Econ 340 Lecture 14 Pegging the Exchange Rate

75 Slides550.53 KB

Econ 340 Lecture 14 Pegging the Exchange Rate

News: Oct 28 – Nov 3 China-US deal signing delayed by Chile APEC cancellation -- WSJ: 10/30 Canvas NYT: 10/30 Canvas FT: 10/30 Canvas WP: 10/30 Canvas – Civil unrest in Chile forced it to cancel a meeting of APEC -- Asia Pacific Economic Cooperation -- scheduled for November 15-17 in Santiago. The unrest is unrelated to trade or APEC, but security concerns prompted the cancellation. – US and China had planned on Presidents Trump and Xi meeting there to sign their "Phase One" trade deal. Though that deal is not yet complete, it is expected to include increased US agricultural exports to China and US delaying increased tariffs on China's exports to US. It might also include on agreements on intellectual property and currencies. – APEC is searching for an alternative venue to hold the meeting, but it may not find one and will have to cancel the meeting. And the US and China are looking for an alternative opportunity to sign their agreement. US wins WTO dispute against India -- FT: 10/31 Canvas – The US had filed a complaint in March 2018 against India for providing 7 billion in annual export subsidies to its companies. A WTO panel has now ruled that these subsidies were indeed illegal under WTO rules. – India had argued that these subsidies were legal under exemptions for developing countries, but the WTO panel rejected that argument. India must end the subsidies within six months or the WTO may permit the US to retaliate with tariffs on India's exports. – India will likely appeal this decision, but in December the WTO Appellate Body will lack a quorum for making decisions, due to US refusal to approve appointments. Incoming ECB President calls on Germany and Netherlands to increase spending -- FT: 10/30 Canvas – Christine Lagarde, incoming president of the European Central Bank and former head of the International Monetary Fund, spoke on French radio and called on Eurozone countries that have government budget surpluses, Germany and Netherlands, to use that "room for manoeuvre" to increase spending in order to stimulate their and their neighbors' economies. – The eurozone countries share a currency, but they do not have any mechanism for fiscal cooperation or common budgetary policy. As a result, when some countries experience macroeconomic weakness, they rely on only monetary policy to help them out, and with today's low or negative interest rates, monetary policy can do little. – It is customary for ECB presidents not to name individual countries, but Lagarde's comments occurred before she was to take the helm of the ECB on Friday. Econ 340, Deardorff, Lecture 14: Pegging 2

News: Oct 28 – Nov 3 China-US deal signing delayed by Chile APEC cancellation – Civil unrest in Chile forced it to cancel a meeting of APEC -- Asia Pacific Economic Cooperation -- scheduled for November 15-17 in Santiago. The unrest is unrelated to trade or APEC, but security concerns prompted the cancellation. – US and China had planned on Presidents Trump and Xi meeting there to sign their "Phase One" trade deal. Though that deal is not yet complete, it is expected to include increased US agricultural exports to China and US delaying increased tariffs on China's exports to US. It might also include on agreements on intellectual property and currencies. – APEC is searching for an alternative venue to hold the meeting, but it may not find one and will have to cancel the meeting. And the US and China are looking for an alternative opportunity to sign their agreement. Econ 340, Deardorff, Lecture 14: Pegging 3

News: Oct 28 – Nov 3 US wins WTO dispute against India – The US had filed a complaint in March 2018 against India for providing 7 billion in annual export subsidies to its companies. A WTO panel has now ruled that these subsidies were indeed illegal under WTO rules. – India had argued that these subsidies were legal under exemptions for developing countries, but the WTO panel rejected that argument. India must end the subsidies within six months or the WTO may permit the US to retaliate with tariffs on India's exports. – India will likely appeal this decision, but in December the WTO Appellate Body will lack a quorum for making decisions, due to US refusal to approve appointments. Econ 340, Deardorff, Lecture 14: Pegging 4

News: Oct 28 – Nov 3 Incoming ECB President calls on Germany and Netherlands to increase spending – Christine Lagarde, incoming president of the European Central Bank and former head of the International Monetary Fund, spoke on French radio and called on Eurozone countries that have government budget surpluses, Germany and Netherlands, to use that "room for manoeuvre" to increase spending in order to stimulate their and their neighbors' economies. – The eurozone countries share a currency, but they do not have any mechanism for fiscal cooperation or common budgetary policy. As a result, when some countries experience macroeconomic weakness, they rely on only monetary policy to help them out, and with today's low or negative interest rates, monetary policy can do little. – It is customary for ECB presidents not to name individual countries, but Lagarde's comments occurred before she was to take the helm of the ECB on Friday. Econ 340, Deardorff, Lecture 14: Pegging 5

Lecture 14 Outline: Pegging the Exchange Rate How It’s Done – – – – Market Intervention Bands of Fluctuation Hybrids of Pegged and Floating The Gold Standard Who Pegs? Mechanics of Intervention – Reserves – Money Supply – Sterilization Effects of Pegging Chinese Currency Manipulation Econ 340, Deardorff, Lecture 14: Pegging 6

How It’s Done What “Pegging” Means – To “fix” the exchange rate by intervening in the market – It does not mean just fixing it by law – making it illegal to exchange the currency at other than the official rate Countries do that too, but that is not pegging, and it does not entirely work: gives rise to “black market” – “Intervention” means Buying or selling foreign currency, so as to Make up the difference between the market’s supply and demand Normally done by the central bank of the pegging country Econ 340, Deardorff, Lecture 14: Pegging 7

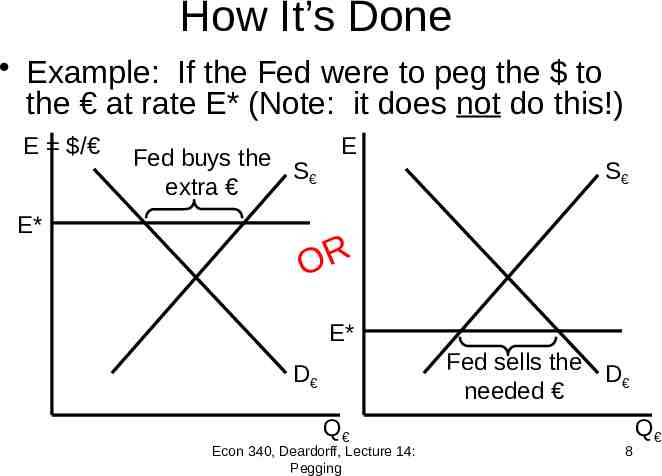

How It’s Done Example: If the Fed were to peg the to the at rate E* (Note: it does not do this!) E / E* Fed buys the S extra E S OR E* Fed sells the D needed D Q Econ 340, Deardorff, Lecture 14: Pegging 8 Q

How It’s Done What “Pegging” Means – In practice, pegs are never exact – Central banks Set a “par value” ( “central value”) Intervene only if rate moves some distance (e.g., 1%) above or below this par value This range of movement is called an “exchange rate band” – We will ignore this complication in drawing the market, and pretend that they peg the rate exactly Econ 340, Deardorff, Lecture 14: Pegging 9

How It’s Done Hybrids of Pegged and Freely Floating Exchange Rates – Managed Float Intervene to influence the rate But do not announce a target rate or par value And do not necessarily keep the rate constant – “Dirty Float” same as Managed Float Econ 340, Deardorff, Lecture 14: Pegging 10

How It’s Done Hybrids of Pegged and Freely Floating Exchange Rates – “Leaning Against the Wind” Particular form of managed float that – Does not try to alter the level of the exchange rate, but – Does try to slow its rate of change Purpose: to dampen fluctuations Econ 340, Deardorff, Lecture 14: Pegging 11

How It’s Done Hybrids of Pegged and Freely Floating Exchange Rates – Crawling Peg A pegged rate with a par value that moves – Slowly and – Predictably Example: Country might announce that the par value will appreciate by 0.01% each week as long as central bank is buying foreign exchange, and vice versa Note: All of these hybrids still do require intervention in the exchange market Econ 340, Deardorff, Lecture 14: Pegging 12

