Chapter 3: Insurance, Collars, and Other Strategies FINA0301

43 Slides993.00 KB

Chapter 3: Insurance, Collars, and Other Strategies FINA0301 Derivatives Faculty of Business and Economics University of Hong Kong Dr. Huiyan Qiu 1

Chapter Outline Basic insurance strategies: insuring a long position: floors; insuring a short position: caps; selling insurance Synthetic forwards: put-call parity Spreads and collars: bull and bear spreads; box spreads; ratio spreads; collars Speculating on volatility: straddles; strangles; butterfly spreads; asymmetric butterfly spreads 2

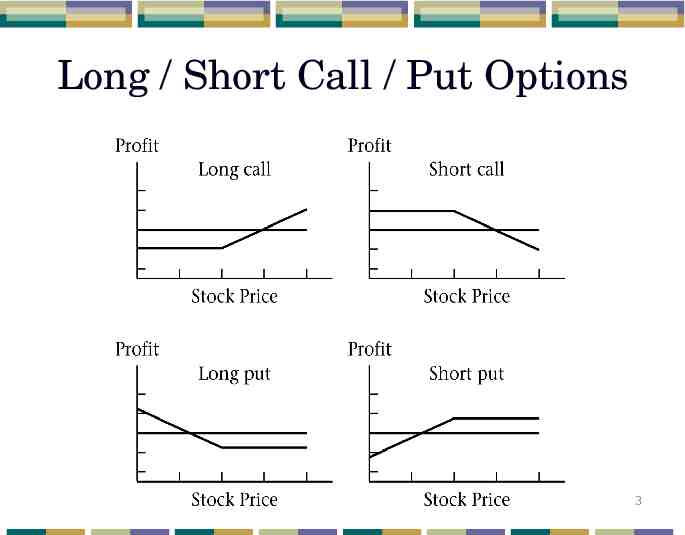

Long / Short Call / Put Options 3

Basic Insurance Strategies Insurance strategies using options: Used to insure long positions Buying put options Used to insure short positions Buying call options Written against asset positions (selling insurance) Covered call Covered put 4

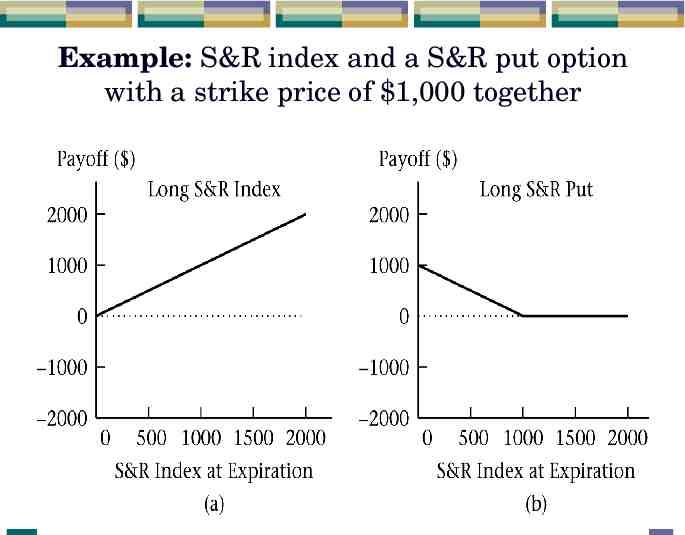

Insuring a Long Position A long position in the underlying asset combined with a put option Goal: to insure against a fall in the price of the underlying asset At time 0 Buy one stock at cost S0 (long position in the asset) Buy a put on the stock with a premium p An insured long position (buy an asset and a put) looks like a call! 5

Example: S&R index and a S&R put option with a strike price of 1,000 together 6

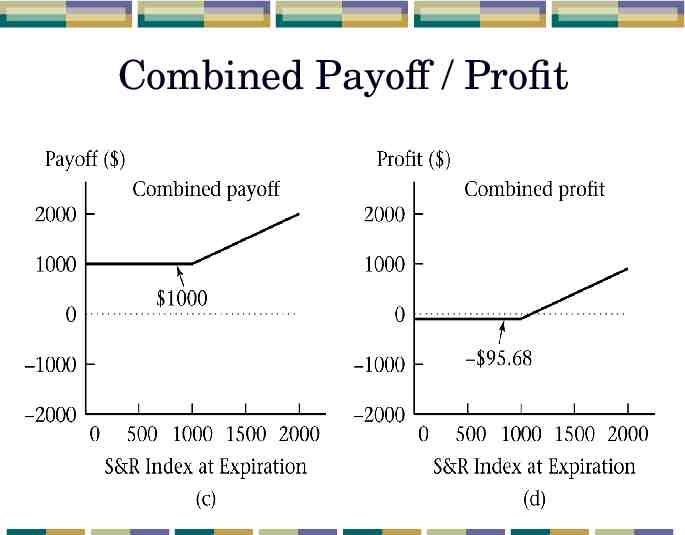

Combined Payoff / Profit 7

Protective Puts The portfolio consisting of a long asset position and a long put position is often called “Protective Put”. Protective puts are the classic “insurance” use of options. The protective put in the portfolio ensures a floor value (strike price of put) for the portfolio. That is, the asset can be sold for at least the strike price at expiration. Varying the strike price varies the insurance cost. 8

Insuring a Short Position A call option is combined with a short position in the underlying asset Goal: to insure against an increase in the price of the underlying asset At time 0 Short one stock at price S0 Buy a call on the stock with a premium c An insured short position (short an asset and buy a call) looks like a put 9

