d r Ca t s i d es e Cr roc P c n o c Re n o i t a ili UNIVERSITY

37 Slides3.30 MB

d r Ca t s i d es e Cr roc P c n o c Re n o i t a ili UNIVERSITY OF SOUTH FLORIDA CREDIT CARD PRESENTATION

BANKING, CASH COLLECTIONS AND RECONCILIATION TRAINING: Today’s training has been design for all departments that are using credit cards, new staff that need to understand the process of reconciling the credit cards. We encourage you to have your PCI compliance test up to date.

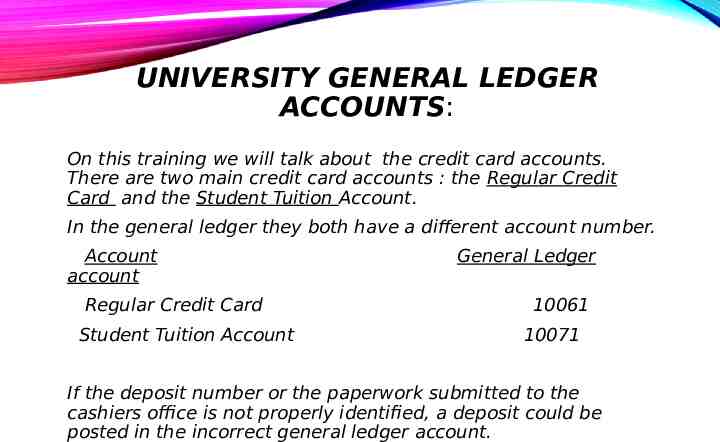

UNIVERSITY GENERAL LEDGER ACCOUNTS: On this training we will talk about the credit card accounts. There are two main credit card accounts : the Regular Credit Card and the Student Tuition Account. In the general ledger they both have a different account number. Account account Regular Credit Card Student Tuition Account General Ledger 10061 10071 If the deposit number or the paperwork submitted to the cashiers office is not properly identified, a deposit could be posted in the incorrect general ledger account.

REQUESTING A NEW CREDIT CARD MERCHANT 1.Send an email requesting your new credit card merchant account to General Accounting. ([email protected]) 2. A form will be sent to you to provide the merchant name, the contact person, phone number, fax number, email address and campus mail address. 3. We will also need a chart field to post the revenue and the merchant fees. 4. Also specify which credit card types would you like to accept: Visa, Master Card, Discover and American Express.

CHANGE IN YOUR DEPARTMENT On a new fiscal year some departments close a fund or a project and open another. If any change occurs on the revenue or merchant fees chart field, we encourage you to inform General Accounting to make the appropriate correction. Make sure to have budget in place to be able to post your fees. Also if an employee leaves the department please make sure you notify us so we can make sure we contact the new employee to have our credit card contact list updated. Also a change on name if you get married and your email changes please notify us to make the changes as well.

TYPES OF TRANSACTIONS ACCEPTED The University of South Florida has two different forms of accepting a credit card transaction. - Online payments or card not present transactions: these are processed thru Touch net Payment Gateway. A website is setup for the department to receive the payments online for the products or services they want to provide. - Card Swipe or Card present transactions: This is the typical transactions where the customer is present and swipes its card to pay for the transaction.

