NCPHA – FAMI A GUIDE TO SUCCESSFUL CODING & BILLING PRESENTED BY: NC

53 Slides1.32 MB

NCPHA - FAMI A GUIDE TO SUCCESSFUL CODING & BILLING PRESENTED BY: NC DHHS/DPH ADMINISTRATIVE & FINANCIAL CONSULTANTS

How Can We Increase our Revenue? Client Education Establish Expectations for Payment Explain the Need for Payment Develop a Payment Plan Follow Billing Policies Send Statements on a Regular Basis Credit/Debit Cards

Collection of Revenue Make every reasonable effort to collect your cost in providing services, for which Medicaid reimbursement is sought, through public or private third- party payors except where prohibited by Federal regulations or State law; however, no one shall be refused services solely because of an inability to pay.

Collection of Revenue Private Insurance (third-party) Medicaid Billed at the undiscounted rate Billed at the undiscounted rate Self-pay is based on income & family size Billed at a discounted rate based on the sliding fee scale

General Billing Information Revenue Sources may include: Cash Check Major Credit Cards Medicaid Third Party Insurance Company Billing NC Debt Set-Off Clearinghouse (debt over 50.00)

General Billing Information Medicaid is billed as the payer of last resort. Verification that Client is covered by Medicaid should be done at or before each visit. The health department bills Medicaid and accepts payment in full.

General Billing Information You can bill client for NonMedicaid covered services, but you must inform the client that they will be responsible PRIOR to the service being performed. If unable to determine Medicaid eligibility (not covered during period of service) then the client should be billed based on SFS. If the client presents for services that are billable to insurance (BCBSImmunizations, MNT), obtain all information necessary to submit a claim.

Collecting Co-Pays and Applying Sliding Fee Scales. REMEMBER! FAMILY PLANNING CLIENTS SHOULD NEVER PAY MORE IN COPAYS, DEDUCTIBLES OR CO-INSURANCE THAN WHAT THEY OWE BASED ON THE SLIDING FEE SCALE.

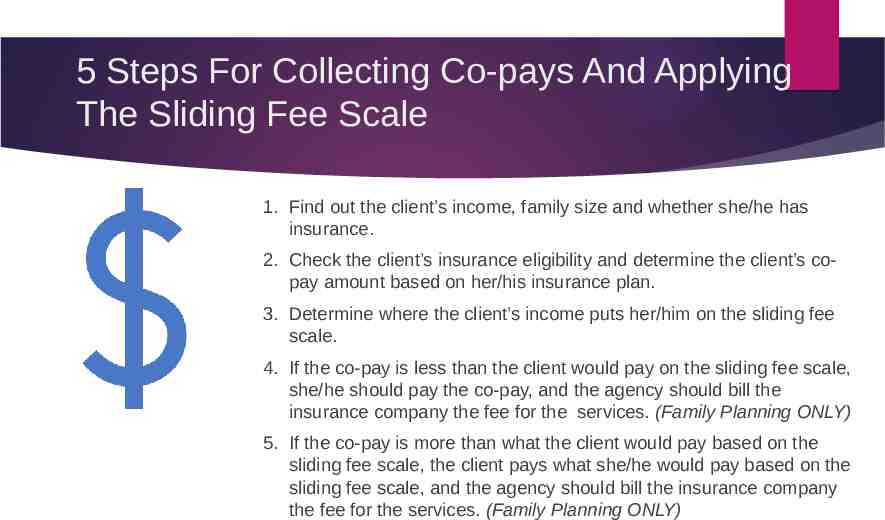

5 Steps For Collecting Co-pays And Applying The Sliding Fee Scale 1. Find out the client’s income, family size and whether she/he has insurance. 2. Check the client’s insurance eligibility and determine the client’s copay amount based on her/his insurance plan. 3. Determine where the client’s income puts her/him on the sliding fee scale. 4. If the co-pay is less than the client would pay on the sliding fee scale, she/he should pay the co-pay, and the agency should bill the insurance company the fee for the services. (Family Planning ONLY) 5. If the co-pay is more than what the client would pay based on the sliding fee scale, the client pays what she/he would pay based on the sliding fee scale, and the agency should bill the insurance company the fee for the services. (Family Planning ONLY)

Managing Outstanding Accounts Receivable

Identifying Outstanding Accounts Aged Accounts Receivable Report Medicaid Insurance Patient Pay-When was the last visit?-When was the last payment? You should have a written procedure for how you handle your aged accounts receivable report. You should run reports in your system monthly to identify outstanding Accounts. Once you have identified outstanding accounts you will need to work them.

