VA R I A B L E A N N U I T I E S : PRINCIPLE-BASED RESERVES AND C A P

32 Slides726.63 KB

VA R I A B L E A N N U I T I E S : PRINCIPLE-BASED RESERVES AND C A P I TA L N A I C VA R E F O R M NOVEMBER 5, 2018 Peter Abramovich, FSA, MAAA A V P & A c t u a r y , A n n u i t y V a l u a ti o n P a c i fi c L i f e I n s u r a n c e C o m p a n y

TABLE OF CONTENTS VA base product Risks in retirement years (responsibility shifted to individual, market risk, inflation risk, longevity risk) Retirement income solutions: deferred VA’s with living benefits Principles-based approach for statutory reserves and capital Timeline of Statutory VA reserves and capital Current Statutory VA reserves Current Statutory VA capital Framework challenges and industry response NAIC Statutory VA review NAIC VA reserves and capital framework changes and next steps Contact info VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 2

OVERVIEW OF VA BASE PRODUCT Accumulation Phase (Deferred Annuity) – Similar to Mutual Funds, but earnings grow on a tax deferred basis Income Phase (Income Annuity) – Annuitize the contract to convert to a steady stream of income VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 3

THE PROBLEM Responsibility has shifted to the individual Number of Defined Benefit plans has decreased by 50% in last 20 years* Social Security accounts for just 38% of total income for retired people age 65 or older** 401(k) plans often don’t provide for lifetime income *Source: Department of Labor Pension and Welfare Administration **Social Security Administration, January 2003 VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 4

THE RISKS Market Risk Inflation Risk Longevity Risk VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 5

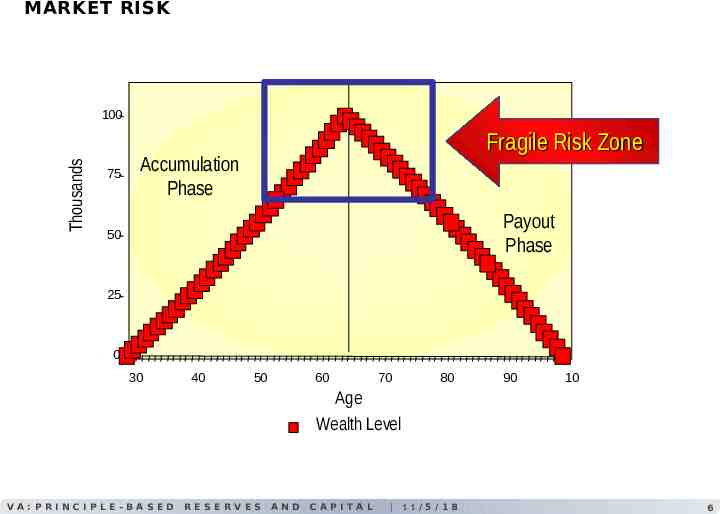

MARKET RISK Thousands 100 75 Fragile Risk Zone Accumulation Phase Payout Phase 50 25 0 30 40 50 60 70 80 90 10 Age Wealth Level VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 6

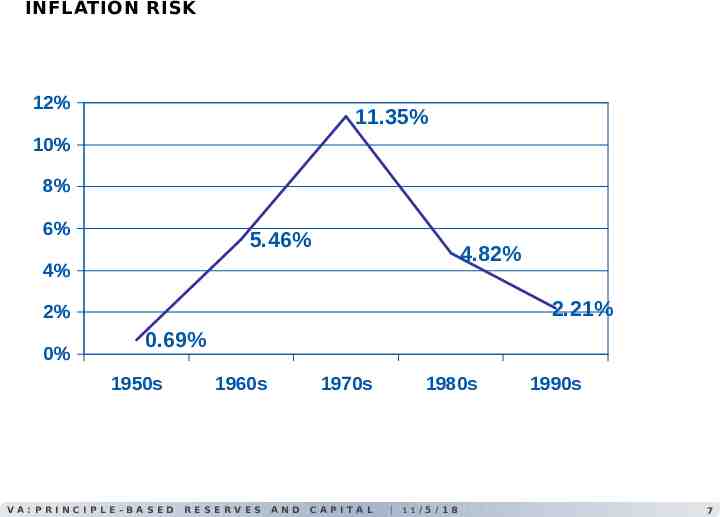

INFLATION RISK 12% 11.35% 10% 8% 6% 5.46% 4.82% 4% 2.21% 2% 0% 0.69% 1950s VA :PRINCIPLE-BASED 1960s RESERVES 1970s AND CAPITAL 1980s 11/5/18 1990s 7