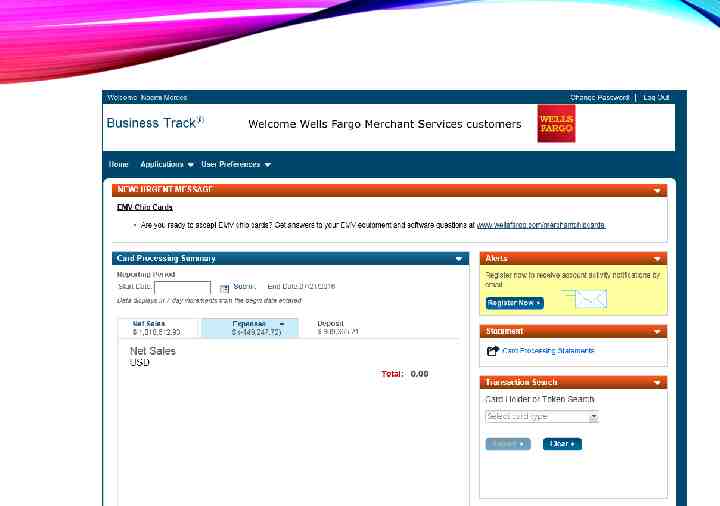

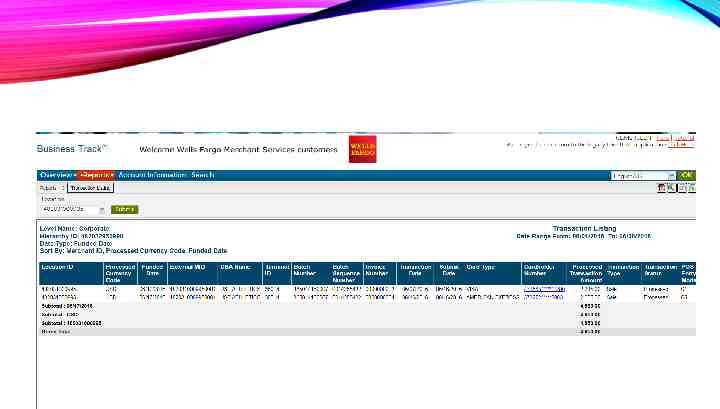

WELLS FARGO MERCHANT SERVICES: 1.On their website https://www.myclientline.net/,we can view all our credit card deposit activity, chargebacks, merchant fees at all times. 2. All departments have the access to this website and they are responsible of reconciling on a monthly basis. 3.If you have not setup your account in client line please do so to view your merchant statements and reconcile. You will need your merchant number, bank account number and tax id number. You can setup more than one person if needed for reconciling purposes. If you do not have this information send me an email and I would gladly sent it to you.

RECORDING CREDIT CARD DEPOSITS: 1. All credit cards being processed thru touch net are posted on a daily basis by the cashier’s office but the chargebacks need to be posted by the department. 2. All departments that send the credit card deposits to the cashier’s office should do them on a daily basis. Deposits are sent to cashiers in a Miscellaneous receipts Form. Please remember to write the correct chart field, the deposit number and the amount. 3. The deposit number for Visa, Master Card and Discover merchants is the last five numbers of the merchant number for example: USF Athletics – 482032953994 53994 4. For American Express merchants the deposit number is: 376 the last three numbers of your merchant number for example: USF Athletics – 4098139008 – 376008.

