BUDGET WORK SESSION FISCAL YEAR 2017 City of Mustang

34 Slides2.48 MB

BUDGET WORK SESSION FISCAL YEAR 2017 City of Mustang

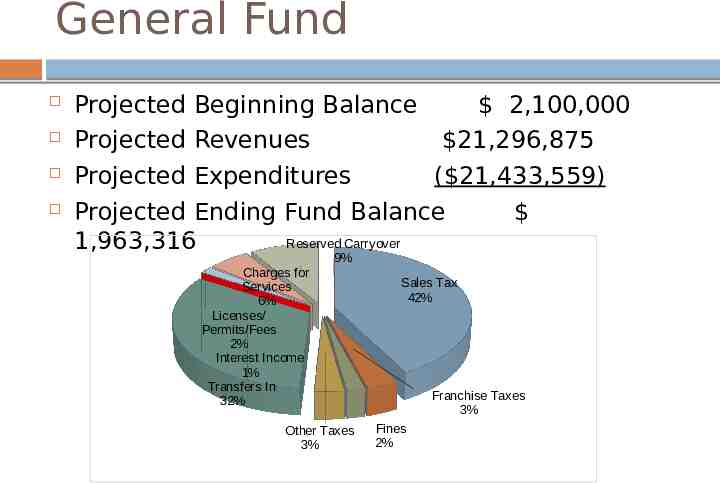

General Fund Projected Beginning Balance 2,100,000 Projected Revenues 21,296,875 Projected Expenditures ( 21,433,559) Projected Ending Fund Balance Reserved Carryover 1,963,316 Charges for Services 6% Licenses/ Permits/Fees 2% Interest Income 1% Transfers In 32% 9% Other Taxes 3% Sales Tax 42% Franchise Taxes 3% Fines 2%

General Fund – Revenue The General Fund is the City’s primary operating fund and the source of day-to-day operations. The General Fund is significantly reliant on sales tax revenues for operations. Staff has projected sales tax revenue to remain flat due to the current downturn in the economy facing all Oklahoma municipalities. The City of Mustang has been very fortunate over the last year as general revenues have remained flat. Sales and use tax are both running alongside with last year's receipts

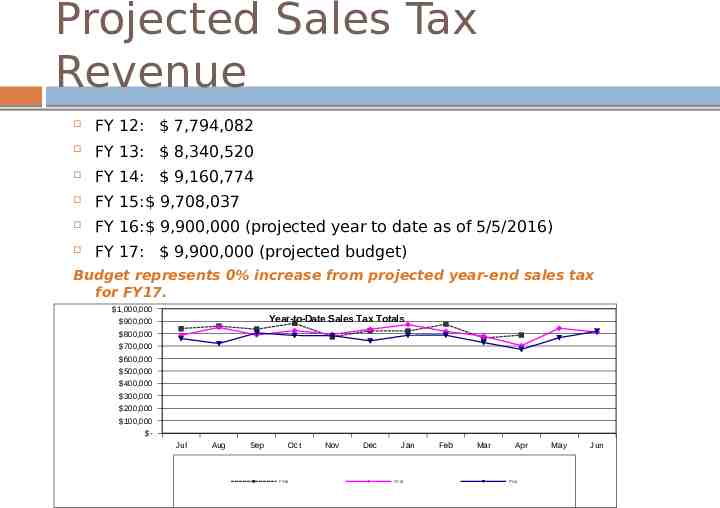

Projected Sales Tax Revenue FY 12: 7,794,082 FY 13: 8,340,520 FY 14: 9,160,774 FY 15: 9,708,037 FY 16: 9,900,000 (projected year to date as of 5/5/2016) FY 17: 9,900,000 (projected budget) Budget represents 0% increase from projected year-end sales tax for FY17. 1,000,000 Year-to-Date Sales Tax Totals 900,000 800,000 700,000 600,000 500,000 400,000 300,000 200,000 100,000 Jul Aug Sep Oct FY16 Nov Dec Jan FY15 Feb Mar Apr FY14 May Jun

