Investing Principles RK Wealth Management, LLC

73 Slides3.05 MB

Investing Principles RK Wealth Management, LLC

Disclaimer: This presentation is not intended to advertise or sell any financial products, investment strategies or services; it is intended only to help educate. The presentation addresses only broad aspects of investing and financial planning and is not meant to provide detailed information or be applied to any individual’s unique circumstances. It is not a substitute for personalized financial planning with a professional advisor.

“In the long run, it’s not just how much money you make that will determine your future prosperity. It’s how much of that money you put to work by saving it and investing it.” – Peter Lynch

In this presentation we’ll discuss: What investing is all about Two main approaches to owning stocks and investments Understanding an investment Personal pitfalls of investing

In this presentation we’ll discuss: What investing is all about Two main approaches to owning stocks and investments Understanding an investment Personal pitfalls of investing

In this presentation we’ll discuss: What investing is all about Two main approaches to owning stocks and investments Understanding an investment Personal pitfalls of investing

In this presentation we’ll discuss: What investing is all about Two main approaches to owning stocks and investments Understanding an investment Personal pitfalls of investing

“Investing money is the process of committing resources in a strategic way to accomplish a specific objective.” The Idea of Investing – Alan Gotthardt

Why do we invest? What does it mean?

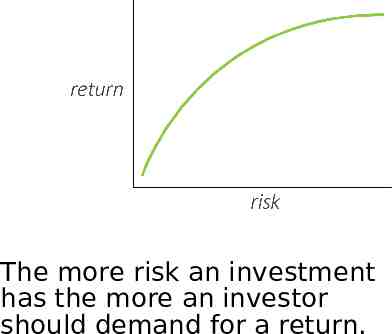

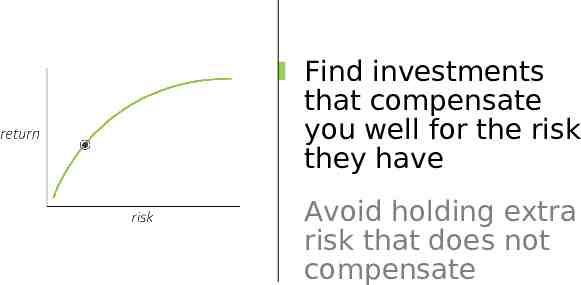

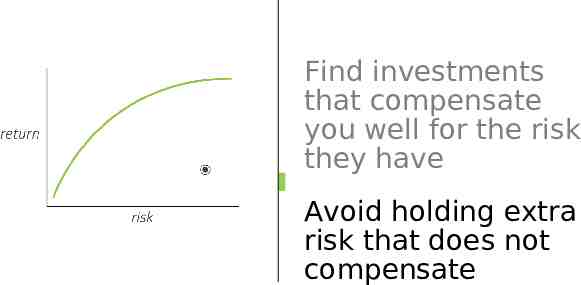

Investing is about getting paid to hold on to risk.

The more risk an investment has the more an investor should demand for a return.

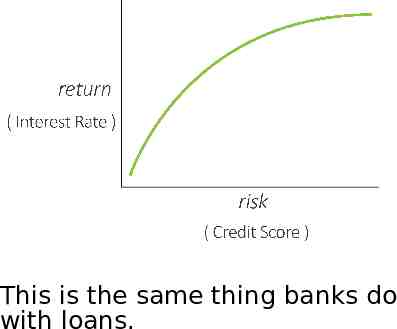

This is the same thing banks do with loans.

“Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now." The Goals of Investing – Warren Buffett

Find investments that compensate you well for the risk they have Avoid holding extra risk that does not compensate

Find investments that compensate you well for the risk they have Avoid holding extra risk that does not compensate

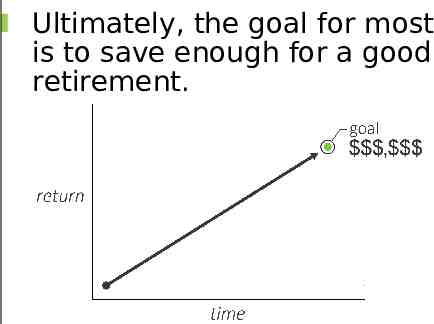

Ultimately, the goal for most is to save enough for a good retirement.

“The individual investor should act consistently as an investor and not as a speculator.” – Benjamin Graham Market “Gambling”

Many people say that the stock market is just a form of gambling.

