Money Management PowerPoint Presentations PowerPoint

22 Slides5.62 MB

Money Management PowerPoint Presentations PowerPoint Presentation Sample *This is a sample of the NFEC’s Money Management PowerPoints Presentation. You can access the full presentation at https://www.financialeducatorscouncil.org/financial-literacy-curriculum/

Budgeting, Budgeting Fundamentals & Overview Money Management PowerPoint Presentations

Benefits of Budgeting Gives you control over your money Keeps you focused toward your financial goals Helps you stay aware of where your money goes Helps you save for expected and unexpected costs Clarifies areas where you can save money Budgeting, Budgeting Fundamentals & Overview - Money Management PowerPoint Presentations

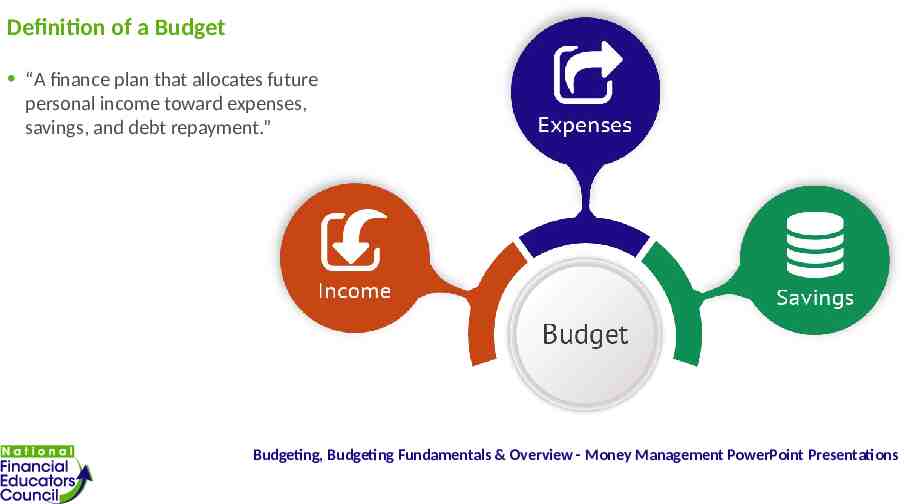

Definition of a Budget “A finance plan that allocates future personal income toward expenses, savings, and debt repayment.” Budgeting, Budgeting Fundamentals & Overview - Money Management PowerPoint Presentations

Three Main Components of a Budget Income Money you earn from a range of sources. Expenses Outgoing funds you pay to others Savings Anything you have left over after paying your expenses. Budgeting Budgeting, Budgeting Fundamentals & Overview - Money Management PowerPoint Presentations

Where to Start when Developing a Budget Understand your money and how you spend it Make tough decisions about spending priorities Budget with a lifestyle in mind Build a budget that allows you to save Budgeting, Budgeting Fundamentals & Overview - Money Management PowerPoint Presentations

Budgeting With A Lifestyle In Mind Clarify the life aspects you give priority, and then split them into 3 areas: Items that create meaning and bring you joy Things you want, but that can wait Things you would like to have, but aren’t essential Budgeting, Budgeting Fundamentals & Overview - Money Management PowerPoint Presentations

Things to Remember about Budgeting Make sure your list reflects your priorities You can always adjust your goals as your priorities change Budgeting takes time, patience, and effort If your first attempts don’t go as planned, don’t give up Look for ways to make tracking spending easier – like mobile apps Budgeting, Budgeting Fundamentals & Overview - Money Management PowerPoint Presentations

What Happens if you Don’t Budget Overspending Falling into a debt cycle Limited spending power Limited savings and investments Lack of future security Budgeting, Budgeting Fundamentals & Overview - Money Management PowerPoint Presentations

Finally Budgeting is about saving money Better budgeting helps you end up with more money to manage An accurate budget brings discipline and order to your finances Use your budget to guide important decisions Earning more than you spend is the way to a low-stress, comfortable life!

Budgeting, Setting Savings Goals And Creating A Savings Plan Money Management PowerPoint Presentations Budgeting, Setting Savings Goals & Creating a Savings Plan - Money Management PowerPoint Presentations

Three Components of a Savings Plan Budgeting, Setting Savings Goals & Creating a Savings Plan - Money Management PowerPoint Presentations

Emergency Fund Should be liquid (easily converted to cash) Equal to at least 6 months of your essential living expenses Those in downsizing or highly competitive industries should save more Be prepared for a market collapse Cushion for handling unexpected expenses Budgeting, Setting Savings Goals & Creating a Savings Plan - Money Management PowerPoint Presentations

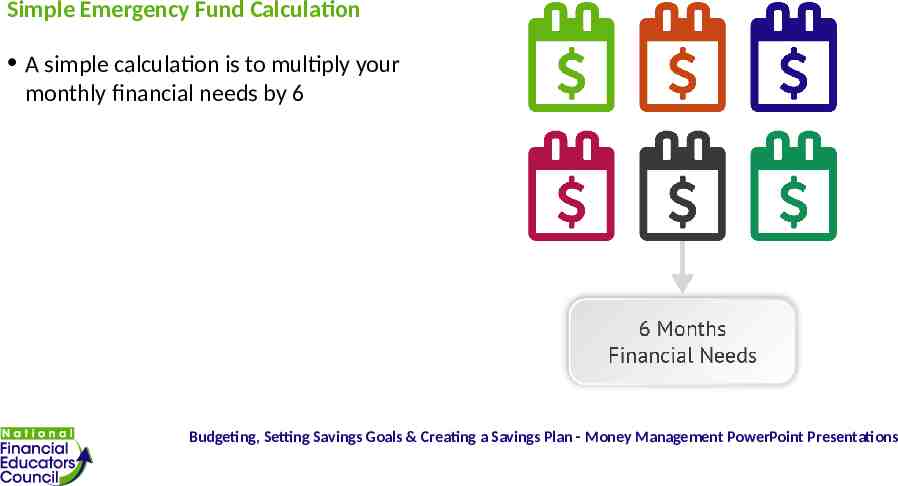

Simple Emergency Fund Calculation A simple calculation is to multiply your monthly financial needs by 6 Budgeting, Setting Savings Goals & Creating a Savings Plan - Money Management PowerPoint Presentations