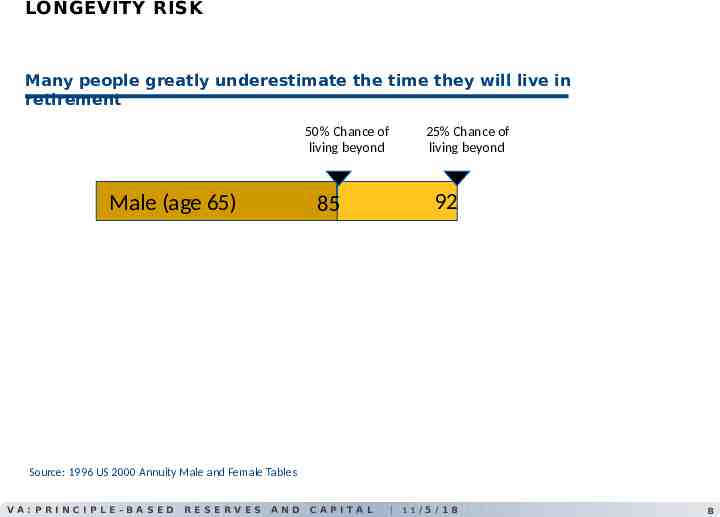

LONGEVITY RISK Many people greatly underestimate the time they will live in retirement 50% Chance of living beyond Male (age 65) 92 85 Female (age 65) 25% Chance of living beyond 88 Source: 1996 US 2000 Annuity Male and Female Tables VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 8

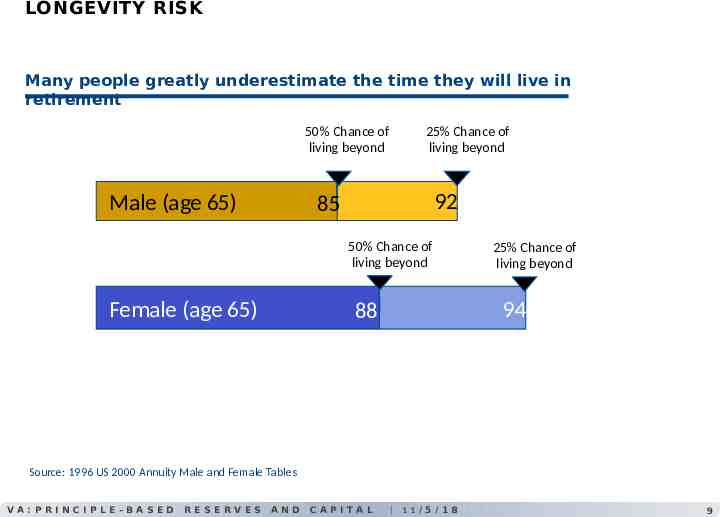

LONGEVITY RISK Many people greatly underestimate the time they will live in retirement 50% Chance of living beyond Male (age 65) 25% Chance of living beyond 92 85 50% Chance of living beyond Female (age 65) 25% Chance of living beyond 94 88 Source: 1996 US 2000 Annuity Male and Female Tables VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 9