How It’s Done The Gold Standard – Common in 19th century, but ended 1914. – Countries Defined their currencies in terms of gold Stood ready to buy and sell gold at their official rate – Result was like pegged exchange rates, except that the pegging was to gold. – “Rules” of the Gold Standard Fix price of gold in terms of your own currency Keep money supply equal gold supply (or proportional to it) Be ready to redeem currency in terms of gold and allow gold (and thus money) to flow internationally – Implication of the gold standard: Changes in money supply (gold) equilibrate the markets Econ 340, Deardorff, Lecture 14: Pegging 13

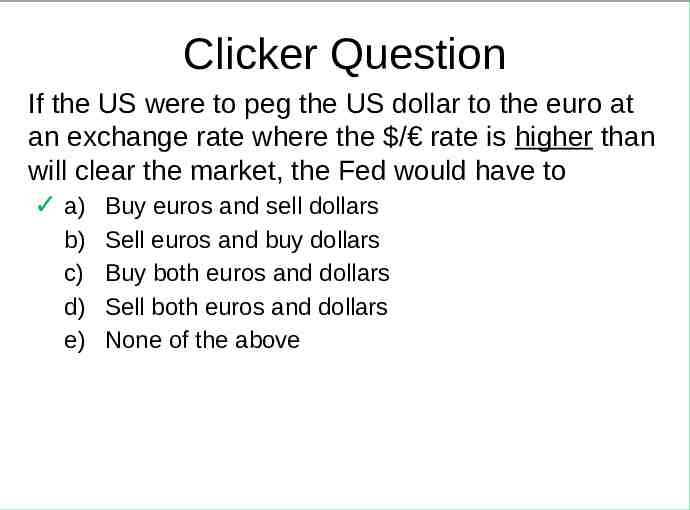

Clicker Question If the US were to peg the US dollar to the euro at an exchange rate where the / rate is higher than will clear the market, the Fed would have to a) Buy euros and sell dollars b) c) d) e) Sell euros and buy dollars Buy both euros and dollars Sell both euros and dollars None of the above

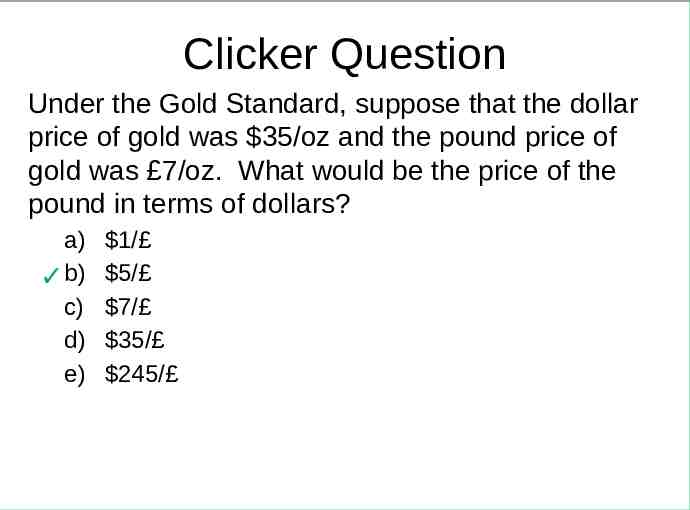

Clicker Question Under the Gold Standard, suppose that the dollar price of gold was 35/oz and the pound price of gold was 7/oz. What would be the price of the pound in terms of dollars? a) b) c) d) e) 1/ 5/ 7/ 35/ 245/

Lecture 14 Outline: Pegging the Exchange Rate How It’s Done – – – – Market Intervention Bands of Fluctuation Hybrids of Pegged and Floating The Gold Standard Who Pegs? Mechanics of Intervention – Reserves – Money Supply – Sterilization Effects of Pegging Chinese Currency Manipulation Econ 340, Deardorff, Lecture 14: Pegging 16

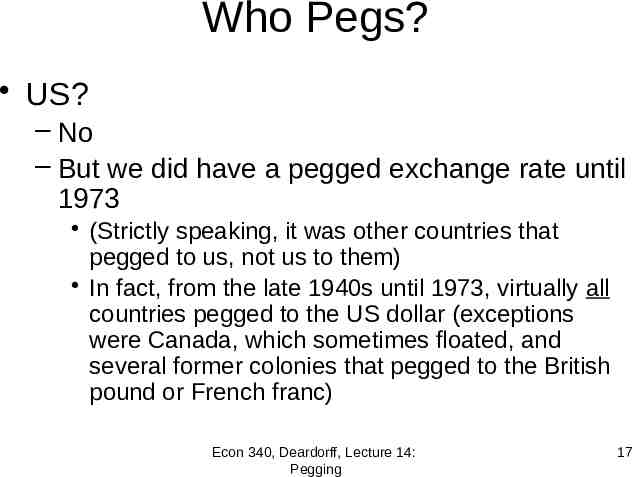

Who Pegs? US? – No – But we did have a pegged exchange rate until 1973 (Strictly speaking, it was other countries that pegged to us, not us to them) In fact, from the late 1940s until 1973, virtually all countries pegged to the US dollar (exceptions were Canada, which sometimes floated, and several former colonies that pegged to the British pound or French franc) Econ 340, Deardorff, Lecture 14: Pegging 17

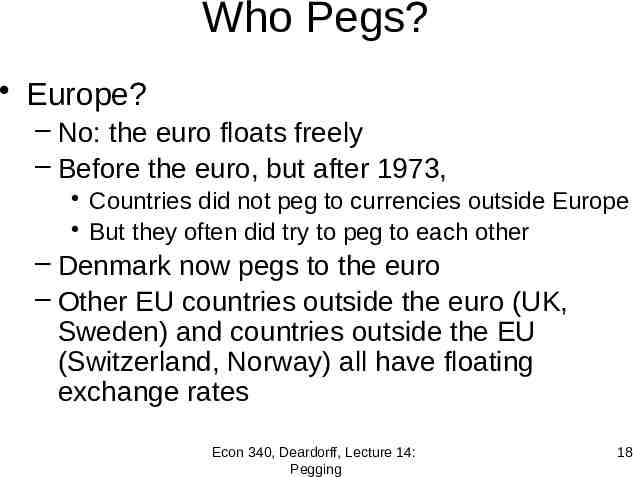

Who Pegs? Europe? – No: the euro floats freely – Before the euro, but after 1973, Countries did not peg to currencies outside Europe But they often did try to peg to each other – Denmark now pegs to the euro – Other EU countries outside the euro (UK, Sweden) and countries outside the EU (Switzerland, Norway) all have floating exchange rates Econ 340, Deardorff, Lecture 14: Pegging 18

Who Pegs? Other Developed Countries? – No: Canada, Japan, Australia, New Zealand, S. Korea all have floating rates Econ 340, Deardorff, Lecture 14: Pegging 19

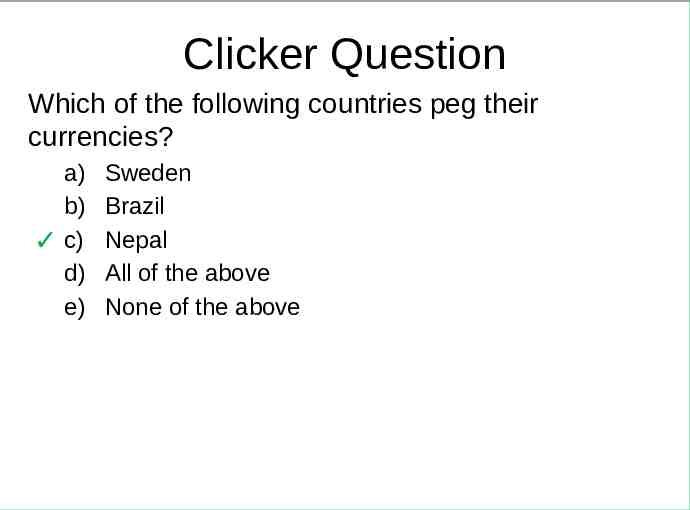

Who Pegs? Developing Countries? – They are mixed – A sample (from IMF, 2008): Argentina: pegged (to US dollar) Brazil: float Bulgaria: currency board (pegged to euro) China pegged to dollar until summer 05, and July 08 to July 2010; now sometimes says it pegs to basket of currencies Costa Rica: crawling peg India: managed float Egypt: managed float Nepal: pegged (to India’s rupee) Econ 340, Deardorff, Lecture 14: Pegging 20

