The Time Value of Money References: Keown, 2005, Financial Management:

79 Slides629.50 KB

The Time Value of Money References: Keown, 2005, Financial Management: Principles and Applications, 10th ed., Prentice Hall Ross, Westerfield, and Jordan, 2006, Fundamentals of Corporate Finance, 7th ed., McGraw-Hill Brigham & Houston, Fundamentals of Financial Management, 8th ed. Prepared By: Liem Pei Fun, S.E., MCom.

About me 1998-2002 Bachelor of Economics (Majoring in Finance), Petra Christian University 2004-2005 Postgraduate Diploma in Finance, The University of Melbourne 2005-2006 Master of Commerce (Finance), The University of Melbourne Pass CFA Exam Level I Bloomberg Global Product Certification – Equity Level One Head of Finance Program, Faculty of Economics, Petra Christian University

OUTLINE Future Value Single Sum Present Value Single Sum Future Value Annuities Present Value Annuities Ordinary Annuity vs Annuity Due Perpetuities Practice Problems

The Time Value of Money , Prentice Hall, Inc.

Compounding and Discounting Single Sums

We know that receiving 1 today is worth more than 1 in the future. This is due to opportunity costs. The opportunity cost of receiving 1 in the future is the interest we could have Today Future earned if we had received the 1 sooner.

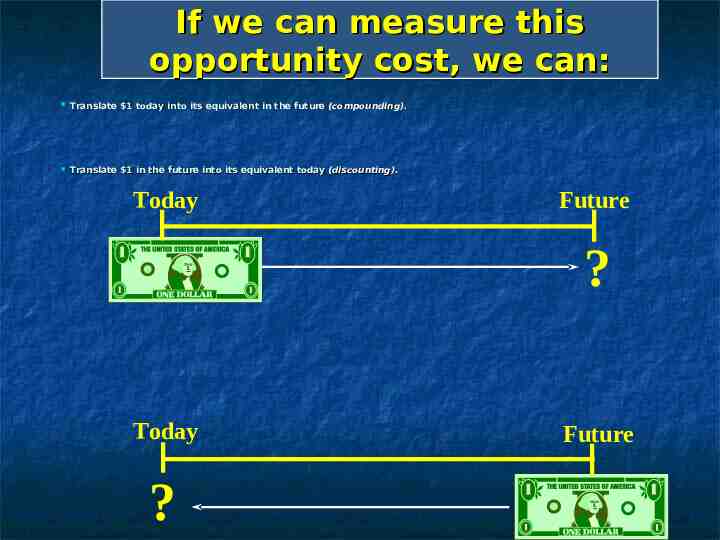

If we can measure this opportunity cost, we can: Translate 1 today into its equivalent in the future (compounding). (compounding). Translate 1 in the future into its equivalent today (discounting). (discounting). Today Future ? Today ? Future

Future Value

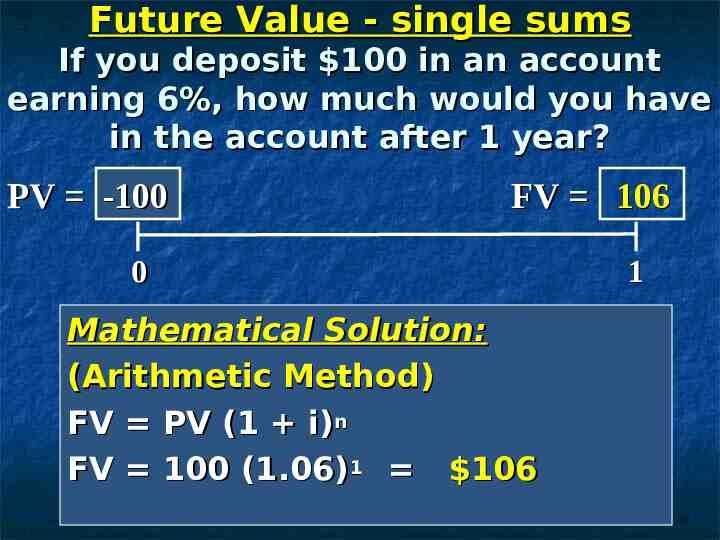

Future Value - single sums If you deposit 100 in an account earning 6%, how much would you have in the account after 1 year? PV -100 FV 106 0 Mathematical Solution: (Arithmetic Method) FV PV (1 i)n FV 100 (1.06)1 106 1

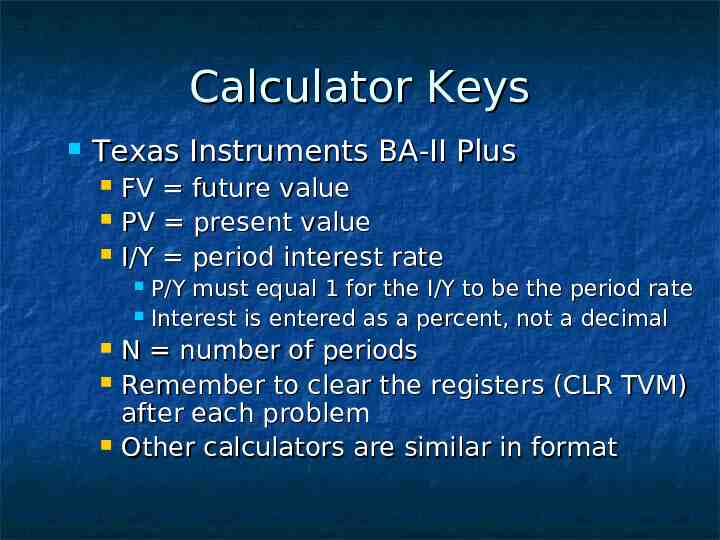

Calculator Keys Texas Instruments BA-II Plus FV future value PV present value I/Y period interest rate P/Y must equal 1 for the I/Y to be the period rate Interest is entered as a percent, not a decimal N number of periods Remember to clear the registers (CLR TVM) after each problem Other calculators are similar in format

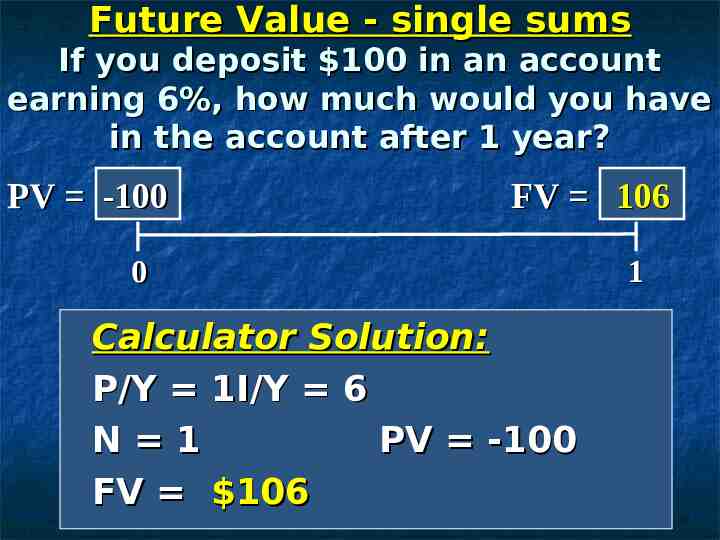

Future Value - single sums If you deposit 100 in an account earning 6%, how much would you have in the account after 1 year? PV -100 FV 106 0 Calculator Solution: P/Y 1I/Y 6 N 1 PV -100 FV 106 1

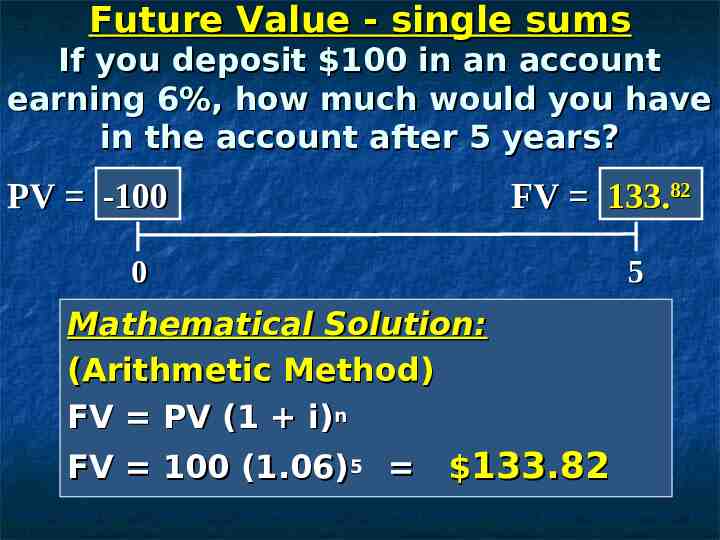

Future Value - single sums If you deposit 100 in an account earning 6%, how much would you have in the account after 5 years? PV -100 FV 133.82 0 5 Mathematical Solution: (Arithmetic Method) FV PV (1 i)n FV 100 (1.06)5 133.82

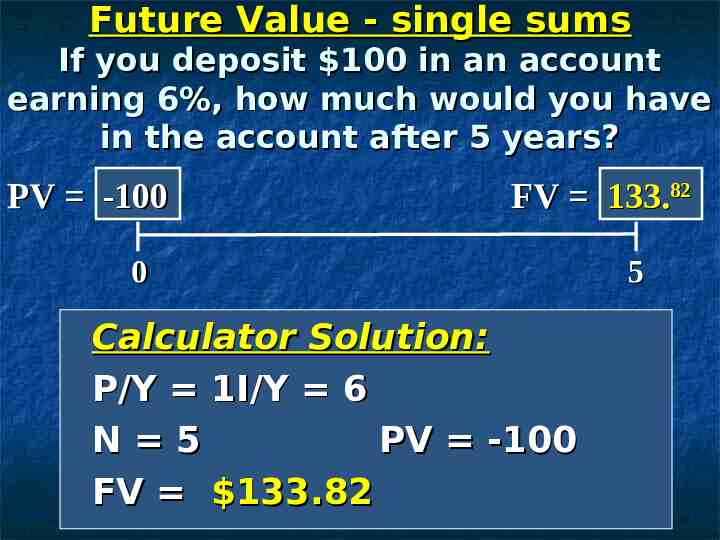

Future Value - single sums If you deposit 100 in an account earning 6%, how much would you have in the account after 5 years? PV -100 FV 133.82 0 Calculator Solution: P/Y 1I/Y 6 N 5 PV -100 FV 133.82 5

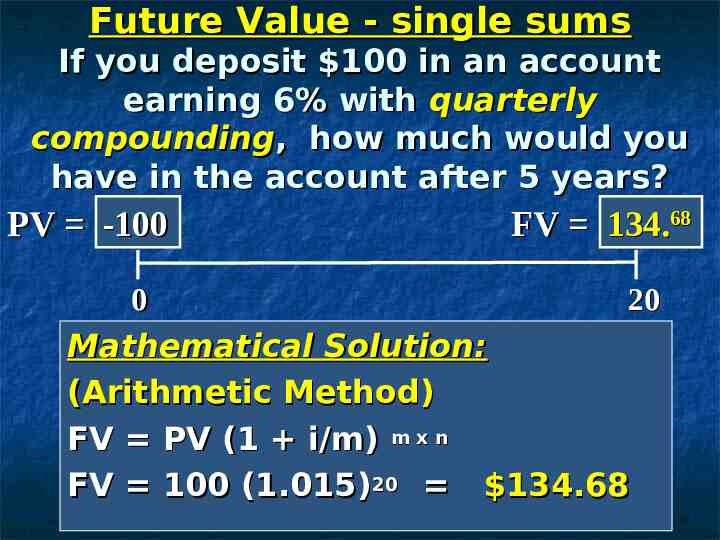

Future Value - single sums If you deposit 100 in an account earning 6% with quarterly compounding, how much would you have in the account after 5 years? PV -100 FV 134.68 0 20 Mathematical Solution: (Arithmetic Method) FV PV (1 i/m) m x n FV 100 (1.015)20 134.68

