How to Survive an IRS or Department of Labor Audit of Your Retirement

65 Slides1.88 MB

How to Survive an IRS or Department of Labor Audit of Your Retirement Plan Gary Blachman Ice Miller, LLP December 5, 2019 Ice on Fire

You walk into the office one Monday morning and you find this on your desk . . . 2 Ice on Fire

3 Ice on Fire

Or this. . 4 Ice on Fire

Ice on Fire

Is this a bad day? Diligent preparation can soften the blow and mitigate the potential risks. 6 Ice on Fire

IRS Audits 7 Ice on Fire

IRS Audits Background Retirement plan examinations are conducted by the Employee Plans section of the Tax Exempt and Governmental Entities Division of the IRS IRS has primary enforcement authority over the retirement plans qualification requirements under the Internal Revenue Code, and other areas designated under Reorganization Plan No. 4 of 1978 Primary purposes of plan examinations Operational compliance with the qualification requirements and plan terms Protect the government's interests in tax liabilities 8 Ice on Fire

IRS Audits Background In contrast, the DOL focuses on fiduciary matters, prohibited transactions, and participant communications Remember, the agencies share information! The IRS Coordination Agreement with the DOL requires the DOL to refer Prohibited transactions for excise taxes under Code Section 4975 Potential issues affecting tax qualified status 9 Ice on Fire

IRS Audit Letter What should you do first when you receive a letter from the IRS regarding your company's plan? Confirm the purpose An inquiry regarding the plan does not necessarily mean you are under examination Possible "information gathering" for future audits Compliance check 10 Ice on Fire

IRS Audit Letter For instance, it could be a letter from the IRS Employee Plans Compliance Unit (EPCU) Performs compliance checks of plans A compliance check is not an examination Is it a distinction without a difference? No. A compliance check does not preclude your use of the various correction programs available through EPCRS, including the voluntary correction program. Cooperate! Remember, while you are not legally required to respond to a compliance check, failure to do so may trigger an exam. 11 Ice on Fire

IRS Audits Let's assume you've read the letter and confirmed that it is an EP examination. What next? Contact your retirement plan service providers Recordkeeper / Plan Trustee – administrative records Independent Investment Advisor – fund fees and expenses ERISA Counsel - upon completion of a Form 2848, counsel can serve as the primary contact with the IRS Accountant – annual audit records 12 Ice on Fire

IRS Audits Why counsel? Counsel can assist in assembling and reviewing documents prior to production, and help identify compliance gaps Counsel can provide an objective review of the issues Counsel can help prepare interviewees for their interview with the examiner Your communications with counsel are subject to confidentiality and attorney-client privilege 13 Ice on Fire

IRS Audits Why was our retirement plan selected for an audit? Random selection Selection does not necessarily mean there's a problem Red flags on Form 5500 Referrals from other agencies Complaints Withdrawn voluntary correction program (VCP) submission An audit of the retirement plan's auditor 14 Ice on Fire