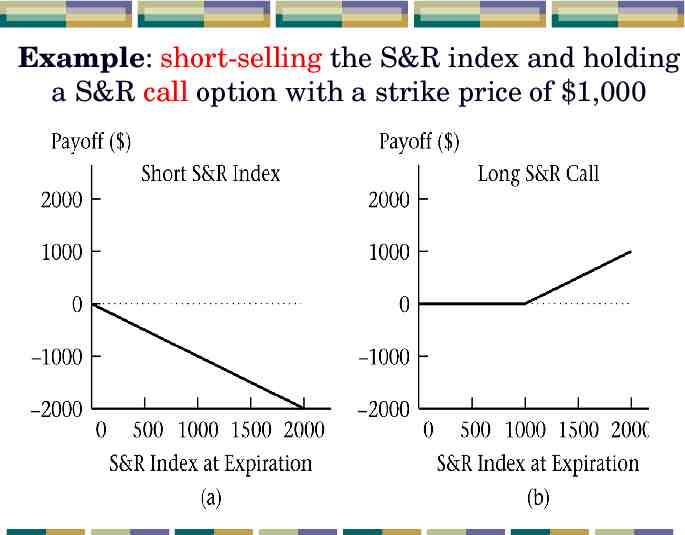

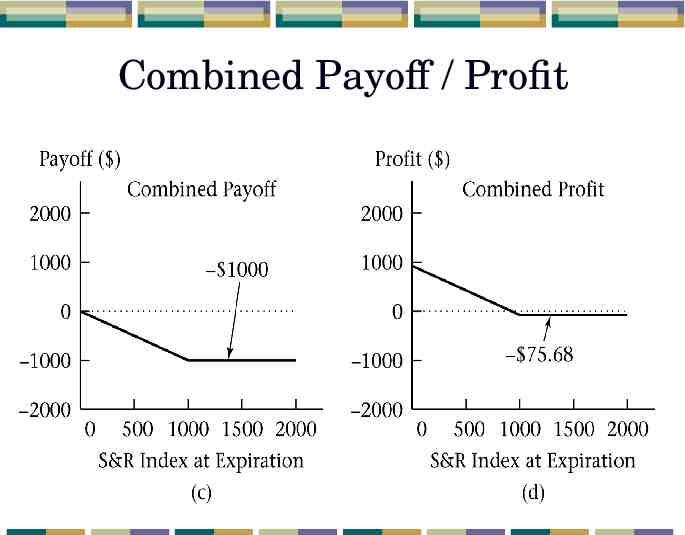

Example: short-selling the S&R index and holding a S&R call option with a strike price of 1,000 10

Combined Payoff / Profit 11

Selling Insurance For every insurance buyer there must be an insurance seller Naked writing is writing an option when the writer does not have a position in the asset Covered writing is writing an option when there is a corresponding position in the underlying asset Write a call and long the asset Write a put and short the asset 12

Covered Writing Covered calls: write a call option and hold the underlying asset. (The long asset position “covers” the writer of the call if the option is exercised.) A covered call looks like a short put Covered puts: write a put option and short the underlying asset A covered put looks like a short call 13

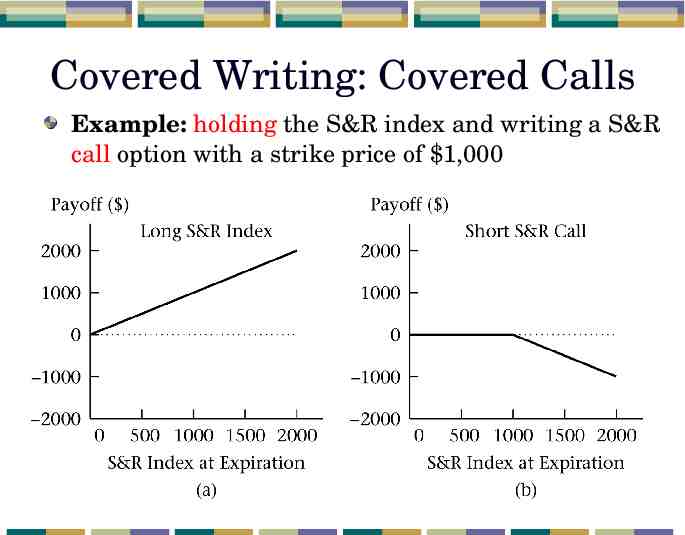

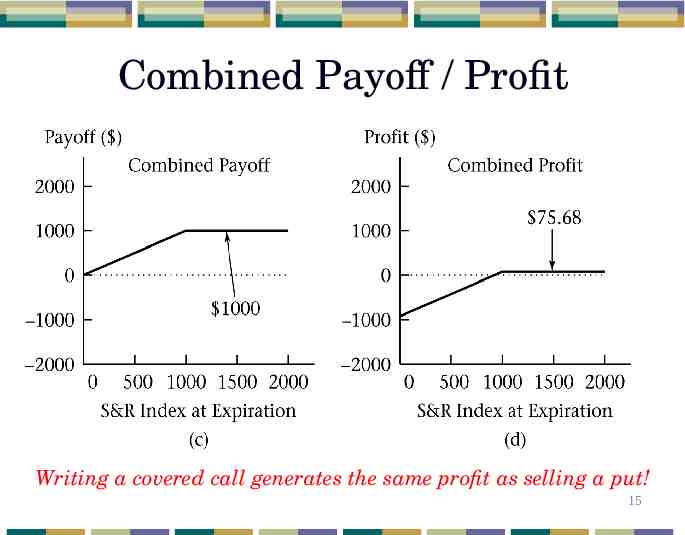

Covered Writing: Covered Calls Example: holding the S&R index and writing a S&R call option with a strike price of 1,000 14

