Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316

97 Slides3.91 MB

Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Systems Development and Documentation Techniques Acct 316 Chapter Acct 316 6 UAA – ACCT 316 – Fall 2003 Accounting Information Systems Dr. Fred Barbee

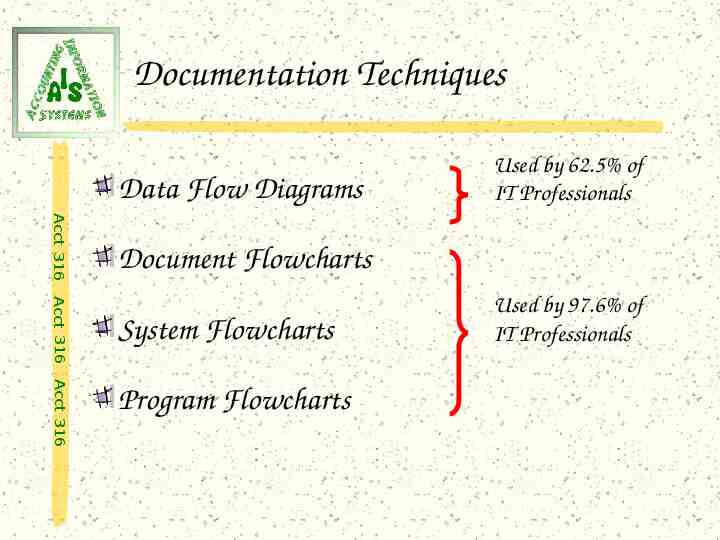

Documentation Techniques Data Flow Diagrams Used by 62.5% of IT Professionals Acct 316 Document Flowcharts Acct 316 System Flowcharts Acct 316 Program Flowcharts Used by 97.6% of IT Professionals

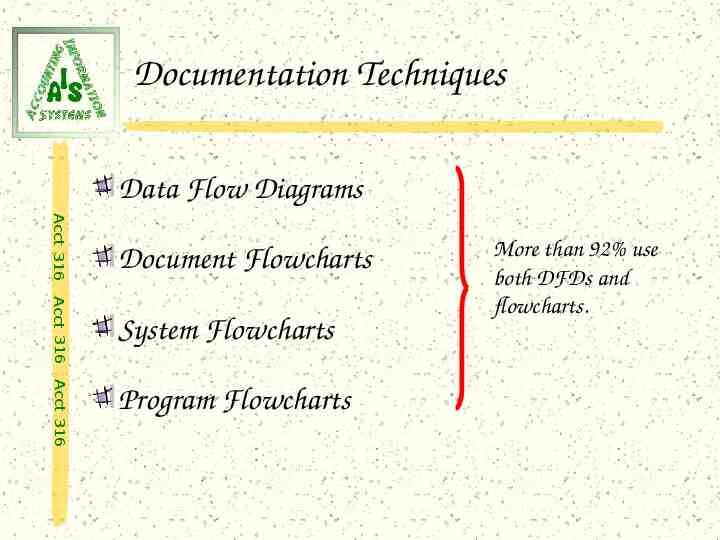

Documentation Techniques Data Flow Diagrams Acct 316 Document Flowcharts Acct 316 System Flowcharts Acct 316 Program Flowcharts More than 92% use both DFDs and flowcharts.

Typical Information System Computer-based; Acct 316 Acct 316 Has a number of terminals connected to it via telecommunications links; Acct 316 Is used by dozens of people within and outside the organization;

Typical Information System Acct 316 Has hundreds of programs that perform functions for virtually every department in the organization. Acct 316 Processes thousands of transactions and hundreds of requests for management information. Acct 316

For such a system . . . We need “pictures” Source Document Co m put e r - Ba s e d Ba t c h Pr o c e s s ing o f T r a ns a c t io ns Acct 316 rather than a narrative description Compute Batch Total Source Document Master Files (Sub Ledgers) Batch Total Convert to Mag. Tape Trans Data Edit & Sort Sorted Data Summary of data Update Files Source Document Acct 316 To Next Slide Acct 316 to “see” and analyze all the inputs and outputs.

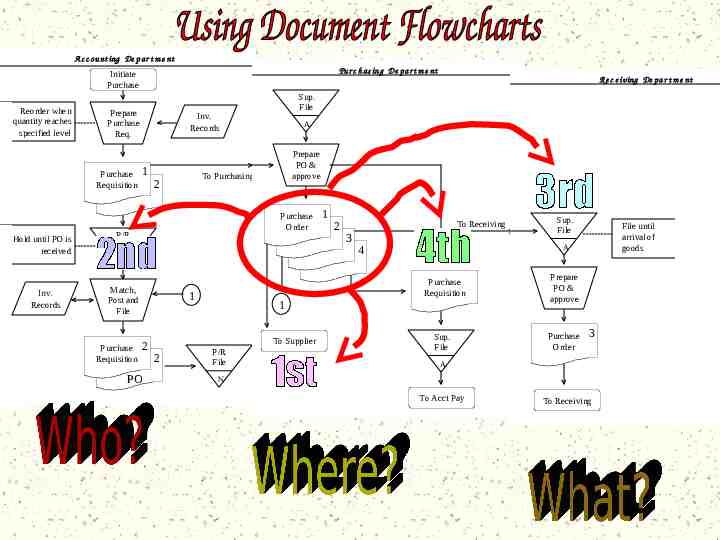

A c c ou nt ing De p ar t m e nt Pu r c h as in g De pa r t m e nt Initiate Purchase Reorder when quantity reaches specified level Prepare Purchase Req. Purchase Requisition Hold until PO is received Sup. File Inv. Records 1 A Prepare PO & approve To Purchasing 2 Purchase Order P/R File Re c e iving De pa r t m e nt 1 2 To Receiving 3 Sup. File File until arrival of goods A 4 C Inv. Records Match, Post and File Purchase Requisition 1 2 PO Prepare PO & approve Sup. File Purchase Order 1 To Supplier 2 Purchase Requisition P/R File 3 A N To Acct Pay To Receiving N

Documentation Techniques Acct 316 Acct 316 . . . are tools used in analyzing, designing, and documenting system and subsystem relationships . . . Acct 316

Documentation Techniques They are largely graphical in nature; Acct 316 Acct 316 Are essential to both internal and external auditors; and Acct 316 Are indispensable in the development of information systems.

Acct 316 Acct 316 Acct 316 Auditors Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316

Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Systems Development Acct 316 Acct 316 Acct 316 Acct 316

Acct 316 Acct 316 Acct 316 Acct 316 Management Acct 316 Acct 316 Acct 316 Acct 316 Acct 316

Acct 316 Acct 316 Acct 316 Other Users Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316

Acct 316 Acct 316 Acct 316 You! Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316

Classification . . . Acct 316 Acct 316 Documentation is classified according to the level of the accounting system to which it relates. Acct 316

Typical System Documentation Acct 316 System narrative descriptions Block diagrams Acct 316 Document flowcharts Acct 316 Data flow diagrams

Overall System Documentation Acct 316 System Flowcharts Program Flowcharts; and Acct 316 Decision Flowcharts Acct 316

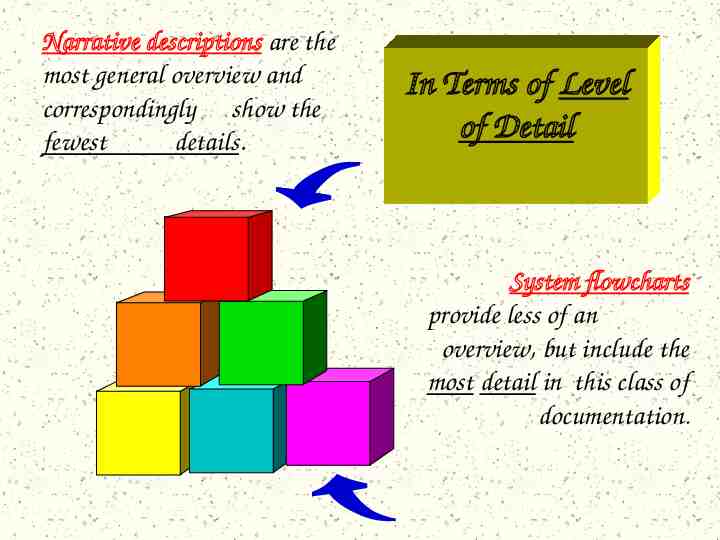

Narrative descriptions are the most general overview and correspondingly show the fewest details. In Terms of Level of Detail System flowcharts provide less of an overview, but include the most detail in this class of documentation.

