WORKSHOP: Tax Situation SOS: Dealing with Client Interactions with

33 Slides3.14 MB

WORKSHOP: Tax Situation SOS: Dealing with Client Interactions with the IRS

Housekeeping This webinar will be recorded and will be made available to registrants All webinar attendees are muted upon entry to ensure sound quality Ask a question or share your thoughts anytime by typing into the text box of your Zoom portal If you experience any technical issues, email us at [email protected]

Workshop Agenda Session Introduction Presentation: Accounting Aid Society Presentation: University of Denver Discussion: Q&A Discussion: Breakout Rooms Wrap Up and Next Steps

Workshop Speakers Margarita Perez United Way Suncoast Samantha Galvin University of Denver Dennis Dolbee Accounting Aid Society

Presentation: University of Denver Samantha Galvin

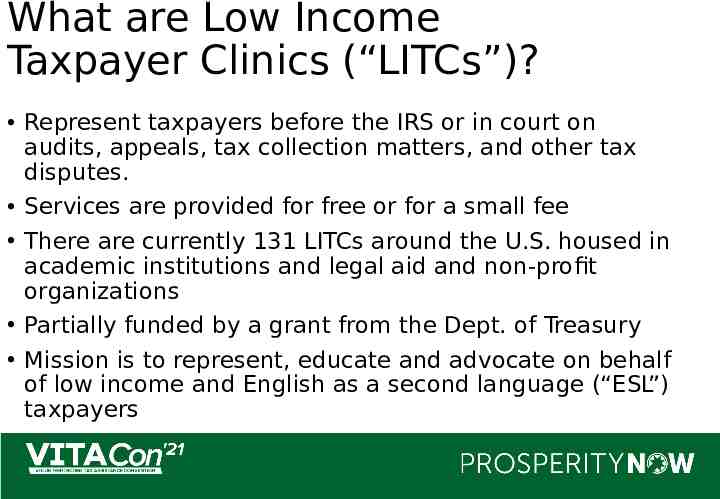

What are Low Income Taxpayer Clinics (“LITCs”)? Represent taxpayers before the IRS or in court on audits, appeals, tax collection matters, and other tax disputes. Services are provided for free or for a small fee There are currently 131 LITCs around the U.S. housed in academic institutions and legal aid and non-profit organizations Partially funded by a grant from the Dept. of Treasury Mission is to represent, educate and advocate on behalf of low income and English as a second language (“ESL”) taxpayers

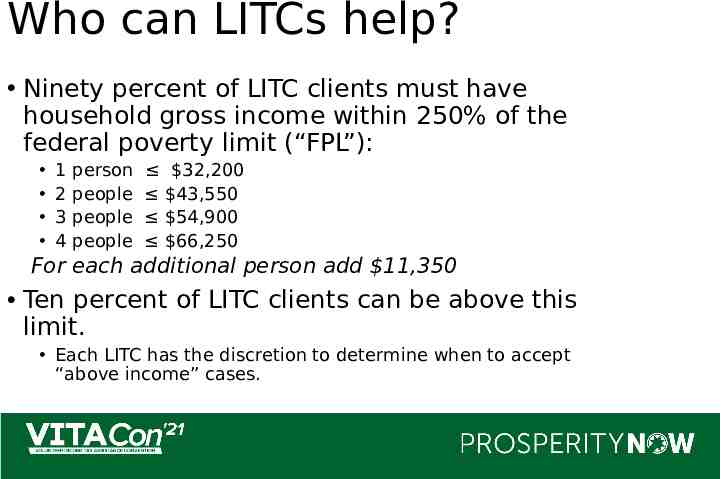

Who can LITCs help? Ninety percent of LITC clients must have household gross income within 250% of the federal poverty limit (“FPL”): 1 2 3 4 person people people people 32,200 43,550 54,900 66,250 For each additional person add 11,350 Ten percent of LITC clients can be above this limit. Each LITC has the discretion to determine when to accept “above income” cases.