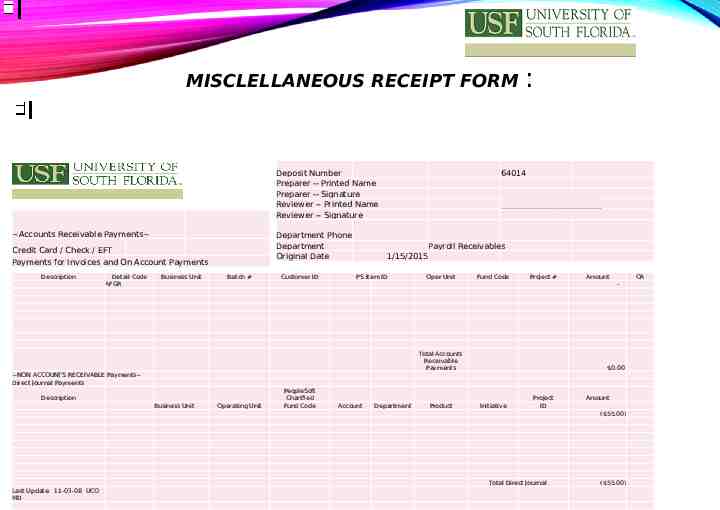

MISCLELLANEOUS RECEIPT FORM Deposit Number Preparer -- Printed Name Preparer -- Signature Reviewer -- Printed Name Reviewer -- Signature Accounts Receivable Payments Department Phone Department Original Date Credit Card / Check / EFT Payments for Invoices and On Account Payments Description Detail Code AFGR Business Unit Batch # Customer ID : 64014 Payroll Receivables 1/15/2015 PS Item ID Oper Unit Fund Code Project # Amount OA - Total Accounts Receivable Payments 0.00 NON ACCOUNTS RECEIVABLE Payments Direct Journal Payments Description Business Unit Operating Unit PeopleSoft Chartfied Fund Code Account Department Product Initiative Project ID Amount ( 55.00) Total Direct Journal Last Update: 11-03-08 UCO MD ( 55.00)

DEPOSITS SENT TO THE CASHIERS THRU EMAIL When sending the cashiers office deposits thru an email please remember to : Attach paperwork with deposit number, amount, date and for ex. if it is a credit card or lockbox deposit since they belong to different general ledger accounts specify what type of deposit it is. Make sure the email was received by the cashiers office and that you have a confirmation from them. Also if it is a correction make sure to write a brief but clear note of what is being corrected. The date of the original transaction and the amount.

ADD ALL BACKUP PAPERWORK NEEDED: All departments that originate their own Miscellaneous Receipts Form should include back up paperwork for example : copy of the invoice, check , credit card slip, etc. All information pertaining the deposit should be included in order to have backup papers for future reference. On the Miscellaneous Receipts Form do not change the order of the chart field. It is in order for the cashiers benefit.

TAKING DEPOSIT PAPERWORK TO THE CASHIER’S OFFICE: 1. The Cashier’s Office rules are: Take all deposits to the office before 2:30 p.m. in order to be processed the same date. 2. If a deposit number is not on the paper submitted it will be returned to the department. 3. Identify clearly if it is an e check, check, lockbox or credit card. Remember all American Express deposits should be posted separate from the Visa, Master Card and Discover Card. 4. If submitting a prior month correction please write a note stating the correction and the original transaction’s date and amount to facilitate the reconciliation process.

DEPARTMENTS RECONCILIATION : 1.All departments are responsible of reconciling their credit card account on a monthly basis. 2.Find your Book side at FAST – DATA MART – FINANCE MART 3.The credit card account in the General Ledger is 10061. 4.Compare all deposits posted in your revenue account against your merchant statements information which is your Bank side. 5.It is your responsibility to follow up, dispute and resolve all chargebacks done to your credit card account. 6.Sent to cashiers office all refunds to be posted. Debits and negative amounts. 7.Save a copy of your reconciliation for audit purposes.