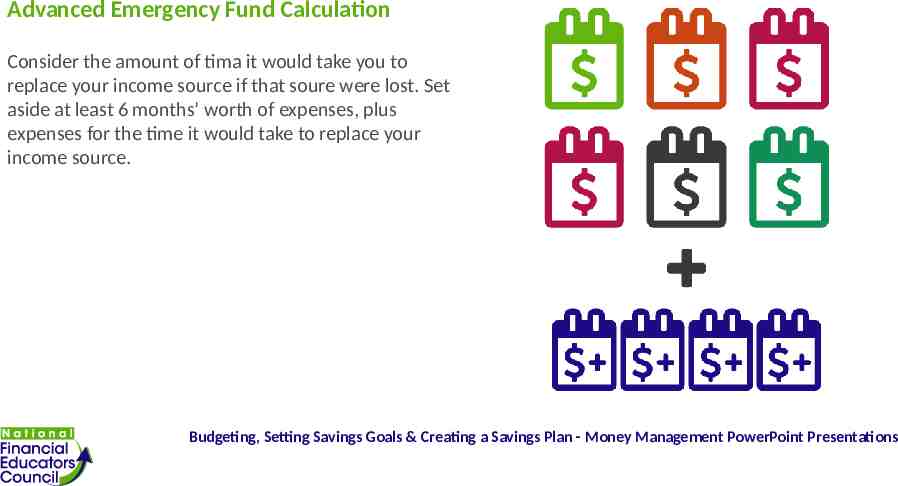

Advanced Emergency Fund Calculation Consider the amount of tima it would take you to replace your income source if that soure were lost. Set aside at least 6 months’ worth of expenses, plus expenses for the time it would take to replace your income source. Budgeting, Setting Savings Goals & Creating a Savings Plan - Money Management PowerPoint Presentations

When should you use your emergency fund? Sudden unemployment Replace things you must have to make money Emergency medical expenses Disaster recovery Deductibles in case of accident or loss Repairs that would result in further damage if neglected Unexpected expenses: Was it impossible to plan for? Is it urgent? Budgeting, Setting Savings Goals & Creating a Savings Plan - Money Management PowerPoint Presentations

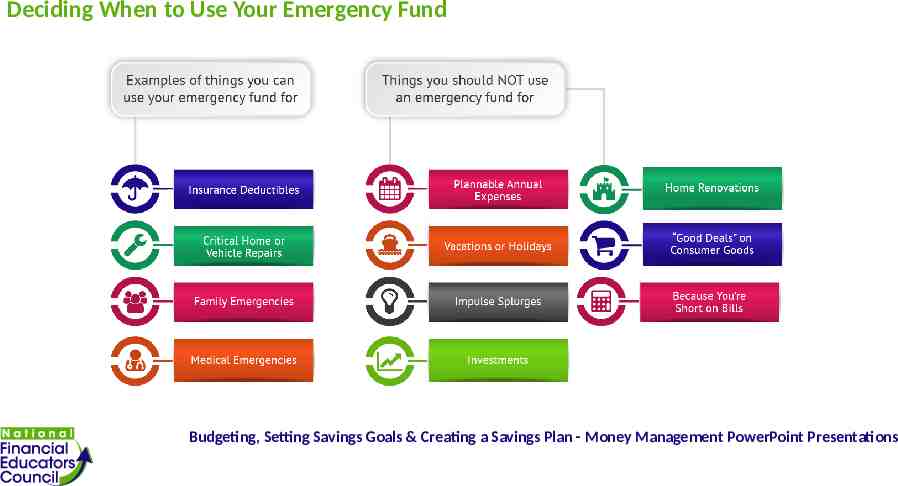

Deciding When to Use Your Emergency Fund Budgeting, Setting Savings Goals & Creating a Savings Plan - Money Management PowerPoint Presentations

Short-term Savings Money set aside for fun things now Enjoy the fruits of your labor Provides near-term gratification without going into debt Gets you in the habit of evaluating and prioritizing your wants

Long-term Savings Money for future investments Long-term financial plans, such as retirement “Pay yourself first” Target 10% of your take-home income Increase the amount over time Use automatic transfers to make long-term savings routine Budgeting, Setting Savings Goals & Creating a Savings Plan - Money Management PowerPoint Presentations

Setting a Long-term Savings Goal Budgeting, Setting Savings Goals & Creating a Savings Plan - Money Management PowerPoint Presentations

Factors to Consider Find out the real cost of unemployment in your industry Caring for aging family members Debt load vs. your savings or investment returns Two simple ways to save more money: Increase income Cut down on expenses Budgeting, Setting Savings Goals & Creating a Savings Plan - Money Management PowerPoint Presentations

Developing an Individualized Savings Plan Set emergency fund targets Decide on the standard of living you’ll maintain during unemployment Short-term savings targets What major expenses are coming up? How much do you have saved now? When do you need them? Long-term savings targets Shoot for saving 10% of your net income Budgeting, Setting Savings Goals & Creating a Savings Plan - Money Management PowerPoint Presentations