Republic Act No. 9504 AN ACT AMENDING SECTIONS 22, 24, 34, 35, 51 AND

38 Slides1.38 MB

Republic Act No. 9504 AN ACT AMENDING SECTIONS 22, 24, 34, 35, 51 AND 79 OF RA 8424, AS AMENDED, OTHERWISE KNOWN AS THE NATIONAL INTERNAL REVENUE CODE OF 1997

Effectivity Clause The act shall take effect 15 days following its publication in the Official Gazette or in at least two (2) newspaper of General Circulation It was approved by GMA on June 17, 2008 It was published on June 21, 2008 in Malaya and Manila Bulletin Date of Effectivity: July 06, 2008

Compensation Income Defined Compensation means all remuneration for services performed by an employee for his employer under an employee-employer relationship unless exempted by the Code.

Exemptions from withholding tax on compensation 1. Remunerations received as an incident of employment (retirement/separation) 2. Remuneration paid for agricultural labor 3. Remuneration for domestic services 4. Remuneration for casual labor not in the course of an employer’s trade or business

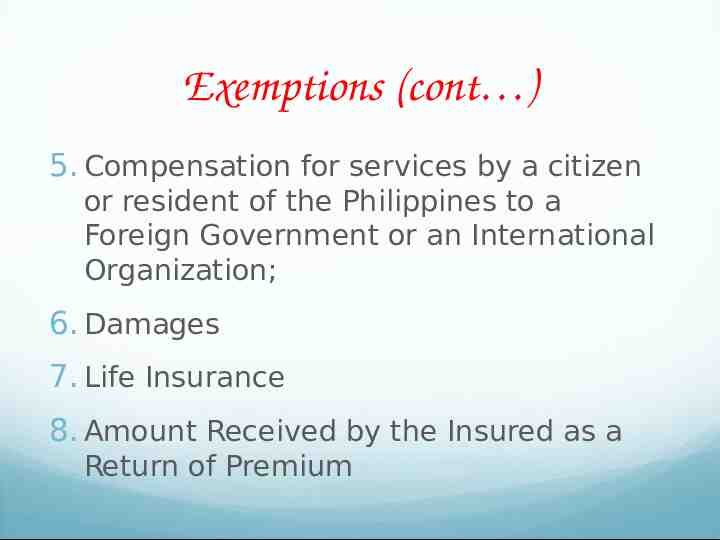

Exemptions (cont ) 5. Compensation for services by a citizen or resident of the Philippines to a Foreign Government or an International Organization; 6. Damages 7. Life Insurance 8. Amount Received by the Insured as a Return of Premium

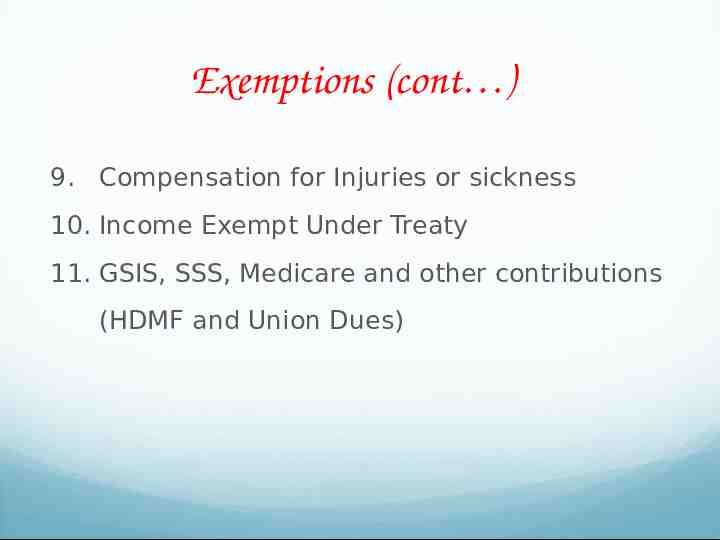

Exemptions (cont ) 9. Compensation for Injuries or sickness 10. Income Exempt Under Treaty 11. GSIS, SSS, Medicare and other contributions (HDMF and Union Dues)

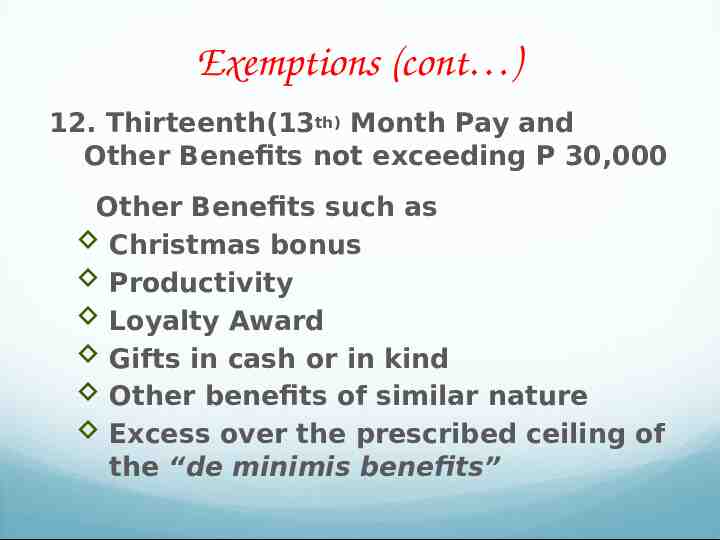

Exemptions (cont ) 12. Thirteenth(13th) Month Pay and Other Benefits not exceeding P 30,000 Other Benefits such as Christmas bonus Productivity Loyalty Award Gifts in cash or in kind Other benefits of similar nature Excess over the prescribed ceiling of the “de minimis benefits”

