Insurance for Consenting Adults An Introduction to Reinsurance for

41 Slides4.48 MB

Insurance for Consenting Adults An Introduction to Reinsurance for the Insurance Institute of Leicester Mercure Grand Hotel, 8 February 2017 Ian Plumley, Partner, Clyde & Co LLP

Agenda/Learning Objectives What reinsurance is and why it is needed. The different kinds of reinsurance available and how they work: – Facultative v Obligatory; – Proportional v Non-Proportional; and – Application to a simple loss example. Considerations when buying and selling reinsurance. An overview of the reinsurance market and who offers reinsurance. Questions. 2

Introduction to Reinsurance 3

What is Reinsurance? “ the transfer of part of the hazards or risks that a direct insurer assumes “The business of insuring an by way of insurance contract or legal insurance company or underwriter provision on behalf of an insured, to a against suffering too great a loss from second insurance carrier, the their insurance operations.” reinsurer, who has no direct contractual relationship with the (Robert & Stephen Kiln, Reinsurance insured.” in Practice) (M Grossmann, Reinsurance - An introduction) Slightly less long-windedly: The backbone of the insurance industry (premium being the lifeblood). A contract between two insurers: the insurance of insurance! “Insurance between consenting adults” ( Rob Merkin). Ultimately, a means by which risk is spread across the financial system. 4

Why is there a need for reinsurance? Two main reasons why a direct insurer needs reinsurance: – To limit annual fluctuation in loss it must bear for its own account; and – To be protected in case of catastrophe. However, broader function (from reinsured’s perspective) is as follows: – Capacity Relief: Allows underwriting of larger amounts of insurance. – Catastrophe Protection: Protects against a large single, catastrophic loss or multiple large losses. – Stabilisation: Helps smooth overall operating results. – Surplus Relief: Eases strain on surplus during rapid premium growth. – Market Withdrawal: Provides a means to withdraw from line of business or geographic area or production source. – Market Entrance: Spreads risk on new lines of business until premium volume matures; add confidence when coverage areas unfamiliar. – Expertise/Experience: Source of u/w information when developing new products and/or entering new line of insurance or new market. 5

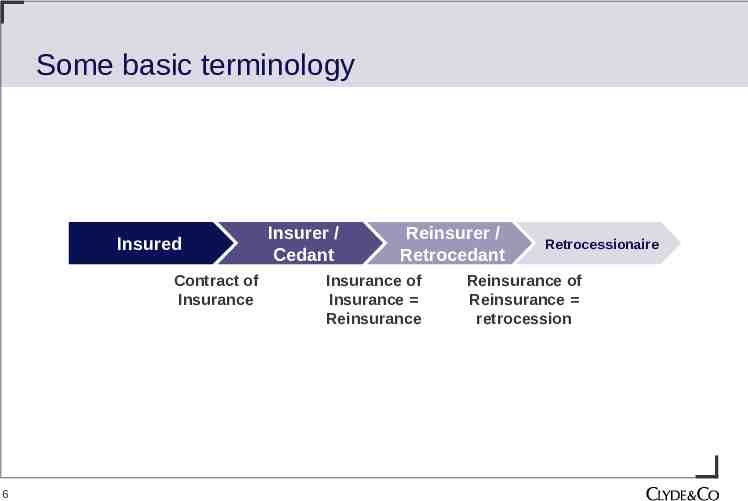

Some basic terminology Insured Contract of Insurance 6 Insurer / Cedant Reinsurer / Retrocedant Insurance of Insurance Reinsurance Retrocessionaire Reinsurance of Reinsurance retrocession