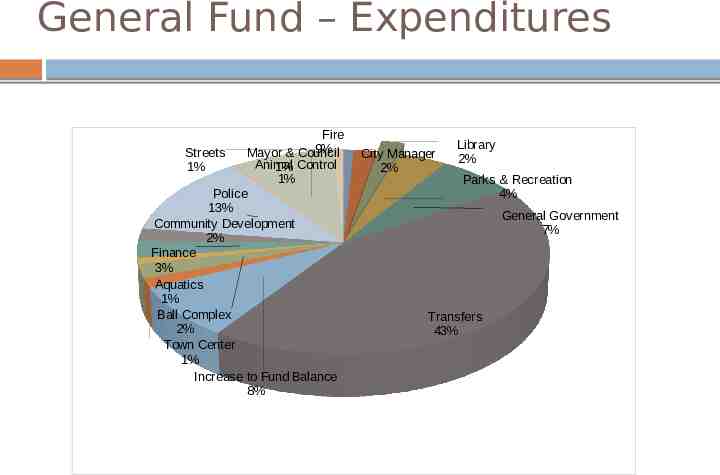

General Fund – Expenditures Fire 9% Streets Mayor & Council Animal 1% 1% Control 1% Police 13% Community Development 2% Finance 3% Aquatics 1% Ball Complex 2% Town Center 1% Increase to Fund Balance 8% City Manager 2% Library 2% Parks & Recreation 4% General Government 7% Transfers 43%

General Fund – Expenditure Changes Financing the City’s operations. Strategies were implemented to reduce operational department budgets by 5%. No change - Oklahoma Municipal Retirement Fund (11.79%), Police (13%), and Fire (14%). Recommended transfer to Risk Management Fund from 75,000 to 100,000 to cover annual excess workers compensation coverage . Shared costs with the MIA. The budget does not include merit increases for all employees. The FY 2016-17 budget includes job reclassifications for two positions in the

General Fund – Expenditure Changes Premium Healthcare Rate Increase of 7.5% Budget includes a plan premium rate increase of 7.5% in costs associated with employee health care. The national average is between 9-19%. Once again, this is the beneficial result of joining the Oklahoma Public Employees Health and Welfare Consortium. When it comes to dental health, staff has chosen OPEH&W for its plan. This package has the best balance of value and coverage with a cost savings of 10,800 to the City.

General Fund Reserve The General Reserve Fund was established by Resolution 06-017. Original funding was deposited from other funds for maintenance of city facilities, infrastructure, and other capital purchases. Ordinance No. 1105 was approved on July 15, 2015 to levy a tax of (5%) on the rental of hotel and motel rooms within the city limits. All taxes collected shall be deposited into the City’s General Fund. The City Council shall determine on a yearly basis the use of the room tax funds. Projected Projected Projected Projected 16,100 Beginning Balance 9,000 Revenues 7,100 Expenditures ( 0) Ending Fund Balance

Impound Fee Fund The Impound Fee Fund was established by Ordinance No. 1102 on May 2, 2014 amending impoundment of vehicles. An impound fee of 100 by the person to whom the release is issued to cover towing service for the impoundment and storage. Projected 20,000 Projected Projected Projected 22,600 Beginning Balance Revenues 30,100 Expenditures ( 27,500) Ending Fund Balance

Park Improvement Fund The Park Improvement Fund is used to account for the revenue received from business licenses ( 15 per license) required by ordinance; court costs assessed for parks; and park fees from subdivisions. Funds are restricted for improvements to and Projected Beginning Balance 39,000 Projected Revenues 66,200 Projected Expenditures ( 105,200) Projected Ending Fund Balance 0

Park Improvement Fund Accessible Playground 50,000 Park Signage (3) 10,650 Bleacher Covers for Baseball Complex (11) 44,550 TOTAL 105,200

Alcohol Enforcement Fund The Alcohol Enforcement Fund is used to account for fines and fees generated as a result of intoxicating substances and traffic related offenses. Ordinance #1087 established the fund. Projected 6,150 Projected Projected Projected 0 Beginning Balance Revenues 8,600 Expenditures ( 14,750) Ending Fund Balance

Library Fund The Library Fund is used to account for restricted state grant agreements and fines generated as a result of overdue library materials. Funds are used for library operations, local programs, and capital purchases. Projected 0 Projected Projected Projected Beginning Balance Revenues 11,775 Expenditures (11,775) Ending Fund Balance 0

Traffic Enforcement Fund The Traffic Enforcement Fund is used to account for fines and fees restricted for capital and training expenses related to traffic enforcement. Ordinance #920 established legislative restriction. Projected 8,000 Projected Projected Projected 6,200 Beginning Balance Revenues 14,100 Expenditures (15,900) Ending Fund Balance

2012 GO Bonds – Baseball Complex Fund The City issued 1,550,000 General Obligation Bonds, Series 2012, dated June 1, 2012 to provide financing for the construction of a baseball complex. Proceeds must be used for new baseball complex purpose only. Projected 39 Projected Projected Projected 0 Beginning Balance Revenues Expenditures ( Ending Fund Balance 1 40)