When can LITCs help? Liability Disputes Audits Tax Court Liability Defenses ID Theft Innocent Spouse Relief Collection Cases Collection Due Process Hearings Collection Alternative Options

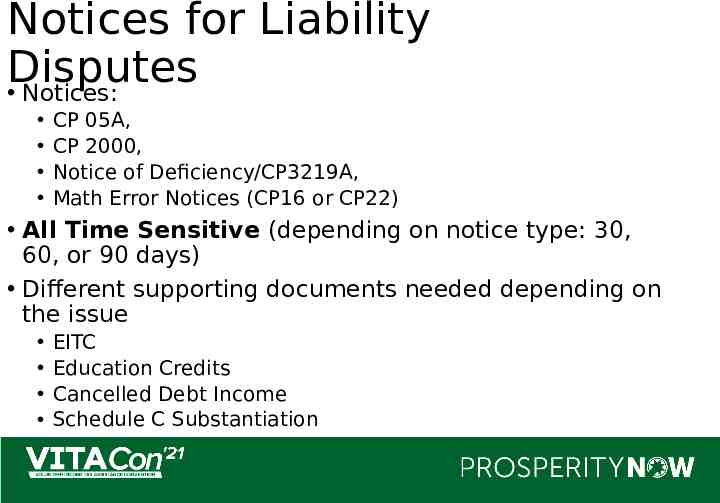

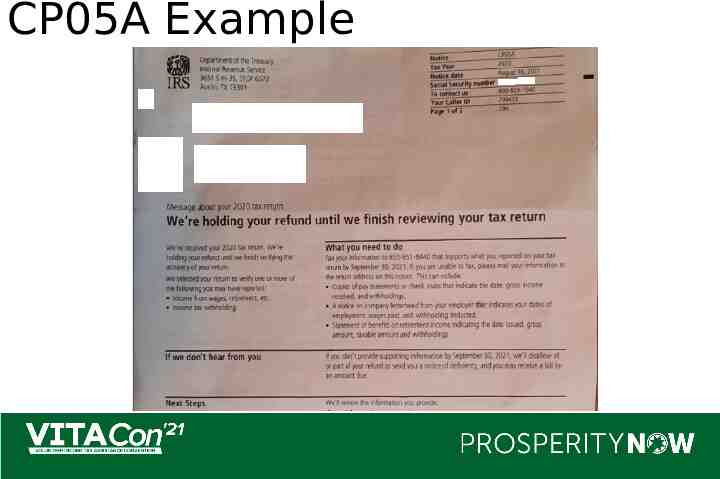

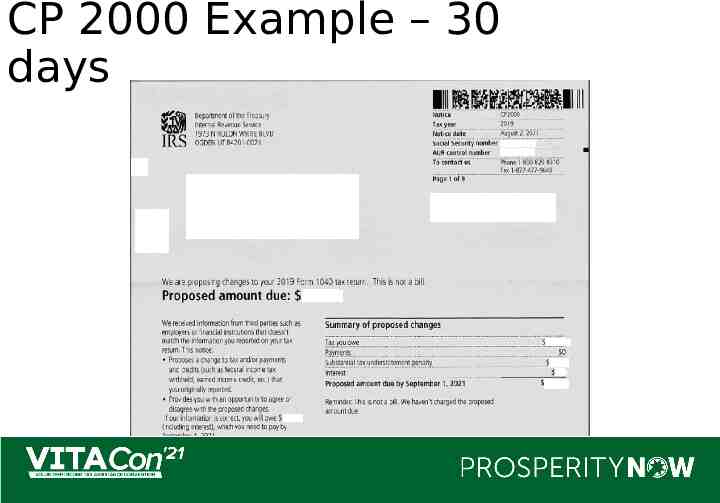

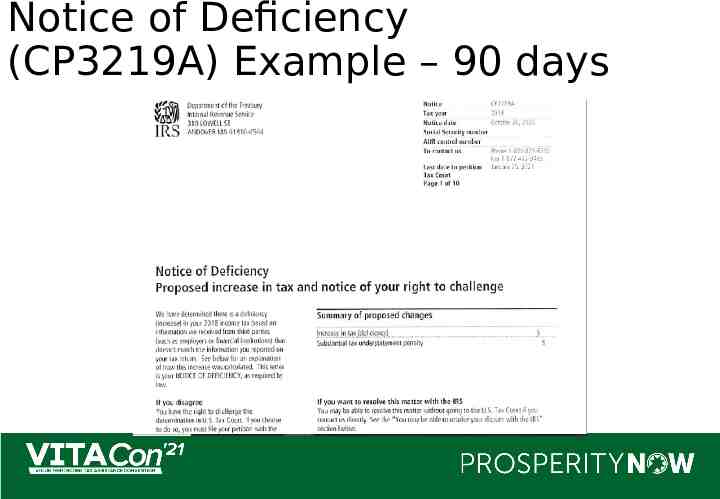