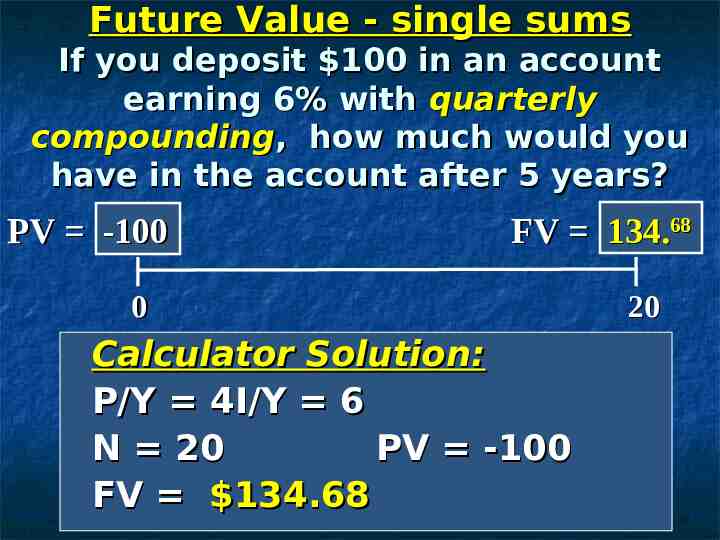

Future Value - single sums If you deposit 100 in an account earning 6% with quarterly compounding, how much would you have in the account after 5 years? PV -100 FV 134.68 0 Calculator Solution: P/Y 4I/Y 6 N 20 PV -100 FV 134.68 20

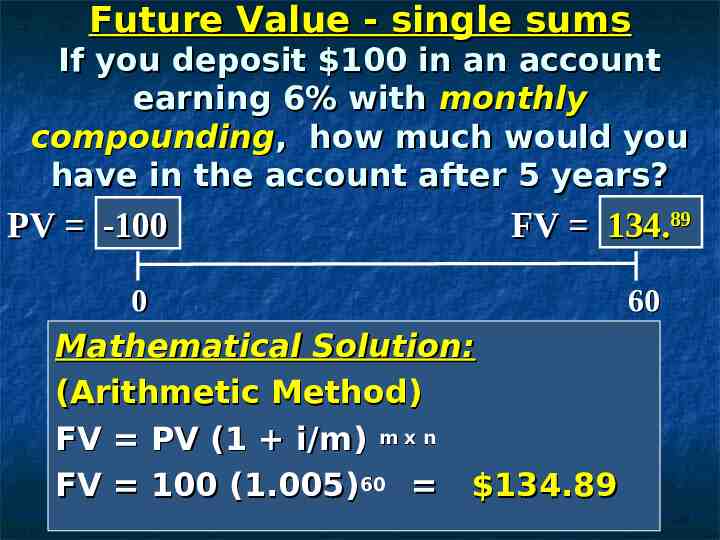

Future Value - single sums If you deposit 100 in an account earning 6% with monthly compounding, how much would you have in the account after 5 years? PV -100 FV 134.89 0 60 Mathematical Solution: (Arithmetic Method) FV PV (1 i/m) m x n FV 100 (1.005)60 134.89

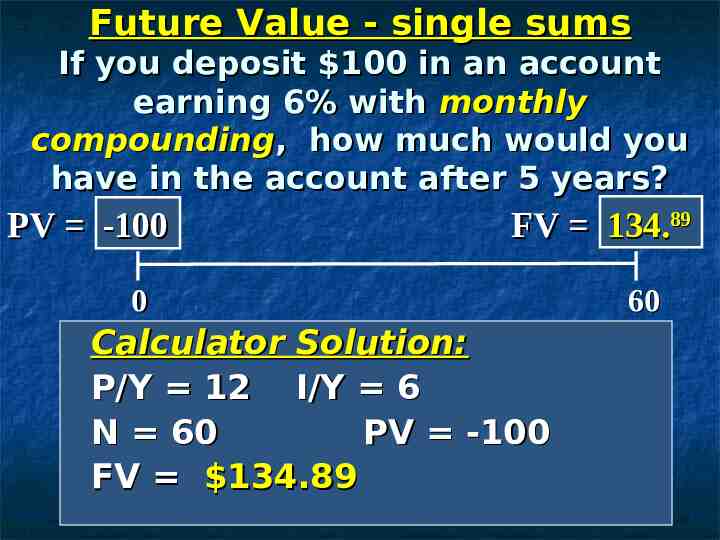

Future Value - single sums If you deposit 100 in an account earning 6% with monthly compounding, how much would you have in the account after 5 years? PV -100 FV 134.89 0 Calculator Solution: P/Y 12 I/Y 6 N 60 PV -100 FV 134.89 60

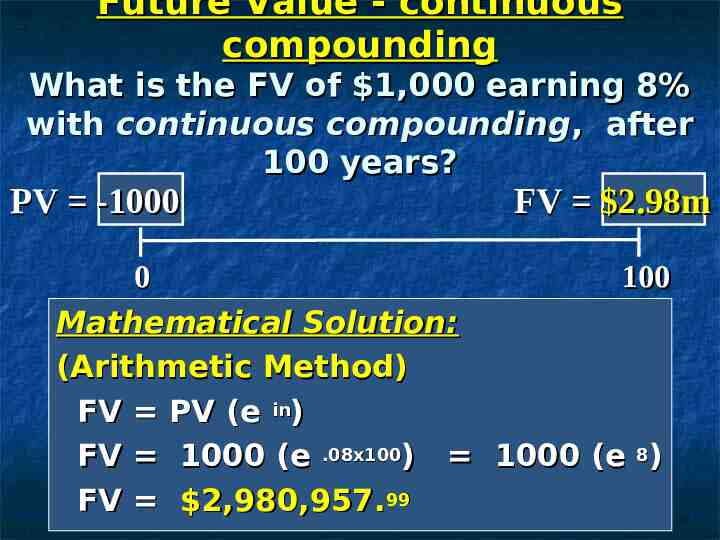

Future Value - continuous compounding What is the FV of 1,000 earning 8% with continuous compounding, after 100 years? PV -1000 FV 2.98m 0 100 Mathematical Solution: (Arithmetic Method) FV PV (e in) FV 1000 (e .08x100) 1000 (e 8) FV 2,980,957.99

Present Value

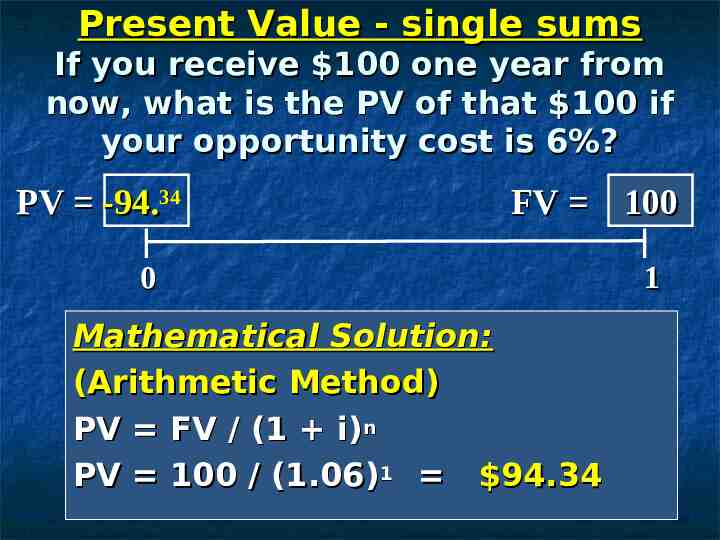

Present Value - single sums If you receive 100 one year from now, what is the PV of that 100 if your opportunity cost is 6%? PV -94.34 FV 100 0 Mathematical Solution: (Arithmetic Method) PV FV / (1 i)n PV 100 / (1.06)1 94.34 1

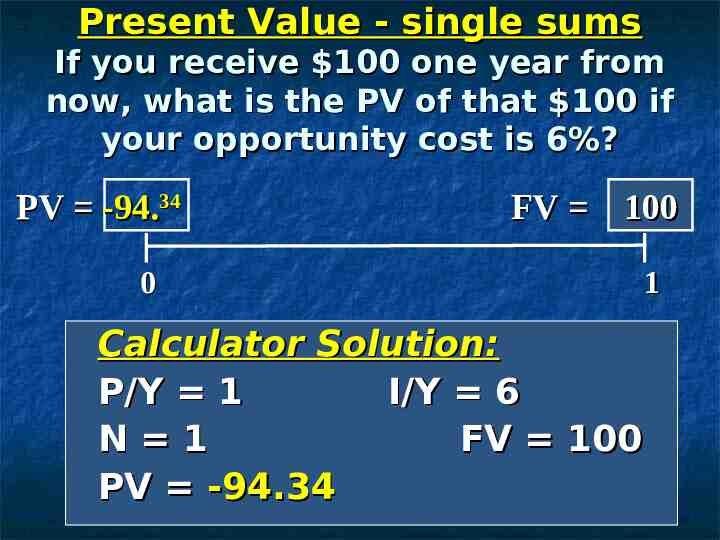

Present Value - single sums If you receive 100 one year from now, what is the PV of that 100 if your opportunity cost is 6%? PV -94.34 FV 100 0 Calculator Solution: P/Y 1 I/Y 6 N 1 FV 100 PV -94.34 1

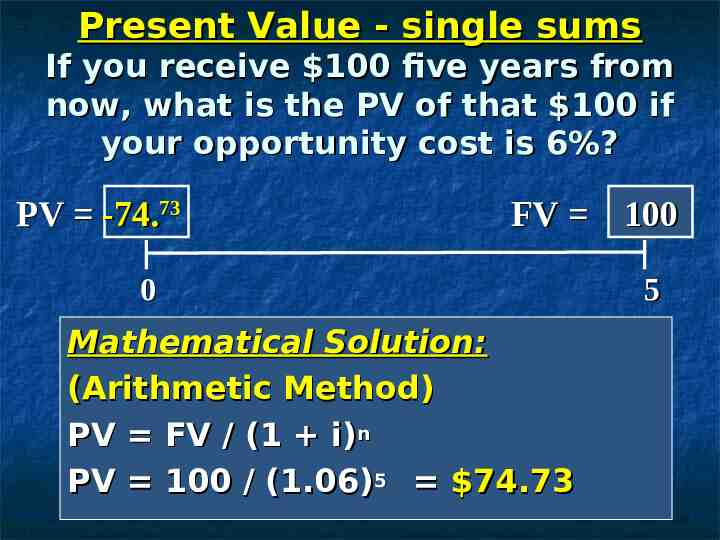

Present Value - single sums If you receive 100 five years from now, what is the PV of that 100 if your opportunity cost is 6%? PV -74.73 FV 100 0 Mathematical Solution: (Arithmetic Method) PV FV / (1 i)n PV 100 / (1.06)5 74.73 5