Clicker Question Which of the following countries peg their currencies? a) b) c) d) e) Sweden Brazil Nepal All of the above None of the above

Lecture 14 Outline: Pegging the Exchange Rate How It’s Done – – – – Market Intervention Bands of Fluctuation Hybrids of Pegged and Floating The Gold Standard Who Pegs? Mechanics of Intervention – Reserves – Money Supply – Sterilization Effects of Pegging Chinese Currency Manipulation Econ 340, Deardorff, Lecture 14: Pegging 22

Mechanics of Intervention Always: Buy or sell foreign currency in exchange for domestic currency This has two effects, if nothing else is done: 1. Changes the level of reserves of foreign currency 2. Changes the level of the country’s own domestic money supply in circulation Econ 340, Deardorff, Lecture 14: Pegging 23

Mechanics of Intervention Change in Central Bank’s Reserves of Foreign Currency – What they buy is added to reserves – What they sell is subtracted from reserves Econ 340, Deardorff, Lecture 14: Pegging 24

Mechanics of Intervention Change in Country’s Domestic Money Supply – When US Central Bank (CB) buys with , those go into circulation This adds to the US money supply (Actually, it adds even more, due to “money multiplier” you learned about in Econ 102) – When CB sells for , those come out of circulation Reducing the money supply Similar to Gold Standard Econ 340, Deardorff, Lecture 14: Pegging 25

Mechanics of Intervention Sterilization – However, Central Bank has the option of preventing this change in the money supply by “sterilization” – Sterilization Use of offsetting open market operations to keep the money supply unchanged – Example: To sterilize a 1 m. purchase of foreign currency, CB would sell 1 m.-worth of bonds This takes the 1 m. back out of circulation – Sterilization is a policy choice Central Bank can do it, or not, as it sees fit Some central banks have said they lack the tools to sterilize Most, if they intervene in the exchange market, do sterilize, thus preventing gold-standard-like adjustment Econ 340, Deardorff, Lecture 14: Pegging 26

Clicker Question Sterilization of exchange-market transactions by a central bank means to prevent those transactions from changing a) b) c) d) e) The level of its reserves The level of its domestic money supply The level of the foreign money supply The spot exchange rate The forward exchange rate

Clicker Question When a central bank is trying to maintain an overvalued currency by buying its own currency on the foreign exchange market, sterilization of that transaction means for it to a) b) c) d) e) Buy foreign currency Sell foreign currency Buy domestic bonds Sell domestic bonds Devalue

Lecture 14 Outline: Pegging the Exchange Rate How It’s Done – – – – Market Intervention Bands of Fluctuation Hybrids of Pegged and Floating The Gold Standard Who Pegs? Mechanics of Intervention – Reserves – Money Supply – Sterilization Effects of Pegging Chinese Currency Manipulation Econ 340, Deardorff, Lecture 14: Pegging 29

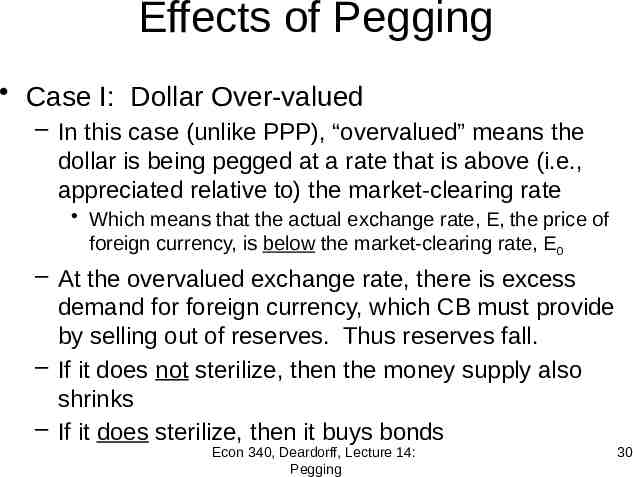

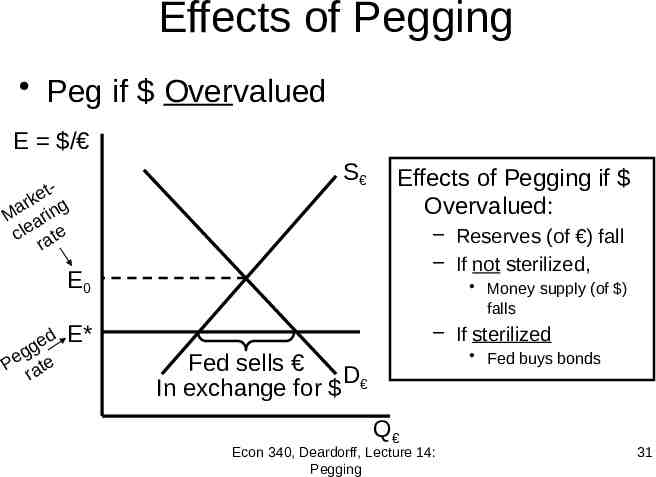

Effects of Pegging Case I: Dollar Over-valued – In this case (unlike PPP), “overvalued” means the dollar is being pegged at a rate that is above (i.e., appreciated relative to) the market-clearing rate Which means that the actual exchange rate, E, the price of foreign currency, is below the market-clearing rate, E0 – At the overvalued exchange rate, there is excess demand for foreign currency, which CB must provide by selling out of reserves. Thus reserves fall. – If it does not sterilize, then the money supply also shrinks – If it does sterilize, then it buys bonds Econ 340, Deardorff, Lecture 14: Pegging 30

Effects of Pegging Peg if Overvalued E / te k r g Ma arin cle ate r S Effects of Pegging if Overvalued: – Reserves (of ) fall – If not sterilized, E0 ed g g Pe ate r Money supply (of ) falls E* – If sterilized Fed buys bonds Fed sells D In exchange for Q Econ 340, Deardorff, Lecture 14: Pegging 31

Effects of Pegging Further implication of an overvalued peg – If it continues, central bank must eventually run out of reserves – This, as we’ll see, causes a Crisis Exchange-rate crisis, or Financial crisis Econ 340, Deardorff, Lecture 14: Pegging 32

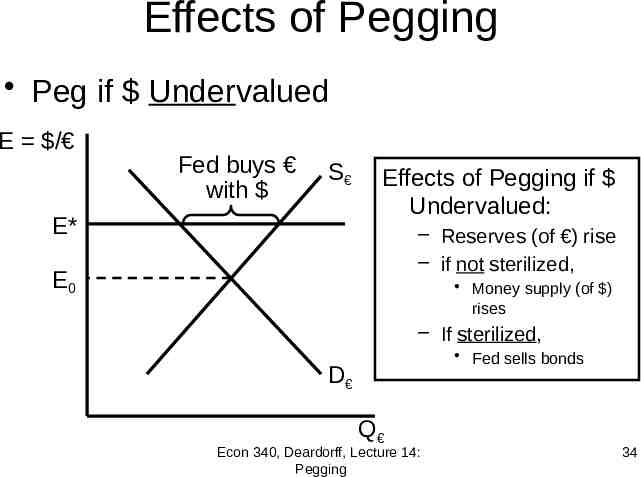

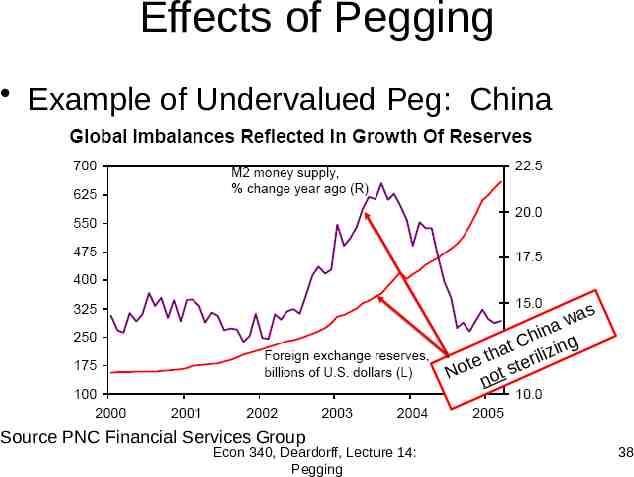

Effects of Pegging Case II: Dollar Under-valued – In this case, “undervalued” means the dollar is being pegged at a rate that is below (i.e., depreciated relative to) the market-clearing rate Which means that E, the price of foreign currency, is above the market-clearing rate, E0 – At undervalued rate, there is excess supply of foreign currency, which CB must take out of the market by buying and adding to reserves – If it does not sterilize, then the money supply grows – If it does sterilize, then it sells bonds Econ 340, Deardorff, Lecture 14: Pegging 33