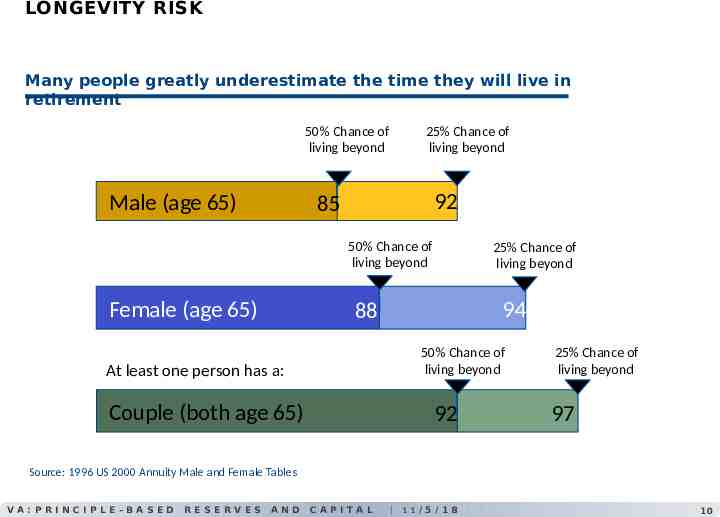

LONGEVITY RISK Many people greatly underestimate the time they will live in retirement 50% Chance of living beyond Male (age 65) 25% Chance of living beyond 92 85 50% Chance of living beyond Female (age 65) 25% Chance of living beyond 94 88 50% Chance of living beyond At least one person has a: Couple (both age 65) 92 25% Chance of living beyond 97 Source: 1996 US 2000 Annuity Male and Female Tables VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 10

THE SOLUTION Retirement Income Solutions VA :PRINCIPLE-BASED Deferred Variable Annuities Living Benefits GMIB GMWB LWG GMAB RESERVES AND CAPITAL 11/5/18 11

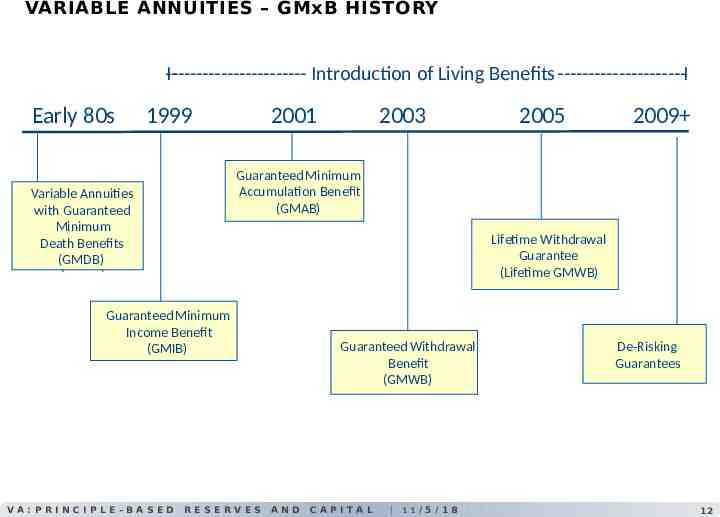

VARIABLE ANNUITIES – GMxB HISTORY ----------------------IIntroduction of Living Benefits ---------------------I Early 80s 1999 2001 2005 2009 Guaranteed Minimum Accumulation Benefit (GMAB) Variable Annuities with Guaranteed Minimum Death Benefits (GMDB) Lifetime Withdrawal Guarantee (Lifetime GMWB) Guaranteed Minimum Income Benefit (GMIB) VA :PRINCIPLE-BASED 2003 RESERVES Guaranteed Withdrawal Benefit (GMWB) AND CAPITAL 11/5/18 De-Risking Guarantees 12

PRINCIPLES – BASED APPROACH FOR STATUTORY RESERVING & CAPITAL What is it? Why is it introduced? Where does it apply Benefits? VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 13

WHAT ARE PRINCIPLES-BASED RESERVES AND RISK-BASED CAPITAL (RBC)? Approach that determines reserves and capital using specific model based approaches that include the use of the company’s own experience, among other things Goal: Develop reserves and capital that are reasonably conservative, but not excessive VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 14

WHAT IS IT? Actuarial principals, not prescribed formulas Reserve Present value of future benefits and expense less present value of future gross premiums Assumptions include margin for adverse deviation Stochastic modeling where necessary Deterministic scenario floor Goal: Develop reserves and capital that are reasonably conservative, but not excessive VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 15

