Basic Considerations and Underwriting Tools RMA-ECU Commercial

41 Slides246.13 KB

Basic Considerations and Underwriting Tools RMA-ECU Commercial Lending School Sr.VP. Mr. Lacy Cross Movement Bank A Return to Fundamentals First Year

Today’s Plan › Introductions › How Investor Real Estate differs from traditional business lending › Your Bank’s Appetite for Real Estate › The Anatomy of a Lease › Direct Cap vs. Discounted Cash Flow › The trouble with cap rates

What is Investor Real Estate? › The primary source of repayment is the Net Operating Income (NOI) from the subject property. – Thus the cash flow from the property is very important. › The secondary source of repayment is the sale of the property in a foreclosure situation. – Thus the appraised value of the property is very important. › The tertiary source of repayment would be recourse to any personal or corporate guarantors to your loan. – Thus the management experience and strength of sponsorship is very important.

Valuing Property: The Appraisal › Lenders require that a third party (engaged by a bank, not the customer) appraise the value of the property. – If the customer engages the appraiser, Federal Regulations (FIRREA) prohibit the bank from using an appraisal that is ordered by the customer; it must be an unbiased valuation › Three forms of value – Market (or Sales) Approach – Cost Approach – Income Approach (Primary Method for this session)

Sales Approach › Appraiser will find comparable (similar) properties in the general area that have recently sold to determine the sales price per square foot. – Comparable properties will be adjusted based on differences when compared to the subject based on the following factors: › › › › › › › › Size of the property Amenities Age of the property Location Quality of construction & Condition of the property Number of Bedrooms and Bathrooms (for apartments) Number of Climate Controlled units (for self-storage units) Any over-improvements- pool, deck, etc. › Appraiser will estimate a property value based on this approach

Cost Approach › Appraiser will determine costs to construct property (whether the property is existing or to be constructed) › Will add in the cost of the land, and will subtract from the final value due to any deficiencies › Appraiser will verify the cost of construction materials, labor, & profit to determine the estimated cost per square foot › Appraisers will also estimate the effective age of the property (which may differ from its actual age if there have been recent improvements or the property has been neglected). – Functional obsolescence- things that make the property less marketable than when it was originally constructed

Cost Approach Continued › Things that can impact the Effective Age of an existing property: – Last time major renovations were made › Roof, heating & air conditioning, elevator – Quality of construction › Structural soundness of the property – Deferred Maintenance › Neglect by owner can reduce effective age of property › The effective age impacts how long a lender is willing to amortize a loan for a given property

Income Approach › This is the primary approach that we will be covering in this class › Appraiser will obtain rent comparable to determine the market rental rates, and will obtain market vacancy rates as well – Appraiser will perform either a fee simple valuation (based solely on market rates) or a leased fee valuation (based on the existing leases in place)

Final Valuation › Once estimates of final value for the subject property have been obtained using the market, cost, and income approach, the appraiser will reconcile the three values to determine the final value › Valuation Theory states that the values for the three alternatives should be very similar – This is not the case lately when comparing the sales approach and the income approach – Will subtract out costs of any environmental remediation for subject property

When Values are Imbalanced › Recently, the values provided by the sales approach are higher than those provided by the income approach – Investors were willing to pay higher than normal prices for investment property due to such factors as: › Having 1031 Exchange Dollars to Invest › Planning to sell the property at a higher value later to realize expected return

The Real Estate Cycle › Real estate market is very large and very fragmented › Market is prone to periods of overbuilding/underbuilding. › As vacancy falls, rents rise, which leads to new construction › The problem is not knowing when to stop building.

Stages of the Real Estate Cycle › Recovery – Higher vacancies, lower rental rates & sales prices › Expansion – Low vacancies, higher sales prices, higher than normal new construction › Balance – Normalized levels of vacancy, rents, sales prices › Decline – Deteriorating conditions falling property values, vacancies begin to rise .leads to recovery stage eventually › What stage is your local market in currently?

Classification of Real Estate Uses › Single Family – Either as primary residence or investment property – Banks have a hard time financing investment single family residences due to the lack of comparabls in the market › Multi-Family – Apartments, Duplexes, etc. › Office › Special Use: Air BB’s, Hotels, Churches, › Retail › Industrial/Warehouse/Self Storage › Recreation – Marinas, country clubs, sports complexes › Institutional – Specialty use, Hospitals, Universities, etc. › Mixed Use – Could combine apartments with retail, retail with office, etc. – Not all combinations are good ones › How would you feel about living in an apartment unit located above a drug rehabilitation clinic?

