Advisor Firm Logo Here RETIREMENT READY Client logo placeholder

23 Slides1.60 MB

Advisor Firm Logo Here RETIREMENT READY Client logo placeholder Add Rep Name Here

TERMS OF USE By using this presentation, you understand and agree to the following: You understand that T. Rowe Price does not undertake to give investment advice in a fiduciary capacity by making available this presentation and that T. Rowe Price Associates, Inc. and/or its affiliates (“T. Rowe Price”) may receive revenue from products and services made available by T. Rowe Price, including investment management, servicing, or other fees related to making available and/or servicing certain investments on its recordkeeping platform. To the extent you modify this presentation you will not attribute this presentation to T. Rowe Price through co-branding or otherwise. To the extent you provide investment recommendations to clients or prospective clients, you will not attribute any such recommendation(s) to T. Rowe Price. You are responsible for satisfying all applicable regulatory standards relating to this communication’s use by your firm, including all applicable content, approval, recordkeeping, and filing requirements. Please insert your data/content where indicated and delete these terms of use and various instructions throughout the PPT before using.

This presentation has been prepared by [Add Firm Name Here] for general education and informational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide fiduciary recommendations concerning investments or investment management; it is not individualized to the needs of any specific benefit plan or retirement investor, nor is it directed to any recipient in connection with a specific investment or investment management decision. Any tax-related discussion contained in this presentation, including any attachments, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or professional tax advisor regarding any legal or tax issues raised in this presentation.

re tire ment /rә tī(ә)r mәnt/ noun The action or fact of leaving one’s job and ceasing to work.

DO I HAVE ENOUGH? AM I ON TRACK? HOW MUCH DO I NEED? CAN I RETIRE EARLY?

REPLACEMENT INCOME 75% Some financial professionals say that investors will need 75% of their income in retirement.

REPLACEMENT INCOME Wages Savings Social Security Pensions

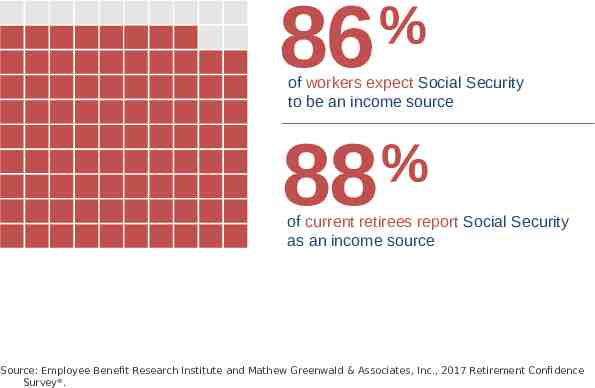

86 % 88 % of workers expect Social Security to be an income source of current retirees report Social Security as an income source Source: Employee Benefit Research Institute and Mathew Greenwald & Associates, Inc., 2017 Retirement Confidence Survey .

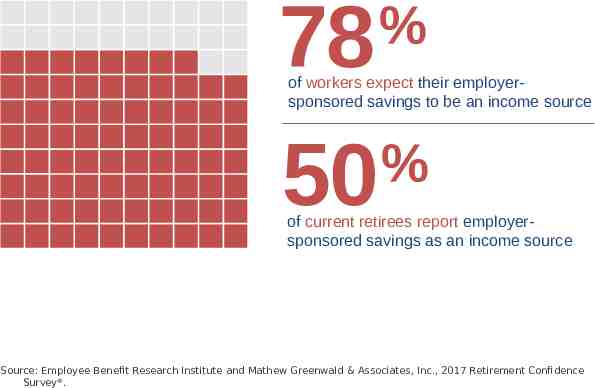

78 % 50 % of workers expect their employersponsored savings to be an income source of current retirees report employersponsored savings as an income source Source: Employee Benefit Research Institute and Mathew Greenwald & Associates, Inc., 2017 Retirement Confidence Survey .

WHAT ROLE WILL YOUR RETIREMENT SAVINGS PLAY?