Narrative Descriptions Acct 316 A written step-by-step explanation of system components and interactions. Acct 316 The highest and broadest form of documentation at the overall system level. Acct 316

Block Diagrams Acct 316 Block diagrams provide a graphic overview of a system. Acct 316 Acct 316 Commonly used to provide an overview of an accounting system in terms of its major components and subsystems

Block Diagrams Acct 316 They help people understand a system without getting bogged down in details. Acct 316 Two types: Acct 316 Horizontal Block Diagram; and Hierarchical Block Diagram

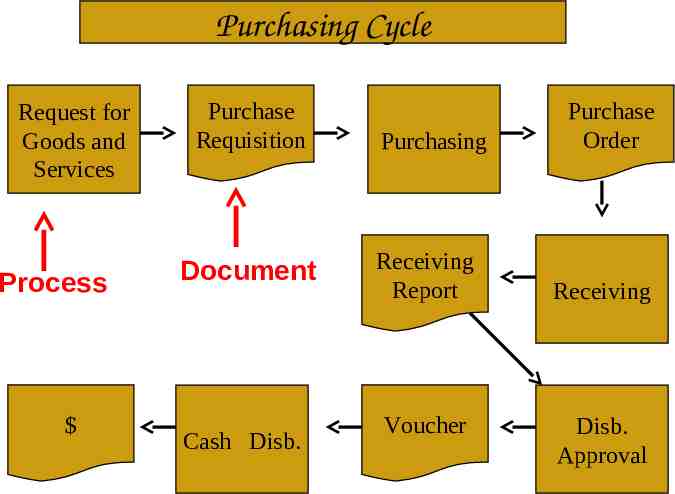

Purchasing Cycle Request for Goods and Services Process Purchase Requisition Document Cash Disb. Purchasing Receiving Report Voucher Purchase Order Receiving Disb. Approval

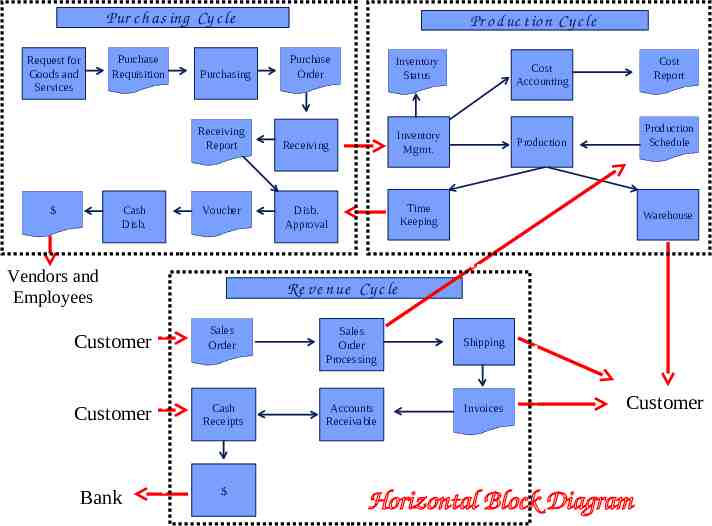

Pur c h as ing Cy c le Request for Goods and Services Purchase Requisition Purchasing Receiving Report Cash Disb. Voucher Vendors and Employees Pr o d uc t ion Cy c le Purchase Order Inventory Status Receiving Inventory Mgmt. Disb. Approval Time Keeping Production Schedule Production Warehouse Re ve nue Cy c le Customer Sales Order Sales Order Processing Customer Cash Receipts Accounts Receivable Bank Cost Report Cost Accounting Shipping Invoices Customer Horizontal Block Diagram

Hierarchical Block Diagrams Acct 316 Show the analysis of a system into successive levels of component subsystems. Acct 316 Connecting lines represent interlevel associations (parent-child relationships). Acct 316

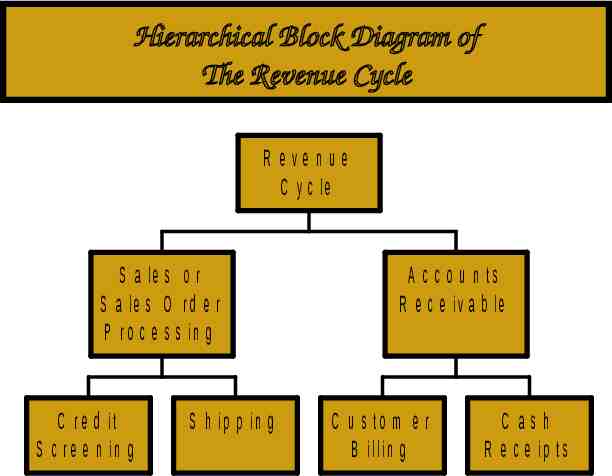

Hierarchical Block Diagram of The Revenue Cycle R even u e C y c le S a le s o r S a le s O r d e r P r o c e s s in g C r e d it S c r e e n in g S h ip p in g A c c o u n ts R e c e iv a b le C u s to m e r B illin g C ash R e c e ip t s

Data Flow Diagrams Bridge the gap between Acct 316 Acct 316 Broad documentation types . . . Acct 316 System Narratives Block Diagrams Document Flow charts Narrow documentation types . . . System Flow Charts

Data Flow Diagrams Provide . . . Acct 316 More detailed representation of an accounting system than block diagrams Acct 316 Fewer technical details than system flowcharts. Acct 316

Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Symbols For Data Flow Diagrams Acct 316 Acct 316 Figure 6-1 (p. 158)

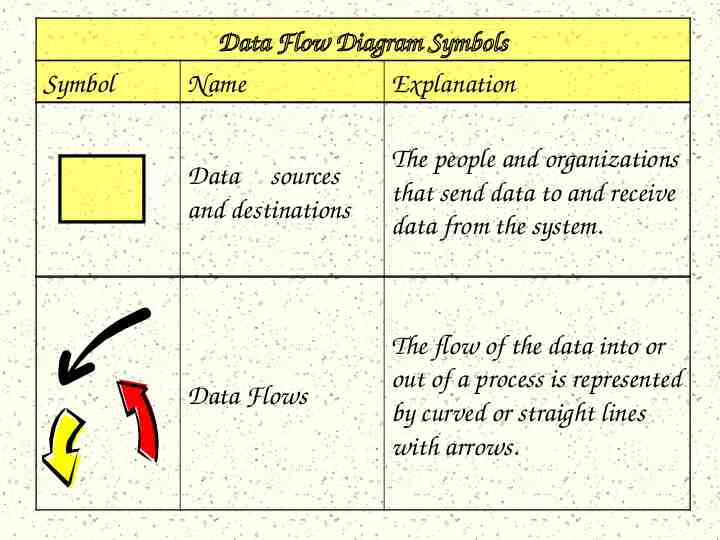

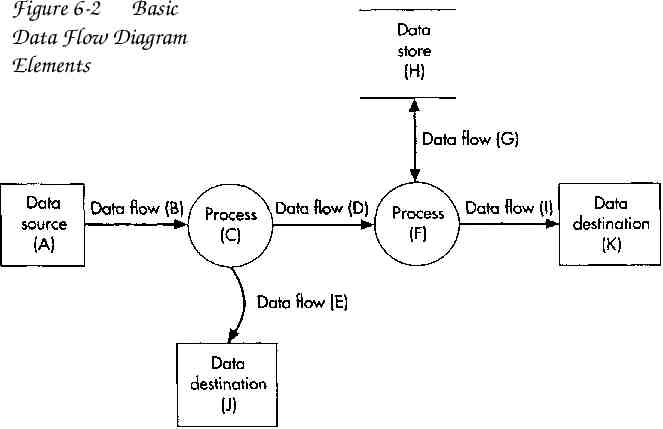

Symbol Data Flow Diagram Symbols Name Explanation Data sources and destinations The people and organizations that send data to and receive data from the system. Data Flows The flow of the data into or out of a process is represented by curved or straight lines with arrows.