Bad debt write-off Outstanding accounts having no activity in more than months shall be written off as bad debts, at least annually upon approval of the Governing Board and the County Commissioners (or per health department policy). Once an account has been written off as a bad debt it should not be reinstated. Only if the client returns to the clinic and wants to make a payment should action be taken to reinstate only the payment amount, post the payment and leave the remaining balance that was initially written off as it stands.

Bankruptcy Legal notification from Bankruptcy court No further collection of outstanding account unless payment schedule is set up by Bankruptcy court Note or flag on patient’s account Account may be written off if mandated by court Patient may volunteer to pay Additional visits are charged

NC Debt Setoff Clearing House North Carolina General Statutes Chapter 105A: Setoff Debt Collection Act NC Income Tax Refund or Lottery (over 600.00) Mandated Fees (charged to individual) Requires Name and SSN/ITIN Not a breach of confidentiality since debt is listed as county, not Health Department Requires Local Policy

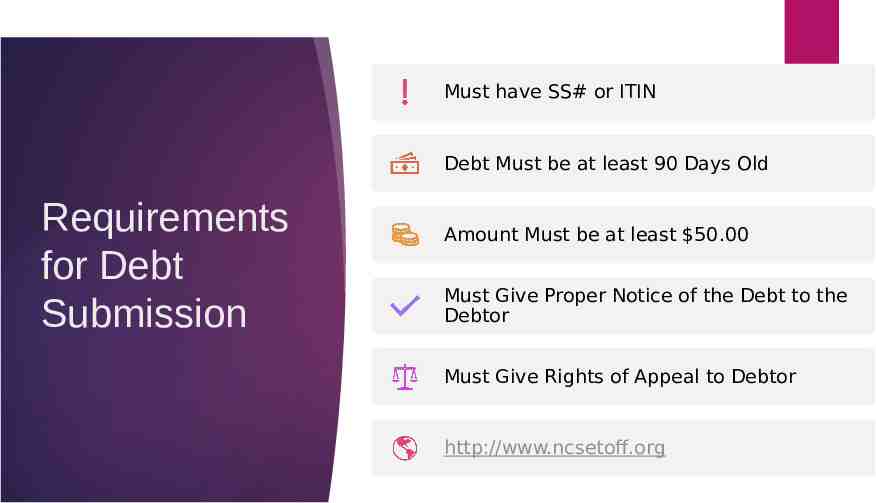

Must have SS# or ITIN Debt Must be at least 90 Days Old Requirements for Debt Submission Amount Must be at least 50.00 Must Give Proper Notice of the Debt to the Debtor Must Give Rights of Appeal to Debtor http://www.ncsetoff.org

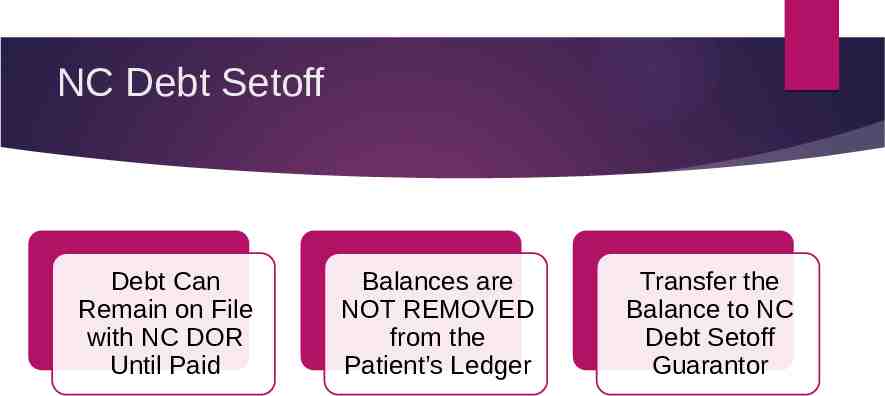

NC Debt Setoff Debt Can Remain on File with NC DOR Until Paid Balances are NOT REMOVED from the Patient’s Ledger Transfer the Balance to NC Debt Setoff Guarantor