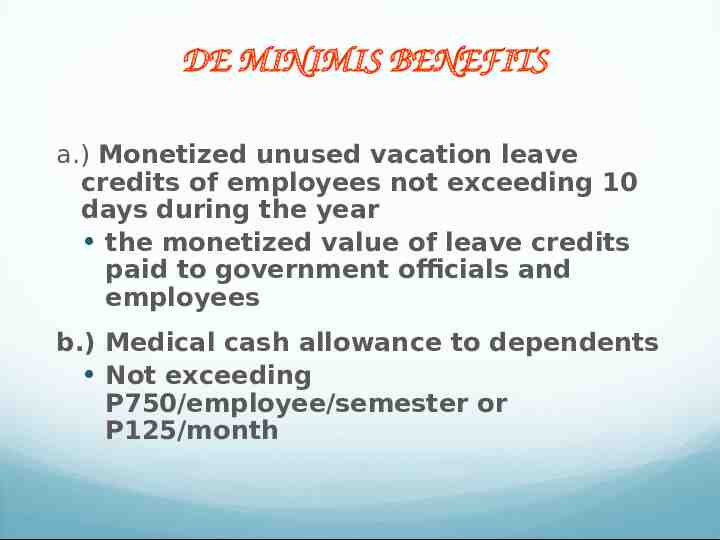

DE MINIMIS BENEFITS a.) Monetized unused vacation leave credits of employees not exceeding 10 days during the year the monetized value of leave credits paid to government officials and employees b.) Medical cash allowance to dependents Not exceeding P750/employee/semester or P125/month

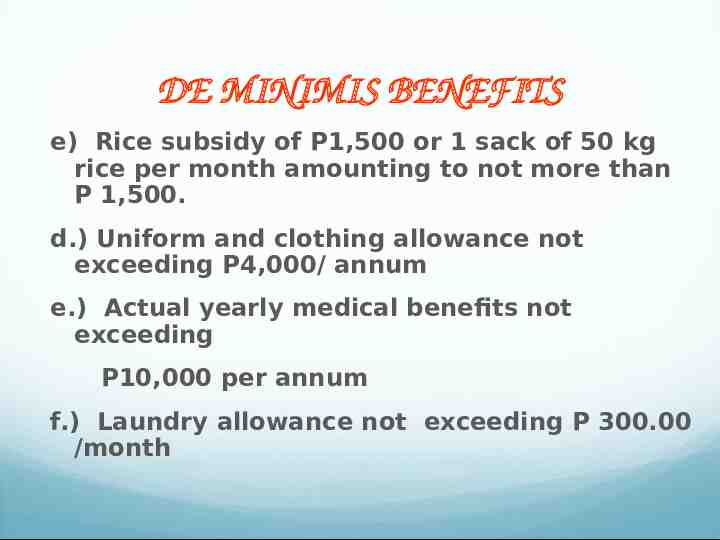

DE MINIMIS BENEFITS e) Rice subsidy of P1,500 or 1 sack of 50 kg rice per month amounting to not more than P 1,500. d.) Uniform and clothing allowance not exceeding P4,000/ annum e.) Actual yearly medical benefits not exceeding P10,000 per annum f.) Laundry allowance not exceeding P 300.00 /month

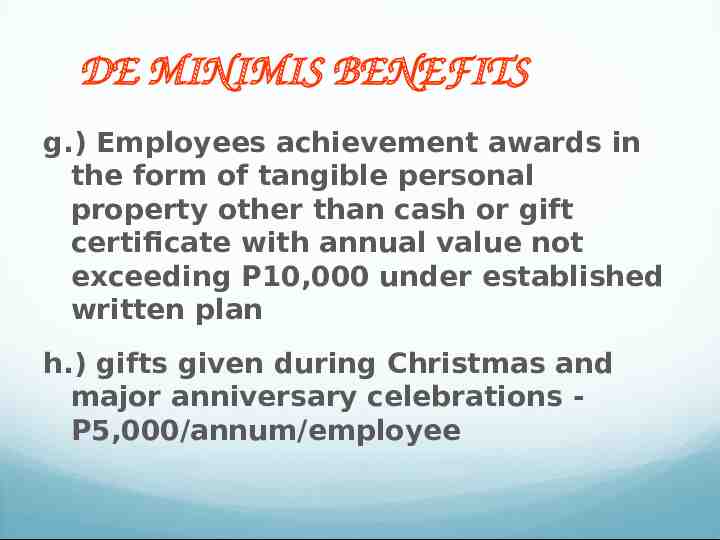

DE MINIMIS BENEFITS g.) Employees achievement awards in the form of tangible personal property other than cash or gift certificate with annual value not exceeding P10,000 under established written plan h.) gifts given during Christmas and major anniversary celebrations P5,000/annum/employee