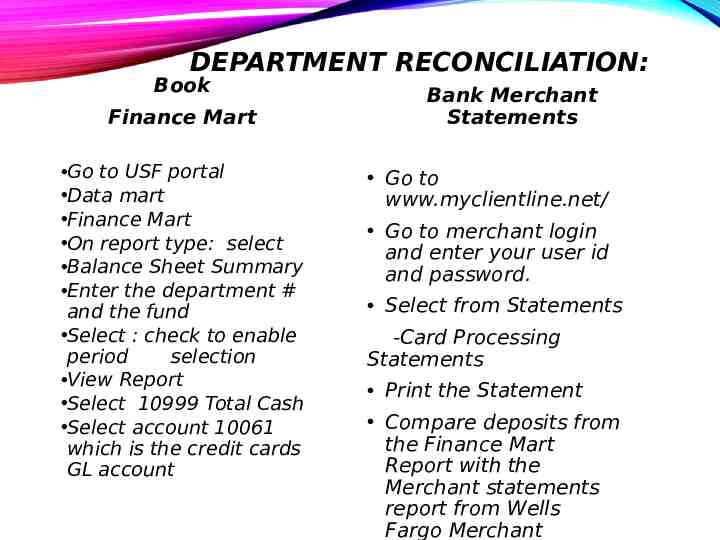

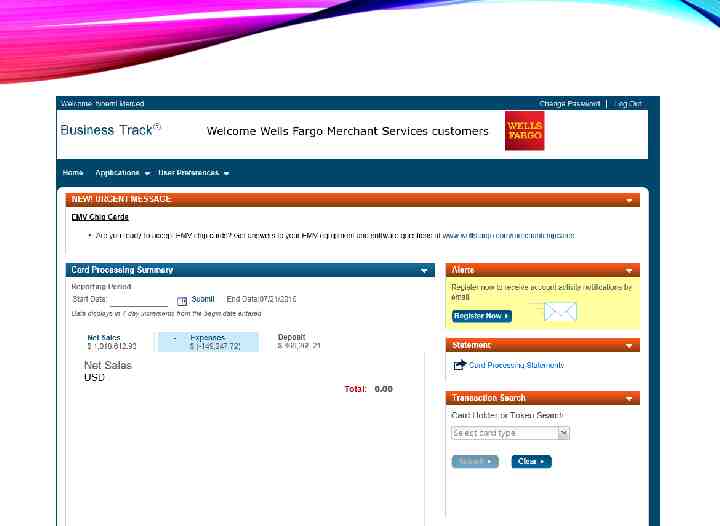

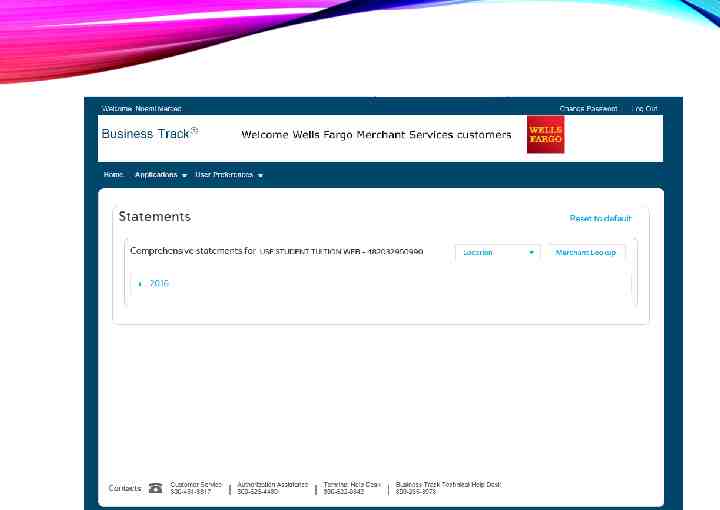

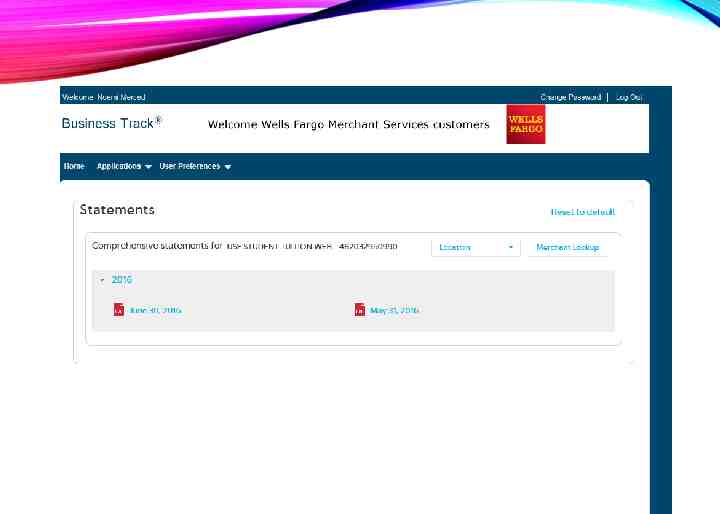

DEPARTMENT RECONCILIATION: Book Finance Mart Go to USF portal Data mart Finance Mart On report type: select Balance Sheet Summary Enter the department # and the fund Select : check to enable period selection View Report Select 10999 Total Cash Select account 10061 which is the credit cards GL account Bank Merchant Statements Go to www.myclientline.net/ Go to merchant login and enter your user id and password. Select from Statements -Card Processing Statements Print the Statement Compare deposits from the Finance Mart Report with the Merchant statements report from Wells Fargo Merchant