WHY WAS IT INTRODUCED? Complexity of products and guarantees Fat tail liabilities Concern over excessive formula reserves Regulator concern over inadequate reserves VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 16

WHERE DOES IT APPLY? Initial implementation focused on capital requirements RBC C3 Phase 1 – 2000 Applies to fixed annuities and single premium life insurance No longer optional for big companies RBC C3 Phase 2 – 2005 Applies to variable annuities VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 17

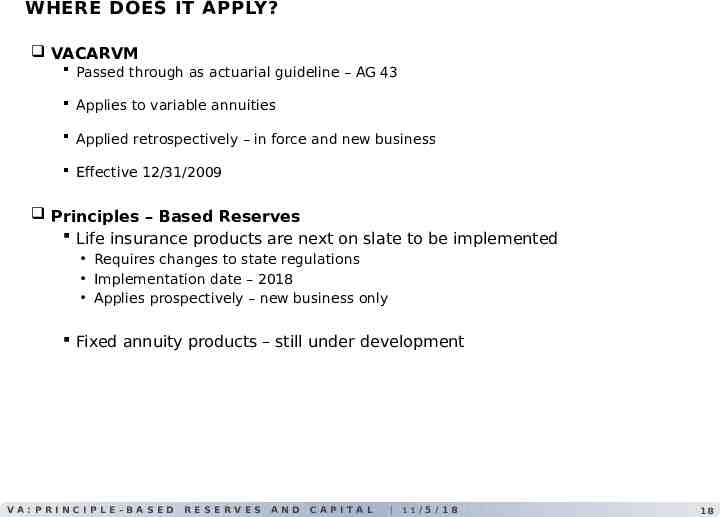

WHERE DOES IT APPLY? VACARVM Passed through as actuarial guideline – AG 43 Applies to variable annuities Applied retrospectively – in force and new business Effective 12/31/2009 Principles – Based Reserves Life insurance products are next on slate to be implemented Requires changes to state regulations Implementation date – 2018 Applies prospectively – new business only Fixed annuity products – still under development VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 18

BENEFITS TO VALUATION AND FINANCIAL REPORTING Reflects company experience Benefit of hedging Sophisticated models vs. simplistic formula VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 19

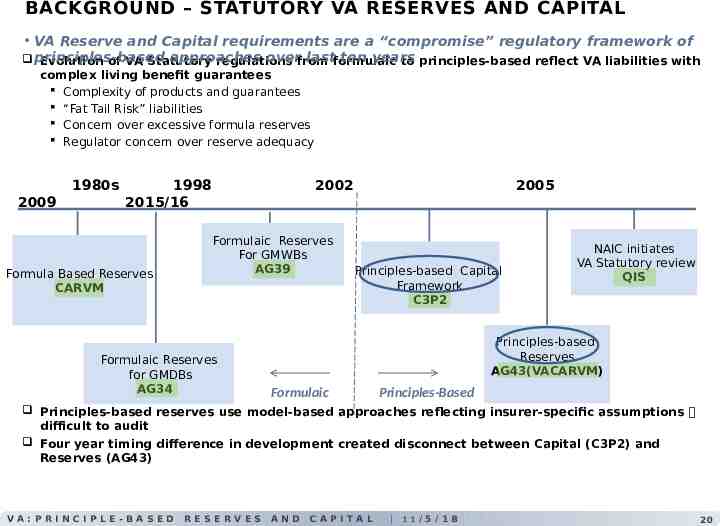

BACKGROUND – STATUTORY VA RESERVES AND CAPITAL VA Reserve and Capital requirements are a “compromise” regulatory framework of approaches overfrom lastformulaic ten years principles-based Evolution of VA Statutory regulations to principles-based reflect VA liabilities with complex living benefit guarantees Complexity of products and guarantees “Fat Tail Risk” liabilities Concern over excessive formula reserves Regulator concern over reserve adequacy 1980s 2009 1998 2015/16 Formula Based Reserves CARVM 2002 Formulaic Reserves For GMWBs AG39 Formulaic Reserves for GMDBs AG34 2005 Principles-based Capital Framework C3P2 NAIC initiates VA Statutory review QIS Principles-based Reserves AG43(VACARVM) Formulaic Principles-Based Principles-based reserves use model-based approaches reflecting insurer-specific assumptions difficult to audit Four year timing difference in development created disconnect between Capital (C3P2) and Reserves (AG43) VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 20