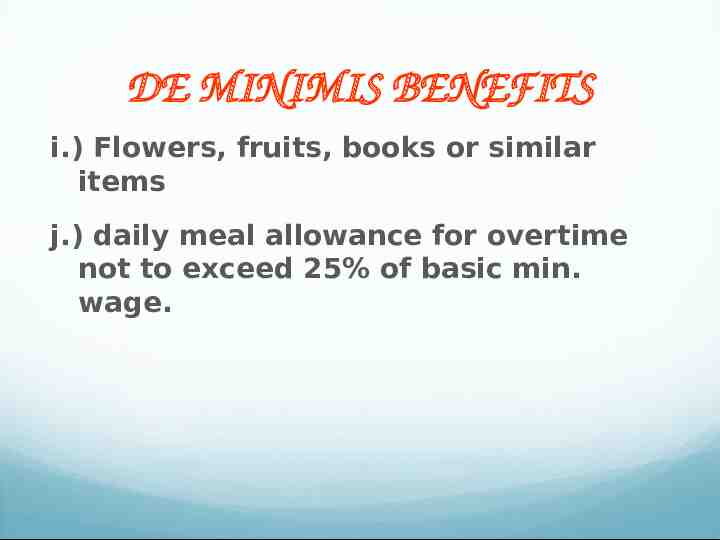

DE MINIMIS BENEFITS i.) Flowers, fruits, books or similar items j.) daily meal allowance for overtime not to exceed 25% of basic min. wage.

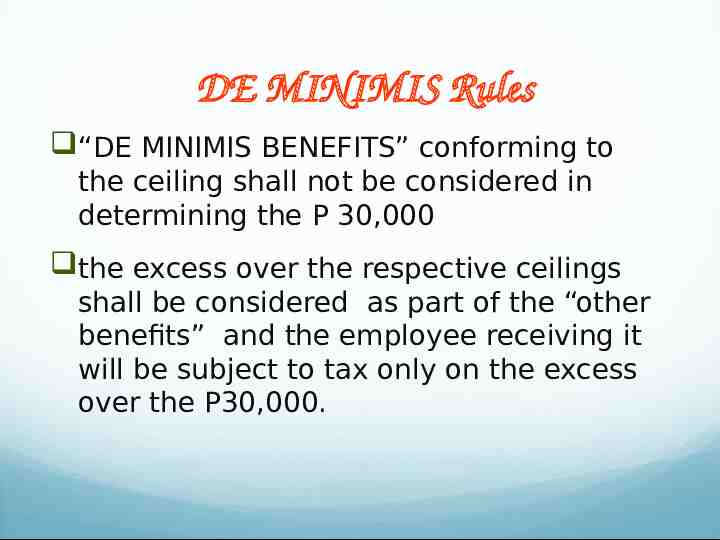

DE MINIMIS Rules “DE MINIMIS BENEFITS” conforming to the ceiling shall not be considered in determining the P 30,000 the excess over the respective ceilings shall be considered as part of the “other benefits” and the employee receiving it will be subject to tax only on the excess over the P30,000.

Exemptions (cont ) (13) Compensation income of MWEs who work in the private sector and being paid the Statutory Minimum Wage applicable to the place where he is assigned.

The following compensation received by minimum wage earners shall likewise be exempt from income tax: holiday pay overtime pay night shift differential pay

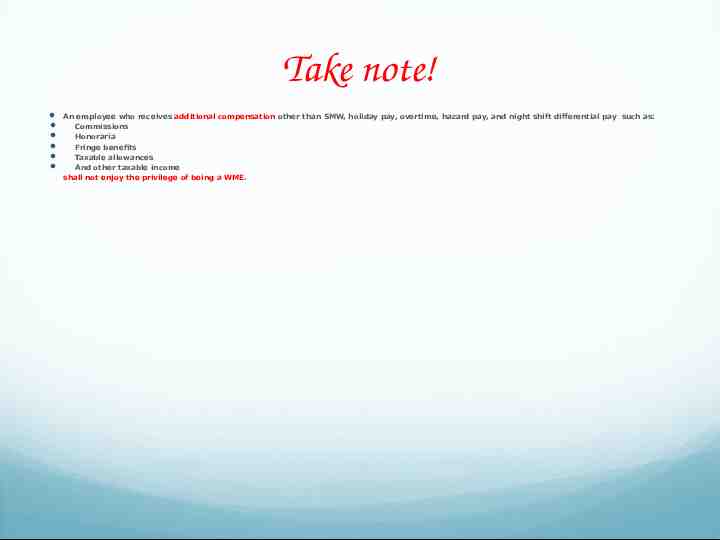

Take note! An employee who receives additional compensation other than SMW, holiday pay, overtime, hazard pay, and night shift differential pay such as: Commissions Honoraria Fringe benefits Taxable allowances And other taxable income shall not enjoy the privilege of being a WME.

