Foundation’s Solution to the Affordable Care Act Presented by John

22 Slides580.29 KB

Foundation’s Solution to the Affordable Care Act Presented by John Hnat and Jason Stypick Disclaimer: The information contained in this presentation is for informational purposes only and is not legal advice or a substitute for legal counsel.

Welcome If you are applying for CPE credit, please be sure to sign in and sign out. Please write legibly! Additionally, fill out the survey for a chance to win a free pass to the 2017 User Conference!

What is the Affordable Care Act? A quick guide to the Affordable Care Act (ACA) and how it affects employers

What is the ACA? The Affordable Care Act is responsible for the most sweeping reform of the American healthcare system since the introduction of Medicare and Medicaid in 1965. Provisions in the ACA are intended to expand access to insurance, emphasize preventative care, improve quality of care, and curb rising health care costs. While certain provisions of the act may affect every individual or business, our focus here is on the responsibilities placed on large employers. These responsibilities include offering health coverage or facing a penalty, providing a statement of offered coverage to employees, and reporting to the IRS what coverage, if any, was offered.

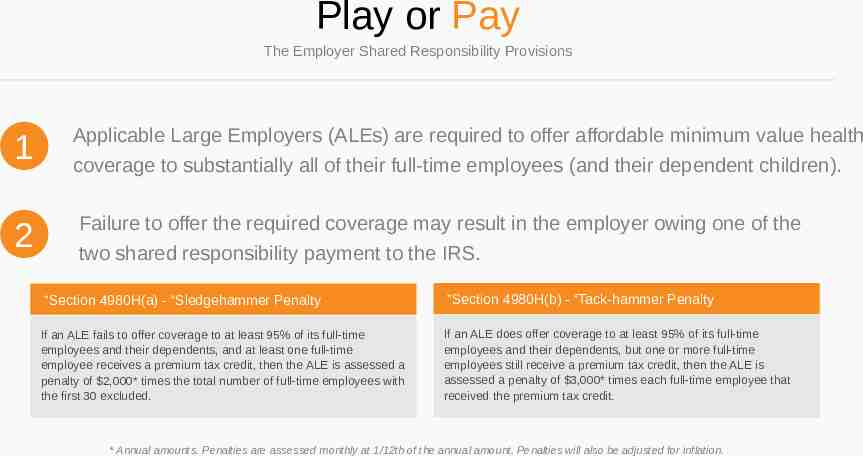

Play or Pay The Employer Shared Responsibility Provisions 1 2 Applicable Large Employers (ALEs) are required to offer affordable minimum value health coverage to substantially all of their full-time employees (and their dependent children). Failure to offer the required coverage may result in the employer owing one of the two shared responsibility payment to the IRS. ”Section 4980H(a) - “Sledgehammer Penalty If an ALE fails to offer coverage to at least 95% of its full-time employees and their dependents, and at least one full-time employee receives a premium tax credit, then the ALE is assessed a penalty of 2,000* times the total number of full-time employees with the first 30 excluded. ”Section 4980H(b) - “Tack-hammer Penalty If an ALE does offer coverage to at least 95% of its full-time employees and their dependents, but one or more full-time employees still receive a premium tax credit, then the ALE is assessed a penalty of 3,000* times each full-time employee that received the premium tax credit. * Annual amounts. Penalties are assessed monthly at 1/12th of the annual amount. Penalties will also be adjusted for inflation.