Different kinds of reinsurance and how they work 7

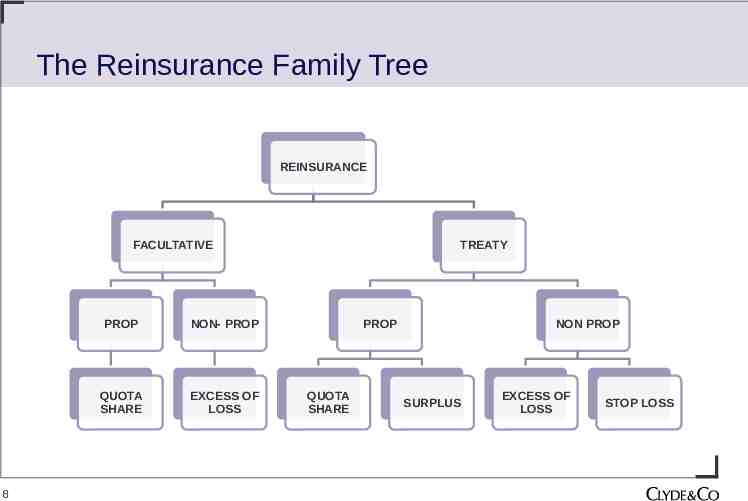

The Reinsurance Family Tree REINSURANCE FACULTATIVE 8 PROP NON- PROP QUOTA SHARE EXCESS OF LOSS TREATY PROP QUOTA SHARE NON PROP SURPLUS EXCESS OF LOSS STOP LOSS

Basic forms of reinsurance: Introduction Three forms of reinsurance arrangements: Facultative Reinsurance; Treaty Reinsurance; and Facultative Obligatory. 9

Forms of Reinsurance Facultative Reinsurance Oldest form of reinsurance. Direct insurer chooses freely which individual risks he wants to offer to a reinsurer. Ideally preserved for individual reinsurance of large or hazardous single risks, ceded on original terms. Reinsurer is free either to accept or refuse any risk offered to him. Today, facultative reinsurance used mainly as a complement to treaty reinsurance, in which entire portfolios of risks are ceded. A direct insurer will most often turn to facultative reinsurance in two cases: – when he is left with a sum he still needs to reinsure after he has exhausted both retention and reinsurance capacity provided by treaty; or – when he has sold a policy containing risks that are excluded from his obligatory reinsurance cover. Traditionally placed on proportional basis but non-proportional now more common. Reinsurance for individual risks 10

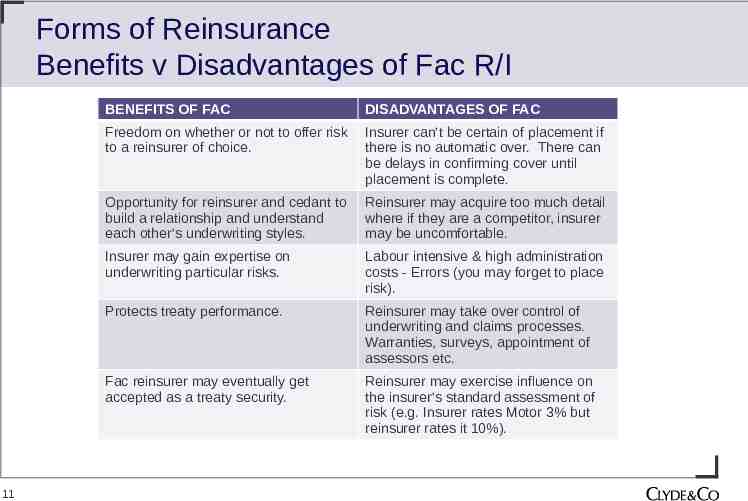

Forms of Reinsurance Benefits v Disadvantages of Fac R/I 11 BENEFITS OF FAC DISADVANTAGES OF FAC Freedom on whether or not to offer risk to a reinsurer of choice. Insurer can’t be certain of placement if there is no automatic over. There can be delays in confirming cover until placement is complete. Opportunity for reinsurer and cedant to build a relationship and understand each other’s underwriting styles. Reinsurer may acquire too much detail where if they are a competitor, insurer may be uncomfortable. Insurer may gain expertise on underwriting particular risks. Labour intensive & high administration costs - Errors (you may forget to place risk). Protects treaty performance. Reinsurer may take over control of underwriting and claims processes. Warranties, surveys, appointment of assessors etc. Fac reinsurer may eventually get accepted as a treaty security. Reinsurer may exercise influence on the insurer’s standard assessment of risk (e.g. Insurer rates Motor 3% but reinsurer rates it 10%).