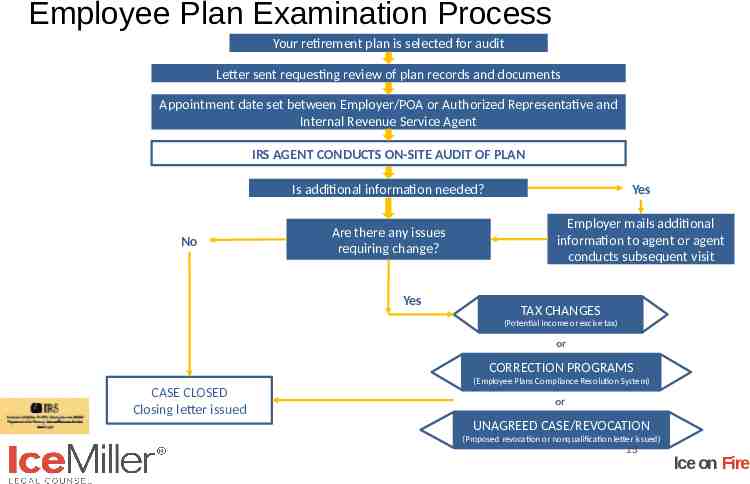

Employee Plan Examination Process Your retirement plan is selected for audit Letter sent requesting review of plan records and documents Appointment date set between Employer/POA or Authorized Representative and Internal Revenue Service Agent IRS AGENT CONDUCTS ON-SITE AUDIT OF PLAN No Is additional information needed? Yes Are there any issues requiring change? Employer mails additional information to agent or agent conducts subsequent visit Yes TAX CHANGES (Potential Income or excise tax) or CORRECTION PROGRAMS (Employee Plans Compliance Resolution System) CASE CLOSED Closing letter issued or UNAGREED CASE/REVOCATION (Proposed revocation or nonqualification letter issued) 15 Ice on Fire

IRS Audits – exam process The examiner will work with you or your representative to schedule an initial meeting and plan document review at the Company location. Evaluate your access to requested information. Do you have the requested documents and information? Do the documents and information reside elsewhere? With your record-keeper? TPA? Accountant? Will you have sufficient time to gather the requested information and assemble it by the meeting date? 16 Ice on Fire

IRS Audits – exam process Evaluate appropriate individuals for interview Which individual(s) are involved with the administration and operation of the plan? Are they available at the scheduled time(s)? Is legal counsel available at the designated time? Is appropriate space available for the examiner? The IRS' default position is that the meetings should take place at the plan sponsor's offices If possible, the examiner should be stationed in a single quiet, remote location Interviewees should be brought to the examiner's location 17 Ice on Fire

Common Areas for Review What does the IRS typically request? According to the IRS, the most common areas for review are — Eligibility, participation, and coverage— Are eligible employees properly participating? Vesting—Have service and vesting been properly credited? Discrimination—Do contributions, benefits, rights or features favor highly compensated employees? Top heavy requirements—Have minimum contributions and benefits, and accelerated vesting, been provided? 18 Ice on Fire

Common Areas for Review Most common areas for review (continued) Contribution and benefit limits—Are contributions and benefits within applicable limits? Funding and deductions—Are contributions sufficient and timely, and deductions within applicable limits? Distributions—Are distributions properly made and timely and accurately reported? Trust activities—Is the trust operated for the exclusive benefit of participants and in accordance with fiduciary standards? Plan and trust documents—Does the form of the plan and trust timely meet applicable tax law? Returns and reports—Were federal returns and reports timely and accurately filed? 19 Ice on Fire

Commonly Requested Documents The IRS posts standard document requests for different types of plans at https://www.irs.gov/retirement-plans/epexamination-process-guide-section-4-communicationsduring-examination-sample-information-documentrequests The website provides sample document requests for Profit Sharing Plans 401(k) Plans Money Purchase Plans ESOPs Defined Benefit Plans Cash Balance Plans 20 Ice on Fire

Commonly Requested Documents The standard document requests can provide valuable information They can be used to help prepare clients before the initiation of an exam They can assist in spotting areas of inquiry unique to the plan and may shed light on what prompted the exam Always keep an exact duplicate of the documents and information you provide to the IRS! Consider assembling duplicate binders of the materials provided. It allows for easy reference in the event of follow-up questions. 21 Ice on Fire

Newly Discovered Problems What should you do if you discover an issue during your preparation for the exam? Consider correction Remember, your ability to correct errors in EPCRS is limited when the plan is under examination However, the Self Correction Program (SCP) is still available for correction of insignificant operational errors (assuming internal controls are in place) How do we determine significance under the SCP? 22 Ice on Fire

Significant or Insignificant? Consideration of the facts and circumstances, includingwhether other failures occurred during the period being examined (for this purpose, a failure is not considered to have occurred more than once merely because more than one participant is affected by the failure) the percentage of plan assets and contributions involved in the failure; the number of years the failure occurred the number of participants affected relative to the total number of participants in the plan the number of participants affected as a result of the failure relative to the number of participants who could have been affected by the failure whether correction was made within a reasonable time after discovery of the failure the reason for the failure (for example, data errors such as errors in the transcription of data, the transposition of numbers, or minor arithmetic errors) 23 Ice on Fire