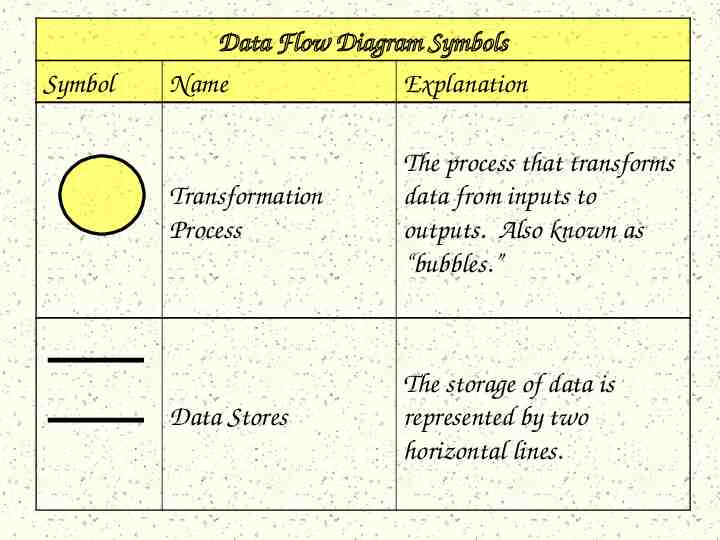

Symbol Data Flow Diagram Symbols Name Explanation Transformation Process The process that transforms data from inputs to outputs. Also known as “bubbles.” Data Stores The storage of data is represented by two horizontal lines.

Data Flow Diagrams Acct 316 The DFD should consist solely of DFD symbols; Acct 316 Each symbol in the DFD, including each pointed flowline, should be labeled; Acct 316

Data Flow Diagrams All names must be meaningful to the end-user. Acct 316 All symbols must have an individual name. Acct 316 Diagrams are always named at the top or bottom. Acct 316 The name should identify the level and the system it represents.

Figure 6-2 Basic Data Flow Diagram Elements

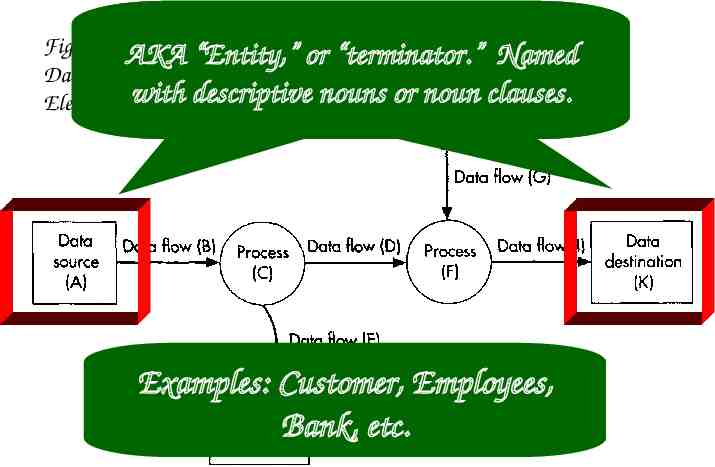

Figure 6-2AKA Basic “Entity,” or “terminator.” Named Data Flow Diagram Elements with descriptive nouns or noun clauses. Examples: Customer, Employees, Bank, etc.

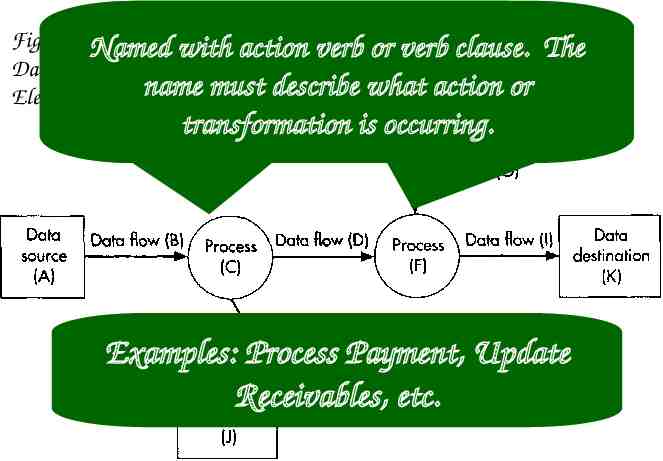

Figure 6-2Named Basicwith action verb or verb clause. Data Flow Diagram name must describe what action or Elements The transformation is occurring. Examples: Process Payment, Update Receivables, etc.

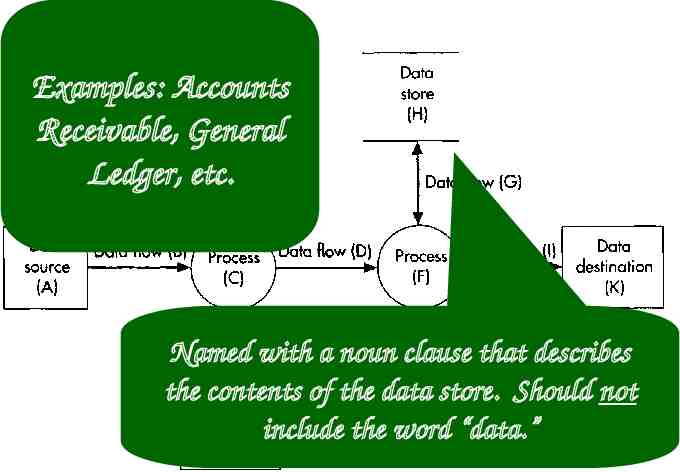

Figure 6-2 Basic Data Flow Diagram Examples: Accounts Elements Receivable, General Ledger, etc. Named with a noun clause that describes the contents of the data store. Should not include the word “data.”

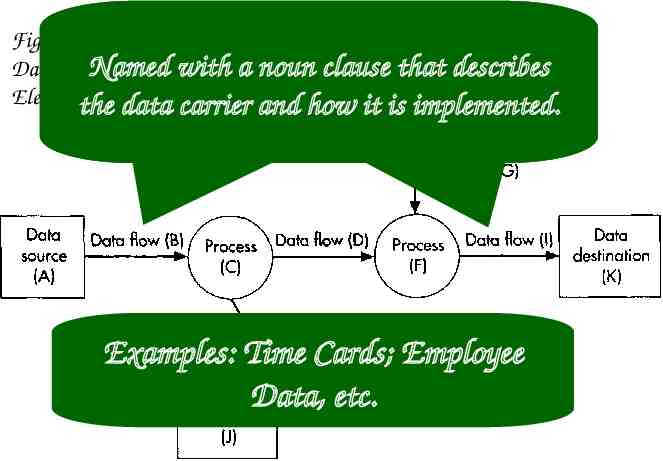

Figure 6-2 Basic Data Flow Diagram Named AKA “Entity,” with a noun or “terminator.” clause that describes Named Elementsthe with datadescriptive carrier andnouns how or it isnoun implemented. clauses. Examples: Time Cards; Employee Data, etc.

