Access to Capital for Entrepreneurs Gary Lindner President & CEO

21 Slides9.38 MB

Access to Capital for Entrepreneurs Gary Lindner President & CEO

Who We Are Certified Texas Non-profit 501(c)3 Established in 1994 US Treasury Certified Community Development Financial Institution (CDFI) Commitment to serve underserved markets Minority, women, veteran owned businesses Businesses in low to moderate income (LMI) census tracts Small Business Administration (SBA) Certified Lender SBA Microloans – up to 50,000 SBA 7a Community Advantage Loans - up to 250,000 Largest 7A Portfolio in Texas, top 10 Nationally SBA 504 Loans – up to 5 million Eligible SBA microloan capital and Technical Assistance Grants CDFI Analysis and Rating System known (AERIS) AA 2

Our Mission, Vision, & Core Values Our Mission PeopleFund creates economic opportunity and financial stability for underserved people by providing access to capital, education and resources to build healthy small businesses. Our Vision To become the premier non-profit business lender in Texas. Core Values Integrity First Service Before Self Excellence in All We Do

Texas Market Small business is BIG business in Texas 254 counties 2.2 million businesses with 5 or fewer employees Represent 89.4% of all Texas businesses Access to capital cited as biggest challenge If just 1 of 3 small business hired a single employee, U.S. would be at full employment

Access to Capital Biggest challenge for business owners How to become bank loan ready Questions you need to ask prospective lenders How to choose best source of capital Money alone not the answer, particularly for small startups Ongoing mentorship, businesses education & training essential to success

Bank Loan Readiness Get personal credit in order—FICO score will enable or limit you (unpaid collections, past due/default student loans, tax liens, past due child support) Source of Income— must verify with tax returns/pay stubs. Is income stable? Retirement? Disability Pay? Business Plan—resume, project budget, use of funds, 2-3 years financial projections, business description, use of funds, market research, 25K – 2-3 pages Collateral— adequate to support loan. 100% for some lenders. Most lenders use liquidation value (50-80%). Options for loans without collateral.

Bank Loan Readiness Most lenders require borrower Equity “skin in the game”. May require 20% or more equity for the loan (cash, inventory, real estate). Your business must be Competitive as assessed by lender. Character— honorable in meeting past obligations. Sincere and responsive. Can be “gut feeling”. Understanding Financials essential to any well run business. o Profit & Loss o Balance Sheet o Cash Flow

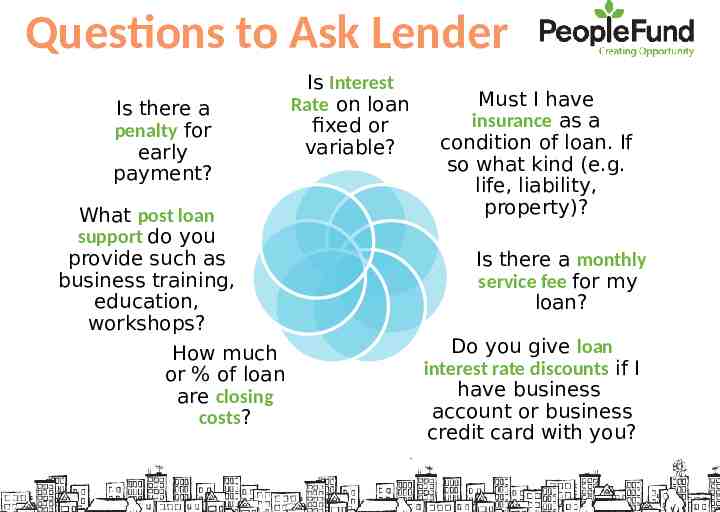

Questions to Ask Lender Is there a penalty for early payment? What post loan support do you provide such as business training, education, workshops? How much or % of loan are closing costs? Is Interest Rate on loan fixed or variable? Must I have insurance as a condition of loan. If so what kind (e.g. life, liability, property)? Is there a monthly service fee for my loan? Do you give loan interest rate discounts if I have business account or business credit card with you?

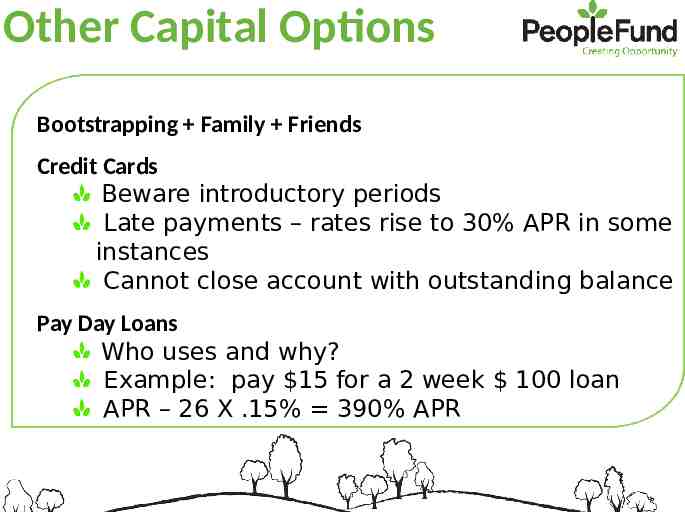

Other Capital Options Bootstrapping Family Friends Credit Cards Beware introductory periods Late payments – rates rise to 30% APR in some instances Cannot close account with outstanding balance Pay Day Loans Who uses and why? Example: pay 15 for a 2 week 100 loan APR – 26 X .15% 390% APR

