Econ 350 Public Expenditure Economics Introduction to Public

34 Slides912.00 KB

Econ 350 Public Expenditure Economics Introduction to Public Economics Public Expenditure In Canada Political Economy Lorne Priemaza, M.A. [email protected] Quotes, tables, graphs and definitions from Rosen et al’s “Public Finance in Canada”

Course Overview Econ 350 is divided into 4 sections: 1)Introduction -What is Public Economics, Welfare Economics, and why is the government involved? 2) Public Economic Framework -How do we analyze aspects of Public Economics (Public Goods, Externalities, Income Redistribution, Cost-Benefit Analysis)?

Course Overview Econ 350 is divided into 4 sections: 3) Public Expenditures In Canada -How do our Public Economics tools apply to Canadian programs (Social Welfare, EI, Pensions, Healthcare, Education)? (-Note: Part 4 in textbook) 4) Political Economy -How do governments make decisions and what is Fiscal Federalism? (-Note: Part 3 in textbook)

Course Content Most topics will consist of 4 sections: 1)History 2)Theoretical Framework and Analysis 3)Mathematical Framework and Analysis -Note that since Econ 450 covers more in-depth math, this coverage will vary widely by topic 4) Analysis and Discussion Note: As the text was last updated in 2008, it lacks a comprehensive analysis of the 2008-present financial crisis

Part 1: Introduction Chapter 1: Introduction to Public Finance in Canada Chapter 2: Fundamentals of Welfare Economics Chapter 3: The Economic Roles of Government

Chapter 1: Introduction to Public Finance In Canada Canadian Government Government Size Expenditures Revenues

Theory -Why are we here? This course will take a microeconomic view of: 1)Why the government affects allocation of resources and distribution of income 2)How the government affects allocation of resources and distribution of income -Often there are many options, each with pro’s and con’s

The Big Question Public Economics examines the tension between two philosophies and their implications: Good of the individual VS Good of society Low taxes High taxes No healthcare Healthcare No social services Social services High tuition Low tuition

Canadian Government Federal Government -Capital Ottawa Provincial Government -10 provinces, 3 territories -Alberta Capital Edmonton Local Government -Cities, towns, hamlets, counties, etc. ie: Edmonton, Leduc, Milk River, Lac St. Anne County

History - Canadian Taxation British North American Act/Constitution Act (1867) 1) Federal government can raise money through tax (except property taxes on provincial property) 2) Provinces can’t charge custom duties, excise duties and other indirect taxes 3) Provinces can use direct taxes (income taxes, estate taxes, inheritance taxes, property taxes)

A History of Canadian Taxation Original taxes -Before confederation, provinces went into debt to build infrastructure (roads, ports, etc) -After confederation, federal government assumed this debt -Federal government responsible for: defense, navigation, shipping, trade regulation, criminal justice, and banking

A History of Canadian Taxation Original taxes -99% of tax revenue import & excise taxes -Founding fathers favored a strong federal government -Provinces were given subsidies to cover justice, education, welfare, and internal transport

A History of Canadian Taxation Tax Changes -World War I (1917) introduced corporate and personal income tax -1919 excise and custom duties were 78% of taxes -1920 saw first federal sales tax -1912 to the 1930’s: federal government used “conditional grants” to fund provincial employment, highways, some education, old age pensions, disease prevention, and social assistance

A History of Canadian Taxation Tax Amendments -1940 amended the constitution to allow federal employment insurance -1951 amended the constitution to allow federal/provincial old age pensions -this lead to an increase in payroll taxes

A History of Canadian Taxation Tax Fights -Provinces (especially Quebec) have opposed the federal government’s expansion of taxation and provision powers -Tax revenues have moved from excise and import to income, payroll, and sales tax -all new taxes originate in the House of Commons and cannot be introduced by the senate

A History of Canadian Taxation Provincial Taxes -Constitution Act limits provinces to direct taxation -To pay for increased welfare (especially after Great Depression), health, and education, provinces introduced income taxes and sales taxes -Provinces determine what taxes local governments can impose (usually property)

Summary of Canadian Taxation 1867 Constitution Act laid out tax powers This act has been amended to give federal government more power Provinces don’t like this fact, and they fight back Governments have supplied more and more services over time, required more and more taxes Tax revenue has moved from import and excise taxes to income, payroll and sales taxes