CHARGEBACK RECORDING: 1.The contact person for the department will receive a chargeback document that the bank sends General Accounting and they make a copy and send to the contact person via campus mail . 2.It is your responsibility to print your merchant statement and review if any chargeback has been charged to your account, follow up with the student or owner of the credit card. Dispute and send any information the bank is requesting. 3.Send the appropriate Miscellaneous Receipts form with the posting of the chargeback to the cashier’s office. Also remember to write a note and include any backup paperwork.

ALL CORRECTIONS AND CHARGEBACKS POSTING SHOULD BE ON THE SAME MONTH: 1. All prior month corrections should be stated in a note in the Miscellaneous Receipts form sent to the cashiers. Include as much information to be able to tie the correction to the original transaction. 2. All chargebacks are always in the first page of your merchant statements. 3. All corrections and chargebacks should be posted or corrected in the same month . 4. If a chargeback has not been posted or a correction done, when General Accounting reconciles and finds it they will send you an email informing you to post the chargeback. 5. Chargebacks are also known as debits in your merchant statements and they are negative amounts when sent to post to cashiers office.

GENERAL ACCOUNTING RECONCILIATION PROCESS: The accountant has 30 days to reconcile the accounts for all the credit card departments. There is 30 days to make corrections for the current month. Prior to year end old outstanding items will be removed from the Credit Card account and will be taken against merchant fees or revenue if the department doesn’t provide another chart field where they would like it to be posted.

UNDERSTANDING YOUR MERCHANT STATEMENTS Credit Card Statements

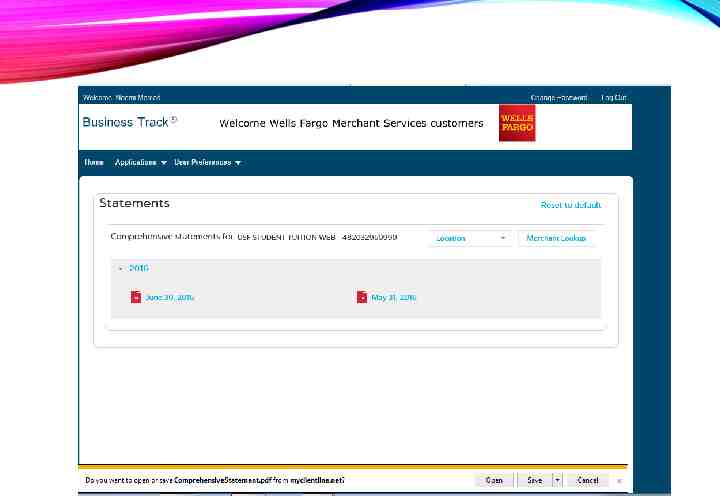

VISA, MASTER CARD AND DISCOVER MERCHANT STATEMENTS: Go to https://www.myclientline.net/ -Log in with your user Id and password -Proceed to Statements on your right side -Select Statement Type - Location -Select the date year and month -Open the statements -Print statement