Your Bank’s Appetite for Real Estate › Commercial Banks typically lend on four primary types of investment real estate: – – – – Apartment Buildings Office Buildings Retail Buildings Industrial/Warehouse/Self Storage Facilities › Some banks also lend on properties such as hotels and assisted living facilities, but these are seen as having higher risk than the categories listed above.

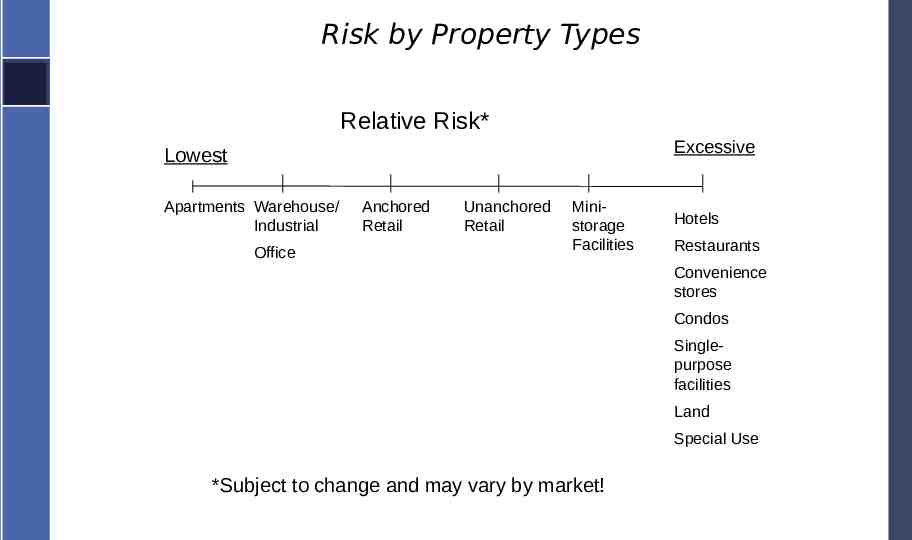

Risk by Property Types Relative Risk* Excessive Lowest Apartments Warehouse/ Industrial Office Anchored Retail Unanchored Retail Ministorage Facilities Hotels Restaurants Convenience stores Condos Singlepurpose facilities Land Special Use *Subject to change and may vary by market!

Why are Some Property Types Better Than Others? › Availability of Comparable in the Market – Can better ascertain vacancy and market rental and expense rates › Availability of Investor/Secondary Financing in the Market – Serve as Source of financing for buyers › Higher Probability of Finding Replacement Tenants – The more special the purpose of a property, the more likely it is to remain vacant if the tenant vacates the property – Think about restaurants in your neighborhood and compare with five years ago. How many have been there over that entire period of time? › Not all Net Operating Income is the Same

Cash Flow Fundamentals › Quantity › How much lease income per month (historical/projected)? › Comparison to market rental rates per square foot for similar properties. › Quality › Diversification (number of tenants) › Tenant financial strength (internal information or Business Credit Report when applicable) › Durability › Length of leases relative to term of loan. › Mgmt Experience with property (or similar properties)

Some Definitions Net Operating Income (NOI): Income from property after operating expenses and vacancy factors have been deducted, but before deducting income taxes and financing expenses (interest and principal payments). This represents the primary source of repayment for definition real estate loans. Debt Service Coverage Ratio (DSCR): The relationship between net operating income (NOI) and the annual debt service (ADS). The Formula is DSCR NOI ADS This is a typical covenant contained in most definition real estate loans (i.e. minimum DSCR of 1.25x)

Supportable Loan Amount Supportable Loan Amount (SLA): The net operating income of the property (NOI) divided by the loan constant (debt service divided by the loan amount) and divided by the desired debt service coverage ratio. This is in effect how much of a loan amount that the NOI of the property will support, given a desired coverage ratio, and a specific loan constant.

Regional Economic Influences on Property Values › Similar to NOI, not all markets are the same. – Would you rather purchase an apartment building in Raleigh, NC or in a much smaller town? › The profitability of an investment property is highly dependent on the region where property is located – Also important is where a property is located within the city or sub-market

Comparative Advantage › Some geographic areas outperform others due to: – Natural advantages › Seaports, beaches, natural resources › Which types of properties would MOST benefit from these variables? – Quality of Workforce › Education, skill sets, etc. › Which types of properties would LEAST benefit from these variables? – Proximity to Major Consumer Markets › What are some local examples of this concept? – Proximity to Major Employment Hubs › How has Eastern NC improved in recent years in this area?