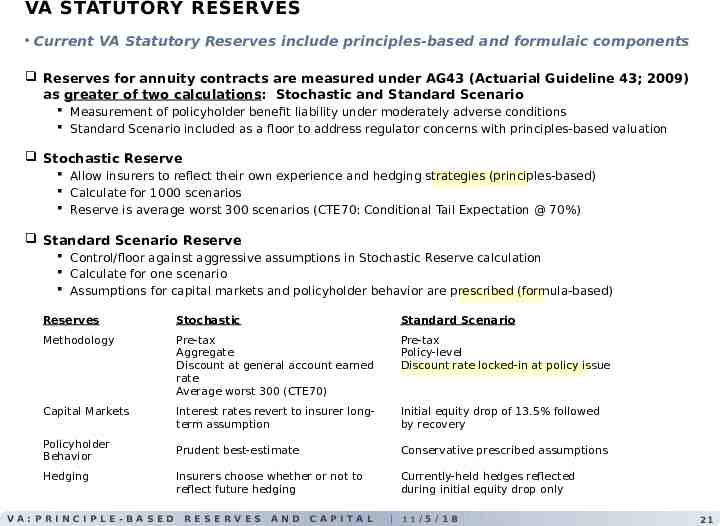

VA STATUTORY RESERVES Current VA Statutory Reserves include principles-based and formulaic components Reserves for annuity contracts are measured under AG43 (Actuarial Guideline 43; 2009) as greater of two calculations: Stochastic and Standard Scenario Measurement of policyholder benefit liability under moderately adverse conditions Standard Scenario included as a floor to address regulator concerns with principles-based valuation Stochastic Reserve Allow insurers to reflect their own experience and hedging strategies (principles-based) Calculate for 1000 scenarios Reserve is average worst 300 scenarios (CTE70: Conditional Tail Expectation @ 70%) Standard Scenario Reserve Control/floor against aggressive assumptions in Stochastic Reserve calculation Calculate for one scenario Assumptions for capital markets and policyholder behavior are prescribed (formula-based) Reserves Stochastic Standard Scenario Methodology Pre-tax Aggregate Discount at general account earned rate Average worst 300 (CTE70) Pre-tax Policy-level Discount rate locked-in at policy issue Capital Markets Interest rates revert to insurer longterm assumption Initial equity drop of 13.5% followed by recovery Prudent best-estimate Conservative prescribed assumptions Insurers choose whether or not to reflect future hedging Currently-held hedges reflected during initial equity drop only Policyholder Behavior Hedging VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 21

