Session 17 PLUS Processing A to Z Wendy Jerreld and Wood Mason| Nov.

62 Slides6.58 MB

Session 17 PLUS Processing A to Z Wendy Jerreld and Wood Mason Nov. 2012 U.S. Department of Education 2012 Fall Conference

Direct PLUS Loans from A to Z A bit of history Federal Direct PLUS Loan basics Federal Direct PLUS Loan eligibility Master Promissory Note Credit Check Entrance Counseling Processing 2 School and Borrower Disbursing Repayment

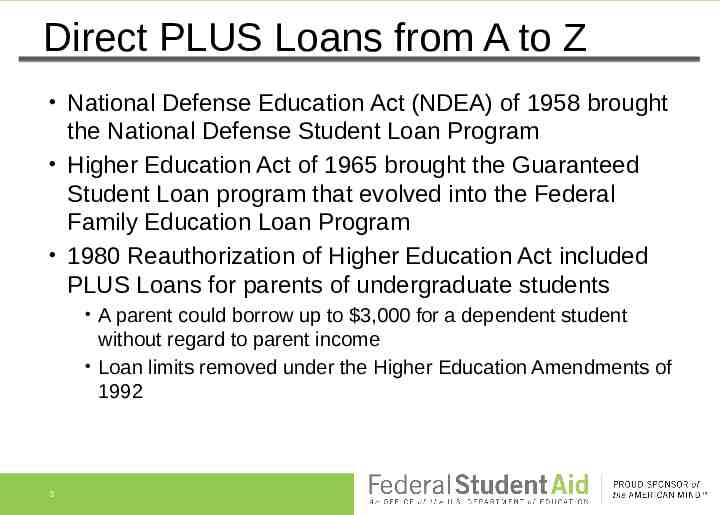

Direct PLUS Loans from A to Z National Defense Education Act (NDEA) of 1958 brought the National Defense Student Loan Program Higher Education Act of 1965 brought the Guaranteed Student Loan program that evolved into the Federal Family Education Loan Program 1980 Reauthorization of Higher Education Act included PLUS Loans for parents of undergraduate students 3 A parent could borrow up to 3,000 for a dependent student without regard to parent income Loan limits removed under the Higher Education Amendments of 1992

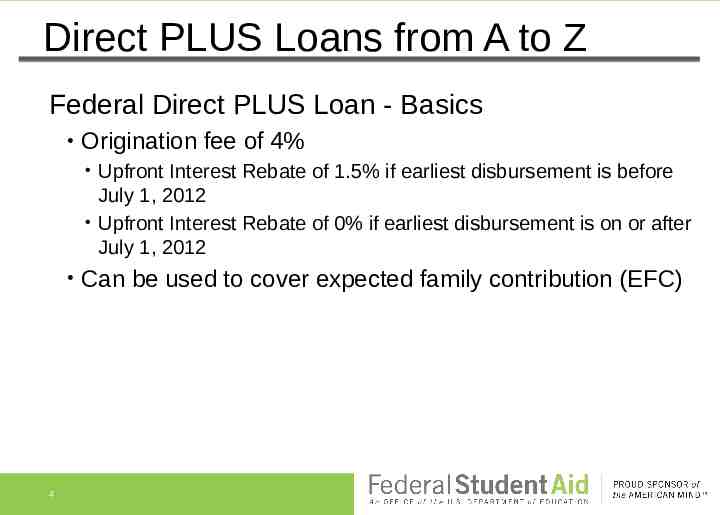

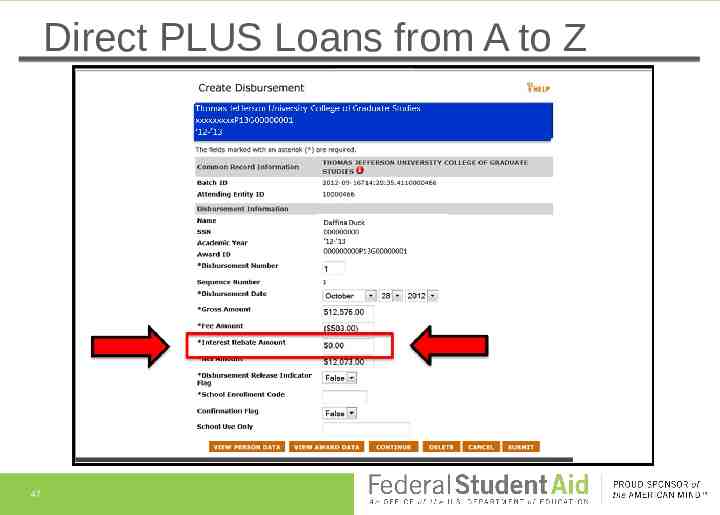

Direct PLUS Loans from A to Z Federal Direct PLUS Loan - Basics Origination fee of 4% 4 Upfront Interest Rebate of 1.5% if earliest disbursement is before July 1, 2012 Upfront Interest Rebate of 0% if earliest disbursement is on or after July 1, 2012 Can be used to cover expected family contribution (EFC)

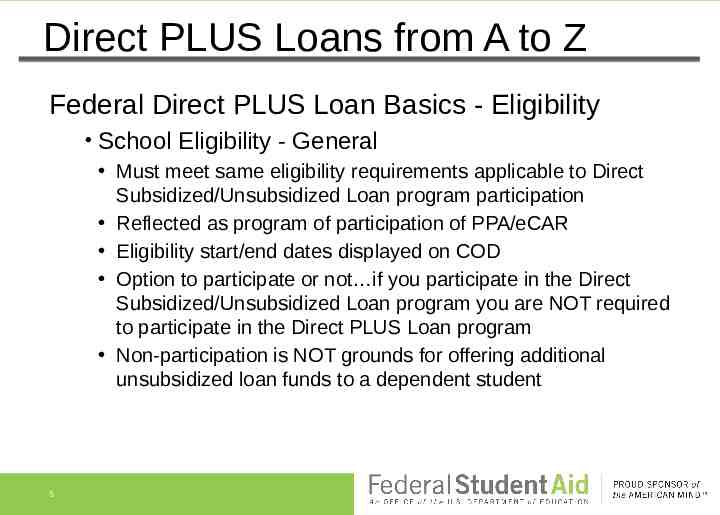

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Eligibility School Eligibility - General Must meet same eligibility requirements applicable to Direct Subsidized/Unsubsidized Loan program participation Reflected as program of participation of PPA/eCAR Eligibility start/end dates displayed on COD Option to participate or not if you participate in the Direct Subsidized/Unsubsidized Loan program you are NOT required to participate in the Direct PLUS Loan program Non-participation is NOT grounds for offering additional unsubsidized loan funds to a dependent student 5