The Anatomy of a Lease › Lease represents the “duration” of the income stream for an investment property › Lease is an agreement between the lessor (owner) and lessee (tenant) › Lease Terms can vary depending on property type: – – – – – – – Apartment: monthly to annually Office/retail: monthly up to five years Hotel/motel: daily Warehouse/industrial: much longer terms (20 years) Percent of Sales: ( Restaurants ) Build to Suite Escalation Clauses

Contents of Leases › Date › Parties to lease › Length of Lease › Approved use & legal description of property › Responsibility for maintenance and repair – Determined by negotiating power of landlord and tenants › Any Limitations on expenses › Common area maintenance (CAM) › Base rent plus any escalations › Renewal options

Financial Contents of Leases › Rent – Could be set over entire term of lease – Could rise with a certain index (CPI for example) › Index should not be something controlled by the landlord – Percentage/Overage Rent › For retail properties. Have a base rent and then additional rent once tenant’s sales surpass a certain benchmark › For example: Tenant pays 20 per square foot annually, but could also pay 1% annually for sales over 400,000 at the Panera Bread › If rent is fixed over entire term of lease, who bears the risk if rental rates rise over the period?

Financial Contents of Leases Cont › Type of lease: Gross, Modified Gross, or Net – Gross/Full Service: owner pays all expenses – Modified Gross: tenant pays for some expenses (possibly utilities for an office building) – Absolute Net: tenant pays all expenses – Triple Net: tenant pays for taxes, insurance, and maintenance of property – Expense Stops: owner pays for expenses up to a certain (stop) point. Above this level, the tenant pays › Expenses are passed through to the tenant › Called Common Area Maintenance (CAM)

Other Lease Contents › Concessions – Lease will disclose amount of free rent, if tenant improvements will be paid by the owner, and other discounts › When would these be more likely: Low or High Vacancy markets? › Non-compete clause – Lease will specify if cannot lease adjacent space to a competitor › Non-dilution/radius clause – Or if tenant cannot lease another location within a certain radius – Common for retail leases. › Domino (or “Go Dark”) Clause – If anchor tenant vacates, in-line (or supporting) tenants may have the ability to break their leases for a specified fee

Discounted Cash Flow (DCF) › Investor will pay a sum equal to the present value of all future cash flow streams (NOI) produced by the subject property. › The Forecast of NOI should be for the foreseeable future only. – One assumption is that an adequate holding period is 5-10 years. – The long run growth rate of NOI should be consistent with supply and demand conditions for comparable space in the area.

DCF Model: Discount Rate › Discount rate is the same as the internal rate of return (IRR) › What would be an acceptable process of selecting a discount rate? – Capital Asset Pricing Model (Weighted Average Cost of Capital) – Estimate the return that you would expect to get in the marketplace for similar levels of risk

Other DCF Assumptions › Once you determine the discount rate, other variables will need to be considered: › Holding period for the investment – This deals with what an investor’s investment horizon is for a particular investment. – Is the strategy a buy and hold (value oriented approach) – Or is the strategy a speculative play (buy with a quick sale once improvements to property are made)? – Many investors assume an average holding period of 7-10 years.

Other DCF Model Assumptions › Probability of lease renewal for each tenant – The term of the leases may be less than either the term of the loan or the holding period assumption › Reversion Value – This is essentially the present value of the NOI beyond the holding period assumed in the DCF model (from sale). – Should assume normal growth during this time – Should track along with US Economy (from 34% annually in normal times)

Other DCF Assumptions › Terminal Cap Rate – DCF model requires an estimate for the cap rate obtained when the property is sold. – Given the recent historical lows for cap rates, what are our feelings on where they will be ten years down the road?

The Bell Curve and Terminal Cap Rates › The theory goes that a new property will have super normal growth early, then will return to more normalized growth over the remaining holding period. – Property returns will revert to the mean over time. › Ceteris paribus, if the tenant mix and market conditions remain the same, it is likely that the value of the property will rise over the holding period – This of course assumes that the investor did not over pay from the very beginning!

