2010 BROKER-DEALER COORDINATED EXAMINATIONS PROJECT North

16 Slides232.50 KB

2010 BROKER-DEALER COORDINATED EXAMINATIONS PROJECT North American Securities Administrators Association

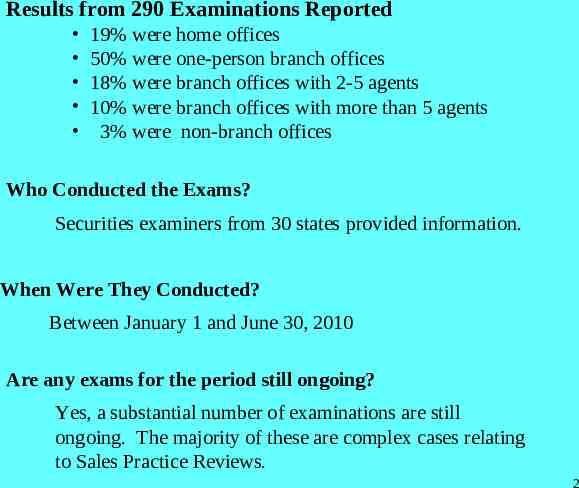

Results from 290 Examinations Reported 19% were home offices 50% were one-person branch offices 18% were branch offices with 2-5 agents 10% were branch offices with more than 5 agents 3% were non-branch offices Who Conducted the Exams? Securities examiners from 30 states provided information. When Were They Conducted? Between January 1 and June 30, 2010 Are any exams for the period still ongoing? Yes, a substantial number of examinations are still ongoing. The majority of these are complex cases relating to Sales Practice Reviews. 2

Examination Focus The focus/emphasis of the last Coordinated Broker-Dealer Exam Sweep in 2006 related to firms’ compliance with the then new books and records rules which were adopted in 2003 as we approached the 3-year anniversary. The 2010 Coordinated Broker-Dealer Exams Sweep reflects the results of the states securities regulators’ examinations conducted during the normal course of business. During the last few years securities regulators have been forced to leverage their resources. As such, the results reflect that a substantial number of examinations were focused. However, even in focused exams, a general overview of the firm’s operations is conducted. Examinations focused on number of different areas: Sales Practices Supervision Operations Books & Records Registration/Licensing 3

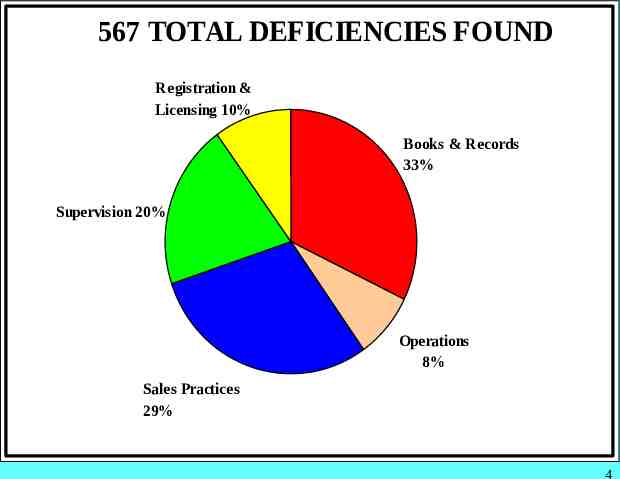

567 TOTAL DEFICIENCIES FOUND Registration & Licensing 10% Books & Records 33% Supervision 20% Operations 8% Sales Practices 29% 4

