Commitment to Servicing Higher Education March 2013 Wendy Burleson,

16 Slides3.25 MB

Commitment to Servicing Higher Education March 2013 Wendy Burleson, Account Executive

Today’s Agenda Landscape: Education Today’s Challenges: Costs PCI Compliance Hosted Solutions About Chase Paymentech Q&A 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 2

What is on your mind today? SURCHARGING? REDUCE MY COSTS! KEEPING UP WITH PCI COMPLIANCE IMPROVING STUDENT EXPERIENCE PROCESSOR SERVICE

Convenience Fees and Surcharging are different The current Tax Payment Program has been renamed the Government and Higher Education Payment Program. Colleges may now charge a convenience fee on Visa Transactions to cover the cost of acceptance. Some of the requirements include: Registrations with Visa and your merchant acquirer Convenience fee transactions must be submitted and processed as two separate transactions. The service fee must be disclosed to the cardholder as a fee assessed by the merchant or third party The service must be clearly disclosed to the cardholder in advance of the payment. The variable service fee applies to both card present and card not present environments Only applicable to tuition and fees. (Not cafeteria, foundation etc) Surcharging is different than Convenience fees. Numerous rules apply. See www.visa.com/merchantsurcharging for more information 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 4

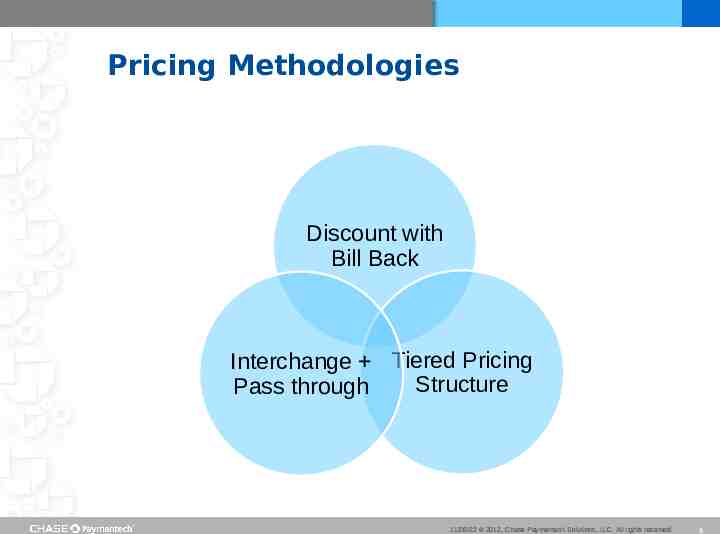

Pricing Methodologies Discount with Bill Back Interchange Tiered Pricing Structure Pass through 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 5

PCI Compliance Chase Paymentech is fully PCI Compliant Hosted Solutions Certified Third Parties Merchant Compliance No non-receipt of PCI validation charges SAQ is between your college and the payment brands (i.e. Chase does not automatically require a copy) Network scans are recommended but not required by Chase Paymentech Best Practices Verify compliance of point-of-sale software providers and your specific version Examine your hardware regularly Review your business practices Visit www.pcisecuritystandards.org 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 6

How We Help Our Clients Bulletproof Technology Automate and reduce cost of payments Speed cash flow/revenue cycle Billing reconciliation improvement through reporting Robust Products Improve Customer service Streamline technology and eliminate unnecessary providers Reduce outstanding receivables implementing reoccurring payments best practices Deep Expertise Innovation Reduce PCI compliance scope/cost of compliance through Chase Paymentech hosted solutions Process 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 7