Combined Payoff / Profit Writing a covered call generates the same profit as selling a put! 15

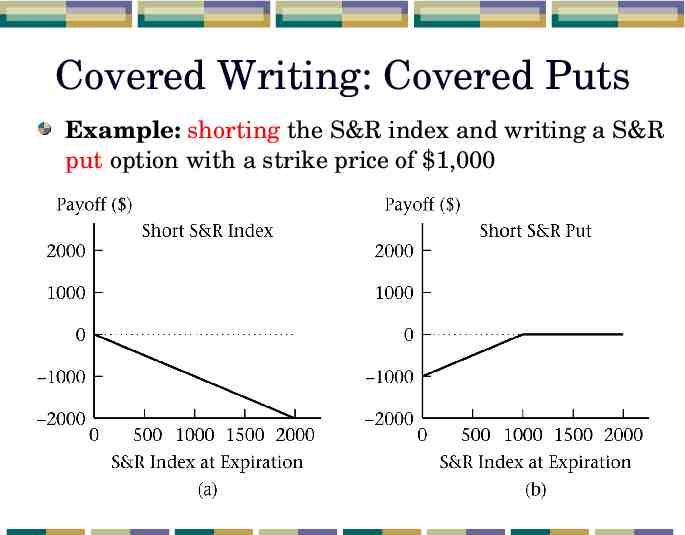

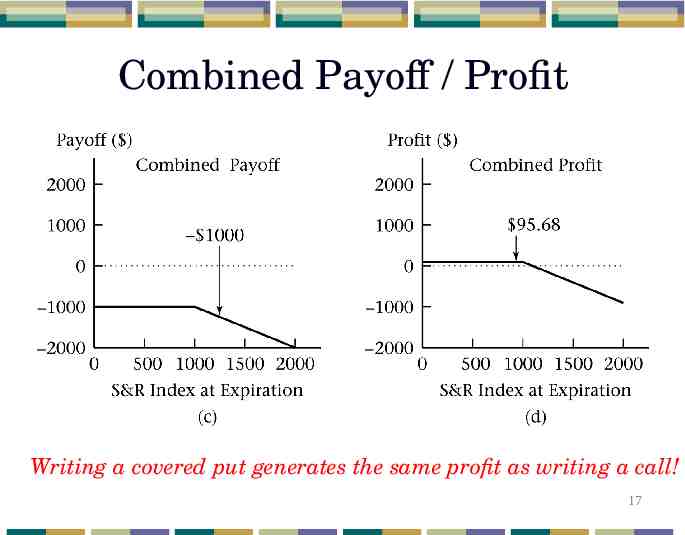

Covered Writing: Covered Puts Example: shorting the S&R index and writing a S&R put option with a strike price of 1,000 16

Combined Payoff / Profit Writing a covered put generates the same profit as writing a call! 17

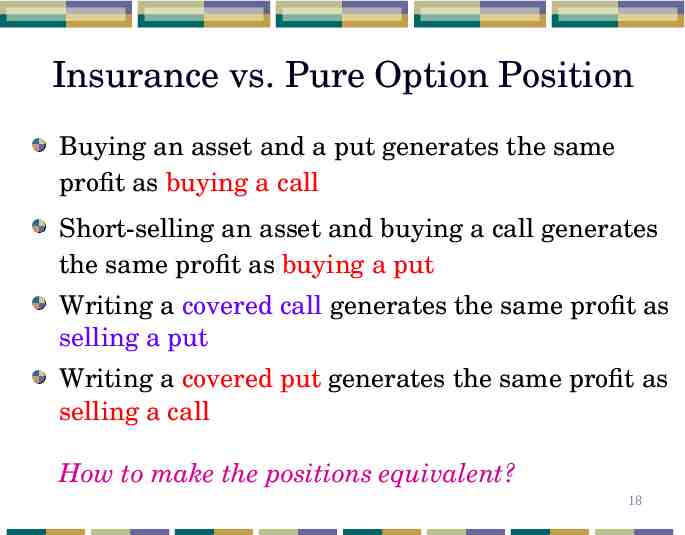

Insurance vs. Pure Option Position Buying an asset and a put generates the same profit as buying a call Short-selling an asset and buying a call generates the same profit as buying a put Writing a covered call generates the same profit as selling a put Writing a covered put generates the same profit as selling a call How to make the positions equivalent? 18

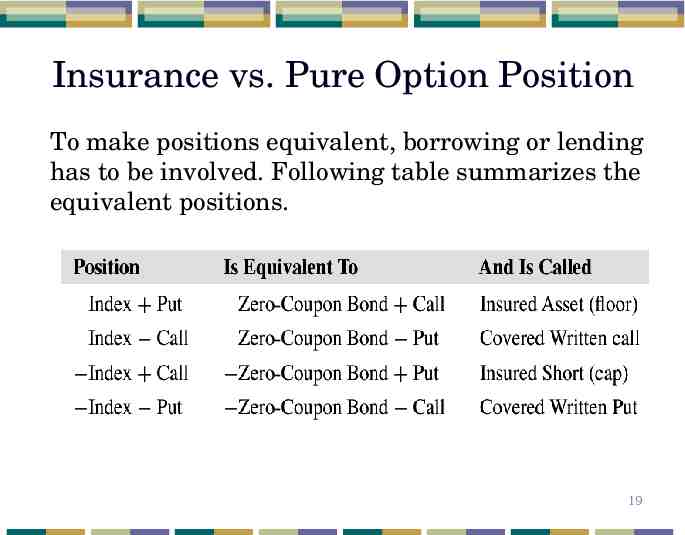

Insurance vs. Pure Option Position To make positions equivalent, borrowing or lending has to be involved. Following table summarizes the equivalent positions. 19