Effects of Pegging Peg if Undervalued E / Fed buys with S E* Effects of Pegging if Undervalued: – Reserves (of ) rise – if not sterilized, E0 Money supply (of ) rises – If sterilized, Fed sells bonds D Q Econ 340, Deardorff, Lecture 14: Pegging 34

Effects of Pegging Further implication of an undervalued peg – Nothing critically important – If it continues, Central Bank piles up more and more reserves, but there is no limit on its ability to do that – Result: No crisis – However, if it does not sterilize, then money supply grows too, and this may cause inflation Econ 340, Deardorff, Lecture 14: Pegging 35

Effects of Pegging Note the asymmetry: – Overvalued peg leads to crisis – Undervalued peg does not Econ 340, Deardorff, Lecture 14: Pegging 36

Clicker Question Which of the following leads to crisis, and why? a) An undervalued peg, because the world avoids the currency b) An overvalued peg, because it discourages exports c) An undervalued peg, because pegging causes inflation d) An overvalued peg, because pegging exhausts reserves e) A floating exchange rate, because it can form a bubble

Effects of Pegging Example of Undervalued Peg: China as w a hin g C at ilizin h t er te No not st Source PNC Financial Services Group Econ 340, Deardorff, Lecture 14: Pegging 38

Effects of Pegging A Special Case: The US Dollar – Most countries that peg their currencies, peg them to the US dollar – That means that their reserves are dollardenominated assets, mostly US gov’t bonds – If they keep their currencies undervalued, then that means the dollar is overvalued But the overvalued dollar need not lead to crisis Others want, need, or at least choose, to hold our dollars Econ 340, Deardorff, Lecture 14: Pegging 39

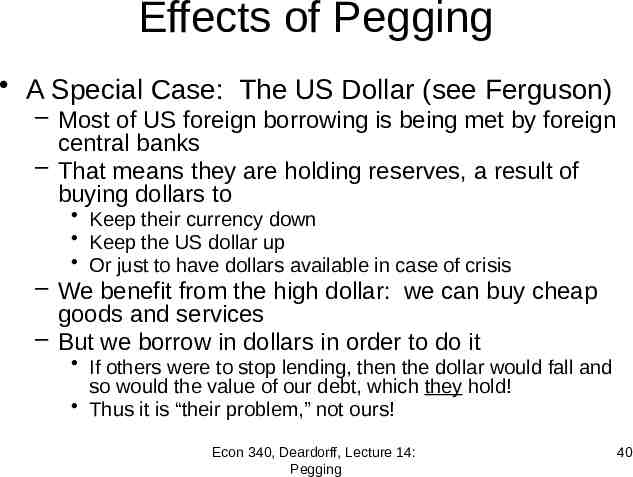

Effects of Pegging A Special Case: The US Dollar (see Ferguson) – Most of US foreign borrowing is being met by foreign central banks – That means they are holding reserves, a result of buying dollars to Keep their currency down Keep the US dollar up Or just to have dollars available in case of crisis – We benefit from the high dollar: we can buy cheap goods and services – But we borrow in dollars in order to do it If others were to stop lending, then the dollar would fall and so would the value of our debt, which they hold! Thus it is “their problem,” not ours! Econ 340, Deardorff, Lecture 14: Pegging 40

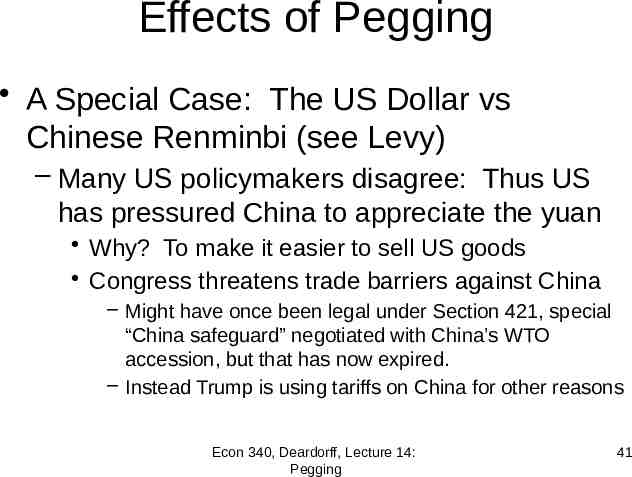

Effects of Pegging A Special Case: The US Dollar vs Chinese Renminbi (see Levy) – Many US policymakers disagree: Thus US has pressured China to appreciate the yuan Why? To make it easier to sell US goods Congress threatens trade barriers against China – Might have once been legal under Section 421, special “China safeguard” negotiated with China’s WTO accession, but that has now expired. – Instead Trump is using tariffs on China for other reasons Econ 340, Deardorff, Lecture 14: Pegging 41

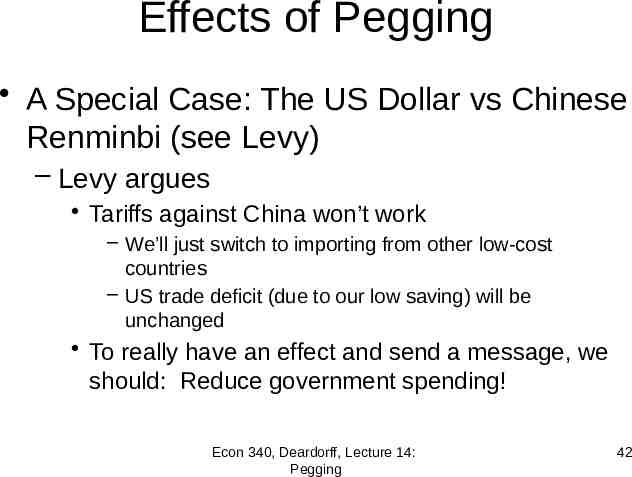

Effects of Pegging A Special Case: The US Dollar vs Chinese Renminbi (see Levy) – Levy argues Tariffs against China won’t work – We’ll just switch to importing from other low-cost countries – US trade deficit (due to our low saving) will be unchanged To really have an effect and send a message, we should: Reduce government spending! Econ 340, Deardorff, Lecture 14: Pegging 42

China’s Exchange Rate, US /Yuan, 2000-2019 0.180 0.160 0.140 0.120 0.100 0.080 0.060 0.040 The exchange rate did not change at all between 2000 and 2005 0.020 0.000 Econ 340, Deardorff, Lecture 14: Pegging 43

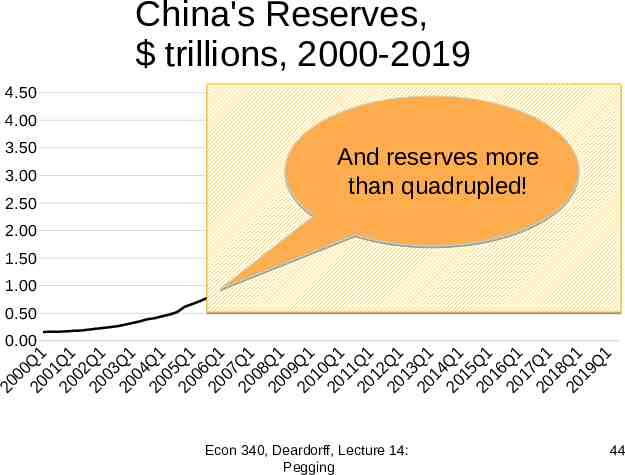

China's Reserves, trillions, 2000-2019 4.50 4.00 3.50 3.00 2.50 And reserves more than quadrupled! 2.00 1.50 1.00 0.50 0.00 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Q 0 0 1Q 0 2 Q 0 3 Q 0 4 Q 0 5 Q 06 Q 0 7 Q 0 8Q 0 9 Q 1 0 Q 1 1 Q 1 2 Q 13 Q 1 4Q 15 Q 1 6Q 1 7 Q 1 8 Q 1 9Q 0 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 Econ 340, Deardorff, Lecture 14: Pegging 44