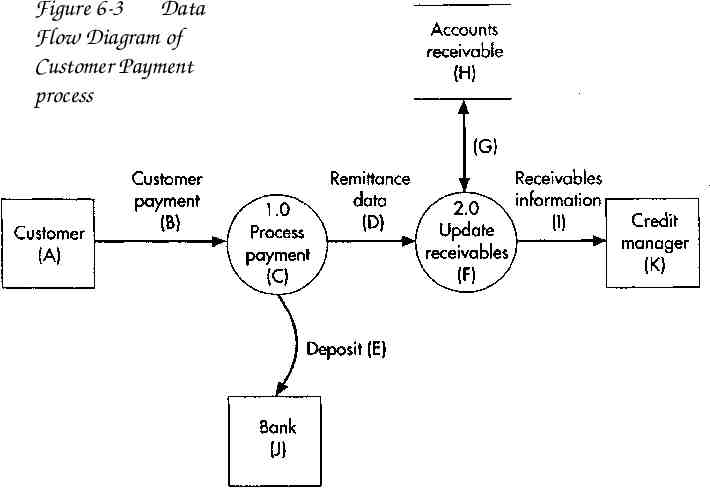

Figure 6-3 Data Flow Diagram of Customer Payment process

Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 DFDs – Some Do’s Don’ts Acct 316 Acct 316 and Acct 316 Acct 316 First – the Do’s

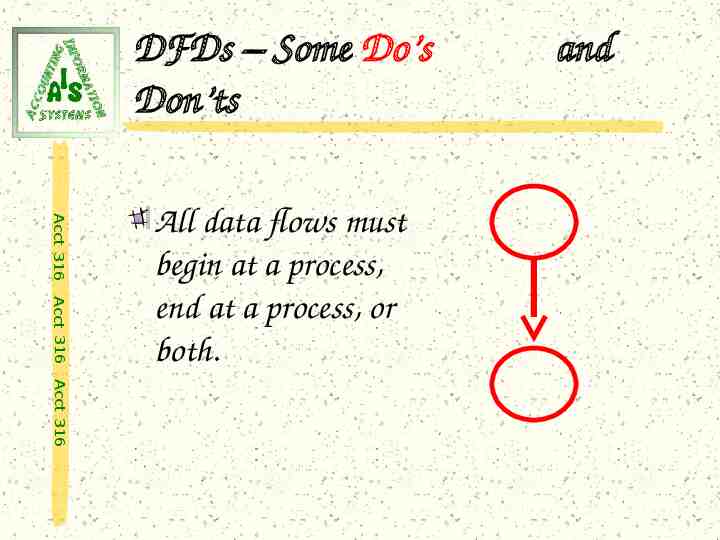

DFDs – Some Do’s Don’ts Acct 316 Acct 316 All data flows must begin at a process, end at a process, or both. and Acct 316

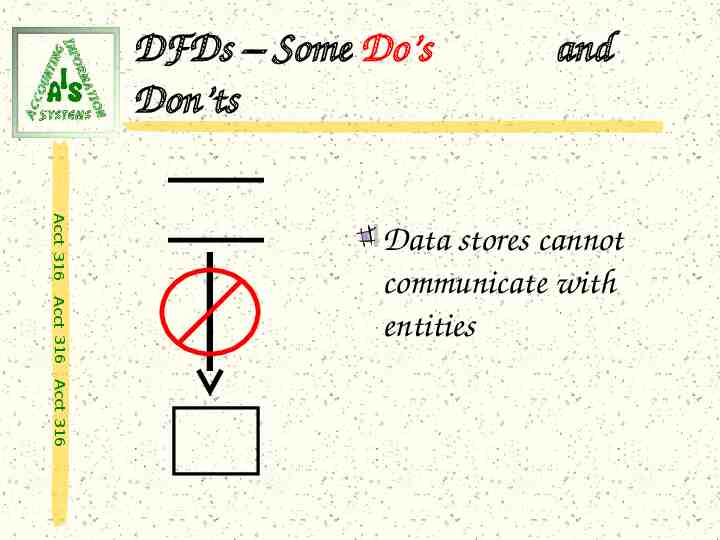

DFDs – Some Do’s Don’ts and Acct 316 Acct 316 Data stores cannot communicate with entities Acct 316

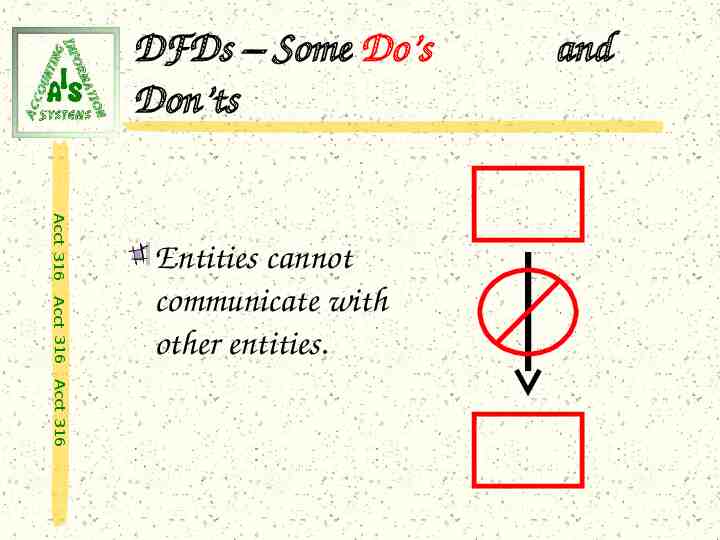

DFDs – Some Do’s Don’ts Acct 316 Acct 316 Entities cannot communicate with other entities. and Acct 316

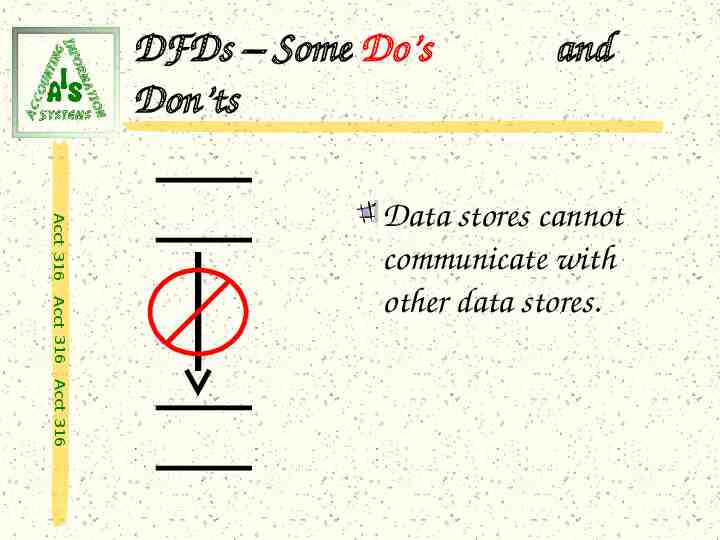

DFDs – Some Do’s Don’ts and Acct 316 Acct 316 Data stores cannot communicate with other data stores. Acct 316

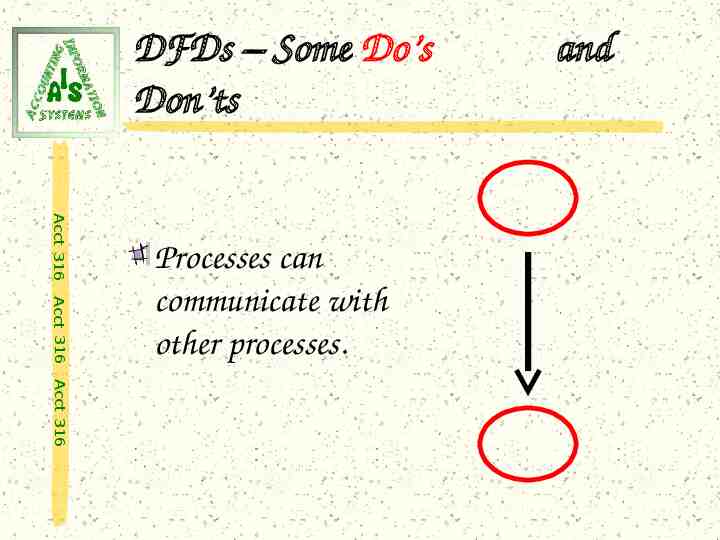

DFDs – Some Do’s Don’ts Acct 316 Acct 316 Processes can communicate with other processes. and Acct 316