Many people say that the stock market is just a form of gambling. Why isn’t investing gambling? At its core, gambling is about purchasing risk and nothing else. Investing is owning financial assets that have the potential to

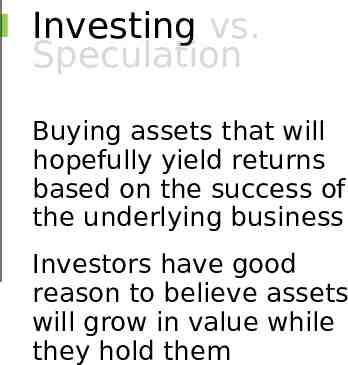

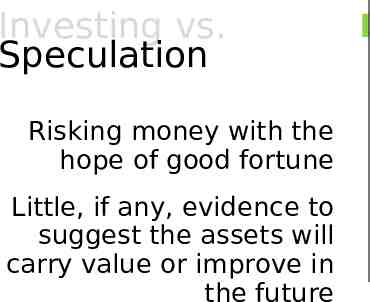

Investing vs. Speculation

Investing vs. Speculation Buying assets that will hopefully yield returns based on the success of the underlying business Investors have good reason to believe assets will grow in value while they hold them

Investing vs. Speculation Risking money with the hope of good fortune Little, if any, evidence to suggest the assets will carry value or improve in the future

What’s the problem with speculation? Speculation does not focus on the asset being purchased

What’s the problem with speculation? Speculation does not focus on the asset being purchased Instead, it focuses on the returns the asset could produce if certain unpredictable conditions

Which is it? Investing vs. Speculation

“This stock is HOT!”

N O I “This stock isT HOT!” A L U C E SP

“The underlying fundamentals of the company are solid.”

“The underlying fundamentals of the company are solid.” Investing

“Emerging markets have been dropping for a while, so we expect to see a reversal soon.”

N IO “Emerging markets have been dropping for a while, so we expect to see a reversal soon.” T A L U C E SP

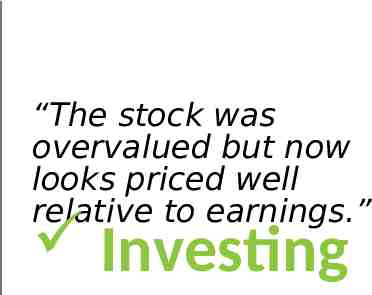

“The stock was overvalued but now looks priced well relative to earnings.”

“The stock was overvalued but now looks priced well relative to earnings.” Investing

Investing Principles Foundational Investing Concepts

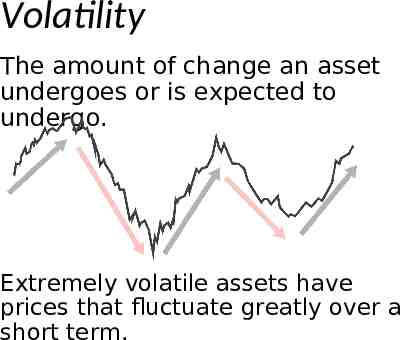

Volatility The amount of change an asset undergoes or is expected to undergo. Extremely volatile assets have prices that fluctuate greatly over a short term.

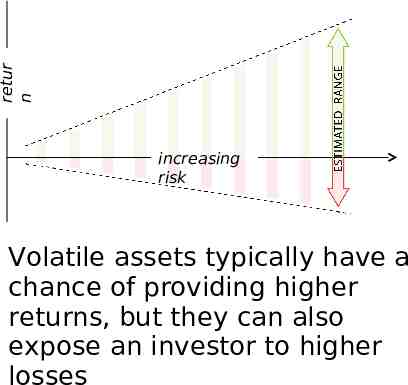

retur n increasing risk Volatile assets typically have a chance of providing higher returns, but they can also expose an investor to higher losses

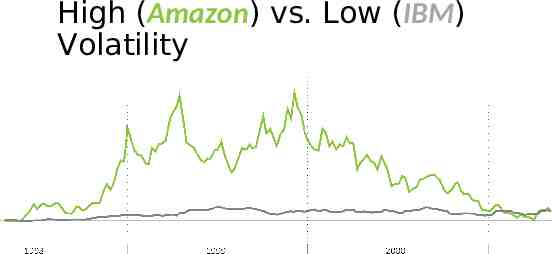

High (Amazon) vs. Low (IBM) Volatility

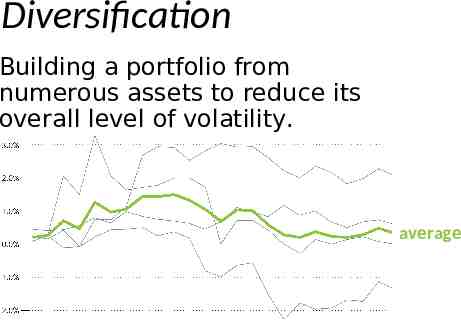

Diversification Building a portfolio from numerous assets to reduce its overall level of volatility. average