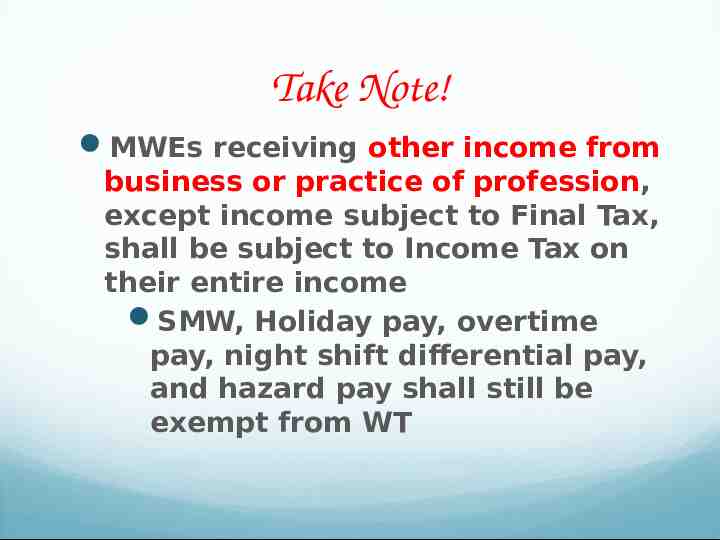

Take Note! MWEs receiving other income from business or practice of profession, except income subject to Final Tax, shall be subject to Income Tax on their entire income SMW, Holiday pay, overtime pay, night shift differential pay, and hazard pay shall still be exempt from WT

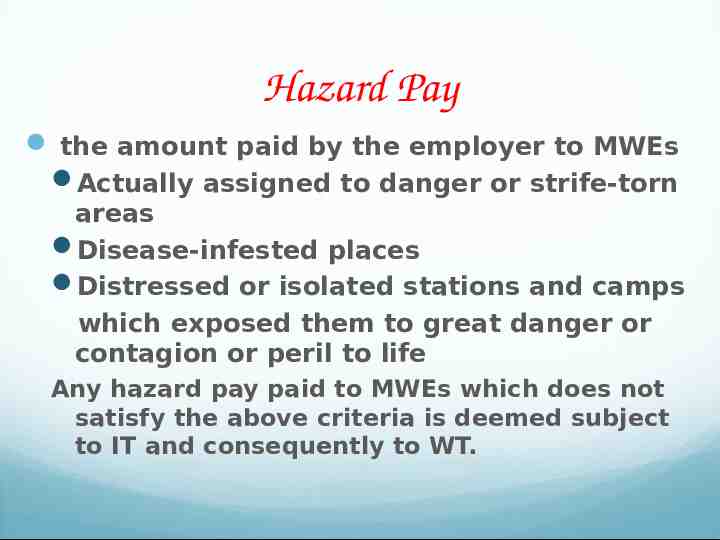

Hazard Pay the amount paid by the employer to MWEs Actually assigned to danger or strife-torn areas Disease-infested places Distressed or isolated stations and camps which exposed them to great danger or contagion or peril to life Any hazard pay paid to MWEs which does not satisfy the above criteria is deemed subject to IT and consequently to WT.

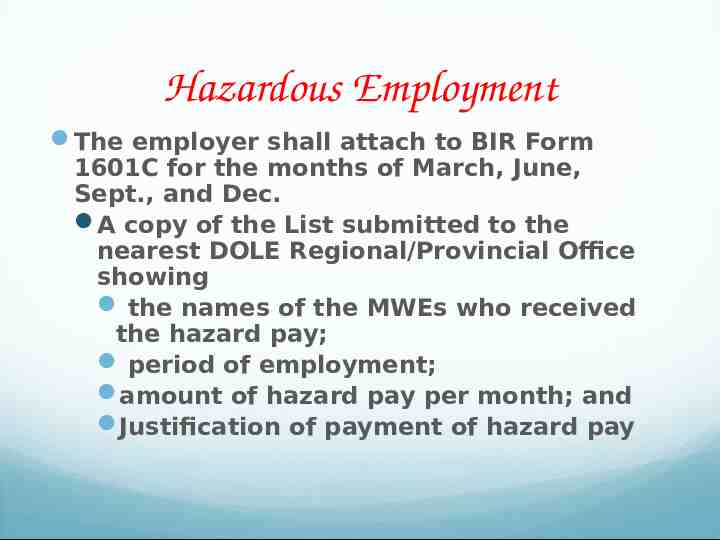

Hazardous Employment The employer shall attach to BIR Form 1601C for the months of March, June, Sept., and Dec. A copy of the List submitted to the nearest DOLE Regional/Provincial Office showing the names of the MWEs who received the hazard pay; period of employment; amount of hazard pay per month; and Justification of payment of hazard pay

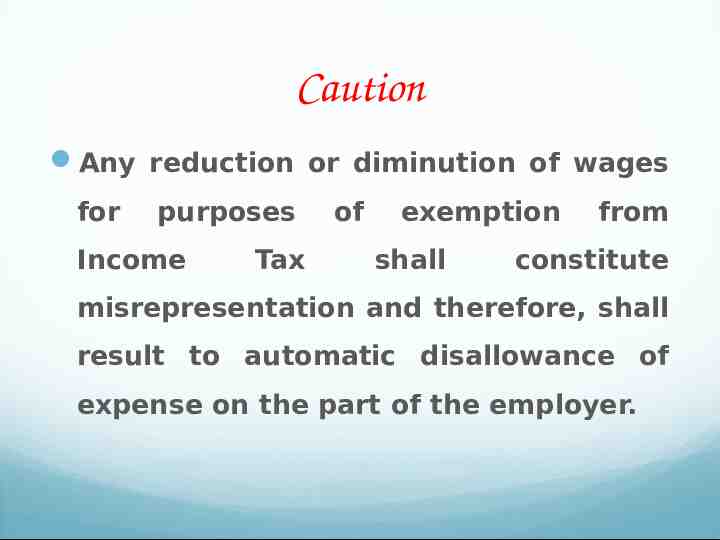

Caution Any reduction or diminution of wages for purposes Income Tax of exemption shall from constitute misrepresentation and therefore, shall result to automatic disallowance of expense on the part of the employer.