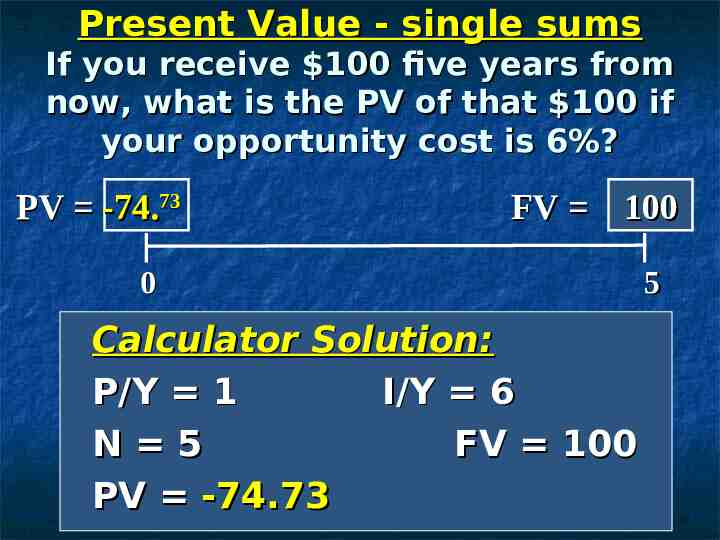

Present Value - single sums If you receive 100 five years from now, what is the PV of that 100 if your opportunity cost is 6%? PV -74.73 FV 100 0 Calculator Solution: P/Y 1 I/Y 6 N 5 FV 100 PV -74.73 5

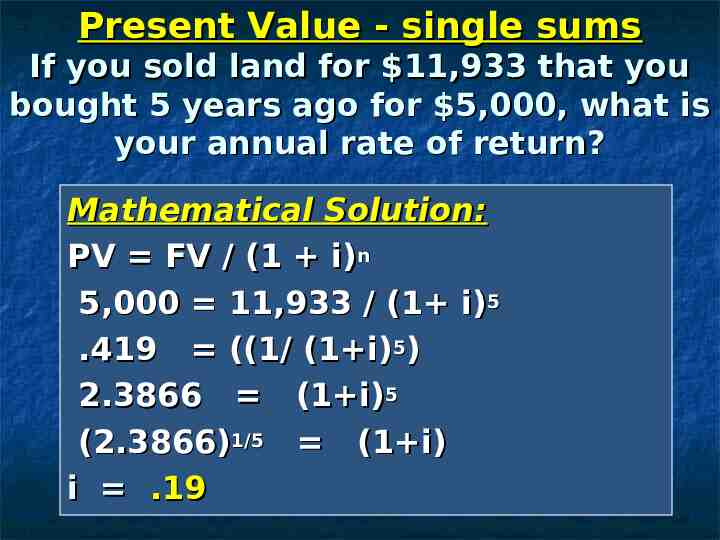

Present Value - single sums If you sold land for 11,933 that you bought 5 years ago for 5,000, what is your annual rate of return? Mathematical Solution: PV FV / (1 i)n 5,000 11,933 / (1 i)5 .419 ((1/ (1 i)5) 2.3866 (1 i)5 (2.3866)1/5 (1 i) i .19

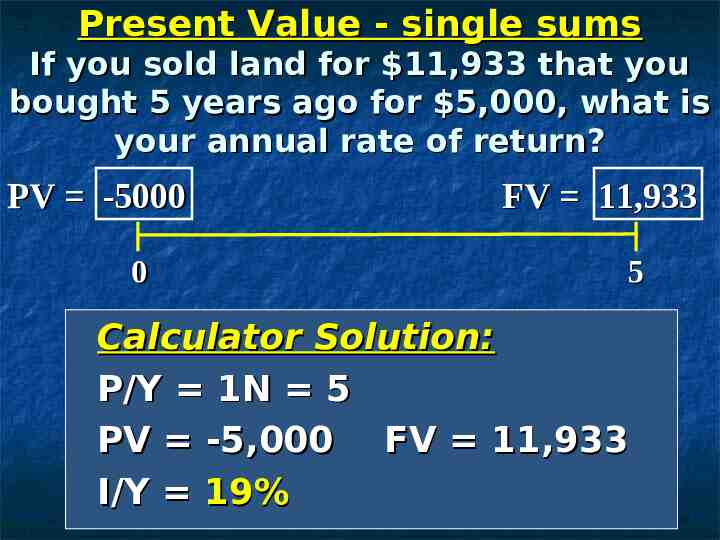

Present Value - single sums If you sold land for 11,933 that you bought 5 years ago for 5,000, what is your annual rate of return? PV -5000 0 FV 11,933 5 Calculator Solution: P/Y 1N 5 PV -5,000 FV 11,933 I/Y 19%

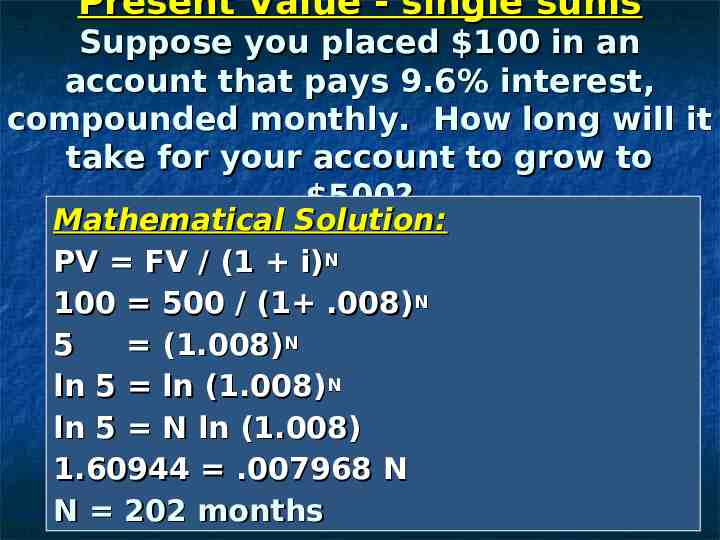

Present Value - single sums Suppose you placed 100 in an account that pays 9.6% interest, compounded monthly. How long will it take for your account to grow to 500? Mathematical Solution: PV FV / (1 i)N 100 500 / (1 .008)N 5 (1.008)N ln 5 ln (1.008)N ln 5 N ln (1.008) 1.60944 .007968 N N 202 months

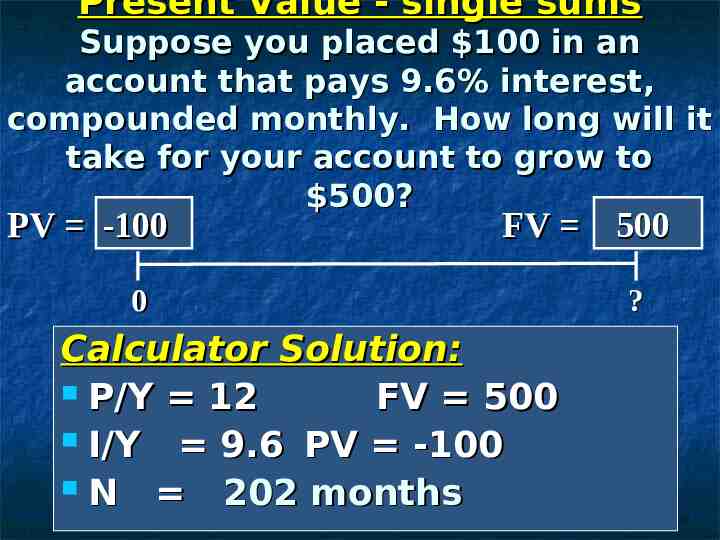

Present Value - single sums Suppose you placed 100 in an account that pays 9.6% interest, compounded monthly. How long will it take for your account to grow to 500? PV -100 FV 500 0 Calculator Solution: P/Y 12 FV 500 I/Y 9.6 PV -100 N 202 months ?

Compounding and Discounting Cash Flow Streams 0 1 2 3 4

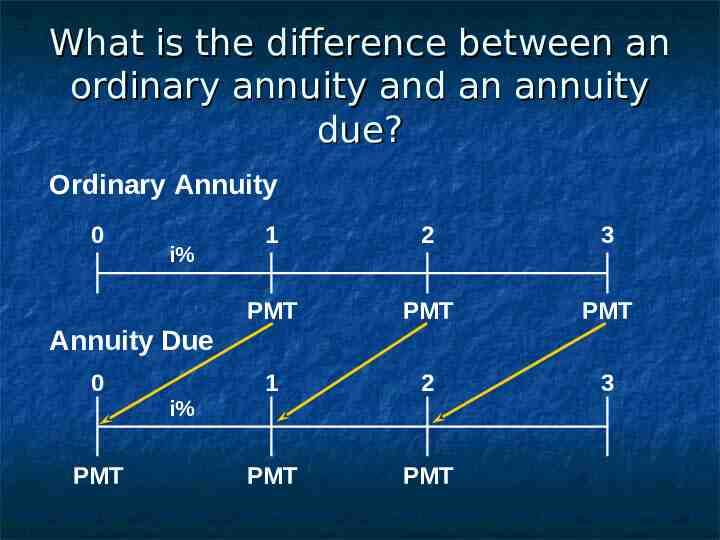

What is the difference between an ordinary annuity and an annuity due? Ordinary Annuity 0 i% Annuity Due 0 PMT i% 1 2 3 PMT PMT PMT 1 2 3 PMT PMT

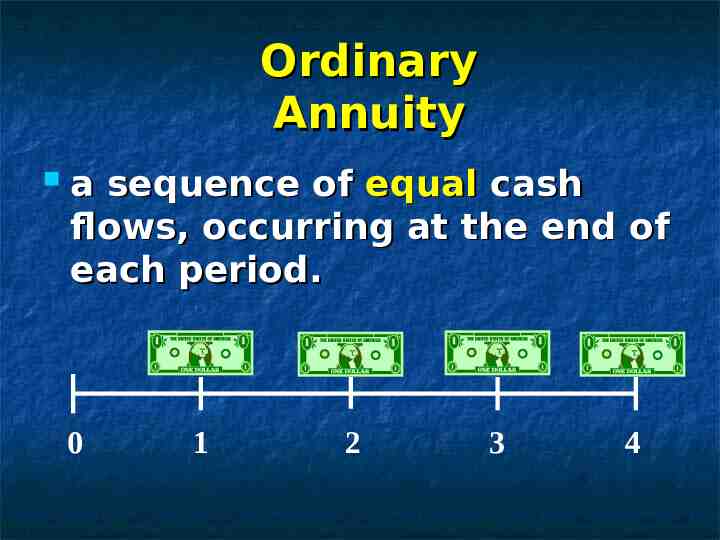

Ordinary Annuity a sequence of equal cash flows, occurring at the end of each period. 0 1 2 3 4

Examples of Annuities: If you buy a bond, you will receive equal semi-annual coupon interest payments over the life of the bond. If you borrow money to buy a house or a car, you will pay a stream of equal payments.