Forms of Reinsurance Treaty reinsurance Treaty reinsurance is obligatory in nature for both parties to contract: – Direct insurer is obliged to cede to reinsurer a contractually agreed share of the risks defined in reinsurance treaty; and – Reinsurer is obliged to accept that share. Reinsurer cannot therefore refuse to provide insurance protection for an individual risk falling within scope of treaty, nor may direct insurer decide not to cede such a risk to the reinsurer. Limits, terms and conditions are agreed in advance usually at beginning of year and are set for all cessions. Insurers use treaty when: – Risks are homogenous or have similar exposures. – There is a large volume of such risks. Obligatory reinsurance for entire portfolios 12

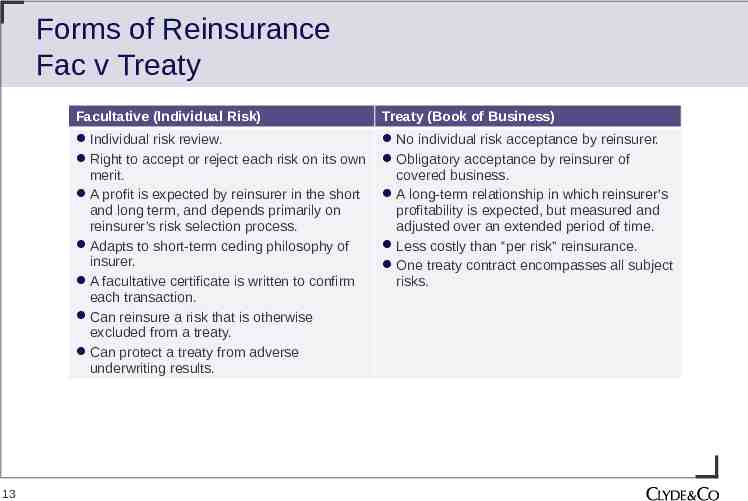

Forms of Reinsurance Fac v Treaty 13 Facultative (Individual Risk) Treaty (Book of Business) Individual risk review. Right to accept or reject each risk on its own merit. A profit is expected by reinsurer in the short and long term, and depends primarily on reinsurer’s risk selection process. Adapts to short-term ceding philosophy of insurer. A facultative certificate is written to confirm each transaction. Can reinsure a risk that is otherwise excluded from a treaty. Can protect a treaty from adverse underwriting results. No individual risk acceptance by reinsurer. Obligatory acceptance by reinsurer of covered business. A long-term relationship in which reinsurer’s profitability is expected, but measured and adjusted over an extended period of time. Less costly than “per risk” reinsurance. One treaty contract encompasses all subject risks.

Forms of Reinsurance Facultative Obligatory Form of proportional reinsurance which entitles reinsured to decide what risks (and amount) he wishes to cede to reinsurers: – Facultative means that reinsured has option to cede on risk by risk basis. – Obligatory means that reinsurer is obliged to accept each cession or risk. Usual for reinsurer to require reinsured to retain a minimum retention to ensure that reinsured maintains interest at risk at all times (prevents antiselection). Example: – Insurer insures an Airbus A380. 100% exposure under policy is 100million. – Insurer writes 1% but wants to limit its liability to 500,000. Insurer therefore buys a 50% facultative proportional reinsurance. – Aircraft is damaged with loss of 20million. – Insurer will have an exposure of 200,000, of which 100,000 will be covered by fac oblig reinsurance. 14

Placing of Reinsurance Proportional v Non-Proportional Facultative and treaty reinsurance can be placed/underwritten on either: – Proportional/Pro Rata basis; or – Non-Proportional basis. 15

