Planning, Sampling and Documentation in Bank Branch Audit 2019 Abhijit

25 Slides123.93 KB

Planning, Sampling and Documentation in Bank Branch Audit 2019 Abhijit Bandyopadhyay ACAE 15 March 2019 th

Planning SA 300 Objective Plan an audit so that engagement is performed in an effective manner. 2

Requirements 1. Involvement of key engagement team members 2. Preliminary engagement activities 3. Planning activities 4. Documentation 5. Additional considerations in initial audit engagement 3

Audit Sampling SA 530 Plans When planning the sample consider: The relationship of the sample to the relevant audit objective Materiality or the maximum tolerable misstatement or deviation rate Allowable sampling risk Characteristics of the population Select sample items in such a manner that they can be expected to be representative of the population Sample results should be projected to the population Items that cannot be audited should be treated as misstatements or deviations in evaluating the sample results Nature and cause of misstatements or deviations should be evaluated

Audit Sampling for Tests of Controls Determine the objective of the test Define the attributes and deviation conditions Define the population to be sampled Choose an audit sampling technique Specify: The risk of assessing control risk too low The tolerable deviation rate Estimate the population deviation rate Determine the sample size Select the sample Test the sample items Evaluate the sample results Document the sampling procedure

Audit Sampling for Substantive Tests Determine the objective of the test Define the population and sampling unit Choose an audit sampling technique Determine the sample size Select the sample Test the sample items Evaluate the sample results Document the sampling procedure

Documentation SA 230 Objective Sufficient appropriate record of the basis for auditor’s report Evidence that audit planned and performed in accordance with ISAs

Factors determining form of working papers Size & complexity of the entity Conclusion & its need to document. Audit methodology & tools used. Nature of the audit procedures. Significance of the audit evidence. Identified risks of material misstatement. Nature & extent of exceptions identified.

Contents - Permanent and Current Audit file There are two types(a) Permanent Audit File (b) Current Audit File Permanent Audit File (a) Legal & organizational structure of the entity (MoA, AoA etc) (b) Copies of important legal documents, agreements & minutes. (c) Study and evaluation of internal controls. (d) Copies of the audited financial statements for previous years and significant observations, (e) Communication with retiring auditor. Current Audit File (a) Letters on re-appointment (b) Board/General meeting minutes (c) Audit plan & programme and results (d) Supervision and review documents. (e) Letters with other auditors, exporters etc. (f) Copies of the financial statements.

On Receipt of Appointment Letter Write a communication to the immediate previous auditors – it is necessary Send Acceptance Letter along with Statement of Fidelity, Confidentiality etc. Contact the respective Branch Manager – ask about location / stay arrangement i.e. a few question about the branch / STATUTORY REPORT – LFAR

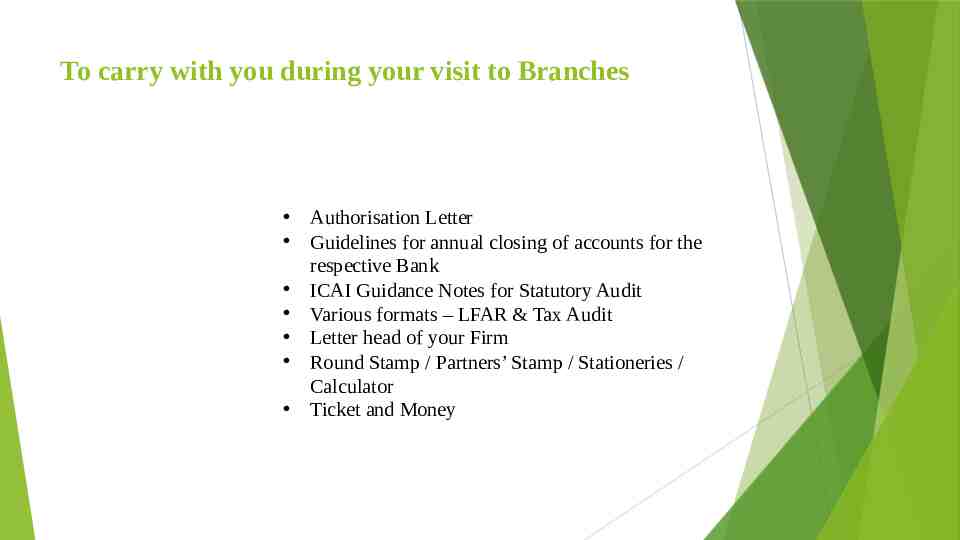

To carry with you during your visit to Branches Authorisation Letter Guidelines for annual closing of accounts for the respective Bank ICAI Guidance Notes for Statutory Audit Various formats – LFAR & Tax Audit Letter head of your Firm Round Stamp / Partners’ Stamp / Stationeries / Calculator Ticket and Money