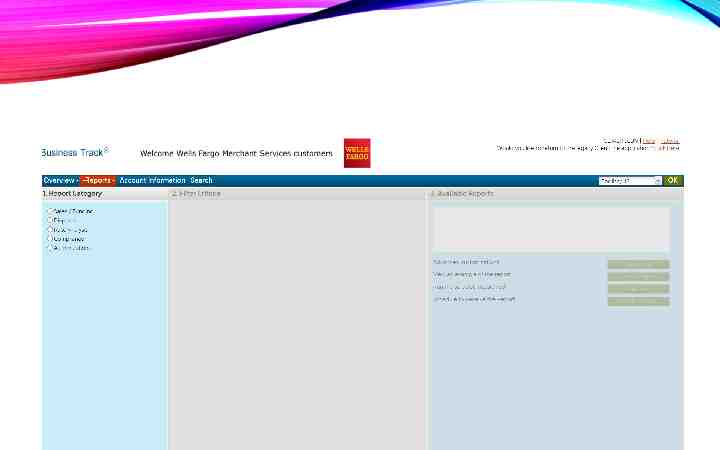

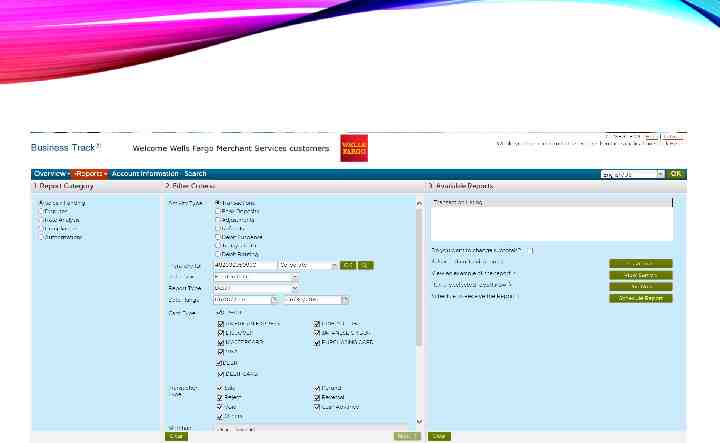

HOW TO CREATE A REPORT: Go to Applications on your top left hand side Go to Reports / Create a Report Select : Sales/Funding, Transactions On Date Type: Select Funded Date to match the bank On Report Type: Select Detail Select the Date Range needed Then Hit Next Hit Run Now on your Right hand side The report will be available and you can export it as a PDF file, Excel Spreadsheet, CSV or HTML.

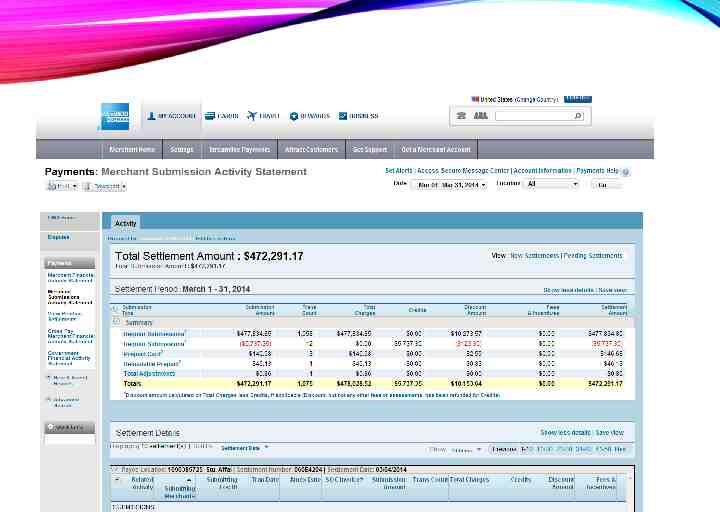

AMERICAN EXPRESS MERCHANT STATEMENTS Go to https://sso.americanexpress.com Log in with your user id and password Select the month you need to view an hit view statement If you need to view a prior month statement go to customize statement Select the month and hit Go Select view E statement Select print Hit print The merchant fees are called Discount Amount on the American Express statements. :

CREDIT CARD MACHINE REPLACEMENT: Please contact Cherie Carson or Noemi Merced in General Accounting to find out if your credit card is still under warranty. All replacements should be done thru us so we can get the best deal for your department according to our contract with Wells Fargo Merchant Services.

CONTACT INFORMATION : The credit card accountant reconciling is Noemi Merced General Accounting Manager is Cherie Carson. Phone number Phone number (813) 974-4914 Noemi Merced (813) 974-7686 Cherie Carson Fax number Email address (813) 974-2622 [email protected] [email protected]