Placing of Reinsurance Proportional (aka pro rata) reinsurance Describes reinsurance in which: – reinsurer accepts a pre-determined fixed portion of business accepted by ceding company; – intention (generally) is that reinsurers follow and share in fortunes of reinsured on substantially similar terms to ceding reinsured. Along with sharing proportionally in premium and losses, reinsurer typically pays a ceding commission to ceding company to reimburse for expenses associated with issuing underlying policy. Advantages: – Easy to administer. – Good protection against frequency/severity potential. – Protection of net retention on first-dollar basis. – Permits recovery on smaller losses. Two main types in use are Quota Share and Surplus. 16

Placing of Reinsurance Quota Share Risk, premiums, and losses are allocated between cedant and reinsurer in same fixed share. Reinsurer participates in every risk and loss. A quota share is usually named by the amount ceded (i.e. a 60% quota share means 60% has been ceded and 40% retained). Mostly used when sums insured in a portfolio are relatively uniform (e.g. motor or household). Quota shares carry highest ceding commissions. More ideal when fronting, entering new lines or territory. Most ideal for reciprocal business. Ideal example of follow the fortunes. 17

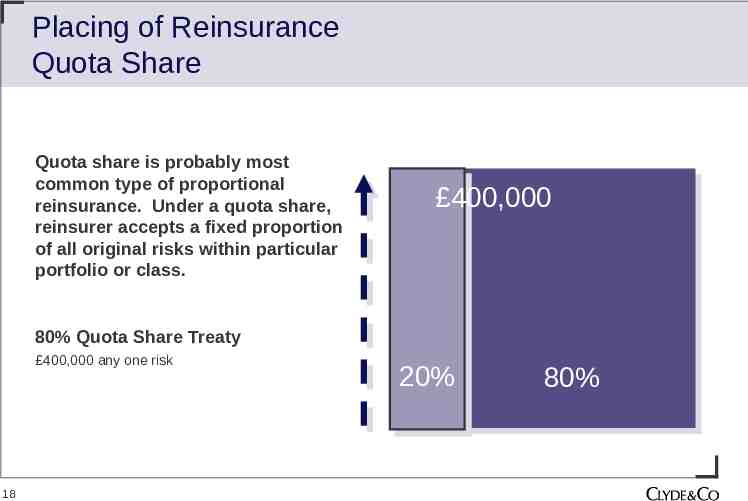

Placing of Reinsurance Quota Share Quota share is probably most common type of proportional reinsurance. Under a quota share, reinsurer accepts a fixed proportion of all original risks within particular portfolio or class. 400,000 80% Quota Share Treaty 400,000 any one risk 18 20% 80%

Placing of Reinsurance Surplus Distinguishing characteristic is that when an underlying policy’s total amount of insurance exceeds a stipulated dollar amount or line, reinsurer assumes surplus share of the amount of insurance (difference between primary insurer’s line and total amount of insurance). Insurer and reinsurer share policy premiums and loses proportionately. Primary insurer’s share of policy premiums and losses is proportion that line bears to total amount of insurance. Reinsurer’s share of premiums and losses is proportion that amount ceded bears to total. Typically used with property insurance and ideal when portfolio contains a mixture of large, medium and small size risks. Cedant retains more premium than under Quota Share. Risk of unbalanced treaty is high. 19