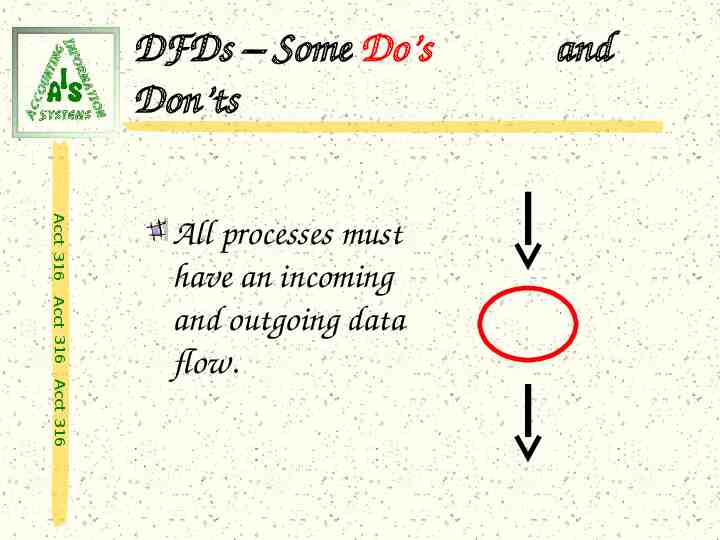

DFDs – Some Do’s Don’ts Acct 316 Acct 316 Acct 316 All processes must have an incoming and outgoing data flow. and

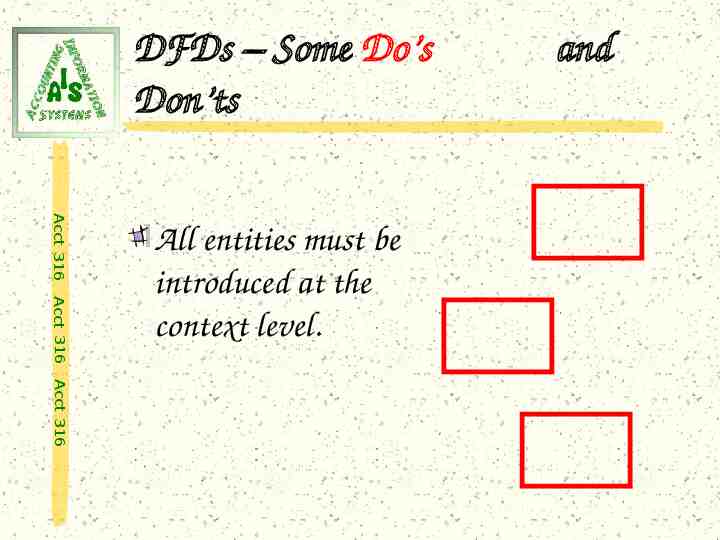

DFDs – Some Do’s Don’ts Acct 316 Acct 316 All entities must be introduced at the context level. and Acct 316

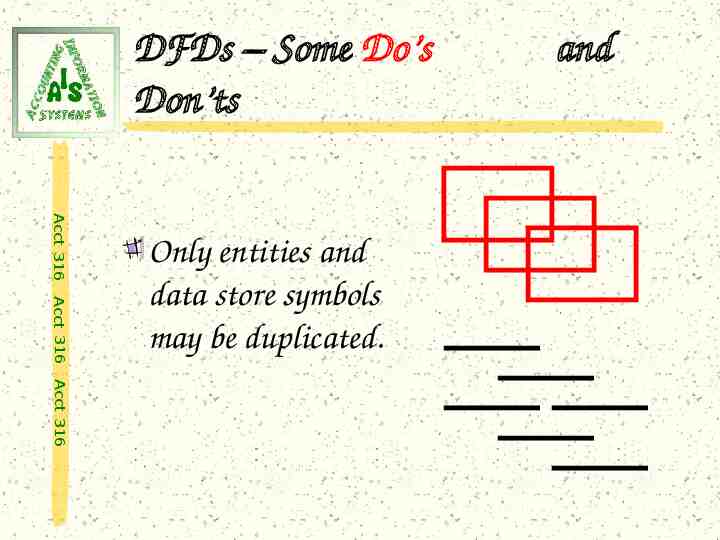

DFDs – Some Do’s Don’ts Acct 316 Acct 316 Only entities and data store symbols may be duplicated. and Acct 316

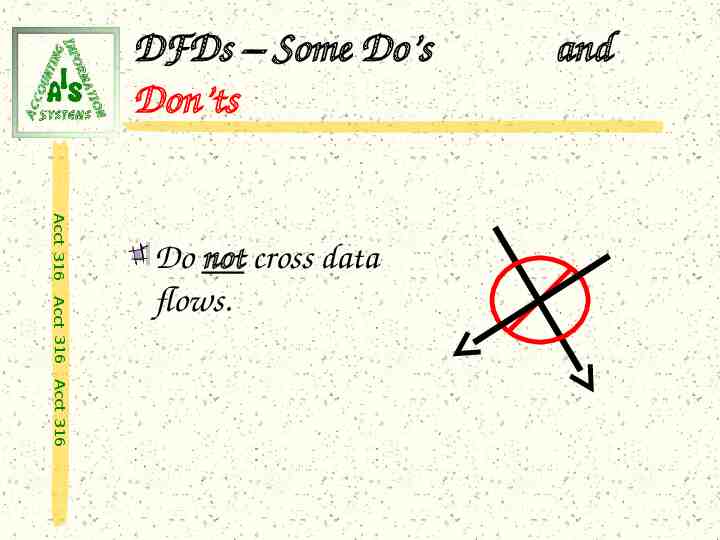

DFDs – Some Do’s Don’ts Acct 316 Acct 316 Do not cross data flows. and Acct 316

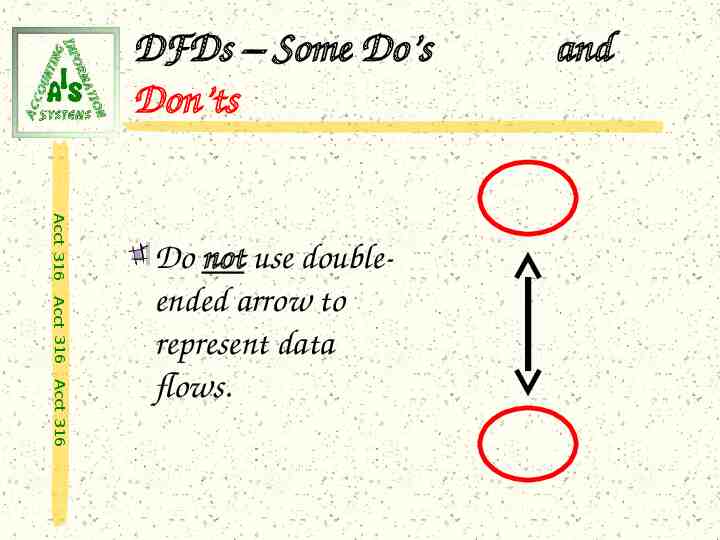

DFDs – Some Do’s Don’ts Acct 316 Acct 316 Acct 316 Do not use doubleended arrow to represent data flows. and