Employee Flex Spending Fund The City offers its employees a Flexible Spending Program, which is allowable under Internal Revenue Code, Section 125. The program allows employees to deposit a portion of their pre-tax income into the account maintained for health care expenditures. Projected 3,700 Projected Projected Projected 3,300 Beginning Balance Revenues 3,300 Expenditures ( 3,700) Ending Fund Balance

Park & Recreation Donation Fund The Donation Fund is used to account for specified donations that are restricted for the use of park and recreational events/project s. Projected 5,000 Projected Projected Projected 5,000 Beginning Balance Revenues Expenditures ( Ending Fund Balance 0 0)

2012 GO Bonds – Town Center Expansion The City issued 2,050,000 combined purpose General Obligation Bonds, Series 2012, dated June 1, 2012 for the purpose of expanding the Town Center Building-Library. Proceeds from the bonds provided financing for the construction of this project. Ad valorem revenue is collected to pay principal and interest on general obligation bonds within the Debt Service Fund. Projected 75,000 Projected Projected Projected 0 Beginning Balance Revenues 250 Expenditures ( 75,250) Ending Fund Balance

Street/Drainage Fund The Street/Drainage Improvement Fund is a special revenue fund used to account for the proceeds of specified revenue sources that are restricted or committed to expenditures for street projects and repair. Projected Beginning Balance 730,000 Projected Revenues 454,000 Projected Expenditures ( 228,500) Projected Ending Fund Balance 955,500

Debt Service Fund The City Debt Service Fund is used to account for ad valorem taxes levied by the city for use in retiring general obligation bonds, courtassessed judgments, and their related interest and fiscal agent fees. In State law, this fund is referred to as the Sinking Fund. Current obligations are the 2012 General Obligation Bond Projects (Ball Field and Town Center Expansion). Projected Projected 220,000 Projected Projected 233,950 Revenues 320,200 Beginning Balance Expenditures (306,250) Ending Fund Balance

Limited Purpose Fund The Limited Purpose Fund is a capital project fund used to purchase capital outlay, including the acquisition or construction of capital facilities, or other capital assets. The restricted 3rd penny sales tax collected (MIA) in excess of debt payments are set aside to the Limited Purpose Fund. Resolution 15-058 amended 05-027 to read ‘10% of sales tax revenue received in excess of 800,000 per month’. Projected 840,000 Projected Projected Projected 965,964 Beginning Balance Revenues 890,000 Expenditures (764,036) Ending Fund Balance

Limited Purpose Fund - Capital Outlay Spending Library – RFID (radio frequency identification ( 12,000); Parks and Recreation – accessible playground ( 50,000), hammer strength dumbbell set ( 5,194), two Wi-Fi connections ( 2,600), park video security system ( 20,000), sprinkler covers ( 2,000); General Government – Microsoft upgrade (15) police mobile terminals ( 4,151), Elite desk (14) new computers ( 14,886), upgrade Microsoft 2016 Standard (72 units) – ( 19,927), upgrade Microsoft 2016 Pro Plus (23 units) – ( 8,689); Town Center – two new HVA units ( 15,132), Christmas lighting ( 5,000), window tinting in Senior Center-game room ( 2,439), new switch for computer system ( 3,767), banquet kitchen warming oven ( 4,699), new carpet in facility ( 21,000), new tile in Senior Center ( 14,000); Ball Complex – field and bunker rake ( 16,000), three drop in ceiling ( 13,500), walk in refrigerator ( 18,194), five softball scoreboards ( 45,000) ; Aquatic Center – sound system ( 5,642), 162 lounge pool chairs ( 18,709); Community Development – Extended cab truck ( 32,050), comprehensive plan update ( 60,000); Police – New Vehicles ( 45,996), Prior Year Leases – Vehicles ( 107,111), diesel generator ( 70,905), RTU HVAC unit ( 39,445);

Limited Purpose Fund - Capital Outlay Spending CONT’D Fire – desktop computer ( 2,000) Street Division – directional signs in City ( 25,000), two welcome to Mustang signs ( 20,000), mower ( 24,000) Water Division – Resolution 05-027 infrastructure ( 15,000) Sub-total of Capital Requests ( 764,036) Reserves for fund balance ( 965,964) Total - 1,730,000

2014A Series Bond Fund The City pledged the 4th penny of future sales tax to repay of Series 2006 Revenue Bonds. The sales tax is legally restricted by a vote of the citizens and cannot be spent on any other items. Proceeds from the notes provided financing for community facilities in 1999. Debt service payments are received and paid within this fund. Taxes collected in excess of the debt service payments are set aside for the early retirement of debt as serial bonds become due. On May 13, 2014 the 2014A Notes refinanced the Series 2006 Revenue Bonds for the purpose of reducing maturity years by 3.33 years, note amount of 7,740,000, interest rate reduced from 5.0% to 2.1%. Projected Beginning Balance 680,000 Projected Revenues 2,478,600 Projected Expenditures (2,243,925) Projected Ending Fund Balance 914,675