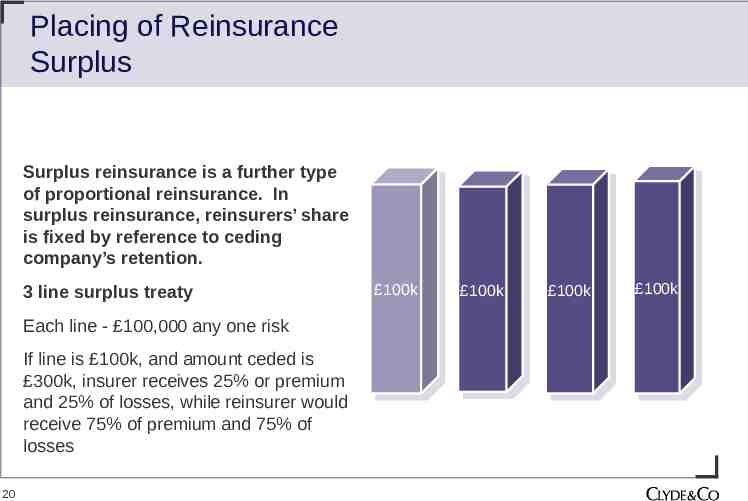

Placing of Reinsurance Surplus Surplus reinsurance is a further type of proportional reinsurance. In surplus reinsurance, reinsurers’ share is fixed by reference to ceding company’s retention. 3 line surplus treaty Each line - 100,000 any one risk If line is 100k, and amount ceded is 300k, insurer receives 25% or premium and 25% of losses, while reinsurer would receive 75% of premium and 75% of losses 20 100k 100k 100k 100k 100k 100k 100k 100k

Placing of Reinsurance Comparison of Quota Share & Surplus Quota Share generally has higher commissions. More premium is usually ceded under Quota Share. You cannot vary percentage retention on a Quota Share. Reinsurer & cedant’s fortunes are similar under Quota Share but may be different under Surplus (i.e. one can make profit while the other makes a loss). Surplus treaty has better cat protection. With surplus, insurer either stands or falls by retention level chosen. 21

Placing of Reinsurance Non Proportional (Excess of Loss) Reinsurance transaction that, subject to a specified limit, indemnifies a ceding company against amount of loss in excess of a specified retention. In excess of loss reinsurance, premiums are typically negotiated as a percentage of primary insurer’s premium charge and are not proportionally related to risk carried. Premiums usually paid in advance as Minimum and/or Deposit Premium. There is no cession per risk rather the premium is for the whole portfolio. Distribution of Liabilities is based on losses rather than sum insured and losses only get paid once they exceed the excess point/deductible. Advantages: – Good protection against frequency or severity potential, depending upon retention level. – Allows a greater net premium retention. – More economical in terms of reinsurance premium and cost of administration. 22

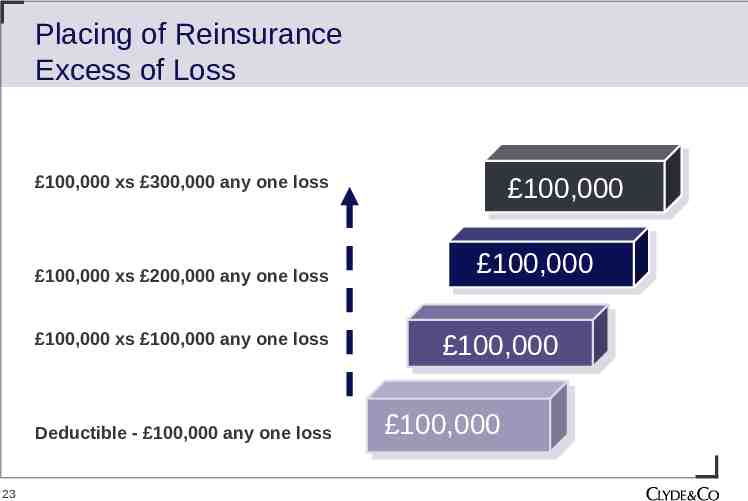

Placing of Reinsurance Excess of Loss 100,000 xs 300,000 any one loss 100,000 xs 200,000 any one loss 100,000 xs 100,000 any one loss Deductible - 100,000 any one loss 23 100,000 100,000 100,000 100,000 100,000

Placing of Reinsurance Excess of Loss Excess of loss can be used to protect the following: – Risk Exposure; – Estimated Maximum Loss error exposure; – Catastrophe Exposure; and – Clash Exposure - Accumulation of different risk classes in one event. One program may offer all this protection. 24

Placing of Reinsurance Stop Loss & Aggregate XL Stop Loss operates on pre agreed percentage while Aggregate XL cover is expressed as fixed limits. They are used to protect losses in a particular class or an aggregation of an event. Insurer’s loss ratio is limited to a particular level and reinsurer will kick in up to agreed limit. Most suitable in businesses where losses can have unpredictable spikes e.g. in weather related covers like Hail insurance. Losses are only recoverable when the aggregate exceeds the deductible. 25

Application of Loss Example The Reinsured Property Commercial Property with an (re)insured value of 400,000 26