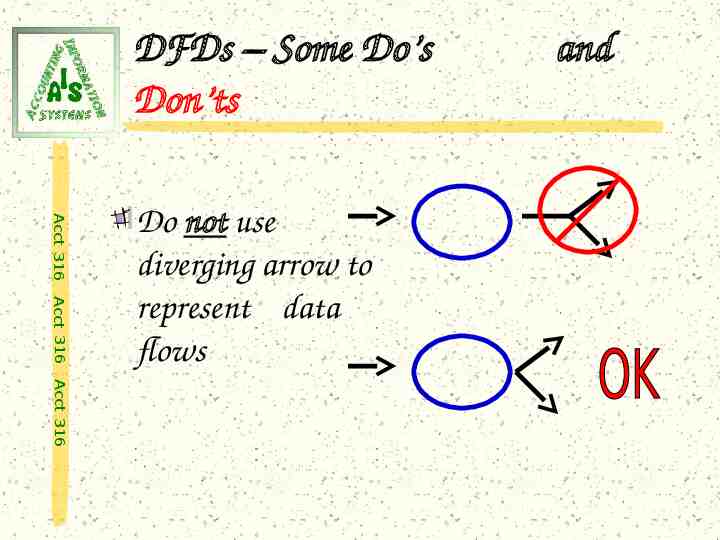

DFDs – Some Do’s Don’ts Acct 316 Acct 316 Do not use diverging arrow to represent data flows and Acct 316

DFDs – Some Do’s Don’ts Acct 316 Acct 316 Data stores do not appear on the context level diagram. and Acct 316

Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Data Flow Diagrams Acct 316 Acct 316 Some Helpful Hints

DFDs Some Helpful Hints Place entities on the outer edge of the paper. Acct 316 Place the processes toward the center Acct 316 Place data stores around the processes. Acct 316

DFDs Some Helpful Hints Acct 316 May need to move location of entities and data stores from level to level. Acct 316 Duplicate entities and data stores as needed to make drawing easier. Acct 316

Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Acct 316 Data Flow Diagrams are Constructed in Levels Acct 316 Acct 316

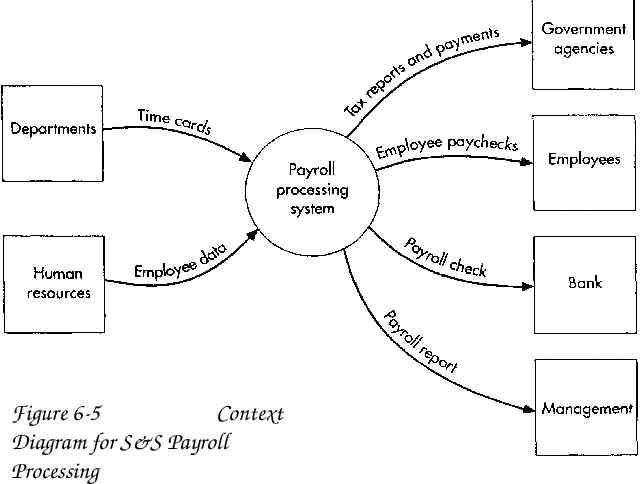

Figure 6-5 Context Diagram for S&S Payroll Processing

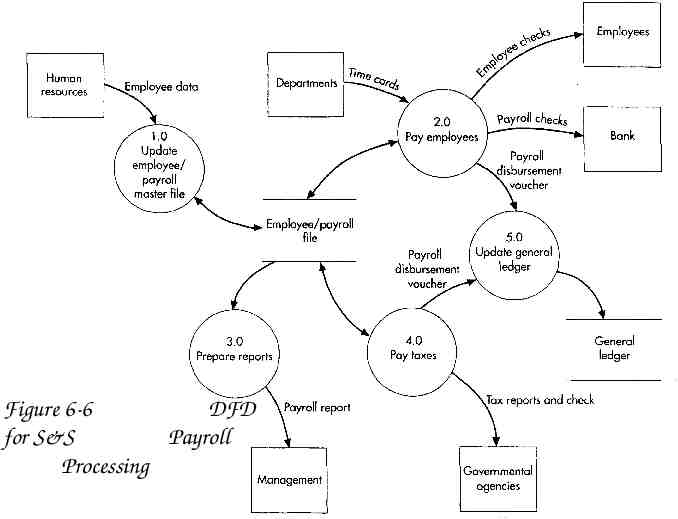

Figure 6-6 DFD for S&S Payroll Processing

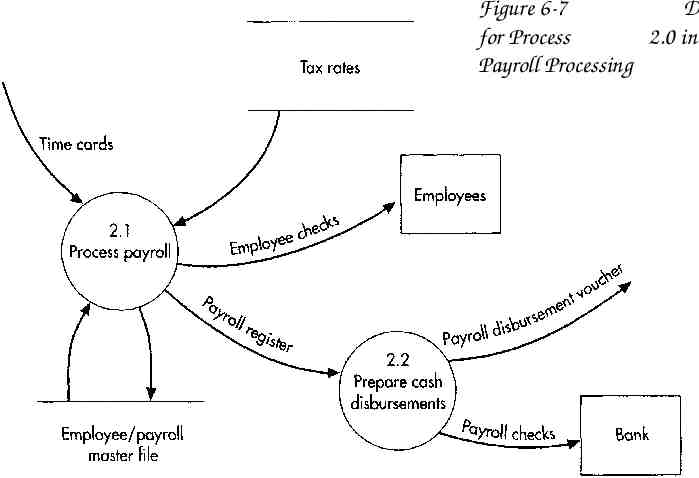

Figure 6-7 D for Process 2.0 in Payroll Processing

Let’s pause here and do some data flow diagrams. First P6-9 (p. 180)

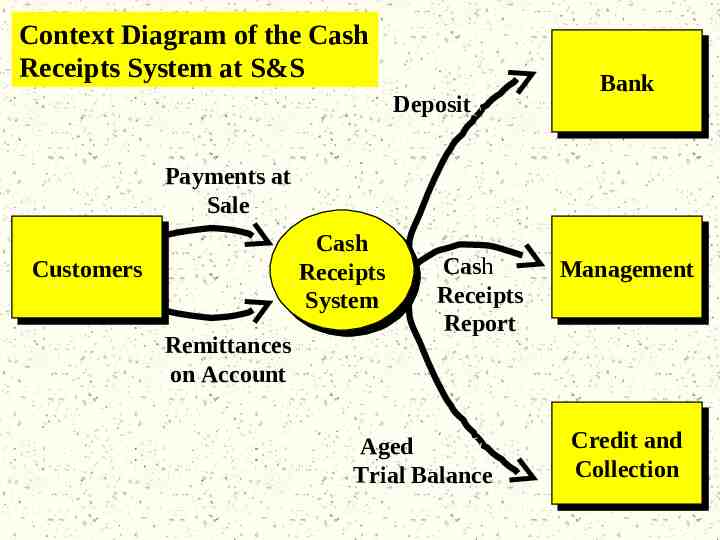

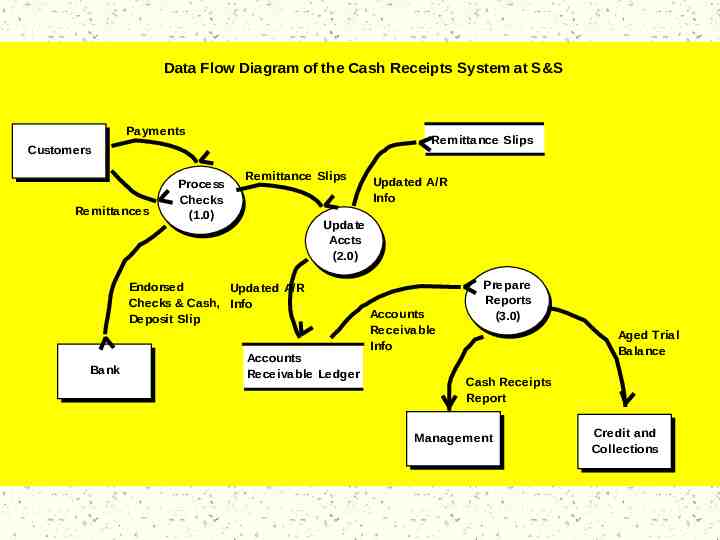

Ashton Fleming has worked furiously for the past month trying to completely document the major business information flows at S&S. Upon completing his personal interviews with cash receipts clerks, Ashton asks you to develop a comprehensive DFD for the cash receipts system. Ashton’s narrative of the system follows:

Customer payments include cash received at the time of purchase and account payments received in the mail. At day’s end, the treasurer endorses all checks and prepares a deposit slip for the checks and the cash. A clerk then deposits the checks, cash, and deposit slip at the local bank each day.