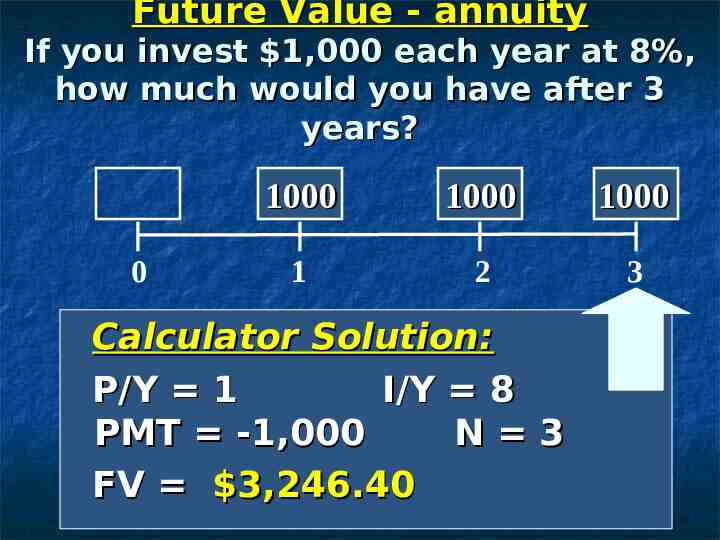

Future Value - annuity If you invest 1,000 each year at 8%, how much would you have after 3 years? 0 1 2 3

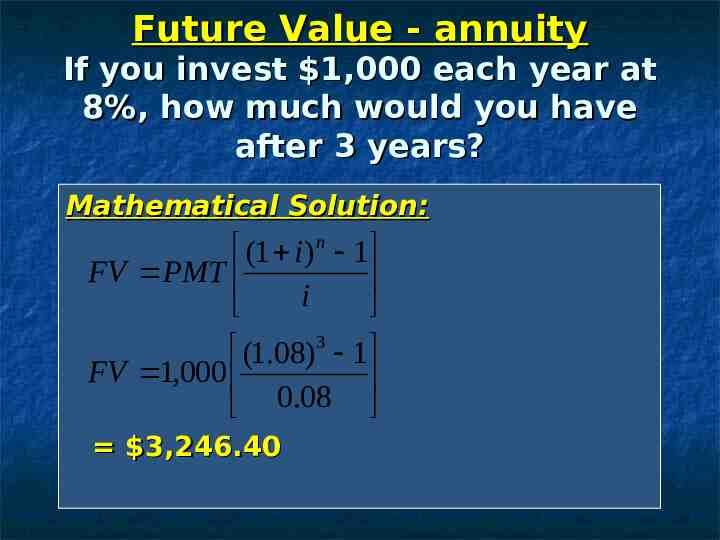

Future Value - annuity If you invest 1,000 each year at 8%, how much would you have after 3 years? Mathematical Solution: (1 i ) n 1 FV PMT i (1.08) 3 1 FV 1,000 0.08 3,246.40

Future Value - annuity If you invest 1,000 each year at 8%, how much would you have after 3 years? 0 1000 1000 1000 1 2 3 Calculator Solution: P/Y 1 I/Y 8 PMT -1,000 N 3 FV 3,246.40

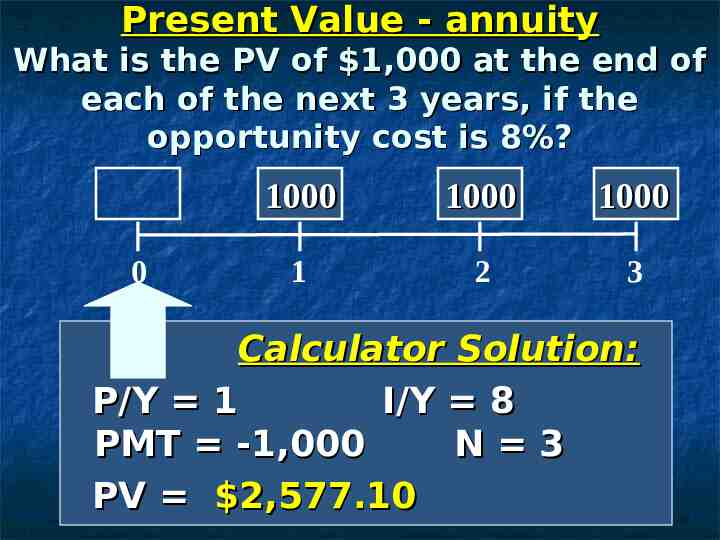

Present Value - annuity What is the PV of 1,000 at the end of each of the next 3 years, if the opportunity cost is 8%? 0 1 2 3

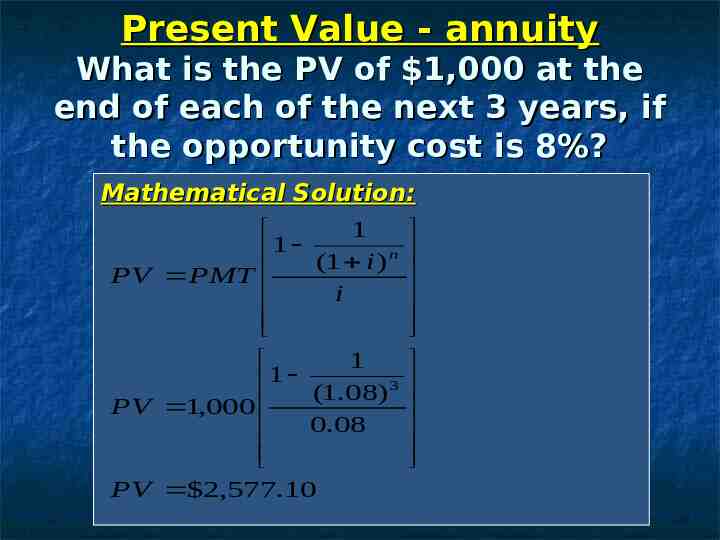

Present Value - annuity What is the PV of 1,000 at the end of each of the next 3 years, if the opportunity cost is 8%? Mathematical Solution: 1 1 (1 i ) n PV PMT i 1 1 (1.08) 3 PV 1,000 0.08 PV 2,577.10

Present Value - annuity What is the PV of 1,000 at the end of each of the next 3 years, if the opportunity cost is 8%? 0 1000 1000 1000 1 2 3 Calculator Solution: P/Y 1 I/Y 8 PMT -1,000 N 3 PV 2,577.10

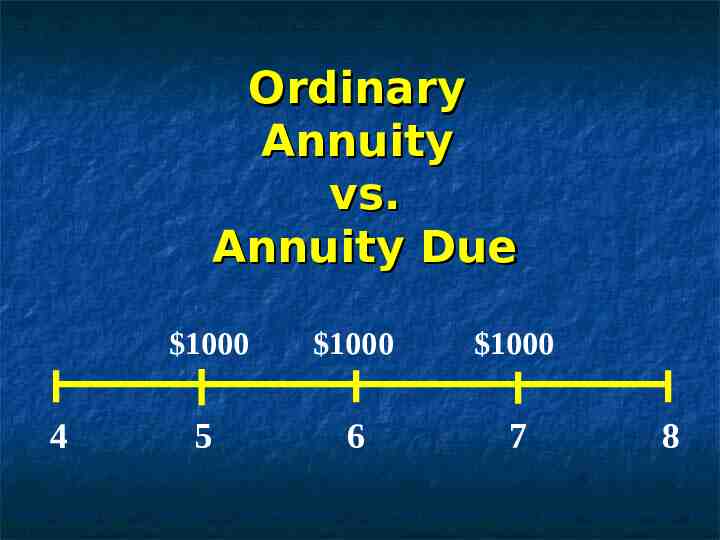

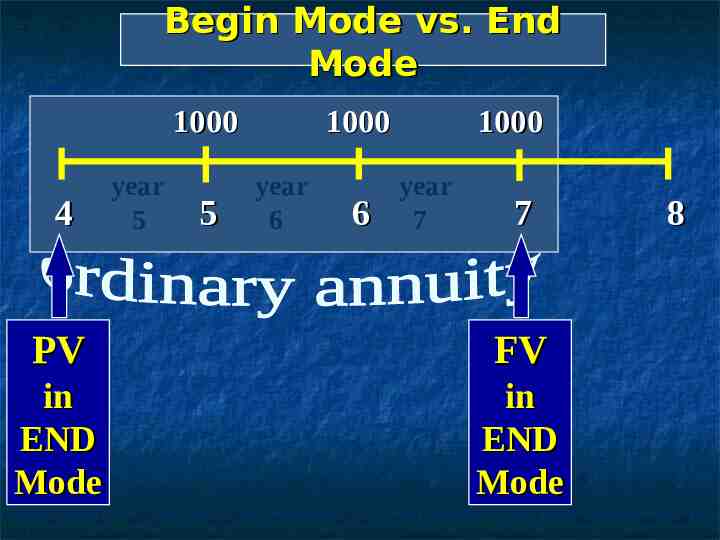

Ordinary Annuity vs. Annuity Due 4 1000 1000 1000 5 6 7 8

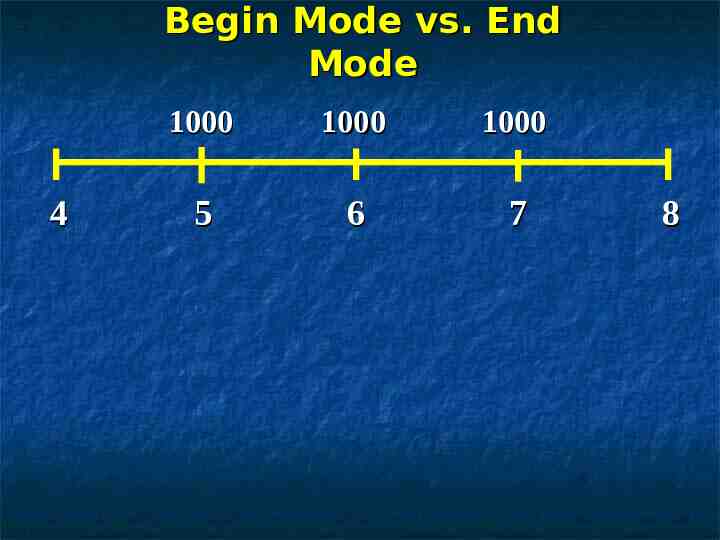

Begin Mode vs. End Mode 4 1000 1000 1000 5 6 7 8

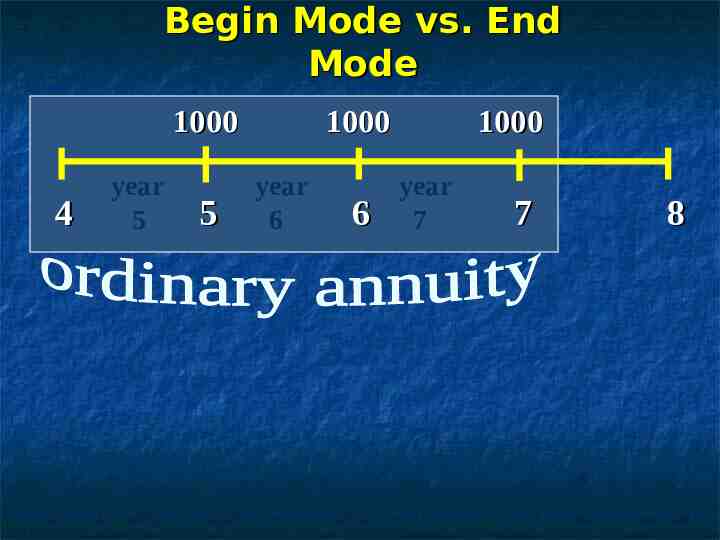

Begin Mode vs. End Mode 1000 4 year 5 5 1000 year 6 6 1000 year 7 7 8

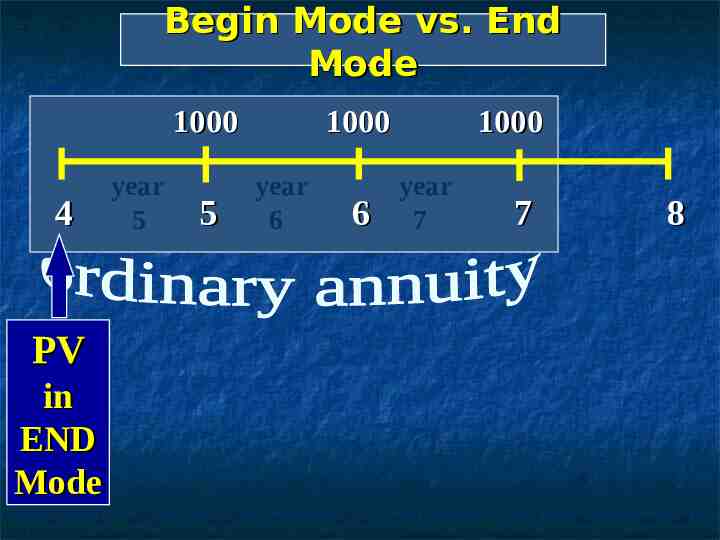

Begin Mode vs. End Mode 1000 4 PV in END Mode year 5 5 1000 year 6 6 1000 year 7 7 8