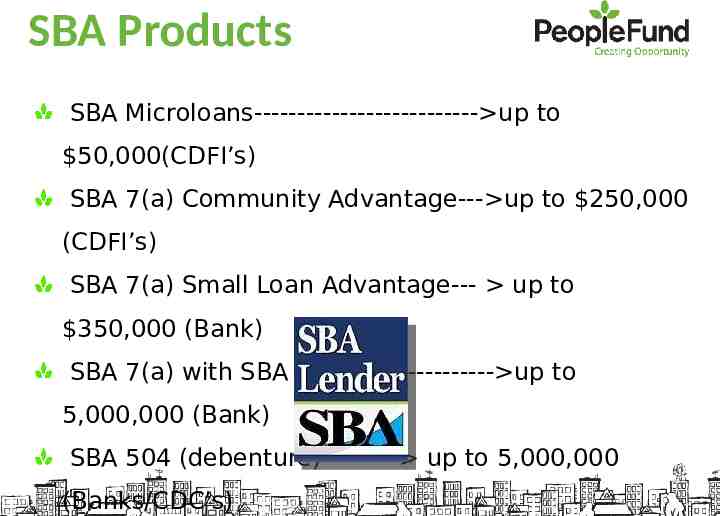

SBA Products SBA Microloans-------------------------- up to 50,000(CDFI’s) SBA 7(a) Community Advantage--- up to 250,000 (CDFI’s) SBA 7(a) Small Loan Advantage--- up to 350,000 (Bank) SBA 7(a) with SBA Guaranty---------- up to 5,000,000 (Bank) SBA 504 (debenture)--------- up to 5,000,000 (Banks/CDC’s)

Financing Alternatives Person to Person (P2P) Financing www. prosper.com – 1.74 million members 2,000- 35,000. 500,000,000 funded – similar to KIVA model Business to Business B2B Financing www.growfound.com - apply for a loan online; lenders purchase lead from GrowFound and make contact, 600,000 loan applicants, also has crowdfunding site, insurance, mortgage, business services

Crowdfunding Collective efforts of individuals who pool their money to support a cause or project – 1884 example Historic Use: Disaster relief, political campaigns 2012 JOBS Act: Relaxed SEC rules Investment, equity 2000-2012: 450 Crowdfunding platforms

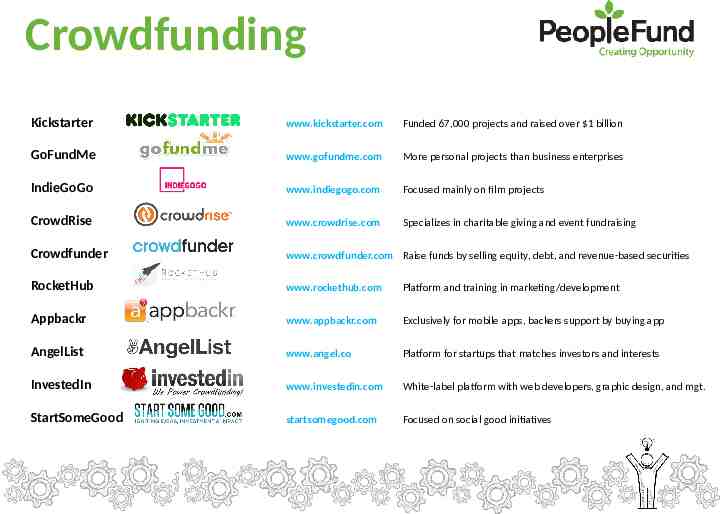

Crowdfunding Kickstarter www.kickstarter.com Funded 67,000 projects and raised over 1 billion GoFundMe www.gofundme.com More personal projects than business enterprises IndieGoGo www.indiegogo.com Focused mainly on film projects CrowdRise www.crowdrise.com Specializes in charitable giving and event fundraising Crowdfunder www.crowdfunder.com Raise funds by selling equity, debt, and revenue-based securities RocketHub www.rockethub.com Platform and training in marketing/development Appbackr www.appbackr.com Exclusively for mobile apps, backers support by buying app AngelList www.angel.co Platform for startups that matches investors and interests InvestedIn www.investedin.com White-label platform with web developers, graphic design, and mgt. StartSomeGood startsomegood.com Focused on social good initiatives