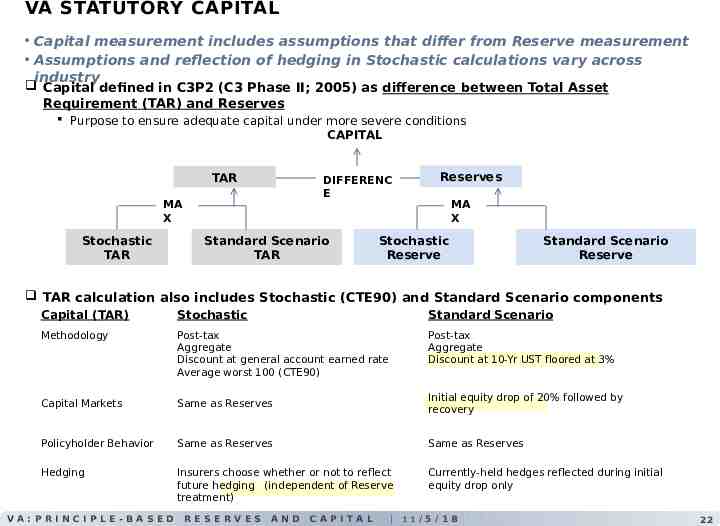

VA STATUTORY CAPITAL Capital measurement includes assumptions that differ from Reserve measurement Assumptions and reflection of hedging in Stochastic calculations vary across industry Capital defined in C3P2 (C3 Phase II; 2005) as difference between Total Asset Requirement (TAR) and Reserves Purpose to ensure adequate capital under more severe conditions CAPITAL TAR DIFFERENC E MA X Stochastic TAR Standard Scenario TAR Reserves MA X Stochastic Reserve Standard Scenario Reserve TAR calculation also includes Stochastic (CTE90) and Standard Scenario components Capital (TAR) Stochastic Standard Scenario Methodology Post-tax Aggregate Discount at general account earned rate Average worst 100 (CTE90) Post-tax Aggregate Discount at 10-Yr UST floored at 3% Capital Markets Same as Reserves Initial equity drop of 20% followed by recovery Policyholder Behavior Same as Reserves Same as Reserves Hedging Insurers choose whether or not to reflect future hedging (independent of Reserve treatment) Currently-held hedges reflected during initial equity drop only VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 22

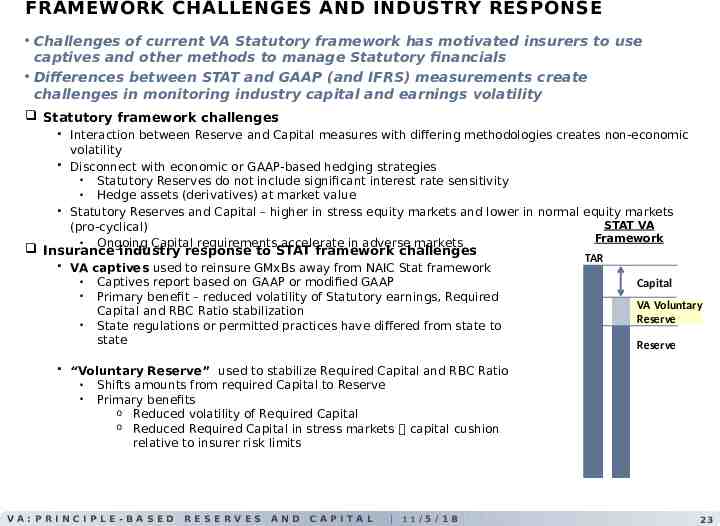

FRAMEWORK CHALLENGES AND INDUSTRY RESPONSE Challenges of current VA Statutory framework has motivated insurers to use captives and other methods to manage Statutory financials Differences between STAT and GAAP (and IFRS) measurements create challenges in monitoring industry capital and earnings volatility Statutory framework challenges Interaction between Reserve and Capital measures with differing methodologies creates non-economic volatility Disconnect with economic or GAAP-based hedging strategies Statutory Reserves do not include significant interest rate sensitivity Hedge assets (derivatives) at market value Statutory Reserves and Capital – higher in stress equity markets and lower in normal equity markets STAT VA (pro-cyclical) Framework Ongoing Capital requirements accelerate in adverse markets Insurance industry response to STAT framework challenges TAR VA captives used to reinsure GMxBs away from NAIC Stat framework Captives report based on GAAP or modified GAAP Capital Primary benefit – reduced volatility of Statutory earnings, Required VA Voluntary Capital and RBC Ratio stabilization Reserve State regulations or permitted practices have differed from state to state Reserve “Voluntary Reserve” used to stabilize Required Capital and RBC Ratio Shifts amounts from required Capital to Reserve Primary benefits o Reduced volatility of Required Capital o Reduced Required Capital in stress markets capital cushion relative to insurer risk limits VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 23