Begin Mode vs. End Mode 1000 4 year 5 5 1000 year 6 6 1000 year 7 7 PV FV in END Mode in END Mode 8

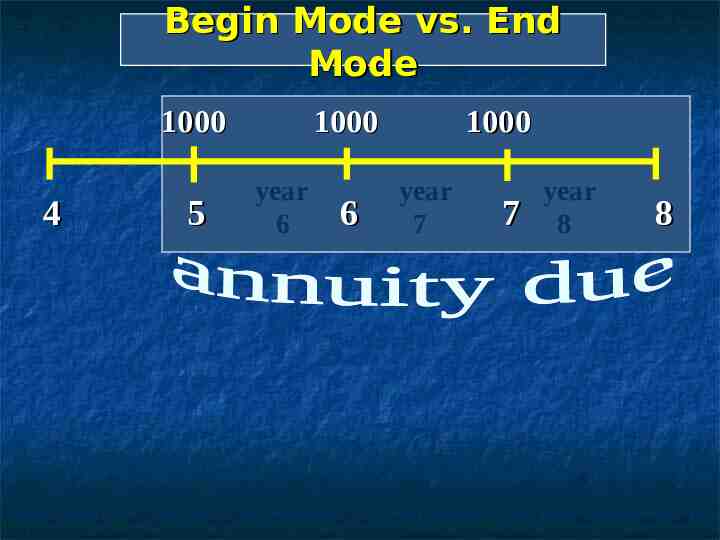

Begin Mode vs. End Mode 1000 4 5 1000 year 6 6 1000 year 7 7 year 8 8

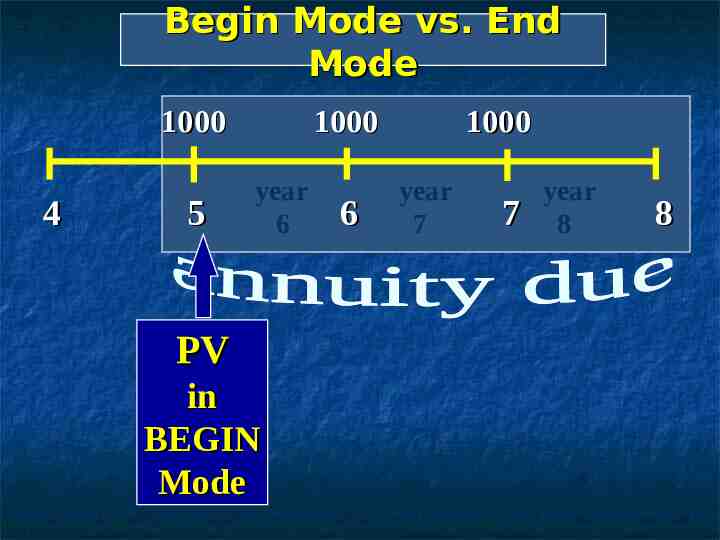

Begin Mode vs. End Mode 1000 4 5 1000 year 6 PV in BEGIN Mode 6 1000 year 7 7 year 8 8

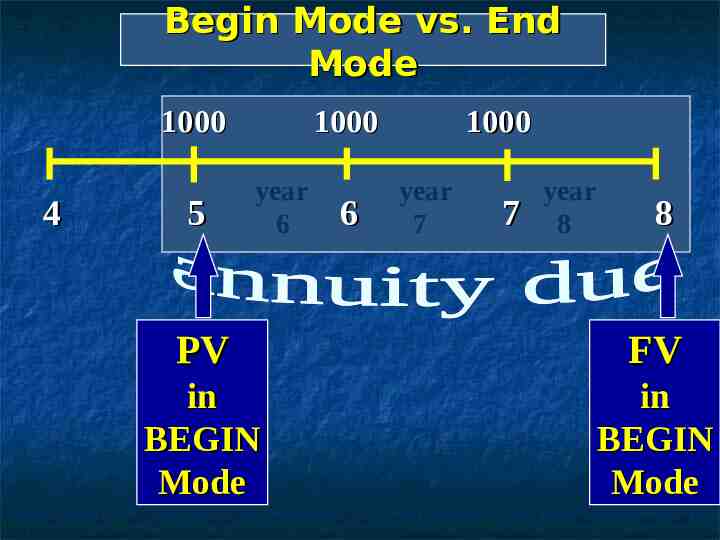

Begin Mode vs. End Mode 1000 4 5 1000 year 6 6 1000 year 7 7 year 8 8 PV FV in BEGIN Mode in BEGIN Mode

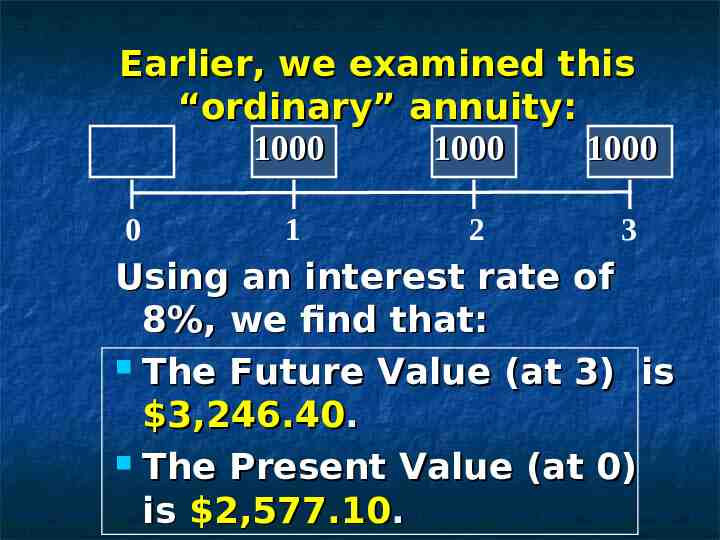

Earlier, we examined this “ordinary” annuity: 1000 1000 1000 0 1 2 3 Using an interest rate of 8%, we find that: The Future Value (at 3) is 3,246.40. The Present Value (at 0) is 2,577.10.

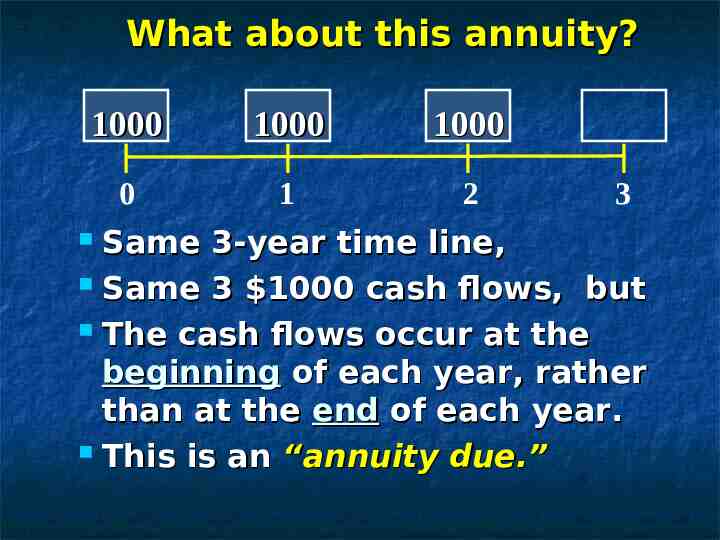

What about this annuity? 1000 1000 1000 0 1 2 3 Same 3-year time line, Same 3 1000 cash flows, but The cash flows occur at the beginning of each year, rather than at the end of each year. This is an “annuity due.”

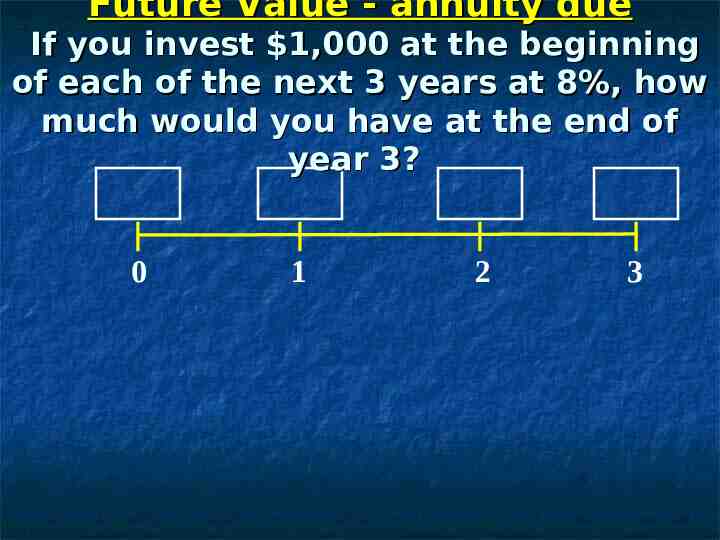

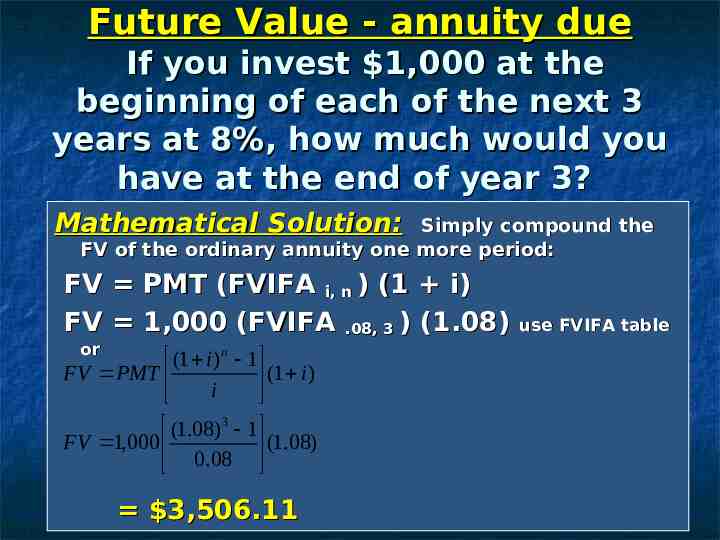

Future Value - annuity due If you invest 1,000 at the beginning of each of the next 3 years at 8%, how much would you have at the end of year 3? 0 1 2 3