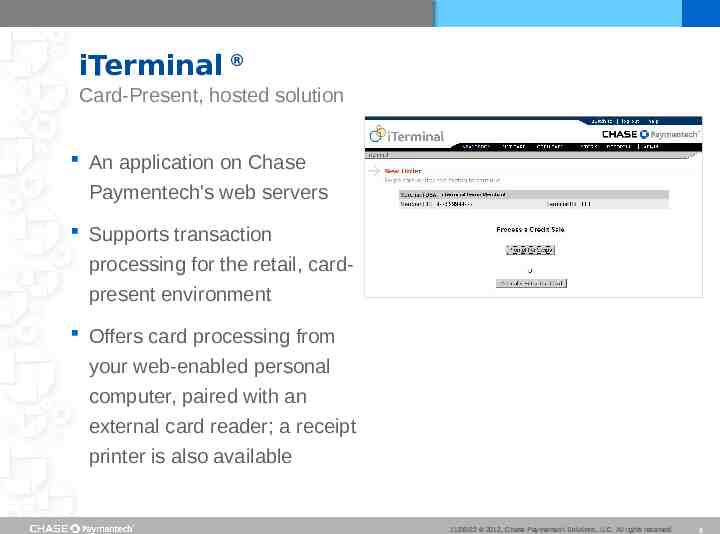

iTerminal Card-Present, hosted solution An application on Chase Paymentech's web servers Supports transaction processing for the retail, cardpresent environment Offers card processing from your web-enabled personal computer, paired with an external card reader; a receipt printer is also available 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 8

iTerminal How can I control my account? Your iTerminal account may have multiple user logons. You have the flexibility to designate each user’s level of access. Control permissions and track users’ transaction history by assigning one of these three access levels: Manager Full Access: No security restrictions and full rights to all features without having to enter access codes Administrator Read-Only Access: Read-only rights to iTerminal screens and report generation Store Regular Access: User must enter correct access codes where enabled 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 9

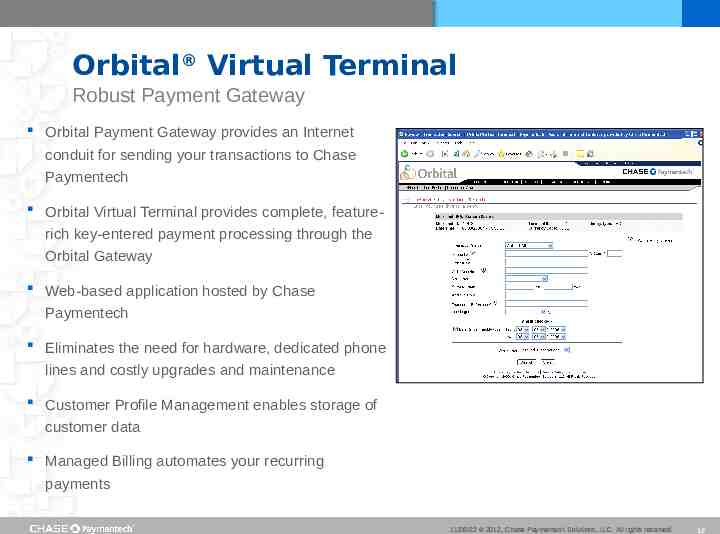

Orbital Virtual Terminal Robust Payment Gateway Orbital Payment Gateway provides an Internet conduit for sending your transactions to Chase Paymentech Orbital Virtual Terminal provides complete, featurerich key-entered payment processing through the Orbital Gateway Web-based application hosted by Chase Paymentech Eliminates the need for hardware, dedicated phone lines and costly upgrades and maintenance Customer Profile Management enables storage of customer data Managed Billing automates your recurring payments 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 10

Hosted Pay Page Your brand presented your way Orbital Hosted Pay Page clones your payment page so you maintain complete control of the customer checkout experience No static templates to update No need to use a Chase Paymentech-branded payment page You can change your payment page elements at any time and Hosted Pay Page will capture the changes in real time You’re in control of your brand on the payment page at all times 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 11

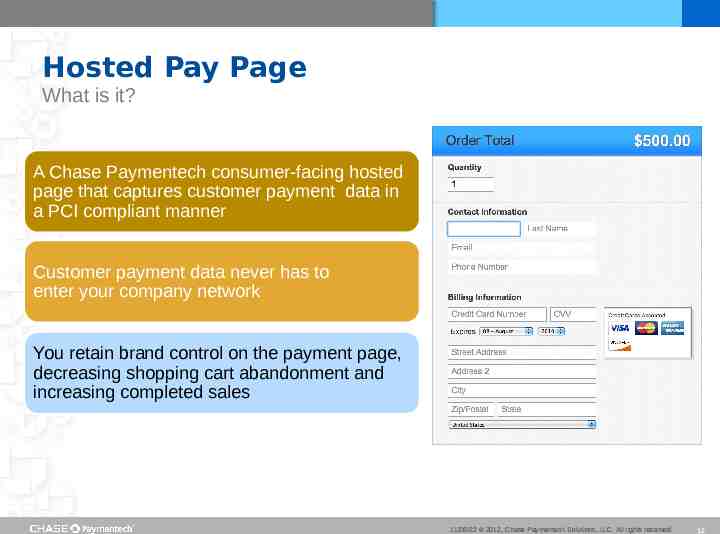

Hosted Pay Page What is it? A Chase Paymentech consumer-facing hosted page that captures customer payment data in a PCI compliant manner Customer payment data never has to enter your company network You retain brand control on the payment page, decreasing shopping cart abandonment and increasing completed sales 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 12