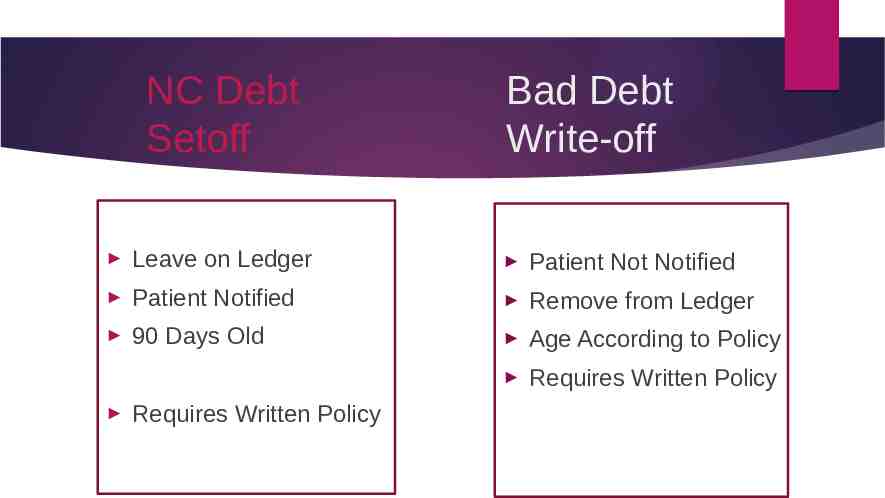

NC Debt Setoff Bad Debt Write-off Leave on Ledger Patient Not Notified Patient Notified Remove from Ledger 90 Days Old Age According to Policy Requires Written Policy Requires Written Policy

Billing Efficiency, Tips & Tricks

What is one tool I can use to improve Billing Efficiency? The Coding and Billing Guidance Document is a great resource and a quick guide to help answer questions. https://publichealth.nc.gov/lhd/

Coding and Billing Guidance Document This document was developed to provide local health departments (LHD) with guidance and resources specific to public health coding and billing of services rendered. This information was developed using current program Agreement Addenda, Medicaid bulletins and Clinical Coverage Policies, and Current Procedural Terminology (CPT) and International Classification of Diseases or Diagnosis (ICD-10) code books.

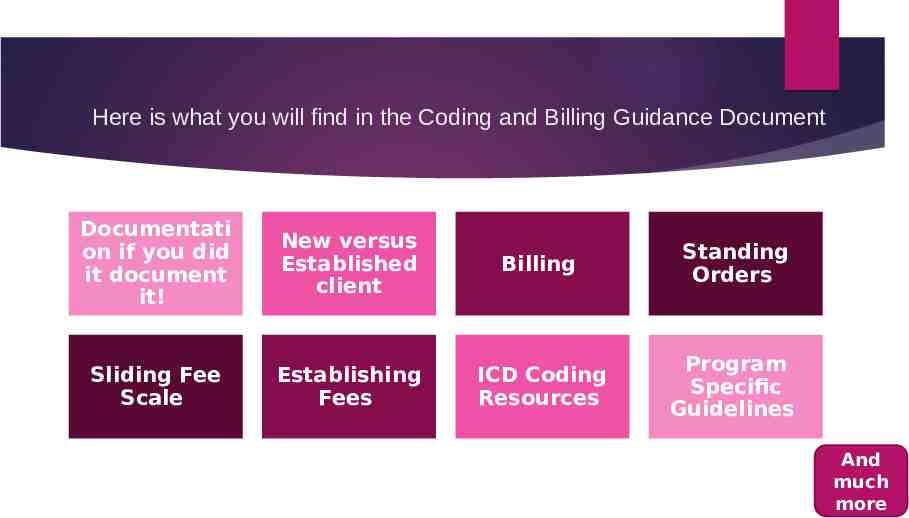

Here is what you will find in the Coding and Billing Guidance Document Documentati on if you did it document it! New versus Established client Billing Standing Orders Sliding Fee Scale Establishing Fees ICD Coding Resources Program Specific Guidelines And much more

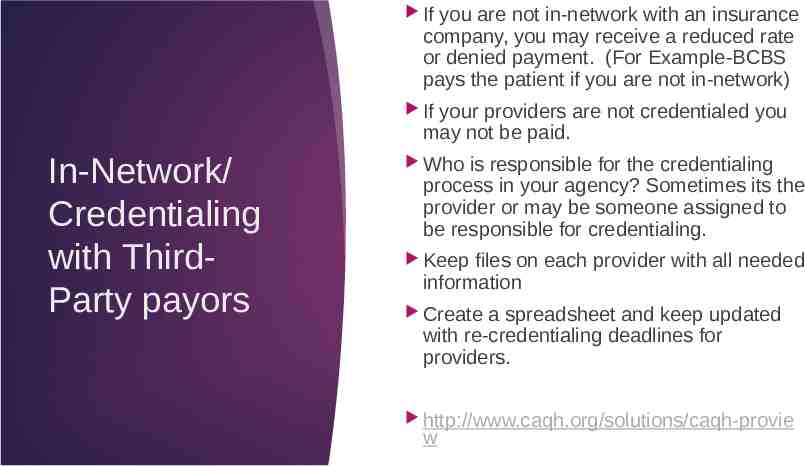

If you are not in-network with an insurance company, you may receive a reduced rate or denied payment. (For Example-BCBS pays the patient if you are not in-network) If your providers are not credentialed you may not be paid. In-Network/ Credentialing with ThirdParty payors Who is responsible for the credentialing process in your agency? Sometimes its the provider or may be someone assigned to be responsible for credentialing. Keep files on each provider with all needed information Create a spreadsheet and keep updated with re-credentialing deadlines for providers. http://www.caqh.org/solutions/caqh-provie w