Effects of Pegging A Special Case: The US Dollar vs Chinese Renminbi – It is clear from the two graphs that China was pegging their currency to the US dollar in 2000-2005 To do so they were buying dollars and thus accumulating almost 1 trillion of reserves Econ 340, Deardorff, Lecture 14: Pegging 45

Effects of Pegging Example: To see the effects on US of China pegging versus floating, – Consider the Chinese foreign exchange market (for ) – Suppose the US economy expands, increasing US imports from China. – What will happen if The renminbi floats? Or, instead, if The renminbi is pegged to the US dollar? – We’ll look at China’s market for foreign exchange, where their foreign currency is the dollar Econ 340, Deardorff, Lecture 14: Pegging 46

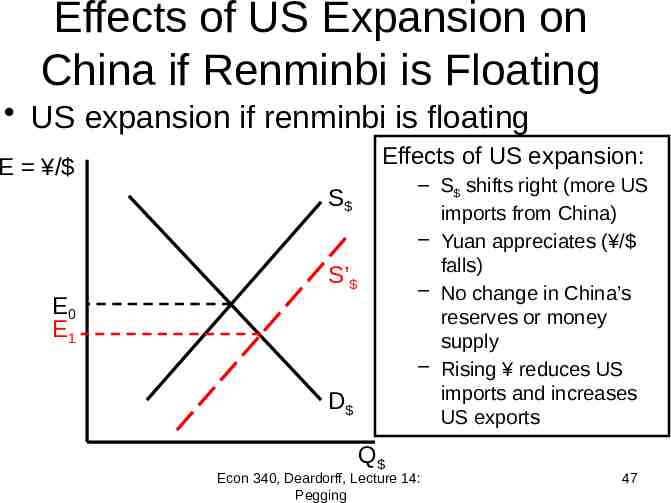

Effects of US Expansion on China if Renminbi is Floating US expansion if renminbi is floating Effects of US expansion: E / – S shifts right (more US imports from China) – Yuan appreciates ( / falls) – No change in China’s reserves or money supply – Rising reduces US imports and increases US exports S E0 E1 S’ D Q Econ 340, Deardorff, Lecture 14: Pegging 47

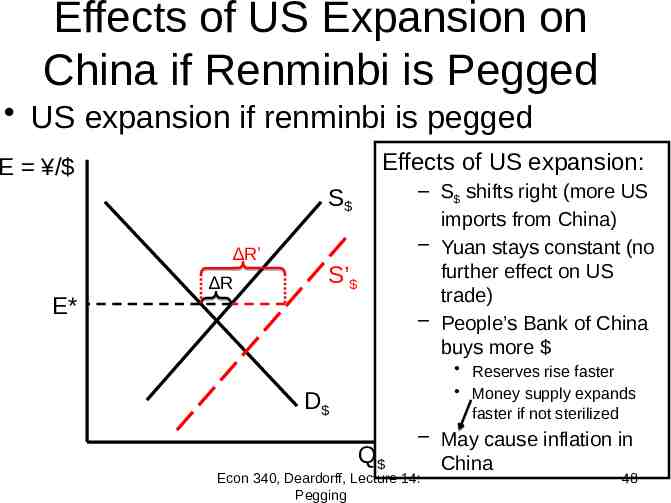

Effects of US Expansion on China if Renminbi is Pegged US expansion if renminbi is pegged Effects of US expansion: E / – S shifts right (more US imports from China) – Yuan stays constant (no further effect on US trade) – People’s Bank of China buys more S ΔR’ E* ΔR S’ Reserves rise faster Money supply expands faster if not sterilized D Q – May cause inflation in China Econ 340, Deardorff, Lecture 14: Pegging 48

Effects of Pegging Implication of Example: – Something always changes in the exchange market when changes occur for trade, capital flows, or other transactions Exchange rate changes if floating Reserves (and maybe money supply) change if pegged Econ 340, Deardorff, Lecture 14: Pegging 49

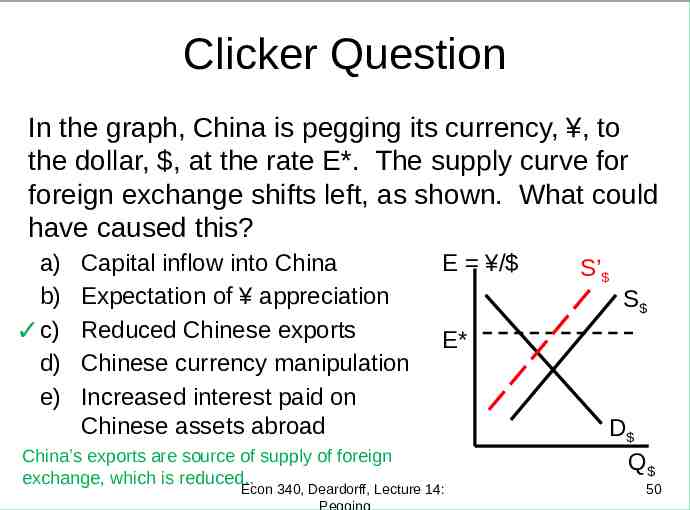

Clicker Question In the graph, China is pegging its currency, , to the dollar, , at the rate E*. The supply curve for foreign exchange shifts left, as shown. What could have caused this? a) b) c) d) e) Capital inflow into China Expectation of appreciation Reduced Chinese exports Chinese currency manipulation Increased interest paid on Chinese assets abroad China’s exports are source of supply of foreign exchange, which is reduced. E / S’ S E* Econ 340, Deardorff, Lecture 14: Pegging D Q 50

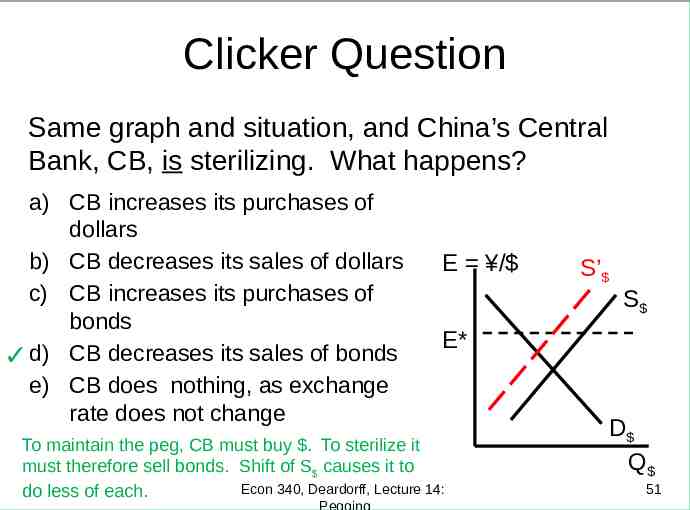

Clicker Question Same graph and situation, and China’s Central Bank, CB, is sterilizing. What happens? a) CB increases its purchases of dollars b) CB decreases its sales of dollars c) CB increases its purchases of bonds d) CB decreases its sales of bonds e) CB does nothing, as exchange rate does not change E / S E* To maintain the peg, CB must buy . To sterilize it must therefore sell bonds. Shift of S causes it to Econ 340, Deardorff, Lecture 14: do less of each. Pegging S’ D Q 51

Lecture 14 Outline: Pegging the Exchange Rate How It’s Done – – – – Market Intervention Bands of Fluctuation Hybrids of Pegged and Floating The Gold Standard Who Pegs? Mechanics of Intervention – Reserves – Money Supply – Sterilization Effects of Pegging Chinese Currency Manipulation Econ 340, Deardorff, Lecture 14: Pegging 52