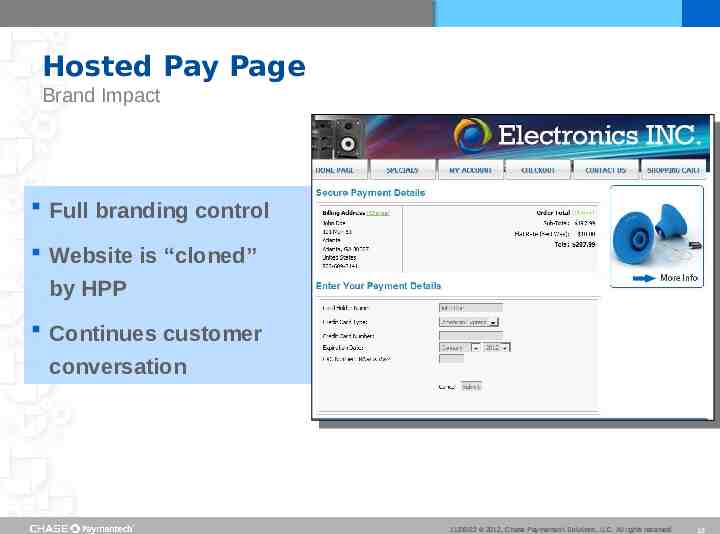

Hosted Pay Page Brand Impact Full branding control Website is “cloned” by HPP Continues customer conversation 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 13

Internet Reporting Resource Online (ROL) Get your financial data straight from the source Resource Online (ROL) is Chase Paymentech’s proprietary suite of innovative web-based tools that enables you to quickly and easily access all of your payment processing data. With a few simple clicks of a mouse, you have round-the-clock answers to your payment processing questions. 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 14

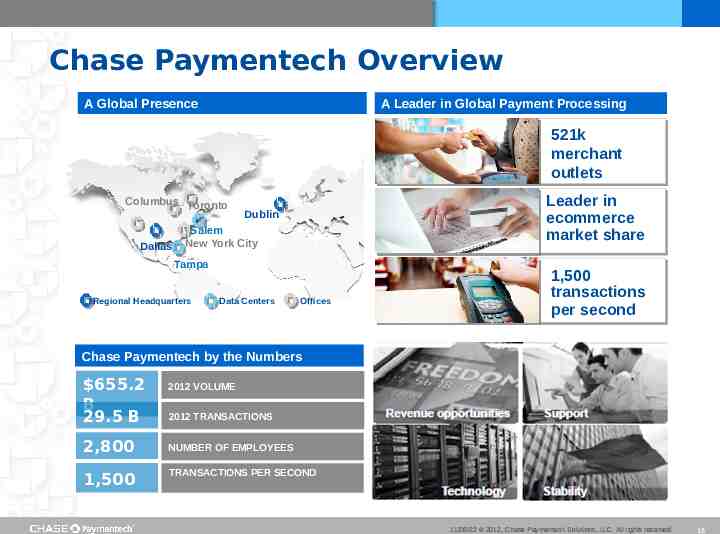

Chase Paymentech Overview A Global Presence A Leader in Global Payment Processing 521k merchant outlets Columbus Toronto Dallas Leader Leader in in ecommerce ecommerce market market share share Dublin Salem New York City Tampa Regional Headquarters Data Centers Offices 1,500 transactions per second Chase Paymentech by the Numbers 655.2 B 29.5 B 2,800 1,500 2012 VOLUME 2012 TRANSACTIONS NUMBER OF EMPLOYEES TRANSACTIONS PER SECOND 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 15

Questions? Wendy Burleson 517-586-0292 [email protected] 11/26/22 2012, Chase Paymentech Solutions, LLC. All rights reserved. 16