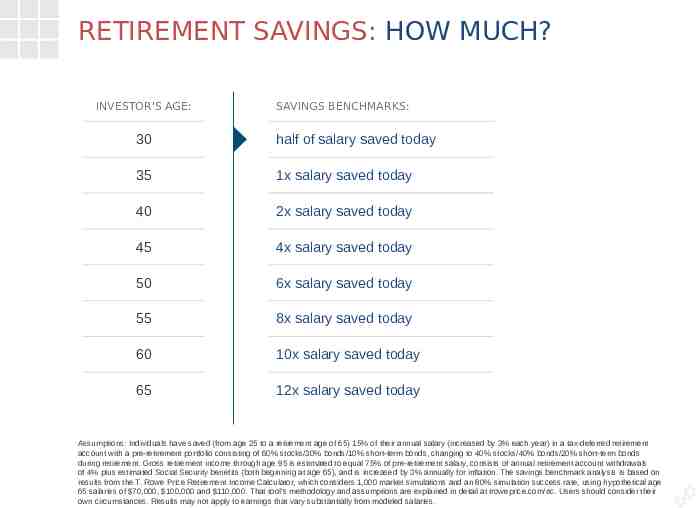

RETIREMENT SAVINGS: HOW MUCH? INVESTOR'S AGE: SAVINGS BENCHMARKS: 30 half of salary saved today 35 1x salary saved today 40 2x salary saved today 45 4x salary saved today 50 6x salary saved today 55 8x salary saved today 60 10x salary saved today 65 12x salary saved today Assumptions: Individuals have saved (from age 25 to a retirement age of 65) 15% of their annual salary (increased by 3% each year) in a tax-deferred retirement account with a pre-retirement portfolio consisting of 60% stocks/30% bonds/10% short-term bonds, changing to 40% stocks/40% bonds/20% short-term bonds during retirement. Gross retirement income through age 95 is estimated to equal 75% of pre-retirement salary, consists of annual retirement account withdrawals of 4% plus estimated Social Security benefits (both beginning at age 65), and is increased by 3% annually for inflation. The savings benchmark analysis is based on results from the T. Rowe Price Retirement Income Calculator, which considers 1,000 market simulations and an 80% simulation success rate, using hypothetical age 65 salaries of 70,000, 100,000 and 110,000. That tool’s methodology and assumptions are explained in detail at troweprice.com/ric. Users should consider their own circumstances. Results may not apply to earnings that vary substantially from modeled salaries.

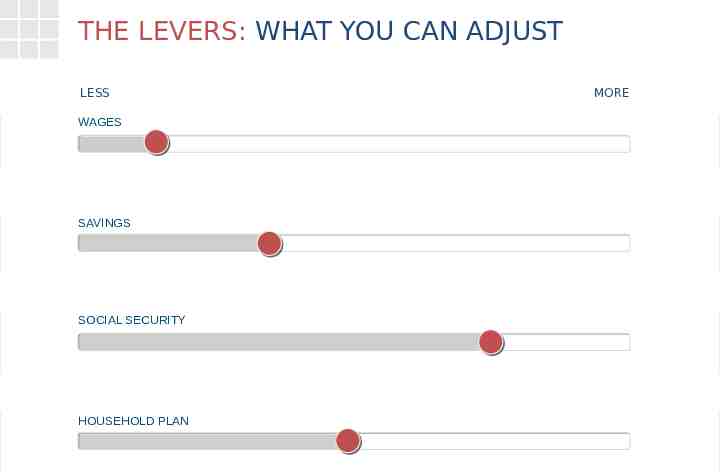

THE LEVERS: WHAT YOU CAN ADJUST LESS WAGES SAVINGS SOCIAL SECURITY HOUSEHOLD PLAN MORE

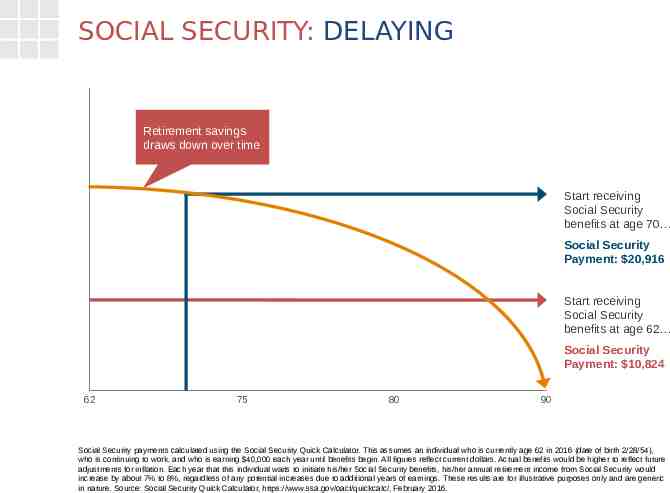

SOCIAL SECURITY: DELAYING Retirement savings draws down over time Start receiving Social Security benefits at age 70 Social Security Payment: 20,916 Start receiving Social Security benefits at age 62 Social Security Payment: 10,824 62 75 80 90 Social Security payments calculated using the Social Security Quick Calculator. This assumes an individual who is currently age 62 in 2016 (date of birth 2/28/54), who is continuing to work, and who is earning 40,000 each year until benefits begin. All figures reflect current dollars. Actual benefits would be higher to reflect future adjustments for inflation. Each year that this individual waits to initiate his/her Social Security benefits, his/her annual retirement income from Social Security would increase by about 7% to 8%, regardless of any potential increases due to additional years of earnings. These results are for illustrative purposes only and are generic in nature. Source: Social Security Quick Calculator, https://www.ssa.gov/oact/quickcalc/, February 2016.