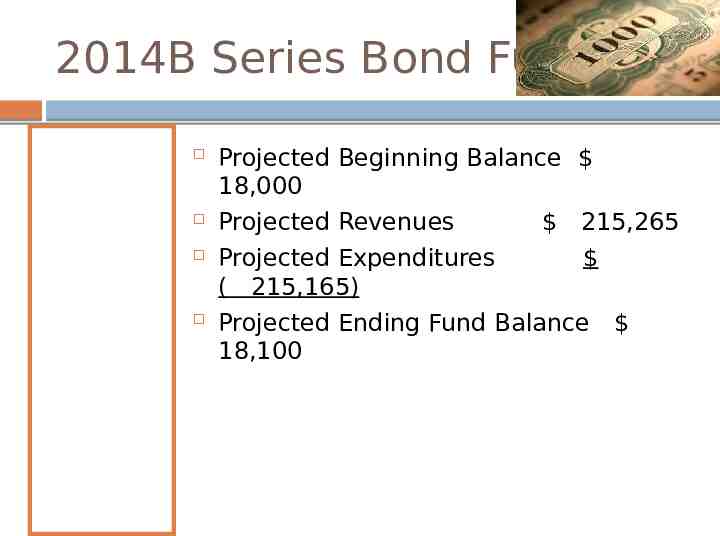

2014B Series Bond Fund In December 2014, the City issued the Series 2014B and pledged the net utility revenues and four cents of sales tax. Interest payments started June 1, 2015 within the MIA fund. Payments will be received and paid within the 2014B Series Bond Fund for fiscal year 2017. Principal payments do not begin until June 2018 and the note is payable through June 2026. The 2014B note of 7,985,000, with an interest rate of 2.7% with Branch Banking and Trust Company (BB&T). Projected Beginning Balance 18,000 Projected Revenues 215,265 Projected Expenditures ( 215,165) Projected Ending Fund Balance 18,100

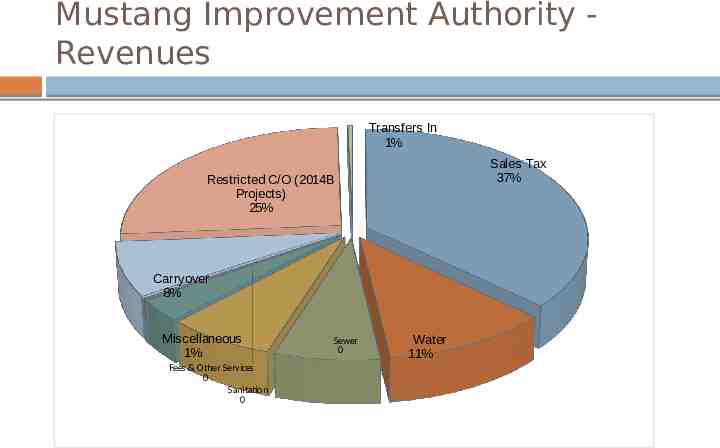

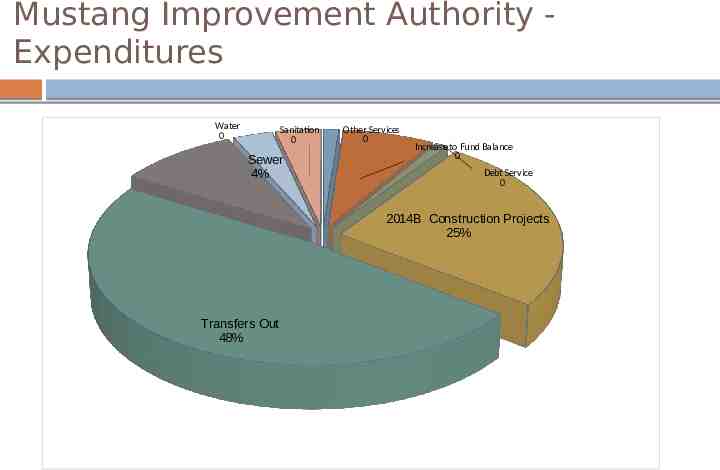

Mustang Improvement Authority The Mustang Improvement Authority (MIA) was created June 4, 1963 to finance, develop and operate the water, sewer and solid waste activities. These activities are financed primarily by user charges and similar to the private sector. This fund accounts for activities of the public trust in providing water, wastewater, sanitation, and recycling to the public. Projected Beginning Balance 2,150,000 2014B Restricted Carryover 6,942,020 Projected Revenues Projected Expenditures 2014B Construction Projects ( 6,942,020) Projected Ending Fund Balance 1,972,005 17,754,020 (17,932,015)

