FAIR TREATMENT OF CONSUMER (FTC) REGIME IN BANKING INDUSTRY

17 Slides466.00 KB

FAIR TREATMENT OF CONSUMER (FTC) REGIME IN BANKING INDUSTRY OF PAKISTAN

FTC/Responsible Banking Conduct Culture : Way of doing business or Mindset or the set of shared attitudes, values, goals, and practices that characterizes an institution or organization Banks should deal fairly and honestly with consumers at all stages of their relationship, so that it is an integral part of the culture of a bank.

FTC/Responsible Banking Conduct Fair market infrastructure where consumers make informed financial decisions, have confidence in the Banking industry, understand and exercise their rights, and have effective recourse for their grievances. The fair treatment of customers is synonymous to a consumer-centric approach of conducting business that reaps higher customer satisfaction.

SBP Vision-2020 Strategic Goal: To improve the efficiency, effectiveness and fairness of the banking system. Strengthen the Fair Treatment of Consumers (FTC) regime

FTC/Responsible Banking Conduct State Bank of Pakistan (SBP) has been making efforts through related regulations, guidelines, instructions, etc. to bring improvement in market conduct to ensure Responsible Banking- a proposition where the interests of consumer, banks and the regulator converge.

FTC/Responsible Banking Conduct Strengthening the effectiveness of the Banking Mohtasib Pakistan dispute resolution regime. Strengthen FTC requirements and implement monitoring, evaluation and a supervisory program to assess the level of industry compliance. Establish a joint working group with SECP to ensure consistency in application of conduct standards across the financial sector.

FTC/Responsible Banking Conduct promote good banking practices by setting out the minimum standards in dealings with customers; Increase transparency through disclosures, Promote a fair and cordial relationship between banks and their customers; and enhance customers’ confidence in banking system by creating awareness among them of their rights and obligation.

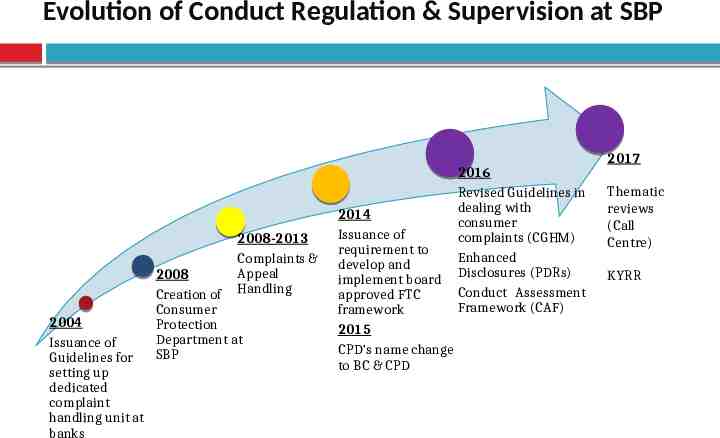

Evolution of Conduct Regulation & Supervision at SBP 2008-2013 Complaints & Appeal Handling 2004 Issuance of Guidelines for setting up dedicated complaint handling unit at banks 2008 Creation of Consumer Protection Department at SBP 2014 Issuance of requirement to develop and implement board approved FTC framework 2015 CPD’s name change to BC & CPD 2016 Revised Guidelines in dealing with consumer complaints (CGHM) Enhanced Disclosures (PDRs) Conduct Assessment Framework (CAF) 2017 Thematic reviews (Call Centre) KYRR

Recent Market Conduct Regulations Sale of Third Party Products by Banks: These instructions were issued in the backdrop of rising complaints relating to deceptive sales of Bancassurance and other third party investment products. The instructions require disclosure requirement and additional controls. Fair Treatment of Customers Framework (FTC): Banks/DFIs/MFBs vide CPD Circular 4 of 2014 have been advised to develop and implement Financial Consumer Protection Framework, duly approved by their BODs, by July 1, 2015. Guiding principles on Fairness of Service Charges: Being non prescriptive, the guidelines set forth high level principles that bank need to follow while devising their schedule of charges for the consumers. Consumer Grievance Handling Mechanism: With SBP’s 2020 vision to focus on core supervisory activities, the complaint handling function in banks have to be fair, efficient and effective. These guidelines give directions on conducive culture, communication with the complainants, TATs, record retention, annual disclosures and regulatory.

Recent Market Conduct Regulations Prevention of Fraudulent Payment Instruments: Provision of safe and secure payment instruments is one of the vital features of an effective financial consumer protection regime. Realizing the same, minimum security features as well as the internal controls for processing of cheques and Pay Orders have been issued by SBP. After the said instructions, the complaints against fraudulent cheques and pay orders have come down substantially. Equal Banking opportunities: SBP has also ensured provision of equal banking rights for visually impaired and special person by issuing guidelines on banking for visually impaired and customers with physical disability. This has helped banks invade untapped or discouraged segments of the market in a Responsible way. This step has been largely appreciated by the stakeholders.