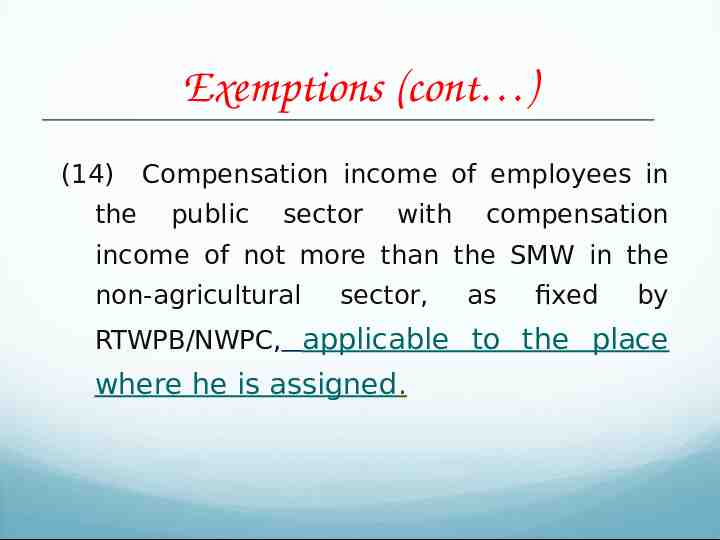

Exemptions (cont ) (14) the Compensation income of employees in public sector with compensation income of not more than the SMW in the non-agricultural sector, as fixed by RTWPB/NWPC, applicable to the place where he is assigned.

FACTOR OR NUMBER OF WORKING/PAID DAYS IN A YEAR

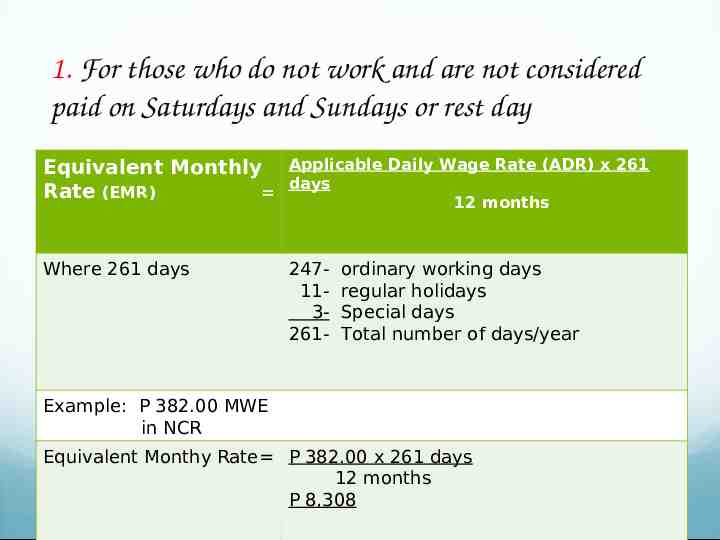

1. For those who do not work and are not considered paid on Saturdays and Sundays or rest day Equivalent Monthly Rate (EMR) Applicable Daily Wage Rate (ADR) x 261 days 12 months Where 261 days 247113261- ordinary working days regular holidays Special days Total number of days/year Example: P 382.00 MWE in NCR Equivalent Monthy Rate P 382.00 x 261 days 12 months P 8,308

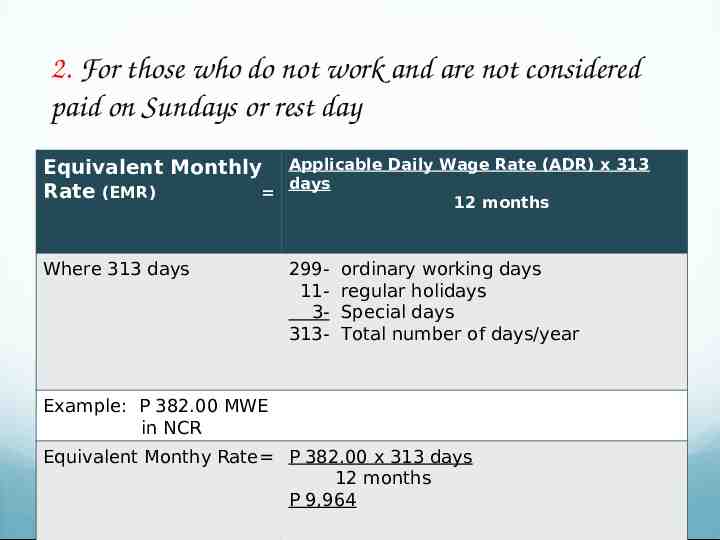

2. For those who do not work and are not considered paid on Sundays or rest day Equivalent Monthly Rate (EMR) Applicable Daily Wage Rate (ADR) x 313 days 12 months Where 313 days 299113313- ordinary working days regular holidays Special days Total number of days/year Example: P 382.00 MWE in NCR Equivalent Monthy Rate P 382.00 x 313 days 12 months P 9,964

