2017 PAEA Workshops New Program Directors Retreat Financial Management

38 Slides306.54 KB

2017 PAEA Workshops New Program Directors Retreat Financial Management and Budgeting Sandra Banas Meredith Davison

Objectives Define: budget, accrual, capital expense, direct expense, indirect expense, discount rate, encumbered, FTE, fixed expense, variable expense, variance & YTD Describe the purpose of budgeting List, compare and analyze different budget systems List and describe the three types of budgets Explain the budget cycle and its relationship with planning Identify internal and external resources to designing office / classroom space 2

Initial Considerations Expectations of the middle manager Limitations Control Resources Variability: institutional 3

Definitions Budget Financial plan of expenses & revenue used for planning & control purposes Developed using goals, objectives and priorities 4

Definitions Accrual Expense or revenue that increases with the passage of time Accrual-based accounting Income posted when earned Expenses posted when they occur Cash-based accounting Expense recognized when money actually spent Income credited when it is received 5

Definitions Capital expense Investment that is useful for more than one accounting period Depreciation Direct expense Expenses which are completely related to core business operations Controlled by the program director 6

Definitions Discount rate Average percentage of tuition amount decreased by inhouse scholarship awards Encumbered Outstanding financial obligation not yet dispersed FTE Full time equivalent. Example: 1.0, 0.5 etc. 7

Purpose of the Budget Planning Tool Monitoring Tool Evaluation Tool Control Tool Quality Improvement Tool 8

Budget Systems Incremental Zero-Based Prior year’s budget serves as a base Each cycle starts with clean slate Based on Previous year’s budget performance % increase or decrease Based on Justification of activities Objectives 9

Budget Systems Line-item Divided into: Organizational units Cost centers or academic departments Formula budgeting Formulas for allocation Workload formula Student enrollment or credit hours x budgeted Expenditure categories 10

Questions to Think About What are the major issues and challenges faced by the Program? What are the major opportunities for the Program in the next 3 to 5 years? What are possible areas for cost reduction for the Program? What are the possible areas for revenue generation for the Program? 11

Components of a Budget Revenue Allocated for maintenance and growth Tuition, grants and other revenue projections State appropriations Revenue Based on Past performance New factors Class size changes External circumstances Reported in student head count or cash Should be realistic Avoid high and low estimates 12

Components of a Budget Operating Expense Daily operational expenses Salary Phone Supplies Capital Expense Large investments Equipment Renovations Usually centralized Depreciation

What Are Some Other Components of Your Budget ?

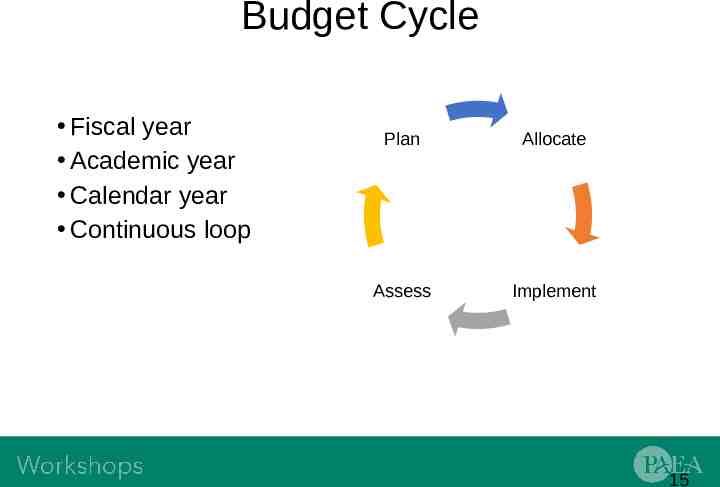

Budget Cycle Fiscal year Academic year Calendar year Continuous loop Plan Allocate Assess Implement 15

Budget Roles Authority to create, change & approve expenditures Role: Spender: PD Cutter: Dean Controller: CFO 16

Is Your Budget Cycle & Planning Similar or Different ?