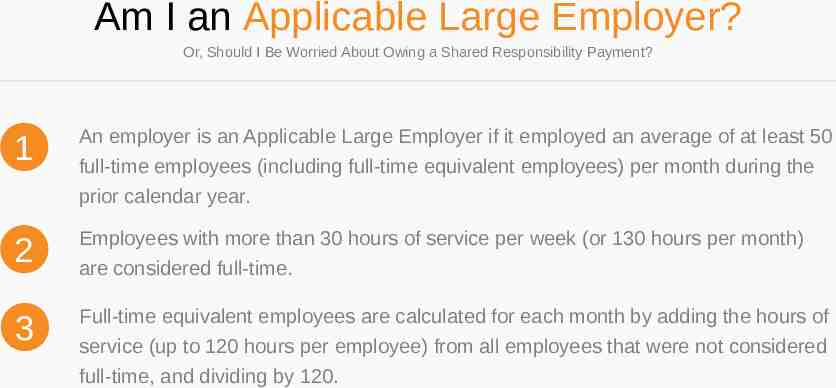

Am I an Applicable Large Employer? Or, Should I Be Worried About Owing a Shared Responsibility Payment? 1 An employer is an Applicable Large Employer if it employed an average of at least 50 full-time employees (including full-time equivalent employees) per month during the prior calendar year. 2 Employees with more than 30 hours of service per week (or 130 hours per month) are considered full-time. 3 Full-time equivalent employees are calculated for each month by adding the hours of service (up to 120 hours per employee) from all employees that were not considered full-time, and dividing by 120.

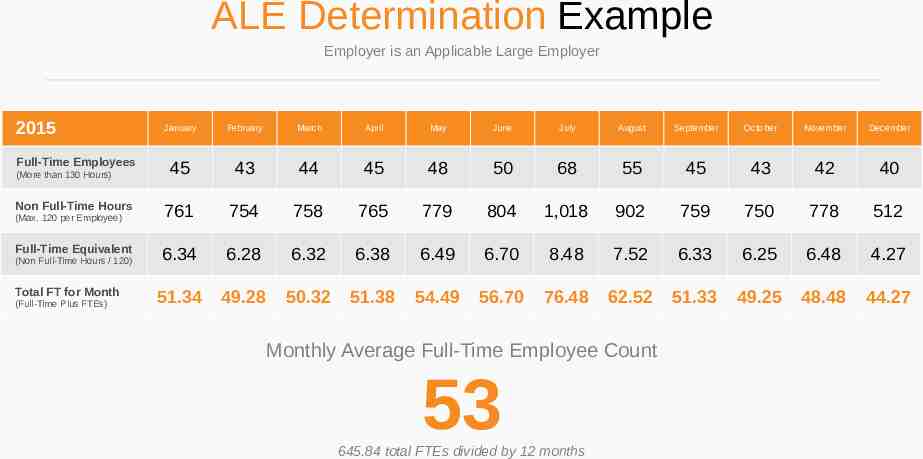

ALE Determination Example Employer is an Applicable Large Employer 2015 January February March April May June July August September October November December 45 43 44 45 48 50 68 55 45 43 42 40 Non Full-Time Hours 761 754 758 765 779 804 1,018 902 759 750 778 512 Full-Time Equivalent 6.34 6.28 6.32 6.38 6.49 6.70 8.48 7.52 6.33 6.25 6.48 4.27 51.34 49.28 50.32 51.38 54.49 56.70 76.48 62.52 51.33 49.25 48.48 44.27 Full-Time Employees (More than 130 Hours) (Max. 120 per Employee) (Non Full-Time Hours / 120) Total FT for Month (Full-Time Plus FTEs) Monthly Average Full-Time Employee Count 53 645.84 total FTEs divided by 12 months

Who Are My Full-Time Employees? Identifying the employees that should be offered coverage 1 Any employees that average at least 30 hours of service per week (or 130 hours per month) are considered full-time. 2 The IRS allows for measuring employee hours of service by one of two methods: Monthly Look-Back Measurement Method Measurement Method Note: These methods are only available for the purpose of determining if an individual employee is full-time and required to be offered coverage. The ALE determination must be done as described earlier.

