Geneva Financial July 2019 FHA Streamline Review

24 Slides1.12 MB

Geneva Financial July 2019 FHA Streamline Review

FHA Streamline An FHA Streamline is still an FHA Product It can have reduced requirements for income/assets/appraisal Must currently have an FHA Loan to qualify Must have made 6 payments and be current Will be considered No-Cash Out Refinances

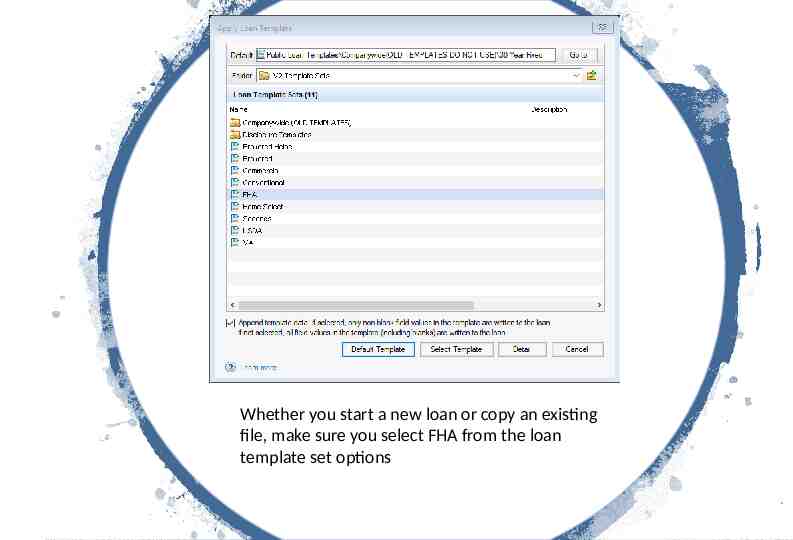

Choosing the Correct Loan Template Set

Whether you start a new loan or copy an existing file, make sure you select FHA from the loan template set options

Qualifying and NonQualifying

Non-Credit Qualifying Loan application and the HUD Addendum 92900A must be complete and fully executed by all borrowers prior to underwriting. An abbreviated version of the application is acceptable. Sections IV, V, VI and VIII (a) through VIII (k) are not required provided all other required information is captured Income and Assets are not required

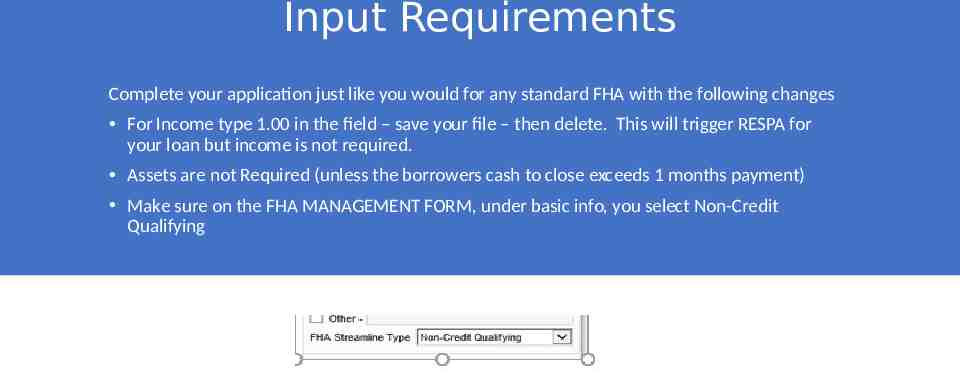

Input Requirements Complete your application just like you would for any standard FHA with the following changes For Income type 1.00 in the field – save your file – then delete. This will trigger RESPA for your loan but income is not required. Assets are not Required (unless the borrowers cash to close exceeds 1 months payment) Make sure on the FHA MANAGEMENT FORM, under basic info, you select Non-Credit Qualifying

Credit Qualifying All borrowers must credit qualify Loan application and the HUD Addendum 92900A must be complete and fully executed by all borrowers prior to underwriting. An abbreviated version of the application is not acceptable This includes Income and Assets

