Distressed Investing Fundamentals Ignacio Jiménez Navarro Sensitivity:

20 Slides3.57 MB

Distressed Investing Fundamentals Ignacio Jiménez Navarro Sensitivity: Public Jun 26, 2023

Sobre mí UBS – Middle Market Investment Banking Alantra – Restructuring M&A (Project Phoenix) BBVA – M&A Sherpa Capital – Special Situations & Private Equity Ignacio Jiménez Navarro Cheyne Capital – Strategic Value Credit Graduated from ICADE (E2) in 2015 Sensitivity: Public

What is a distressed opportunity? Sensitivity: Public

Distressed Investing vs. Private Equity (1/2) Sensitivity: Public

Distressed Investing vs. Private Equity (2/2) Sensitivity: Public

Distressed Situations – Fundraising Environment Nice momentum for the distressed debt fundraising after years of limited interest from LPs Sensitivity: Public

Distressed Situations – Day-day Sensitivity: Public

Distressed Situations – Key Causes Sensitivity: Public

Distressed Situations – Investment Strategies Sensitivity: Public

Distressed Situations – Analysis Sensitivity: Public

Distressed Situations – Value Creation Innitiatives ENTERPRISE VALUE Equity 25% return Equity 7.5x-10x Junior Debt 15% PIK Junior Debt 6.0x-7.5x Senior Debt E 700bps Senior Debt 0.0x-6.0x 10x EBITDA Sensitivity: Public

Financial Analysis – Capital Structure Example Sensitivity: Public

Financial Analysis – Capital Structure Example Sensitivity: Public

Financial Analysis – EBITDA Sensitivity: Public

Financial Analysis – Attchment and Detachment Sensitivity: Public

Operational Analysis – Strategic Assesment (1/3) 1) Bank lends//Company borrows 100M 2) B ank se Sensitivity: Public lls lo an t o Sp ec S its F und fo r 3 0M Spec Sits Fund

Operational Analysis – Strategic Assesment(2/3) Sensitivity: Public

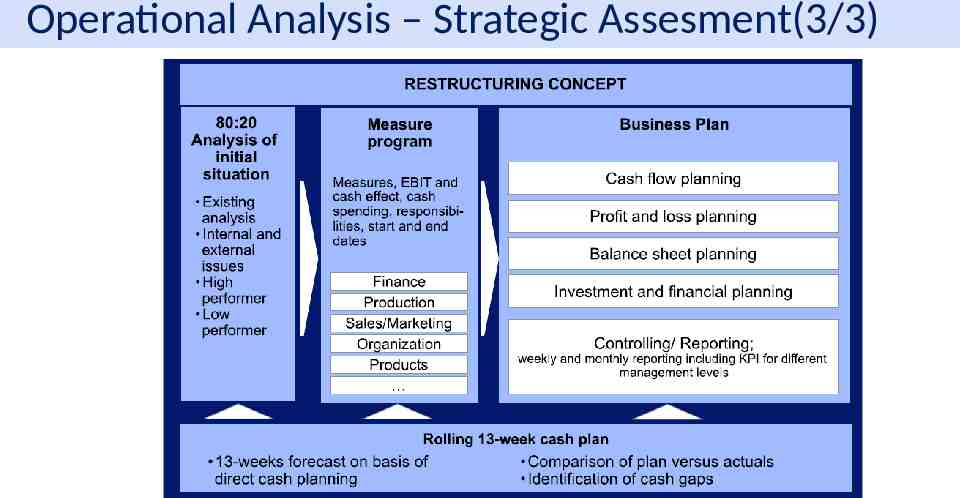

Operational Analysis – Strategic Assesment(3/3) Sensitivity: Public

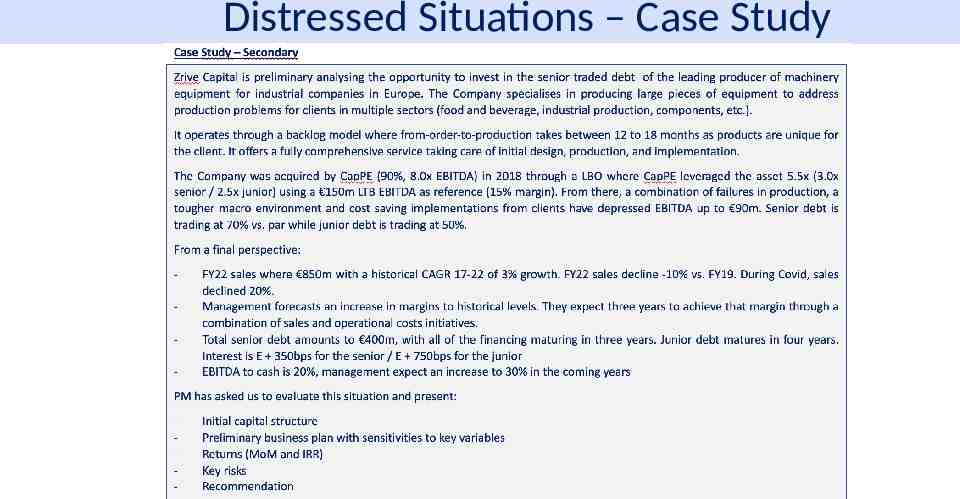

Distressed Situations – Case Study Sensitivity: Public

Preguntas Sensitivity: Public