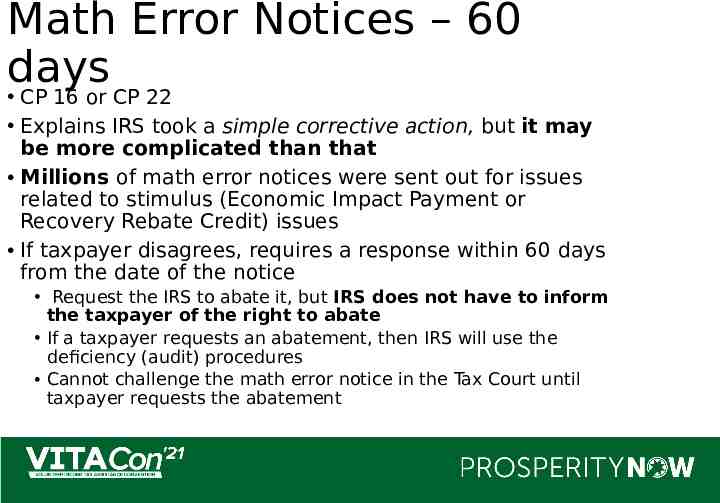

Notices for Liability Disputes Notices: CP 05A, CP 2000, Notice of Deficiency/CP3219A, Math Error Notices (CP16 or CP22) All Time Sensitive (depending on notice type: 30, 60, or 90 days) Different supporting documents needed depending on the issue EITC Education Credits Cancelled Debt Income Schedule C Substantiation