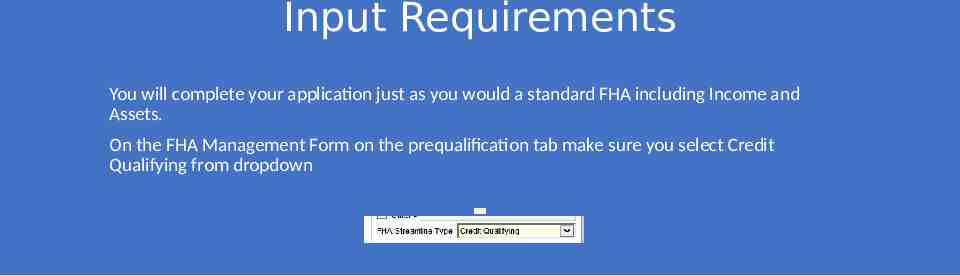

Input Requirements You will complete your application just as you would a standard FHA including Income and Assets. On the FHA Management Form on the prequalification tab make sure you select Credit Qualifying from dropdown

Benefits of Credit Qualifying? Pricing is based on the credit score and can be better in many circumstances Underwriting the credit and capacity reduces risk

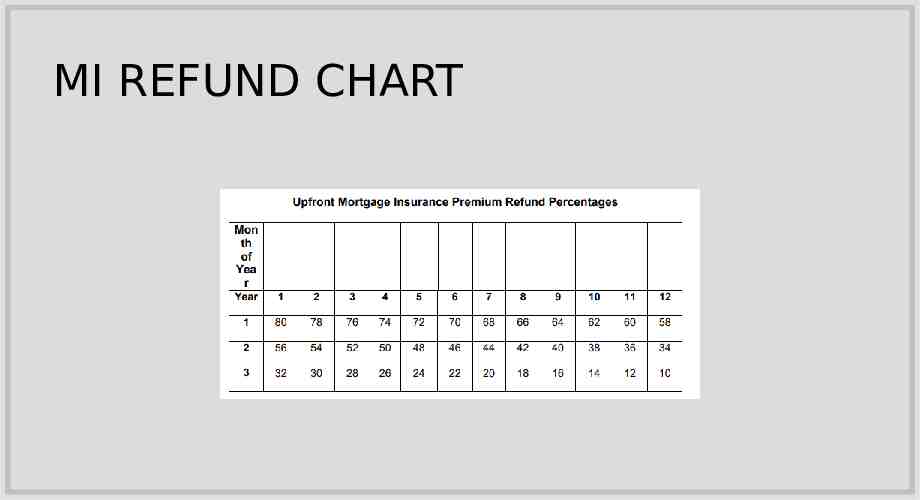

MI REFUND MI Refunds for FHA to FHA refinances are available if the previous loan was closed within the last 36 months Your Processor will pull the official refund amount from FHA Connection You can estimate the refund using the chart on the following page ***Using the chart is only an estimate. The final number will need to come from FHA.

MI REFUND CHART

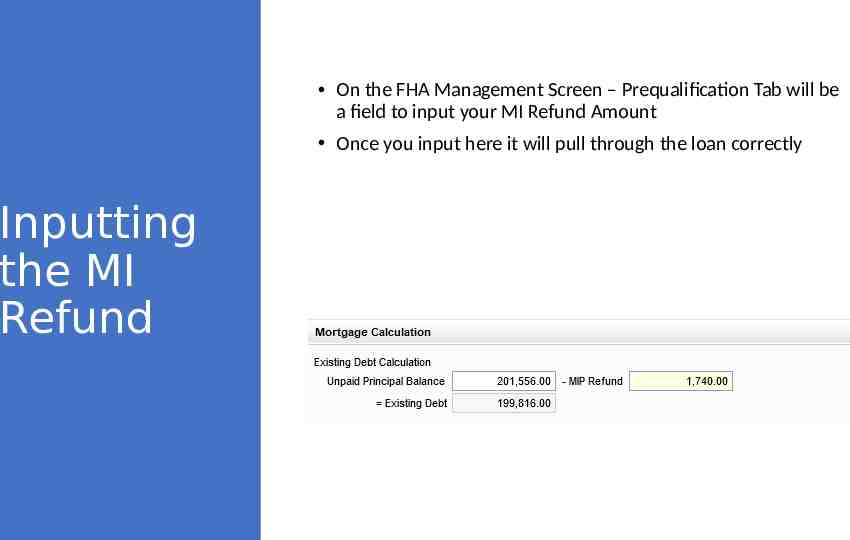

On the FHA Management Screen – Prequalification Tab will be a field to input your MI Refund Amount Once you input here it will pull through the loan correctly Inputting the MI Refund