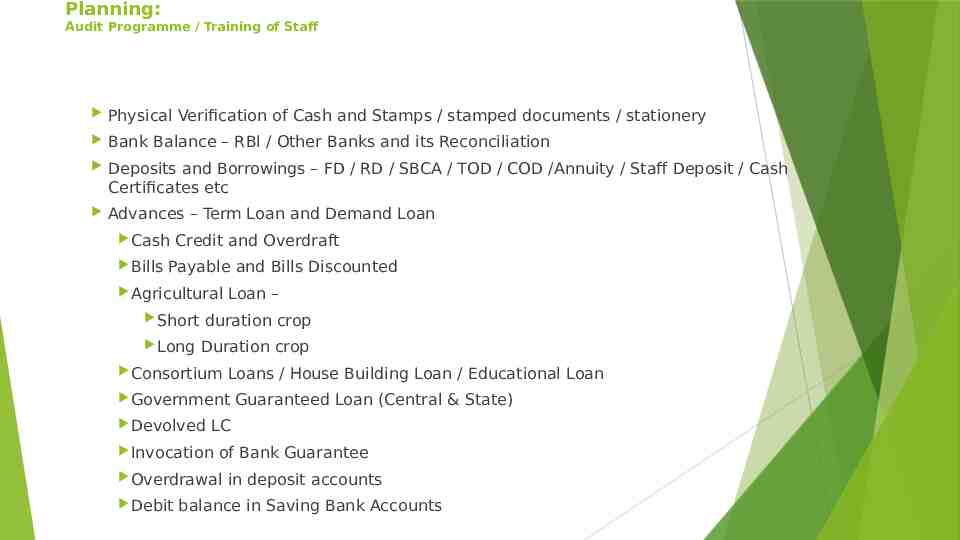

Planning: Audit Programme / Training of Staff Physical Verification of Cash and Stamps / stamped documents / stationery Bank Balance – RBI / Other Banks and its Reconciliation Deposits and Borrowings – FD / RD / SBCA / TOD / COD /Annuity / Staff Deposit / Cash Certificates etc Advances – Term Loan and Demand Loan Cash Bills Credit and Overdraft Payable and Bills Discounted Agricultural Loan – Short duration crop Long Duration crop Consortium Loans / House Building Loan / Educational Loan Government Devolved LC Invocation of Bank Guarantee Overdrawal Debit Guaranteed Loan (Central & State) in deposit accounts balance in Saving Bank Accounts

Planning contd. Foreign Exchange – Deposits and Advances Accounts Inter Branch Adjustment accounts Housekeeping – Maintenance of Books and Records – GL / SL Returns – Daily / Weekly / Fortnightly / Monthly / Quarterly / Yearly (wherever applicable as per existing Bank Norms ) Income – Interest / Commission / Service on Draft etc. Loan processing charges / Investment Income (Comparative study and its various analysis) Expenditure – Interest – Operational Expenses – Salary and Administrative Expenditure (Comparative study and its various analysis) Investment Contingent Liability Frauds and its Present status