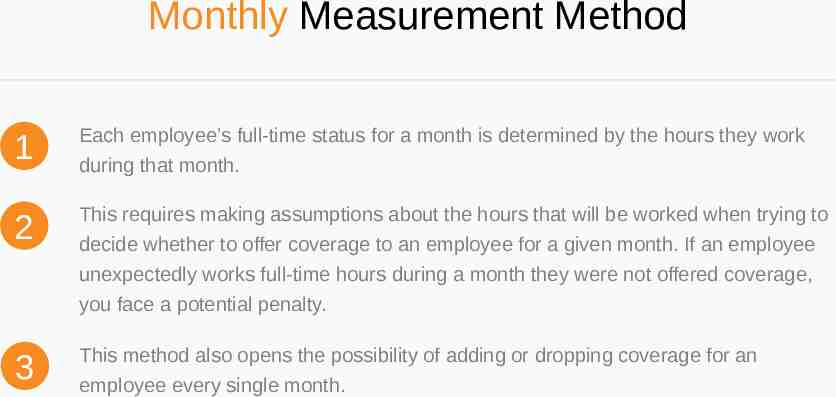

Monthly Measurement Method 1 Each employee’s full-time status for a month is determined by the hours they work during that month. 2 This requires making assumptions about the hours that will be worked when trying to decide whether to offer coverage to an employee for a given month. If an employee unexpectedly works full-time hours during a month they were not offered coverage, you face a potential penalty. 3 This method also opens the possibility of adding or dropping coverage for an employee every single month.

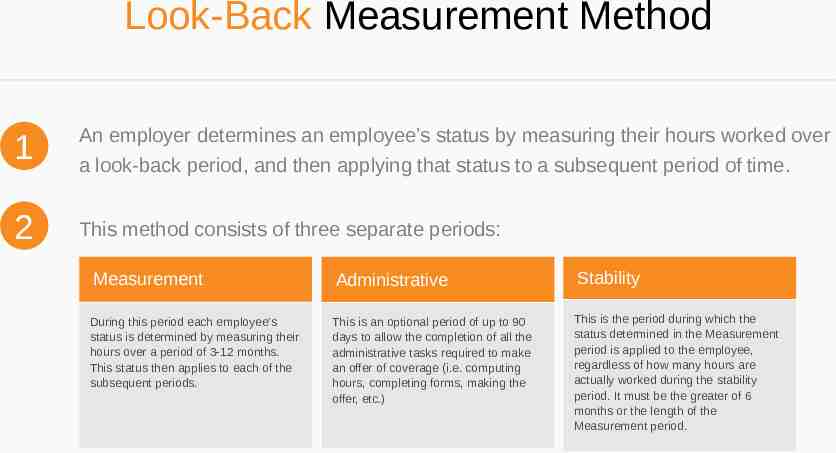

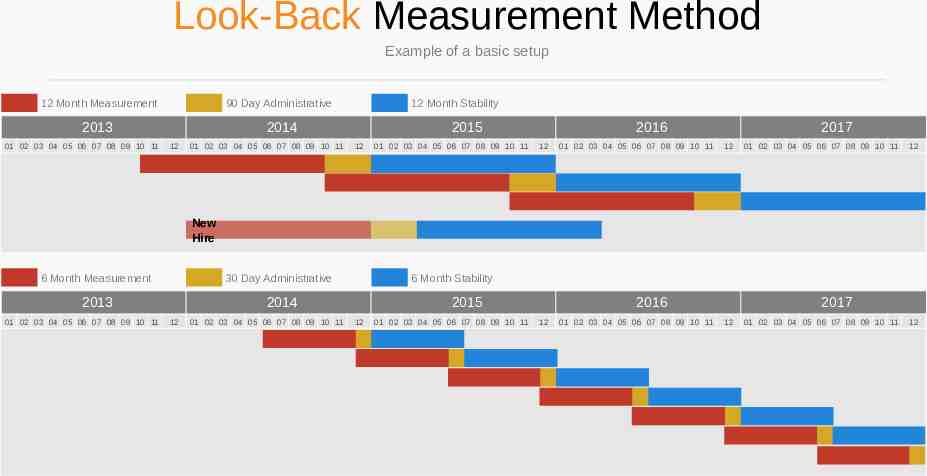

Look-Back Measurement Method 1 An employer determines an employee’s status by measuring their hours worked over a look-back period, and then applying that status to a subsequent period of time. 2 This method consists of three separate periods: Measurement During this period each employee’s status is determined by measuring their hours over a period of 3-12 months. This status then applies to each of the subsequent periods. Administrative This is an optional period of up to 90 days to allow the completion of all the administrative tasks required to make an offer of coverage (i.e. computing hours, completing forms, making the offer, etc.) Stability This is the period during which the status determined in the Measurement period is applied to the employee, regardless of how many hours are actually worked during the stability period. It must be the greater of 6 months or the length of the Measurement period.