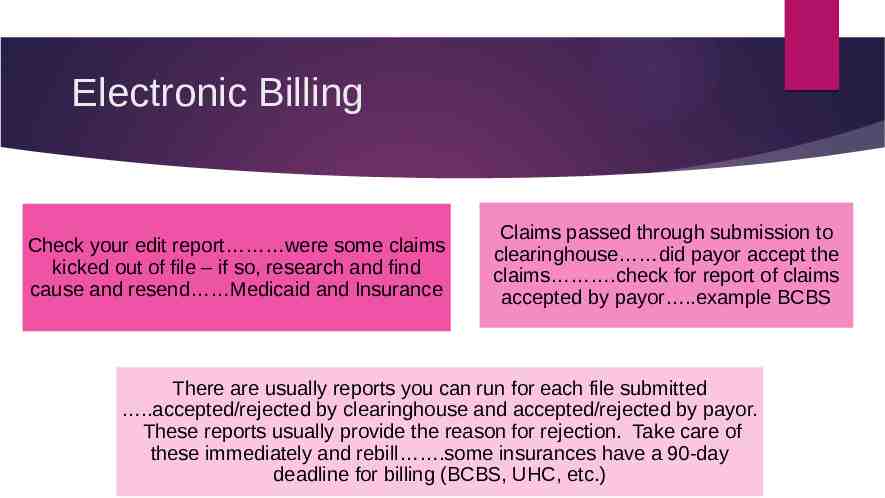

Electronic Billing Check your edit report were some claims kicked out of file – if so, research and find cause and resend Medicaid and Insurance Claims passed through submission to clearinghouse did payor accept the claims .check for report of claims accepted by payor .example BCBS There are usually reports you can run for each file submitted .accepted/rejected by clearinghouse and accepted/rejected by payor. These reports usually provide the reason for rejection. Take care of these immediately and rebill .some insurances have a 90-day deadline for billing (BCBS, UHC, etc.)

Electronic Billing NCTracks – you can see if rebilled claims paid/denied the following day if needed. NCTracks – bill directly online for difficult claims or those close to deadline. Insurances – bill directly on-line for difficult claims or those close to deadline.

Billing Follow-up Payments were received .but Denied claims should be reviewed, researched and resubmitted immediately. Get them corrected and rebilled asap. Denied claims .are you seeing patterns of denials red flag should go up. Are these data entry errors, coverage errors or NCTracks errors. Identify as early as possible so corrections can be made or issue can be reported to NCTracks (via Consultants). How to handle denied claims should be addressed in your policy.

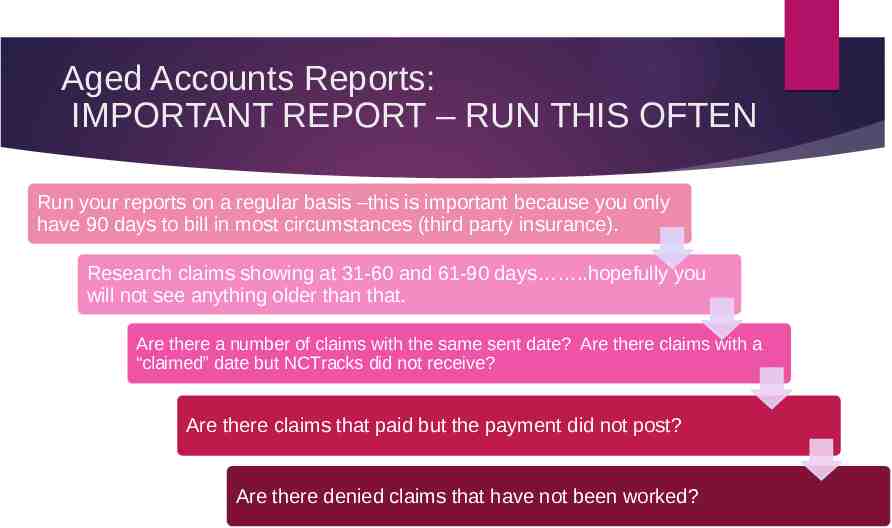

Aged Accounts Reports: IMPORTANT REPORT – RUN THIS OFTEN Run your reports on a regular basis –this is important because you only have 90 days to bill in most circumstances (third party insurance). Research claims showing at 31-60 and 61-90 days .hopefully you will not see anything older than that. Are there a number of claims with the same sent date? Are there claims with a “claimed” date but NCTracks did not receive? Are there claims that paid but the payment did not post? Are there denied claims that have not been worked?