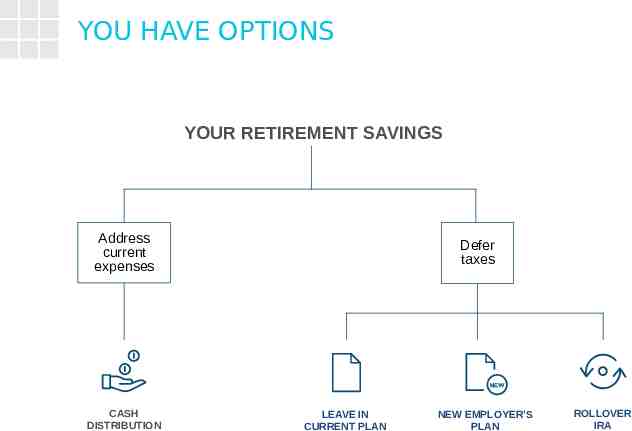

YOU HAVE OPTIONS YOUR RETIREMENT SAVINGS Address current expenses CASH DISTRIBUTION Defer taxes LEAVE IN CURRENT PLAN NEW EMPLOYER’S PLAN ROLLOVER IRA

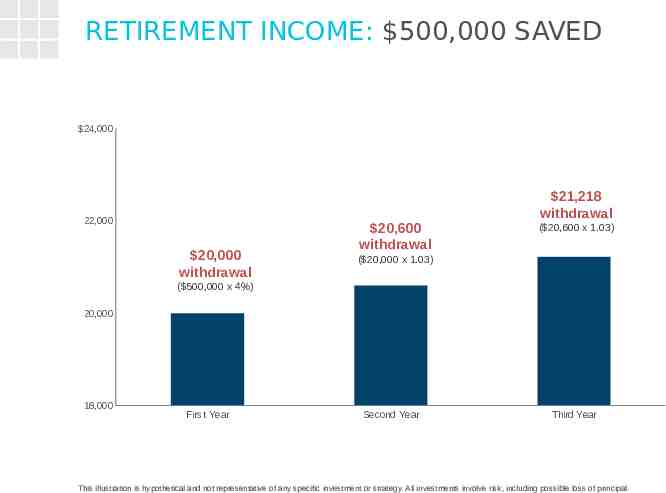

RETIREMENT INCOME: FIRST YEAR MANY INVESTORS SET THEIR INITIAL WITHDRAWAL PERCENTAGE AT 4 % Increase dollar amount by 3% in subsequent years (based on 3% inflation assumption)

RETIREMENT INCOME: 500,000 SAVED 24,000 22,000 20,000 withdrawal 20,600 withdrawal 21,218 withdrawal ( 20,600 x 1.03) ( 20,000 x 1.03) ( 500,000 x 4%) 20,000 18,000 First Year Second Year Third Year This illustration is hypothetical and not representative of any specific investment or strategy. All investments involve risk, including possible loss of principal.

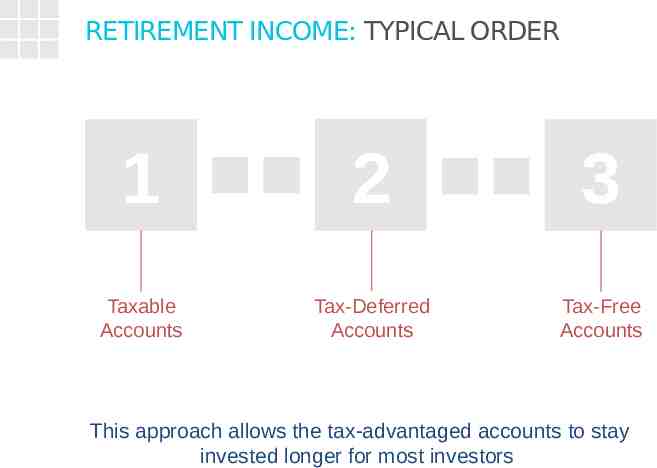

RETIREMENT INCOME: TYPICAL ORDER 1 2 3 Taxable Accounts Tax-Deferred Accounts Tax-Free Accounts This approach allows the tax-advantaged accounts to stay invested longer for most investors

MONITOR YOUR ACCOUNT ONLINE Please add in any graphics you think are appropriate, like images of participant websites or account summaries: Quickly view and access accounts and balances Perform transactions Check in on your progress toward retirement Research investments Log in wherever you are, whatever your device (if that is true)

IT’S YOUR FUTURE

SAVE ENOUGH FOR RETIREMENT

WE’RE HERE TO HELP

Add your logo, telephone number, email/website C1Q4ZY02I 2/18 201802-237329

TO PLAN SPONSORS This presentation should only be used as a visual presentation for client meetings. This program should not be altered, printed, distributed, or posted for employees to access. TO WEB MEETING ATTENDEES This web meeting may be recorded and posted for other employees to access. For security reasons, please do not speak or email any personal information during this meeting. For example, you should not give your address, Social Security number, or account information during this web meeting.