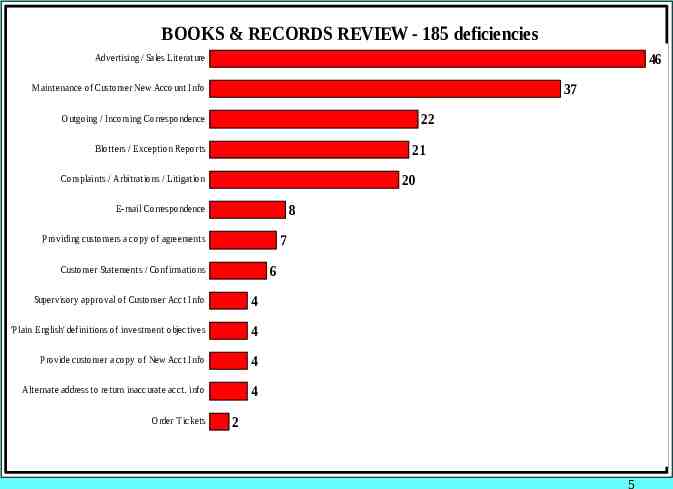

BOOKS & RECORDS REVIEW - 185 deficiencies 46 Advertising / Sales Literature 37 Maintenance of Customer New Account Info 22 Outgoing / Incoming Correspondence 21 Blotters / Exception Reports 20 Complaints / Arbitrations / Litigation 8 E-mail Correspondence 7 Providing customers a copy of agreements 6 Customer Statements / Confirmations Supervisory approval of Customer Acct Info 4 'Plain English' definitions of investment objectives 4 Provide customer a copy of New Acct Info 4 Alternate address to return inaccurate acct. info 4 Order T ickets 2 5

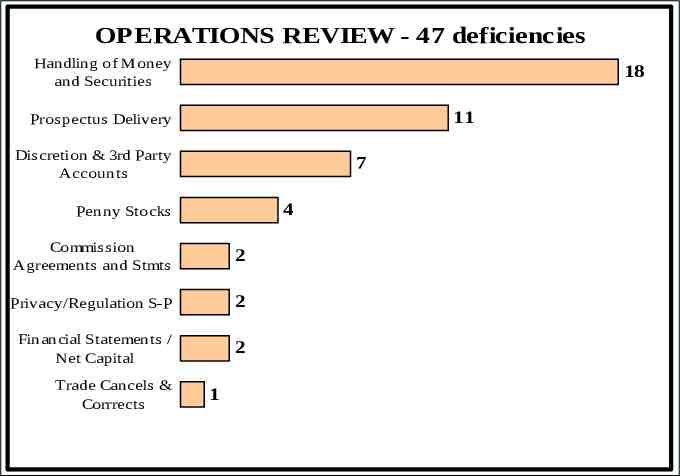

OPERATIONS REVIEW - 47 deficiencies Handling of Money and Securities 18 11 Prospectus Delivery Discretion & 3rd Party Accounts 7 4 Penny Stocks Commission Agreements and Stmts 2 Privacy/Regulation S-P 2 Financial Statements / Net Capital 2 OPERATIONS REVIEW Trade Cancels & Corrrects 1

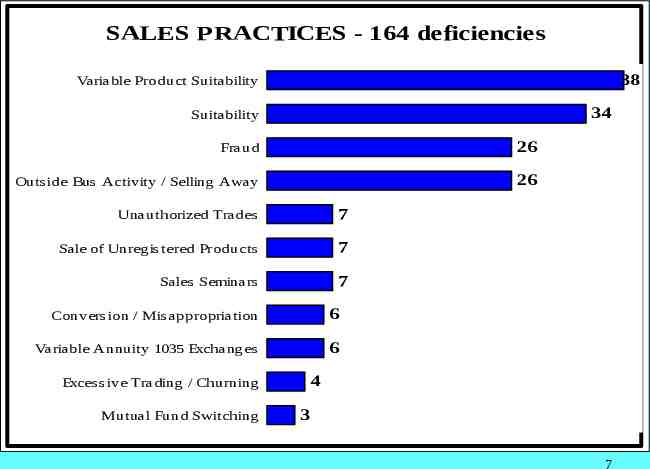

SALES PRACTICES - 164 deficiencies 38 Variable Product Suitability 34 Suitability Fraud 26 Outside Bus Activity / Selling Away 26 Unauthorized Trades 7 Sale of Unregistered Products 7 Sales Seminars 7 Conversion / Misappropriation 6 Variable Annuity 1035 Exchanges 6 4 Excessive Trading / Churning Mutual Fund Switching 3 7