Internal Controls A few words about Internal Controls What processes and procedures does the plan sponsor have in place to minimize mistakes in plan administration? Why are internal controls important? They are a prerequisite to correcting errors through SCP! The presence of strong internal controls may support a focused rather than broad audit If an error is found that must be corrected through the Audit Closing Agreement Program (Audit CAP), the presence of internal controls is a factor in determining the sanction The IRS has posted helpful guidance on internal controls at https://www.irs.gov/retirement-plans/retirement-plan-operation-andmaintenance 24 Ice on Fire

Additional Inquiries The IRS may reach out with additional questions/requests for documents These follow-up requests and questions may shed light on potential problem areas Ultimately, the audit will conclude in one of two ways: Closing letter with no identified issues Closing letter identifying deficiencies 25 Ice on Fire

Closing Letter What happens if issues are identified in the closing letter? The IRS generally will favor maintaining the tax qualified status of the plan Participants generally should be placed in the position they would have been in but for the error Remember, VCP is no longer available. You generally must proceed through the Audit Closing Agreement Program (CAP) which involves payment of sanctions. If the errors are not corrected, the plan may be disqualified 26 Ice on Fire

Appeals What if you disagree with the errors identified in the closing letter? You have the legal right to appeal The appeal steps include— Requesting a meeting with the examiner's supervisor Appeal to the IRS Office of Appeals If the issue involves an income or excise tax adjustment—take the case directly to the United States Tax Court (if challenging a determination that the plan is not qualified, you must first appeal to the IRS Office of Appeals) 27 Ice on Fire

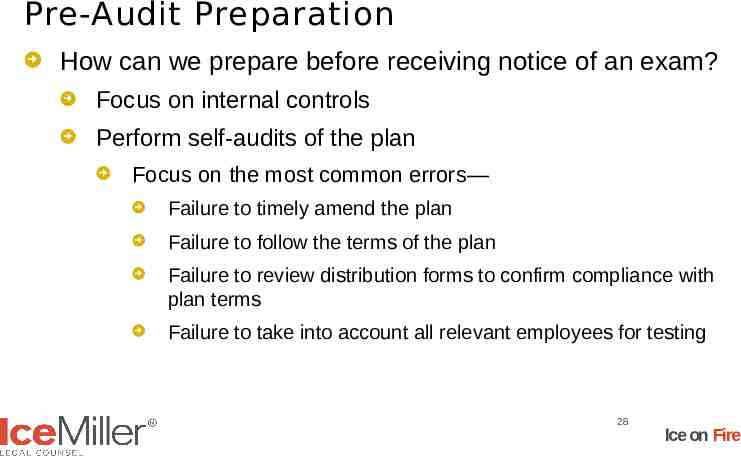

Pre-Audit Preparation How can we prepare before receiving notice of an exam? Focus on internal controls Perform self-audits of the plan Focus on the most common errors— Failure to timely amend the plan Failure to follow the terms of the plan Failure to review distribution forms to confirm compliance with plan terms Failure to take into account all relevant employees for testing 28 Ice on Fire

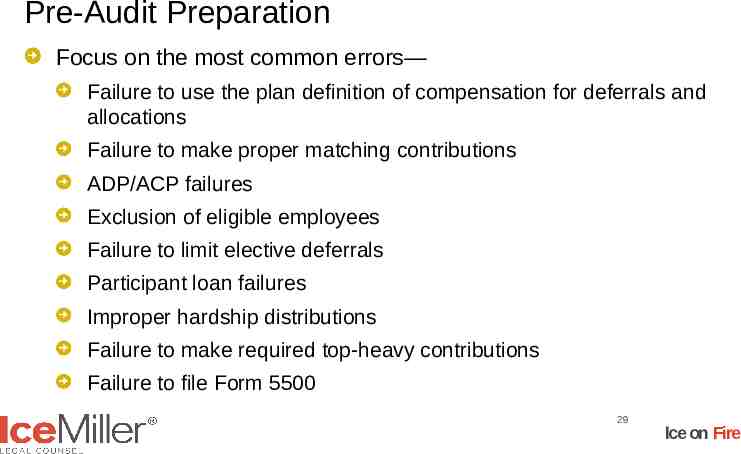

Pre-Audit Preparation Focus on the most common errors— Failure to use the plan definition of compensation for deferrals and allocations Failure to make proper matching contributions ADP/ACP failures Exclusion of eligible employees Failure to limit elective deferrals Participant loan failures Improper hardship distributions Failure to make required top-heavy contributions Failure to file Form 5500 29 Ice on Fire