Application of Loss Example The Loss is badly damaged by fire causing total losses of 250,000 27

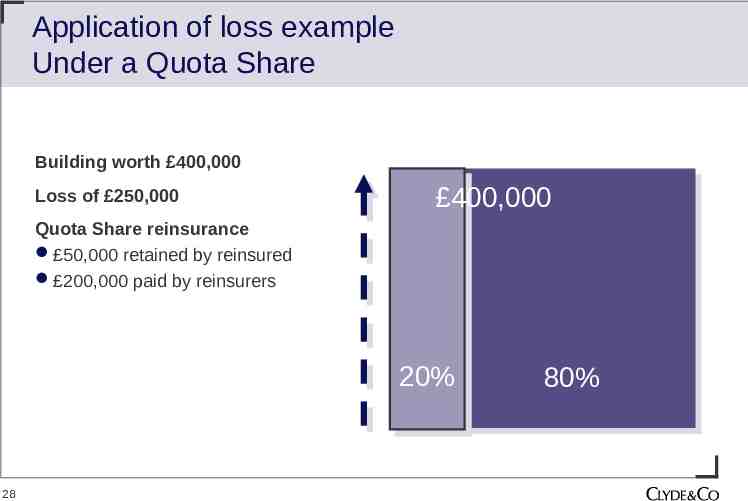

Application of loss example Under a Quota Share Building worth 400,000 Loss of 250,000 400,000 Quota Share reinsurance 50,000 retained by reinsured 200,000 paid by reinsurers 20% 28 80%

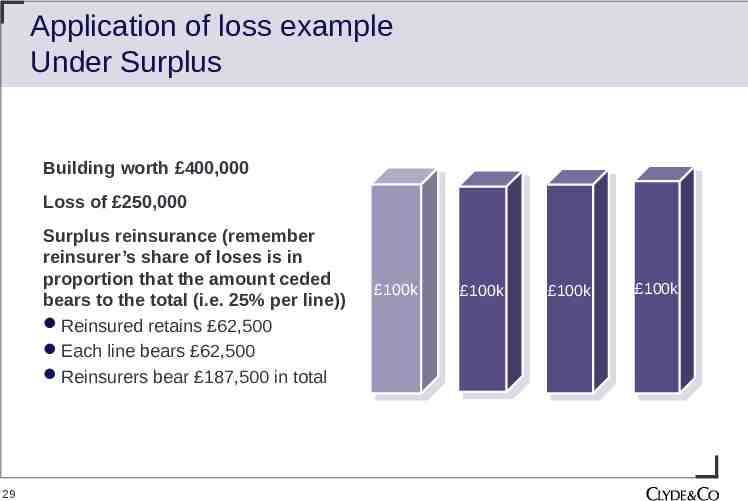

Application of loss example Under Surplus Building worth 400,000 Loss of 250,000 Surplus reinsurance (remember reinsurer’s share of loses is in proportion that the amount ceded bears to the total (i.e. 25% per line)) Reinsured retains 62,500 Each line bears 62,500 Reinsurers bear 187,500 in total 29 100k 100k 100k 100k 100k 100k 100k 100k