SUPERVISION - 115 deficiencies 57 WSP's - failure to follow procedures 10 9 Internal Audits - Non-OSJ Branch Internal Audits - OSJ Branch 8 Use of Professional Designations 6 WSP's - adequate written procedures 4 Branch Manager approving own trades 3 3 3 Failure to indicate review of correspondence Hiring Procedures WSP's - maintaining current procedures 3 3 WSP's - RR's not assigned to qualified supervisor Anti-Money Laundering WSP's - designation of person to review Annual Compliance Meeting WSP's - designation of principals WSP's - not available to RR's 2 2 1 1

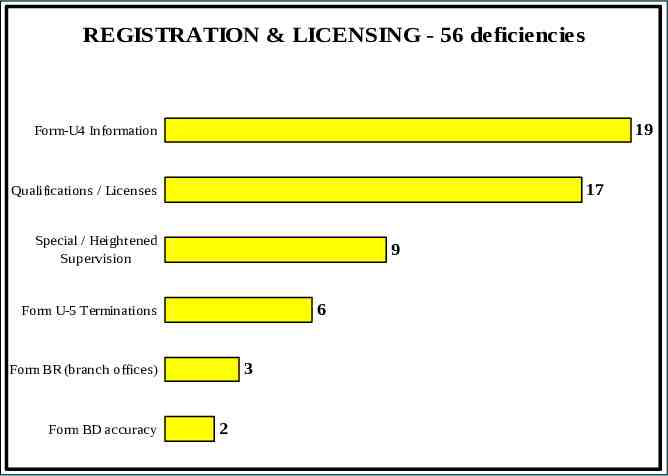

REGISTRATION & LICENSING - 56 deficiencies 19 Form-U4 Information 17 Qualifications / Licenses Special / Heightened Supervision 9 6 Form U-5 Terminations 3 Form BR (branch offices) Form BD accuracy 2 9

TOP 10 DEFICIENCIES 57 WSP's - Failure to Follow Procedures 46 Advertising / Sales Literature 38 Variable Product Suitability 37 Maintenance of Customer Acct Info 34 Suitability 30 Correspondence / E-mail 26 Fraud 26 Outside Business Activity / Selling Away Complaints / Arbitration Internal Audits 20 19 10

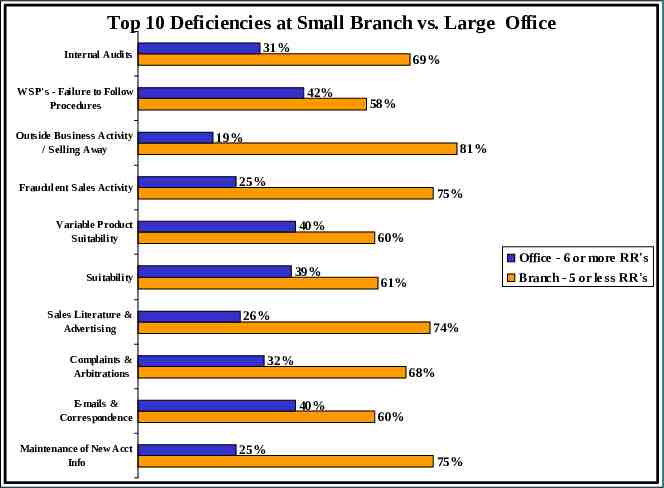

Top 10 Deficiencies at Small Branch vs. Large Office 31% Internal Audits 42% WSP's - Failure to Follow Procedures Outside Business Activity / Selling Away Fraudulent Sales Activity 81% 25% 75% 40% 39% Suitability 60% Office - 6 or more RR's 74% 32% 68% 40% E-mails & Correspondence 25% Branch - 5 or less RR's 61% 26% Complaints & Arbitrations Maintenance of New Acct Info 58% 19% Variable Product Suitability Sales Literature & Advertising 69% 60% 75% 11