CP05A Example

CP 2000 Example – 30 days

Notice of Deficiency (CP3219A) Example – 90 days

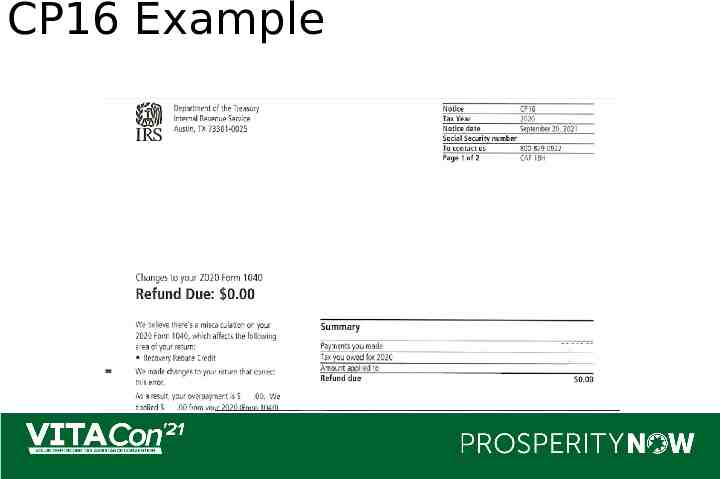

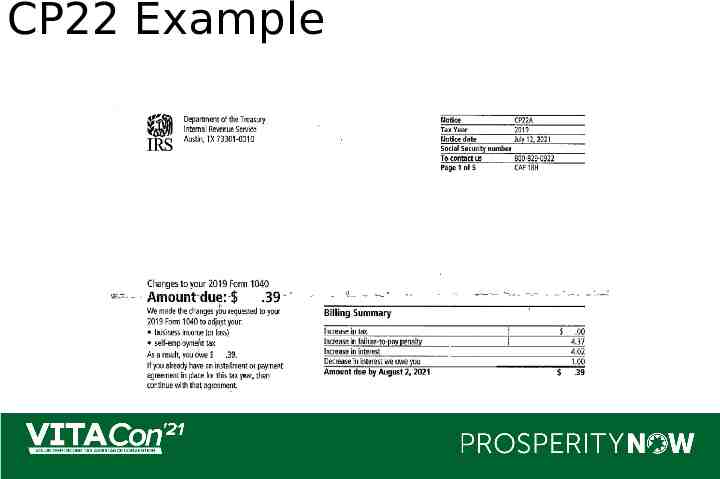

Math Error Notices – 60 days CP 16 or CP 22 Explains IRS took a simple corrective action, but it may be more complicated than that Millions of math error notices were sent out for issues related to stimulus (Economic Impact Payment or Recovery Rebate Credit) issues If taxpayer disagrees, requires a response within 60 days from the date of the notice Request the IRS to abate it, but IRS does not have to inform the taxpayer of the right to abate If a taxpayer requests an abatement, then IRS will use the deficiency (audit) procedures Cannot challenge the math error notice in the Tax Court until taxpayer requests the abatement

CP16 Example

CP22 Example

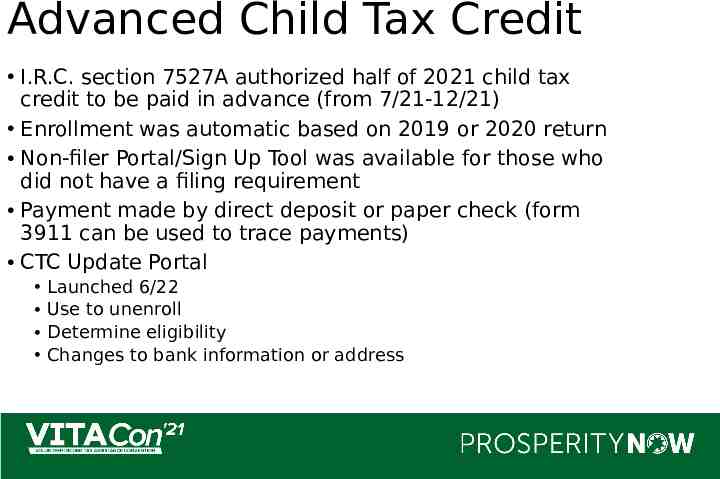

Advanced Child Tax Credit I.R.C. section 7527A authorized half of 2021 child tax credit to be paid in advance (from 7/21-12/21) Enrollment was automatic based on 2019 or 2020 return Non-filer Portal/Sign Up Tool was available for those who did not have a filing requirement Payment made by direct deposit or paper check (form 3911 can be used to trace payments) CTC Update Portal Launched 6/22 Use to unenroll Determine eligibility Changes to bank information or address

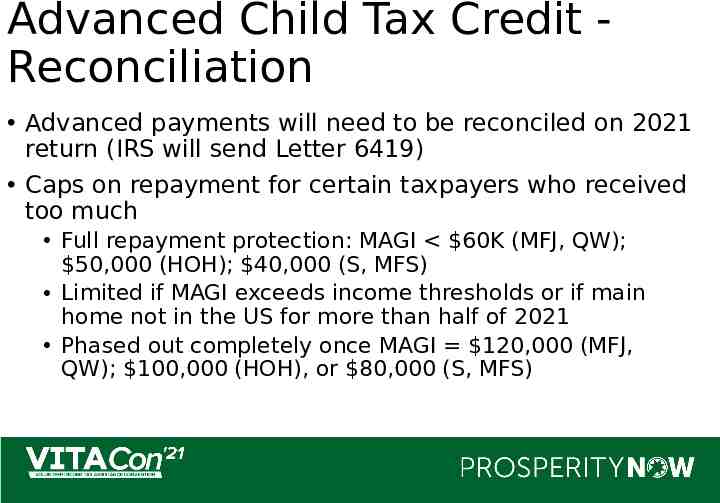

Advanced Child Tax Credit Reconciliation Advanced payments will need to be reconciled on 2021 return (IRS will send Letter 6419) Caps on repayment for certain taxpayers who received too much Full repayment protection: MAGI 60K (MFJ, QW); 50,000 (HOH); 40,000 (S, MFS) Limited if MAGI exceeds income thresholds or if main home not in the US for more than half of 2021 Phased out completely once MAGI 120,000 (MFJ, QW); 100,000 (HOH), or 80,000 (S, MFS)