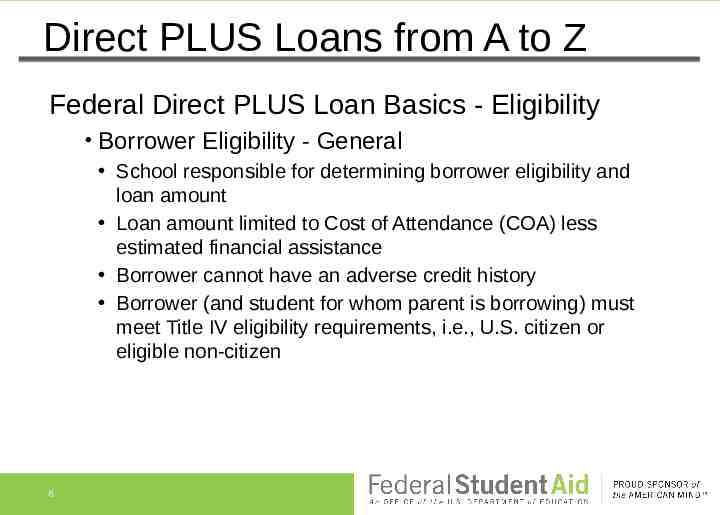

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Eligibility Borrower Eligibility - General School responsible for determining borrower eligibility and loan amount Loan amount limited to Cost of Attendance (COA) less estimated financial assistance Borrower cannot have an adverse credit history Borrower (and student for whom parent is borrowing) must meet Title IV eligibility requirements, i.e., U.S. citizen or eligible non-citizen 6

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Eligibility Parent must be the student’s biological or adoptive Mother or Father 7 Can be a stepparent if his/her income and assets are used to calculate the EFC A legal guardian is not an eligible borrower Not eligible if delinquent on a debt to the Federal Government, or is incarcerated Must not have an adverse credit history Must meet same basic eligibility criteria as an eligible dependent student, i.e., citizenship status

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Eligibility A parent can borrow for multiple dependent students Unique parent/dependent student “pair” for each PLUS loan 8 Unique PLUS Request via StudentLoans.gov website Unique Master Promissory Note (MPN) for each parent/student “pair” StudentLoans.gov will retain parent/student “pair” data for subsequent PLUS loans

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Eligibility Graduate or professional student 9 Eligible award year 2005-2006 and forward School MUST determine eligibility for, and offer, Direct Unsubsidized Loan first Must meet Title IV eligibility requirements Must be enrolled at least half-time in an eligible program at an eligible school

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics – Master Promissory Note (MPN) Unique PLUS loan Master Promissory Note & Application (MPN) 10 NOT a subsidized/unsubsidized loan MPN Contains borrower and/or student data PLUS MPN used for both parent and graduate/professional student PLUS loan Expires 10 years from date of receipt at COD provided a disbursement has taken place on the linked loan within the first 12 months

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics – Master Promissory Note Has “N” as MPN “type” in MPN Identification Links on the SSN, DOB, and first two characters of the first name of both borrower and student 11 Student SSN, “N,” award year, school direct loan school code, sequence number XXXXXXXXXN13GXXXXX001 Must use unique MPN for each parent/student “pair” if multiple dependent students

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics – Master Promissory Note Single-Loan MPN 12 When an endorser is linked to the PLUS Loan MPN Linked MPN reflects a status of “Inactive-Endorser” Expiration is one year from the date of receipt at COD provided a disbursement has taken place on the endorsed loan within 12 months from the date of receipt at COD Any future loan will need a new MPN

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Credit Borrower must undergo a credit check Must have borrower authorization to conduct a credit check Regardless of the credit result, you should originate the PLUS loan if borrower otherwise eligible 13 Authorization included on Federal Direct PLUS Loan MPN Authorization downloaded from COD website in online Credit Check Request process Hand written/faxed signed authorization Only exception is when the borrower with adverse credit doesn’t plan to pursue the PLUS loan

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Credit Initiated by 14 COD upon receipt of loan origination record (LOR) StudentLoans.gov via a Direct PLUS Loan request The school online at COD website SSN is the key identifier for a credit check and change will trigger a new credit history “Hard hit” on the borrower’s credit history Reported to credit bureaus as any other account

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Credit A credit check result will be used for 90 days if additional activity occurs that would otherwise trigger a credit check during that period Credit result can be 15 An LOR with an “A” result will undergo no additional credit check unless identifiers are changed Accepted (A) Declined (D) – indicates adverse credit history Pending (P) – indicates an issue with the borrower ID/credit bureau and COD will contact the school to remedy

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Credit Denial of one parent is sufficient to offer additional unsubsidized loan funds to dependent student Other parent does NOT have to undergo PLUS loan process A credit result of Declined is not school specific and can be used across schools School can determine to forego the Direct PLUS Loan process with knowledge, and documentation, of inability of Parent to borrow due to adverse credit or other exceptional circumstances 34 CFR 685.203 DCL ID: GEN-11-07 16

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Credit A Direct PLUS Loan with a credit decision of Pending (P) or Declined (D) can be modified 17 Pending (P) status indicates an issue between the borrower identifiers submitted and those held by the credit bureau Resolved with COD Customer Service Representative contact with the school Cannot change SSN on a PLUS loan not inactivated (reduced to 0) or fully disbursed for more than 24 hours