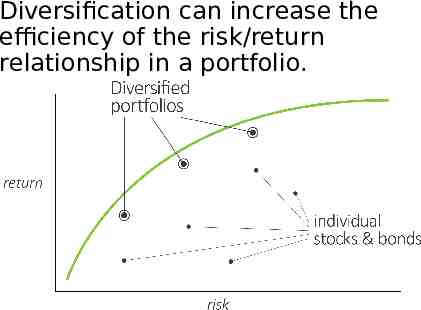

Diversification can increase the efficiency of the risk/return relationship in a portfolio.

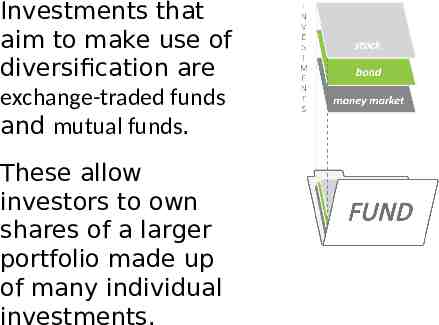

Investments that aim to make use of diversification are exchange-traded funds and mutual funds. These allow investors to own shares of a larger portfolio made up of many individual investments.

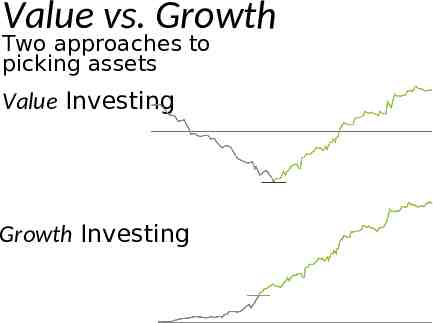

Value vs. Growth Two approaches to picking assets Value Investing Growth Investing

Value Investing Estimated real value Purchasing assets believed to be temporarily undervalued or out of favor with investors

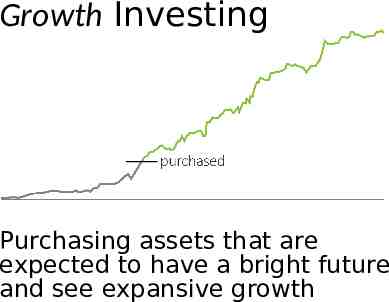

Growth Investing Purchasing assets that are expected to have a bright future and see expansive growth

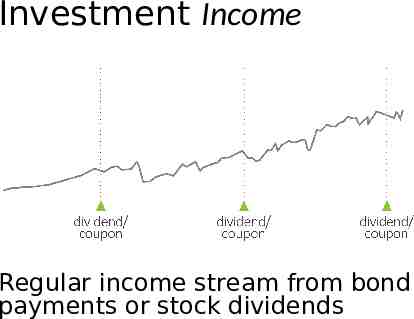

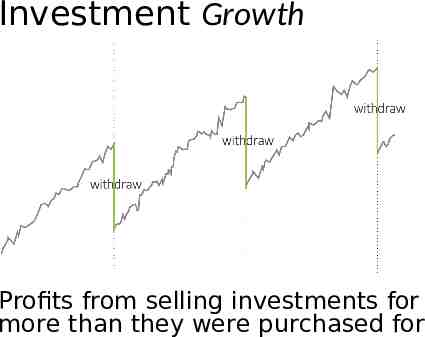

Income vs. Growth Portfolio returns/withdrawal/etc. strategies Investment Income Investment Growth

Investment Income Regular income stream from bond payments or stock dividends

Investment Growth Profits from selling investments for more than they were purchased for

“There seems to be some perverse human characteristic that likes to make easy things difficult." – Warren Buffett The pitfalls we create for ourselves

PITFALL: Excitement and Fear “If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.” -John Bogle

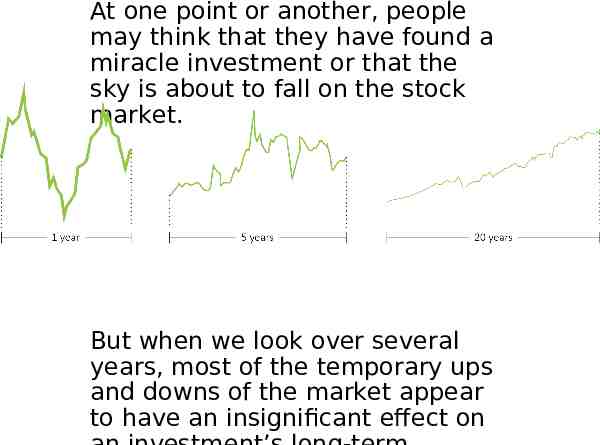

At one point or another, people may think that they have found a miracle investment or that the sky is about to fall on the stock market. But when we look over several years, most of the temporary ups and downs of the market appear to have an insignificant effect on

What to do: Keep a healthy level of mental detachment from your money. Remember that the market is often irrational in the short term but tends to behave more efficiently in the long term.

