Chapter 25 Other Assurance and Nonassurance Services

21 Slides336.50 KB

Chapter 25 Other Assurance and Nonassurance Services

Presentation Outline Attestation Engagements II. Compilation Engagements III. Review Engagements I.

I. Attestation Engagements A. C. The Appropriate Set of Standards B. Levels of Service Five Areas of Detailed Attestation Standards

A. The Appropriate Set of Standards Attestations that deal with providing assurance on historical financial statements, including one or more parts of those statements, are addressed in auditing standards. Reviews of historical financial statements use SSARS. Other forms of attestation use attestation standards.

B. Levels of Service Examination – a direct statement is made as to whether presentation of the assertions, taken as a whole, conforms with the applicable criteria. (See Fig. 25-1 on p. 744) Review – form of negative assurance as to whether anything came to the practitioner’s attention that the assertions are not presented in all material respects in conformity with the applicable criteria. Agreed-upon procedures – procedures to be performed are agreed to by the practitioner, the responsible party making the assertions, and the intended user of the report. Distribution is limited to involved parties who possess requisite knowledge about the procedures and the level of assurance.

C. Five Areas of Detailed Audit Standards WebTrust Services 2. SysTrust Services Prospective Financial Statements 4. Agreed-Upon Procedures 1. 3.

1. WebTrust Services In a WebTrust assurance services engagement, a client engages a CPA to provide reasonable assurance that a company’s Web site complies with certain Trust Services principles and criteria for one or more aspects of e-commerce activities. (See Table 25-2 on p. 745)

2. SysTrust Services In a SysTrust engagement, the SysTrust licensed accountant evaluates a company’s computer system using Trust Services principles and criteria.

3. Prospective Financial Statements (Predicted or Expected Financial Statements) Permissible engagements include examination, compilation, or agreed-upon procedures. Two general types of prospective financial statements: Forecasts – presents an entity’s expected financial position, results of operations, and cash flows, to the best of the responsible parties knowledge and belief. May be for limited or general use. Projections - presents an entity’s expected financial position, results of operations, and cash flows, to the best of the responsible parties knowledge and belief, given one or more hypothetical assumptions. Generally restricted to limited use.

4. Agreed Upon Procedures The primary appeal to practitioners of agreedupon procedures engagements is making management or a third-party user specify the procedures they want performed.

II. Compilation Engagements A. C. D. Compilation Engagements and Reports B. Contents of Compilation Report The Effect of a Departure from GAAP on a Compilation Report The Effect of a Lack of Independence on a Compilation Report

A. Compilation Engagements CPA prepares financial statements but does not express any assurance on them. When the CPA expects that a third-party will use the financial statements, a compilation report must be prepared. A CPA does not have the issue the report if a third party is not involved. Such an arrangement must be clearly set out in the engagement letter. May omit substantially all disclosures, but report must be modified (See Figure 25-9 on p. 755) Each page should state “See Accountant’s Compilation Report.”

B. Contents of Compilation Report Compilation has been performed in accordance with the SSARS issued by the AICPA. Compilation is limited to presenting in the form of financial statements information that is the representation of management. Financial statements have not been audited or reviewed and, accordingly, the accountant does not express an opinion or any other form of assurance on them. See requirements on page 754.

C. The Effect of a Departure from GAAP on a Compilation Report Report should be modified to disclose the departure. Dollar effect of departure should be disclosed if it has been determined. Accountant is not required to determine dollar effect of departure.

D. The Effect of a Lack of Independence on a Compilation Report I am not independent with respect to XYZ Company. The accountant can issue a compilation report when he or she is not independent as long as the lack of independence is disclosed in the compilation report.

III. Review Engagements Review Engagements B. Contents of Review Report C. The Effect of a Departure from GAAP on a Review Report D. Circumstances that Preclude a Review Report A.

A. Review Engagements CPA expresses limited assurance that the financial statements are in accordance with GAAP or another comprehensive basis of accounting. CPA must be independent to perform a review. Suggested procedures include: Obtain knowledge of the accounting principles and practices of the client’s industry. Obtain knowledge of the client Make inquiries of management Perform analytical procedures Obtain letter of representation Each page should state “See Accountant’s Review Report.”

B. Contents of Review Report Review was performed in accordance with SSARS. All information in the financial statements is the representation of management. Review consists principally of inquiries of company personnel and analytical procedures applied to financial data. Review is substantially less in scope than an audit and, accordingly, no opinion is expressed. Accountant is not aware of any material modifications that should be made to the financial statements for them to conform with GAAP, other than those mentioned in the report.

C. The Effect of a Departure from GAAP on a Review Report Report should be modified to disclose the departure. Dollar effect of departure should be disclosed if it has been determined by client management.

D. Circumstances that Preclude a Review Report I believe that I can still issue a compilation report. If the accountant is unable to perform the inquiry and analytical procedures necessary or if those procedures are restricted. If the accountant is not independent.

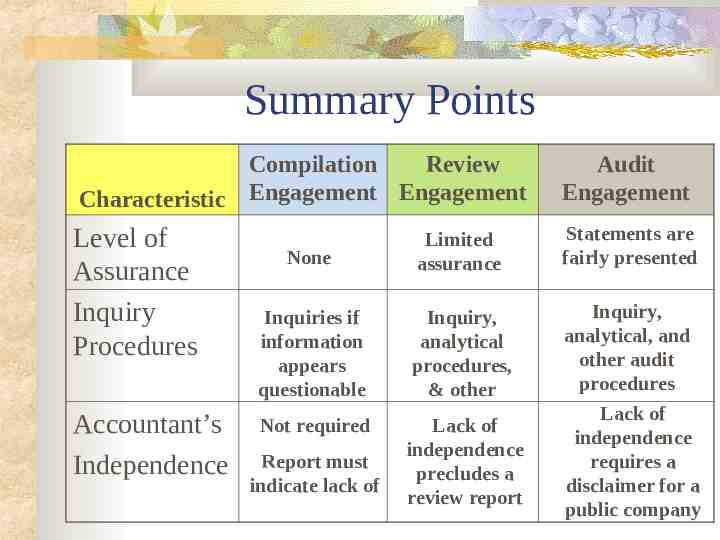

Summary Points Compilation Review Characteristic Engagement Engagement Audit Engagement Level of Assurance Inquiry Procedures None Limited assurance Statements are fairly presented Inquiries if information appears questionable Inquiry, analytical procedures, & other Not required Lack of independence precludes a review report Inquiry, analytical, and other audit procedures Lack of independence requires a disclaimer for a public company Accountant’s Independence Report must indicate lack of