Appraisal Options FHA Streamline

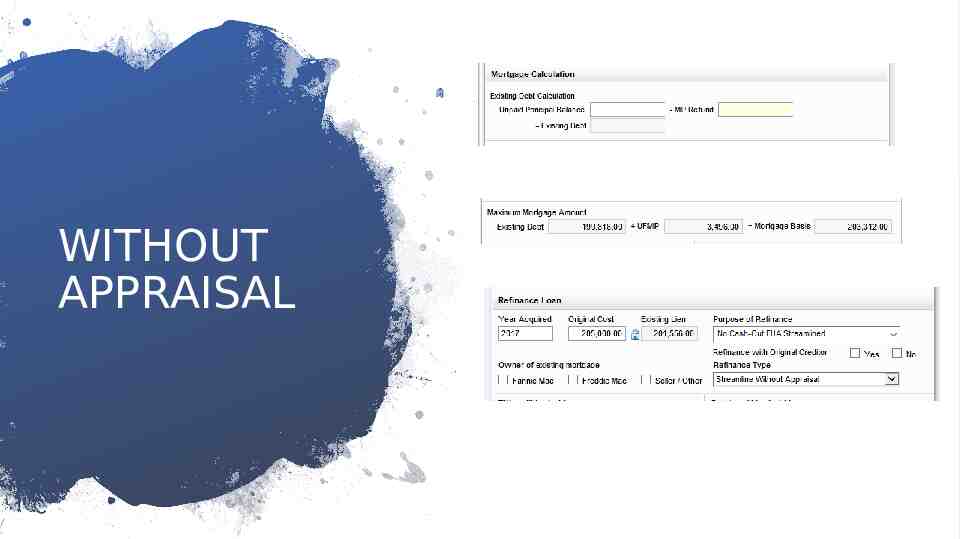

WITHOUT APPRAISAL Value will be based on the LAST appraised value as listed in FHA Connection This can affect your MI Rates

WITHOUT APPRAISAL For owner-occupied Principal Residences and HUDapproved Secondary Residences (see definition in Occupancy Section below), the maximum Base Loan Amount for Streamline Refinances is: the lesser of: the outstanding principal balance of the existing mortgage as of the month prior to mortgage disbursement; plus: interest due on the existing mortgage and MIP due on existing Mortgage; or the original principal balance of the existing mortgage (including financed UFMIP); less any refund of UFMIP (if financed in original mortgage). For Investment Properties, the maximum Base Loan Amount for Streamline Refinances is: the lesser of: the outstanding principal balance of the existing mortgage as of the month prior to mortgage Disbursement; or the original principal balance of the existing mortgage (including financed UFMIP); less any refund of UFMIP (if financed in original mortgage) There is a screen that will help calculate this

WITHOUT APPRAISAL

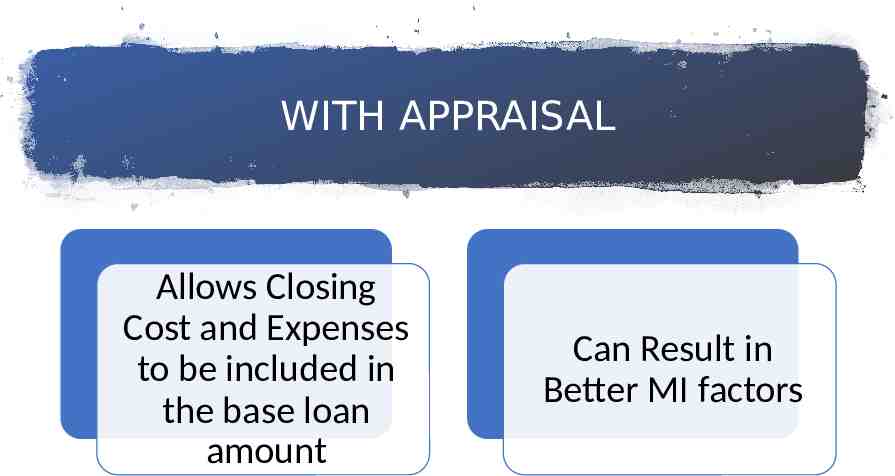

WITH APPRAISAL Allows Closing Cost and Expenses to be included in the base loan amount Can Result in Better MI factors