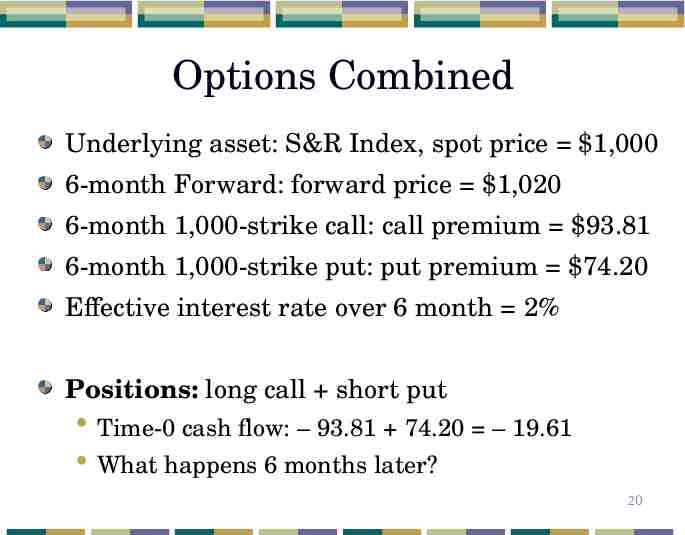

Options Combined Underlying asset: S&R Index, spot price 1,000 6-month Forward: forward price 1,020 6-month 1,000-strike call: call premium 93.81 6-month 1,000-strike put: put premium 74.20 Effective interest rate over 6 month 2% Positions: long call short put Time-0 cash flow: – 93.81 74.20 – 19.61 What happens 6 months later? 20

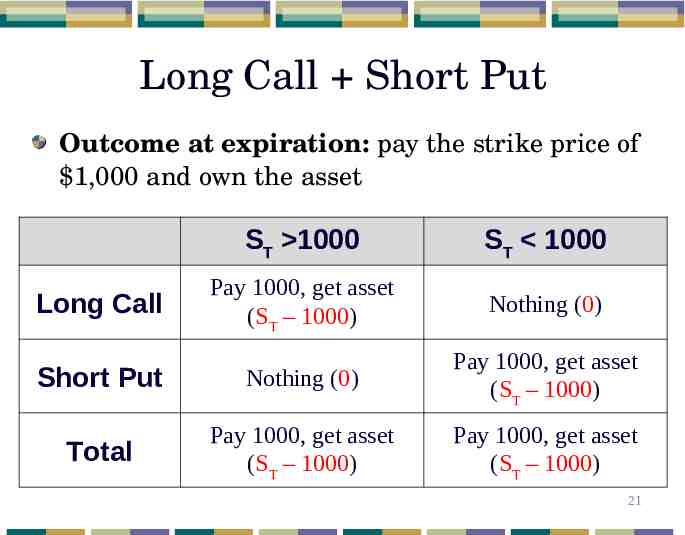

Long Call Short Put Outcome at expiration: pay the strike price of 1,000 and own the asset ST 1000 ST 1000 Pay 1000, get asset (ST – 1000) Nothing (0) Short Put Nothing (0) Pay 1000, get asset (ST – 1000) Total Pay 1000, get asset (ST – 1000) Pay 1000, get asset (ST – 1000) Long Call 21

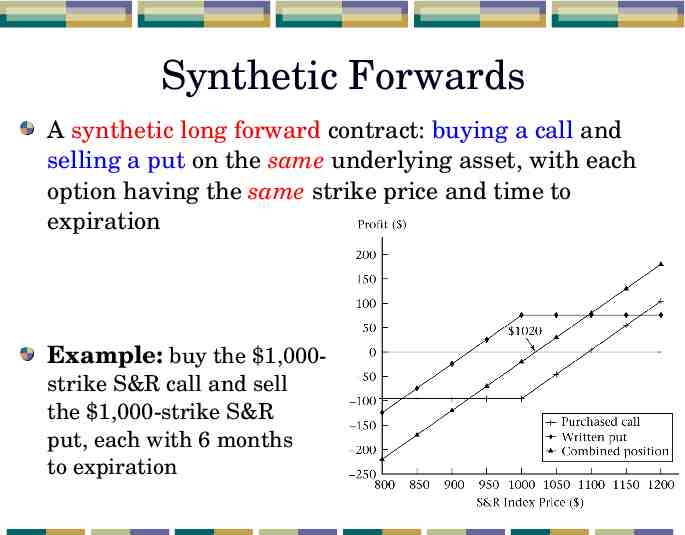

Synthetic Forwards A synthetic long forward contract: buying a call and selling a put on the same underlying asset, with each option having the same strike price and time to expiration Example: buy the 1,000strike S&R call and sell the 1,000-strike S&R put, each with 6 months to expiration 22