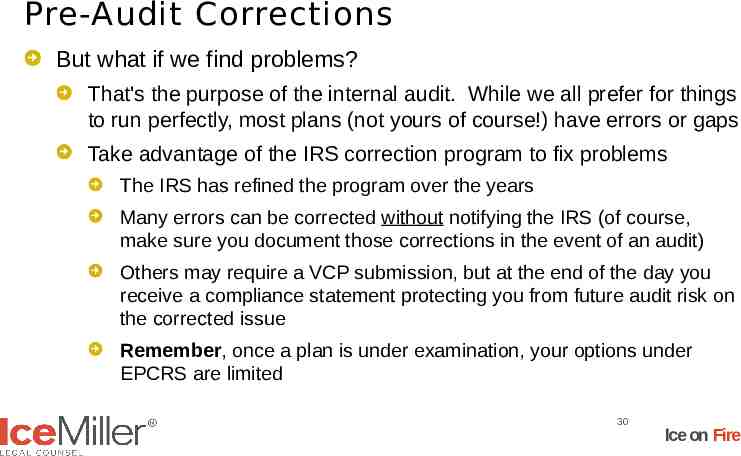

Pre-Audit Corrections But what if we find problems? That's the purpose of the internal audit. While we all prefer for things to run perfectly, most plans (not yours of course!) have errors or gaps Take advantage of the IRS correction program to fix problems The IRS has refined the program over the years Many errors can be corrected without notifying the IRS (of course, make sure you document those corrections in the event of an audit) Others may require a VCP submission, but at the end of the day you receive a compliance statement protecting you from future audit risk on the corrected issue Remember, once a plan is under examination, your options under EPCRS are limited 30 Ice on Fire

The DOL Investigation 31 Ice on Fire

The DOL Investigation DOL reviews both qualified retirement plans and health and welfare plans Primary jurisdiction over fiduciary standards, ACA reporting and disclosure, prohibited transactions, and other non-qualification matters 32 Ice on Fire