Sensitivity Analysis › Both the direct cap and DCF models involve estimating best case, worst case, and most likely case scenarios based on the following variables: – Vacancy Rates at Increased Levels – Interest Rates at Increased Levels › Sensitivity analysis should involve determining how high vacancy and/or interest rates could climb, ceteris paribus, and the investor would have trouble meeting annual debt service obligations › Also known as Break Even Analysis

Basics of Pro-Forma Income Statement › Potential Gross Income (PGI) – Minus vacancy and collection losses › Effective Gross Income – Minus operating expenses – Consider whether expenses are recurring or not › Net Operating Income – Then take into account tax effects

Other Assumptions › Vacancy Factor to correspond with guidelines, market, or actual rates › 3-6% Management Fee › Do not include officer salaries, non-cash expenses, or other nonreal estate related expenses › Either Flat % of EGI for Structural Reserves or based on cost per square foot.

Abuses in Pro Forma Cash Flow Projections › Mismatched growth rates between rental income and expenses › Failure to consider rental concessions and effective rents › Absence of lease-by-lease analysis in properties encumbered by long-term leases › Figures that project expense recovery will increase at same growth rate as other expenses, but there are expense stops in place › Projections for vacancy & collection losses that are not in line with market averages › Use of operating expense categories that do not include all cost items (do not include tenant improvements and leasing commissions) › Underestimation of sales and other reversion costs

The Trouble with Cap Rates › Used to estimate the market value of property prior to receipt of appraisal. › Implied cap rate is NOI divided by property value › Can also be built in a method similar to deriving a discount rate for stocks (i.e. Capital Asset Pricing Model) › Appraisals should include construction of a cap rate rather than on simply relying on comparables of other property sales in the market › Cap Rate can be calculated using transaction specific debt and equity components as follows .

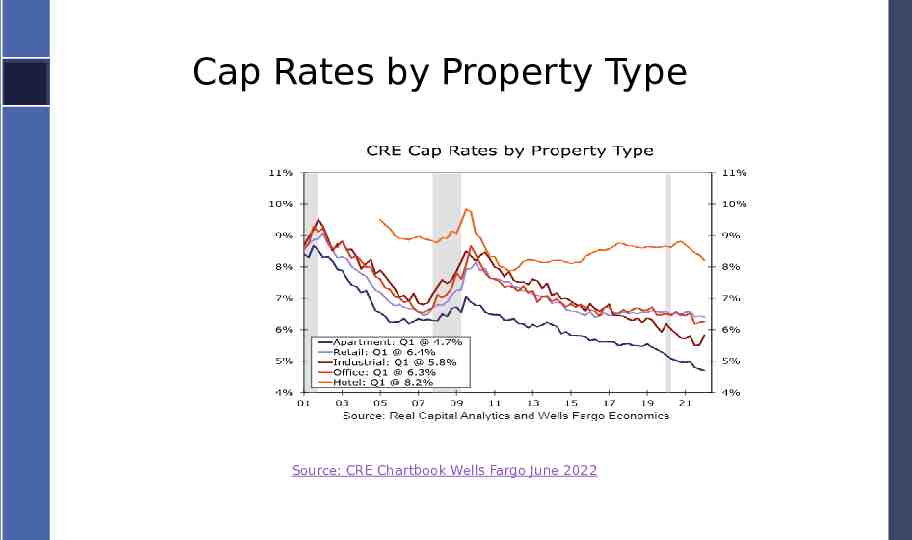

Movements in Cap Rates › Keep in mind that as cap rates fall, property values rise – And as cap rates rise, property values fall › Cap rates rise in periods of over-supply – Excess supply drives cap rates up as investors will want a higher return relative to the higher risk – This will move property values downward › Cap rates have been near 40 year lows in many markets in recent years!! – Cap rates have been falling over last 18 months – We will see how things play out over next year or so.

Current Cap Rate Situation › Throughout the East Coast, cap rates had been near historical lows in many markets › This was due to excess demand and low interest rates › This caused speculation in many markets as investors purchased properties not for the return due to the income on the underlying property, but due to the expected return for a future resale. › Tax Laws like the 1031 Exchange have helped to sustain this speculation in many markets.

Cap Rates by Property Type Source: CRE Chartbook Wells Fargo June 2022

Any Questions? Mr.Lacy Cross: Sr. VP Commercial Banking Officer, Movement Bank 828-230-3201 [email protected]