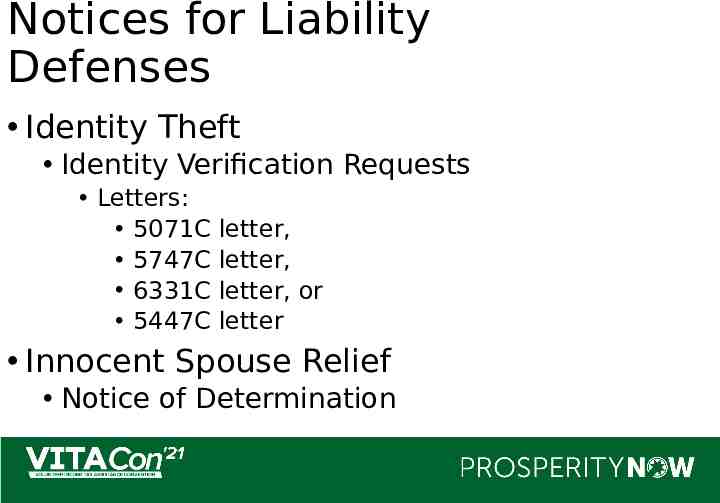

Notices for Liability Defenses Identity Theft Identity Verification Requests Letters: 5071C 5747C 6331C 5447C letter, letter, letter, or letter Innocent Spouse Relief Notice of Determination

ID Verification Options and Issues Online at idverify.irs.gov: Account number from credit card, mortgage, student loan, home equity loan or home equity line of credit, car loan, and Mobile phone number in taxpayer’s name, Also notice, tax return, address on last year’s return ID Verification Number: (800) 830-5084 Schedule appointment at Taxpayer Assistance Center

Other Resources Internal Revenue Service: www.irs.gov Specific information on Adv. CTC: https://www.irs.gov/credits-deductions/advan ce-child-tax-credit-payments-in-2021 Taxpayer Advocate Service: https://www.taxpayeradvocate.irs.gov/ LITC Consultation; find LITC closest to you at: https://www.taxpayeradvocate.irs.gov/ab out-us/low-income-taxpayer-clinics-litc/# finder

Presentation: Accounting Aid Society Dennis Dolbee

IRS Notices for Tax Levies DENNIS DOLBEE ACCOUNTING AID SOCIETY

The seizure of a taxpayer’s property What is a Levy? Usually happens when a taxpayer fails to respond to IRS notices

IRS Levy Required notices that must be given to a taxpayer: Notice and demand Notice of intent to levy and Notice of a right to a Collection Due Process (CPD) hearing

IRS Levy Two types of levies: Regular and Continuing

Regular Levy A regular levy seizes whatever the taxpayer owns at that moment Banks hold funds for 21 days before sending to the IRS

Continuing Levy A continuing levy remains in effect until it is released by the IRS Usually wages and regular payments IRS will allow the taxpayer a standard deduction and personal exemptions Everything above the exempt amount will be taken by IRS

CP 90 IRS Notices Letter 1158 Letter 11

Discussion: Q&A

Discussion: Breakout Rooms

Breakout Room Expectations You’ll be sent out into randomly assigned breakout rooms! Here’s some discussion questions to guide the conversation: Are you connected with your local LITC? How to you work with them and what best practices do you have to share? When clients bring IRS letters into your site, what steps do you usually take? If you experience any technical issues, email us at [email protected]

Wrap Up & Next Steps

Wrap Up & Next Steps Recommended Practices Coming Up: Workshop: I’m In: Virtual Reloaded