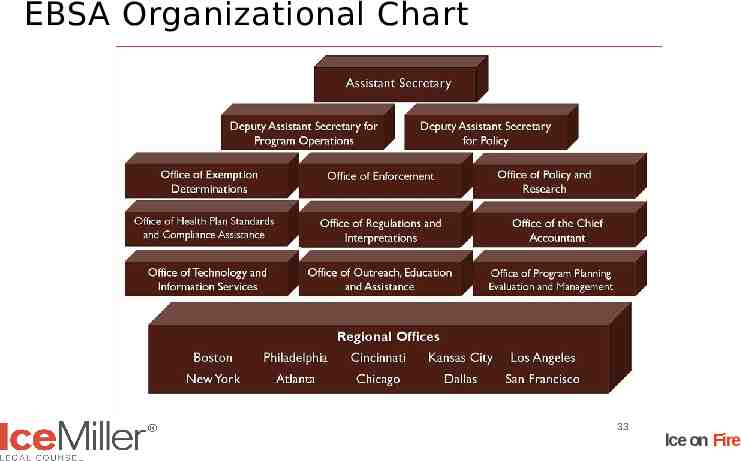

EBSA Organizational Chart 33 Ice on Fire

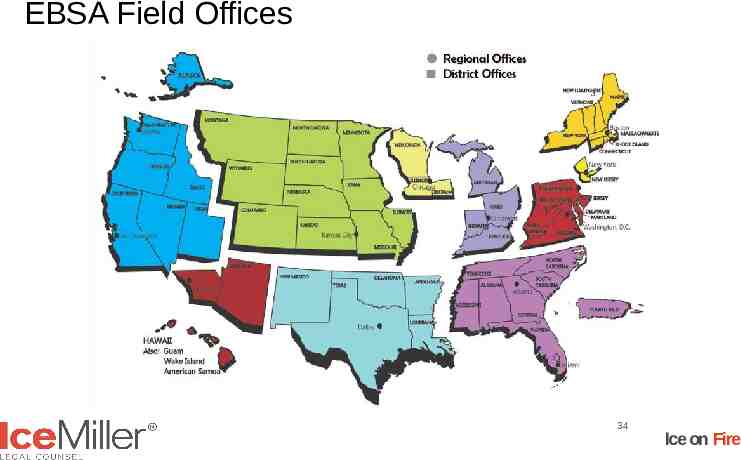

EBSA Field Offices 34 Ice on Fire

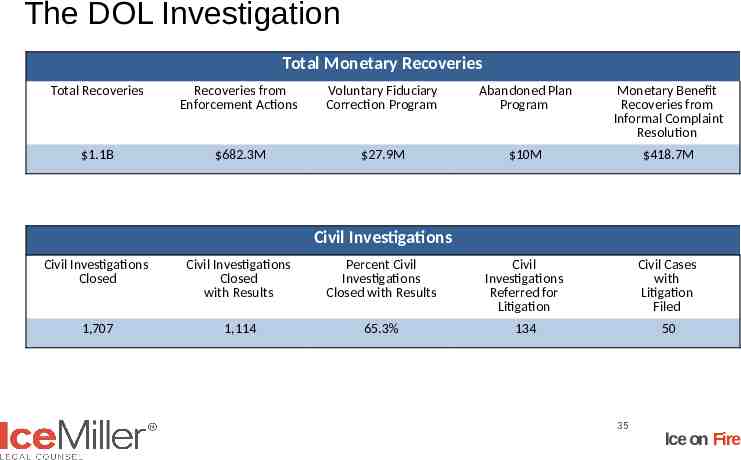

The DOL Investigation Total Monetary Recoveries Total Recoveries Recoveries from Enforcement Actions Voluntary Fiduciary Correction Program Abandoned Plan Program Monetary Benefit Recoveries from Informal Complaint Resolution 1.1B 682.3M 27.9M 10M 418.7M Civil Investigations Civil Investigations Closed Civil Investigations Closed with Results Percent Civil Investigations Closed with Results Civil Investigations Referred for Litigation Civil Cases with Litigation Filed 1,707 1,114 65.3% 134 50 35 Ice on Fire

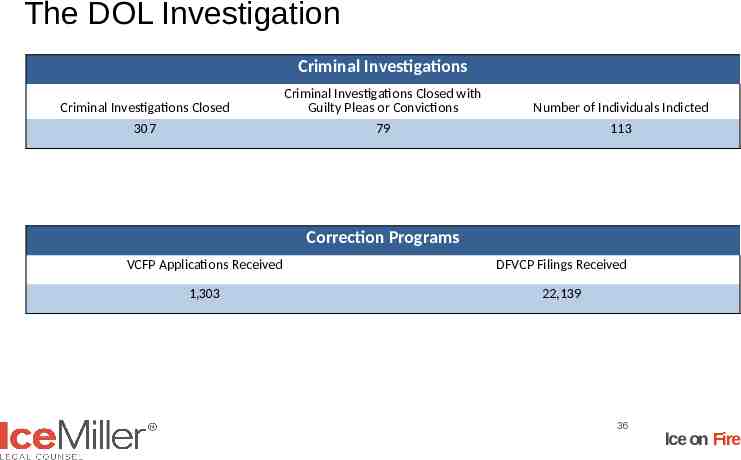

The DOL Investigation Criminal Investigations Criminal Investigations Closed Criminal Investigations Closed with Guilty Pleas or Convictions Number of Individuals Indicted 307 79 113 Correction Programs VCFP Applications Received DFVCP Filings Received 1,303 22,139 36 Ice on Fire