Synthetic Forwards (cont’d) Both synthetic long forward contract and actual forward contract result in owning the asset at the expiration. Differences The forward contract has a zero premium, while the synthetic forward requires that we pay the net option premium With the forward contract, we pay the forward price, while with the synthetic forward we pay the strike price 23

Put-Call Parity The net cost of buying the index using options (synthetic forward contract) must equal the net cost of buying the index using a forward contract Call (K, t) – Put (K, t) PV (F0,t – K) Call (K, t) and Put (K, t) denote the premiums of options with strike price K and time t until expiration PV (F0,t ) is the present value of the forward price This is one of the most important relations in options! 24

More Option Strategies Combined option positions can be taken to speculate on price direction or on volatility. Speculating on direction: bull and bear spreads; ratio spreads; collars Speculating on volatility: straddles; strangles; butterfly spreads; asymmetric butterfly spreads Box spread 25

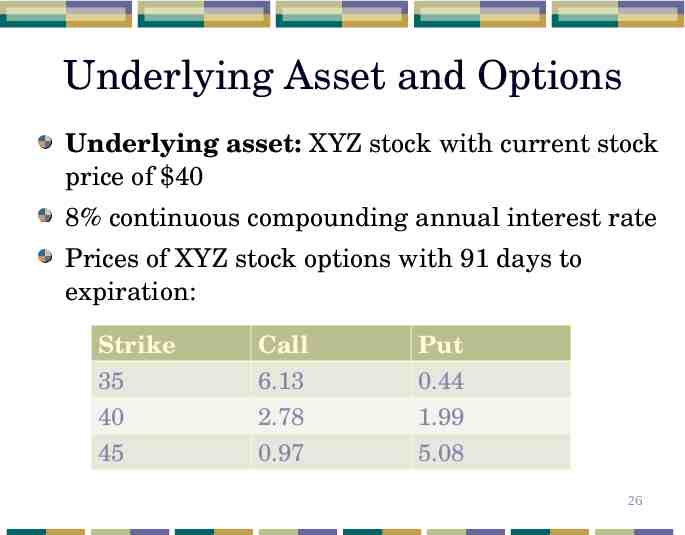

Underlying Asset and Options Underlying asset: XYZ stock with current stock price of 40 8% continuous compounding annual interest rate Prices of XYZ stock options with 91 days to expiration: Strike Call Put 35 6.13 0.44 40 2.78 1.99 45 0.97 5.08 26

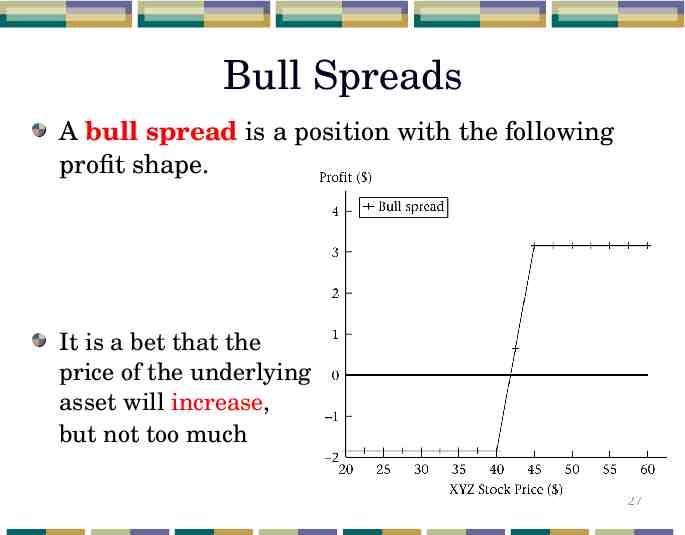

Bull Spreads A bull spread is a position with the following profit shape. It is a bet that the price of the underlying asset will increase, but not too much 27

Bull Spreads (cont’d) A bull spread is to buy a call/put and sell an otherwise identical call/put with a higher strike price Bull spread using call options: Long a call with no downside risk, and Short a call with higher strike price to eliminate the upside potential Bull spread using put options: Short a put to sacrifice upward potential, and Long a put with lower strike price to eliminate the downside risk 28

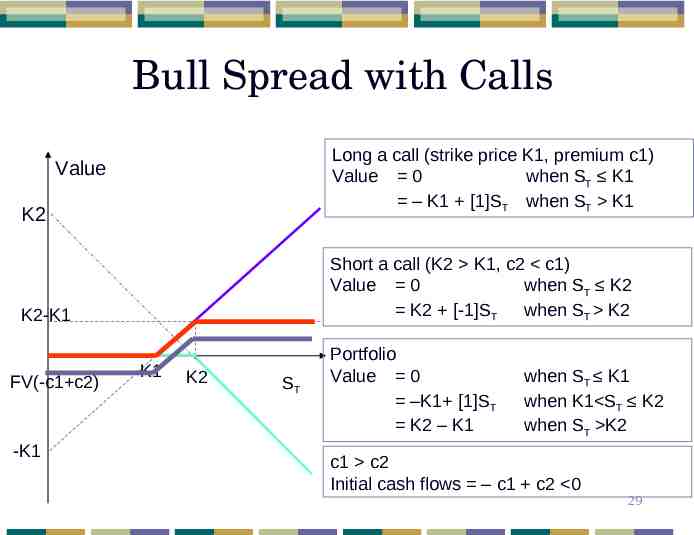

Bull Spread with Calls Long a call (strike price K1, premium c1) Value 0 when ST K1 – K1 [1]ST when ST K1 Value K2 Short a call (K2 K1, c2 c1) Value 0 when ST K2 K2 [-1]ST when ST K2 K2-K1 FV(-c1 c2) -K1 K1 K2 ST Portfolio Value 0 –K1 [1]ST K2 – K1 when ST K1 when K1 ST K2 when ST K2 c1 c2 Initial cash flows – c1 c2 0 29