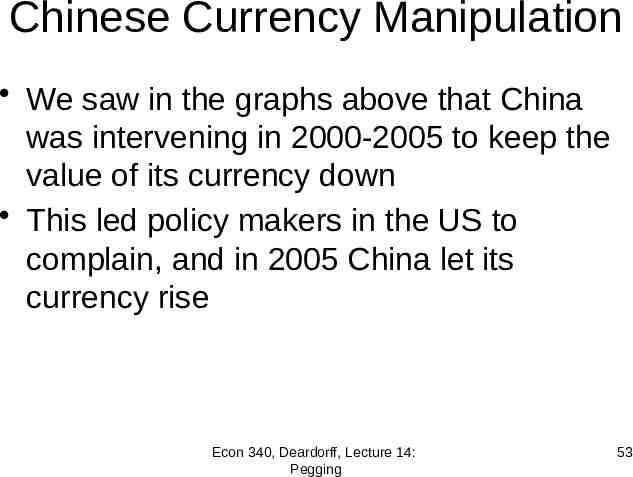

Chinese Currency Manipulation We saw in the graphs above that China was intervening in 2000-2005 to keep the value of its currency down This led policy makers in the US to complain, and in 2005 China let its currency rise Econ 340, Deardorff, Lecture 14: Pegging 53

China’s Exchange Rate, US /Yuan, 2000-2019 0.180 0.160 0.140 0.120 0.100 0.080 0.060 The yuan appreciated steadily between 2005 and 2008 0.040 0.020 0.000 Econ 340, Deardorff, Lecture 14: Pegging 54

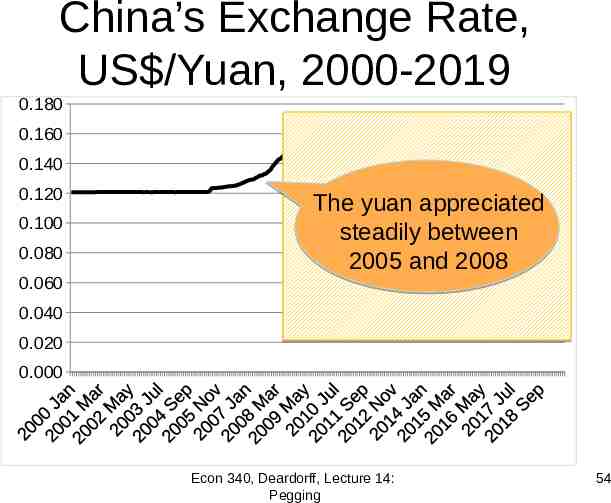

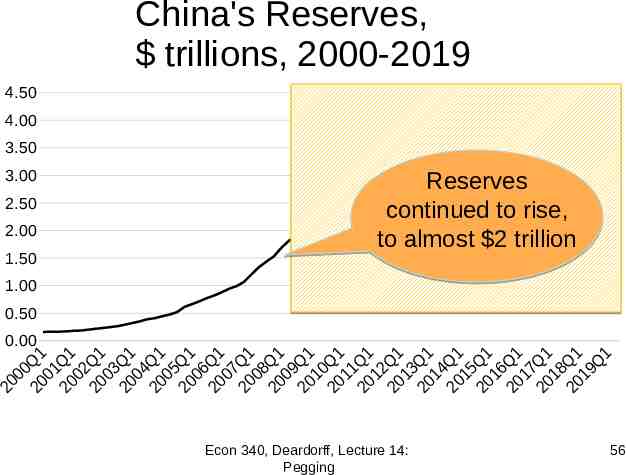

Chinese Currency Manipulation But China’s reserves continued to rise, indicating that it was still buying dollars. Econ 340, Deardorff, Lecture 14: Pegging 55

China's Reserves, trillions, 2000-2019 4.50 4.00 3.50 3.00 2.50 2.00 1.50 Reserves continued to rise, to almost 2 trillion 1.00 0.50 0.00 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Q 0 0 1Q 0 2 Q 0 3 Q 0 4 Q 0 5 Q 06 Q 0 7 Q 0 8Q 0 9 Q 1 0 Q 1 1 Q 1 2 Q 13 Q 1 4Q 15 Q 1 6Q 1 7 Q 1 8 Q 1 9Q 0 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 Econ 340, Deardorff, Lecture 14: Pegging 56

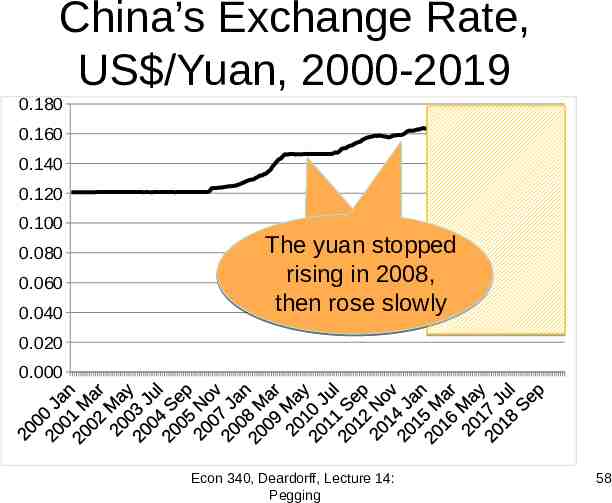

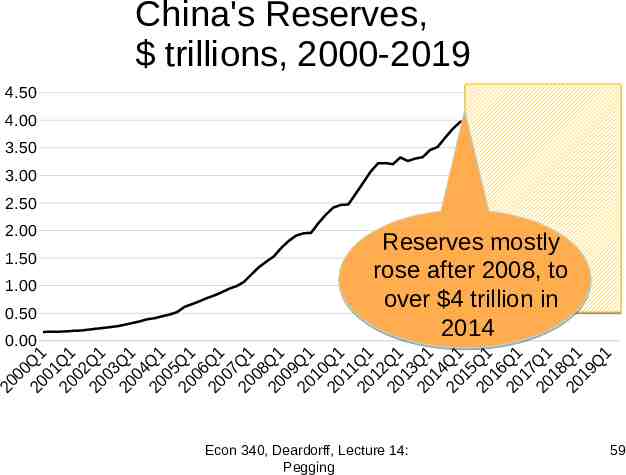

Chinese Currency Manipulation The financial crisis of 2008 slowed down both – The appreciation of the renminbi, and – The growth of reserves Econ 340, Deardorff, Lecture 14: Pegging 57

China’s Exchange Rate, US /Yuan, 2000-2019 0.180 0.160 0.140 0.120 0.100 0.080 0.060 0.040 The yuan stopped rising in 2008, then rose slowly 0.020 0.000 Econ 340, Deardorff, Lecture 14: Pegging 58

China's Reserves, trillions, 2000-2019 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 Reserves mostly rose after 2008, to over 4 trillion in 2014 0.00 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Q 0 0 1Q 0 2 Q 0 3 Q 0 4 Q 0 5 Q 06 Q 0 7 Q 0 8Q 0 9 Q 1 0 Q 1 1 Q 1 2 Q 13 Q 1 4Q 15 Q 1 6Q 1 7 Q 1 8 Q 1 9Q 0 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 Econ 340, Deardorff, Lecture 14: Pegging 59

Chinese Currency Manipulation The financial crisis of 2008 – Slowed down the appreciation of the renminbi, off and on – But reserves continued to grow rapidly in most periods until 2014 – China’s purchases of US dollars were still holding down the yuan’s value, or slowing its rise But all that changed in 2014 Econ 340, Deardorff, Lecture 14: Pegging 60