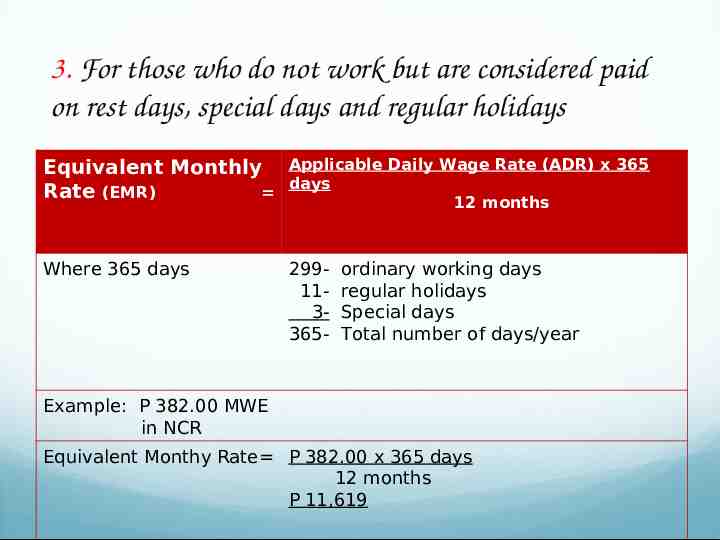

3. For those who do not work but are considered paid on rest days, special days and regular holidays Equivalent Monthly Rate (EMR) Applicable Daily Wage Rate (ADR) x 365 days 12 months Where 365 days 299113365- ordinary working days regular holidays Special days Total number of days/year Example: P 382.00 MWE in NCR Equivalent Monthy Rate P 382.00 x 365 days 12 months P 11,619

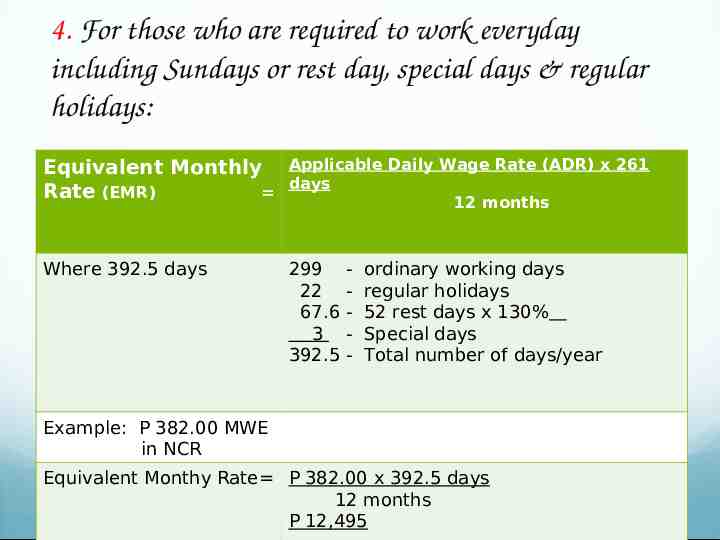

4. For those who are required to work everyday including Sundays or rest day, special days & regular holidays: Equivalent Monthly Rate (EMR) Applicable Daily Wage Rate (ADR) x 261 days 12 months Where 392.5 days 299 22 67.6 3 392.5 - ordinary working days regular holidays 52 rest days x 130% Special days Total number of days/year Example: P 382.00 MWE in NCR Equivalent Monthy Rate P 382.00 x 392.5 days 12 months P 12,495

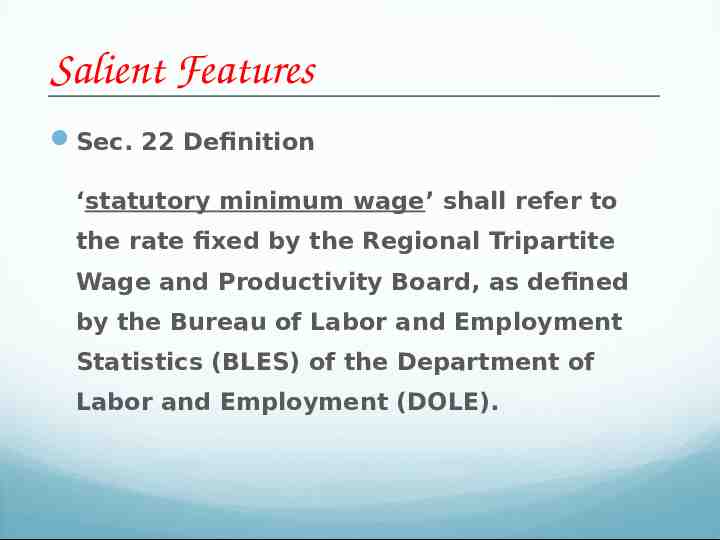

Salient Features Sec. 22 Definition ‘statutory minimum wage’ shall refer to the rate fixed by the Regional Tripartite Wage and Productivity Board, as defined by the Bureau of Labor and Employment Statistics (BLES) of the Department of Labor and Employment (DOLE).