Increase your revenue with In-house Audits

Make sure you are getting paid for your services! IN-HOUSE AUDIT SHOULD INCLUDE YOUR CLINICAL STAFF AND YOUR BILLING STAFF. WHY? TO MAKE SURE YOU ARE CODING CORRECTLY AND GETTING PAID FOR YOUR SERVICES.

Form a committee and have a Lead identified Form an in-house Audit Committee Ask each clinic to send the committee lead charts from their clinic. (Self-pay, Medicaid, Insurance, and Medicare). You determine the number you want to look at. Have a team review the charts for clinical marks and billing to see if everything is being documented and billed correctly, paid correctly, and posted correctly. Once the review is complete the committee will need to compile the data and write a report on the findings.

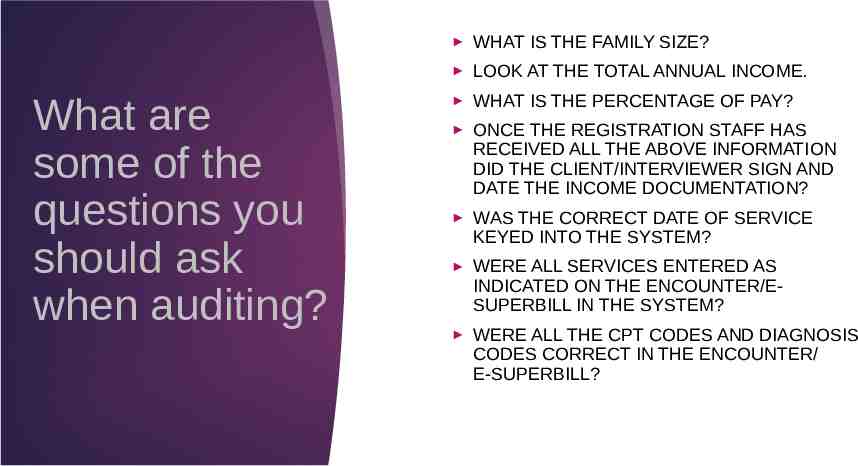

What are some of the questions you should ask when auditing? WHAT IS THE FAMILY SIZE? LOOK AT THE TOTAL ANNUAL INCOME. WHAT IS THE PERCENTAGE OF PAY? ONCE THE REGISTRATION STAFF HAS RECEIVED ALL THE ABOVE INFORMATION DID THE CLIENT/INTERVIEWER SIGN AND DATE THE INCOME DOCUMENTATION? WAS THE CORRECT DATE OF SERVICE KEYED INTO THE SYSTEM? WERE ALL SERVICES ENTERED AS INDICATED ON THE ENCOUNTER/ESUPERBILL IN THE SYSTEM? WERE ALL THE CPT CODES AND DIAGNOSIS CODES CORRECT IN THE ENCOUNTER/ E-SUPERBILL?

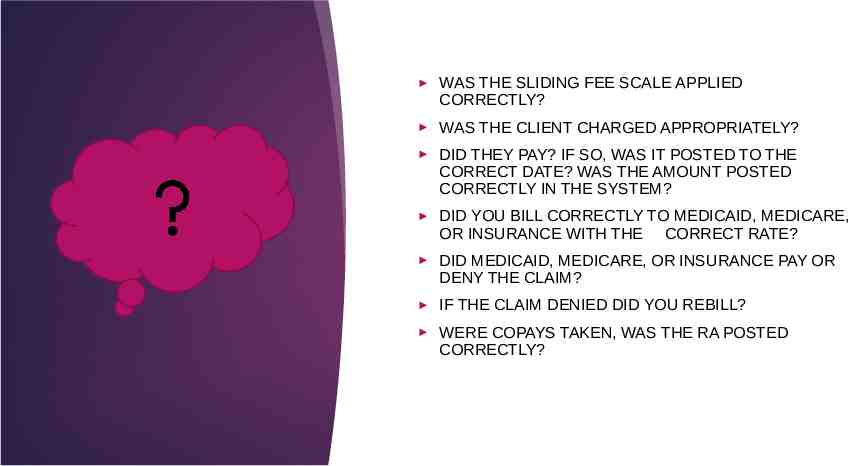

WAS THE SLIDING FEE SCALE APPLIED CORRECTLY? WAS THE CLIENT CHARGED APPROPRIATELY? DID THEY PAY? IF SO, WAS IT POSTED TO THE CORRECT DATE? WAS THE AMOUNT POSTED CORRECTLY IN THE SYSTEM? DID YOU BILL CORRECTLY TO MEDICAID, MEDICARE, OR INSURANCE WITH THE CORRECT RATE? DID MEDICAID, MEDICARE, OR INSURANCE PAY OR DENY THE CLAIM? IF THE CLAIM DENIED DID YOU REBILL? WERE COPAYS TAKEN, WAS THE RA POSTED CORRECTLY?