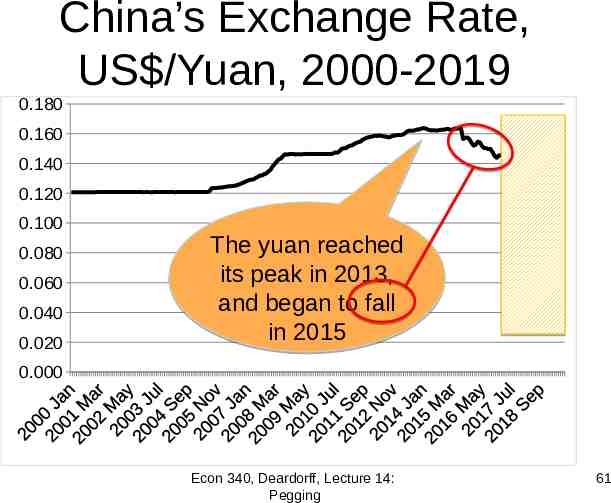

China’s Exchange Rate, US /Yuan, 2000-2019 0.180 0.160 0.140 0.120 0.100 0.080 0.060 0.040 0.020 The yuan reached its peak in 2013, and began to fall in 2015 0.000 Econ 340, Deardorff, Lecture 14: Pegging 61

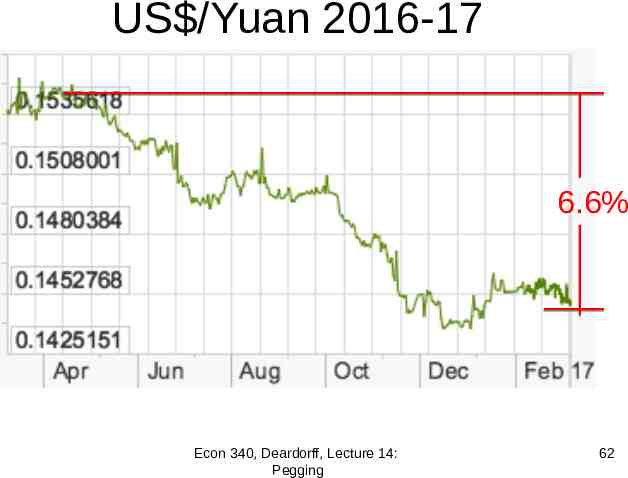

US /Yuan 2016-17 6.6% Econ 340, Deardorff, Lecture 14: Pegging 62

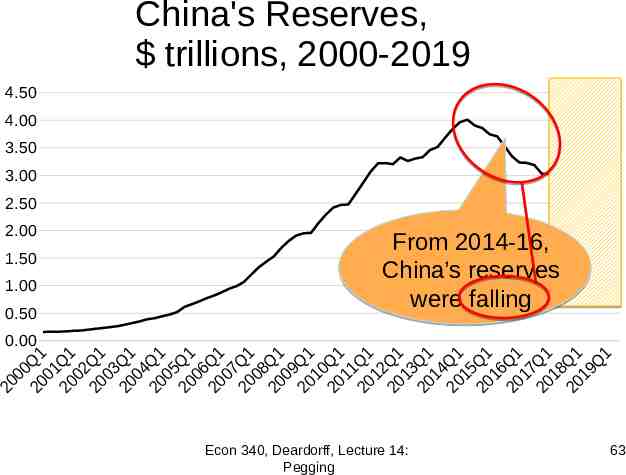

China's Reserves, trillions, 2000-2019 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 From 2014-16, China’s reserves were falling 0.00 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Q 0 0 1Q 0 2 Q 0 3 Q 0 4 Q 0 5 Q 06 Q 0 7 Q 0 8Q 0 9 Q 1 0 Q 1 1 Q 1 2 Q 13 Q 1 4Q 15 Q 1 6Q 1 7 Q 1 8 Q 1 9Q 0 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 Econ 340, Deardorff, Lecture 14: Pegging 63

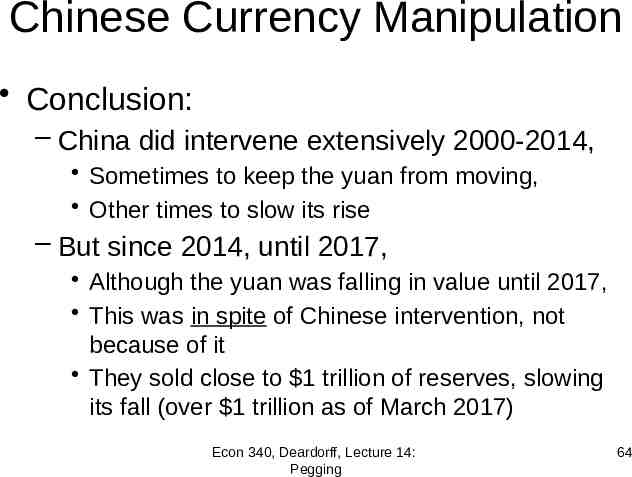

Chinese Currency Manipulation Conclusion: – China did intervene extensively 2000-2014, Sometimes to keep the yuan from moving, Other times to slow its rise – But since 2014, until 2017, Although the yuan was falling in value until 2017, This was in spite of Chinese intervention, not because of it They sold close to 1 trillion of reserves, slowing its fall (over 1 trillion as of March 2017) Econ 340, Deardorff, Lecture 14: Pegging 64

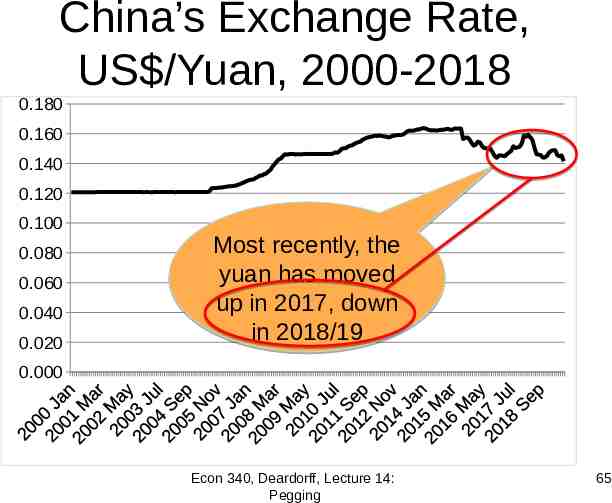

China’s Exchange Rate, US /Yuan, 2000-2018 0.180 0.160 0.140 0.120 0.100 0.080 0.060 0.040 0.020 Most recently, the yuan has moved up in 2017, down in 2018/19 0.000 Econ 340, Deardorff, Lecture 14: Pegging 65

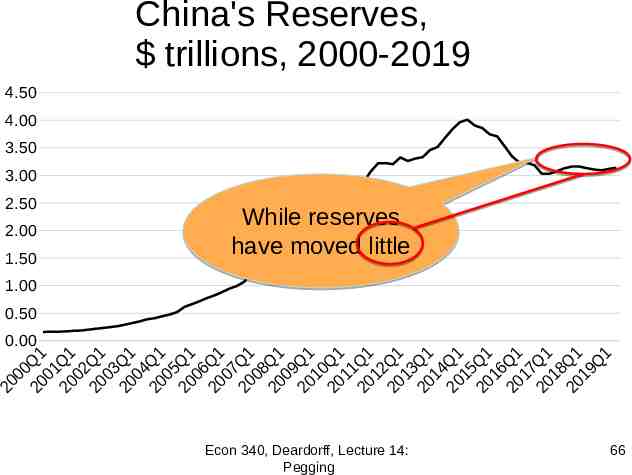

China's Reserves, trillions, 2000-2019 4.50 4.00 3.50 3.00 2.50 2.00 1.50 While reserves have moved little 1.00 0.50 0.00 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Q 0 0 1Q 0 2 Q 0 3 Q 0 4 Q 0 5 Q 06 Q 0 7 Q 0 8Q 0 9 Q 1 0 Q 1 1 Q 1 2 Q 13 Q 1 4Q 15 Q 1 6Q 1 7 Q 1 8 Q 1 9Q 0 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 Econ 340, Deardorff, Lecture 14: Pegging 66