Mustang Improvement Authority Revenues Transfers In 1% Sales Tax 37% Restricted C/O (2014B Projects) 25% Carryover 8% Miscellaneous 1% Fees & Other Services 0 Sanitation 0 Sewer 0 Water 11%

Mustang Improvement Authority Expenditures Water 0 Sanitation 0 Sewer 4% Other Services 0 Increase to Fund Balance 0 Debt Service 0 2014B Construction Projects 25% Transfers Out 48%

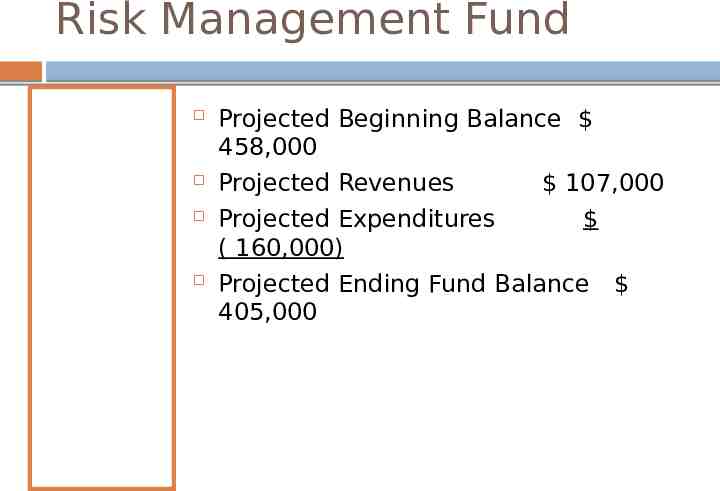

Risk Management Fund The Internal Service Fund (Worker’s Compensation Fund) is used to account for self-insured worker’s compensation claims. Projected Beginning Balance 458,000 Projected Revenues 107,000 Projected Expenditures ( 160,000) Projected Ending Fund Balance 405,000

MIA Reserve Fund The MIA Reserve fund is used for maintenance, infrastructure, and capital purchases for the enterprise funds. On an annual basis 33 1/3% of the connection fees will be appropriated for operating and maintaining utility systems, and 66 2/3% of connection fees for expanding and upgrading water and sewer utilities. Ordinance 1106 added 4.50 per month for each utility account for capital improvements to water and wastewater facility and line maintenance and construction. Projected 405,000 Projected Projected 0) Projected 793,700 Beginning Balance Revenues Expenditures 388,700 ( Ending Fund Balance

MIA Reserve Fund The MIA Reserve Fund projected of 405,000 for fiscal year 2016. - CONT’D Current Fiscal Year 2016 Projects: 181,493 59th Street Water Line Relocation Replace Well #1 Pump/Motor Completion of Meadow Lane Sewer Rehabilitation Project Repaired Well #3 Pump, Meter, & Install Rebuilt Discharge Pumps #1, #2, and #3 (WWTP)

Sewer Impact Fund The Sewer Infrastructure Impact Fund is used to account for fees established per house top to developers. Funds are used to pay the Series 2009 Clean Water SRF Note to OWRB dated June 8, 2009 and future indebtedness. Projected Beginning Balance 525,000 Projected Revenues 92,000 Projected Expenditures (100,000) Projected Ending Fund Balance 517,000

2013 Refinancing (1998A B) Fund The City has pledged future net water and sewer revenues and one cent sales tax to repay the 1998 Revenue Bonds Payable. Proceeds from the bonds provided financing for utility system capital assets. The bonds were defeased in April 2013, funded by the issuance of a refunding private placement note, with the pledged revenues assumed by note holder. Projected Beginning Balance 110,000 Projected Revenues 1,130,100 Projected Expenditures (1,126,000) Projected Ending Fund Balance 114,100

Depository Fund Title 11 O.S., 35-107 & 17-101 deposits for utility service shall be refunded or credited to the customer upon termination of service. Refund checks to be issued within 30 days following termination of service. No interest is required to be paid to customer. Interest earnings transferred to the Mustang Improvement Authority at year-end. Projected Beginning Balance 3,000 Projected Revenues 120 Projected Expenditures ( 3,000) Projected Ending Fund Balance 120