When checks are received as payment for accounts due, a remittance slip is included with the payment. The remittance slips are used to update the accounts receivable file at the end of the day. The remittance slips are stored in a file drawer by date.

Every week, a cash receipts report and an aged trial balance are generated from the data in the accounts receivable ledger. The cash receipts report is sent to Scott and Susan. A copy of the aged trial balance by customer account is sent to the Credit and Collections Department.

Required Acct 316 Develop a context diagram and a DFD for the cash receipts system at S&S. Acct 316 Acct 316

Context Level Diagram Shows the boundary of the system; Acct 316 Shows the name of the system; Acct 316 Acct 316 Shows net data flows to and from the system; and Identifys all entities.

Context Level Diagram Acct 316 On the context level, the system is represented by a single process symbol with the number 0. Acct 316 The name of the system is used for the process. Acct 316

OK . . . Let’s Identify . . . Data sources and destinations (terminators); Acct 316 Transformation processes; Acct 316 Data stores; and Acct 316 Data flows

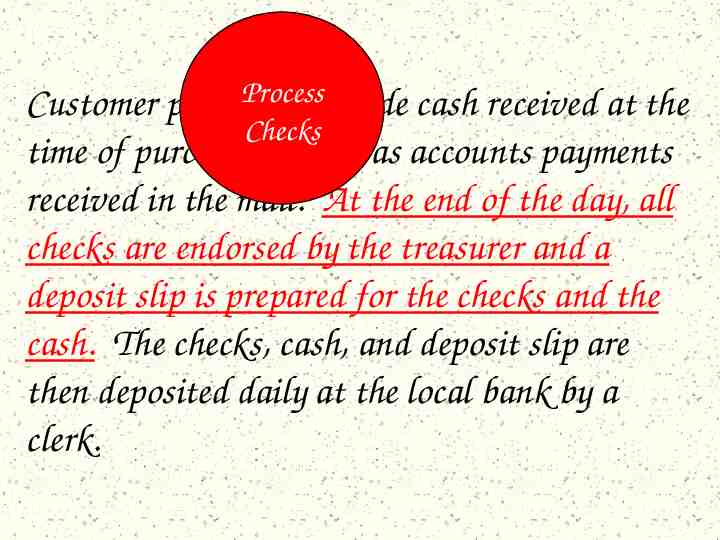

Customer payments include cash received at the time of purchase as well as accounts payments received in the mail. At the end of the day, all checks are endorsed by the treasurer and a deposit slip is prepared for the checks and the cash. The checks, cash, and deposit slip are then deposited daily at the local bank by a clerk.

When checks are received as payment for accounts due, a remittance slip is included with the payment. The remittance slips are used to update the accounts receivable file at the end of the day. The remittance slips are stored in a file drawer by date.

Every week, a cash receipts report and an aged trial balance are generated from the data in the accounts receivable ledger. The cash receipts report is sent to Scott and Susan. A copy of the aged trial balance by customer account is sent to the Credit and Collections Department.

Context Diagram of the Cash Receipts System at S&S Deposit Bank Bank Payments at Sale Cash Cash Receipts Receipts System System Customers Customers Remittances on Account Cash Receipts Report Aged Trial Balance Management Management Credit Creditand and Collection Collection

OK . . . Let’s Identify . . . Data sources and destinations (terminators); Acct 316 Transformation processes; Acct 316 Data stores; and Acct 316 Data flows

Customer payments include cash received at the time of purchase as well as accounts payments received in the mail. At the end of the day, all checks are endorsed by the treasurer and a deposit slip is prepared for the checks and the cash. The checks, cash, and deposit slip are then deposited daily at the local bank by a clerk.

Process Customer payments include cash received at the Checks time of purchase as well as accounts payments received in the mail. At the end of the day, all checks are endorsed by the treasurer and a deposit slip is prepared for the checks and the cash. The checks, cash, and deposit slip are then deposited daily at the local bank by a clerk.

When checks are received as payment for accounts due, a remittance slip is included with the payment. The remittance slips are used to update the accounts receivable file at the end of the day. The remittance slips are stored in a file drawer by date.

Update Accounts WhenReceivable checks are received as payment for accounts due, a remittance slip is included with the payment. The remittance slips are used to update the accounts receivable file at the end of the day. The remittance slips are stored in a file drawer by date.

Every week, a cash receipts report and an aged trial balance are generated from the data in the accounts receivable ledger. The cash receipts report is sent to Scott and Susan. A copy of the aged trial balance by customer account is sent to the Credit and Collections Department.

Every week, a cash receipts report and an aged trial balance are generated from the data in the accounts receivable ledger. The cash receipts report is sent to Scott and Susan. A copy of the aged trial balance by customer account is Prepare Reports sent to the Credit and Collections Department.

What are the Processes? 1. Process checks (1.0) Acct 316 2. Update Customer Accounts (2.0) Acct 316 3. Prepare Reports (3.0) Acct 316

Data Flow Diagram of the Cash Receipts System at S&S Payments Remittance Slips Customers Remittances Process Checks (1.0) Remittance Slips Update Accts (2.0) Endorsed Updated A/R Checks & Cash, Info Deposit Slip Bank Updated A/R Info Accounts Receivable Ledger Accounts Receivable Info Prepare Reports (3.0) Aged Trial Balance Cash Receipts Report Management Credit and Collections

Wow! That was fun! Now, let’s see if you can do it! Try P6-6 (p. 179)

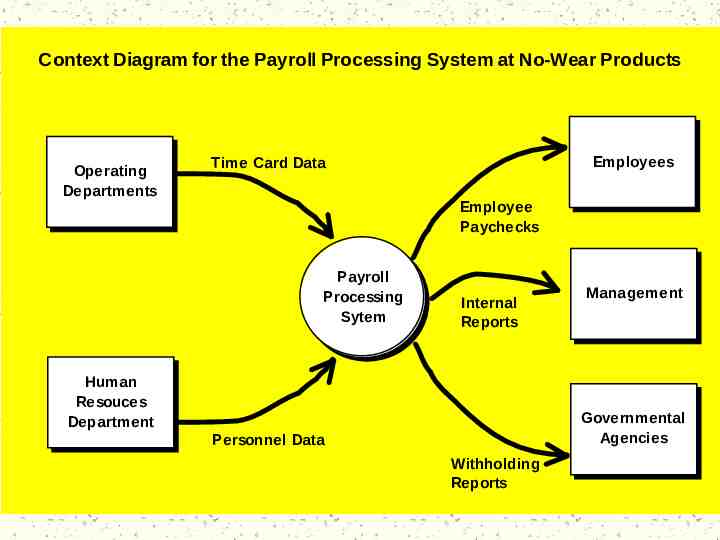

As the internal auditor for No-Wear Products of Hibbing, MN, you have been asked by your supervisor to document the company’s current payroll processing system. Based on your documentation, No-Wear hopes to develop a plan for revising the current IS to eliminate unnecessary delays in paycheck processing.

Your best explanation of the system came from an interview with the head payroll clerk. The payroll processing system at No-Wear Products is fairly simple. Time data are recorded in each department using time cards and clocks.

It is annoying, however, when people forget to punch out at night and we have to record their time information by hand. At the end of the period, our payroll clerks enter the time card data into a payroll file for processing. Our clerks are pretty good – though I’ve had to make my share of corrections when they mess up the data entry.

Before the payroll file is processed for the current period, human resources sends us data on personnel changes, such as increases in pay rates and new employees. Our clerks enter this information into the payroll file so it is available for processing. Usually, when mistakes get back to us, it’s because human resources is recording the wrong pay rate or an employee has left and the department forgets to remove the record.

The data are then processed and individual employee paychecks are generated. Several important reports are also generated for management – though I don’t know exactly what they do with them. In addition, the government requires regular federal and state withholding reports for tax purposes. Currently, the system generates these reports automatically, which is nice.