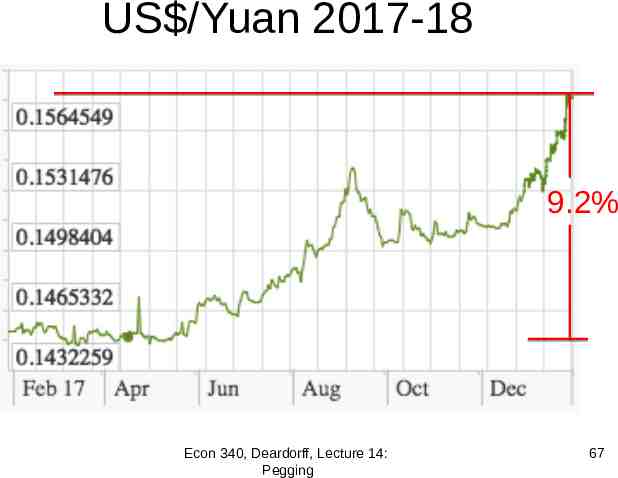

US /Yuan 2017-18 9.2% Econ 340, Deardorff, Lecture 14: Pegging 67

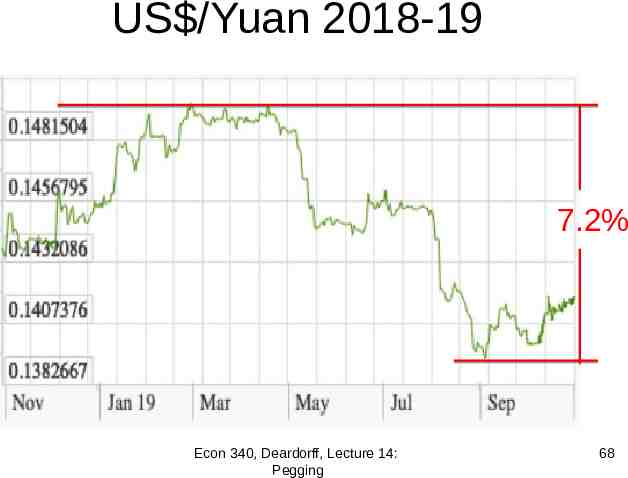

US /Yuan 2018-19 7.2% Econ 340, Deardorff, Lecture 14: Pegging 68

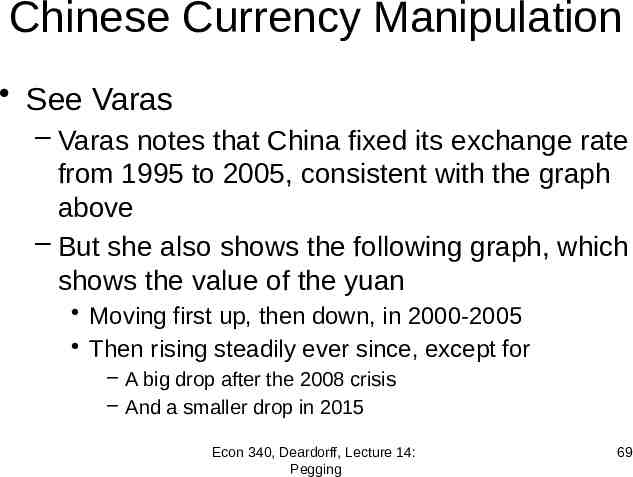

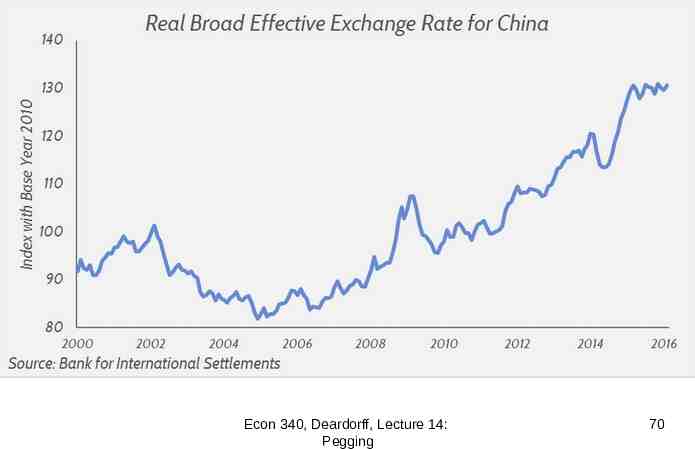

Chinese Currency Manipulation See Varas – Varas notes that China fixed its exchange rate from 1995 to 2005, consistent with the graph above – But she also shows the following graph, which shows the value of the yuan Moving first up, then down, in 2000-2005 Then rising steadily ever since, except for – A big drop after the 2008 crisis – And a smaller drop in 2015 Econ 340, Deardorff, Lecture 14: Pegging 69

Econ 340, Deardorff, Lecture 14: Pegging 70

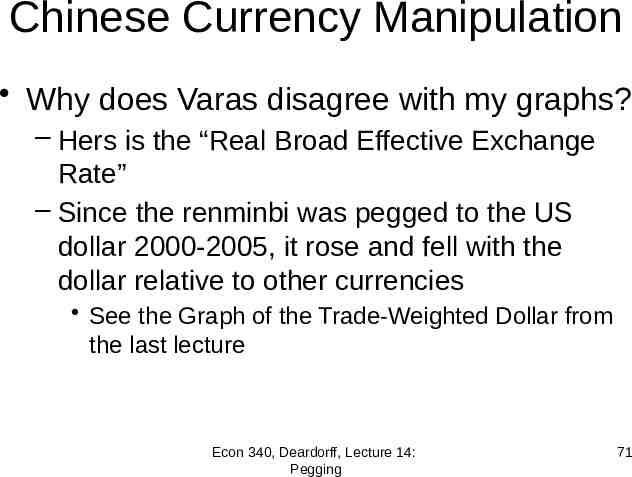

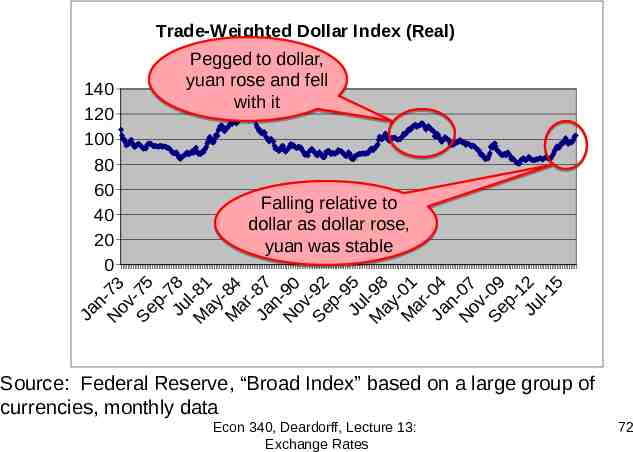

Chinese Currency Manipulation Why does Varas disagree with my graphs? – Hers is the “Real Broad Effective Exchange Rate” – Since the renminbi was pegged to the US dollar 2000-2005, it rose and fell with the dollar relative to other currencies See the Graph of the Trade-Weighted Dollar from the last lecture Econ 340, Deardorff, Lecture 14: Pegging 71

Trade-Weighted Dollar Index (Real) Pegged to dollar, yuan rose and fell with it 140 120 100 80 60 Falling relative to 40 dollar as dollar rose, 20 yuan was stable 0 73 -75 -78 l-81 -84 r-87 -90 -92 -95 l-98 -01 r-04 -07 -09 -12 l-15 n v p u y a n v p u y a n v p u Ja No Se J Ma M Ja No Se J Ma M Ja No Se J Source: Federal Reserve, “Broad Index” based on a large group of currencies, monthly data Econ 340, Deardorff, Lecture 13: Exchange Rates 72

Chinese Currency Manipulation Conclusion from both Varas and these graphs: – China did manage its exchange rate and limited its appreciation until fairly recently – During 2014-16, however, China acted to raise its currency’s value, not to lower it – And since 2016, it has hardly intervened at all – It has not, throughout this time span, ever acted deliberately to depreciate the yuan – Therefore China has not been a currency manipulator More on this in a week. Econ 340, Deardorff, Lecture 14: Pegging 73

Clicker Question How do we conclude that China was not manipulating its currency during 2015-16 to give an advantage to its exports? a) Its international reserves were falling b) c) d) e) Its international reserves were rising Its currency value was falling Its currency value was rising Such manipulation is not possible

Next Time International Macroeconomics – Macro Effects ON the Exchange Market – Macro Effects OF the Exchange Market – Macro Effects THROUGH the Exchange Market Econ 340, Deardorff, Lecture 14: Pegging 75