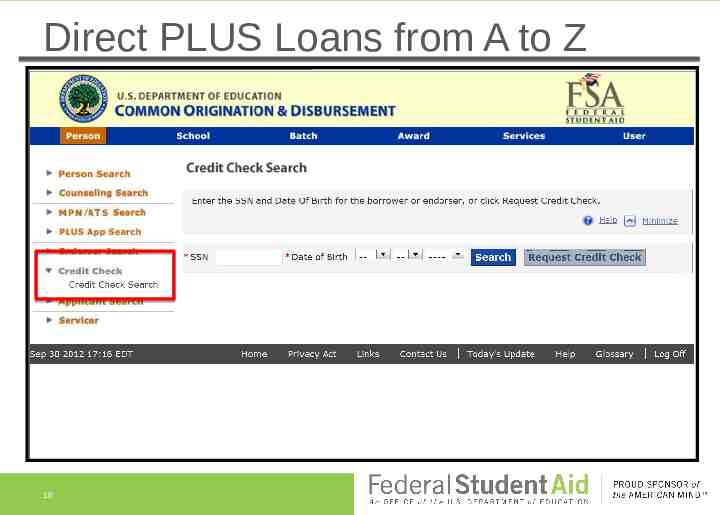

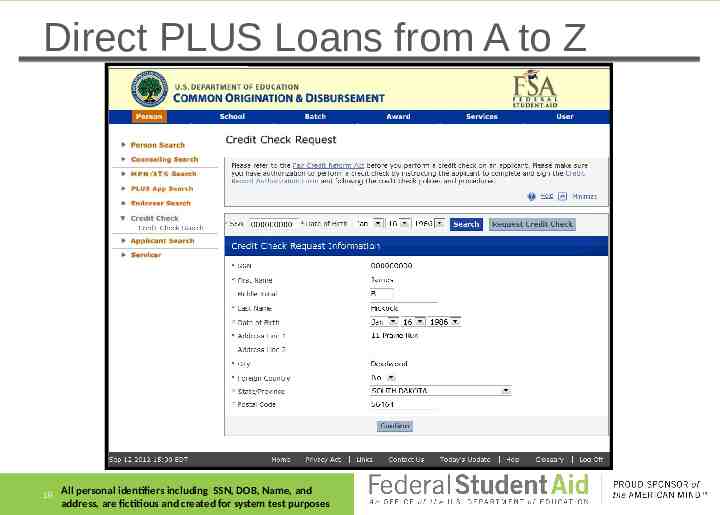

Direct PLUS Loans from A to Z 18

Direct PLUS Loans from A to Z 19 All personal identifiers including SSN, DOB, Name, and address, are fictitious and created for system test purposes

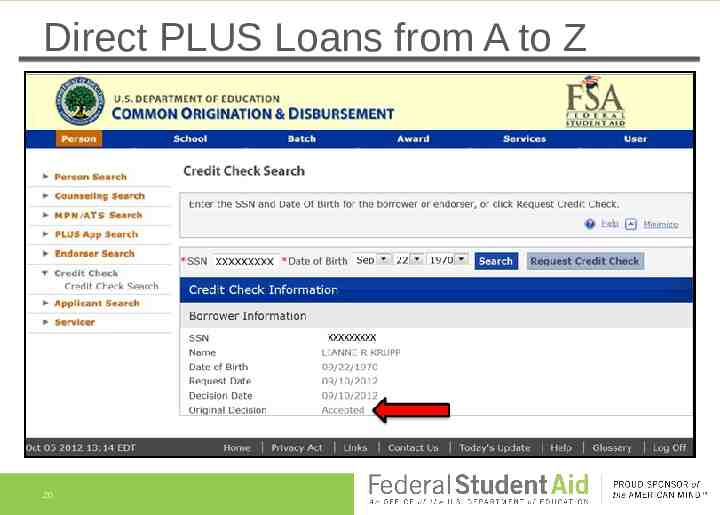

Direct PLUS Loans from A to Z XXXXXXXXX 20

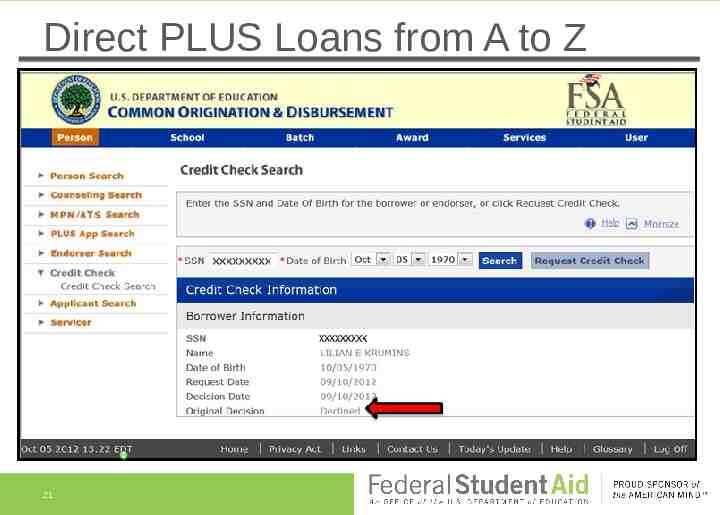

Direct PLUS Loans from A to Z XXXXXXXXX 21

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Credit PLUS loan with credit declination 22 Can be accepted and displayed on COD but with an unacceptable credit decision Can’t disburse unless and until credit denial is cured by a successful appeal via COD or by borrower securing an endorser Initial declined credit status remains on the COD website and is NOT changed after a successful appeal or securing an endorser

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics – Credit Appeal Appeals 23 Appeal on extenuating circumstances or errant data from the Credit Bureau Appeal by submitting via fax the specific documents requested by COD Can start appeal process on StudentLoans.gov – COD CSR will contact borrower A successful appeal will result in a credit override response (Document Type CO) sent to the school

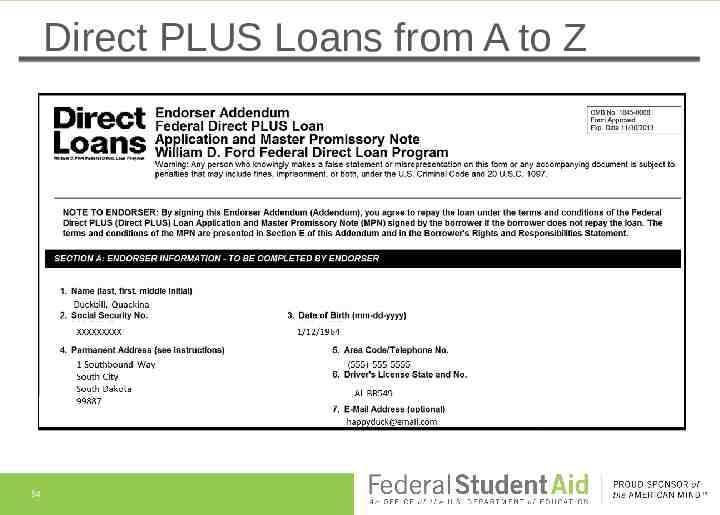

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Endorser Declined Federal Direct PLUS Loan can be remedied with an acceptable endorser Endorser undergoes a credit check 24 Cannot be the student for whom the loan is intended Endorser promises to pay outstanding principal balance, accrued interest, any penalties, AND any collection Endorser completes an Endorser Addendum, NOT another MPN Paper or electronic via StudentLoans.gov A “hard hit” credit inquiry same as borrower Endorsement reported to credit bureau