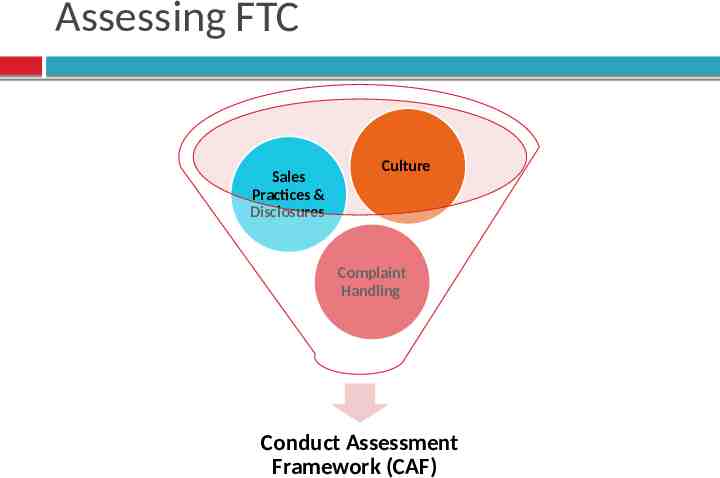

Recent Market Conduct Regulations Effective Disclosures: Recognizing the fact that transparency in disclosures gives customer the opportunity to make informed decision and avail the service that best suit their needs, SBP has issued disclosure requirements for Credit Cards, personal loans, Mortgage and auto loan products. Guidelines of Business Conduct: In order to exert self-discipline on the banks with respect to responsible banking and promote healthy competition and ethical practices SBP has issued Guidelines of Business Conduct for Banks. Conduct Assessment Framework: To help banks guage their state of Conduct, SBP has developed a “Conduct Assessment Framework” which is a self assessment model to be used by the banks themselves and share their findings with SBP. This framework will help identify grey areas and eventually help banks improve their conduct. First return under this framework was advised to be submitted till first quarter of 2018.

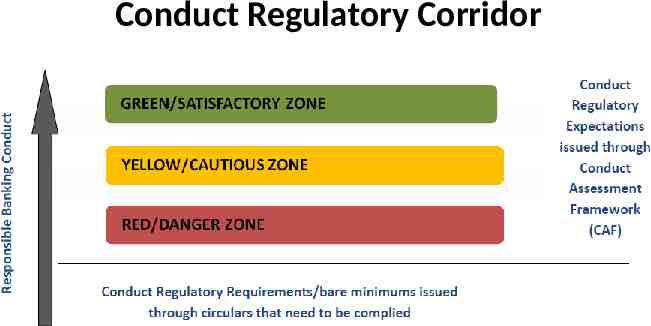

Conduct Regulatory Corridor

Assessing FTC Sales Practices & Disclosures Culture Complaint Handling Conduct Assessment Framework (CAF)

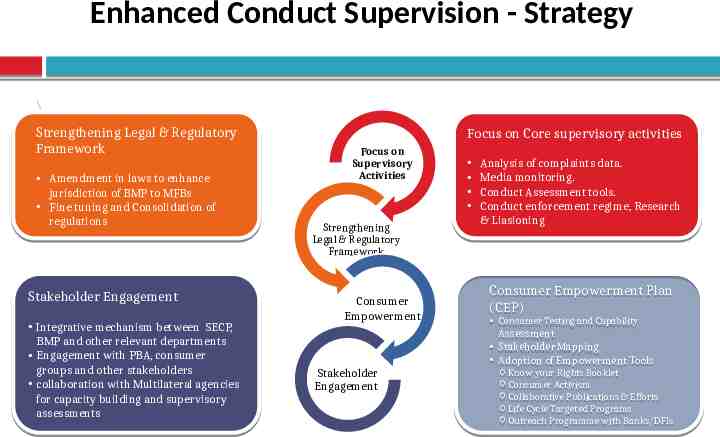

Enhanced Conduct Supervision - Strategy \ Strengthening Legal & Regulatory Framework Amendment Amendment in in laws laws to to enhance enhance jurisdiction jurisdiction of of BMP BMP to to MFBs MFBs Fine tuning and Consolidation of regulations regulations Stakeholder Engagement Integrative Integrative mechanism mechanism between between SECP, SECP, BMP and other relevant departments Engagement with PBA, consumer groups and other stakeholders collaboration with Multilateral agencies for capacity building and supervisory assessments assessments Focus on Core supervisory activities Focus on Supervisory Activities Strengthening Legal & Regulatory Framework Consumer Empowerment Stakeholder Engagement Analysis of complaints data. Media monitoring. Conduct Assessment tools. Conduct enforcement regime, Research & & Liasioning Liasioning Consumer Empowerment Plan (CEP) Consumer Consumer Testing Testing and and Capability Capability Assessment Assessment Stakeholder Stakeholder Mapping Mapping Adoption Adoption of of Empowerment Empowerment Tools Tools o o Know Know your your Rights Rights Booklet Booklet o Consumer Activism o Consumer Activism o o Collaborative Collaborative Publications Publications & & Efforts Efforts o Life Cycle Targeted Programs o Life Cycle Targeted Programs o o Outreach Outreach Programme Programme with with Banks/DFIs Banks/DFIs

Regulatory Expectations Right tone at the top Business conduct should be given same priority as given to business targets Reflected in policy and procedures Dissemination to the frontline staff Considered in employee assessment Appropriate monitoring and controls Adequate resources & training Customer should be seen being treated fairly

Regulatory Expectations Product design and offering Complaints are feedback not criticism Put yourself in the shoes of customer Equitable treatment of customer Should be used to improve product design and delivery Efficient and fair Consumer empowerment is your corporate social responsibility

Thank you Banking Conduct & Consumer Protection Department