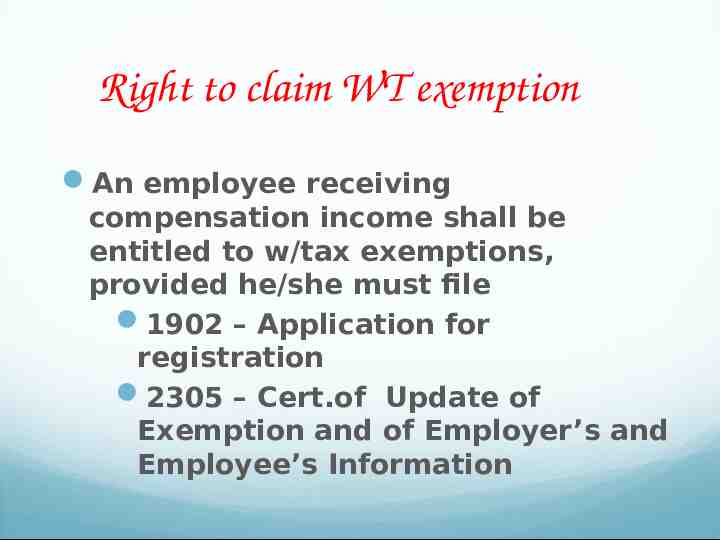

Right to claim WT exemption An employee receiving compensation income shall be entitled to w/tax exemptions, provided he/she must file 1902 – Application for registration 2305 – Cert.of Update of Exemption and of Employer’s and Employee’s Information

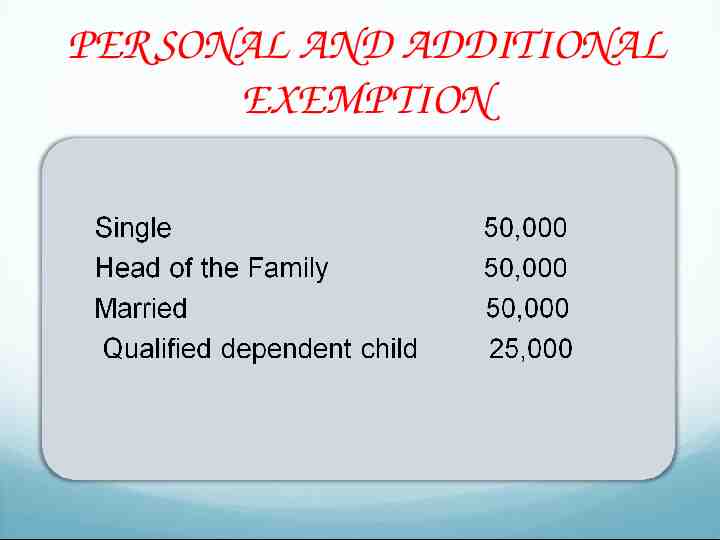

PER SONAL AND ADDITIONAL EXEMPTION

On exemptions Every employer should ascertain whether or not a child being claimed is a qualified dependent If TP should have additional exemption during the taxable year, he may claim the corresponding additional exemption in full for such year If the TP dies during the taxable year, the estate may claim the full exemptions as if he died at the close of the year

On exemptions If TP earned taxable income between Jan. to July 5, 2008 and did not earn any taxable income for the rest of the year, he is entitled only to the old exemption. If TP earned his taxable income from July 6, 2008 (after the effectivity of this law), he is entitled to the prorated exemption.

On exemptions TP may still claim full exemptions during the taxable year on the following cases: Spouse or any of the dependent dies Any of such dependents marries Becomes 21 y.o. Becomes gainfully employed As if it occurred at the close of such year

Failure to Register / Update Failure to file 1902 The employer shall withhold under zero exemption Failure to file 2305 The employer shall withhold based on the reported exemption existing prior to the change of such status Any refund/under-withholding shall be covered by the penalties prescribed under Sec. 80 of the Code

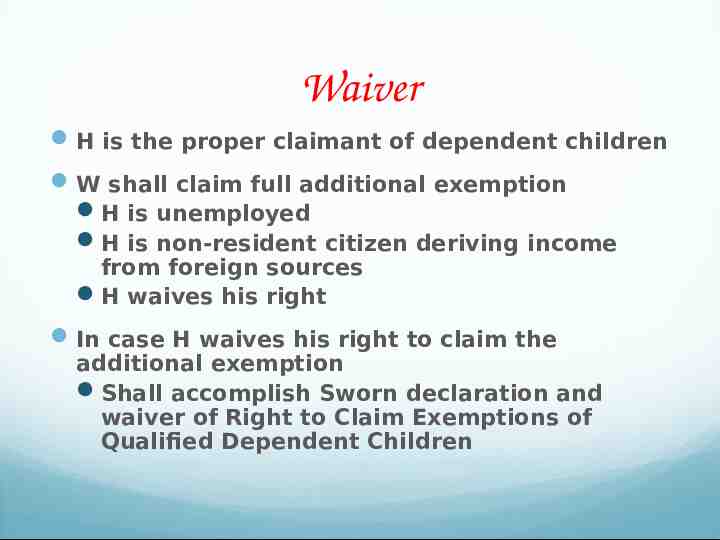

Waiver H is the proper claimant of dependent children W shall claim full additional exemption H is unemployed H is non-resident citizen deriving income from foreign sources H waives his right In case H waives his right to claim the additional exemption Shall accomplish Sworn declaration and waiver of Right to Claim Exemptions of Qualified Dependent Children