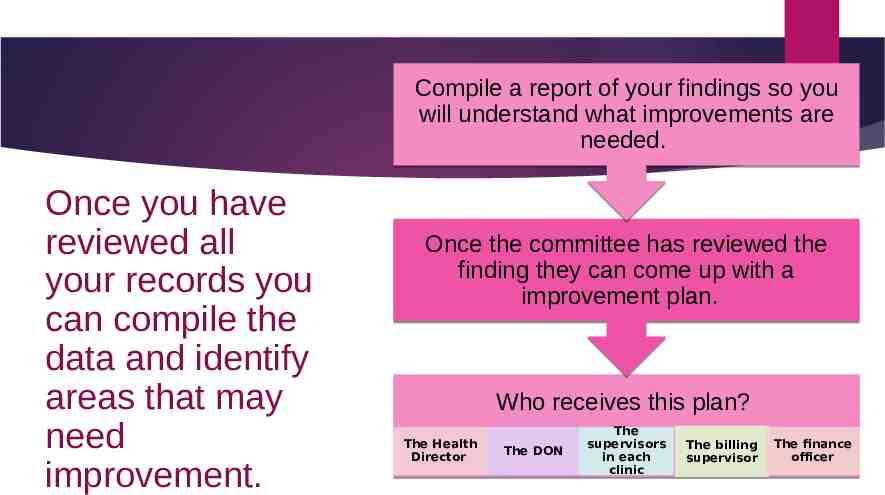

Compile a report of your findings so you will understand what improvements are needed. Once you have reviewed all your records you can compile the data and identify areas that may need improvement. Once the committee has reviewed the finding they can come up with a improvement plan. Who receives this plan? The Health Director The DON The supervisors in each clinic The billing supervisor The finance officer

The purpose of an in-house audit is to catch any errors before they can get too big. It will also improve your billing, revenue and coding. This is a great way to train staff on how to make sure your billing is being keyed correctly. Audits should be performed every quarter.

Coding & Billing; The Basics

CPT & ICD-10: What’s What? CPT codes what you did ICD-10 codes why you did it ICD-10 codes justify CPT codes Correct CPT and ICD Must Be Used When you bill the incorrect CPT or ICD-10 code you will hold up your revenue. To bill efficiently, you should review before you send to the payor.

New vs Established New No billable service provided in last 3 years that requires History & Physical Includes billable Preventive and E&M visits Established In past 3 years, billed 99381-99387, 99391-99397 99211-99215 Client can be New to a program but established with the agency

The Encounter Providers may not charge for an office visit unless they see the client face to face (with the exception of Telehealth Services) Individual staff member’s ID # or initials should be on the paper encounter form when a service is billed or reported. This is used to capture the number and type of services provided by each staff member. Paper encounter forms may be very useful when cross-checking services provided to services billed. They are also needed by consultants performing coding & billing audits.

What are Modifiers? A modifier provides the means to report or indicate that a service or procedure that has been performed has been altered by some specific circumstance, but not changed in its definition or code. Modifiers enable health care professionals to effectively respond to payment policy requirements established by other entities (Medicaid, Insurance, Medicare,etc)

How do I know which modifier to use? Any CPT coding book will include a section on modifiers. In addition the Coding & Billing Guidance Document prepared by DPH/LTAT/PHNPDU includes a chapter on modifiers. Each modifier description provides details on when it is appropriate to use.