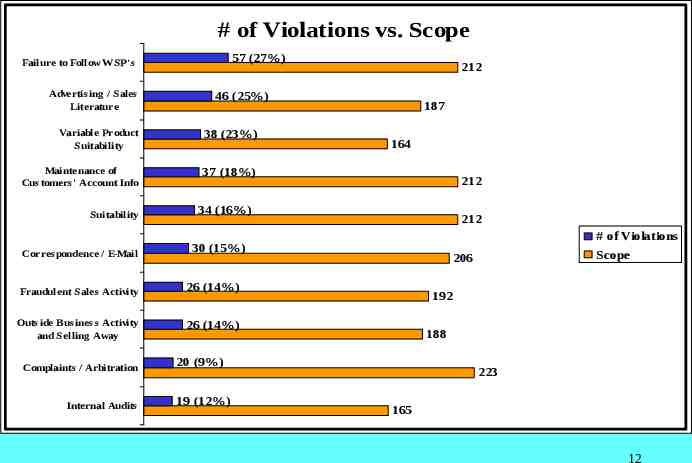

# of Violations vs. Scope 57 (27%) Failure to Follow WSP's Advertising / Sales Literature 46 (25%) Variable Product Suitability 38 (23%) Maintenance of Customers' Account Info 37 (18%) Suitability Correspondence / E-Mail 164 212 212 # of Violations 30 (15%) 26 (14%) Outside Business Activity and Selling Away 26 (14%) Internal Audits 187 34 (16%) Fraudulent Sales Activity Complaints / Arbitration 212 192 188 20 (9%) 19 (12%) Scope 206 223 165 12

HOT TOPICS AND BEST PRACTICES FOR BROKER DEALERS 1) Develop effective standards and criteria for determining suitability. 2) Ensure that exception reports are generated, when necessary, and that “red flags” are documented and resolved in a timely manner. If the BD elects to electronically recreate an exception report the BD must not only be able to recreate the report but also document how the exception was resolved. 3) Develop, Update, and Enforce Written Supervisory Procedures. BD’s should also ensure that staffing and expertise are commensurate with the size of the BD and type(s) of business engaged in by the firm. 4) Develop a branch audit program which includes an meaningful audit plan, unannounced visits, a means to convey audit results, and a follow-up plan for requesting that the branch take corrective action. 13

HOT TOPICS AND BEST PRACTICES (cont.) 5) Firms must ensure that adequate procedures are in place to prohibit and detect unauthorized private securities transactions (selling away). If this activity is permitted, the firm’s written supervisory procedures should be adequate to monitor this activity on an ongoing basis. 6) Outside business activity requests from RRs must be received and reviewed by the firm prior to the activity. The firm and RR are obligated to report the outside business activity on the RR’s Form U-4. The firm should have a supervisory procedure in place to address its approval/denial process. 7) Advertisements and sales literature MUST be balanced, make full and fair disclosure, and be approved, as necessary, prior to use. 8) Seminar notices/advertisements, seminars, and seminar materials utilized MUST be approved by the BD prior to use and the seminar being held. Additionally, any guest speakers and their materials must also be reviewed and approved prior to the seminar. In instances where RR routinely conduct seminars, a supervisory representative of the firm should randomly attend the seminar for compliance purposes. 14

HOT TOPICS AND BEST PRACTICES (cont.) 9) Correspondence, both electronic and hard copy, MUST be effectively monitored by the BD including a system of capturing and maintaining Emails sent by RR’s from websites and Internet Service Providers outside the firm. 10) Upon receipt of a complaint, the firms must acknowledge receipt, update RR’s Form U-4, if required, conduct and document a thorough review of the customer’s allegations. In situations where the firm discovers wrongdoing, the firm should redress customer harm. Failure to do so may result in enhanced penalties under NASAA guidelines. 15

Comments & questions