorchester Dorchester Capital Capital Advisors, Advisors, LLC LLC (“DCA”) (“DCA”) is is the the investment investment manager manager for for Dorchester Dorchester Capital Capital International International Retirement Retirement Plan, Plan, Ltd Ltd (“DCIRP”). (“DCIRP”). Dorchester Dorchester Capital Capital Advisors Advisors International, International, LLC LLC is is the the Investment Investment Manager Manager of of Dorchester Dorchester Capital Capital International, International, Ltd Ltd (“DCI”), (“DCI”), and and Dorchester Dorchester Capital Capital International International Select Select Opportunities, Opportunities, Ltd Ltd (“DCISO”). (“DCISO”). Dorchester Dorchester Capital Capital Advisors, Advisors, LLC LLC (“DCA”) (“DCA”) and and Dorchester Dorchester Capital Capital Advisors Advisors International, International, LLC LLC (“DCAI”) (“DCAI”) are are collectively collectively referred referred to to as as “Dorchester”. “Dorchester”. This This presentation presentation is is not not intended intended to to be be aa risk risk disclosure disclosure document document and and should should be be read read in in conjunction conjunction with with offering offering and and subscription subscription documents documents (collectively, (collectively, the the “Documents”) “Documents”) for for DCP, DCP, DCPSO, DCPSO, DCP DCP III, III, DCPG, DCPG, DCP DCP LV, LV, DCIRP, DCIRP, DCI, DCI, and/or and/or DCISO, DCISO, each each referred referred to to as as the the “Fund” “Fund” or or collectively collectively referred referred to to as as the the “Funds.” “Funds.” The The indices indices included included in in this this presentation presentation are are disclosed disclosed to to allow allow for for comparison comparison of of the the Fund’s Fund’s performance performance to to that that of of well-known well-known and and widely widely recognized recognized indices. indices. The The S&P S&P 500 500 (dividends (dividends included) included) is is an an index index of of common common stock stock prices prices and and is is generally generally considered considered representative representative of of the the U.S. U.S. stock stock markets. markets. The The Barclays Barclays Aggregate Aggregate Bond Bond Index Index is is comprised comprised of of approximately approximately 6,000 6,000 publicly publicly traded traded bonds bonds including including U.S. U.S. Government, Government, mortgage-backed, mortgage-backed, corporate, corporate, and and Yankee Yankee bonds bonds with with an an approximate approximate average average maturity maturity of of 10 10 years. years. The The HFRI HFRI Monthly Monthly Indices Indices (“HFRI”) (“HFRI”) are are equally equally weighted weighted performance performance indices indices and and represent represent aa database database of of over over 1,000 1,000 funds. funds. The The HFRI HFRI are are broken broken down down into into 37 37 different different categories categories by by strategy. strategy. Funds Funds included included in in the the HFRI HFRI must must report report monthly monthly returns returns net net of of all all fees fees and and report report assets assets in in USD. USD. There There is is no no required required asset-size asset-size minimum minimum or or required required length length of of time time aa fund fund must must be be actively actively trading trading before before inclusion inclusion in in the the HFRI. HFRI. Trailing Trailing 4 4 months months are are left left as as estimates estimates and and are are subject subject to to change. change. Performance Performance prior prior to to that that is is locked locked and and no no longer longer subject subject to to change. change. The The HFRI HFRI are are updated updated 3 3 times times aa month. month. We We have have selected selected the the HFRI HFRI indices indices which which include include onshore onshore funds funds only. only. Some Some information information contained contained in in this this presentation presentation is is from from third-party third-party sources sources and and believed believed to to be be reliable. reliable. However, However, Dorchester Dorchester does does not not guarantee guarantee the the accuracy accuracy or or completeness completeness of of such such information. information. This This presentation presentation is is aa summary summary and and does does not not constitute constitute an an offer offer to to sell sell or or aa solicitation solicitation of of any any offer offer to to buy buy or or sell sell any any securities, securities, units units or or interests interests in in any any Fund. Fund. In In making making decisions decisions to to invest invest in in aa Fund, Fund, prospective prospective investors investors should should rely rely solely solely upon upon their their independent independent investigation, investigation, including including aa review review of of the the Documents. Documents. Neither Neither Dorchester Dorchester nor nor any any of of its its affiliates, affiliates, employees employees or or agents agents are are authorized authorized to to make make (or, (or, through through the the information information in in this this presentation, presentation, are are making) making) any any representations representations or or warranties warranties inconsistent inconsistent with with or or in in addition addition to to those those contained contained in in the the Documents. Documents. Prospective Prospective investors investors must must review review the the actual actual Documents Documents for for complete complete information information as as to to the the rights rights and and obligations obligations of of an an investor. investor. Certain Certain historical historical numbers numbers are are included included in in this this document; document; however, however, no no representation representation is is made made that that an an investor investor will will or or is is likely likely to to achieve achieve results results similar similar to to those those shown shown herein, herein, as as such, such, results results may may vary. vary. No No assurance assurance can can be be given given that that the the objectives objectives of of Dorchester Dorchester or or any any of of its its Funds Funds will will be be achieved. achieved. PAST PAST PERFORMANCE PERFORMANCE IS IS NOT NOT PREDICTIVE PREDICTIVE OF OF FUTURE FUTURE RETURNS. RETURNS. INHERENT INHERENT IN IN ANY ANY INVESTMENT INVESTMENT IS IS THE THE RISK RISK OF OF LOSS. LOSS. Dorchester Capital Advisors, LLC CONFIDENTIAL 23

DORCHESTER CAPITAL ADVISORS, LLC 11111 Santa Monica Boulevard, Suite 1250 Los Angeles, California USA 90025 Attn: Kelsey Quane 1.310.402.5090 [email protected] www.dorchestercapital.com