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Endorser Endorser completes an electronic Endorser Addendum via StudentLoans.gov 25 Must have FSA PIN to access StudentLoans.gov Uses PLUS loan ID (if PLUS Loan originated by school) or the Loan Reference Number (if borrower has completed a PLUS Request via StudentLoans.gov and no LOR on COD database) Accepted endorser sets endorsed loan amount COD will send “CO” response to school if there is a PLUS loan origination on the COD database or Subsequent “SP” response if no LOR on COD

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Endorser Endorser completes a paper Endorser Addendum 26 Endorser can print a paper addendum, and obtain the mailing address, via StudentLoans.gov If no PLUS loan LOR on the system, no response from COD until PLUS loan LOR is submitted PLUS loan LOR will link to endorser addendum and COD will generate a “CO” response and send to school

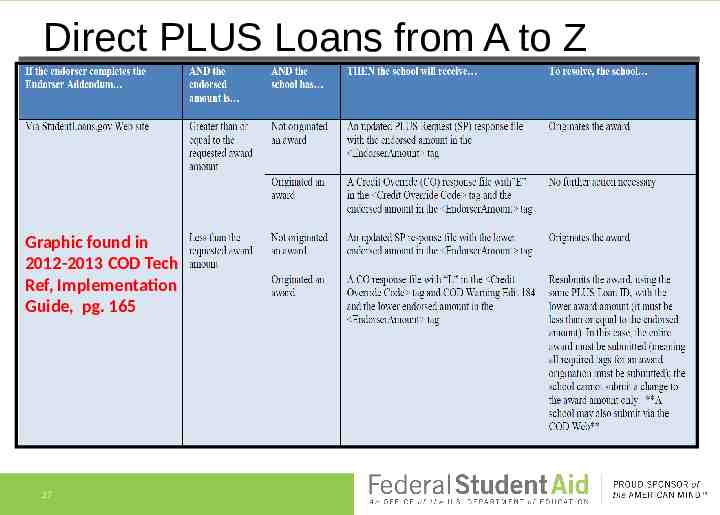

Direct PLUS Loans from A to Z Graphic found in 2012-2013 COD Tech Ref, Implementation Guide, pg. 165 27

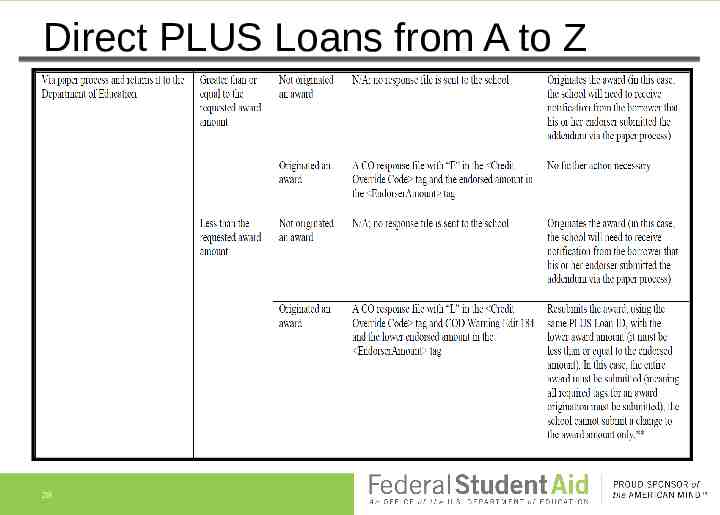

Direct PLUS Loans from A to Z 28

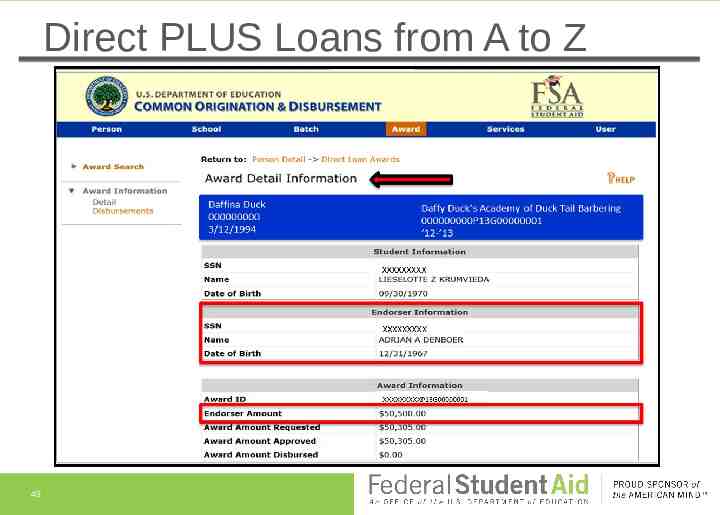

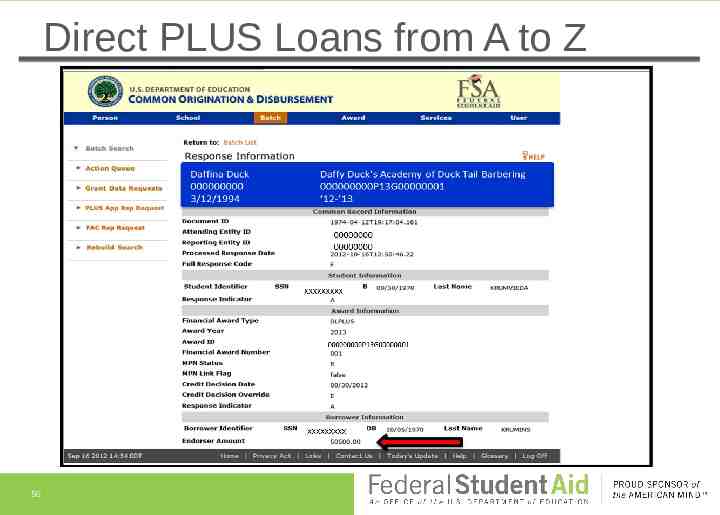

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Endorser Endorser data and endorsed amount displayed on the COD loan information screen Endorsed amount is displayed on response from StudentLoans.gov CANNOT increase a PLUS loan with an endorser 29 Cannot disburse more than the lesser of the endorsed amount or loan amount approved Must create and originate a subsequent PLUS loan A new credit history on borrower and endorser if last credit check older than 90 days