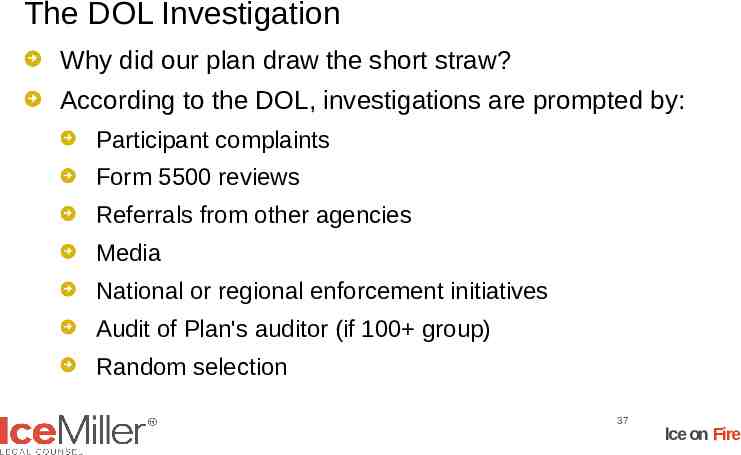

The DOL Investigation Why did our plan draw the short straw? According to the DOL, investigations are prompted by: Participant complaints Form 5500 reviews Referrals from other agencies Media National or regional enforcement initiatives Audit of Plan's auditor (if 100 group) Random selection 37 Ice on Fire

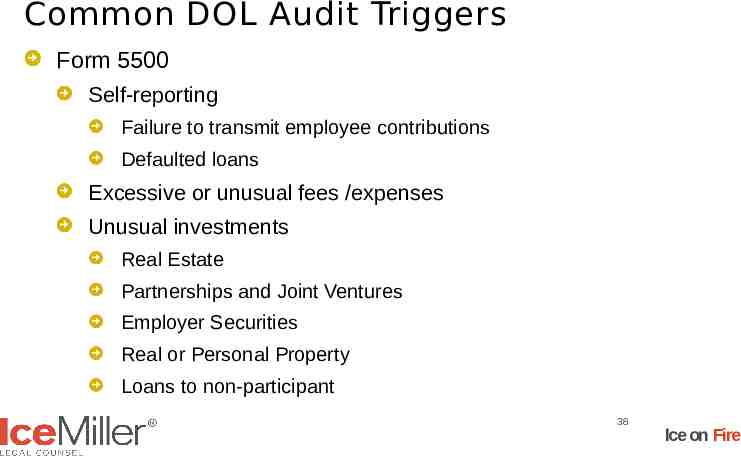

Common DOL Audit Triggers Form 5500 Self-reporting Failure to transmit employee contributions Defaulted loans Excessive or unusual fees /expenses Unusual investments Real Estate Partnerships and Joint Ventures Employer Securities Real or Personal Property Loans to non-participant 38 Ice on Fire

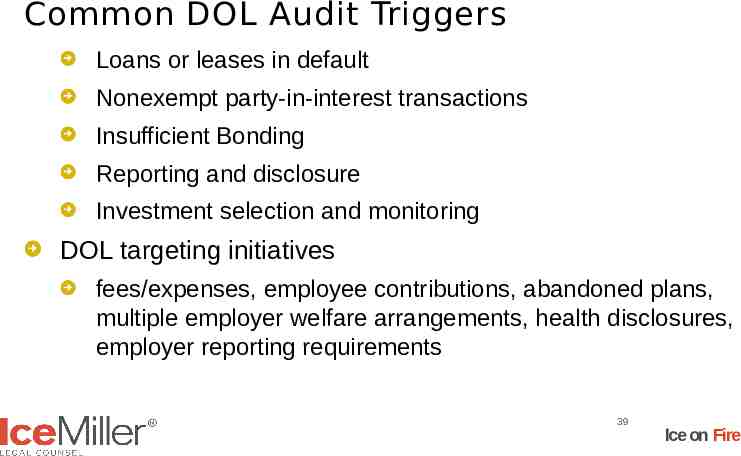

Common DOL Audit Triggers Loans or leases in default Nonexempt party-in-interest transactions Insufficient Bonding Reporting and disclosure Investment selection and monitoring DOL targeting initiatives fees/expenses, employee contributions, abandoned plans, multiple employer welfare arrangements, health disclosures, employer reporting requirements 39 Ice on Fire

How to Increase Audit Risk? Reporting and Disclosure - Form 5500s do not conform to company payroll or census records Decentralized payroll and lack of coordination among subsidiaries/divisions and corporate office increased chance of operational errors, e.g., eligibility determinations, plan compensation, vesting Problems with inaccurate data census errors cause inaccurate testing and reporting, e.g., date of hire/termination, age and service 40 Ice on Fire