Look-Back Measurement Method Example of a basic setup 12 Month Measurement 90 Day Administrative 2013 2014 01 02 03 04 05 06 07 08 09 10 11 12 01 02 03 04 05 06 07 08 09 10 11 12 Month Stability 2015 12 01 02 03 04 05 06 07 08 09 10 11 2016 12 01 02 03 04 05 06 07 08 09 10 11 2017 12 01 02 03 04 05 06 07 08 09 10 11 12 New Hire 6 Month Measurement 30 Day Administrative 2013 2014 01 02 03 04 05 06 07 08 09 10 11 12 01 02 03 04 05 06 07 08 09 10 11 6 Month Stability 2015 12 01 02 03 04 05 06 07 08 09 10 11 2016 12 01 02 03 04 05 06 07 08 09 10 11 2017 12 01 02 03 04 05 06 07 08 09 10 11 12

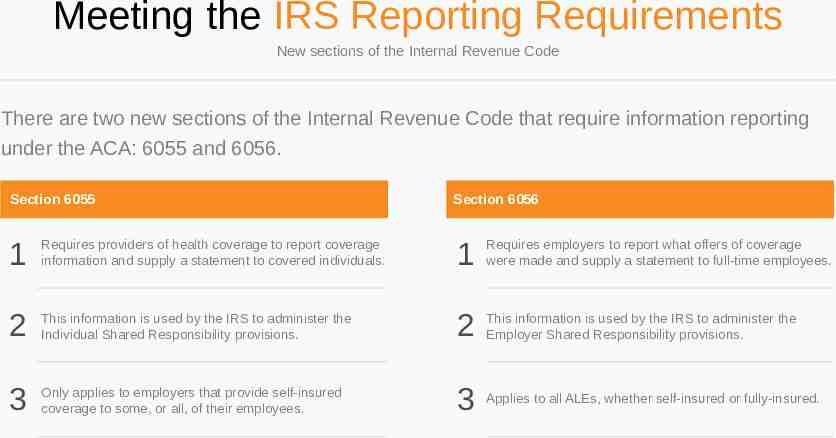

Meeting the IRS Reporting Requirements New sections of the Internal Revenue Code There are two new sections of the Internal Revenue Code that require information reporting under the ACA: 6055 and 6056. Section 6055 Section 6056 1 Requires providers of health coverage to report coverage information and supply a statement to covered individuals. 1 Requires employers to report what offers of coverage were made and supply a statement to full-time employees. 2 This information is used by the IRS to administer the Individual Shared Responsibility provisions. 2 This information is used by the IRS to administer the Employer Shared Responsibility provisions. 3 Only applies to employers that provide self-insured coverage to some, or all, of their employees. 3 Applies to all ALEs, whether self-insured or fully-insured.