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics – Entrance Counseling Graduate & professional students requesting a PLUS Loan for the first time MUST complete graduate student PLUS loan entrance counseling Completion of undergraduate entrance counseling doesn’t count for PLUS Cannot disburse graduate/professional student PLUS loan if entrance counseling not completed Available via StudentLoans.gov Not required to participate in e-counseling Response to participating schools-results on COD website and Counseling Report 30

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics – Entrance Counseling Graduate/professional student PLUS loan entrance counseling offered at StudentLoans.gov 31 Results sent to COD Schools are NOT required to use FSA online counseling Not the same as undergraduate entrance counseling

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Processing Same origination and disbursement requirements as Federal Direct Subsidized & Unsubsidized Loans 32 Anticipated and/or actual disbursements required on origination Anticipated and/or actual disbursements must total loan amount on origination Up to 20 actual disbursements Report ACTUAL date of disbursements Interest accrues from date of disbursement

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Caveat School can deny origination, or originate a reduced award, on a case-by-case basis and MUST document the reason Cannot limit the borrower on an across-the-board basis 2012-2013 FSA Student Aid Handbook, Volume 3, pg. 86 34 CFR 685.203 33

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Processing PLUS loan processing can be done by batch via submission of Common Record (CR) Individually online at COD website 34 CR response returned reflecting status of award, credit, and MPN Disclosure Statement generated seven days prior to earliest disbursement date reflected on an LOR with accepted credit Virtually real-time processing including immediate editing of submitted data

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Processing Federal Direct PLUS Loan Request by borrower at StudentLoans.gov 35 4-step process with instant credit result Ability to begin appeal process if needed School is responsible for determining eligibility and certifying that the borrower is eligible for the loan and amount

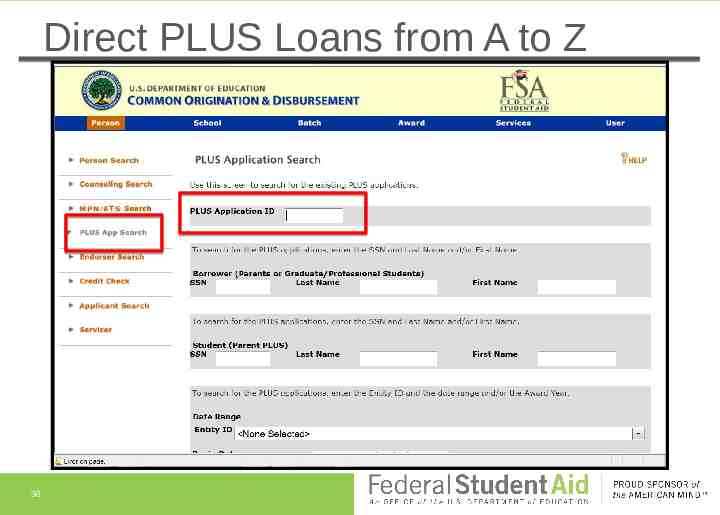

Direct PLUS Loans from A to Z 36

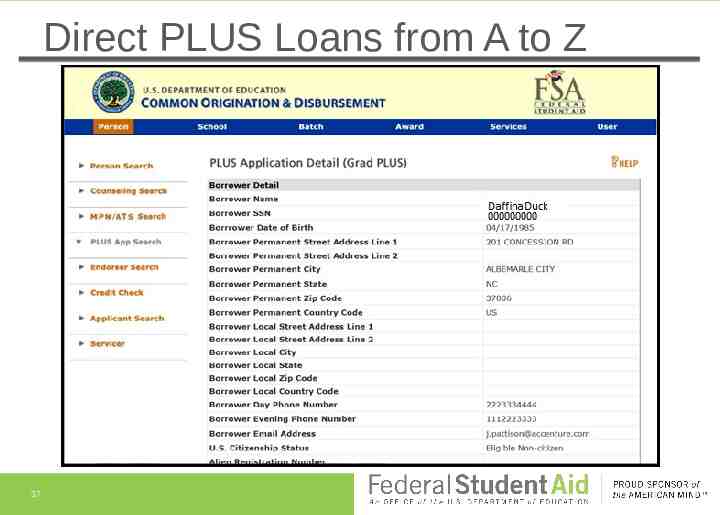

Direct PLUS Loans from A to Z Daffina Duck 000000000 37

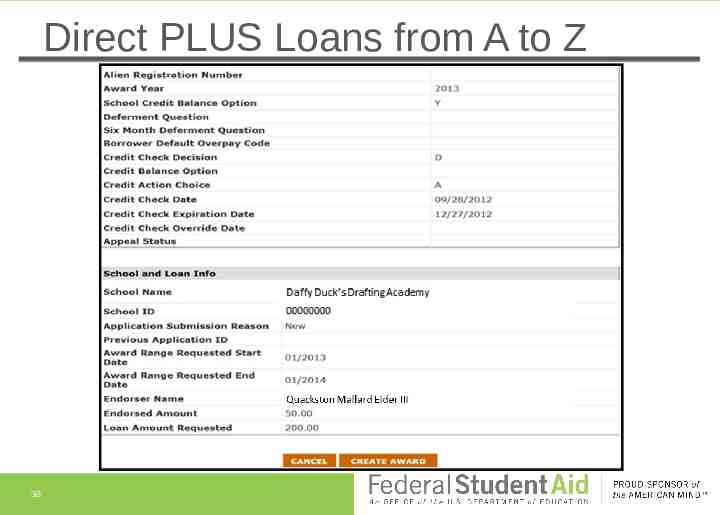

Direct PLUS Loans from A to Z Daffy Duck’s Drafting Academy 00000000 Quackston Quackston Mallard Mallard EiderEider III III 38