How to Reduce Audit Risk? Strong internal procedures Help minimize or eliminate operational errors Plan sponsor can more quickly identify and correct plan errors Will reduce penalties for errors discovered upon audit Provide a road map to guide the scope of DOL audit Single issue audit Multi-issue examination Expand the scope of exam territory (additional plan years and/or full plan review) 41 Ice on Fire

How to Reduce Audit Risk? Strong Internal Procedures Examples: Clear lines of responsibility and division of duties between finance, human resources, and payroll departments Current technology for data gathering and reporting to record keeper and other vendors Documented systems and procedures Easier reconciliation and tracking of data for reporting and disclosure (Form 5500s) 42 Ice on Fire

The DOL Investigation Step 1: Appointment Letter Step 2: Onsite Investigation Inquire why your plan was selected. Is it a criminal investigation? If so, immediately seek counsel! Areas of potential review corporate governance and plan administration reporting and disclosures bonding plan funding investment selection and monitoring of fees service provider selection and monitoring of fees participant loans and hardships contribution testing 43 Ice on Fire

The DOL Investigation Step 3: Interview of plan administrator Review of internal controls helps auditor determine if plan is properly administered and, if not, may lead to expanded scope of audit review A knowledgeable plan administrator and strong internal controls can greatly reduce length of audit Step 4: Compliance DOL auditor will encourage procedures to maintain ongoing plan compliance Voluntary Compliance Letter (negotiate/take action/closing letter) 44 Ice on Fire

The DOL Investigation DOL will not be able to conclude a field audit without a comfort level that prior errors are fixed and effective procedures are in place for ongoing administration Post-audit Closing Letter "No issue" letter Minor issues, all corrections completed or a process is in place to make corrections Closing letter outlines all completed corrections and no further action will be taken 45 Ice on Fire

Potential Penalties DOL may try to impose civil penalties for fiduciary breaches — 20% of amount recovered DOL may waive penalties for financial hardship or good faith actions DOL will issue penalties for Civil litigation Formal settlements Intentional or repeat violations Bad actors 46 Ice on Fire

Current Hot Button Issues Payment of Plan Fees and Expenses Missing Plan Documents Eligible Participants Loans and Hardship Withdrawals Committee Meetings Investment Policy Statement Missing or Lost Participants Late 401(k) Contributions 47 Ice on Fire

Payment of Plan Fees and Expenses Under ERISA, reasonable plan expenses can be paid from plan assets Settlor (business) Functions — not a permissible payment from plan assets Decision to amend plan Discussion of plan design changes Decision to terminate plan Plan assets used to pay settlor functions Plan sponsor must make plan whole Possible fines due to fiduciary breach Fiduciary Functions Actions to implement a settlor function are permissible 48 Ice on Fire

Missing Plan Documents DOL auditors will review plan documents Current plan document Plan amendments since last restatement Board or Retirement Committee actions to adopt plan changes and amendments Failures to timely adopt or execute plan amendments Auditors will verify plan sponsor adopted amendments to comply with statutory and administrative changes 49 Ice on Fire

Missing Plan Documents DOL will review internal procedures What is process used by plan sponsor to timely amend plan documents? Is the plan reviewed annually or other regular basis Is the required amendments list issued by IRS reviewed annually Frequent discussions and meetings with record keeper and other vendors How are discretionary changes to plan implemented? Plan amendment adopted by end of plan year when change becomes effective 50 Ice on Fire

Eligible Participants DOL auditors will review eligibility to determine whether all eligible participants are participating in the plan What is the process to determine if an employee is eligible to participate? Who is responsible for making eligibility determinations? How are participants notified when they are eligible to participate in the plan? How is eligibility determination and enrollment coordinated with record keeper? 51 Ice on Fire

Participant Loans DOL auditors will confirm if loans do not comply with plan loan requirements, e.g., 5 year term limits, interest calculation, substantial level amortization, prohibited transactions How to avoid participant loan errors? Review participant loans including loan amount, term of loan, and repayment terms Implement proper procedures to prevent prohibited transactions or errors with other loan requirements 52 Ice on Fire