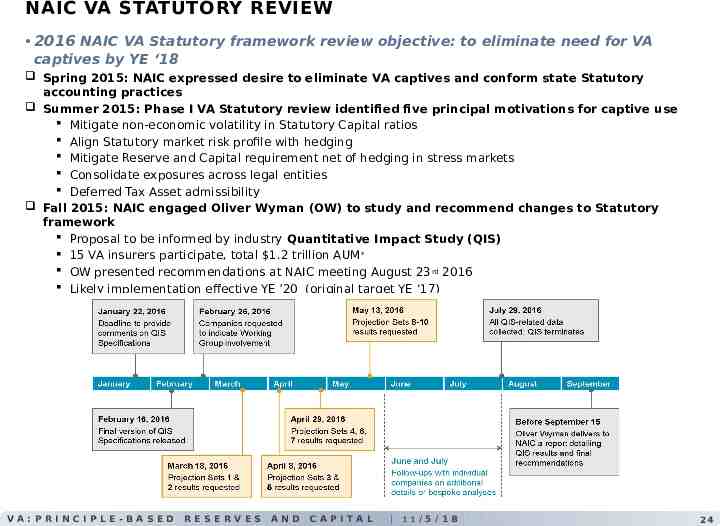

NAIC VA STATUTORY REVIEW 2016 NAIC VA Statutory framework review objective: to eliminate need for VA captives by YE ‘18 Spring 2015: NAIC expressed desire to eliminate VA captives and conform state Statutory accounting practices Summer 2015: Phase I VA Statutory review identified five principal motivations for captive use Mitigate non-economic volatility in Statutory Capital ratios Align Statutory market risk profile with hedging Mitigate Reserve and Capital requirement net of hedging in stress markets Consolidate exposures across legal entities Deferred Tax Asset admissibility Fall 2015: NAIC engaged Oliver Wyman (OW) to study and recommend changes to Statutory framework Proposal to be informed by industry Quantitative Impact Study (QIS) 15 VA insurers participate, total 1.2 trillion AUM * OW presented recommendations at NAIC meeting August 23 rd 2016 Likely implementation effective YE ’20 (original target YE ‘17) VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 24

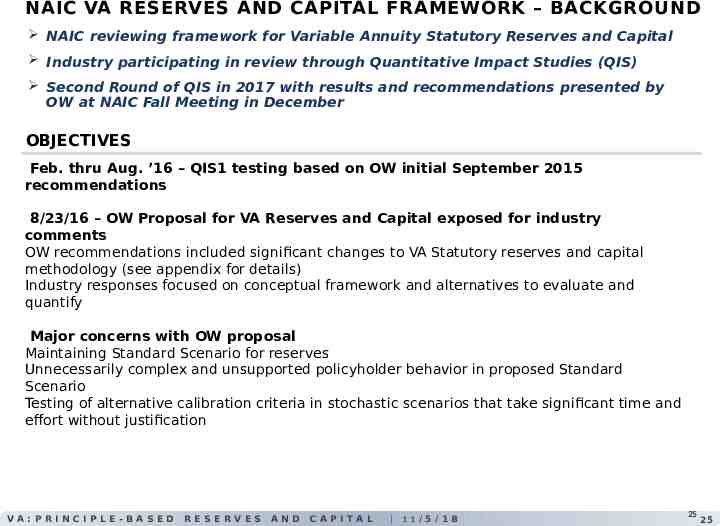

NAIC VA RESERVES AND CAPITAL FRAMEWORK – BACKGROUND NAIC reviewing framework for Variable Annuity Statutory Reserves and Capital Industry participating in review through Quantitative Impact Studies (QIS) Second Round of QIS in 2017 with results and recommendations presented by OW at NAIC Fall Meeting in December OBJECTIVES Feb. thru Aug. ’16 – QIS1 testing based on OW initial September 2015 recommendations 8/23/16 – OW Proposal for VA Reserves and Capital exposed for industry comments OW recommendations included significant changes to VA Statutory reserves and capital methodology (see appendix for details) Industry responses focused on conceptual framework and alternatives to evaluate and quantify Major concerns with OW proposal Maintaining Standard Scenario for reserves Unnecessarily complex and unsupported policyholder behavior in proposed Standard Scenario Testing of alternative calibration criteria in stochastic scenarios that take significant time and effort without justification VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 25 25