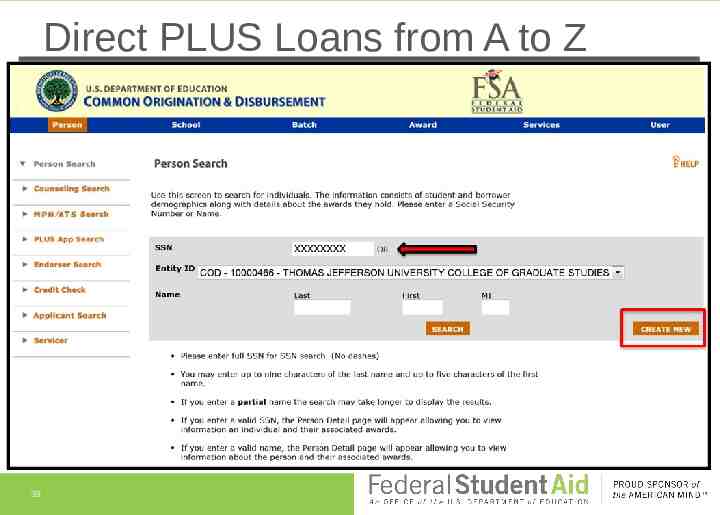

Direct PLUS Loans from A to Z 39

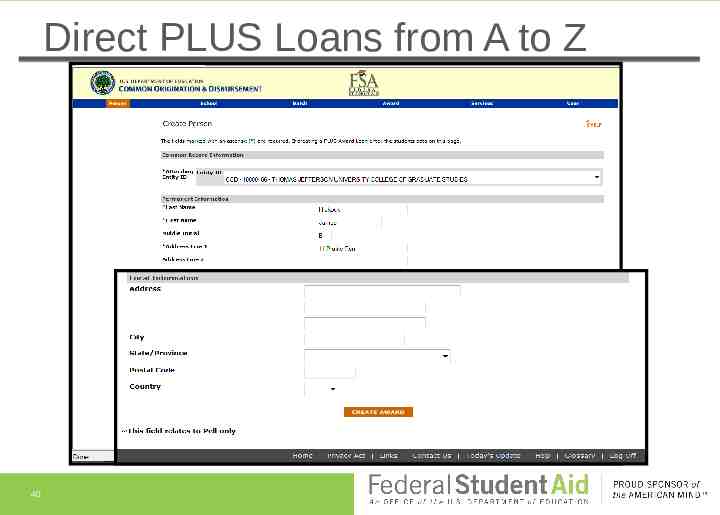

Direct PLUS Loans from A to Z 40

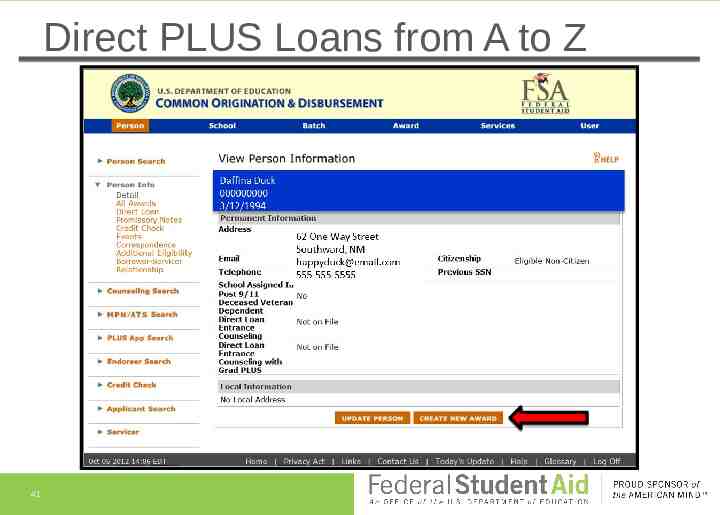

Direct PLUS Loans from A to Z Daffina Duck 000000000 3/12/1994 41

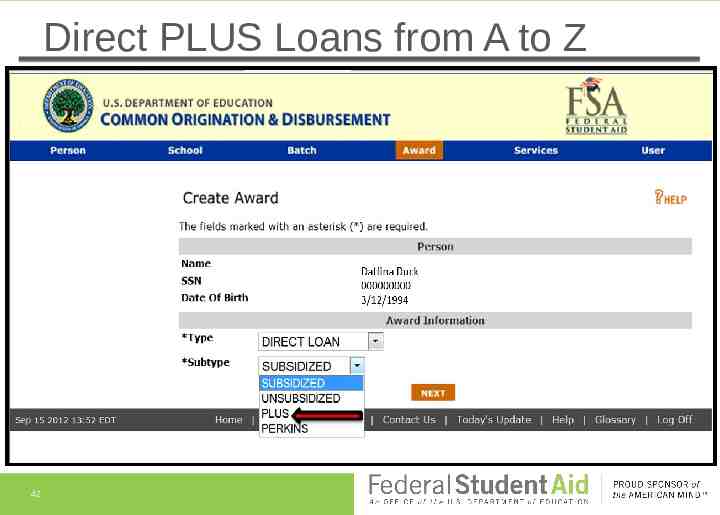

Direct PLUS Loans from A to Z 42

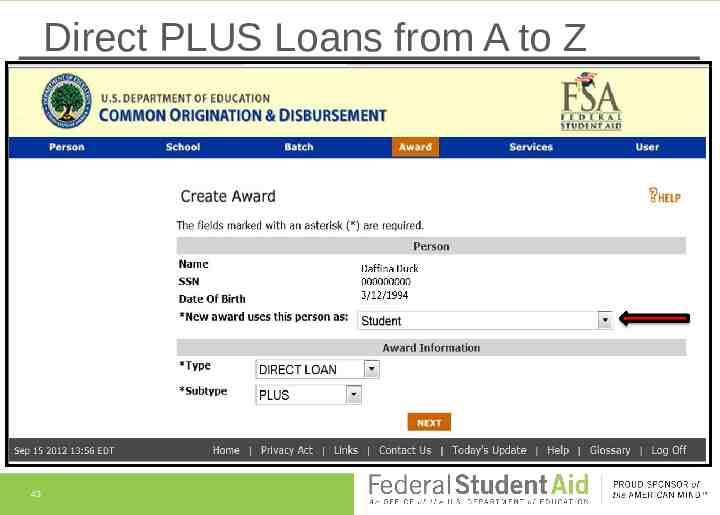

Direct PLUS Loans from A to Z Daffina Duck 000000000 3/12/1994 43

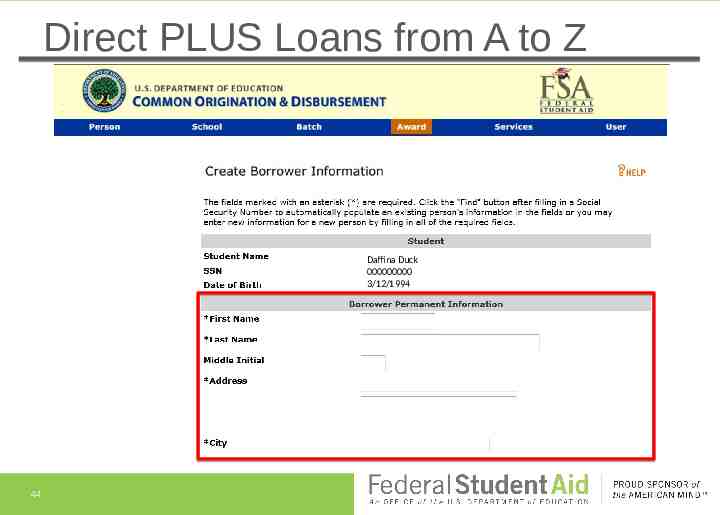

Direct PLUS Loans from A to Z Daffina Duck 000000000 3/12/1994 44

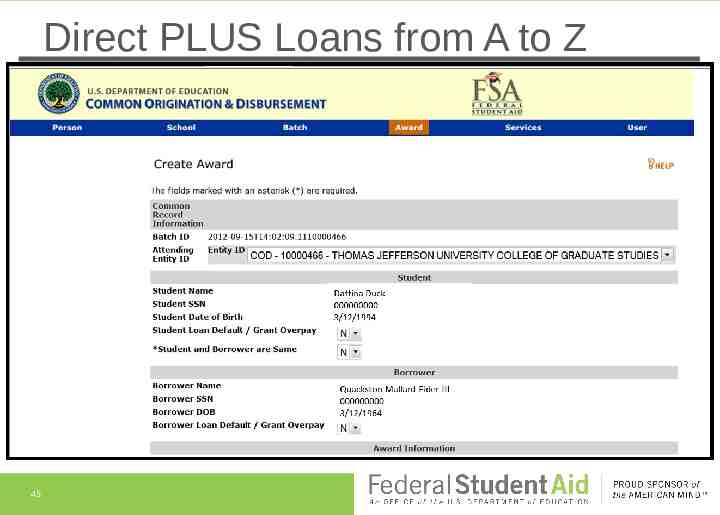

Direct PLUS Loans from A to Z 45

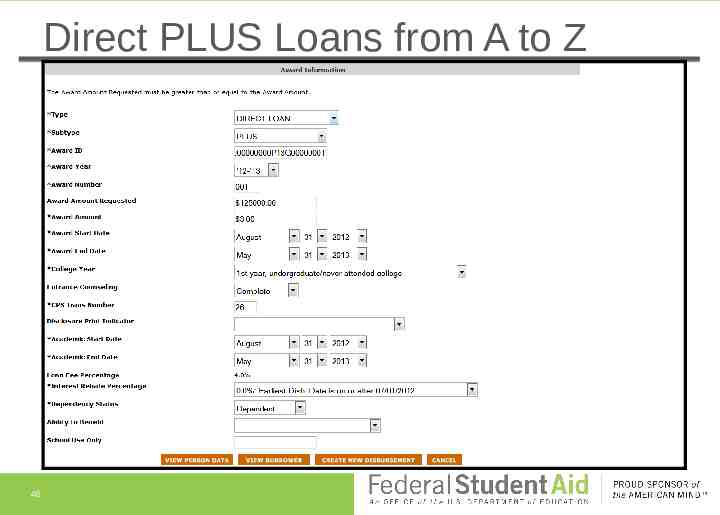

Direct PLUS Loans from A to Z 46

Direct PLUS Loans from A to Z 47

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - IMPORTANT For Federal Direct PLUS Loans with an earliest disbursement date on or after July 1, 2012, the loan has no eligibility for an upfront interest rebate! Schools that have Federal Direct PLUS Loans on the COD system with an incorrect rebate percentage MUST CORRECT THEM IMMEDIATELY 48 Interest rebate report posted weekly to your school newsbox that identifies each errant loan Call your COD CSR, or your Federal Loan School Support Team Point of Contact for help with the report or fixing errant loans