Hardship Withdrawals DOL auditors will review hardship provisions to confirm plan provides for them Proper training of plan administrators and payroll and human resources Maintain records of all information used to determine eligibility for hardship withdrawals Oh no! the plan does not provide for hardships! Participants should return the amounts distributed plus earnings Plan sponsor may amend retroactively to allow for hardship distributions 53 Ice on Fire

Committee Meetings DOL auditors are asking about the frequency of retirement committee meetings ERISA does not require a minimum frequency of meetings Recommend at least semi-annual meetings and possibly quarterly Can vary depending on current plan issues and plan size Investment decisions What actions were taken by plan fiduciaries? Document, document and document some more! 54 Ice on Fire

Investment Policy Statement DOL auditors are asking to review Investment Policy Statements (IPS) An IPS is not required under ERISA however, it is a best practice Does the plan sponsor maintain an IPS? Was the IPS followed? Are investment decisions consistent with the IPS? Following an IPS can demonstrate prudent investment decisions EVEN IF the investment does not perform well 55 Ice on Fire

Missing or Lost Participants DOL auditors are reviewing tax-qualified defined benefit plans Focus is on participants not receiving benefits according to the terms of the plan documents Clear guidance is not yet available DOL regional office initiatives — aggressive audits Plan sponsor's failure to locate plan participants may be a breach of fiduciary duty, even if all other plan procedures are followed 56 Ice on Fire

Missing or Lost Participants Missing plan participants must be searched for annually, if not indefinitely DOL has suggested that forfeiting a missing participant's account and using those plan forfeitures to reduce future employer contributions may be a prohibited transaction, even if the forfeited amounts are later restored when the participant is located What is appropriate due diligence? Contact beneficiaries under other plans Contact former co-workers Internet searches 57 Ice on Fire

Late 401K Contributions DOL rule — maximum period is the 15 th business day of the month following the date in which the amounts would otherwise have been received by the employer in cash "15th day" is not a safe harbor! Consider earliest day such amounts can be reasonably segregated from employer's general assets When are payroll taxes wired? Exception for small plans ( 100 participants) — contributions must be deposited into the plan no later than the 7th business day following the day the amount would have been payable to participant as wages in cash 58 Ice on Fire

Late 401(k) Contributions DOL will review plan documents and administrative procedures Does plan contain specific language stating when deposits will be made? Are the plan documents being followed? How to avoid late 401(k) contributions? Periodic reconciliation of payroll records Written procedures for deposits Assigned personnel to verify allocations Coordinate timing of deposits with payroll provider 59 Ice on Fire

Late 401(k) Contributions Prohibited transactions Late 401(k) contributions are subject to an excise tax of 15% of the amount involved Form 5330 excise tax filing Disclosed on Form 5500 and independent audit report DOL Voluntary Fiduciary Correction Program (VFCP) Fix before discovered upon a DOL audit or following a participant complaint! 60 Ice on Fire

Best Practices BEFORE an Audit Culture of plan governance Clearly defined division of duties Administrative Procedures Maintain records and meeting minutes If it's not in writing it never happened! Process, process, process! Monitor on an ongoing basis Conduct an internal review/audit Maintain plan documentation 61 Ice on Fire

Best Practices to Survive an Audit Organize a team to respond to audit inquiries (HR, finance, record keeper, ERISA counsel, other vendors and consultants) Identify point person for contact with DOL investigator (ERISA counsel or HR) Use ERISA counsel to review documents and prepare responses to DOL auditor Provide only the requested information Request extensions for additional time to respond when needed, confirm in writing 62 Ice on Fire

Best Practices to Survive an Audit Work with ERISA counsel to review documents and prepare employees for DOL interviews Notify senior management and liability insurer Debrief with employees after interview with DOL to identify potential open issues Maintain notes of all DOL interviews and information provided by employees Negotiate all proposed corrections Confirm outcomes and timing of Closing Letter 63 Ice on Fire

Summary An ounce of prevention is worth a pound of cure! Benjamin Franklin 64 Ice on Fire

Questions? Gary Blachman Ice Miller, LLP (312) 726-7375 email: [email protected] 65 Ice on Fire