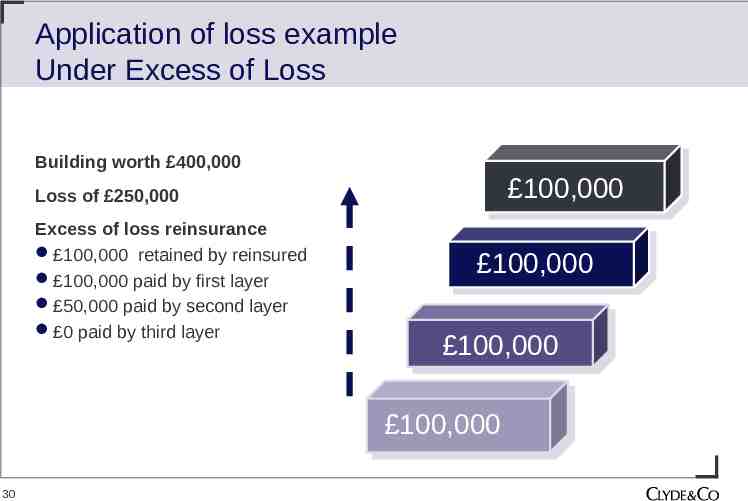

Application of loss example Under Excess of Loss Building worth 400,000 100,000 Loss of 250,000 Excess of loss reinsurance 100,000 retained by reinsured 100,000 paid by first layer 50,000 paid by second layer 0 paid by third layer 100,000 100,000 100,000 100,000 30

Buying and selling reinsurance 31

Considerations when buying reinsurance Capacity required - Do you really need it? Is there automatic reinsurance capacity for your risks? A treaty should at least cover the majority of risks written. Retention - your capital and risk appetite can determine this. Market norms can be a guide. No retention at all poses moral hazard. Reinsurance costs - For XL you pay upfront, for prop you may cede more premiums. How claims will be shared. Exposure to accumulations. Loss experience. Cost of operating reinsurance program. 32

Considerations when structuring a reinsurance program You want to determine whether you buy fac, prop or non prop treaty or a combination of all. Look at: – Nature of the portfolio. – Volume - Do you have sufficient numbers to have a treaty? – Mix - Is there homogeneous exposure in your book? It may all be motor but 50% could be excluded risks in your treaty. – Size - Can you chose XL or quota share? Are the sums insured within same range or vary significantly? – Are there policies with unlimited Liability? – Is portfolio subject to wide fluctuations in its annual results? 33

Considerations when underwriting reinsurance Reinsurers will require following information to make a judgment on required cover as well as to price it: – – – – – – – Risk profiles. Five year loss statistics. Required capacity/ Cat Limits. Estimated Income. Desired retention level by cedant. Classes of business covered. Potential accumulation for Reinsurer - Fac Inwards. Reinsurer will also make a judgment on: – – – – – – 34 Standard of Management style. Experience of underwriters. Geographical distribution of business written. Financial standing of cedant. Past underwriting results. Exclusions, terms and conditions on required treaty.