History - Canadian Expenditure

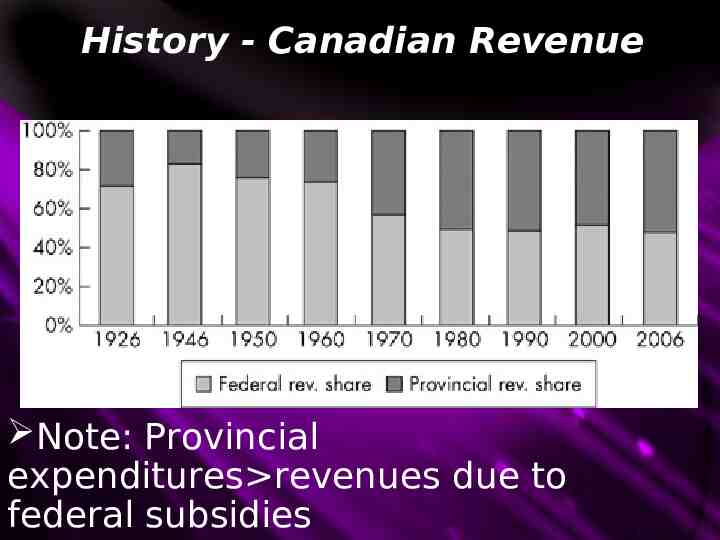

History - Canadian Revenue Note: Provincial expenditures revenues due to federal subsidies

Summary of Canadian Taxation Government programs have increased over time Therefore Taxes have grown and changed over time Therefore Government size has grown

Theory - Government Size Employment - poor measure of government size. Which is bigger: A)A department with 20 people? B)A department with 2 people and a supercomputer? C)A department with 10 full time staff and 40 seasonal staff?

Theory - Government Size Three methods of judging government size are: 1)Government purchases -(of goods and services) 2)Government transfers -(to people, business, and other governments) -(ie: welfare) 3)Interest payments But even these methods have problems

Government Size Measurement Problems 1) Accounting issues -Assess loan guarantees when made, when defaulted, or a mixture? -Assess pension plans as they are paid out or as they are paid into? -How to assess the liability of contaminated land or aboriginal claims -Miscellaneous uncertainty (is a child tax credit a tax/revenue reduction or an expenditure)?

Government Size Measurement Problems 2) Hidden Government Costs -If a new regulation has a huge cost to society, how is that measured? -How are the impacts of a change to tax law measured? -The government doesn’t spread capital purchases over the lifetime of the capital (as the private sector does)

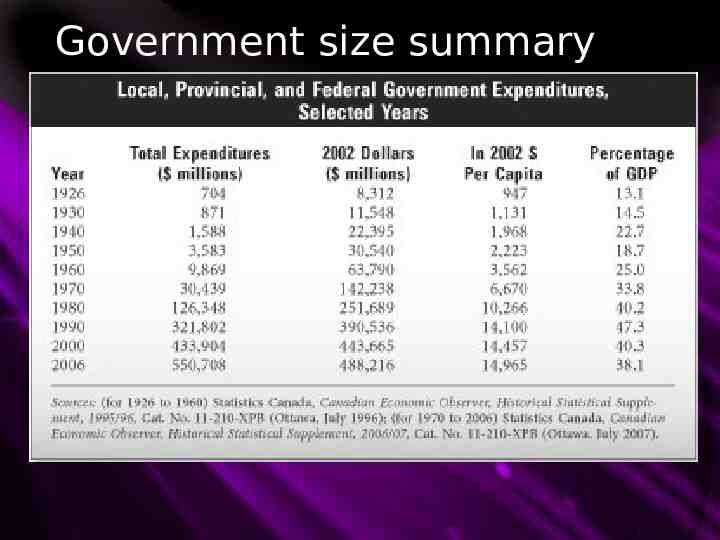

Government Size Measurement Problems We can’t precisely measure the size of the government, but we still gain information by asking: 1) Is government relatively small or relatively big 2) Has government size been increasing or decreasing over time Regardless of the measure, government size has increased since confederation. For example, Government expenditure in 2006 was 38% of GDP.

Government size summary

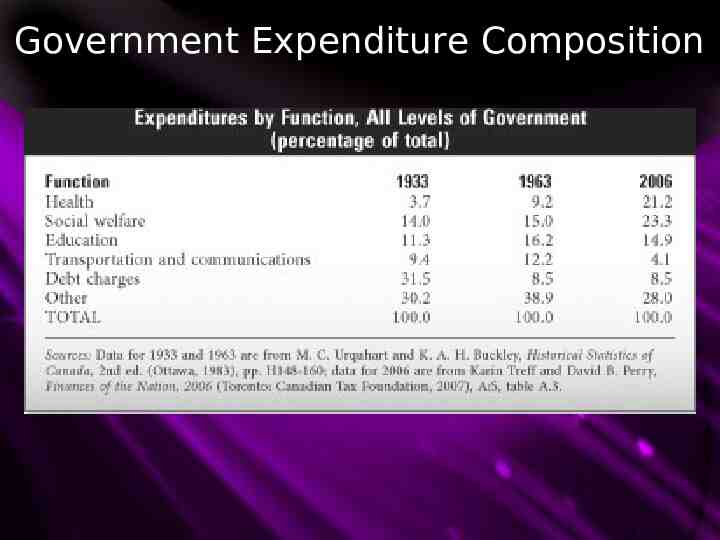

History - Government Expenditure Government expenditure on health and social welfare has INCREASED (17.7% of government exp. in 1930’s to 44.5% today) Transportation and communication expenditure had decreased (is this an issue?) Debt charges used to be high, rose into the 90’s, and recently have fallen Expenditures such as social welfare and interest payments are often determined in advance (ie: Pensions)