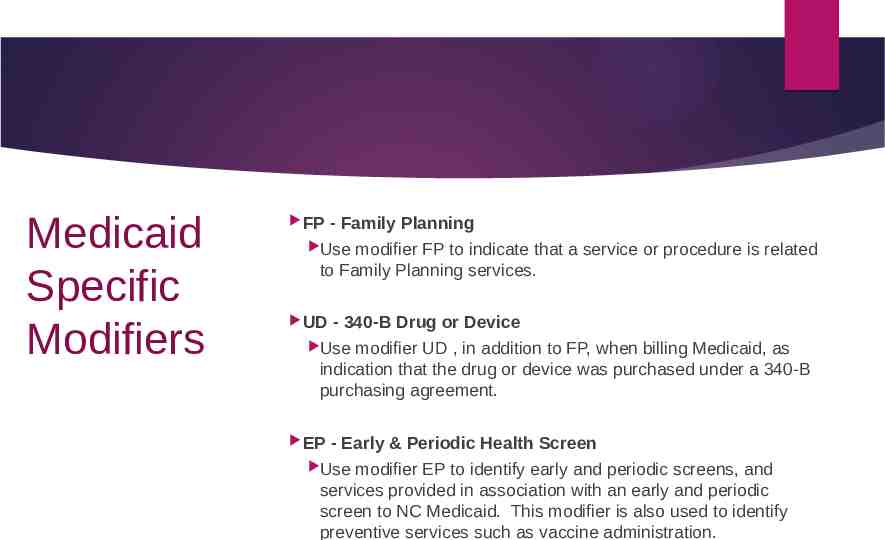

Medicaid Specific Modifiers FP - Family Planning Use modifier FP to indicate that a service or procedure is related to Family Planning services. UD - 340-B Drug or Device Use modifier UD , in addition to FP, when billing Medicaid, as indication that the drug or device was purchased under a 340-B purchasing agreement. EP - Early & Periodic Health Screen Use modifier EP to identify early and periodic screens, and services provided in association with an early and periodic screen to NC Medicaid. This modifier is also used to identify preventive services such as vaccine administration.

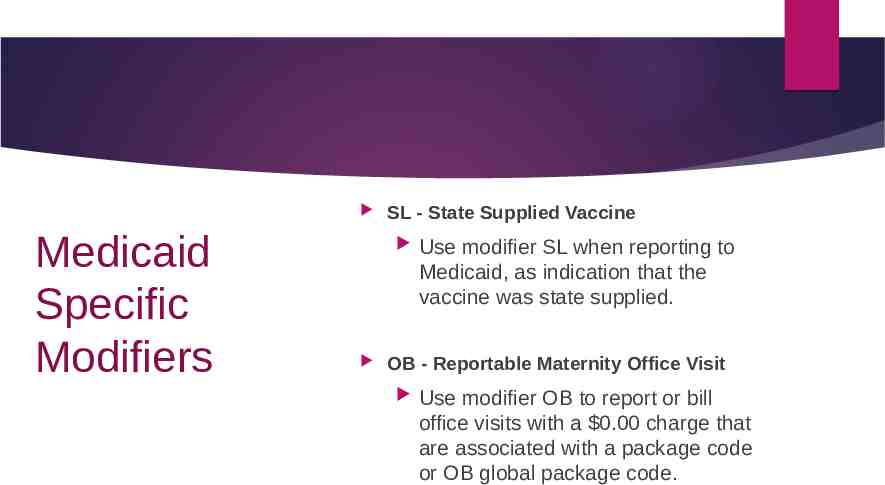

Medicaid Specific Modifiers SL - State Supplied Vaccine Use modifier SL when reporting to Medicaid, as indication that the vaccine was state supplied. OB - Reportable Maternity Office Visit Use modifier OB to report or bill office visits with a 0.00 charge that are associated with a package code or OB global package code.

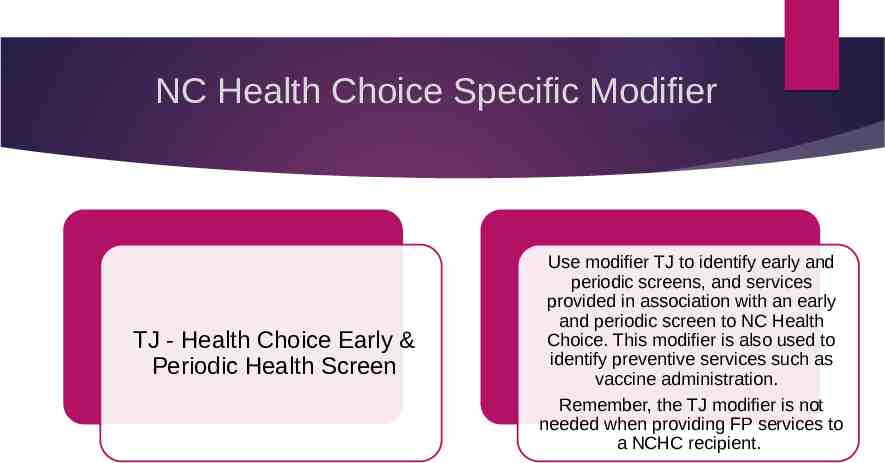

NC Health Choice Specific Modifier TJ - Health Choice Early & Periodic Health Screen Use modifier TJ to identify early and periodic screens, and services provided in association with an early and periodic screen to NC Health Choice. This modifier is also used to identify preventive services such as vaccine administration. Remember, the TJ modifier is not needed when providing FP services to a NCHC recipient.