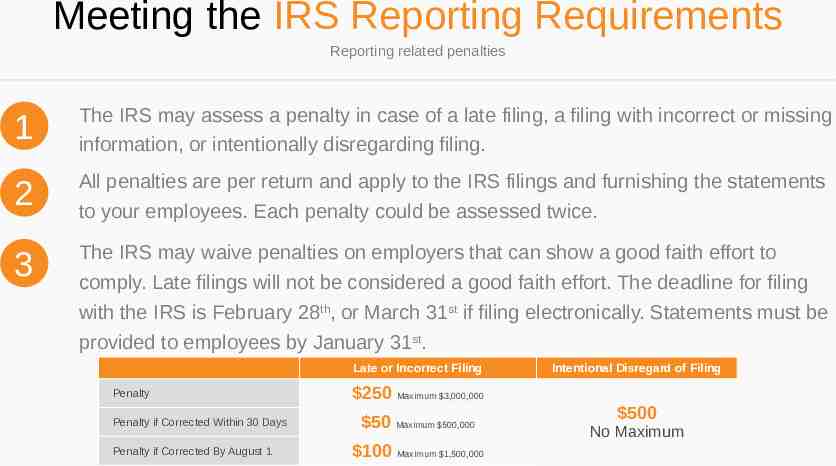

Meeting the IRS Reporting Requirements Reporting related penalties 1 The IRS may assess a penalty in case of a late filing, a filing with incorrect or missing information, or intentionally disregarding filing. 2 All penalties are per return and apply to the IRS filings and furnishing the statements to your employees. Each penalty could be assessed twice. 3 The IRS may waive penalties on employers that can show a good faith effort to comply. Late filings will not be considered a good faith effort. The deadline for filing with the IRS is February 28th, or March 31st if filing electronically. Statements must be provided to employees by January 31st. Late or Incorrect Filing Penalty Penalty if Corrected Within 30 Days Penalty if Corrected By August 1 250 Maximum 3,000,000 50 Maximum 500,000 100 Maximum 1,500,000 Intentional Disregard of Filing 500 No Maximum

How Can FOUNDATION Help? Using FOUNDATION to help with the administration of the Employer Shared Responsibility provisions

How Can FOUNDATION Help? FOUNDATION will help meet the ACA requirements in several ways. 1 Proper Tracking of Employee Hours of Service 2 Determining Applicable Large Employer Status 3 Monitoring and Measuring Employee Status Using the Look-Back Measurement Method 4 Meeting the IRS Reporting Requirements

Proper Tracking of Employee Hours No matter which measurement method you use, tracking hours correctly is now more important than ever 1 Salary Employees - Unless you will always be assuming full-time status, you may want to track the hours of salary employees using the salary proration feature. 2 History Adjustments – Be careful when including hours on a history adjustment. Posting hours for a long time frame to a specific date may lead to your employee’s full-time status being reported incorrectly. 3 Hours Adjustment Worksheet – A new hours worksheet has been added to allow you to enter adjustments for your employees hours on a monthly basis. These hours adjustments are used only in ACA reporting. ! The only way to get truly accurate reporting is to be sure you are entering accurate, hourly timecards for all of your employees.

Determining Your ALE Status Determining your ALE status can be done using the Monthly Hours Report. For a given year, It will provide you with your count of full-time employees, full-time equivalent employees, your totals for each month, and your overall average. Things to Watch For: 1 Under the ACA, separate companies that are part of a “controlled group” are considered one employer for purposes of determining whether they are an ALE. That means that if you are using FOUNDATION for multiple companies, you will need to run this report for each company and combine the results. 2 If you have any salary employees that had no hours entered in a month they were paid, this report will give them estimated hours based on the Employment Status on their Employee Record. The net effect of this is that if you don’t enter hours for a salary employee, they will at least be considered a Full-Time Equivalent for any month they collect pay. 3 The report will alert you if the seasonal work exception may apply to you. This exception has a lot of potential variables to it, so you’ll want to look at it closer in these cases, and discuss with your legal counsel.

Monitoring & Measuring Employee Status Setting Up Look-Back Measurement Method Tracking – Defining Measurement Groups 1 Measurement Groups are created in the Payroll Control File. 2 They are used to define the measurement, admin, and stability periods you want to use for each group of employees. You will define ongoing and initial period rules. 3 Under the ACA, you’re allowed to set up different groups under the following scenarios: union and non-union employees, employees in different unions, salaried and hourly employees, and employees who primarily work in different states.

Monitoring & Measuring Employee Status Setting Up Look-Back Measurement Method Tracking – Employee Maintenance 1 The “ACA” tab of the Employee Record is where you specify which Measurement Group the employee belongs to. 2 You will also need to enter the start date for each employee on the “General” tab of the Employee Record. For employees that existed prior to this feature, the hire date was automatically inserted. 3 You can also enter an Employment Status on the “General” tab.