Direct PLUS Loans from A to Z 49

Direct PLUS Loans from A to Z 50

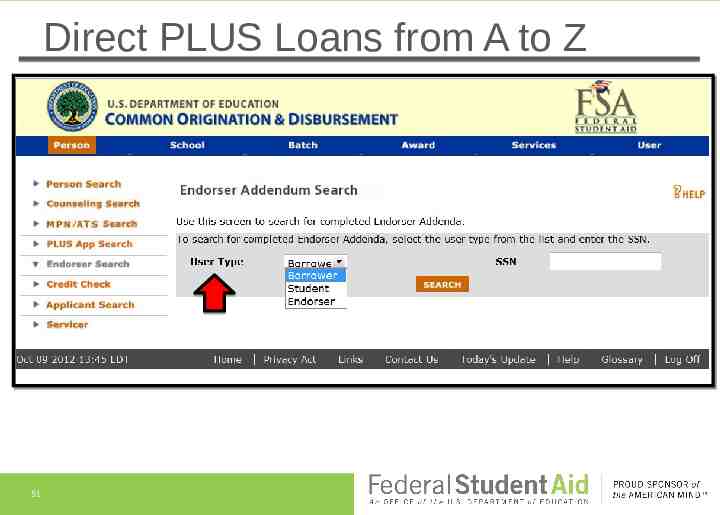

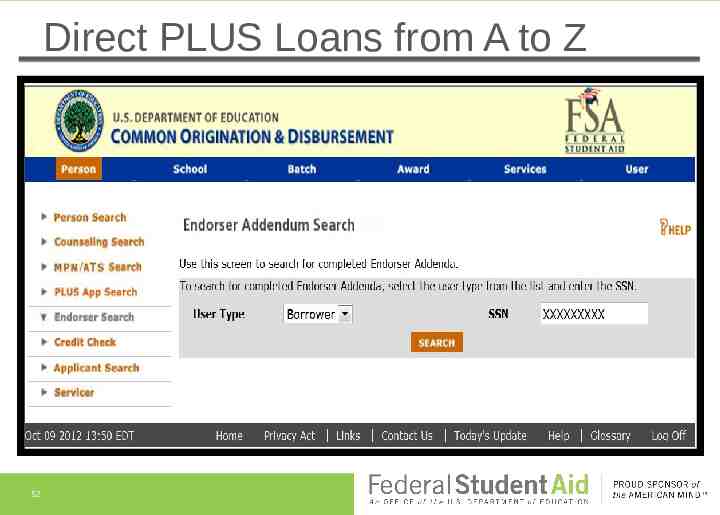

Direct PLUS Loans from A to Z 51

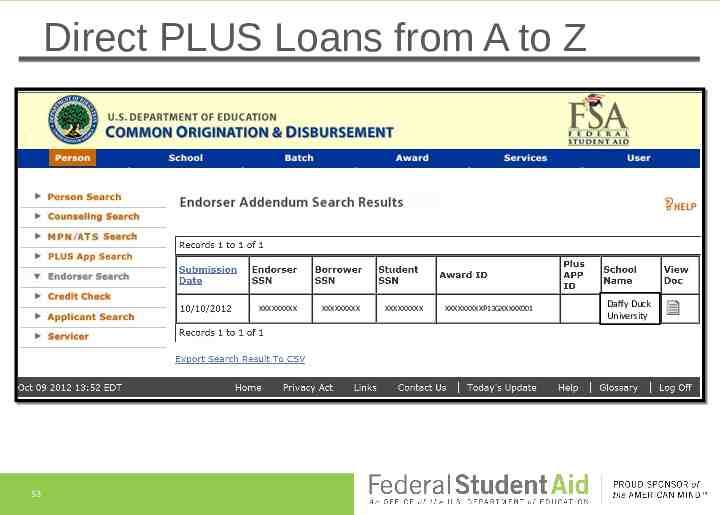

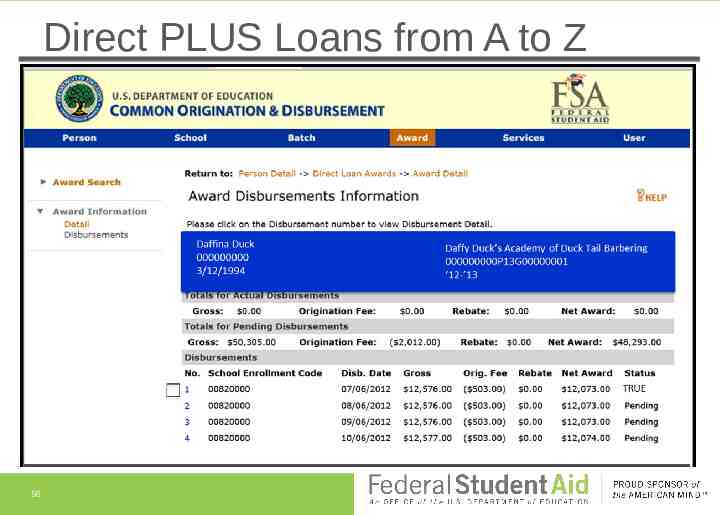

Direct PLUS Loans from A to Z Daffina Duck 000000000 3/12/1994 52 Daffy Duck’s Academy of Duck Tail Barbering 000000000P13G00000001 ‘12-’13

Direct PLUS Loans from A to Z Daffina Duck 000000000 3/12/1994 Daffy Duck’s Academy of Duck Tail Barbering 000000000P13G00000001 ‘12-’13 XXXXXXXXX 53 XXXXXXXXX XXXXXXXXX XXXXXXXXXP13GXXXXX001 Daffy Duck University

Direct PLUS Loans from A to Z 54

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Disbursement Assure eligibility of the dependent student Unless otherwise directed, any credit balance is given to the parent Adhere to the normal and required notifications 14-day cancellation request/credit balance The disbursement data MUST be accepted by COD within 30 days of the actual date of disbursement You must report the ACTUAL DISBURSEMENT DATE Business office date that funds were credited to the student account must match actual disbursement date reported to COD 55

Direct PLUS Loans from A to Z 56

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Disbursement You may increase a PLUS loan established on the COD database But you cannot increase an established PLUS loan if in receipt of a subsequent adverse credit decision 57 Change record if software allows New PLUS loan for the difference requested If the established PLUS loan is NOT fully disbursed you can fully disburse it Alternatively, reduce remaining disbursements to 0 and offer student unsubsidized funds up to their eligibility for grade level and COA using disbursed unsubsidized loan funds as estimated financial assistance

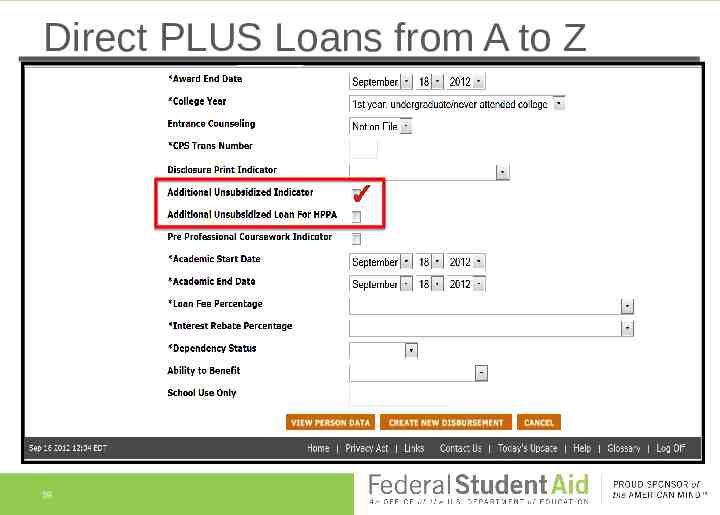

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Disbursement If the established PLUS loan has been fully disbursed 58 Offer the dependent student additional unsubsidized loan funds up to their eligibility appropriate to their grade level and COA reflecting the disbursed PLUS loan funds as estimated financial assistance If awarding additional unsubsidized loan funds you must make sure your incoming LOR reflects the award as such

Direct PLUS Loans from A to Z 59

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Disbursement If an established PLUS loan with a declined credit decision is remedied AFTER the dependent student has received an additional unsubsidized loan If not disbursed the unsubsidized loan must be reduced to 0 If partially disbursed you MUST cancel any pending disbursements before awarding the PLUS loan Disbursed additional unsubsidized funds must be applied as estimated financial assistance when calculating the now approved PLUS loan amount Reduce the disbursed additional unsubsidized loan funds, and the unsubsidized loan itself, to 0 and disburse the PLUS loan in full Parent and student decision 60

Direct PLUS Loans from A to Z Federal Direct PLUS Loan Basics - Repayment Deferment and Forbearance options same as subsidized/unsubsidized loans Parent can request to defer repayment while dependent student, or parent, is enrolled at an eligible school more than half-time Student does not need to request in-school deferment Repayment options much like subsidized/unsubsidized loan borrowers 61 Parent can request to defer repayment for an additional six months from the date the dependent student ceases to be enrolled on at least a half-time basis Income-Based Repayment (IBR) and Income-Contingent Repayment (ICR) plans are NOT an option for parent PLUS loans

QUESTIONS? 62