Future Value - annuity due If you invest 1,000 at the beginning of each of the next 3 years at 8%, how much would you have at the end of year 3? Mathematical Solution: Simply compound the FV of the ordinary annuity one more period: FV PMT (FVIFA i, n ) (1 i) FV 1,000 (FVIFA .08, 3 ) (1.08) or (1 i ) n 1 FV PMT (1 i ) i (1.08) 3 1 FV 1,000 (1.08) 0.08 3,506.11 use FVIFA table

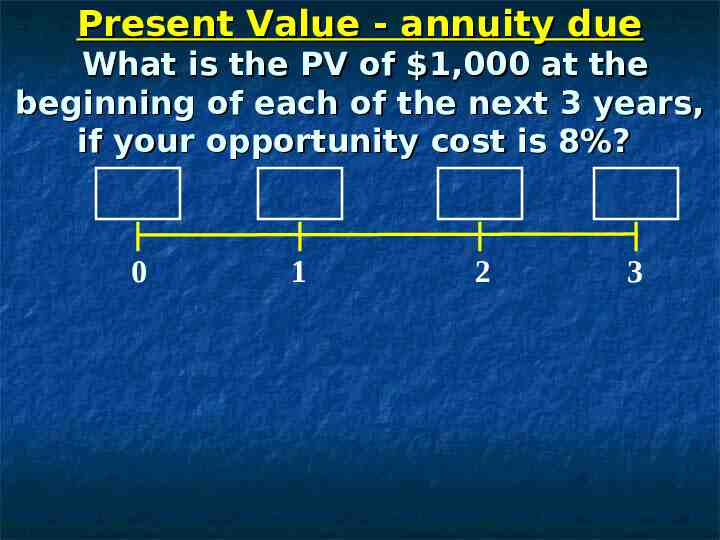

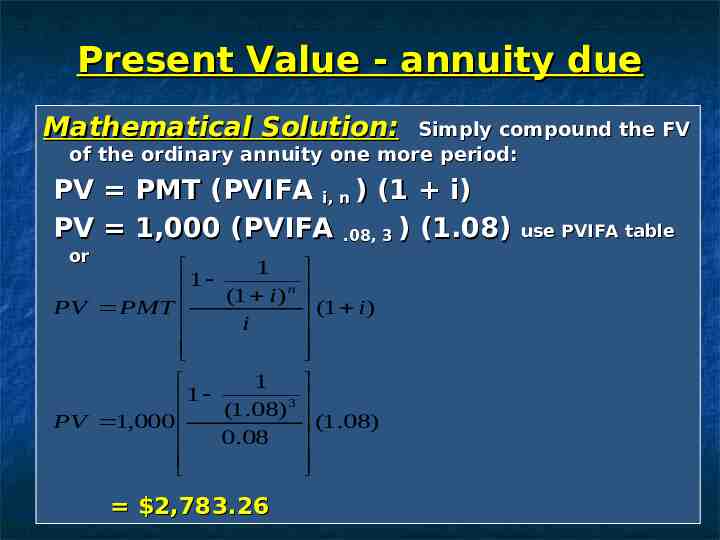

Present Value - annuity due What is the PV of 1,000 at the beginning of each of the next 3 years, if your opportunity cost is 8%? 0 1 2 3

Present Value - annuity due Mathematical Solution: Simply compound the FV of the ordinary annuity one more period: PV PMT (PVIFA i, n ) (1 i) PV 1,000 (PVIFA .08, 3 ) (1.08) use PVIFA table or 1 1 (1 i ) n PV PMT i 1 1 (1.08) 3 PV 1,000 0.08 2,783.26 (1 i ) (1.08)

Other Cash Flow Patterns 0 1 2 3

Perpetuities Suppose you will receive a fixed payment every period (month, year, etc.) forever. This is an example of a perpetuity. You can think of a perpetuity as an annuity that goes on forever.

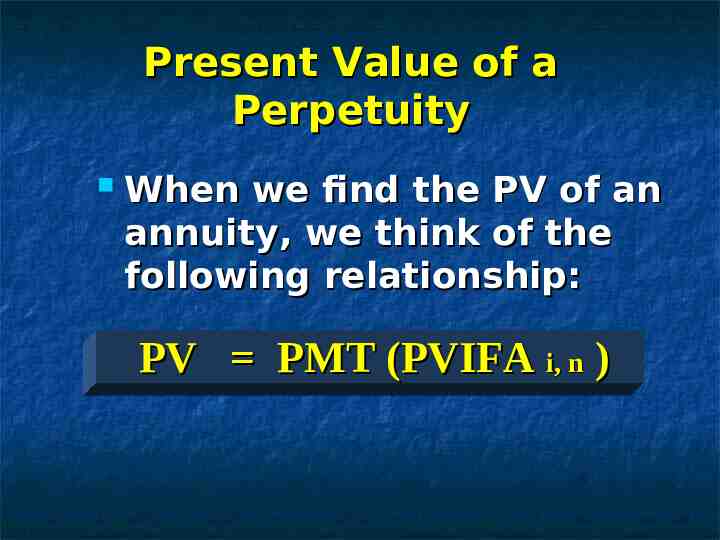

Present Value of a Perpetuity When we find the PV of an annuity, we think of the following relationship: PV PMT (PVIFA i, n )

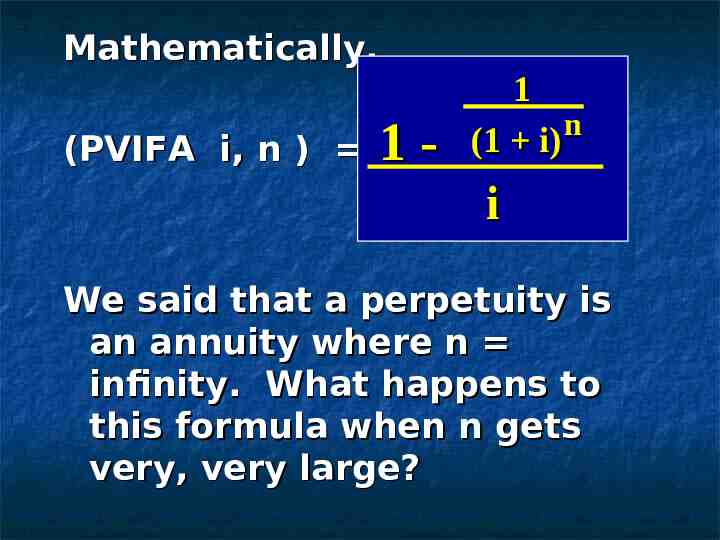

Mathematically, (PVIFA i, n ) 1- 1 n (1 i) i We said that a perpetuity is an annuity where n infinity. What happens to this formula when n gets very, very large?

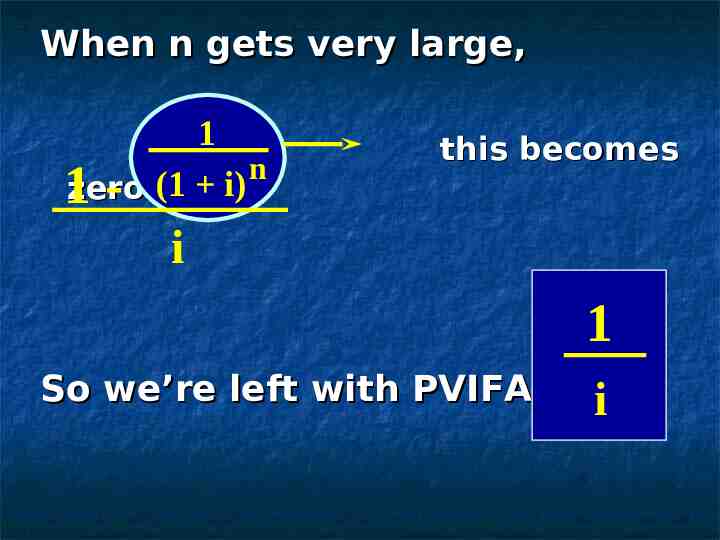

When n gets very large, 1 n 1zero. - (1 i) this becomes i 1 So we’re left with PVIFA i

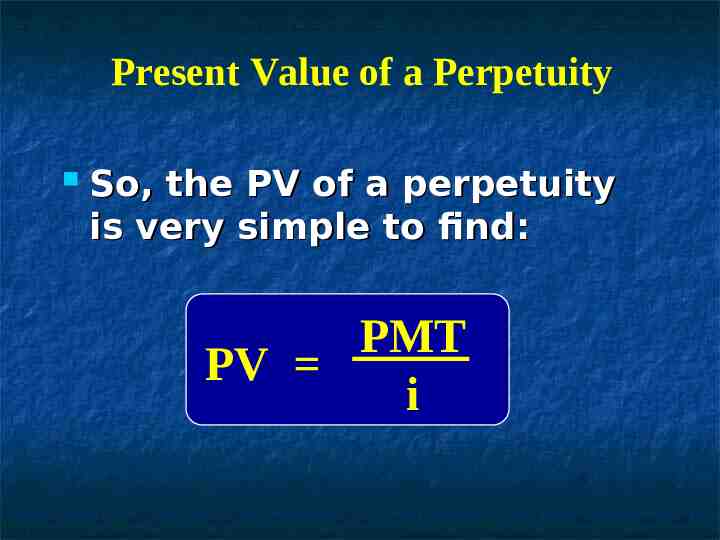

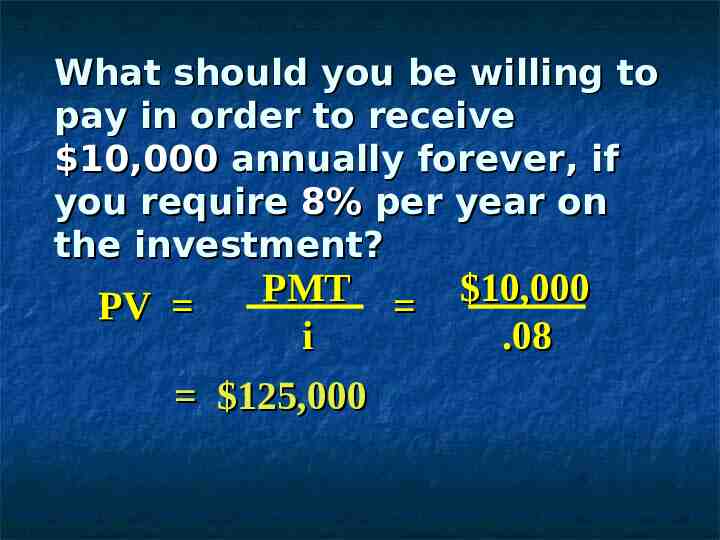

Present Value of a Perpetuity So, the PV of a perpetuity is very simple to find: PMT PV i

What should you be willing to pay in order to receive 10,000 annually forever, if you require 8% per year on the investment? PMT PV i 125,000 10,000 .08

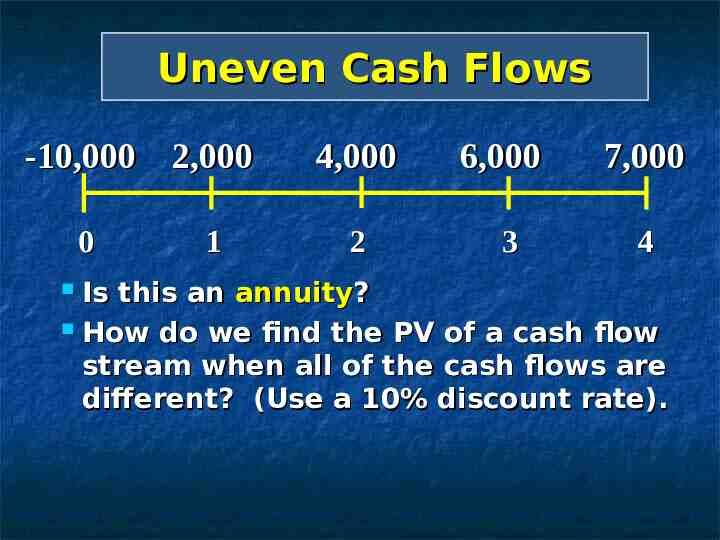

Uneven Cash Flows -10,000 2,000 0 1 4,000 6,000 7,000 2 3 4 Is this an annuity? How do we find the PV of a cash flow stream when all of the cash flows are different? (Use a 10% discount rate).