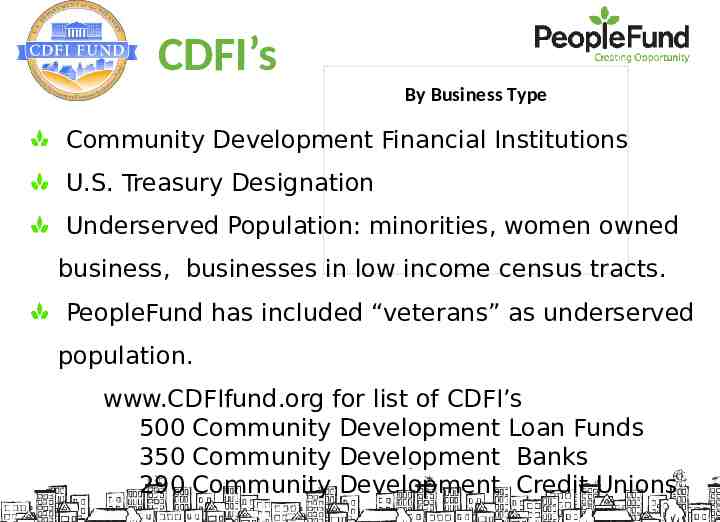

CDFI’s By Business Type Community Development Financial Institutions U.S. Treasury Designation Underserved Population: minorities, women owned business, businesses in low income census tracts. PeopleFund has included “veterans” as underserved population. www.CDFIfund.org for list of CDFI’s 500 Community Development Loan Funds 350 Community Development Banks 290 Community Development Credit Unions

What Makes PeopleFund & CDFI’s Different Non-Profit Business Lender CDFI – Support Underserved Populations No Application Fee No Established Minimum FICO Score Low Loan Equity Contribution Flexible Loan Terms and No Pre-Payment Penalty Post Loan Business Training and Support Variety of Loan Products: PeopleFund Loans, SBA Microloan, SBA Community Advantage Loans, Lines of Credit – amounts vary – 350,000 maximum

Education & Training Tailored to individual client needs Credit counseling, business plan, financials Loan readiness and application prep. Business training programs 230 Volunteer Mentors paired based on need 15,000 TA hours in 2016 Results: 4% net loan charge off annually and delinquency rate 2.7%

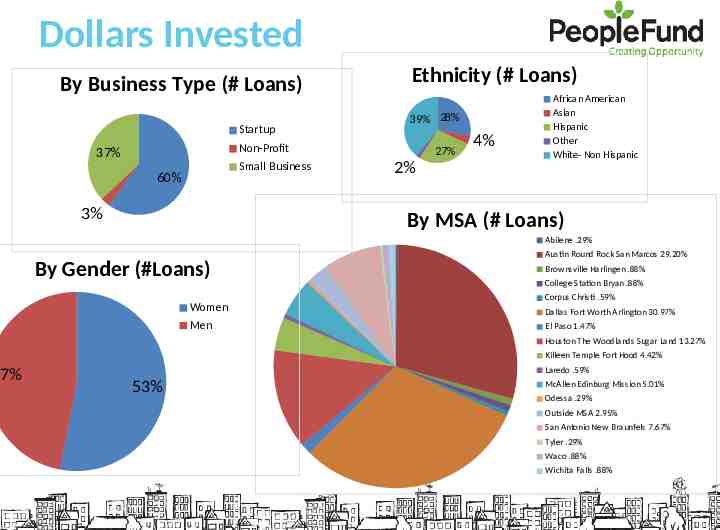

7% Dollars Invested By Business Type (# Loans) Startup Ethnicity (# Loans) 39% 28% Non-Profit 37% Small Business 60% 3% 27% 2% 4% African American Asian Hispanic Other White- Non Hispanic By MSA (# Loans) Abilene .29% Austin Round Rock San Marcos 29.20% By Gender (#Loans) Women Men Brownsville Harlingen .88% College Station Bryan .88% Corpus Christi .59% Dallas Fort Worth Arlington 30.97% El Paso 1.47% Houston The Woodlands Sugar Land 13.27% Killeen Temple Fort Hood 4.42% Laredo .59% 53% McAllen Edinburg Mission 5.01% Odessa .29% Outside MSA 2.95% San Antonio New Braunfels 7.67% Tyler .29% Waco .88% Wichita Falls .88%

PeopleFund Office Locations

Contact Us Amber Cooney Mari Montoya Jemerell Rogers Gary Lindner Director & Senior Loan Officer - of Advancement Loan Officer – South Austin/ President & CEO Education Dallas San Antonio [email protected] [email protected] [email protected] [email protected] 512-222-1015 512-222-1006 rg 512-222-2119 214-942-6698 Rocio Vallejo Jessica Hernandez Director of Lending Erika Hersh [email protected] Officer – Fort Worth Loan Officer- San Antonio 512-222-1011 [email protected] [email protected] 512-222-1017 214-942-6698 Bill Anderson Nini Gutierrez Senior Loan Officer – Loan Officer – Rio Grande Valley [email protected] Houston 956-322-4323 [email protected] g 512-222-3781 Esther Lopez Loan Officer – El Paso

This presentation contains proprietary information that was researched and assembled by the PeopleFund team. Please obtain permission from a PeopleFund representative prior to reproduction, dissemination, or sharing of this presentation. Thank you for your interest and commitment to our mission. Together, we can provide economic opportunity and help disadvantaged people live the American Dream.