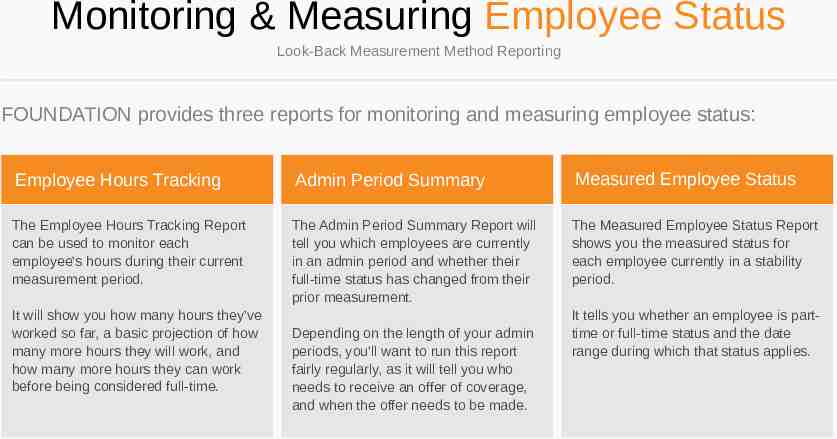

Monitoring & Measuring Employee Status Look-Back Measurement Method Reporting FOUNDATION provides three reports for monitoring and measuring employee status: Employee Hours Tracking Admin Period Summary Measured Employee Status The Employee Hours Tracking Report can be used to monitor each employee’s hours during their current measurement period. The Admin Period Summary Report will tell you which employees are currently in an admin period and whether their full-time status has changed from their prior measurement. The Measured Employee Status Report shows you the measured status for each employee currently in a stability period. It will show you how many hours they’ve worked so far, a basic projection of how many more hours they will work, and how many more hours they can work before being considered full-time. Depending on the length of your admin periods, you’ll want to run this report fairly regularly, as it will tell you who needs to receive an offer of coverage, and when the offer needs to be made. It tells you whether an employee is parttime or full-time status and the date range during which that status applies.

Meeting the IRS Reporting Requirements IRS forms 1094-C and 1095-C 2 FOUNDATION will allow Applicable Large Employers to meet the IRS reporting requirements by generating forms 1094-C and 1095-C in printed and electronic formats. 1095-C Parts I and II can be entered through the bulk entry interface or on each individual Employee Record. 3 1095-C Part III can be entered only on each individual Employee Record. This part should only be filled out for employees enrolled in a self-insured plan. 4 1094-C will be entered as part of the generation process. 1 ! FOUNDATION will not allow for the generation of IRS forms 1094-B or 1095-B.

More Information Further resources on the Affordable Care Act IRS Affordable Care Act Employer Portal http://www.irs.gov/Affordable-Care-Act/Employers IRS Affordable Care Act Employer Shared Responsibility Provisions FAQs http://www.irs.gov/Affordable-Care-Act/Employers/Questions-and-Answers-on-Employer-Shared-Responsibility-Provisions-Under-the-Affordable-Care-Act Shared Responsibility for Employers Regarding Health Coverage – Official Rule from Federal Register https://www.federalregister.gov/articles/2014/02/12/2014-03082/shared-responsibility-for-employers-regarding-health-coverage 1094-C (Draft) 1095-C (Draft) 1094/1095-C Instructions (Draft) http://www.irs.gov/pub/irs-dft/f1094c--dft.pdf http://www.irs.gov/pub/irs-dft/f1095c--dft.pdf http://www.irs.gov/pub/irs-dft/i109495c--dft.pdf For questions on the setup or reporting available in Foundation, please contact our Support department at (800) 246-0800 or review the materials available at www.foundationsoft.com. For questions on the Affordable Care Act or its implications, please contact your legal counsel or financial/benefits advisor.