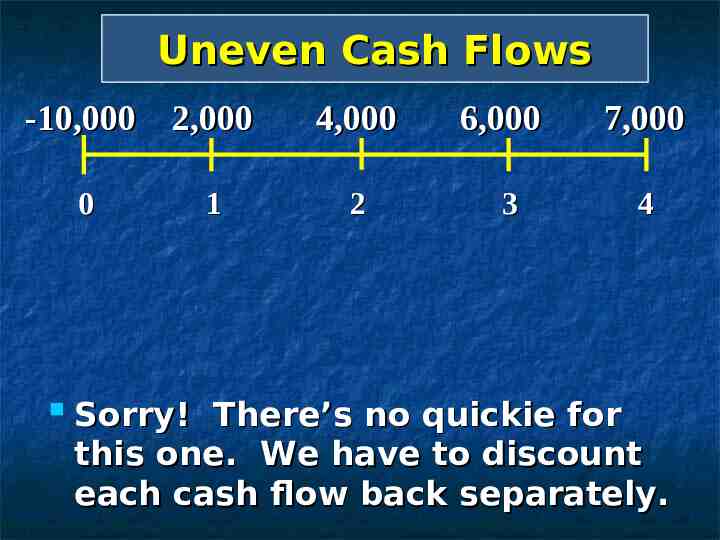

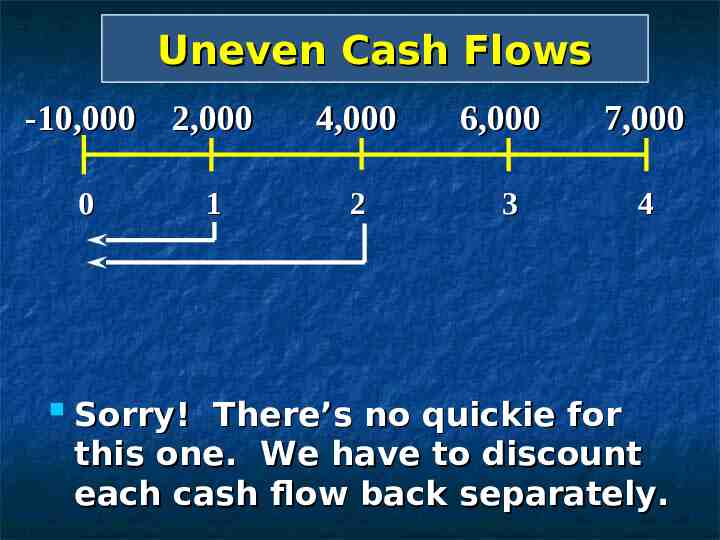

Uneven Cash Flows -10,000 2,000 0 1 4,000 6,000 7,000 2 3 4 Sorry! There’s no quickie for this one. We have to discount each cash flow back separately.

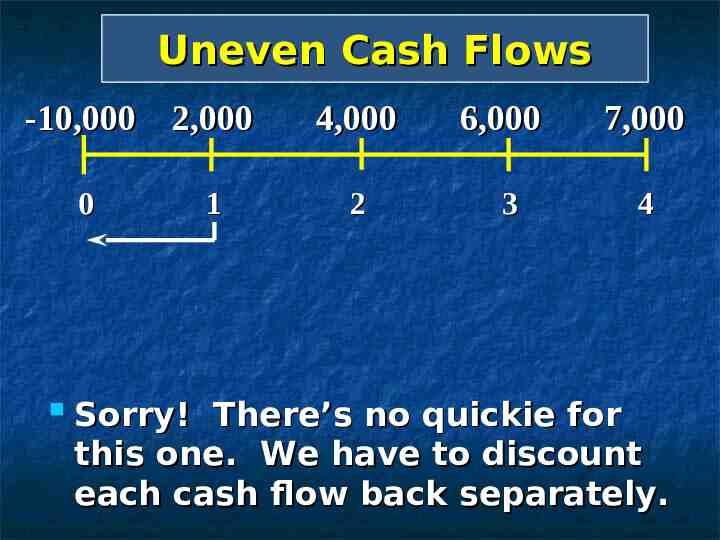

Uneven Cash Flows -10,000 2,000 0 1 4,000 6,000 7,000 2 3 4 Sorry! There’s no quickie for this one. We have to discount each cash flow back separately.

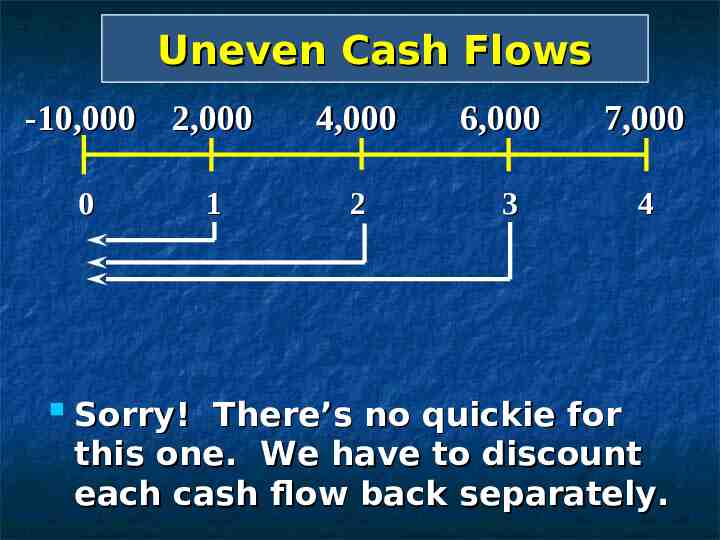

Uneven Cash Flows -10,000 2,000 0 1 4,000 6,000 7,000 2 3 4 Sorry! There’s no quickie for this one. We have to discount each cash flow back separately.

Uneven Cash Flows -10,000 2,000 0 1 4,000 6,000 7,000 2 3 4 Sorry! There’s no quickie for this one. We have to discount each cash flow back separately.

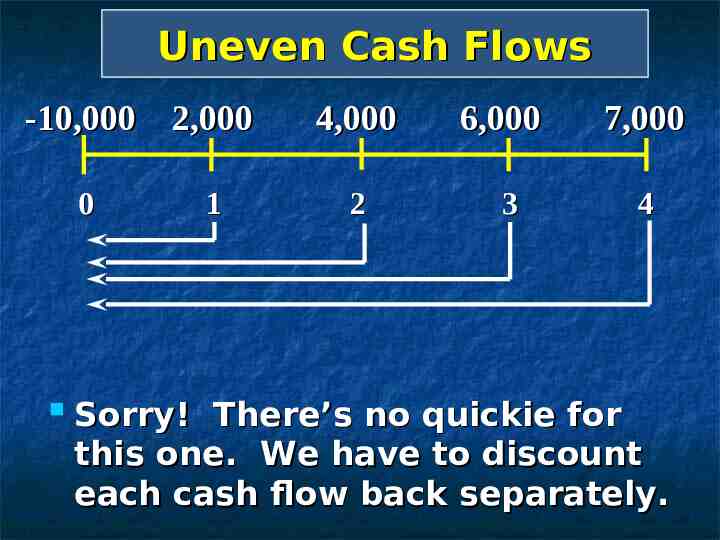

Uneven Cash Flows -10,000 2,000 0 1 4,000 6,000 7,000 2 3 4 Sorry! There’s no quickie for this one. We have to discount each cash flow back separately.

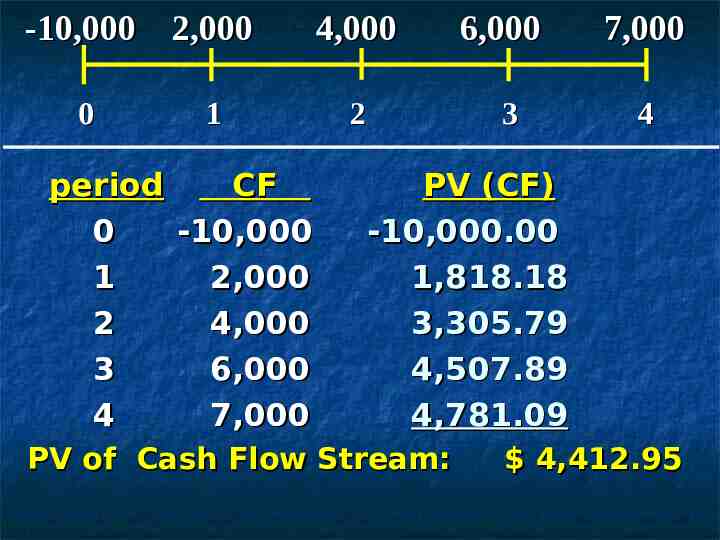

-10,000 2,000 0 1 period CF 0 -10,000 1 2,000 2 4,000 3 6,000 4 7,000 4,000 6,000 7,000 2 3 4 PV (CF) -10,000.00 1,818.18 3,305.79 4,507.89 4,781.09 PV of Cash Flow Stream: 4,412.95