Required Acct 316 a. Prepare a context diagram for the current payroll processing system at No-Wear Products. Acct 316 b. Develop a DFD to document the payroll processing system at no-Wear Products. Acct 316

Context Diagram for the Payroll Processing System at No-Wear Products Operating Departments Employees Time Card Data Employee Paychecks Payroll Processing Sytem Internal Reports Human Resouces Department Management Governmental Agencies Personnel Data Withholding Reports

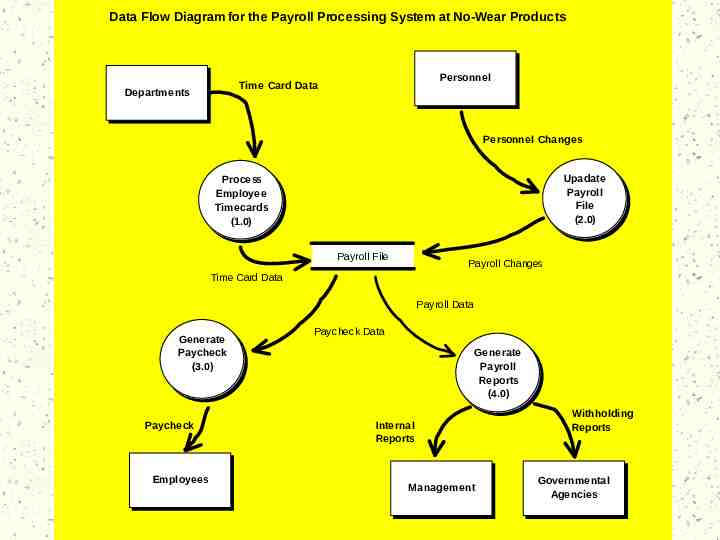

Data Flow Diagram for the Payroll Processing System at No-Wear Products Personnel Time Card Data Departments Personnel Changes Upadate Payroll File (2.0) Process Employee Timecards (1.0) Payroll File Payroll Changes Time Card Data Payroll Data Generate Paycheck (3.0) Paycheck Employees Paycheck Data Generate Payroll Reports (4.0) Internal Reports Management Withholding Reports Governmental Agencies

Wow! That was fun! Now, let’s see if you can do it! Try P6-11 (p. 181)

The local community college requires that each student complete a registration request form and mail or deliver it to the registrar’s office. A clerk enters the request into the system. First, the system checks accounts receivable subsystem to ensure that no fees are owed from the previous quarter. Next, for each course, the system checks the student transcript to ensure that he or she has completed the course prerequisites. Then the system checks class position availability and adds the students SSN to the class list.

The report back to the student shows the result of registration processing: If the student owes fees, a bill is sent and the registration is rejected. If prerequisites for a course are not fulfilled, the student is notified and that course is not registered. If the class is full, the student request is annotated with “course closed.”

If a student is accepted into a class, then the day, time, and room are printed next to the course number. Student fees and total tuition are computed and printed on the form. Student fee information is interfaced to the accounts receivable subsystem. Course enrollment reports are prepared for the instructors.

Required Acct 316 Prepare a context diagram and at least two levels of logical DFDs for this operation. Acct 316 Acct 316

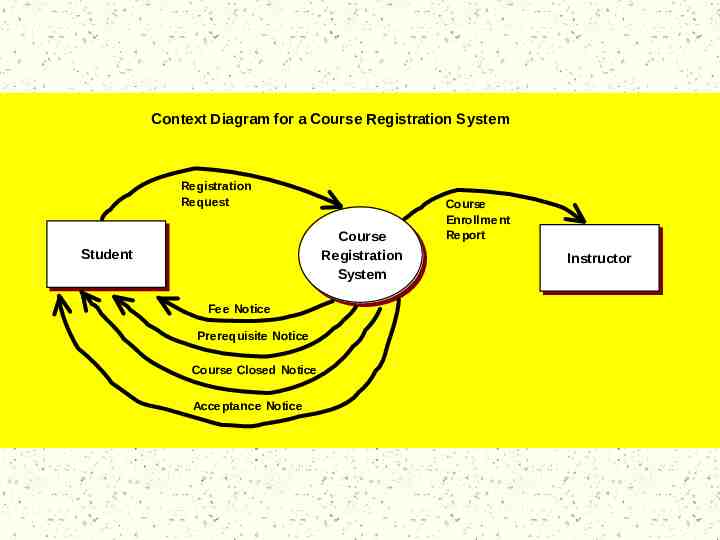

Context Diagram for a Course Registration System Registration Request Course Registration System Student Fee Notice Prerequisite Notice Course Closed Notice Acceptance Notice Course Enrollment Report Instructor

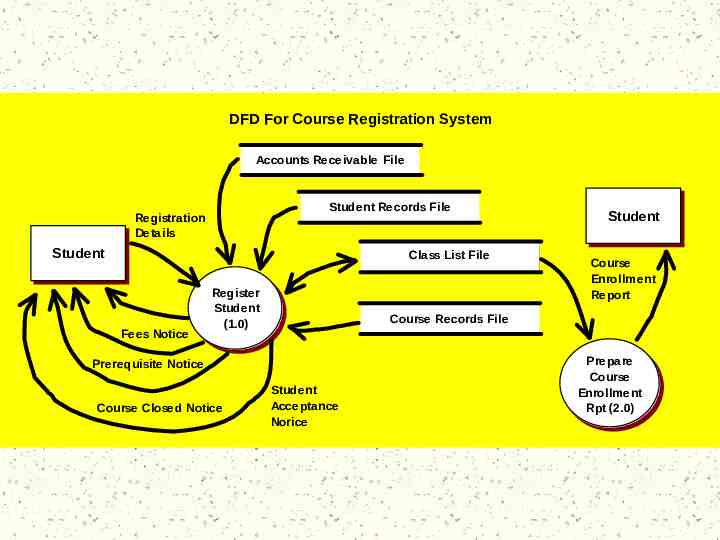

DFD For Course Registration System Accounts Receivable File Student Records File Registration Details Student Class List File Fees Notice Register Student (1.0) Course Enrollment Report Course Records File Prerequisite Notice Course Closed Notice Student Student Acceptance Norice Prepare Course Enrollment Rpt (2.0)

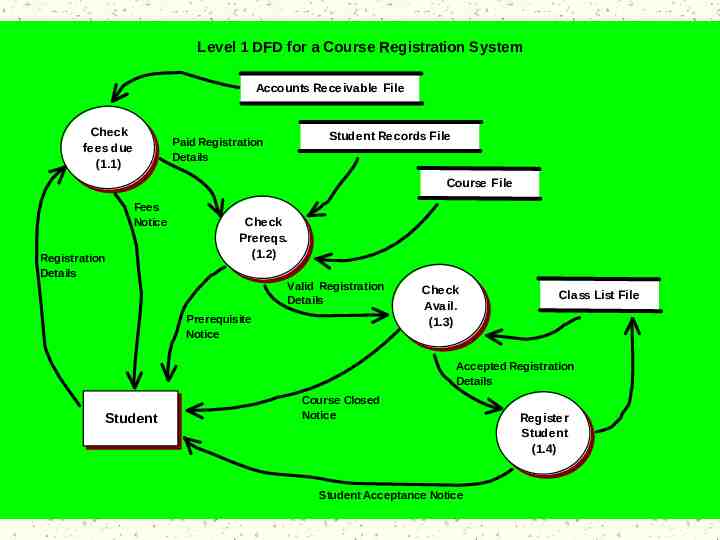

Level 1 DFD for a Course Registration System Accounts Receivable File Check fees due (1.1) Student Records File Paid Registration Details Course File Fees Notice Registration Details Check Prereqs. (1.2) Valid Registration Details Prerequisite Notice Check Avail. (1.3) Class List File Accepted Registration Details Student Course Closed Notice Student Acceptance Notice Register Student (1.4)