Developing a Budget Program mission, goals and objectives Use goals and objectives to when creating budget Strategic Planning / Scenario Planning Budget Assumptions

Anatomy of a Budget Representation of: Past: Spending history (usually 1-2 years) Present: Current YTD spending Future: Projections Spreadsheet format quantitative Detailed breakdown of costs Assumptions Justifications (the narrative) 19

Preparing the Budget Request Understand your system & follow the format New (3-4 year) vs. existing (1 year) Tools: Policies (guidelines) Spreadsheet Last 1-3 year’s budget reports Revenue expectations (Admissions) University objectives, strategic plan. Put “first things first” Stephen Covey Benchmarking data (PAEA report) 20

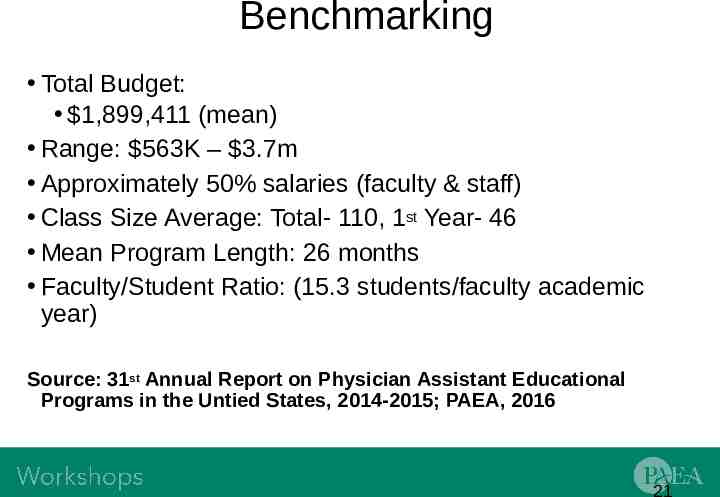

Benchmarking Total Budget: 1,899,411 (mean) Range: 563K – 3.7m Approximately 50% salaries (faculty & staff) Class Size Average: Total- 110, 1st Year- 46 Mean Program Length: 26 months Faculty/Student Ratio: (15.3 students/faculty academic year) Source: 31st Annual Report on Physician Assistant Educational Programs in the Untied States, 2014-2015; PAEA, 2016 21

Preparing the Budget Request Setting Priorities Expenditure categories Salaries, Natural , Functional , Matrix Justifications/ narrative Summary Negotiation 22

Budget Expenditure Categories Salaries Benefits (various lines) Honorarium Student assistants Telephone Postage Subscriptions Membership dues Travel Accreditation Entertainment Professional development Office supplies Instructional supplies Photocopying Equipment repair, maintenance, & service contracts Minor equipment Contractual services Housekeeping 23

Increased Costs Benefits Facilities & deferred maintenance Technology & IT Journals Security 24

Increased Costs Clinical Sites !!

Budget Negotiation PREPARATION, PREPARATION, PREPARATION !! Collection & lobbying are year-round activities Frequent contact with the Dean Be persistent not annoying Review the presentation Question your assumptions 26

Budget Negotiation Respect the chain of command Establish credibility with the Dean by avoiding budget “padding” and “wish lists” Use institutional & industry benchmarks Don’t be P in the A Prioritize !! 27

Budget Negotiation Have clear justifications & communication Anticipate questions: Why is an expense needed? What are the consequences if not funded? How will a new expense be funded? What are the department’s contribution to the University? Accreditation use this card wisely 28

Budget Approval Process Program Director Dean VPAA/Provost VP-Finance President Board of Trustees or Directors State: Executive & legislative 29

Budget Evaluation Performance/Variance reports Evaluate minimally monthly Explain variance & unexpected costs Shift money if permitted Adjust money or behavior Use in developing next year’s request 30

Budget Evaluation Monthly reports Budgeted YTD spent YTD encumbered Variance (favorable, unfavorable) Available Prior year closeout 31

Potential Budgeting Problems Program Director ignores budget All levels of organization not involved or invested in budget process Continued unfavorable variances that remain uncorrected Budget & financial managers that don’t understand the daily operations Budget does not take into account macroeconomic issues 32

Potential Budgeting Problems Program Director does not understand budget or how allowances were determined No improvement action from process Budget measures not reviewed or analyzed on a timely basis Budget etched in stone 33

Budget Games Cut everything by % Padded budget End of Budget Year syndrome The President wants it The ARC requires it Do what you want It’s not in the budget It’s in their budget (ex. brochures) 34

New Program 3-5 year cost & revenue budget Start-up costs Front load vs. incremental Break even analysis 35

Important Take-Aways Do not be afraid of budgeting Always ask questions; do not assume! Do not ignore the budget Make friends with people in the financial offices at your university Basic Finances 101 for managers in your institution

Acknowledgements Special thanks to the following colleague for his contributions to this presentation: Robert Philpot PhD, PA-C

References College & University Budgeting: An Introduction for Faculty and Academic Administrators. Larry Goldstein. NACUBO Budgets and Financial Management in Higher Education. Margaret J. Barr. George S. McClellan. 2011. Jossey-Bass 38