Bear Spreads A bear spread is a position in which one sells a call (or a put) and buys an otherwise identical call (or put) with a higher strike price. Opposite of a bull spread. Example: short 40-strike call and long 45-strike put It is a bet that the price of the underlying asset will decrease, but not too much Option traders trading bear spreads are moderately bearish on the underlying asset 30

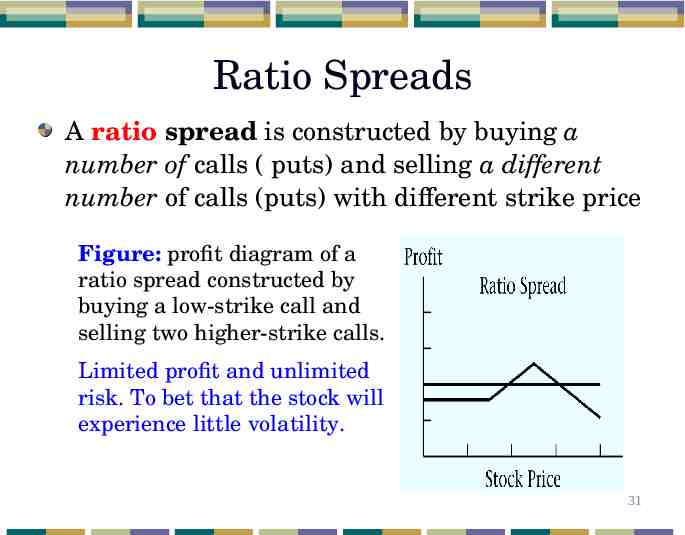

Ratio Spreads A ratio spread is constructed by buying a number of calls ( puts) and selling a different number of calls (puts) with different strike price Figure: profit diagram of a ratio spread constructed by buying a low-strike call and selling two higher-strike calls. Limited profit and unlimited risk. To bet that the stock will experience little volatility. 31

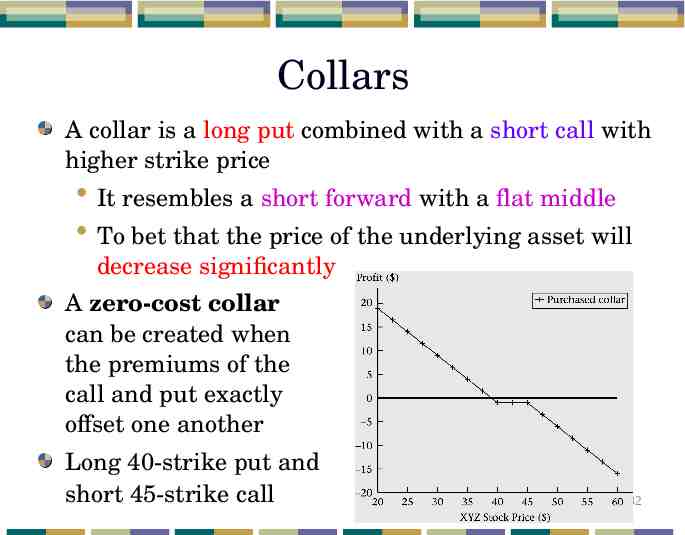

Collars A collar is a long put combined with a short call with higher strike price It resembles a short forward with a flat middle To bet that the price of the underlying asset will decrease significantly A zero-cost collar can be created when the premiums of the call and put exactly offset one another Long 40-strike put and short 45-strike call 32

Box Spreads A box spread is accomplished by using options to create a synthetic long forward at one price and a synthetic short forward at a different price Synthetic long forward: long a call and short a put with the same strike price The combination of payoff diagrams of a synthetic long forward and a synthetic short forward is a horizontal line. A box spread is a means of borrowing or lending money. It has no stock price risk! 33

Speculating on Volatility Non-directional speculations: Straddles Strangles Butterfly spreads Asymmetric butterfly spreads Who would use non-directional positions? Investors who have a view on volatility but are neutral on price direction Speculating on volatility 34

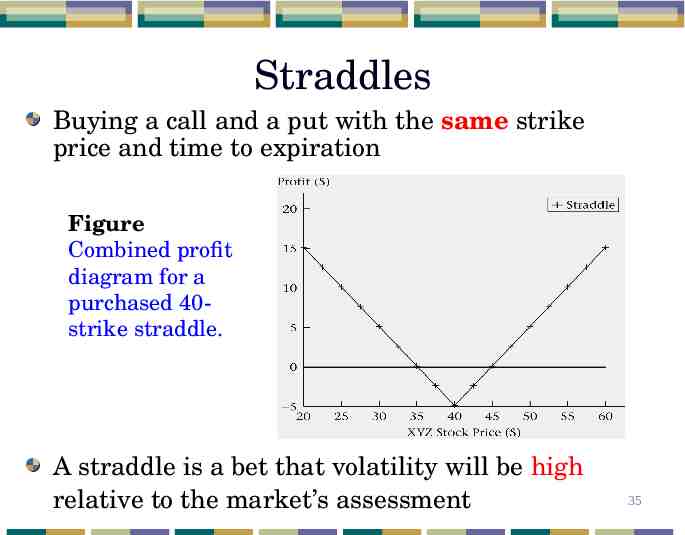

Straddles Buying a call and a put with the same strike price and time to expiration Figure Combined profit diagram for a purchased 40strike straddle. A straddle is a bet that volatility will be high relative to the market’s assessment 35