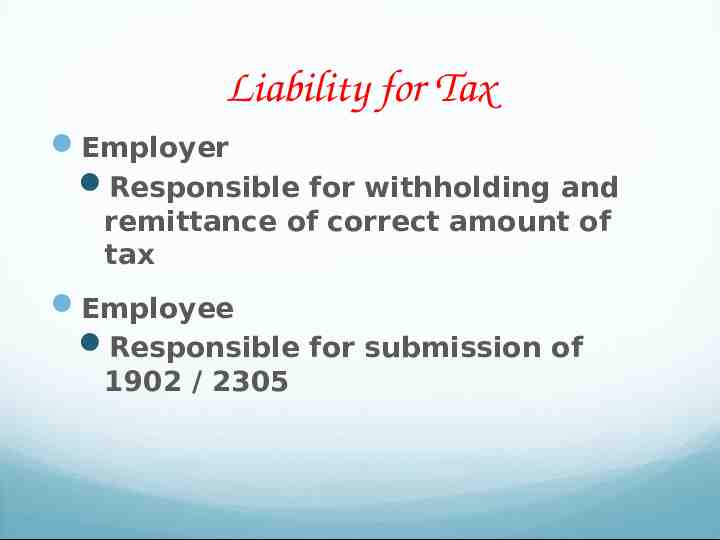

Liability for Tax Employer Responsible for withholding and remittance of correct amount of tax Employee Responsible for submission of 1902 / 2305

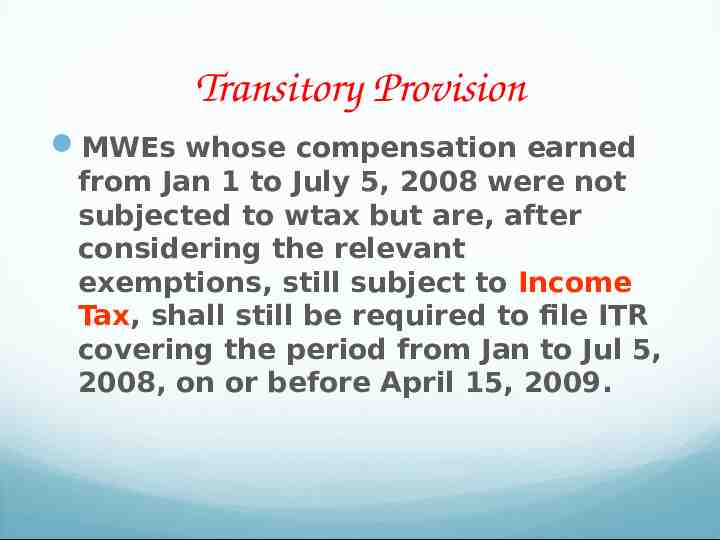

Transitory Provision MWEs whose compensation earned from Jan 1 to July 5, 2008 were not subjected to wtax but are, after considering the relevant exemptions, still subject to Income Tax, shall still be required to file ITR covering the period from Jan to Jul 5, 2008, on or before April 15, 2009.

YEAR END ADJUSTMENT (YEA)

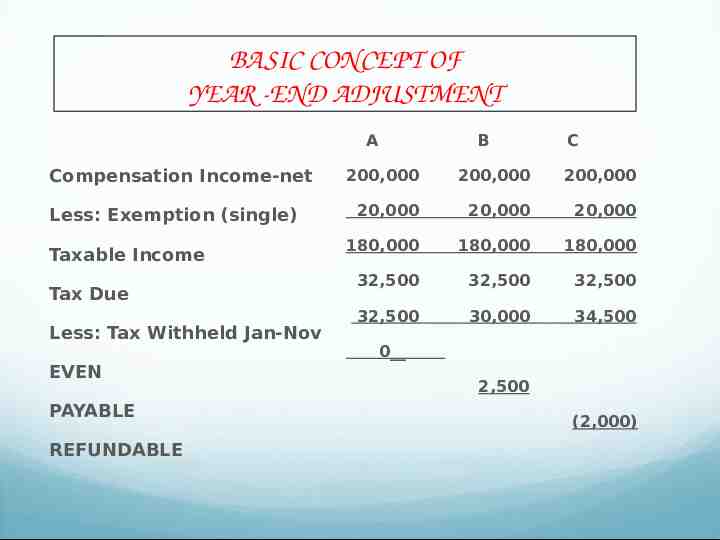

BASIC CONCEPT OF YEAR -END ADJUSTMENT A Compensation Income-net Less: Exemption (single) Taxable Income Tax Due Less: Tax Withheld Jan-Nov EVEN PAYABLE REFUNDABLE B C 200,000 200,000 200,000 20,000 20,000 20,000 180,000 180,000 180,000 32,500 32,500 32,500 32,500 30,000 34,500 0 2,500 (2,000)

The end