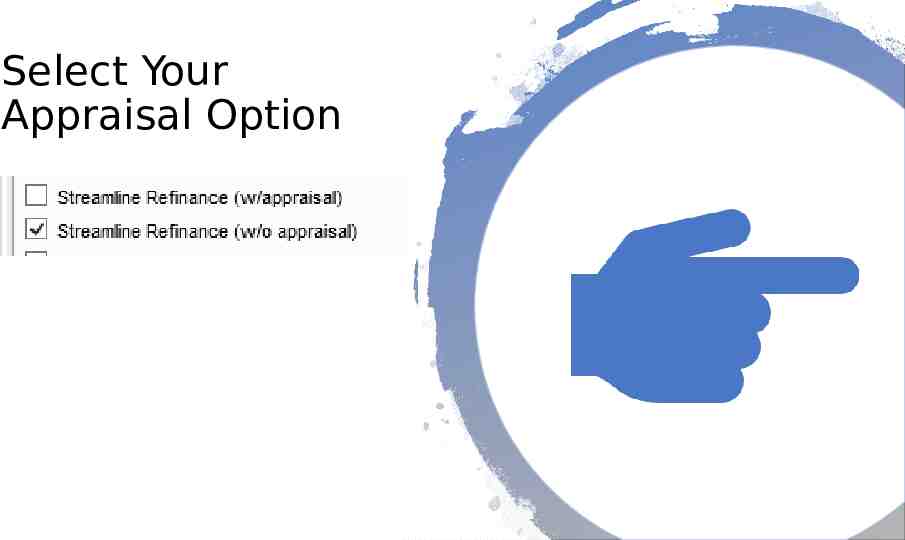

Select Your Appraisal Option

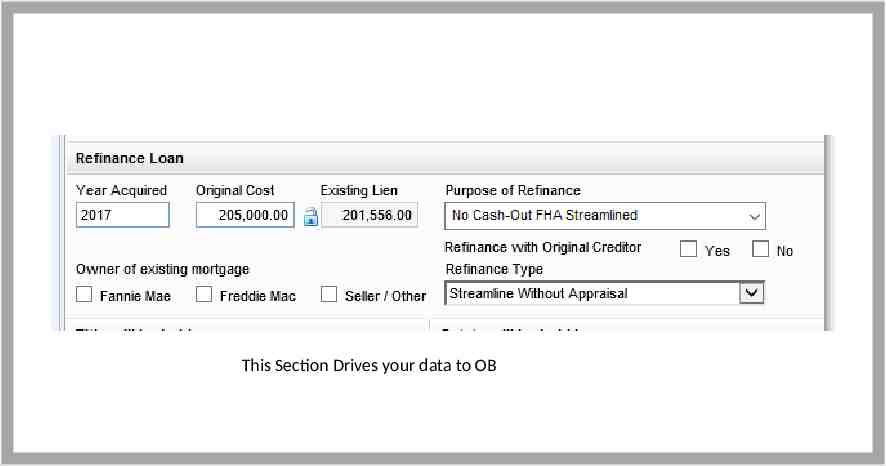

Fannie Mae Streamline 1003 Make sure you complete the following

This Section Drives your data to OB

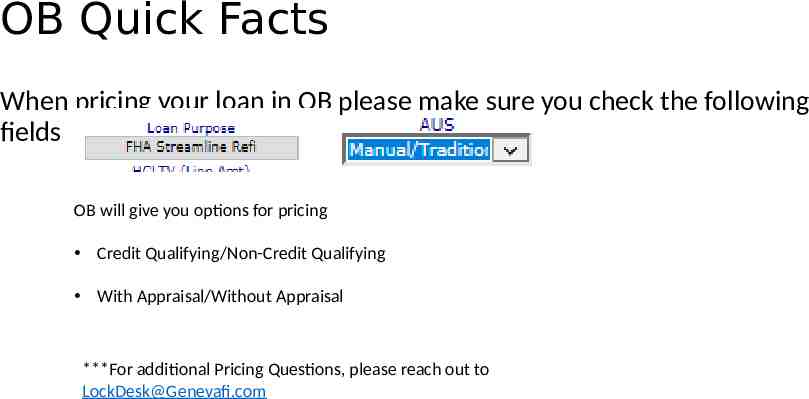

OB Quick Facts When pricing your loan in OB please make sure you check the following fields OB will give you options for pricing Credit Qualifying/Non-Credit Qualifying With Appraisal/Without Appraisal ***For additional Pricing Questions, please reach out to [email protected]

Additional Facts AUS will not be run on an FHA Streamline Refinance All loans are Manual Underwrites The borrower cannot receive more than 500 back at closing You will still pull Credit Fico Score will be used in Pricing Score Requirements still Follow Geneva Financial Product Rules ***For Additional Qualification questions please reach out to [email protected]

THE END