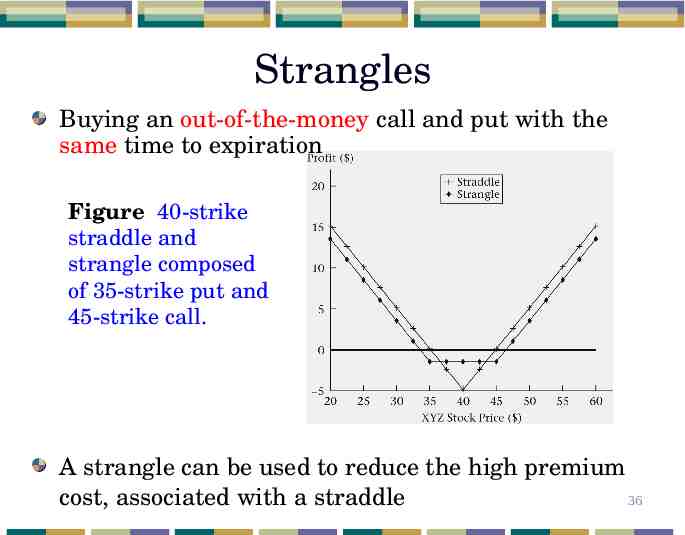

Strangles Buying an out-of-the-money call and put with the same time to expiration Figure 40-strike straddle and strangle composed of 35-strike put and 45-strike call. A strangle can be used to reduce the high premium 36 cost, associated with a straddle

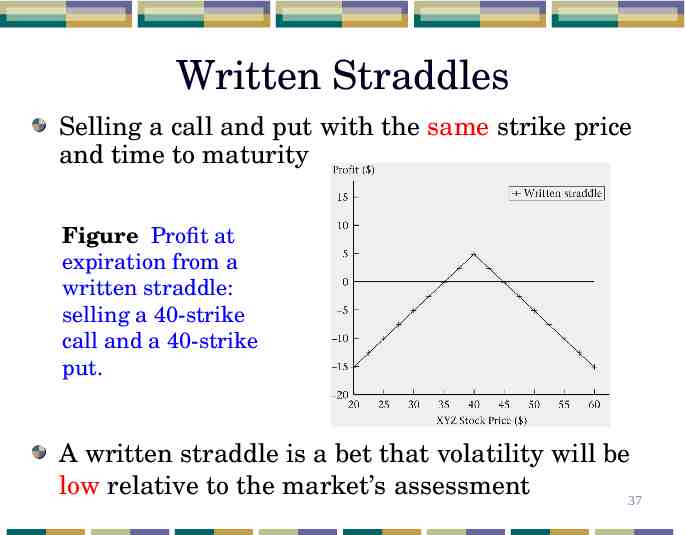

Written Straddles Selling a call and put with the same strike price and time to maturity Figure Profit at expiration from a written straddle: selling a 40-strike call and a 40-strike put. A written straddle is a bet that volatility will be low relative to the market’s assessment 37

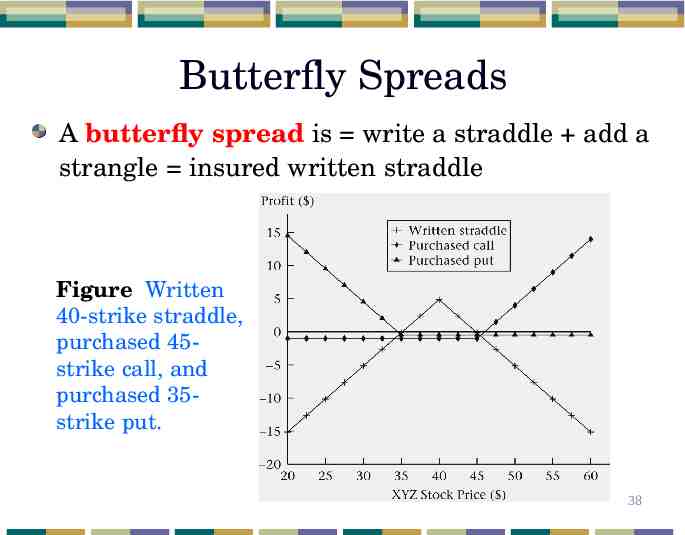

Butterfly Spreads A butterfly spread is write a straddle add a strangle insured written straddle Figure Written 40-strike straddle, purchased 45strike call, and purchased 35strike put. 38