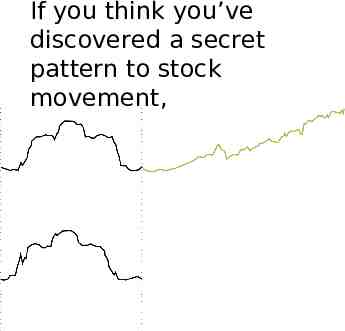

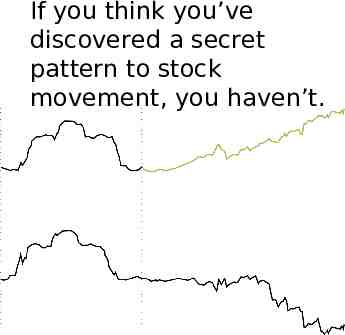

PITFALL: We think We’ve Found a Pattern “The first principle is that you must not fool yourself, and you are the easiest person to fool.” -Richard Feynman

If you think you’ve discovered a secret pattern to stock movement,

If you think you’ve discovered a secret pattern to stock movement, you haven’t.

These false patterns lead us to create superstitious behavior, that encourage us to trust our “gut” rather than rational thinking.

PITFALL: We follow the crowd simply because it’s popular

Investing isn’t supposed to be about getting on “the next big thing.” If everyone is convinced a stock is a sure buy, it may be overvalued.

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” -Charlie Munger

PITFALL: We Feel Compelled to Constantly Watch our Investments

Our stress level is the only thing that we can make rise by watching the stock market constantly. Watching stocks leads to decisions made out of fear or excitement. A good investment can be left alone for years.

Investing Principles Your mindset as an investor

Know your investments “Behind every stock is a company. Find out what it’s doing.” -Peter Lynch

Know your investments Owning shares is owning a stake in a business. If you owned a company, wouldn’t you try to know how things were working?

Know your investments Owning shares is owning a stake in a business. If you owned a company, wouldn’t you try to know how things were working?

Know yourself “If you don’t feel comfortable owning something for 10 years, then don’t own it for 10 minutes.” -Warren Buffett

Know yourself Do you prefer Growth or Value strategies? Are you optimistic about investing? Are you very conservative with how you use your money?

Know yourself Do you prefer Growth or Value strategies? Are you optimistic about investing? Are you very conservative with how you use your money?

Know yourself Do you prefer Growth or Value strategies? Are you optimistic about investing? Are you very conservative with how you use your money?

Understand the Market

Understand the Market You don’t need to know every little change the market might make.

Understand the Market You don’t need to know every little change the market might make; you need to recognize that it will always be somewhat unpredictable.

What is the one asset every investor must have?

What is the one asset every investor must have? Time. The most valuable thing you are investing is your time. It’s the most potent tool an investor has and it can’t be earned back later. So make the most of it! RK Wealth Management, LLC (515) 348-6019 1200 Valley West Drive, Suite 403 West Des Moines, IA 50266 This article was written by Advicent Solutions, an entity unrelated to RK Wealth Management, LLC. The information contained in this article is not intended to be tax, investment, or legal advice, and it may not be relied on for the purpose of avoiding any tax penalties. RK Wealth Management, LLC does not provide tax or legal advice. You are encouraged to consult with your tax advisor or attorney regarding specific tax issues. 2014, 2016 Advicent Solutions. All rights reserved.

Securities and investment advisory services are offered solely through registered representatives and investment advisor representatives of Ameritas Investment Corp. (AIC), a registered Broker/Dealer, Member FINRA/SIPC and a registered investment advisor. AIC is not affiliated with RK Wealth Management, LLC or Midwest Financial Solutions, LLC. Additional products and services may be available through Eric Raasch and Chris Kramer, RK Wealth Management, LLC or Midwest Financial Solutions, LLC that are not offered through AIC. Representatives of AIC do not provide tax or legal advice. Please consult your tax advisor or attorney regarding your situation.