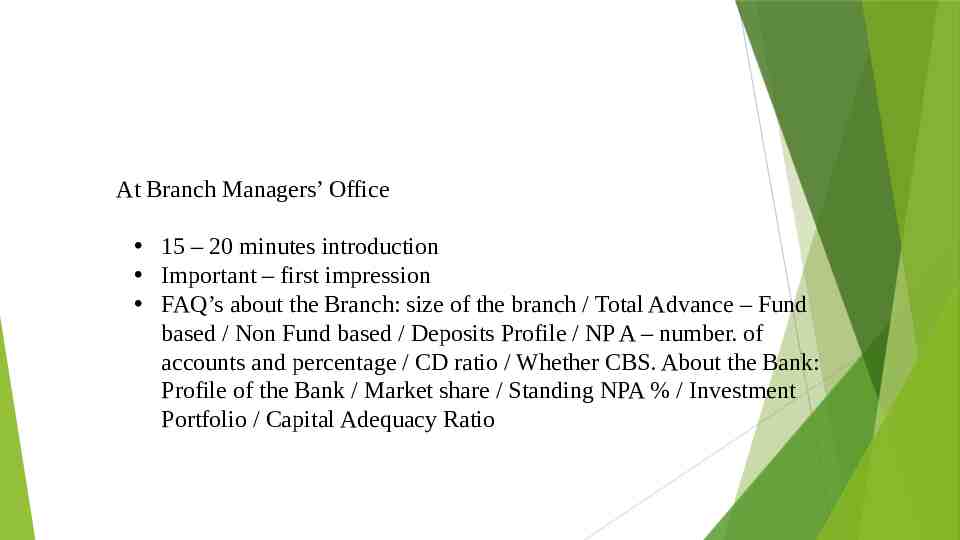

At Branch Managers’ Office 15 – 20 minutes introduction Important – first impression FAQ’s about the Branch: size of the branch / Total Advance – Fund based / Non Fund based / Deposits Profile / NP A – number. of accounts and percentage / CD ratio / Whether CBS. About the Bank: Profile of the Bank / Market share / Standing NPA % / Investment Portfolio / Capital Adequacy Ratio

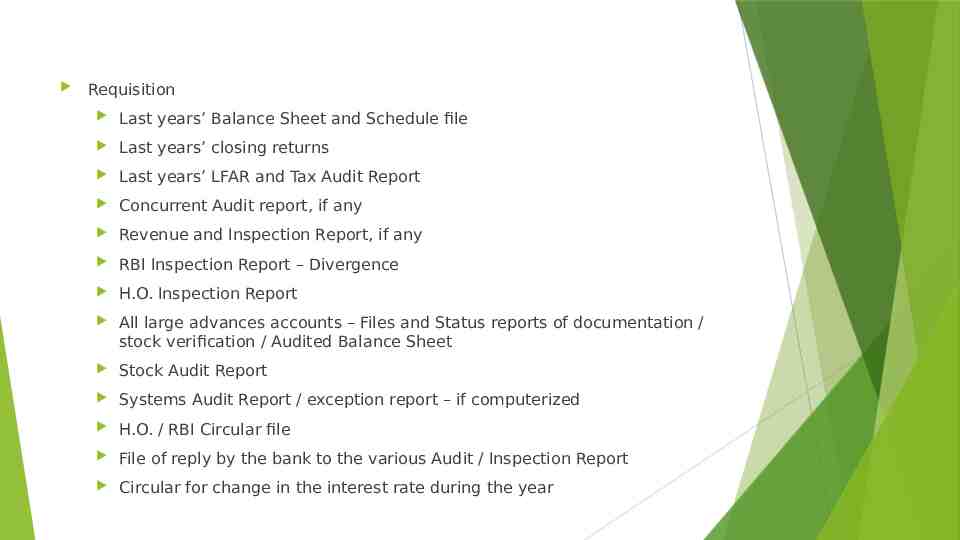

Requisition Last years’ Balance Sheet and Schedule file Last years’ closing returns Last years’ LFAR and Tax Audit Report Concurrent Audit report, if any Revenue and Inspection Report, if any RBI Inspection Report – Divergence H.O. Inspection Report All large advances accounts – Files and Status reports of documentation / stock verification / Audited Balance Sheet Stock Audit Report Systems Audit Report / exception report – if computerized H.O. / RBI Circular file File of reply by the bank to the various Audit / Inspection Report Circular for change in the interest rate during the year

Study of Reports Identify weak areas Identify weak advance accounts Revenue Leakage if any RBI adverse comments if any Resultant Provisioning requirement Advance accounts checking Statements – Borrowers’ classification accountwise Summary presentation of Advance Accounts LFAR Tax Audit report preparation Closing Returns checking – Balance Sheet, Profit & Loss Accounts i.e. the final accounts scrutiny Provisioning of Income and Expenditure Presentation Foreign Exchange Transaction – including NOSTRO / VOSTRO accounts Asset Liability Management – Residual Maturity Statements Movement of NPA’s Ghosh and Jilani Fraud / Internal control and checking Committee Recommendations

Physical Verification Cash / Petty cash – Cash scroll / Day book Security papers Tokens Printing and Stationery items particularly Cheque Books, Drafts and Bankers’ Cheque Investment papers, if any Bills purchase Foreign currency, if any Fixed Asset Register Numbering of each Fixed Assets of the Branch House Keeping GL to SL in all Deposits and Advances Accounts Reconciliation Maintenance of Books and Records – List of Books and records Calendar of Returns Obtain balance confirmation certificates from SBI / RBI and other Banks Reconciliation Statement of accounts with the Banks Profit and Loss Account Vouching and Income and Expenditure checking Income Checking – proper accounting Revenue leakage – Accuracy and Documentation inclusive of Penal interest applicable areas Expenditure checking Proper Accounting Propriety Statutory Compliance Documentation Authority