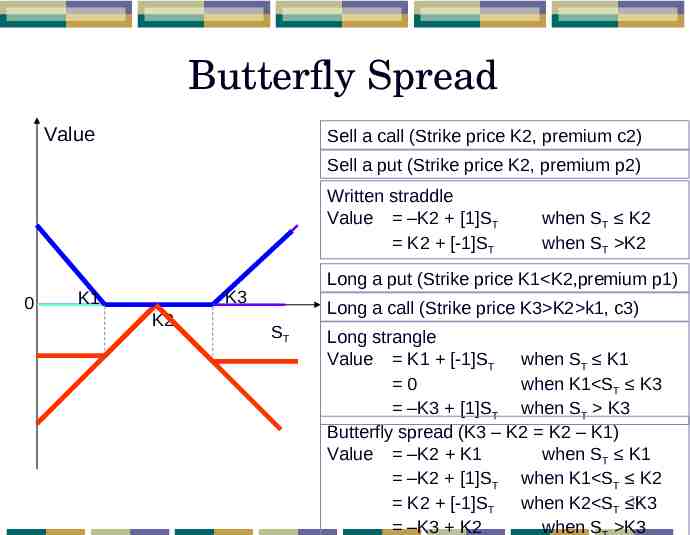

Butterfly Spread Value Sell a call (Strike price K2, premium c2) Sell a put (Strike price K2, premium p2) Written straddle Value –K2 [1]ST K2 [-1]ST 0 Long a put (Strike price K1 K2,premium p1) K3 K1 K2 when ST K2 when ST K2 Long a call (Strike price K3 K2 k1, c3) ST Long strangle Value K1 [-1]ST when ST K1 0 when K1 ST K3 –K3 [1]ST when ST K3 Butterfly spread (K3 – K2 K2 – K1) Value –K2 K1 when ST K1 –K2 [1]ST when K1 ST K2 39 K2 [-1]ST when K2 ST K3 –K3 K2 when S K3

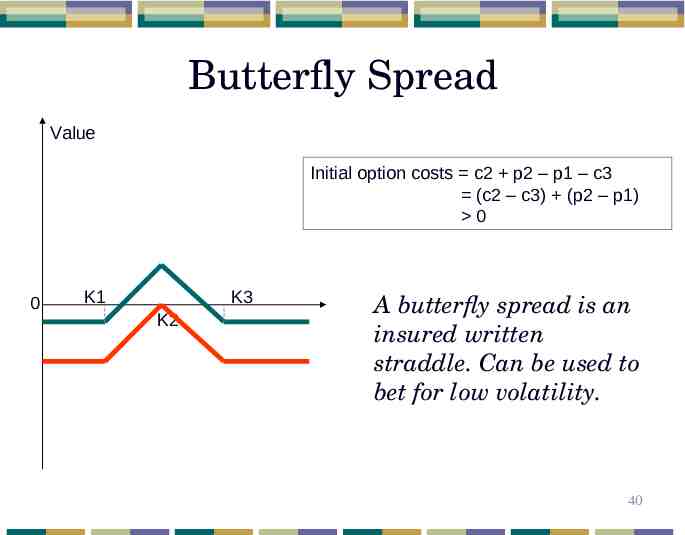

Butterfly Spread Value Initial option costs c2 p2 – p1 – c3 (c2 – c3) (p2 – p1) 0 0 K1 K3 K2 A butterfly spread is an insured written straddle. Can be used to bet for low volatility. 40

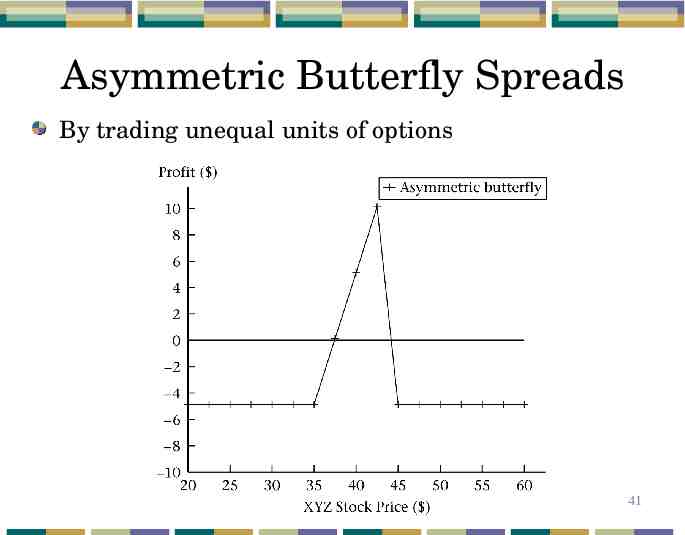

Asymmetric Butterfly Spreads By trading unequal units of options 41

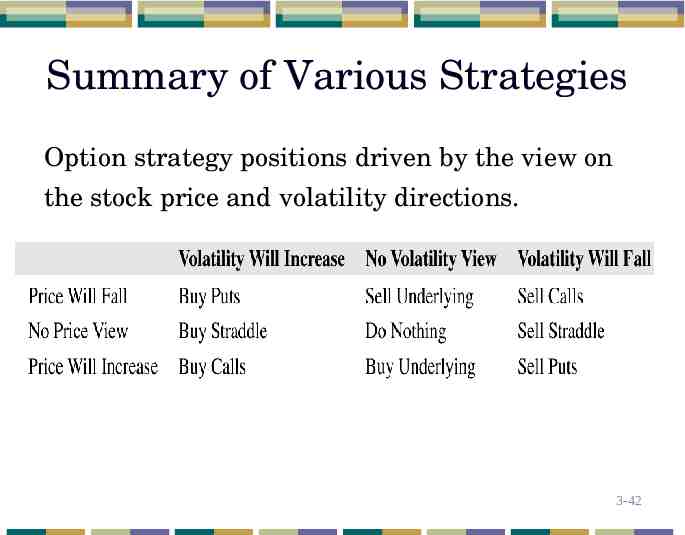

Summary of Various Strategies Option strategy positions driven by the view on the stock price and volatility directions. 3-42

End of the Notes! 43