E/M Changes in 2021 American Medical Association E/M office-visit changes on track for 2021: What doctors must know https://www.ama-assn.org/practice-management/cpt/em-office-visit-changes -track-2021-what-doctors-must-know#: :text Key%20elements%20of%20t he%20E,determine%20a%20visit's%20code%20level . AAPC, What’s Changing for E/M Codes 99201-99215 in 2021 https://www.aapc.com/evaluation-management/em-codes-changes-2021.aspx AAPC Burlington Chapter Education – CPT Evaluation & Management Changes for 2021 .\.\.\.\Coding and Billing\AAPC June 2020 EM 2021 Guideline Changes Burlington Chapter.pdf https://publichealth.nc.gov/lhd/index.htm

COVID-19 Telehealth Billing Please remember that all guidance related to COVID-19 is temporary and will be discontinued whenever the COVID-19 Pandemic is determined to be over. At that time we will move to Telehealth services without the COVID-19 special provisions.

Telemedicine & Telepsychiatry “Medicaid made changes to policies to encourage telemedicine effective Monday, March 23, 2020 with temporary modifications to its Telemedicine and Telepsychiatry Clinical Coverage Policies to better enable the delivery of remote care to Medicaid beneficiaries. These temporary changes will be retroactive to March 10, 2020 and will end the earlier of the cancellation of the North Carolina state of emergency declaration or when this policy is rescinded. In particular, Medicaid Special Bulletin #34 reinforces notable changes including payment parity for telehealth, expanding eligible telehealth technologies, expanding eligible provider types, expanding the list of eligible originating and distant sites, and eliminating the need for prior authorization and referrals SPECIAL BULLETIN COVID-19 #34: Telehealth Clinical Policy Modifications – Definitions, Eligible Providers, Services and Codes

UPDATE- CR MODIFIER: (9/4/2020) CR modifier is to be used with telemedicine or VPC that was COVID-19 related. COVID-19 related telemedicine and VPC is interpreted as providing services by telemedicine & VPC due to COVID-19 and the state of emergency. For example, seeing a patient by Telemedicine/VPC rather than having the patient come into the clinic. (e.g. a patient who needs follow up for chronic illness by telemedicine and they should not come to the office). The CR modifier is not exclusively for those patients being seen virtually because they are sick or suspected with COVID-19. Please carefully review the Medicaid Telehealth Billing Code Summary Document https://files.nc.gov/ncdma/covid-19/NCMedicaid-Telehealth-Billing-Code-Summary.pdf

New DPH For Local Health Departments webpage https://publichealth.nc.gov/lhd/index.htm Administrative & Financial Support Unit (AFSU) Administrative Monitoring Budget Prep & Monitoring Consolidated Agreement & AA’s Forms & Tools Newsletters Policy & Procedure Development Training Public Health Nursing & Professional Development Unit (PHNPDU) Coding & Billing Review Tools Documentation Guidelines Documentation & Training from Licensing Boards Problem Oriented Health Records (POHR) Training

Coding & Billing Resources Coding Billing Guidance Document COVID-19 Billing Quick Guides ICD-10 Coding Resources Training Handouts General Information Practice Management Record Retention Telemedicine Training Reimbursement

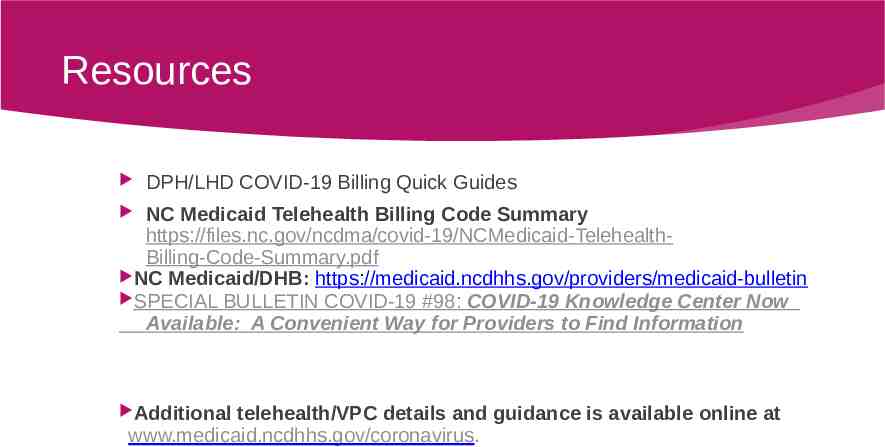

Resources DPH/LHD COVID-19 Billing Quick Guides NC Medicaid Telehealth Billing Code Summary https://files.nc.gov/ncdma/covid-19/NCMedicaid-TelehealthBilling-Code-Summary.pdf NC Medicaid/DHB: https://medicaid.ncdhhs.gov/providers/medicaid-bulletin SPECIAL BULLETIN COVID-19 #98: COVID-19 Knowledge Center Now Available: A Convenient Way for Providers to Find Information Additional telehealth/VPC details and guidance is available online at www.medicaid.ncdhhs.gov/coronavirus.