Closing Returns – Figure checking as on the Balance sheet date if not computerized, if computerized, system checking in a selective way may be adopted Inter Branch Adjustment Account – Full provision for Net Debit of transactions which are more than 90 days old Sundry Assets / Receivables Suspense Account Sundry Liabilities / Payable Contingent Liabilities Premises and other Fixed Assets (also rent agreement and renewal) (For all points vi. to ix. above, please obtain a list of pending entries as on 31st March and scrutinize whether it includes any unusual entry i.e. entry with heavy amount and / or very old entry)

Advances:: A. Term Loan -Repayment of Installment due for more than 90 days B. Cash Credit / Overdraft -Interest not paid for a period of more than 90 days or outstanding balance is in excess of limit/DP, whichever is less, for more than 90 days --even if one or two credit/s during last two months and credit not sufficient to cover the interest debited C. Bills payable--bills payable overdue for more than 90 days D. Agricultural loan I. Short duration crop – two harvest season II. Long duration crop – one harvest season E. Consortium Advance--Banks independently to judge the status F. Apportioned Loan– per Main Branch G. Government Sponsored Schemes--Substandard / doubtful but not loss H. Upgradation / Down gradation of NPA List I. List of fresh NPA classified during the year J. Devolved Letter of Credit/ Guarantee --- Due Immediately 90 Days K. Government Guaranteed accounts I. Central Government- Standard unless it is invoked and repudiated II. State Government- Normal Classification norms will apply.

Stock statement older than 3 months- irregular; NPA 90 Days Review- NPA when due for more than 90 days A solitary or a few credits- See inherent weakness in the account operation NPA Consortium advance recovery in Pool account unless they get Share of recovery/ expenses consent from the lead bank NPA Straightaway to Doubtful --in case erosion in value of security is such that the reduced value is below 50% of the value assured by Bank/ RBI at the time of last inspection Straightaway loss --Value of Security is less than 10% of outstanding balance Devolved Letter of Credit or Invoked Letter of Guarantee paid- to add to borrower’s principal operating account for application of Prudential Norms In case of NPA with balance of Rs. 5.00 crore and above Assets / Stock Audit at annual intervals Collaterals Valuation of immovable properties---once in 3 years Current

Advances The documents normally we expect in the files: i. A. Loan Application form B. DPN C. Sanction Letter D.Appraisal of Project E. Letter of Hypothecation F. Agreement for Loan G.Letter of guarantee / Counter guarantee H.Legal Opinion about non encumbrance status of securities I. Non encumbrance certificate J. Pre-disbursement Audit Report K. Registration of charges in case of a Company L. Completion of Mortgaged Properties M. Security pledged and recording its lien N.Insurance on the charged securities O.AOD (Accounts Overdue) P. Stock Statement (only paid stocks)non moving stocks are to be excluded Q.DP and Inspection Register

Non Compliance and irregularities that usually we see: a. Documents not in file b. Documents are there but not executed properly c. Incase of a Company – charge not recorded with ROC within stipulated period d. Blank / Incomplete documents e. Resolution regarding power and authority to borrower – not on record f. FDR pledged – not on record g. FDR pledged – not endorsed h. Latest Financial Statement not on record i. Accounts Overdue (AOD) j. Insurance Papers – not on record k. Insurance expired l. Guarantee / Counter Guarantee – expired and deletion from register within reasonable period m.Valuation report of Immovable Property not on record n. Inspection Report – not on record o. Review Removal Report – not on record p. For charging of penal interest (see conditions from the sanction letter)

Suggested Mechanism of checking Loss – nothing to be seen except proper accounting – 100 % provision Doubtful: For Doubtful – 1, Unsecured part Full provision and Secured part – 20 % For Doubtful – 2, Unsecured part – 100% and Secured part – 30 % For Doubtful – 3, Both part – 100 % --Deficit to be verified and for that Security Valuation to be seen whether proper S/Std.- Date of becoming NPA – if more than 12 months Doubtful otherwise no D. Standard-each and every account – recovery – in light of Prudential Norms

Preparation of Audit Report Accumulate all observations ii. In case of any change, pass MOC and DO NOT change the accounts at Branch level iii. Prepare LFAR – please fill in all the columns, But avoid “yes”, “no” “NA” or “NIL”. Give your opinion clearly and with examples iv.Prepare TAR (Tax Audit Report) v. Any observation on the financial statements, issue special report and attach with the main report vi. Discuss observations vii. Main Report must be on the Firm’s Letter head viii. In case of any serious lapse, report separately to the top management ix. Stamping and initialing – properly done x. Signature by both Auditor and Management of the branch xi. Follow Distribution Chart xii. Take back with you One full set of report and main accounts Stay Certificate Working papers and files duly initialed by the manager wherever required --- Other papers carried by you Office documentation i.

Any Questions ? Thank you