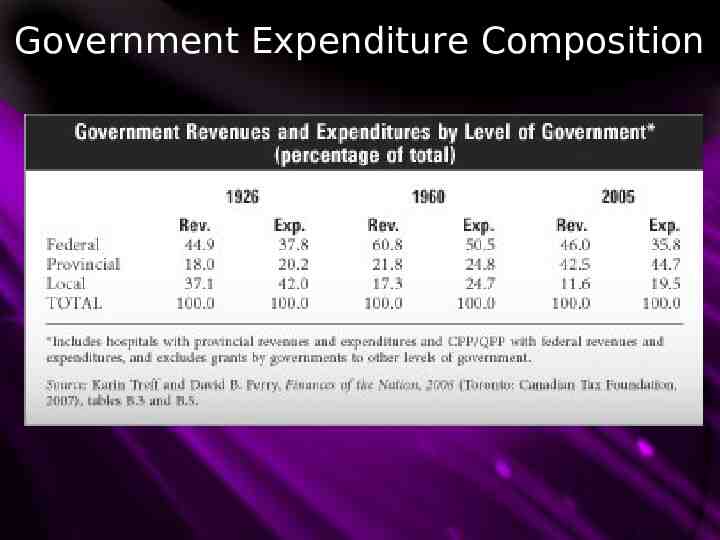

Government Expenditure Composition

Government Expenditure Composition Relative Federal government expenditure was high in 1926, grew by 1960, and shrank since then Relative Provincial government expenditure started small and has grown ever since Relative Local government expenditure started big and has been shrinking Provinces spend more than they make, requiring Federal transfers (as Federal government makes more than it spends generally)

Government Expenditure Composition

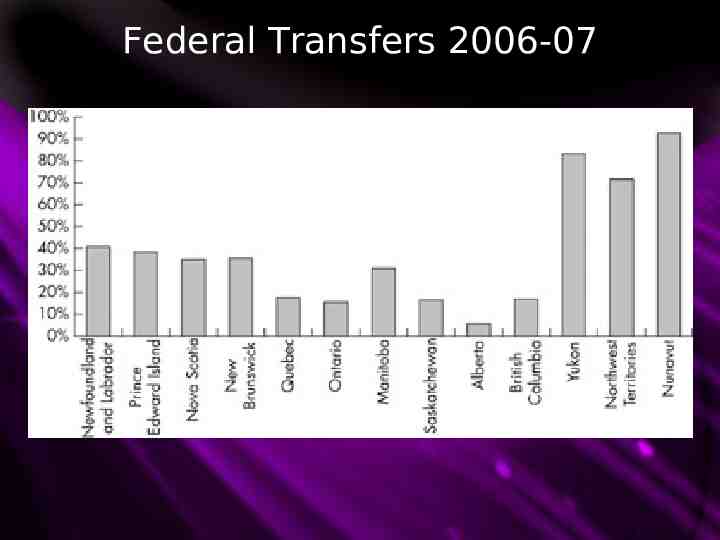

Federal Transfers 2006-07

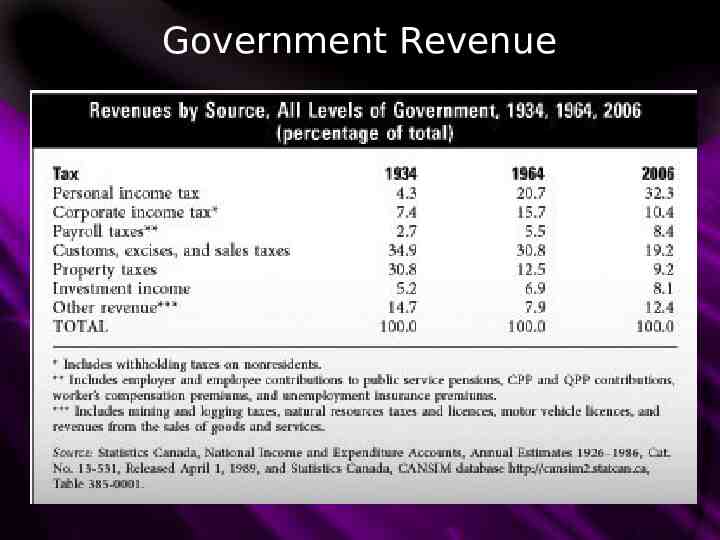

History - Government Revenue As mentioned previously government revenue has changed drastically over the years Personal Income Tax now accounts for 32% of government revenue Payroll taxes have increased to 8.4% Corporate income tax has fallen slightly lately (15.7% in 1964 to 10.4% in 2006) Local government revenue has decreased since 1926

Government Revenue

Chapter 1 Conclusion -The 1867 Constitution Act gave government taxation powers -Revenue and expenditure by all levels of government has changed drastically over the years -Canada has 3 levels of government (federal, provincial and local) which share/fight over revenue and expenditure powers -Government size is hard to determine, but has increased over time