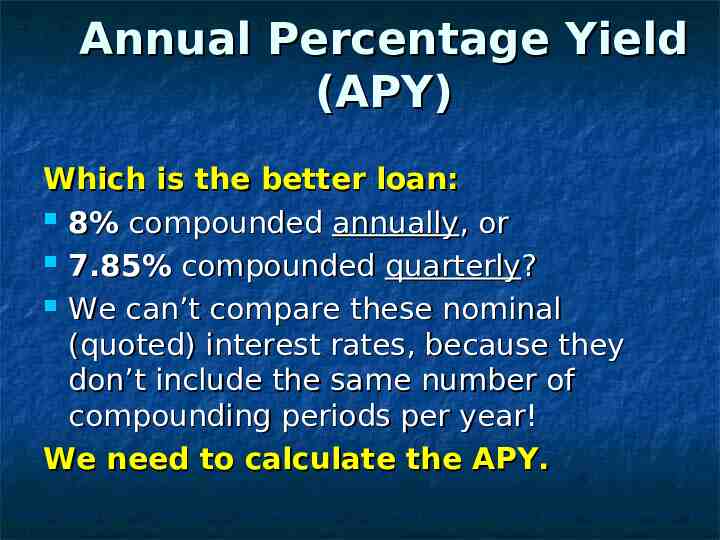

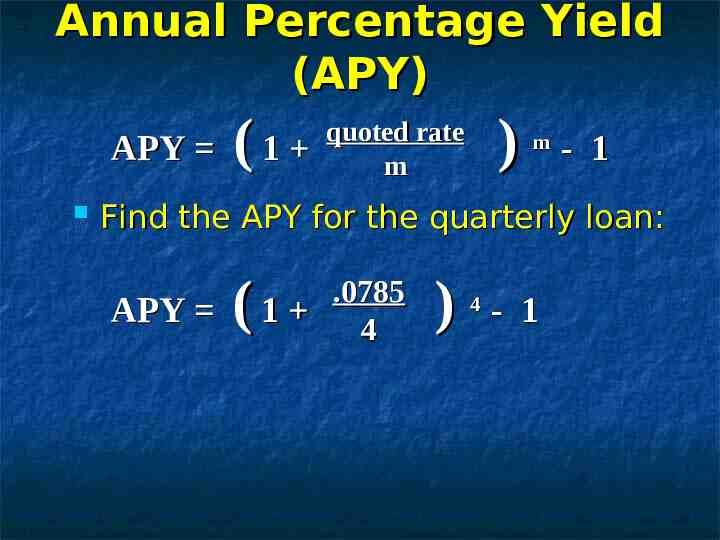

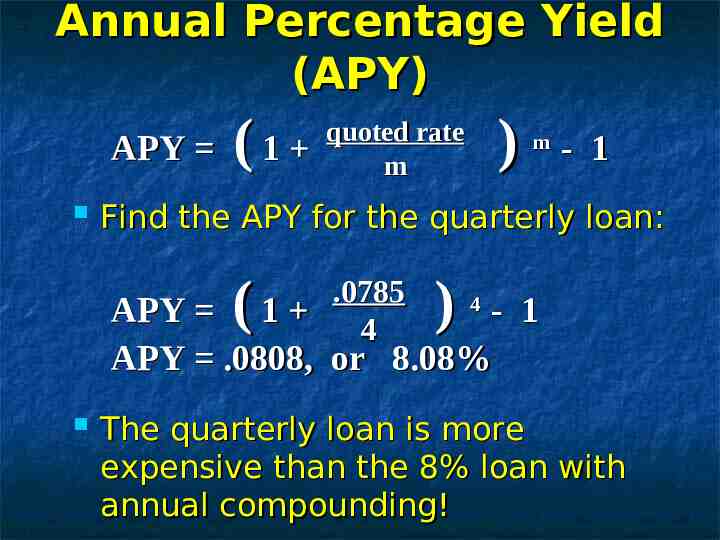

Annual Percentage Yield (APY) Which is the better loan: 8% compounded annually, or 7.85% compounded quarterly? We can’t compare these nominal (quoted) interest rates, because they don’t include the same number of compounding periods per year! We need to calculate the APY.

Annual Percentage Yield (APY)

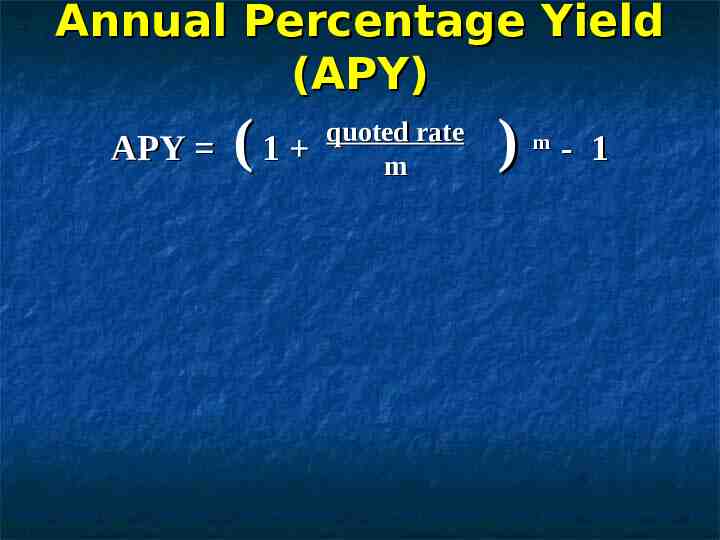

Annual Percentage Yield (APY) APY (1 quoted rate m ) m - 1

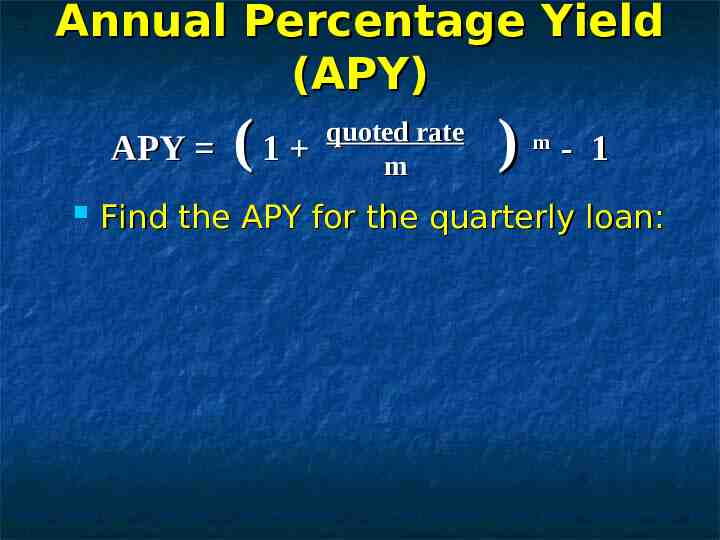

Annual Percentage Yield (APY) APY (1 quoted rate m ) m - 1 Find the APY for the quarterly loan:

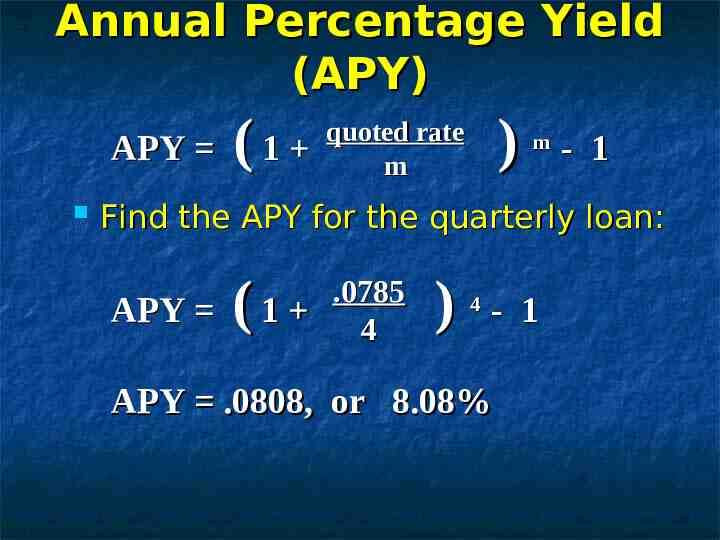

Annual Percentage Yield (APY) APY (1 ) quoted rate m m - 1 Find the APY for the quarterly loan: APY ( .0785 1 4 ) 4 - 1

Annual Percentage Yield (APY) APY (1 ) quoted rate m m - 1 Find the APY for the quarterly loan: APY ( .0785 1 4 ) 4 - 1 APY .0808, or 8.08%

Annual Percentage Yield (APY) APY (1 quoted rate m ) m - 1 Find the APY for the quarterly loan: ( .0785 1 4 ) 4 APY - 1 APY .0808, or 8.08% The quarterly loan is more expensive than the 8% loan with annual compounding!

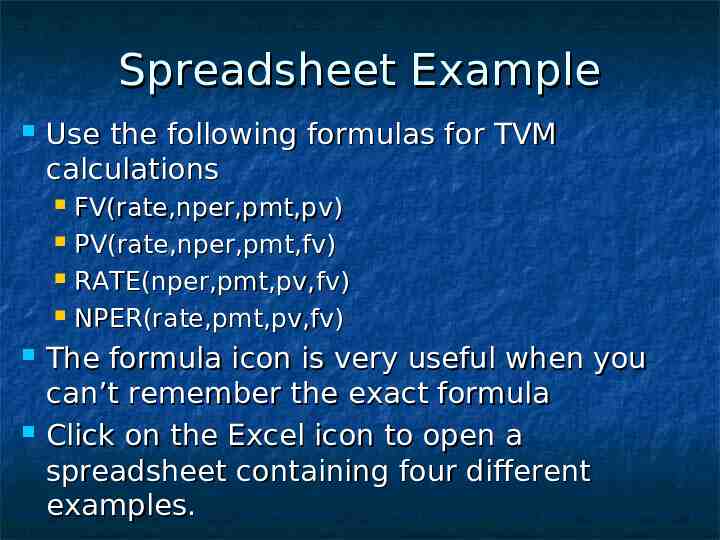

Spreadsheet Example Use the following formulas for TVM calculations FV(rate,nper,pmt,pv) PV(rate,nper,pmt,fv) RATE(nper,pmt,pv,fv) NPER(rate,pmt,pv,fv) The formula icon is very useful when you can’t remember the exact formula Click on the Excel icon to open a spreadsheet containing four different examples.

Practice Problems , Prentice Hall, Inc.

Example Cash flows from an investment are expected to be 40,000 per year at the end of years 4, 5, 6, 7, and 8. If you require a 20% rate of return, what is the PV of these cash flows?

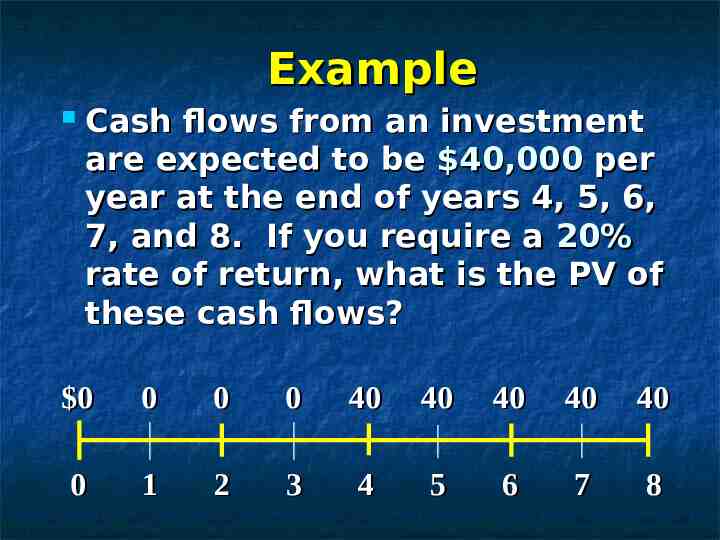

Example Cash flows from an investment are expected to be 40,000 per year at the end of years 4, 5, 6, 7, and 8. If you require a 20% rate of return, what is the PV of these cash flows? 0 0 0 0 40 40 40 40 40 0 1 2 3 4 5 6 7 8

Retirement Example If you invest 400 at the end of each month for the next 30 years at 12%, how much would you have at the end of year 30?

House Payment Example If you borrow 100,000 at 7% fixed interest for 30 years in order to buy a house, what will be your monthly house payment?

Example Baim ingin menabung untuk biaya wisata keluar negeri. Bajuri ingin keluar negeri pada akhir tahun 2012. Ia ingin memulai tabungan ini pada awal tahun 2008. Biaya yang diperlukan untuk keluar negeri adalah Rp. 150.000.000,-. Berapakah yang harus ditabung oleh Baim bila ia ingin menabung sekali saja pada awal tahun 2008 bila suku bunga adalah 15 % ? Berapakah yang harus ditabung Baim bila ia ingin menabung setiap awal tahun mulai tahun 2008 hingga tahun 2012, asumsi suku bunga 15 % ?