NAIC VA RESERVES AND CAPTIAL FRAMEWORK – UPDATE November 2016 NAIC and Industry reached consensus to perform 2 nd round of testing (QIS2) QIS2 scheduled Q1 ‘17 thru Q3 ’17 Provides industry opportunity for evaluation, quantification and ability to assess impacts 3-cycle iterative approach with feedback loop between OW, industry and regulators Significant discussions and modifications on major issues such as economic scenario generator and standard scenario QIS2 Objectives Allow companies to test recommended framework revisions that had not been tested in QIS1 Calibrate specific parameters that remain outstanding in OW’s 8/23/16 recommendations Evaluate modifications to OW’s recommended framework revisions based on industry feedback Test comprehensive “package”, to understand impact on company funding, hedging and other business practices Provide opportunity for remainder of VA industry that did not participate in QIS1 to understand recommendations and conduct internal financial analysis November 2017 OW recommendations to NAIC Significant regulation drafting, exposure and approvals necessary 1/1/20 earliest expected effective date (NAIC original target 1/1/17) May 2018 Final framework with 27 recommendations Adopted by VAIWG and NAIC E Committee in July VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 26 26

VA FRAMEWORK – NOTABLE ELEMENTS Align reserve and capital framework to reduce non-economic volatility in statutory capital ratios VM-20 economic scenario generator (ESG) for interest and equity returns Use of proprietary ESGs only if it increases results More guidance on discount rates and asset projection Promote hedging by aligning the market risk profile of hedge program and statutory funding requirements, and allowing for close to full reflection of hedge impact Enhance disclosures requirements Expand the scope of prescribed assumptions and set regulatory thresholds VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 27 27

VA FRAMEWORK – STANDARD SCENARIO Remove C-3 Phase II Standard Scenario (SS) Rebrand reserves SS as Standard Projection (SP) Align SP with Stochastic Amount (adjusted) Aggregate calculation with disclosure Prescribe policyholder behavior assumptions based on industry experience VAIWG decided to use SP as a minimum reserve floor rather than solely as a disclosure tool Indicated it will be looked at in 3 years VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 28 28

VA FRAMEWORK – NEXT STEPS NAIC C-3 Phase II / AG43 Subgroup Developing revisions to AG43/VM-21 and C3P2 Coordinating other implementation issues Assumption governance and scenario generators Early adoption and phase-in options are being discussed 1/1/2020 target effective date Both C3P2 and AG43 changes will apply to all inforce VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 29 29

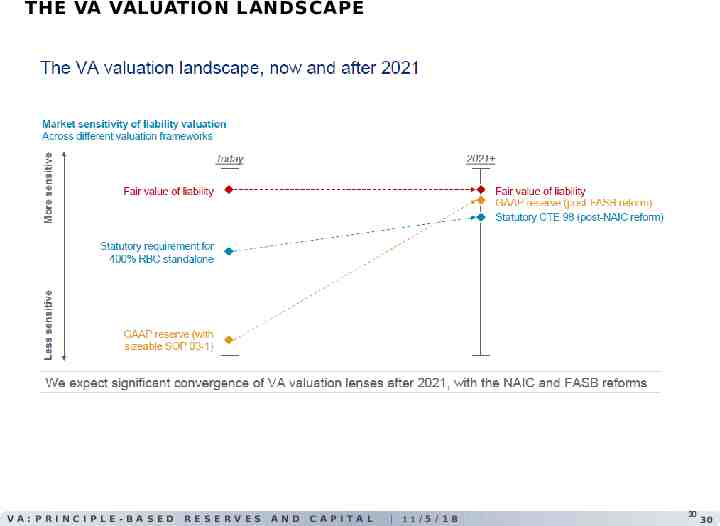

THE VA VALUATION LANDSCAPE VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 30 30

QUESTIONS ? VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 31 31

THANK YOU!!! Contact: Peter Abramovich [email protected] 949-698-8837 VA :PRINCIPLE-BASED RESERVES AND CAPITAL 11/5/18 32 32