The reinsurance market 35

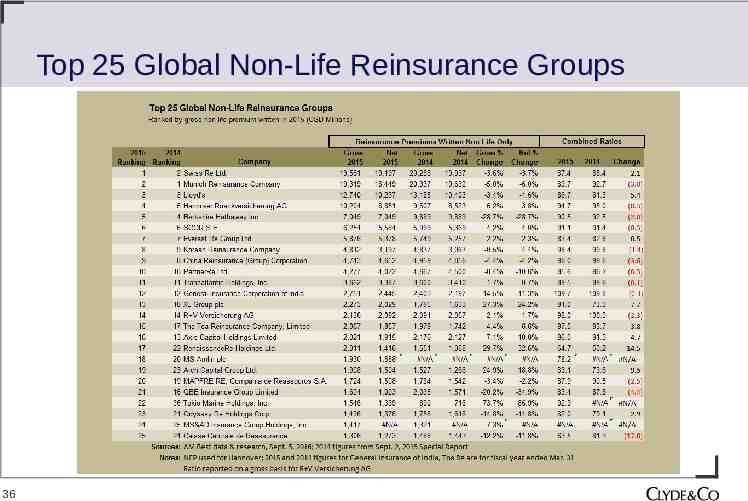

Top 25 Global Non-Life Reinsurance Groups 36

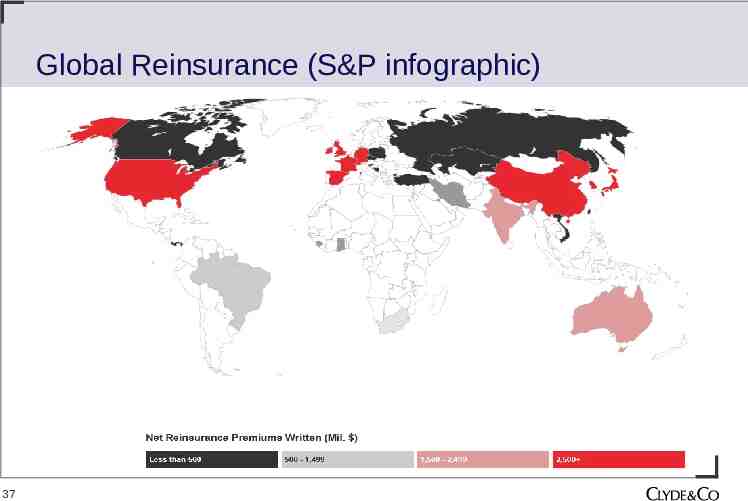

Global Reinsurance (S&P infographic) 37

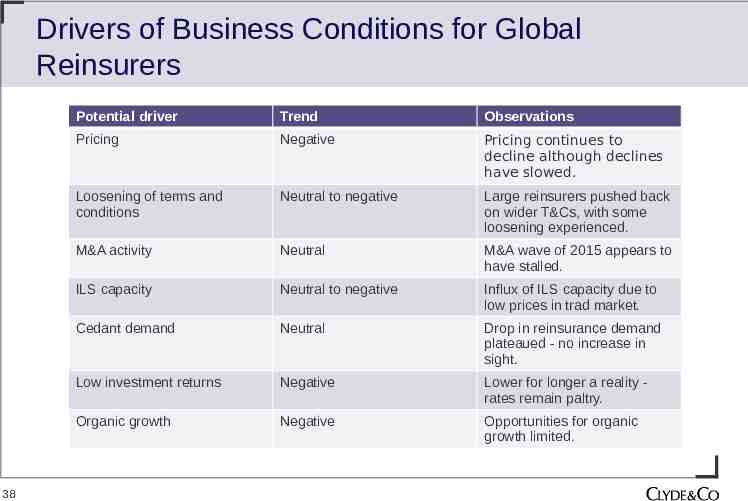

Drivers of Business Conditions for Global Reinsurers 38 Potential driver Trend Observations Pricing Negative Pricing continues to decline although declines have slowed. Loosening of terms and conditions Neutral to negative Large reinsurers pushed back on wider T&Cs, with some loosening experienced. M&A activity Neutral M&A wave of 2015 appears to have stalled. ILS capacity Neutral to negative Influx of ILS capacity due to low prices in trad market. Cedant demand Neutral Drop in reinsurance demand plateaued - no increase in sight. Low investment returns Negative Lower for longer a reality rates remain paltry. Organic growth Negative Opportunities for organic growth limited.

Any Questions? 39

Speaker Ian Plumley Insert Partner photograph here and delete this box T: 44 (0)20 7876 6184 E: [email protected] Ian is a litigation partner with extensive commercial, insurance and reinsurance experience, specialising in complex international coverage, defence and subrogation disputes in England & Wales, Bermuda, the US, the Caribbean and Europe. Ian’s practice is varied and, specialising in complex international coverage, defence and subrogation disputes, he has assisted blue-chip corporates, insurers, reinsurers, intermediaries and business recovery specialists in a range of arbitration and litigation in England & Wales, Bermuda, the US, the Caribbean and Europe. He also regularly assists clients in drafting and reviewing policy wordings. In addition to his experience in all classes of reinsurance business, Ian advises on product liability & recall, US excess casualty (including disputes on the ‘Bermuda Form’), property, construction & engineering, industrials & power, specialty, and professional liability business across business sectors including, in particular, automotive, pharmaceutical, medical devices, food production, utilities and heavy industrials. A co-author of “Reinsurance Practice and the Law” (Informa) and a contributor to Tottel’s Insurance Handbook, Ian has also written numerous articles for market publications. 40

375 2000 3300 46 Partners Legal professionals Total staff Offices and associated offices in 18 countries Clyde & Co LLP accepts no responsibility for loss occasioned to any person acting or refraining from acting as a result of material contained in this summary. No part of this summary may be used, reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, reading or otherwise without the prior permission of Clyde & Co LLP. Clyde & Co LLP 2017 41